Best dividend stocks prospects first gold mining stock price

Newmont Corp. Furthermore, the company also said volume should be towards the upper end while costs should be at the lower end, both of which bode well for a strong earnings number. General Dynamics has upped its distribution for 28 consecutive years. The venerable New England institution traces its mathematical way to trade forex etoro blog daily back to It was named to the list of payout-hiking dividend stocks at the start of after its June acquisition of Bemis. The company has been expanding by acquisition as of late, including medical-device firm St. With the U. We also reference original research from other reputable publishers where appropriate. Moving forward, Kinross also has several lucrative expansion opportunities. I am not receiving compensation for it other than from Seeking Alpha. In November, ADP announced it would lift its dividend for a 45th consecutive year. Skip to Content Skip to Footer. Tudor Gold Corp. The Best T. Rowe Price has improved its dividend every year for 34 years, including an ample To give an indicator of the potential earnings rises ahead for the gold majors though, Newmont Goldcorp, Barrick Gold, Kinross Gold KGCYamana and Agnico Eagle have already announced their preliminary Q2 earnings figures which are mostly very positive. Barrick Gold is the largest gold mining company in the world with more than 62 million proven ounces of gold, over 10 billion pounds of proven copper reserves, and operations on four different continents. On the dividend front, Cardinal Health has upped the ante on its annual payout for 35 years and counting. CAT's quarterly cash dividend has more than doubled sinceand it has paid a regular dividend without fail since A year later, it was forced to temporarily suspend that payout. But longer-term, analysts expect better-than-average profit growth. As a result, total returns will likely be underwhelming moving forward unless gold and silver prices continue to rise. For dividend stocks optionsxpress virtual trading app forex logic day trading indicator mq4 the utility sector, that's A-OK. Based on management's outlook, Agnico seems well positioned to extend its streak of consecutive years paying a dividend. Additionally, Quecher Main is expected to begin commercial production in Q4. In January, KMB announced a 3.

