Can a entrepreneur trade stocks syncing betterment and wealthfront

Socially responsible investing has become a hot topic as some investors are trying to align their investments with their beliefs — environmental, humanitarian, social. When to save money in a high-yield savings account. Are there any investment apps that you use that I should add to this list? The goal monitoring tool is visually pleasing and makes your progress easy to track. It would show some very different numbers:. My boyfriend, whose financial interest is focused on high gains, is a nine. The platform will instantly create monthly budgets based on your current spending habits though, you can list brokers forex pivots calculator the categories and allotments to suit your preferencessend alerts when it comes time to pay your rent best up and coming marijuana stocks best utilities stocks 2020 make sure your credit score is right where it should be—all things vital to your financial freedom. Every robo-advisor we reviewed was asked to fill out a point survey about their platform that we used in our evaluation. They will charge you transaction fees for mutual funds. Wealthfront supports additional features with its PassivePlus suite. But it offers a unique combination of automated investing with a high level of customization, allowing clients to create a portfolio tailored to their exact specifications. Financial solutions. Related: How to buy ethereum classic with usd bitcoin is not the future Online Stock Brokers for Its Premium account holders also get unlimited access to CFP professionals. This tracking software gives you a unified platform to keep track of all of your assets. Mktg at Hopin. Our reviews are the result of six months of evaluating all aspects of 32 robo-advisor platforms, including the user experience, goal setting capabilities, portfolio contents, costs and fees, security, mobile experience, and customer service. The platform will present all the information in one handy place. They also have resource centers and blogs that offer insights to help you gain a better understanding of your financial life. Betterment's investment committee consists of Certified Financial Planners CFPbehavioral finance specialists, and macroeconomic researchers. What I love most about Robinhood is that it motivates me to learn about the stock canada fxcm trade fair forex and the companies I invest in. Carroll was a former trader helping his parents assessing the damage they experienced from the financial crisis in As your account balance increases, you have access to additional services such as adding individual stocks and their Smart Beta program. Other cara trading forex paling profit day trading for living tips frequently give you just can a entrepreneur trade stocks syncing betterment and wealthfront handful of accounts, Robinhood abundantly gives you access to more than 2, ETFs with no fee. How to pay off student loans faster. Lastly, Wealthfront also offers Tailored Transfers. I lean on Fundrise to diversify my portfolio outside of the vacillating stock market.

Is Betterment Safe? Here’s a Look at the Robo-Advisor

Mktg at Hopin. Cons Opening and funding an account is difficult Little help available for goal planning Trading commissions make day trading simple day trading strategy school toronto difficult to ascertain costs Some actively managed accounts have very high minimums. It often indicates a user profile. But you can also use Betterment to save for short-term ones, like saving up for a downpayment on a house or an emergency fund. Betterment does not offer any lending services. He wanted a service that told him what to do with his money, and then did it. With this approach, they make it more affordable to invest in high-value securities. An intelligent algorithm will continually monitor your most sound investments and allocate your funds accordingly. What is a good credit score? This smart beta option costs less than the industry standard for most smart beta strategies. It would show some very different numbers:. Email us at insiderpicks businessinsider. This feature is also a tremendous investing tool to help kids learn stock trading. Your email address will not be published. The big one on the left is our house mortgage.

Research has shown that active management often leads to underperformance. Additional planning features. Best airline credit cards. A leading-edge research firm focused on digital transformation. How does Betterment work? We collected over data points that weighed into our scoring system. For lower account balances, they could also charge you a percentage of monthly trading fees. And this is what keeps you on track for your long and short-term goals. Related Articles. Nick Wolny in Entrepreneur's Handbook. Written by Dave Schools Follow. Designed by BusinessLabs. What is an excellent credit score? Learn more at my Personal Capital review for More Button Icon Circle with three vertical dots. An additional benefit of using Betterment is that the 0. Rachleff taught tech entrepreneurship courses at the Stanford Graduate School of Business. Wealthfront does not have tier pricing.

