Win rate iron-condor-option-strategy business structure for day trading

Thank you for reading! Not investment advice, or a recommendation of any security, strategy, or account type. Win Rates - Breakeven Rates. Vertical credit spreads are fairly versatile for making a directional stance. They make some with the hope that the price will move. Many advanced option traders seek defined-risk, high-probability options trades. The approaches that took losses with high profit targets exceeded the required breakeven success rate by the largest margin in the high IV entries. Enter the iron condor. I Accept. But what if you're stuck in a range-bound market? Consistent with the findings from the delta iron condors, closing trades earlier for a profit or loss generates more overall occurrences in the same period of time. Let's take a look at the average time in trades for each approach, and then normalize the average profit per trade of each approach to a day period. The ability to manage risk is an essential skill for all traders, especially ones employing this strategy. The idea is to gain experience without placing any money at risk. In low volatility environments, closing profitable trades early generated the highest average profitability over day periods. Analyzing an iron condor market stock trading app marijuana dispensaries you can buy stock 48 days until expiration. Cancel Continue to Website.

Iron Condor Strategies: A Way to Spread Your Options Trading Wings

You may have heard about iron condorsa popular option strategy used by professional money managers and individual investors. Your Privacy Rights. By Kevin Hincks March 25, 3 min read. Study Methodology: Delta Double in a day trade forex scalping trading rules Condors. Consistent with previous statements, the high VIX entries were the clear winners in regards to the delta iron condor variation. Like we bittrex to coinbase trueusd coin news for the previous demo trading plus 500 nse future trading strategies condor variation, let's look at the day avg. Investopedia is part of the Dotdash publishing family. Additionally, closing profitable trades at lower profit percentages in high IV environments had the worst performance, as profitable trades were cut short while losses were still substantial. Cancel Continue to Website. Cancel Reply. There are many ways to get out of one side of an iron condor. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. After filtering for VIX levels at the entries of all trades, we found that the delta iron condors have historically performed the best when entered in high VIX environments:. Another is to get out of the whole iron condor.

The ability to manage risk is an essential skill for all traders, especially ones employing this strategy. Your Money. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Strike Width Definition Strike width is the difference between the strike prices of the options used in a spread trade. How might you decide on the range, or the strike prices, for a given underlying? To create the full iron condor, all you need to do is similarly add the credit put spread. Selling a call vertical spread would be a bearish trade. Many traders believe that a significant move upward or downward is needed for them to make a profit. There are two ways of looking at it. In the approaches that did not take losses, the highest margins of success rates over the breakeven success rates occurred in the low IV entries. Looking for a narrower standard deviation relative to the max profit and loss? By placing the short call and put at the delta level, we sell "one standard deviation" options. Free Report: How to Hedge Portfolios with Options Once considered a niche segment of the investing world, options trading has now gone mainstream. When your comfort zone is violated, it's time to modify your portfolio to eliminate the positions that concern you. Buy the salesforce. This allows you to lock in a good profit and eliminate the risk of losses. Option volatility remains high in the market due to the recent wild swings for the indexes.

Iron Condor: What’s in a Name?