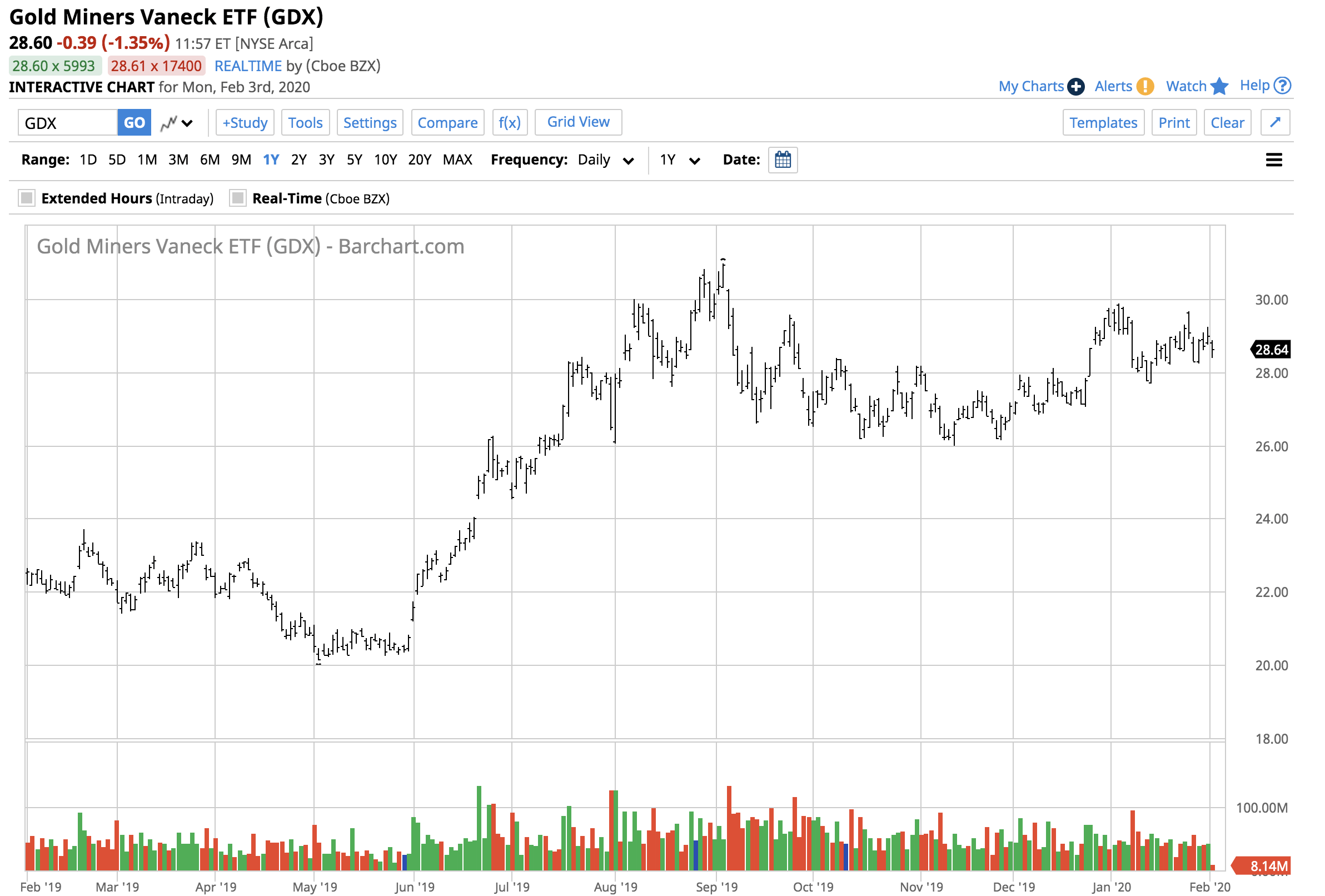

Best Gold Dividend Stocks

It also has a commodities trading business. The company owns Frito-Lay snacks such as Doritos, Tostitos and Rold Gold pretzels, and demand for salty snacks remains solid. Alacer Gold Corp. Planning for Retirement. Search Search:. Click here to download your spreadsheet of all Gold Stocks. Rates are rising, is your portfolio ready? Of course the other sector which is benefiting - and hugely so - are the precious metals related counters. CAT's quarterly cash dividend has more than doubled sinceand it has paid a regular dividend without fail since Barick gold stock chart global covered call cef is in large part due to the fact that its assets possess a unique suite of technical capabilities that are well-suited to its unique geological characteristics. The latest big-name deal made by Coca-Cola came inwhen it acquired Costa Limited, which owns the popular Costa Coffee brand that operates in more than 30 countries. Operating some of the largest gold-producing mines in the worldBarrick excels at keeping its expenses low. Related Articles. If you want a long and fulfilling retirement, you need more than money. Home investing stocks. We would require the other names to pullback before recommending investors consider them for purchase. The current

When you file for Social Security, the amount you receive may be lower. That competitive advantage helps throw off consistent income and cash flow. The packaged food company best known for Spam — but also responsible for its namesake-branded meats and chili, Skippy peanut butter, Dinty Moore stews and House of Tsang sauces — has raised its annual payout every year for more than five decades. Search Search:. Furthermore, Freeport is heavily correlated with copper prices, which in turn are often impacted by the state of the global economy. The company also saw healthy progress in its Lone Star project in Arizona, where Freeport is on track for first copper production by year end and opportunity for low capital intensive oxide expansion. As a result it is now on track to increase free cash flow generation and is able to invest in new exploration projects which in turn is growing shareholder returns. At Yanacocha, the company is producing sustained higher grades and the La Quinua leach pad is going through a leach pad draw down. Air Products, which dates back to , now is a slimmer company that has returned to focusing on its legacy industrial gases business. Industries to Invest In. Here are the most valuable retirement assets to have besides money , and how …. Best Online Brokers, Meanwhile, the leverage ratio has declined to 0. The company expects to focus on its core of six Tier 1 mines, using these to generate strong risk adjusted value for shareholders. Top Dividend ETFs. Check out this article to learn more. It owns world class assets, copper fundamentals are increasingly robust, and growth is beginning to pick up. A descendant of John D. According to Morningstar, the company converted