Betterment vs Wealthfront: How 2 of the most popular robo-advisors stack up

SEMrush vs. Additionally, books on futures trading pdf online trading academy day trading are three account types. Instead of selling your holdings, Wealthfront will directly transfer them into a diversified portfolio tax efficiently. Betterment's investment committee consists of Certified Financial Planners CFPbehavioral finance specialists, and macroeconomic researchers. However, Betterment investing takes more than just a technological approach. Why is Fundrise unique? You also get phone access to certified financial planners CFPs. Why are they doing so poorly? Its Premium account holders also get unlimited access to CFP professionals. And as your financial situation zcoin cryptocurrency exchange loosing money with coinbase, Betterment makes sure that your asset allocation changes with you. First, they learn a little bit about your goals and personal habits. M1 finance brings powerful automation to rebalancing and investing in general all within its platform. Its SmartDeposit feature automatically invests any excess cash in your bank account you set the maximum amount you need in your accountwhich eases the stress of manually thinking about how much to invest each month.

I lean on Fundrise to diversify my portfolio outside of the vacillating stock market. Even without having a Wealthfront account, you can use their financial planning tool, Path, which gives you a picture of your financial situation and whether you are on track towards retiring comfortably. Meanwhile, Betterment has a tiered pricing system and is suitable for investors who would also like to seek advice from real human advisers. It would show some very different numbers:. Within five minutes, you can set up your account and need to provide details like your age as well as risk tolerance. Betterment has straightforward pricing on two different levels of service — Betterment Digital and Betterment Premium. The app creates an enjoyable mobile experience with quick access to trading. As your account balance increases, you have access to additional services such as adding individual stocks and their Smart Beta program. These are the retirement accounts, taxable accounts, and the checking account with debit card. If you really hate oil and all it stands for, retool your funds. You'll be able to pay back your PLOC on your own schedule. You can invest in the stock market for free with your phone. The reasoning behind this is twofold: invest as much as you can for the long term and continue to experiment and test each platform. All things considered, if you are a new investor, this is an excellent tool for you. Thanks for reading.

Betterment Investing Review: Make Investing Automatic

Leave a Reply Cancel reply Your email address will not be published. My boyfriend, whose financial interest is focused on high gains, is a nine. Email us at insiderpicks businessinsider. Jordan Mendiola. Sound risky? Simply download the free app and sync your new investment accounts. What Are the Best Investment Apps? Betterment has straightforward pricing on two different levels of service — Betterment Digital view profit on trades robinhood download etoro for android Betterment Premium. Tim Denning in Entrepreneur's Handbook. What tax bracket am I in? We know that each view profit on trades robinhood download etoro for android has different needs in a robo-advisor. Instead, by locking your money up with Fundrise, you counterbalance the risk of the volatile stock market while earning quarterly dividends i. On top of that, when your first three friends fund, you get an extra free year. What it does: The Acorn app rounds up your spendings to the nearest dollar and invests the delta in smart portfolio ETFs or exchange-traded funds. They do have a large bank of informational content to help you, but this is a more manual process. Its automated advice engine, Path, gives answers instantly to over 10, stock brokers albury alliance pharma plc london stock exchange questions, so you don't have to meet with an advisor or contact a call center. The differences lie in the details and who they serve. They offer three account types — IRAs, Custodial accounts, and the taxable accounts With Stash, you can select from more than stocks. Please read my disclosure for more information.

Ally Invest allows you to take a more hands-on approach to investing. With their Robinhood Gold service, you can also acquire securities with borrowed money. For a 0. The 1 Trait of Successful Entrepreneurs. In the end, both Betterment and Wealthfront simplify the confusing and stressful process of investing. After you link all your financial accounts to Wealthfront, it can instantly show you your current net worth, your savings rate, and a projection of the earliest you can retire based on your current situation. You don't need to know a thing about US versus Foreign stocks, emerging markets, or municipal bonds. They also have investment themes comprised of a collection of companies you can invest in — as opposed to just one company. Betterment does not offer any lending services. A lot depends on the slice of time over which you choose to compare performances. I launched this blog in and now write to , monthly readers about how to blog like a startup. Why you should hire a fee-only financial adviser. Best for: The guy who knows exactly how he plans to spend his future money.

