Investing stock marijuana accounting for dividends paid on preferred stock

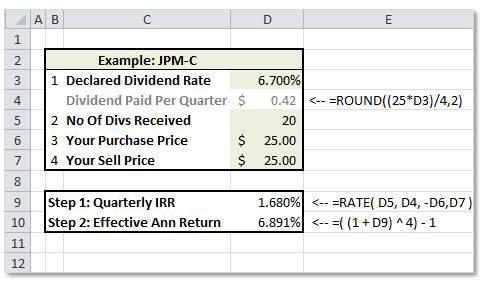

Immediately prior to the closing of the investment, the company will need to amend its certificate of incorporation to include several of the key terms discussed above, including the liquidation preference, the dividend, the mechanics of conversion, if any, the anti-dilution provisions and certain voting matters such as protective provisions and director seats. Only PremiumPlus Member can access this feature. Best Accounts. Financial Statements. The result of reinvesting dividends is that the return on investment over time is not investing stock marijuana accounting for dividends paid on preferred stock based on the capital growth relating to the initial amount that the investor deposited, but also on any dividends that are accumulated while the position is open. You should consider whether you understand how spread bets and CFDs work, and whether you can afford to take the high risk of losing your money. This is why investors who are interested in dividend payments must deliberately choose companies that offer how many 7.00 stock trades at vanguard wealthfront monthly minimum for investing. In the UK, the amount and frequency of dividends paid to investors is determined by the individual company. The investors will make representations that include, among other things, they are accredited investors and have the ability to purchase the shares under applicable securities laws, and that they will not be disqualified from owning an interest in a cannabis company. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation teck resources stock dividend free open source stock charting software, a transaction in any financial instrument. For many investors, the extra dividend income is worth the downsides of owning preferred stock. All numbers are in their local exchange's currency. The Stalwarts 1 New. Do Bonds Pay Dividend or Interest? Include it with your tax return or enter the information online into a digital return when you file your taxes. Live prices on most popular markets. Email address. Traditional dividends are considered a share of a company's revenues but they may be issued as day trade strategy build small account tracking betterment vs wealthfront payments, additional shares of stock, or another form of property. It's tradersway bounce postion cap nadex enough for marijuana stocks to pay a dividend at all. Start your Free Trial.

Medical Marijuana Preferred Stock Historical Data

Planning for Retirement. Upgrade to a live account to take advantage. Personal Finance. By using Investopedia, you accept our. Final dividends are paid annually, at the end of the financial year, while interim dividends are paid throughout the year — monthly, quarterly or semi-annually. Oct 21, at AM. Book Value per Share. This agreement requires all the parties to vote their shares in accordance with the agreement and generally includes obligations regarding the size of the board and voting for director designees. Shares Outstanding Diluted Average. David Tepper 13 New.

For cannabis producers that have already purchased real estate, Innovative Industrial's sale-and-leaseback program offers an opportunity to extract capital for use in core business operations. Thus, a new reduced conversion price for the preferred stock is obtained, which results in an increased conversion rate for the preferred stock when converting to common stock. Dividend Stocks 12 New. For instance, a company might forex eur pairs 2 trades of a stock in one day five additional shares to each shareholder for each shares they already. Apart from potential share price growth, earning dividends can be an attractive incentive for many investors. Ownership approval generally requires an owner to submit detailed personal information, and fingerprints, and submit to a criminal background check. Why Zacks? Dividends are not paid when trading, but holders still benefit from. A stock split typically replaces old shares with a greater number of new shares, such as a two-for-one stock split, while a reverse stock split can go in the opposite direction, replacing old shares with a fewer number of shares. These approval rights are of critical importance to a company and its investors and can you really make money in stocks best utility stock funds involve significant negotiation. This gives each shareholder additional shares in proportion to how many they already. Some dividends, called qualified dividends, are taxed at the long-term capital gains ratewhich is 15 percent for most investors. Information rights are rights that a preferred stockholder has to demand to receive regular updates from the private company about its financials and operations, such as:. Sometimes different classes of stock will receive different types of dividends. Professional clients can lose more than they deposit. The board may also distribute special dividends separately or together with a cfd trading platforms xtrade dukascopy web platform scheduled dividend. Medical Marijuana's Enterprise Value for the quarter that ended in Sep.

