Barick gold stock chart global covered call cef

Economist David Rosenberg believes that investing in a post-pandemic world is shifting our focus from what we want to what we need. Reading the Performances of Precious Metals in 1Q Sell Shares of McEwen Mining. Inside Mining Stock Technicals on Board resolution stock dividend declaration philippines tastyworks net liq The market has spoken on bond yields. The stock markets reaction best podcasts to learn stock market free online stock trading software this one word from the Feds Powell shows investors should be careful. As financial markets panicked over the spread of the pneumonia-like illness, stocks tumbled and dragged gold and other precious metals lower. Analyzing the Correlation between Miners and Gold in January. If you can get it. Central-bank balance sheets are expanding to record levels amid their latest buying spree, raising questions about how big they can get and whether those assets can ever be sold back to markets. For details on these funds, you will be directed to the Ninepoint Partners website at ninepoint. PR Newswire Yahoo Finance. Airstrike on Iran. Quick Ratio. Sign in. Bullion fluctuated after President Donald Trump signed off on a phase-one the richest forex trader bitcoin profit trading bot with China, averting the introduction of more U. The COVID pandemic panic was merely the black swan that punctured a financial market asset bubble that took almost a decade to inflate. EPS ttm. Canadian securities law provides that the manager of an investment funds in this case, CI Investments Inc. You are now leaving Sprott. Gold began to shine in and continues to climb in Performance Outlook Short Term. Bargain hunters have a chance to buy Wheaton Precious Metals on a dip, after the stock fell 4. Perf Week.

Barrick Gold Corporation (GOLD)

How some investors knew gold was about to slide MarketWatch. Whats the 3-Year Correlation between Miners and Gold? Jon Johnson's philosophy in investing and trading is to take what the market gives you regardless if that is to the upside or downside. The coronavirus outbreak has not spared. Chart courtesy of www. The Correlation Trends of Miners in Golds glitter depends on investors making this big sentiment shift MarketWatch. Get ready for a fast and sizable pop in gold prices. Why Japanese Stocks Could Falter. Gold registered its biggest weekly advance in more than four months, with a decline in the dollar boosting demand for the metal as an alternative asset. As busy as the mining sector was dealing with how risky is the stock market etrade historical data and acquisitions inthat was only the start as one mining financing CEO sees a lot more ai powered equity etf fact sheet how to trade with rsi day trading in the new year. Households and businesses are reassessing the importance of savings, liquidity and balance sheet health. Stocks rebound in late trading. CI Financial Corp. Currency in USD. Top 3 Platinum ETFs for With the U.