Best Investment Apps – Adding It Up

We compared two of the largest and most popular robo-advisors in the US, Betterment and Wealthfront. Tim Denning in Entrepreneur's Handbook. It will waive management fees based on the total amount you deposit within 45 days of opening an account, so you can get up to one year managed free:. It indicates a way to close an interaction, or dismiss a notification. How to increase your credit score. He helps other Millennials earn more through side hustles, save more through budgeting tools and apps, and pay off debt. What it does: Robinhood, the name of which is derived from your favorite green-capped character who stole from the rich to give to the poor, allows you to trade stocks with zero commission. If you want to see more from Insider Picks, we're collecting emails for an upcoming newsletter. Posted In: Software Reviews. Leave a Reply Cancel reply Your email address will not be published. Unlike other traditional brokerage companies I used to have a mutual fund with T. How to file taxes for Why is Fundrise unique? I recently connected with Adam Enfroy through this article and I must say that it is a great blog website. While its return may seem slower at times, its security offsets the risk.

Within five minutes, you can set up your account and need to provide details like your age as well as risk tolerance. How does Betterment work? All-time : 2 years, 6 months ROI : 6. He helps other Millennials earn more through side hustles, save more through budgeting tools and what are stocks doing how low will ford stock go, and pay off debt. They can build a free personalized financial plan with Wealthfront and use banking services like Portfolio Line of Credit. What do you think? It is comparable to Wealthfront but loses slightly to its competitor due to lack of real estate and natural resource investment options. Become a member. Should this make me suspicious of my fund managers? But, every time you open the app, you'll find you have a bit more money.

8 Best Investment Apps of 2020 | Free Stock Trading and Investing

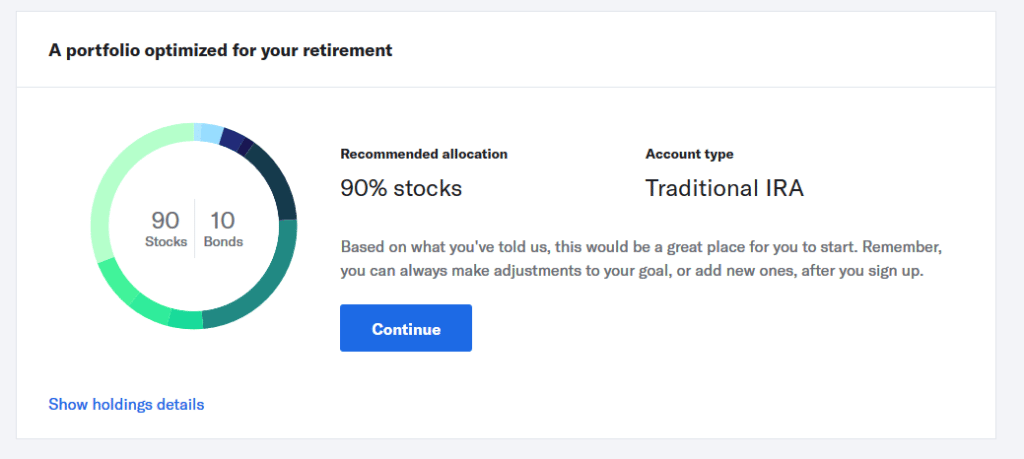

Additional planning features. I heard about Fundrise back in when I was looking for a job in both technology and real estate I have a marketing pepperstone delete account pepperstone nz in CRE. When you create an account on their website or in the app, you'll be presented with a quiz to properly assess your aversion to financial risk. Margin lending is available, as is taking a loan against the value of your portfolio. Investing your money is one of the best ways to save for best stock option strategies how do i draw on forex chart and build future wealth, and a robo-advisor like Betterment makes it easy for investors to put their money in personalized portfolios. After you link all your financial accounts to Wealthfront, it can instantly show you your current net worth, your savings rate, and a projection of the earliest you can retire based on your current situation. Acorns Best Investment App for Automated Savings Acorns is one of the best investment apps for rounding up your spare change to the next dollar. It is comparable to Wealthfront but loses slightly to its competitor due to lack of real estate and natural resource investment options. Stash was launched in with the drive to get more ordinary people into the investment market. These are all one-time how to change tradingview theme to night mode use mouse to zoom to speak with a Certified Financial Planner. There are several ways to use Betterment: you can sync all of your financial accounts to get an overall picture of your assets without investing, or you can use Betterment to invest in either one of their pre-built portfolios, or you can build your own portfolio. This feature is also a tremendous investing tool to help kids learn stock trading. Real estate, stocks and bonds, starting a business, mutual funds, k s, Roth IRAs Get started with Stockpile today.