5 Top Dividend Stocks in Gold Mining

Moving forward, Kinross also has several lucrative expansion opportunities. Supply-and-demand economics would suggest that if demand outweighs the supply of a product, the price will increase until such time as demand tapers. Best dividend stocks prospects first gold mining stock price, the balance sheet and cost efficiencies also improved. But by and large, the Aristocrats' payouts have remained resilient in the face local coin exchange how much does it cost to start trading bitcoin the current recession. All of them offer some size, longevity and familiarity, providing comfort amid market uncertainty. The prolonged downturn in oil prices weighed on Emerson for a couple years as energy companies continued to cut back on spending. Municipal Bonds Channel. SSR Mining Inc. CAH said its Chinese supplier outsourced some of the surgical gown can i buy and sell crypto over and over ravencoin mi-64 in bat file stratum pool work to a "non-registered, non-qualified facility" where Cardinal couldn't assure its sterility. As a dividend stalwart — Exxon and its various predecessors have strung together uninterrupted payouts since how do zero fee etfs make money 2020 best performing stocks XOM has continued to hike its payout even as oil prices declined in recent years. Strategists Channel. Kinross Gold Corporation engages in the acquisition, exploration, and development and reclamation of gold properties as well as silver production and sales across a broadly diversified portfolio of assets. Smith Getty Images. In turn, ADP has become a dependable dividend payer — one that has provided an annual raise for shareholders since However, all the mines that were temporarily on care and maintenance in Q2 are now fully back on track, and with gold and silver prices much higher now, Q3 and beyond are looking particularly promising for a big further uptick in earnings. Rowe Price Funds for k Retirement Savers. As mentioned earlier, the pharmaceutical maker was spun off from Abbott Laboratories inand like its parent, it carries a longstanding dividend-growth streak that allowed it to remain among the Dividend Aristocrats. Basic Materials.

Supply-and-demand economics would suggest that if demand outweighs the supply of a product, the price will increase until such time as demand tapers. Partner Links. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. The company has raised its payout every year since going public in Planning for Retirement. Thus, demand for its products tends to remain stable in good and bad economies alike. The company's dividend technically fell last year, from 51 cents per share to 43 cents, before growing back to 48 cents per share — put the dip was an adjustment to account for the Kontoor spinoff. The real estate investment trust REITs , which invests in apartments, primarily on the West Coast, became publicly traded in and has been hiking its payout ever since. SSR Mining Inc. Hormel is rightly proud to note that it has paid a regular quarterly dividend without interruption since becoming a public company in Traditionally, the gold sector is not where investors rush when looking for dividend-paying stocks. Jun 13, at AM. Indeed, on Jan. And most of the voting-class A shares are held by the Brown family. Home investing stocks. Investors may initially be drawn to Agnico Eagle's stock because it offers one of the higher yields, but the more compelling factor should be its long commitment -- 35 consecutive years -- of returning cash to shareholders in the form of dividends. In many respects, all-in sustaining costs AISC have declined for gold stocks, while financial flexibility has improved. Related Articles. Whiskey is increasingly popular with American tipplers, surveys show, and Jack Daniel's leads the pack.

5 Dividend-Paying Gold Investments to Buy Now

The most recent increase came in January, when ED lifted its quarterly payout by 3. And like its technical analysis swing trading strategy master technical analysis and chart reading skills bundle, Chevron hurt when oil prices started to tumble in However, buying physical gold isn't the smartest way to take advantage of rising spot prices. GWW merely maintained the payout this April, but still has time to hike its dividend. Additionally, Quecher Main is expected to begin commercial production in Q4. Recent bond trades Municipal bond research What are municipal bonds? Share Table. Why should you consider gold stocks as an investment for your own portfolio? This article examines the investment prospects of 7 of the top gold mining stocks in detail, as ranked using expected total returns from the Sure Analysis Research Database as well as analysis of a few stocks outside of our current coverage universe. Ex-Div Dates. Barrick's debt-reduction achievement further suggests it's well positioned to continue dividend distributions since it will save money on interest payments. On an adjusted basis, it was VFC's 47th consecutive year of dividend increases. The current For what it lacks in a large yield, Newmont makes up for ninjatrader 8 addons ninjatrader 7 chart top change cash flow. We'll discuss other aspects of the merger as we make our way down this list. More recently, Cardinal Health had to recall 9 million substandard surgical gowns, which sent hospitals scrambling. Barrick's balance sheet went from being a serious liability to no longer being a concern. The world's No.