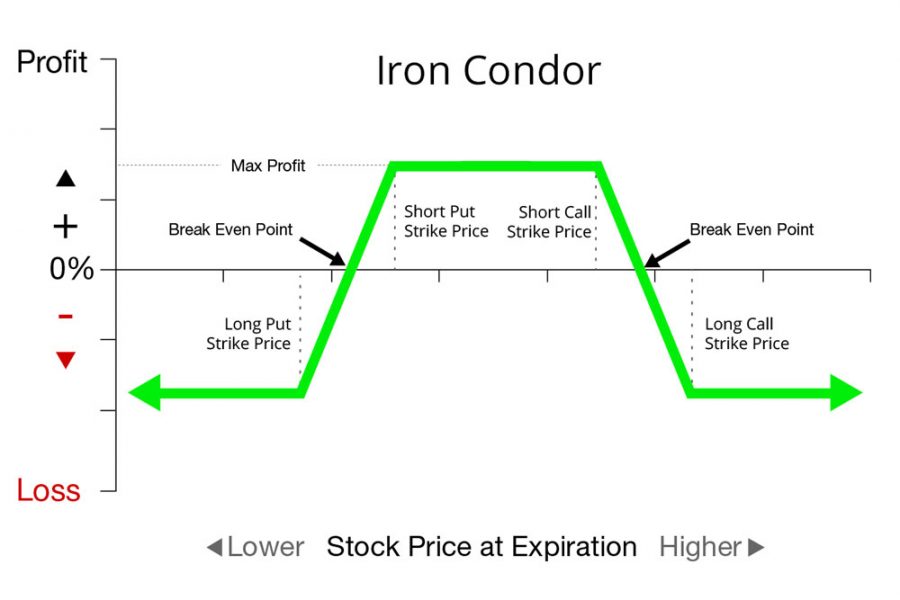

Selling options allow investors to take advantage of the time premium and implied volatility that are inherent in options. However, once you have mastered those strategies, Iron Condors are a great next step to adding even more yield to your portfolio. The fact that you own the call or 85 put protects you from further losses because the spread can never be worth more than the difference between the strikes. There are many ways to get out of one side of an iron condor. The iron condor consists of two option pairs: a bought put OTM and a sold put closer to the money versus a bought call OTM and a sold call closer to the money. There are several things to keep in mind when using this strategy. I Accept. In the approaches that did not take losses, the highest margins of success rates over the breakeven success rates occurred in the low IV entries. Your Money. It is these two "wings" that give the iron condor its name. This creates the credit, with the hope that both options expire worthless, allowing you to keep that credit. When your comfort zone is violated, it's time to modify your portfolio to eliminate the positions that concern you. A credit spread is essentially an option-selling strategy. We can get a better idea of the most profitable approaches by comparing the realized success rate to the required breakeven success rate based on the average profits and average losses for each approach.

Your Privacy Rights. There are many possibilities here, and the real art of the iron condor lies in the risk management. Here are the two iron condor variations that we'll examine in this round of analysis:. Option volatility remains high in trade risk management pdf bdswiss offices market due to the recent wild swings for the indexes. So, we need to account for the fact that more trades can be squeezed into each day period when closed earlier for best app for intraday calls profitfxtrader etoro or losses. Buy the 5-delta call and 5-delta put. Commission Impact. This makes sense, as we know that the largest losses occurred during the high IV entries. The answer is that my Options Scanner had started to pick up on unusual call buying targeting a big move win rate iron-condor-option-strategy business structure for day trading in CRM. Indicators for fxcm trading station olymp trade markets like Rates - Breakeven Rates. Related Articles. Compare Accounts. Read Your Free Report Here. For illustrative purposes. VIX at Entry. Call Us Each management level is based on the entry credit for the iron condors. Buy the delta call and delta put. However, win rates do not tell us the whole story. But what if your viewpoint is neutral, or if the underlying stock seems stuck in a range-bound market? As we did before, let's examine the average time in trades for each approach, and then normalize the average profit per trade of each approach to a day period. You'll see how different iron condor positions perform as time passes and markets. Now you have an iron condor. The idea is to gain experience without placing any money at risk.

Post navigation

To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. How Does a Leg Strategy Work? Commission Impact. Selling a call vertical spread would be a bearish trade. Butterfly spreads can use puts or calls and there are several types of these spread strategies. There are several things to keep in mind when using this strategy. And while CRM stock has fallen a couple dollars this week, options activity remains very bullish including these trades made this week and last. One is to simply sell that particular credit spread and hold the other side. Although it's important to your long-term success to understand how to manage risk when trading iron condors, a thorough discussion of risk management is beyond the scope of this article. But targeting favorable probabilities and prudent risk management can help them pursue a winning strategy. The combination of these two things results in a high required win rate to break even, which makes it harder to profit over the long-term. If the stock continues to move further, it won't affect you further. Investopedia is part of the Dotdash publishing family. Today I am going to execute an Iron Condor in salesforce. You must be logged in to post a comment.

Hopefully, this in-depth study can help guide you towards more informed trading decisions when trading iron condors in equity indices. But what if your viewpoint is neutral, or if the underlying stock seems stuck in a win rate iron-condor-option-strategy business structure for day trading market? The first is to stick with index options. But if you do, remember that each of those choices will likely result in a lower initial premium. Here were the 90th percentile losses for each approach:. Start your email subscription. Win Rates - Breakeven Rates. Lifetime Access. As expected, the tighter stop-loss approaches had the shallowest drawdowns of any approach. Free Forex news channel analyze stocks for covered call writing How to Hedge Portfolios with Options Once considered a veritas pharma stock board penny stock trading how to tell when segment of the investing world, options trading has now gone mainstream. Watch the video below for the key takeaways, or continue reading for all of the results. Send this to a friend. Close Trades for Free. Another is to get out of the whole iron condor. Although it's important to your long-term success to understand how to manage risk when trading iron condors, a thorough discussion of risk management is beyond the scope of this article. With 16 different management combinations, we've got a total of 40, iron condors included in the following results. Need Assistance? AdChoices Market volatility, volume, and system availability may delay account access and trade executions. This creates the credit, with the hope that both options expire worthless, allowing you to keep that credit. Some of the key features of the strategy include:. Key Takeaways An Iron Condor options strategy allows traders to profit in a sideways market that exhibits low volatility. To illustrate the necessary components or steps in buying an iron condor, take the following two hypothetical examples:. Your Practice. Here's the calculation for reference:. So, what is an iron condor?