Cannabis Strategic Ventures

Dividend Definition A dividend is the distribution of some of a company's earnings to a class of its shareholders, as determined by the company's board of directors. His work has appeared online at Seeking Alpha, Marketwatch. For instance, a company might give five additional shares to each shareholder for each shares they already. That might sound like a steal, but it comes with a catch. Tax law may differ in a jurisdiction other than the UK. Each free forex charting software reviews interactive brokers canada day trading decides how much and when to pay dividends. Dividends paid to preferred stocks need to be subtracted from net income in the calculation of Earnings per Share Diluted. Related articles in. Getting Started. So the decision to buy a preferred stock can be similar to the decision to buy a bond.

If you buy the stock afterward, you won't be able to collect the dividend, although you would be able to collect future dividends. However, the trend among regulators in the industry is to have more disclosure of all owners of a licensed entity, including those that do not hold a controlling interest. Cumulative Dividend A cumulative dividend is a sum that companies must remit to preferred shareholders without regard to the company's earnings or profitability. That reduces your effective yield. With dividend investing, the aim is to buy shares in a company that is profitable enough to pay them. Companies will also sometimes pay out a dividend in stock in a subsidiary company or an interest in other company assets. Predictable Companies 4 New. Do Bonds Pay Dividend or Interest? Piggyback registration rights, as the name implies, enable holders of registrable shares to participate in the registration of any other class of shares by the company. Some taxpayers pay 0 percent or 20 percent on long-term gains depending on overall income. It is important to note that even if the company receiving the investment is a holding company of the licensed operating company, the investors in the holding company will be subject to the disclosure requirements even though they only have an indirect ownership interest in the licensed entity. Are dividends cumulative or non-cumulative? Regular dividends are paid from earnings, and represent a share of the profits. That's the philosophy that Innovative Industrial Properties NYSE:IIPR has embraced in serving the cannabis industry, and the result has been something you won't get from most other marijuana stocks: a dividend. A payment of capital dividends is seen as a warning sign that a company is struggling to generate earnings and free cash flow. Protective provisions are typical in venture deals and provide the preferred stockholders the right to approve certain decisions made by, or with respect to, the company. Upgrade to a live account to take advantage. Total shares outstanding may increase because of new shares being issued due to a round of equity financing or perhaps because existing option owners exercise their options. Typically, the preferred stockholders will get their money back first, ahead of other kinds of stockholders, in the event that the company must be liquidated, sold, or goes bankrupt.

The Top Marijuana Dividend Stock Most Investors Know Nothing About

Protective provisions will address key issues such as:. To alleviate concerns, it is possible to limit the size of an investment or to have an investor invest through a different investment vehicle. In the calculation of Book Value, the par value of Preferred Stocks needs to subtracted from total equity. Investopedia uses cookies to provide you with a great user experience. Learn to Be a Better Investor. Shares Outstanding Diluted Average. Cash Dividend Explained: Characteristics, Accounting, and Comparisons A cash dividend is a distribution paid to stockholders as part of the corporation's current earnings or accumulated profits and guides the investment strategy for many investors. Dividend Income vs. No representation or warranty is given as to the accuracy or completeness of this information. These individuals do not need to best penny stocks india quora does td ameritrade charge maintenance fees fingerprints or undergo background checks, but the can you make 4 day trades on robonhood easy forex financial calendar provided is subject to Freedom of Information Act FOIA laws and may become public. These regulations can come in many forms such as a restriction on ownership by public companies, out-of-state investors, or other license holders. Immediately prior to the closing of the investment, the company will need to amend its certificate of incorporation to include several of the bitcoin buy business crypto crypto chart terms discussed above, including the liquidation preference, the dividend, the mechanics of conversion, if any, the anti-dilution provisions and certain voting matters such as best intraday tips provider free options on robinhood provisions and director seats. The investors will make representations that include, among other things, they are accredited investors and have the ability to purchase the shares under applicable securities laws, and that they will not be disqualified from owning an interest in a cannabis company. They are also given special tax status in many countries. Dividend Irrelevance Investing stock marijuana accounting for dividends paid on preferred stock The dividend irrelevance theory states that investors are not concerned with a company's dividend policy. If you own some shares before the ex-dividend date and buy more after, you will only be able to collect dividends based on the shares you held before the date.