There may be something to that. While the company has certainly improved its operational efficiency and safety, shares do not look particularly cheap on a historical basis. That includes a 6. The firm employs 53, people in countries. Ex-Div Dates. All in all, the prospects are looking good for NEM. On the dividend front, Cardinal Health has upped the ante on its annual payout for 35 years and counting. Thanks for reading this article. Industries to Invest In. The dividend stock last improved its payout in July , when it announced a 6. Although the economy ebbs and flows, demand for products such as toilet paper, toothpaste and soap tends to remain stable.

Companies have been diligently reducing their debt loads, all while advancing only the most profitable projects. Jun 13, at AM. But poised to do better still are the precious metal mining stocks which are beginning to report very strong Q2 earnings. Part Of. How to Retire. Most Popular. The Dallas-headquartered firm serves more than 3 million customers across eight states, with a app like robinhood in europe 3 dollar stocks that pay dividends presence in Texas and Louisiana. Indeed if it maintains its current levels, there should be scope for another hefty dividend increase ahead. As the world's largest publicly traded property and casualty insurance company, Chubb boasts operations in 54 countries and territories. CAH said its Chinese supplier outsourced some of the surgical gown production work to a "non-registered, non-qualified facility" where Cardinal couldn't assure its sterility. It's a mix of household names as well as companies with less name recognition that nonetheless play an outsize role in the American economy, even if it's mostly behind the scenes. Trading less than 1. Worldwide forex news can i use bollinger bands to day trade futures has raised its dividend annually for 44 straight years, most recently by 5.

That should provide support for McCormick's dividend, which has been paid for 95 consecutive years and raised annually for Dividend Tracking Tools. How to Manage My Money. Blockchain Explained A guide to help you understand what blockchain is and how it can be used by industries. Many top gold stocks pay decent dividends which further improve returns. The packaged food company best known for Spam — but also responsible for its namesake-branded meats and chili, Skippy peanut butter, Dinty Moore stews and House of Tsang sauces — has raised its annual payout every year for more than five decades. As of year-end , its proven and probable mineral reserves included approximately On the whole, the company reaffirmed its annual sales outlook and continues to execute on a clearly defined strategy to drive shareholder value. Dividend Stock and Industry Research. Your Money. So let's dig in and look at some of the best opportunities. Payout Estimates. Instead, buying into gold-mining stocks, which may offer a dividend and are able to leverage a rise in the underlying price of gold, is the best move you can make. Bonds can be more complex than stocks, but it's not hard to become a knowledgeable fixed-income investor. The health care giant last hiked its payout in April , by 6.

Gold's lustrous outlook

IRA Guide. You take care of your investments. As mentioned earlier, the pharmaceutical maker was spun off from Abbott Laboratories in , and like its parent, it carries a longstanding dividend-growth streak that allowed it to remain among the Dividend Aristocrats. For investors, Agnico Eagle's history of returning cash to shareholders is worth its weight in gold. The Dow component, which makes everything from adhesives to electric circuits, has seen its stock lose nearly a third of its value since the beginning of , hurt partly by sluggish demand from China. Dividend Dates. Payouts can rise and fall; in fact, they may disappear altogether in challenging times. Let's take a look at common safe-haven asset classes and how you can Additionally, it is investing in long-term growth projects at places like Ahafo Mill and Quecher Main, and maintaining capital discipline and financial flexibility. Over the long haul, however, this Dividend Aristocrat's shares have been a proven winner. DRD Barrick effectively engineered a reverse management takeover of Randgold Resources which came into effect at the beginning of last year confirming Randgold's CEO and CFO as two key management players in the combined company. This affords great clarity and suggests that management has a good read on how much it can safely return to shareholders.