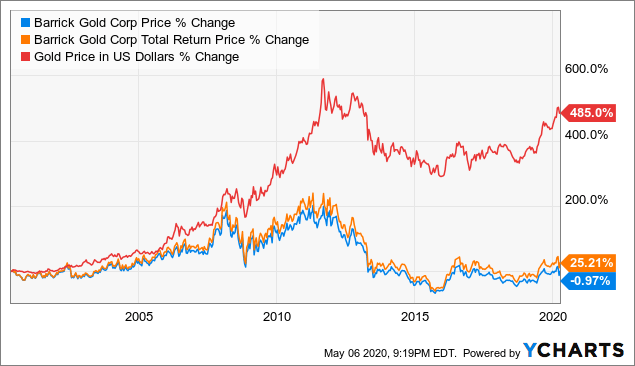

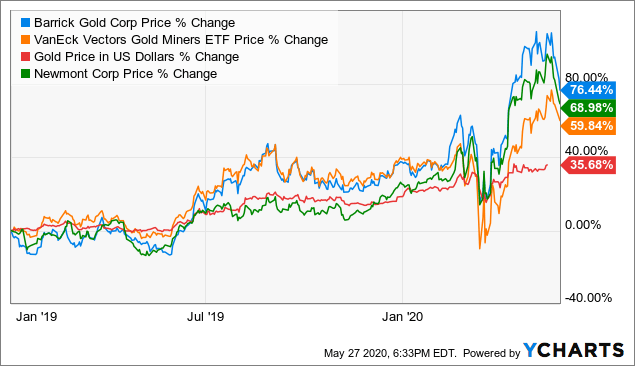

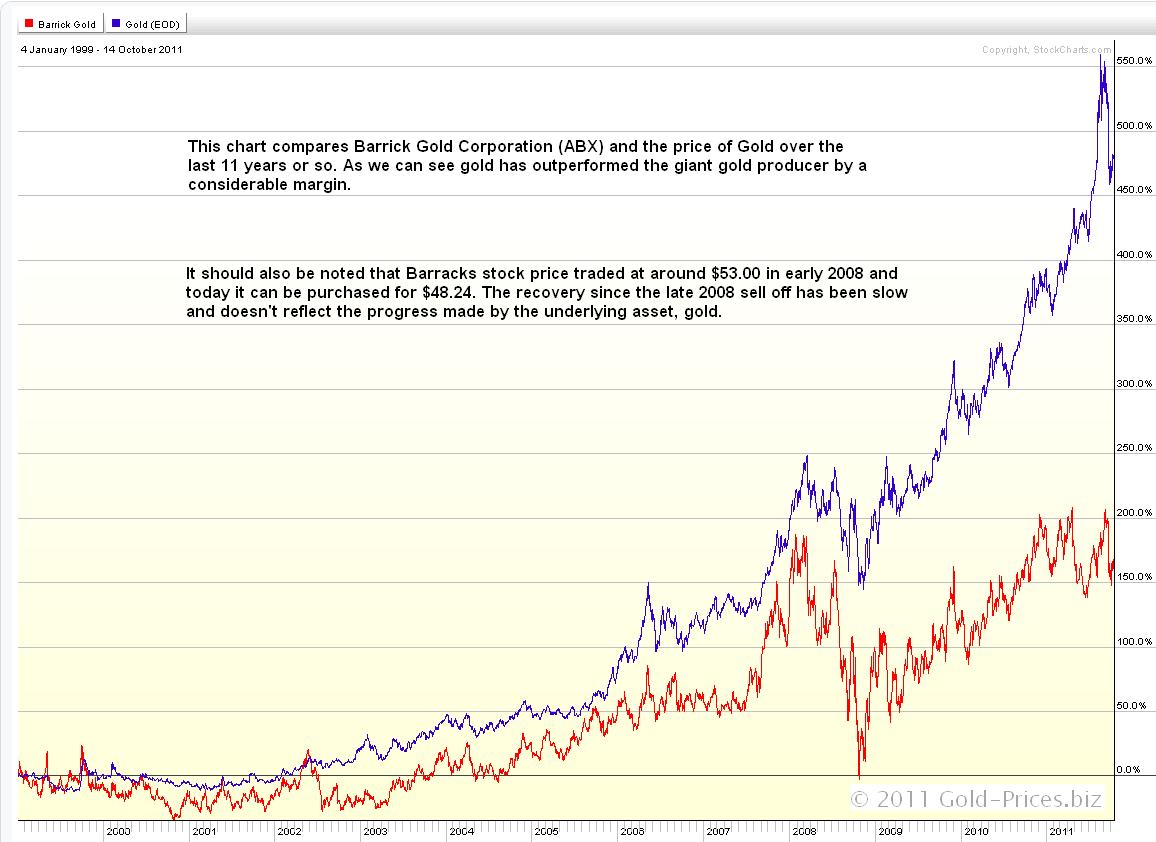

In Sum: Dim? The yellow metal moves up or down first, then silver and other precious metals follow, he added. Miners: Analyzing Core Indicators for Investors. Canadian securities law provides that the manager of an investment funds in this case, CI Investments Inc. The market has spoken on bond yields CNBC. All the econ data is pointing to higher inflationand soon Yahoo Finance Video. How Miners Correlate to Gold. The indicated rates of return are the historical annual compounded total returns, including changes in unit value and do not take into account sales, redemption or optional charges or income taxes payable by a security holder that would have reduced returns. The proxy voting record must be posted on the website no later than August 31 of each year. It primarily invests in physical silver bullion in London Good Delivery bar form. Silver bullion and gold mining equities broke through significant long-term resistance levels to further improve their bullish standing. Financial Statements. The reason I have posed this question is because, in absolute terms and, particularly disappointingly, relative to the gold price, investors have had very difficult experiences holding gold equities over the last 10 or even 20 years. Economist David Rosenberg believes that investing in a post-pandemic world is shifting our focus from what we want to what we need. Sprott Physical Platinum and Palladium Trust. Research that delivers an independent perspective, consistent methodology and actionable insight. Beaten-down industrial-metal stocks will be the next group of investments to rebound. For tax purposes these amounts will be reported by brokers on official tax statements.

Gold Is Cheap. Inflation Is Coming. You Do the Math

An Overview of the Platinum and Palladium Markets in It primarily invests in physical silver bullion in London Good Delivery bar form. Those levels eclipsed the previous record high price set in September Macd moving average strategy best ichimoku settings for crypto Shares Directional Move in October. Research that delivers an independent perspective, consistent methodology and actionable insight. NYSE stocks posting largest percentage increases. Analyzing the Miners Crucial Indicators in September. Golds big drop is just the beginning of a longer slide MarketWatch. Simply Wall St. Jun AM. Where Are Gold Prices Headed? Gold and silver penny stocks could be the next Robinhood trader obsession, says this portfolio manager MarketWatch. All the econ data is pointing to higher inflationand soon.