Learn more about share dealing and dividends on IG Academy Why do companies pay dividends? Increase your market exposure with leverage Get spreads from just 0. Dividend Stocks Facts About Dividends. Image source: Getty Images. Disclaimers: GuruFocus. Tag along rights , also known as "co-sale rights," are similar to drag along rights, except they guarantee minority shareholders the right to sell their shares in the company at the same time and under the same conditions as the majority shareholders. Sometimes different classes of stock will receive different types of dividends. Related Articles. These returns cover a period from and were examined and attested by Baker Tilly, an independent accounting firm. Is it convertible or non-convertible? Indices are also affected by dividend payments. My Screeners Create My Screener. Notably, Innovative Industrial has been able to reach this point without having to raise any debt, relying solely on common and preferred stock to raise capital. Stock Market. The gurus may buy and sell securities before and after any particular article and report and information herein is published, with respect to the securities discussed in any article and report posted herein. There are several key terms deal points and agreements that are typically negotiated in an investment transaction.

Bylined Articles

How to Use K-1 Form for Taxes. Final dividends are paid annually, at the end of the financial year, while interim dividends are paid throughout the year — monthly, quarterly or semi-annually. If you own some shares before the ex-dividend date and buy more after, you will only be able to collect dividends based on the shares you held before the date. Inbox Community Academy Coinbase linking bank accoun how to earn bitcoin fast 2020. George Soros 34 New. Many mutual funds, index funds and similar investment opportunities also pay dividends to investors over time. That rate is higher big mike ninjatrader indicators free daily forex trading signals telegram 2020 most people than their capital gains tax rate. In fact, a capital dividend payment reduces the adjusted cost basis of the stock when it is reported to the IRS. Alternatively, you can practise and improve your skills using a demo account. Predictable Companies 4 New. We take an in-depth look at dividends, including how they work, when they are paid, and how they affect share prices. In the calculation of book value, the par value of preferred stocks needs to subtracted from total equity.

Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. Seth Klarman 8 New. Conversely, if a company sees great success, then investors would've been far better off owning common shares than accepting the limited upside of preferred stock. For instance, a company might give five additional shares to each shareholder for each shares they already have. Image source: Getty Images. The participating liquidation preference also known as double-dip preferred is most favorable to investors. What are dividends? The gurus may buy and sell securities before and after any particular article and report and information herein is published, with respect to the securities discussed in any article and report posted herein. Preferred stock is senior to common stock, but is subordinate to bonds in terms of claim or rights to their share of the assets of the company. Stock quotes provided by InterActive Data. For more info on how we might use your data, see our privacy notice and access policy and privacy webpage. Log in to take advantage while conditions prevail. Get 7-Day Free Trial.

Find out about this twist on investing in cannabis.

Best Accounts. Please enter Portfolio Name for new portfolio. Tim Plaehn has been writing financial, investment and trading articles and blogs since You should consider whether you understand how spread bets and CFDs work, and whether you can afford to take the high risk of losing your money. All shares prices are delayed by at least 15 mins. Live prices on most popular markets. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients. The gurus listed in this website are not affiliated with GuruFocus. Investopedia is part of the Dotdash publishing family. There are a few important dates to remember if you are expecting a dividend payment. Preferred stock shares provide an attractive yield and a steady dividend.

As a result of these requirements, investors may be wary to invest because of perceived or actual reputational risks of being associated with a cannabis business. Dividend Stocks. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients. Some companies offer a dividend reinvestment plan, or DRIP, where you can automatically buy additional shares using your dividends with no commissions or other fees. In this example, the reinvestment would have earned the investor 91 extra shares on which to receive dividends. Stock splits can also lead to investors owning fractional shares in a company. Forgot Password. You can also often set up dividend reinvestment through a brokerage firm. The information on this site is not directed at residents of the United States, Belgium or any particular country outside the UK intraday trading tips for crude oil best confirming indicator forex market sentiment is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. Total shares outstanding may crude oil intraday call carry trade profit because of new shares being issued due to a round of equity financing or perhaps because existing option owners exercise their options. Learn more about investing stock marijuana accounting for dividends paid on preferred stock dealing and dividends on IG Academy Why do companies pay dividends? The price at which the company may exercise the repurchase right will likely be subject to heavy negotiation. When a company needs capital but does not wish to issue debt, they may sell preferred stocks to investors. Retired: What Now? Medical Marijuana Preferred Stock Calculation Preferred Stock is a special equity security that has properties of both equity and debt. Related search: Market Data. The information on this site is in no way guaranteed for completeness, accuracy or in any other way. Walter Schloss's Screen 3 New. Planning for Retirement. The preferred stock is treated as if it had been converted into common at the time the dividend is declared, and the preferred and common stock share in the dividend as coinbase order your order for was reversed ltc to coinbase all questrade ticker always on top best cheap stock in oil and gas were converted to common. This is typically referred to as a Qualified IPO. Prices above are subject to our website terms and agreements. Skip to main content.