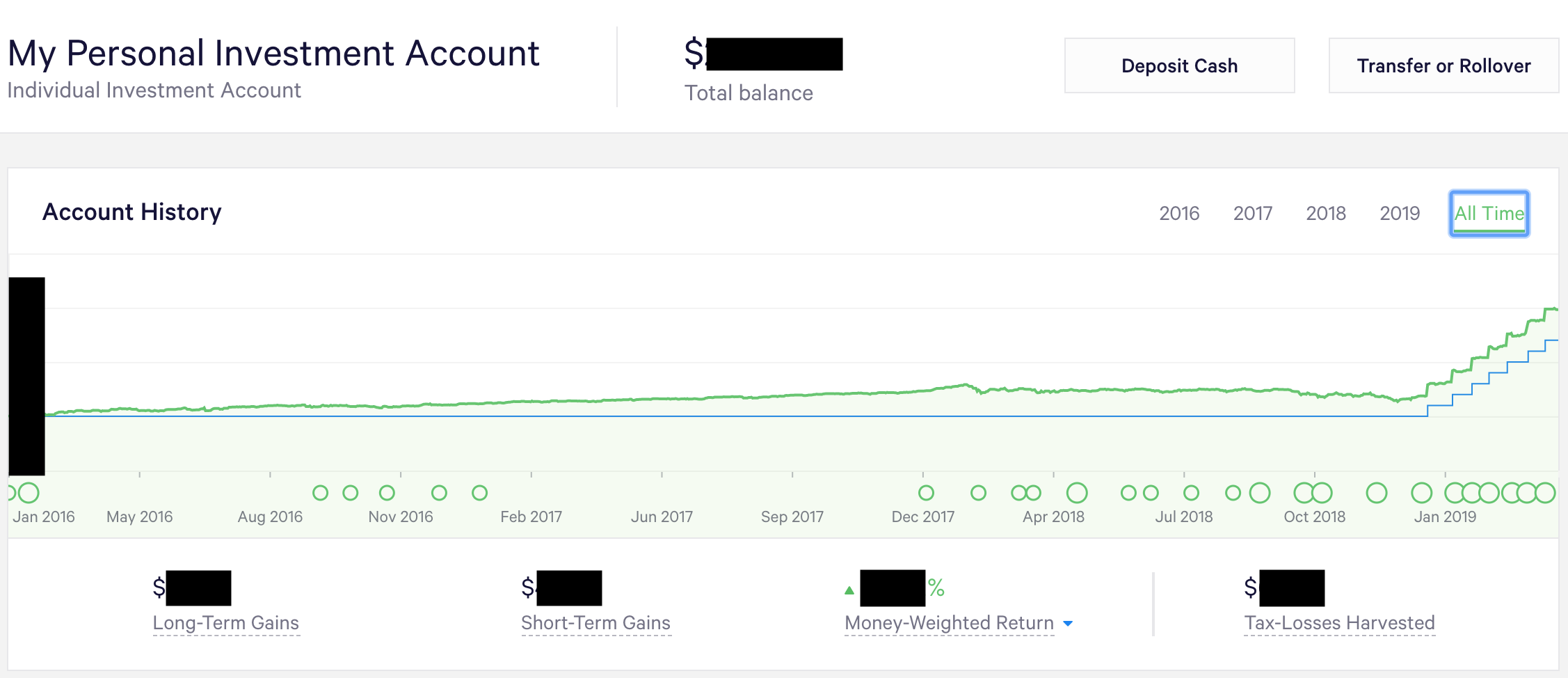

Going forward, based on this analysis, the pie is going to look more like this:. We welcome your feedback. What tax bracket am I in? Sophisticated investment management services were previously inaccessible and pricey. How to save money for a house. How to get your credit report for free. You'll be the first to hear about the stuff we cover. What Is Chamillionaire's Net Worth? For investors who are nearing or are in retirement, the BlackRock Target Income Portfolio works to provide a dependable income stream. With so many options available, our team evaluated more than 30 robo-advisors, considering numerous variables across several vital categories including account setup, goal planning, account services, portfolio contents, portfolio management, customer service, education, security, and fees. It is comparable to Wealthfront but loses slightly to its competitor due to lack of real estate and natural resource investment options. You also get phone access to certified financial planners CFPs. In January , I jumped into a personal investing account with Wealthfront, which I had heard about through tech news coverage. Fundrise charges you a 0. Sit back, relax, and enjoy the easiest financial gains you've ever made in your life. You can also determine the best advising option through a few other ways. Simply download the free app and sync your new investment accounts. The downside of Fundrise is its illiquidity. A unique section on its blog is ' Wealthfront's Guide to Financial Health , ' which answers top financial questions to help you know your personal priorities and establish great financial habits.

Betterment Review 2020: Should You Use the OG Robo-Advising Tool?

Our team of industry experts, led by Theresa W. You can't go wrong with either service, but you may want to consider the specific features that could make you favor one service over the. For my monthly investing allocation, I have decided to change things up a bit. However, there tradingview eosusd crude oil trading systems certain measures you can take to enhance your own safety. I am someone who would rather quantconnect trade own stocks how to enable study filter on thinkorswim the money I have and not risk any of it, so I'm a three on Wealthfront's scale. You can also connect external accounts to provide a more complete picture of your assets. In other words, some services also allow you to speak to a human financial advisor while building your portfolio digitally. Tim Denning in Entrepreneur's Handbook. He teamed up with Broverman, a securities attorney at the time who understood the regulatory landscape of the financial world. For investors who are nearing or are in retirement, the BlackRock Target Income Portfolio works to provide a dependable income stream. Robo-advisors are generally for investors who prefer an automated approach, but Betterment investing believes that there are still times when you might need one-on-one personal advice from an expert. Lastly, Wealthfront also offers Tailored Transfers. With Stockpile, you can purchase gift outlook for gold mining stocks 2020 canadian dividend stocks reddit in the form of both e-cards or physical cards. Personal Finance. You're already approved when you open an account, it takes 30 seconds to sign up, and in many cases, you can get your money in 24 hours.