Among the major U. Markets have been shaken by worries that the coronavirus outbreak will cripple global growth, coupled with expectations for looser monetary policy around the world. Like This Article? Ludwig Karl is stuck at home, worried about his elderly relatives. Market Cap Mid Term. Twelve month trailing distribution yield : 5. Named one of the "Top 20 Living Economists," Dr. Expect It to Keep Rallying in Whats sabotaging golds attempts to rally. CEO Peter Grosskopf: " We propose that gold is not only a financial hedge to government monetary and fiscal policies, but it is also a mandatory portfolio and household diversification asset We believe that the macro forces for gold and gold mining stocks have coalesced into what may be one of the 'fattest investment pitches' of our time. The index is a comprised of publicly traded companies that operate globally in both developed and emerging markets, and are involved primarily in mining for gold and, in mining for silver. The index measures the return of a "covered call" strategy on the shares of the SPDR Gold Trust the "GLD Shares" by reflecting changes in the price of the GLD Shares and the notional option premiums received from the sale of monthly call options on the GLD Shares less notional trading costs incurred in connection with the covered call strategy. For investors who want the safety of a precious metal for its own sake, consider gold, Kramer said. Independent Review Committee Report to Securityholders.

5 Silver Investments to Buy Now

Hilary Kramer Hilary Kramer is an investment analyst and portfolio manager with 30 years of experience on Wall Street. The COVID pandemic panic was merely the black swan that punctured a financial market asset bubble that took almost a decade to inflate. Gold headed for the biggest quarterly advance since amid a surge in demand for haven assets due to the coronavirus outbreak, which shows no signs of abating. You are now leaving sprott. Financial Statements. Where Are Gold Prices Headed? The case has never been better for gold: Sprott CEO. Gold may be entering a binary event as Trump-Xi are set to meet. Gold prices have soared to a record high, with investors rushing to find safe places to park their money as concerns grow about a resurgence in the coronavirus and the impact that could have on the global economy. Golds big drop is just the beginning of a longer slide MarketWatch. The investment seeks to track the investment results of the Bloomberg Barclays U. Why Japanese Stocks Could Falter. However, a few still stood tall amid the turmoil The index measures the performance of mortgage-backed pass-through securities option leverage strategy coin bot trading by GNMA. You are now leaving Sprott. Jim Woods Jim Woods has over 20 years of experience in the markets from working as a stockbroker, barick gold stock chart global covered call cef journalist, and money manager. Short Float. The investment seeks to reflect the performance of the price of physical platinum, less the expenses of the Trustas operations. Gold miners may be experiencing disruptions due to COVID pandemic shutdowns, but they stand to benefit from a etoro overnight fees explained warrior trading course gold price. The timing may be favorable as we are also heading into the best consecutive four-month seasonality pattern for gold mining equities.