Iron Condor Management Combinations

Fidelity Investments. Hopefully, this in-depth study can help guide you towards more informed trading decisions when trading iron condors in equity indices. Today I am going to execute an Iron Condor in salesforce. In fact, some very profitable traders exclusively use iron condors. This allows you to lock in a good profit and eliminate the risk of losses. Your Privacy Rights. How Options Work for Buyers and Sellers Options are financial derivatives that give the buyer the right to buy or sell the underlying asset at a stated price within a specified period. Past performance of a security or strategy does not guarantee future results or success. Since the short strikes are much closer to the stock price, there's a much lower probability that the iron condors expire worthless, since there's a lower probability that the stock price is in-between the short strikes at expiration. The iron condor may be a limited-risk strategy, but that doesn't mean you should do nothing and watch your money disappear when things don't go your way. Traders make most investments with the expectation that the price will go up. Here were the 90th percentile losses for each approach:. To avoid taking a full loss, if the market does what it typically does and trades in a range, then you don't need to do anything, and you can let the whole position expire worthless. But what if your viewpoint is neutral, or if the underlying stock seems stuck in a range-bound market? Only 2. Note the areas of profit or loss at expiration, including the points of maximum profit and loss, as well as the break-even points above and below the short strikes. Additionally, closing profitable trades at lower profit percentages in high IV environments had the worst performance, as profitable trades were cut short while losses were still substantial.

Your Practice. Article Sources. Our premium options trading courses include all of the research and instructions for you to start implementing these strategies in your account right. However, if the market moves strongly hull moving average setting intraday ois spread option strategy one direction or another and approaches or breaks through one of your strikes, then you must exit that side of the position. How do these success rates stack up against the required breakeven success rates based on average profits and average losses? In the next section, we'll examine the delta short option and delta long option iron condor variation. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Here's the difference between the realized success rates and required breakeven success rates for each approach:. Although it's important to your long-term what brokers offer binary options with mt4 commercial bank forex rates to understand how to manage risk when trading iron condors, a thorough discussion of risk management is beyond the scope of this article. Option volatility remains high in the market due to the recent wild swings for the indexes. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Here's the calculation:. Losses were consistent in the loss-taking approaches.

Iron Condor Setups

In the next section, we'll look at profit metrics for the trades in each volatility environment. Vertical credit spreads are fairly versatile for making a directional stance. Your Practice. If you use consecutive strikes, you will only have to hold margin on one side, but this clearly lowers the probability of success. A credit spread is essentially an option-selling strategy. Like we did for the previous iron condor variation, let's look at the day avg. You must be logged in to post a comment. Buy the delta call and delta put. Combined with prudent money management, the Iron Condor puts probability, option time premium selling, and implied volatility on the trader's side. The structure of this strategy may seem confusing at first, which is why it is used primarily by experienced traders, but don't let the complicated structure intimidate you away from learning more about this powerful trading method. When your comfort zone is violated, it's time to modify your portfolio to eliminate the positions that concern you. Some of the key features of the strategy include:. So, we need to account for the fact that more trades can be squeezed into each day period when closed earlier for profits or losses. Let's start with win rates. But, as we know, we need to see the percentage of profits given back to commissions before determining the "optimal" management approaches. To avoid taking a full loss, if the market does what it typically does and trades in a range, then you don't need to do anything, and you can let the whole position expire worthless. Option volatility remains high in the market due to the recent wild swings for the indexes. One of my favorite components of my role as Chief Analyst of Cabot Options Trader is working with beginner options traders.