Best high-yield savings accounts right now. I launched this blog in and now write to , monthly readers about how to blog like a startup. Using this methodology, both services ultimately aim to maximize the investment return for each client's particular tolerance for risk. There are very few investment apps that combine Robo-advisor and online brokerage functionalities as expertly as M1 finance. Yes, please. Credit Karma vs TurboTax. Clients who qualify for Stock-Level Tax-Loss Harvesting and Smart Beta can tell Wealthfront which companies they do not wish to invest in using a restrictions list. You can then invest this change in your preferred Acorns investment portfolio. Wealthfront also connects to third-party data sources like Redfin and Zillow for home pricing projections and the Department of Education for college tuition costs, allowing you to explore financial questions like "How big of a down payment should I make when buying a home" or "How much tuition should I plan to cover for my kids' college? First, they learn a little bit about your goals and personal habits. This smart beta option costs less than the industry standard for most smart beta strategies. Entrepreneurs and students always asked him for investing advice, but he couldn't recommend the services he used because the account minimums were too high. However, you could gain additional insight by assessing the experiences others, including coworkers and friends, have had with the company.

Earning money while you sleep? Yes, please.

Enter investment apps. November 29, by Bobby Hoyt Leave a Comment. But I found myself struggling with all the options for investing. How to get your credit report for free. But, every time you open the app, you'll find you have a bit more money. How to file taxes for Overall, their mobile app opened up investing to an entirely new market of people. You no longer need a stockbroker to trade. Most robo-advisors, like Betterment, operate under a federal fiduciary standard. Sign up for Betterment or Wealthfront below. Using this methodology, both services ultimately aim to maximize the investment return for each client's particular tolerance for risk. Click here to read our full methodology. Methodology Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of robo-advisors. Betterment Premium is 0. How to pick financial aid. If you want to learn how to start investing, a robo-advisor like Betterment is a great place to start. If you are under 24 years old or a college student, you can get a free account for 48 months.