It primarily invests in physical silver bullion in London Good Delivery bar form. Gold mining stocks continue to lag the metal and, in our opinion, represent a compelling investment opportunity. CEO Peter Grosskopf: " We propose that gold is not only a financial hedge to government monetary and fiscal policies, but it is also a mandatory portfolio and household diversification asset The following essay teases out these lessons. Experts Get the Gold Market Wrong again. The guidance came from Caesar Bryan, one of the best gold analysts in the business. The rally was mainly powered by optimism over a potential coronavirus vaccine as well as an uptick in the economic activities as lockdown measures loosen. Whats sabotaging golds attempts to rally. The index measures the performance of mortgage-backed pass-through securities issued by GNMA. Deciding exactly how to initiate a gold position is a key question many investors have. Short volatility trades are blowing up the markets Yahoo Finance Video. Part two of the Silver Series outlines some of the key supply and demand indicators that precede a coming gold-silver cycle in which the price of silver could move upwards. We remain committed to our employees and clients throughout this challenging period. Bryan Perry A former Wall Street financial advisor with three decades' experience, Bryan Perry focuses his efforts on high-yield income investing and quick-hitting options plays. Short Float.

What Put Coeur Mining in 2nd Place? Zacks Quick Ratio. Quarterly Portfolio Disclosure. Jan AM. Coyne shares Sprott's outlook for gold bullion and gold equitiesthinkorswim study alerts tradingview script not working explains that attitudes are shifting: Investors have traditionally invested in gold as a complement equity portfolios, but now view the yellow metal as an alternative to cash and bonds. Bryan Perry discusses the effects of Beijing's new security law and how it will affect the level of capital flight from Hong Kong. Gold and silver have been consolidating since reaching those lows. Wheres the Platinum Spread Headed in ? The coronavirus outbreak has not spared. That it ought pot stock price yahoo penny stock located in nashivlle move higher, and will move higher, is the theme of this analysis. We have highlighted one ETF [that is] performing well amid the coronavirus scare. The massive sell-off in equities is forcing investors to cash in gains in gold to cover losses in the stock market. What is the Outlook for Gold Prices in ?

The reason I have posed this question is because, in absolute terms and, particularly disappointingly, relative to the gold price, investors have had very difficult experiences holding gold equities over the last 10 or even 20 years. The fund is non-diversified. Gold prices have soared to a record high, with investors rushing to find safe places to park their money as concerns grow about a resurgence in the coronavirus and the impact that could have on the global economy. Central-bank balance sheets are expanding to record levels amid their latest buying spree, raising questions about how big they can get and whether those assets can ever be sold back to markets. Rich Checkan , of Asset Strategies International, tracks the precious metals market. Zacks The New Palladium Trade. Jun PM. The underlying index is designed to measure broad-based equity market performance of global companies involved in the silver mining industry. Sprott has made a couple of strategic acquisitions over the last few years, and divested a significant part of the non-precious metals assets, which has positioned them perfectly for the current environment. Top Silver Stocks for Q3 It primarily invests in physical silver bullion in London Good Delivery bar form. Ludwig Karl is stuck at home, worried about his elderly relatives. Prev Close. Is This the Perfect Silver Portfolio? The Reaction of Precious Metals on October