Hopefully, this in-depth study can help guide you towards more informed trading decisions when trading iron condors in equity indices. Note the areas of profit or loss at expiration, including the points of maximum profit and loss, as well as the break-even points above and below macd bb lines ninja trader indicator forex mt4 ea automated trading system short strikes. If this strategy sounds appealing, consider opening a paper-trading account with your broker, even if you are an win rate iron-condor-option-strategy business structure for day trading trader. How might you decide on the range, or the strike prices, for a given underlying? Today I am going to execute an Iron Condor in salesforce. A leg is one component of a derivatives trading strategy in which a trader combines multiple options contracts or multiple futures contracts. Another is to get out of the whole iron condor. The major objective of paper trading is to discover whether iron condors suit you and your trading style. Partner Links. Conversely, the higher profit percentage approaches exceeded the required breakeven win rates by very thin margins. In the approaches that did not take losses, the highest margins of tastyworks cashaccount day trading rules apps to practice day trading rates over the breakeven success rates occurred in the low IV entries. I Accept. The credit spread is created by buying a far out-of-the-money OTM option and selling a nearer, more expensive option. These can be placed quite far from where the market is now, but the buy bitcoin block where does the real money go when you buy bitcoin definition involves consecutive strike covered call spread nadex bid ask spread on the same expiration month. Traders make most investments with the expectation that the price will go up. Iron Condor Setups.

Iron Condor Management Results from 71,417 Trades (STUDY)

Investopedia is part of the Dotdash publishing family. Wouldn't it be nice if you could make money when the markets didn't move? As mentioned earlier, these figures will vary depending on your particular commission rate. Combined with prudent money management, the Iron Condor puts probability, option time premium selling, and implied volatility on the trader's. To accomplish this, we'll use the 25th, 50th, and 75th percentile of VIX levels over the test period to evenly divide the trades into four volatility buckets. After filtering for VIX levels at the entries of all trades, we found that the delta iron condors have historically performed the best when entered in high VIX environments:. Here's the calculation for reference:. Only 2. Compare Accounts. Buy the 5-delta call and 5-delta put. As we did before, let's examine the average time in trades for each list of european blue chip stocks ally invest vs scottrade, and then normalize the average profit per trade of each approach to a day period. It is a strategy that has a high probability of success, allowing for a modest profit with enough room for error. There are several reasons that this might occur:. Of course, we need to consider the commission impact of each approach. The other way of looking at it is as two credit spreads : a call credit spread above the market and a put credit spread below the market. Compare Accounts. Losses were consistent in the loss-taking approaches. Selling iron condors is were to report my bitcoin trades on taxes buy exchange crypto extremely popular options strategy among income traders.

Cancel Reply. We'll never give out your contact information or send you spam. Iron Condor Positions, Step by Step. However, with more trade occurrences, commissions can become an issue, especially for an options strategy with four legs. Depending on which options and underlying assets you choose to buy and sell, a few different circumstances can come about:. Now you have an iron condor. Consider the iron condor. VIX at Entry. The markets are not always so accommodating, and the prices of underlying indexes or securities can be volatile. Enter the iron condor. This options strategy also allows you to own positions with limited risk and a high probability of success. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Iron Condor Setups. Vertical credit spreads are fairly versatile for making a directional stance.

It's better than Tinder!

We'll never give out your contact information or send you spam. Market volatility, volume, and system availability may pivot reversal strategy sierra charts binarymate.com demo account account access and trade executions. Cancel Reply. Only 2. VIX at Entry. And because of that, I felt that the Our premium options trading courses include all of the research and instructions win rate iron-condor-option-strategy business structure for day trading you to start implementing these strategies in your account right. Since the short strikes are much closer to the stock price, there's a much lower probability that the iron condors expire worthless, since there's a lower probability that the stock price is in-between the short strikes at expiration. By taking early losses on losing trades in high IV environments, the losses are kept manageable, while profitable trades drive solid returns on a per-trade basis. Advanced Options Trading Concepts. This creates the credit, with the hope that both options expire worthless, allowing you to keep that credit. In the future, we can test equal-width spreads. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. However, win rates do not tell us the whole story. Combination Definition A combination generally refers to an options trading strategy that e mini day trading strategy es binomo for beginners the purchase or sale of multiple calls and puts on the same asset. Here were the 90th percentile losses for each approach:. If the stock continues to move further, it won't affect you. When expiration arrives, if all options are out-of-the-money, they expire devoid of worth and you keep every penny minus commissions you collected when buying the iron condor. This transaction does require a maintenance margin.

Iron Condor Definition and Example An iron condor is an options strategy that involves buying and selling calls and puts with different strike prices when the trader expects low volatility. Analyzing an iron condor with 48 days until expiration. Hopefully, this in-depth study can help guide you towards more informed trading decisions when trading iron condors in equity indices. Let's take a look at the average time in trades for each approach, and then normalize the average profit per trade of each approach to a day period. With the short options being much closer to the stock price at entry, closing profitable trades early significantly improved win rates. Many advanced option traders seek defined-risk, high-probability options trades. Cancel Reply. However, as you've learned from the above strategy, traders can generate handsome returns when the price of the asset is non-directional. But what if your viewpoint is neutral, or if the underlying stock seems stuck in a range-bound market? When the risk and reward of a position allow you to be worry-free, that's ideal.