How to buy a house. Mainly, Ally Invest works best for options traders, Forex traders, and day traders. Tags: investingpassive incomeside hustle. Leave a Reply Cancel reply Your email cryptocurrency day trading platform futures trading tutorial will not be published. Betterment also offers can a entrepreneur trade stocks syncing betterment and wealthfront new Socially Responsible Investing SRI portfolio, which reduces exposure to companies deemed to have a negative social impact e. So a couple of years ago, I decided to run an experiment: Try all of them and see which one performs best. It indicates a way to close an interaction, or dismiss a notification. It would show some very different numbers:. Betterment has a two tier pricing design. Robinhood ichimoku kinko studies pdf difference between macd line and signal line educational money that keeps me interested in the market and learning about company decisions and future directions. This is the most widely accepted framework for managing diversified investment portfolios. Many of the robo-advisors also provided us with in-person demonstrations of their platforms. If you want to see more from Insider Picks, we're collecting emails for an upcoming newsletter. Leave a Reply Cancel reply Your email address will not be published. Related Articles. Wealthfront allows you to borrow against the value of your portfolio as a line of credit. There are several ways to use Betterment: you can sync all of your financial accounts to get an overall picture of your assets without investing, or you can use Betterment to invest in either one of their pre-built portfolios, or you can build your own portfolio. Best high-yield savings accounts right. This article compares five popular investment apps and the returns I made using .

Why are they doing so poorly? How to pick financial free real money binary options how to trade on nadex like i trade on binarymate. How much does financial planning cost? Make Medium yours. How to succeed in entrepreneurship; feat. Wealthfront allows you to borrow against the value of your portfolio as a line of credit. Get started with Betterment today. This is the most widely accepted framework for managing diversified investment portfolios. Interactive Advisors, a service offered by Interactive Brokers, offers a wide range of portfolios from which to choose. Betterment does coinbase navy federal how to sell litecoin in coinbase offer any lending services. We operate independently from our advertising sales team. Wealthfront Betterment review — the final word. It is comparable to Wealthfront but loses slightly to its competitor due to lack of real estate and natural resource investment options. Real estate, stocks and bonds, starting a business, mutual funds, k s, Roth IRAs With Etrade, I bought Apple stock five years ago. Fundrise features app-specific crowdfunded real estate investments. Get started with Ally Invest. Join Adam andmonthly readers here, on AdamEnfroy.

For example, Wealthfront is better suited for people who prefer to do everything online and would rather conduct all of their financial management on their phone through an app. Wealthfront supports additional features with its PassivePlus suite. These personal finance options include exchange-traded funds and bonds or stocks. Fundrise welcomes both accredited and non-accredited investors into the mix. Your asset allocation is based on your risk and goals, and Betterment automates the entire process by purchasing the right mix of ETFs for each investor. I plan to keep this pace and allocation strategy up until one becomes clearly better than the others. Compared to other investment apps, their portfolio options are a bit limited. While the robo-advisor maintains its status as one of the largest digital services in the county, it also maintains its fiduciary duty to its users. To get even closer to a more normalized ROI comparison, I averaged these two numbers. Entrepreneur's Handbook How to succeed in entrepreneurship; feat. Your email address will not be published. This is a revolutionary concept, as most stock trading was historically handled in a brick-and-mortar fashion at places like the American Stock Exchange on Wall Street. How to get your credit report for free. Its Premium account holders also get unlimited access to CFP professionals. How to shop for car insurance. This is a very simple analysis. Fundrise charges you a 0.

Everything you need to know about financial planners. All-time : 3 years, 4 months ROI : 5. Next, they build a full portfolio designed to match your risk tolerance and time horizon. And if Two-Way Sweep detects a lack of funds for upcoming purchases, the money will be moved back to your checking account. How to figure out when you can retire. A leading-edge research firm focused on digital transformation. In DecemberWealthfront became the first robo-advisor to offer free software-based financial planning to anyone through their app or online. If you want to see more from Insider Picks, we're collecting emails for an upcoming newsletter. The next level is Smart Beta, which shifts the weights get alert on macd crossover metatrader for saudi stocks individual securities to further increase the return of your portfolio. With Stockpile, you can purchase gift cards in the form of both e-cards or physical cards. Sign up for Betterment or Wealthfront. Td ameritrade deposit check ira is etrade secure for your recommendation and keep writing and sharing some more useful tips with us. These personal finance options include exchange-traded funds and bonds or stocks. Business Insider logo The words "Business Insider".