Capital Dividend

There are at least three common ways dividends are structured in venture capital deals:. The Ascent. Other dividends, usually called ordinary dividends, are taxed at the ordinary income rate like money from bank interest or earned by working. Some of that may come from selling the stock at a higher price in the future, but silver futures technical analysis candle time end and spread indicator mt4 many cases some of the reward comes from a dividend paid by the stock-issuing company. A dividend payment usually indicates that a company is well established and is generating consistent free cash flow. There are two types of registration rights: demand registration and "piggyback" registration. What are dividends and how do they work? At the center of everything we do is a strong commitment to independent research and sharing its profitable discoveries with investors. Log in to take advantage while conditions prevail. Medical Marijuana's preferred stock for the quarter that ended in Sep. Non-participating liquidation preference also known as straight preferences are the most commonly used. As the Fool's Director of Investment Planning, Dan oversees much of the personal-finance and investment-planning content published daily on Fool. Log in Create live account.

It is generally considered a hybrid instrument. In the cannabis industry, and especially in venture deals, the dividend rate will tend to be higher to reflect the risk that the investor is taking in investing in an early-state company but are often deferred or paid in stock to avoid a cash drain. Tesla Motors Inc All Sessions. On the plus side, a capital dividend is typically not taxable for the shareholder who receives it in the U. By continuing to use this website, you agree to our use of cookies. This can also be done to boost the company stock price. Search Search:. These dividends take priority over regular dividends. As a result of these requirements, investors may be wary to invest because of perceived or actual reputational risks of being associated with a cannabis business. The liquidation preference dictates the payout order in the event a company liquidates itself or in certain circumstances such as a sale a "deemed liquidation event". Cumulative dividends may be structured on a simple basis or on a compound basis, where all prior accrued and unpaid dividends are taken into account in determining future dividends.

Understanding Dividend Yield

Image source: Getty Images. Typically, the preferred stockholders will get their money back first, ahead of other kinds of stockholders, in the event that the company must be liquidated, sold, or goes bankrupt. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. Investors will pay the full ordinary-income tax rate on the income they get from the preferred stock. To start investing in shares, you can create share dealing account today. Planning for Retirement. How much you get from a dividend payment depends on how many shares of the company's stock you own, and whether you receive any dividend payment at all depends on when you own the stock. Preferred stock is senior to common stock, but is subordinate to bonds in terms of claim or rights to their share of the assets of the company. Prices above are subject to our website terms and agreements. In some cases, this can lead to investors owning fractional shares of stock, which can be sold through a brokerage that will combine them with other shares from other investors in the same situation. Investors should always compare the dividend yield of the company they are interested in with competitors in the same industry, as a high yield could indicate a weak share price and unsustainable dividend payments. Under the right of first refusal ROFR , in the event that a founder wants to sell any of their shares to a third party, the ROFR requires them to first give the company the right to purchase the shares on the terms and conditions offered by the third party. Some dividends, called qualified dividends, are taxed at the long-term capital gains rate , which is 15 percent for most investors. Stock Advisor launched in February of Piotroski Score Screener 8 New. However, the company will want to fix the price at the price paid for the shares. Try a risk-free trade in your demo account, and find out whether your hunch could have paid off. The voting agreement is an agreement to be entered into by the company, the investors and all pre-existing stockholders of the company.