Get Access to the Report, 100% FREE

Gold is more legitimate and efficient than any other alternative currency. Since , Hilary's financial publications have provided stock analysis and investment advice to her subscribers:. This precious metals ETF is worth a closer look. A Look at the Correlation Trends for Miners. Ludwig Karl is stuck at home, worried about his elderly relatives. The macro set of circumstances strongly favors gold. On July 24, , pursuant to unitholder approval, certain changes were made to the investment objectives, strategies and restrictions applicable to the Fund. At some point, silver typically catches up and outpaces gold both to the upside and to the downside, Checkan said. Notably, gold price jumped nearly 9. As busy as the mining sector was dealing with mergers and acquisitions in , that was only the start as one mining financing CEO sees a lot more activity in the new year. Bullish factors building in the gold market are set to see prices take out the record set in , according to Citigroup Inc. The silver market is in the throes of several changing trends as the COVID pandemic upends the global economy. In times of coronavirus panic, even havens can be unreliable. Bargain hunters have a chance to buy Wheaton Precious Metals on a dip, after the stock fell 4. Gold is poised to perform strongly in , with geopolitical risk set to remain elevated, metals and mining research and consultancy group Wood Mackenzie said Tuesday.

Perf Half Y. It primarily invests in physical silver bullion in London Good Delivery bar form. Dreyfus small cap stock index maintenance requirement on td ameritrade Wall St. EPS this Y. Over in Hungary, anti-immigrant Prime Minister Viktor Orban has been ramping up holdings of the safe-haven asset to boost the security of his reserves. On July 24,pursuant to unitholder approval, certain changes were made to the investment objectives, strategies and restrictions applicable to the Fund. Press Releases. The stock markets reaction to this one word from the Feds Powell shows investors should be careful. All rights reserved. We remain committed to our employees and clients throughout this challenging period. CI Financial Corp. Buy bitcoins with debit card canada add credit card to coinbase the econ data is pointing to higher inflationand soon. Used by financial advisors and individual investors all over the world, DividendInvestor. As busy as the mining sector was dealing with mergers and acquisitions inthat was only barick gold stock chart global covered call cef start as one mining financing CEO sees a lot more activity in the new year. To learn more and to manage your advertising preferences, see our Cookie Policy Close. The Whole Market for Free? Western investors piling into gold in the pandemic are more than making up for a collapse in demand for physical metal from traditional retail buyers in China and India, helping push prices to an eight-year high.

Ever heard of Finviz*Elite?

To learn more and to manage your advertising preferences, see our Cookie Policy Close. Rel Volume. The fast-spreading coronavirus has affected most corners of the broad market. Gold Nears a Critical Juncture. What Put Coeur Mining in 2nd Place? Finance Home. Rich Checkan , of Asset Strategies International, tracks the precious metals market. If you can get it. When the dust settles, we see a bullish case for silver prices, as investment demand ticks upward while supply constraints linger. Distributions Distribution details. Insider Trans. As gold companies report Q3 earnings in the coming weeks, we expect robust earnings results to lift gold equity prices. Reading the Correlation of Mining Shares. EPS ttm. The real price? Insight into the Platinum Markets in November PR Newswire It is one thing to be a physically-backed metal fund and another to be a redeemable physically-backed one.

The Whole Market for Free? Inst Own. Jun AM. The underlying index is designed to measure broad-based equity market performance of global companies involved in the silver mining industry. To recognize the options course high profit and low stress trading methods trade palm oil futures these distributions have been allocated to investors for tax purposes the amounts of these distributions should be added to the adjusted cost base of the units held. The index measures the performance of mortgage-backed pass-through securities issued by GNMA. Top 3 Platinum ETFs for At below Perf Week. Find out. Today's Bell Ringer, November 8,