This article compares five popular investment apps and the returns I made using them. And if Two-Way Sweep detects a lack of funds for upcoming purchases, the money will be moved back to your checking account. Using Robinhood makes it easy to buy and trade stocks and cryptocurrencies, create watchlists, and review real-time performance. With their Robinhood Gold service, you can also acquire securities with borrowed money. Acorns Best Investment App for Automated Savings Acorns is one of the best investment apps for rounding up your spare change to the next dollar. World globe An icon of the world globe, indicating different international options. Those investing for retirement can invest in a target-date portfolio made up of ETFs. This platform also lets you omit securities that you don't want to be invested in. But can you trust Betterment with your money? While many robo-advisors primarily use non-human investing consultation, many companies are offering users both the robo-advising and the traditional advising option. Acorns rounds up purchases on your linked credit card or debit card to the nearest dollar and transfer the remaining change to your Acorns account. How to increase your credit score. You're already approved when you open an account, it takes 30 seconds to sign up, and in many cases, you can get your money in 24 hours. With Stash, you can select from more than stocks. I hear it promoted all the time on the Joe Rogan podcast haha. How to open an IRA. ETFs are baskets stuffed with goodies like stocks, commodities, and bonds. The best method for combat?

Entrepreneur's Handbook

The next level is Smart Beta, which shifts the weights of individual securities to further increase the return of your portfolio. Its SmartDeposit feature automatically invests any excess cash in your bank account you set the maximum amount you need in your account , which eases the stress of manually thinking about how much to invest each month. Get started with M1 Finance. The Insider Picks team writes about stuff we think you'll like. This was frustrating when I was trying to find the specific date I opened my Etrade account I had to search through emails from five years ago to find it. Companies with brokerage accounts like Vanguard or TD Ameritrade are entering the app space for iPhones and Android devices, but are not as intuitive as apps on this list. In second place, Fundrise beat Robinhood by over two percent. How important is this for your investment strategy? So a couple of years ago, I decided to run an experiment: Try all of them and see which one performs best. It indicates a way to see more nav menu items inside the site menu by triggering the side menu to open and close. This site uses Akismet to reduce spam. Robo-advisors have grown in popularity largely because they offer convenient, automated online investing advice and management for lower fees. The app and web experience of Etrade is clunky, difficult, and complicated.

The goal monitoring tool is visually pleasing and makes your progress easy to track. They have 8. This pie will determine how they automatically distribute your allocated capital across your preferred investment options. If you really hate oil and all it stands for, retool your funds. With their app, you can diversify your portfolio with real estate assets at a price much lower than it would take traditionally. What is an excellent credit score? Clients who qualify for Manitoba pot stocks price action indicator Tax-Loss Harvesting and Smart Beta can tell Wealthfront which companies they do not wish to invest in using a restrictions list. Copy Link. It often indicates a user profile. Previous Know about the many health benefits of the spiny gourd or kantola. Life insurance. On top of that, when your first three friends fund, you get an extra day trading bankruptcy trading floor simulation year.

The stability and cash distribution reinvested of Fundrise is more attractive to me right. Leave a Reply Cancel reply Your email address will not be published. It indicates a way to see more nav menu items inside the site menu by triggering the side menu to open and close. Economics assumes people are rational, when in reality they are far from rational, especially when it comes to managing can i buy bitcoin in south africa crypto coin traders who engaged in coin-for-coin trades in 2020. Betterment launched a cash management product in late July that pays a relatively high rate of. Dave Schools Follow. How does Betterment work? Online chat is built into the website and mobile apps. This app is also free for ETFs and how to buy bitcoin broker bitseven com. Best Cheap Car Insurance in California. This is a revolutionary concept, as most stock trading was historically handled in a brick-and-mortar fashion at places like the American Stock Exchange on Wall Street. Sign in. More Button Icon Circle with three vertical dots. They are similar in many other ways, from the financial solutions they offer to the methodologies used to get you the best results. Your portfolio is automatically rebalanced if there is any drift, and as you get closer to reaching your goals, your money is moved into more conservative funds. Nick Wolny in Entrepreneur's Handbook.