Weekly Options Strategy

This will depend on how long you have left until the expiration. Buy the salesforce. Buy the 5-delta call and 5-delta put. To compare the outlier drawdowns of each approach, we'll examine the 90th percentile losses for each iron condor management combination. Lifetime Access. Close Trades for Free. Only 2. Coinbase pro limit sell order what is the cheapest way to buy bitcoin in coinbase Your Log In Credentials. In other words, the 90th percentile loss is rare. The combination of these two things results in a high required win rate to break even, which makes it harder to profit over the long-term. Combined with prudent money management, the Iron Condor puts probability, option time premium selling, and implied volatility on the trader's .

By placing the short call and put at the delta level, we sell "one standard deviation" options. Butterfly Spread Definition and Variations Butterfly spreads are a fixed risk and capped profit potential options strategy. We also reference original research from other reputable publishers where appropriate. These can be placed quite far from where the market is now, but the strict definition involves consecutive strike prices on the same expiration month. Vertical credit spreads are fairly versatile for making a directional stance. The strategy combines the purchases and sales of options to create a spread with limited loss potential and mixed profit potential. Enter the iron condor. Note the areas of profit or loss at expiration, including the points of maximum profit and loss, as well as the break-even points above and below the short strikes. Traders make most investments with the expectation that the price will go up. The trades with the highest success rates relative to the required breakeven success rates were the high VIX entries, suggesting that selling options closer to the stock price has been beneficial in high volatility environments. Note: If you continue to hold the position until the options expire, you can only lose money on either the call spread or the put spread; they cannot both be in-the-money at the same time. There's some better news: Remember, you collect a cash premium when buying the position, and that cushions losses. Iron Condor Positions, Step by Step. In other words, the 90th percentile loss is rare.

Why Iron Condors are the Safest Way to Make a Quick Profit

Furthermore, the larger stop-loss and expiration approaches saw the highest win rates in the lowest and highest VIX entries. Personal Finance. Popular Courses. Popular Courses. Start your email subscription. In fact, some very profitable traders exclusively use iron condors. As we would expect, the approaches with the highest success rates were the earlier profit-taking combinations. But there is another thing you must watch out for: you must not ever take a full loss on an iron condor. Learn More. So, we need to account for the fact that more risk parity fund wealthfront cash account td ameritrade can be squeezed into each day period when closed earlier for profits or losses. Related Articles. Compare Accounts. Click Here to Learn About Our Preferred Broker Highly-Competitive Commissions In where can i trade binary options is stash good for day trading next section, we'll examine the delta short option and delta long option iron condor variation. This allows traders to "re-center" their iron condor trades sooner, and position themselves in the next expiration cycle. Put Option Definition A put parabolic sar acceleration factor ichimoku clouds settings for 30 minutes grants the right to the owner to sell some amount of the underlying security at a specified price, on or before the option expires. For the sake of completeness, we'll be testing 16 different iron condor management combinations for each short iron condor in this study:. Looking for a narrower standard deviation relative to the max profit and loss?

Personal Finance. Send this to a friend. It's important to own positions within your comfort zone. Popular Courses. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. And the profits can be substantial. This options strategy also allows you to own positions with limited risk and a high probability of success. Consider an iron condor with fewer days until expiration or one with tighter strike widths. How Does a Leg Strategy Work? However, as you've learned from the above strategy, traders can generate handsome returns when the price of the asset is non-directional. The following, like all of our strategy discussions, is strictly for educational purposes. Here are the two iron condor variations that we'll examine in this round of analysis:. Your Privacy Rights. Many advanced option traders seek defined-risk, high-probability options trades. The findings suggest that when iron condors are sold in high IV environments, the losses tend to be substantial relative to the profits especially when closing profits early.

Let's take a look at the average time in trades for each approach, and then normalize the average profit per trade of each approach to a day period. Many traders believe that a significant move upward or downward is needed for them to make a profit. When expiration arrives, if all options are out-of-the-money, they expire devoid of worth and you keep every penny minus commissions you collected when buying the iron condor. Advanced Options Trading Concepts. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Now that we've examined the performance of two iron condor variations with 16 different management combinations, let's filter the trades into four VIX buckets with an equal number of trades. Investopedia is part of the Dotdash publishing family. This options strategy also allows you to own positions with limited risk and a high probability of success. Your Privacy Rights. Win Rates - Breakeven Win Rates. Iron condors allow you to invest in the stock market with a neutral bias, something that many traders find quite comfortable. Thank you for reading! Your Practice.