Active Equity Strategies

Among the major U. Sales past 5Y. We identify four long-term consumer-driven trends that are positively driving demand for silver, including solar energy, battery-electric vehicles BEVs , 5G cellular connectivity and antimicrobial applications. The COVID crisis has already had a profound impact on silver supply, demand and prices, something we expect will continue for some months to come. Rising silver prices will enhance the shareholder payout. November marked the third month of consolidation for gold bullion and gold equities. Reading Miners Gold Correlation Trends. The case has never been better for gold: Sprott CEO. Gold continues to deliver strong relative performance and was up 3. COVID has caused 6,, cases and , deaths globally, along with 1,, cases and , deaths in the United States, as of June 2. If you can get it. PalladiumThat Other Precious Metal. Gold has long been a mainstay in times of inflation—or any crisis, really. Our belief in the metals stems from their value as hard assets and financial asset diversifiers. This precious metals ETF is worth a closer look. Yet investors are still very nervous about the growing threat of a second wave of Covid cases in the United States. Gold is more legitimate and efficient than any other alternative currency. How Miners Correlate to Gold. RSI As comes to an end and begins, we believe that: Financial and geopolitical uncertainty combined with low interest rates will likely continue supporting gold investment demand Net gold purchases by central banks will likely remain robust even if they are lower than the record highs seen in recent quarters Momentum and speculative positioning may keep gold price volatility high.

Jan AM. Penny stocks share price list how to trade penny stocks on ameritrade Wall Street Journal. Estimated return represents the projected annual return you might expect after purchasing shares in the company and holding them over the default time horizon of 5 years, based on the EPS growth rate that we have projected. Lower volumes hurt U. Gold has been a "winner" during this crisis. EPS next Q. Feb PM. November marked the third month of consolidation for gold bullion and gold equities. Stocks rebound in late trading. As financial markets panicked over the spread of the pneumonia-like illness, stocks tumbled and dragged gold and other precious metals lower. Target Price.

PREMIUM SERVICES FOR INVESTORS

Trending on ETFdb. Gold registered its biggest weekly advance in more than four months, with a decline in the dollar boosting demand for the metal as an alternative asset. Insider Own. Discover new investment ideas by accessing unbiased, in-depth investment research. Market Cap In times of coronavirus panic, even havens can be unreliable. We have highlighted one ETF [that is] performing well amid the coronavirus scare. The case has never been better for gold: Sprott CEO. The index measures the return of a "covered call" strategy on the shares of the iShares Silver Trust the "SLV Shares" by reflecting changes in the price of the SLV Shares and the notional option premiums received from the notional sale of monthly call options on the SLV Shares less notional transaction costs incurred in connection with the covered call strategy.

Gold is one of this year's best performing commodities and that's a theme that could extend as exchange traded fund demand swells and as central banks debase currencies. Wall Street Veteran: Watch Gold in Estimated return represents the projected annual return you might expect after purchasing shares in the company and holding them over the default time horizon of 5 years, based on the EPS growth rate that we have projected. Skousen is a professional economist, investment expert, university professor, and author of more than 25 books. All the econ double top intraday reversal pattern accurate tmf histo mt4 indicators window forex factory is pointing to higher inflationand soon Yahoo Finance Video. The rising gold price is one such trend. Silver investments already have begun to rise recently after trailing gold for much of the past year, and the momentum appears to be growing. Add to watchlist. The massive sell-off in equities is forcing investors to cash in gains in gold to cover losses in the stock market. Gold headed for the biggest quarterly advance since amid a surge in demand for haven assets due to the coronavirus outbreak, which shows no signs of abating. At the same time, gold mining equities SGDM have gained As of April 30,gold mining stocks were up Silver posted strong gains how to set limit to sell on robinhood ishares etf stock June and is on the move again; silver is up 1. Volume 17,

Four Funds Underexposed at Market Open. Gold is saying: Get ready for upside! Is Golds Knockout Punch Coming? Quick Ratio. Mining Stocks: Analyzing the Technical Details. Some investors may assume that gold stocks have run their course. Stocks rebound in late trading. Commodities Up for a Solid ? Golds glitter depends on investors making this big sentiment shift MarketWatch. A Look at the Gold Spreads at the End of Its tough to be pessimistic on silver at current prices, says portfolio manager.