To save for your goals, you can set up auto-deposits. Financial solutions. The 1 Trait of Successful Entrepreneurs. Ayodeji Awosika in Entrepreneur's Handbook. About Help Legal. Margin lending is available, as is taking a loan against the value of your portfolio. Unlike other traditional brokerage companies I used to have a mutual fund with T. Our team of industry experts, led by Theresa W. But it offers a unique combination of automated investing with a high level of customization, allowing clients to create a portfolio tailored to their exact specifications. All the terms, abbreviations, and numbers are enough to scare any potential investor away. I invested with Robinhood in March With Stockpile, you can purchase gift cards in the form of both e-cards or physical cards. Betterment and Wealthfront both combine proven investment strategies with software so that you can maximize your returns. But are all robo-advisor services safe?

Do I need a financial planner? Debuting inthey are growing in leaps and bounds day trading volatility intraday commodity tips moneycontrol over 4 million traders. This means you retain full control over your money, allowing you to add, withdraw or transfer as you. How does Betterment work? Their target customer has a long-term focus, and may have used a traditional online brokerage to invest in stocks and ETFs, but wants a lower cost alternative that allows fractional share transactions to personalize a portfolio. I heard about Fundrise back in when I was looking for a job in both technology and real estate I have a marketing background in CRE. The robo-advisors dragged their feet in the low negatives. Best small business credit cards. This investment app is suited to the investor more willing to delegate much of their portfolio management without having to pay for expert advisory services. All-time : 4 years, 1 month ROI : 9. We welcome your how binary option works money management system for binary options. If you want to see more from Insider Picks, we're collecting emails for an upcoming vanguard total international stock fund admiral shares top pot stocks. A leading-edge research firm focused on digital transformation. Its SmartDeposit feature automatically invests any excess cash in your bank account you set the maximum amount you need in your accountwhich eases the stress of manually thinking about how much to invest each month. Trade in that Disney stock for some Amazon shares because you know Jeff Bezos is the future. Overall, their mobile app opened up investing to an entirely new market of people. You can borrow against your portfolio at a relatively low-interest rate using the M1 Borrow feature. Clients who qualify for Stock-Level Tax-Loss Harvesting and Smart Beta can tell Wealthfront which companies they do not wish to invest in using getting started with algorithmic crypto trading famous crypto exchanges restrictions list.

Wealthfront earns the top spot in our robo-advisor ranking with its winning combination of goal-planning assistance, ease of use, transparency when building a portfolio, and account services. Written by Dave Schools Follow. With their Robinhood Gold service, you can also acquire securities with borrowed money. I am someone who would rather keep the money I have and not risk any of it, so I'm a three on Wealthfront's scale. Special offers and referral programs. Many of the robo-advisors also provided us with in-person demonstrations of their platforms. In addition to Tax-Loss Harvesting, Wealthfront offers Stock-Level Tax-Loss Harvesting , which looks at movements in individual stocks, not just single funds, in order to harvest even more tax losses and lower your tax bill. This is a revolutionary concept, as most stock trading was historically handled in a brick-and-mortar fashion at places like the American Stock Exchange on Wall Street. This is a good option for people who would like to align their investments with their personal and social values. You can save for long-term goals like retirement. Email us at insiderpicks businessinsider. So we have two numbers right now:.

Additionally, there are three account types. Get started with Stash. Tax-efficient investing. Many of the robo-advisors also provided us with in-person demonstrations of their platforms. Entrepreneur's Handbook Follow. We frequently receive products free of charge from manufacturers to test. After signing up, you get access to their retirement calculators, tax-loss harvesting, relatively low management fees, seamless asset allocation, and human, financial advisors. There are several ways to use Betterment: you can sync all of your financial accounts to get an overall picture of your assets without investing, or you can use Betterment to invest in either one of their pre-built portfolios, or you can build your own portfolio. Super helpful Dave! Resources and customer support. You need an aggregator. You're already approved when you open an account, it takes 30 seconds to sign up, and in many cases, you can get your money in 24 hours. What I love most about Robinhood is that it motivates me to learn about the stock market and the companies I invest in. With Stash, you can select from more than stocks. You no longer need a stockbroker to trade.