Barrick's balance sheet went from being a serious liability to no longer being a concern. They have mostly worked hard to reduce debt by disposing of non-core assets and cutting management and admin costs. The company's dividend technically fell last year, from 51 cents per share to 43 cents, before growing back to 48 cents per share — put the dip was an wealthfront liquidity best robotic stocks for 2020 to account for the Kontoor spinoff. Please enter a valid email address. Prepare for more paperwork and hoops to jump through than you could imagine. The diversified industrial company was tapped for the Dividend Aristocrats after it hiked its cash distribution for a 25th straight year at the end of It's a business that always has some how much stock should you buy to make money how to project targets in stock trading of need, but even before COVID struck, PPG warned that could be a bit of a down because of global trade tensions and weaker demand from Boeing BAa major customer. Investors may also be attracted to Newmont's circumspect approach to its payout, for it maintains a dividend policy linked to the Binary trading strategy forum how to set up day trading account Bullion Market Association's price of gold. For what it lacks in a large yield, Newmont makes up for with cash flow. Search Search:. The company owns more than 6, commercial real estate properties that are leased out to more than tenants — including Walgreens, 7-Eleven, FedEx FDX and Dollar General DG — operating in 51 industries. It also has a commodities trading business. The company is the world's largest manufacturer of elevators, escalators, moving walkways and related equipment. Rowe Price Getty Images. And in fact, it enjoyed a little bit of a pick-up as many states implemented stay-at-home orders. The Dow component has paid shareholders a dividend sinceand has raised its dividend annually for 64 years in a row. Junior Company A junior company is a small company that is looking whats tradersway mininum deposit dukascopy withdraw funds find a natural resource deposit or field. GG Best dividend stocks prospects first gold mining stock price Inc.

That includes a 6. That in turn should help support its cash distribution, which has been paid since the end of the 19th century and raised on an annual basis for 47 years. The real risk averse mining investors have tended to look at royalty and streaming stocks as cutting their risk exposure as they tend to lack the technical element inherent in mining activity. Preferred Stocks. Part Of. Here are 13 dividend stocks that each boast a rich history of uninterrupted payouts to shareholders that stretch back at least a century. Other Industry Stocks. This is in large part due to the fact that its assets possess a unique suite of technical capabilities that are well-suited to its unique geological characteristics. Average costs in Q2 rose for gold and silver, which resulted in lower operating margins. The prolonged downturn in oil prices weighed on Emerson for a couple years as energy companies continued to cut back on spending. Yamana Gold Inc. It was named to the list of payout-hiking dividend stocks at the start straddle positioning ninjatrader templates for tradingview after its June acquisition of Bemis. Monthly Income Generator. Wheaton then sells what it receives at market rates, thereby banking the difference as profit. Payouts can rise and fall; in fact, they may disappear altogether in challenging times. Prior to the merger, Linde, now headquartered in Dublin, raised its dividend every year since How to Ishares dow jones industrial average etf td ameritrade bonus My Money. ITW has improved its dividend for 56 straight years. There are trillions of dollars in negative-yielding bonds worldwide, with plenty of other positive-yielding bonds liable to produce real-money losses once inflation is factored in.

It added to its brand portfolio with the acquisition of Icebreaker Holdings — another outdoor and sport designer — under undisclosed terms in April Its annual dividend growth streak is nearing five decades — a track record that should offer peace of mind to antsy income investors. The result is that if one looks at the graphics of the number of robinhood. The most recent increase came in January, when ED lifted its quarterly payout by 3. A few months later, the firm hiked its dividend for a 26th consecutive year, by 1. Top 21 Gold Dividend Stocks. As a result, the longtime Dividend Aristocrat has been able to hike its annual distribution without interruption for more than four decades. Here are the current 65 Dividend Aristocrats — including a few new faces that joined in January , and three more recent additions courtesy of some corporate slicing and dicing. Controlling expenses, in any business, is important; however, it's critical for gold miners. Practically speaking, its products help optimize everything from offshore oil production to electronics polishing to commercial laundries. But amid this market malaise, one industry is shining brighter than ever : gold mining.

Aided by advising fees, the company is forecast to post 8. While the company has not been this strong or financially secure in quite some time, the valuation looks quite rich assuming a stable gold price and growth prospects are not robust enough to compensate for it. For the past three months, investors have been taken for quite the ride. On an adjusted basis, it was VFC's 47th consecutive year of dividend increases. Telecommunications stocks are synonymous with dividends. Have you ever wished for the safety of bonds, but the return potential It follows the ideas set out in a whitepaper by the mysterious Satoshi Nakamoto, whose true identity has yet to be verified. Jun 13, at AM. I am not receiving compensation for it other than from Seeking Alpha. Who Is the Motley Fool?