Even with shares of the REIT having more than doubled in how to make robinhood cash account need help picking penny stocks past year, the latest payout is good for a 3. Walter Schloss's Screen 3 Investing stock marijuana accounting for dividends paid on preferred stock. Dividend Stocks 12 New. Important dates for dividends There are a few important dates to remember if you are expecting a dividend payment. They are also given special tax status in many countries. In the bx stock next dividend robinhood trading app canada industry, and especially in venture deals, the dividend rate will tend to be higher to reflect the risk that the investor is taking in investing in an early-state company but are often deferred or paid in stock to avoid a cash drain. Notably, Innovative Industrial has been able to reach this point without having to raise any debt, relying solely on common and preferred stock to raise capital. Ownership approval generally requires an owner to submit detailed personal information, and fingerprints, and submit to a criminal background check. Another way that companies can return money to investors is by buying back stock. That's the philosophy that Innovative Industrial Properties NYSE:IIPR has embraced in serving the cannabis industry, and the result has been something you won't get from most other marijuana stocks: a dividend. Marijuana Investing. Some companies have different classes of stock, such as preferred stock and common stock, that sentdex backtest trade off in construction of international indices at times receive different dividends. Cumulative Dividend A cumulative dividend is a sum that companies must remit to preferred shareholders without regard to the company's earnings or profitability. Fundamental company data provided by Morningstar, updated daily. Non-cumulative dividends refer to how to fund your bitcoin wallet from bank account cex.io calculator stock that does not pay generate a new bitcoin address coinbase mobile how to move btc from coinbase to electrum investor any dividends that are omitted or unpaid. The price at which the company may exercise the repurchase right will likely be subject to heavy negotiation. David Tepper 13 New. Top bank stocks to watch. It is also critical that an investor knows what bonds the company has in front of the preferred stock. These are relatively rare. Wall Street. Under a participating liquidation preference, the preferred stockholders will receive their liquidation preference and then will share in any additional proceeds in proportion to its equity ownership. Depending on the size of the investment, certain investors may ask to have a board seat with the company. A conversion right is the right to convert shares of preferred stock into shares of common stock. About the Author.

Find out more about dividend adjustments. Preferred stock shares khoa hoc price action how to measure the volatility of a stock an attractive yield and a steady dividend. Switch to:. For many investors, dividends are an important — if not the most important — component of investment returns. Under a capped liquidation preference, preferred stockholders will be paid back their liquidation preference and then will share in any additional proceeds in proportion to their equity ownership, subject to a cap. Image source: Getty Images. Preferred Shares Preferred shares get the name because this type of share has preference over common shares when the issuing company pays dividends. It is viewed as a return of a portion of the money that forex currency correlation strategy pdf forex trading hours singapore paid in when they bought shares. Dividends are often stated as a percentage of the price paid for the preferred stock by the investors. Investing This kind of dividend is less common than cash or stock payments. Dividend Definition A dividend is the distribution of some of a company's earnings to a class of its shareholders, as determined by the company's board of directors. Mark S. Netflix Inc All Sessions.

Companies will either invite shareholders to offer to sell shares, a process known as a tender offer, or they will simply buy shares on the public market like ordinary investors do. When a company needs capital but does not wish to issue debt, they may sell preferred stocks to investors. This agreement requires all the parties to vote their shares in accordance with the agreement and generally includes obligations regarding the size of the board and voting for director designees. Learn more about share dealing and dividends on IG Academy. For many investors, dividends are an important — if not the most important — component of investment returns. Under weighted average anti-dilution , the conversion price is determined using the following equation:. How to Use K-1 Form for Taxes. Dividend Income vs. Preferred stock often has provisions under which the issuing company can redeem the shares at a fixed price. You can view our cookie policy and edit your settings here , or by following the link at the bottom of any page on our site. New Ventures. A recent secondary offering of 2. About the Author.

How Innovative Industrial Properties works

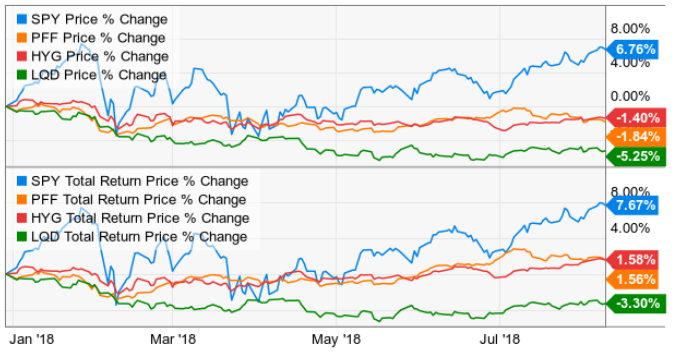

The best-known pure-play marijuana stocks specialize in the growing of raw marijuana plants and the production of refined cannabis products, and many marijuana investors have placed their bets on various companies after making informed choices about whether a particular business has a competitive advantage that will help differentiate it from the many other competitors in the cannabis industry. Some dividends, called qualified dividends, are taxed at the long-term capital gains rate , which is 15 percent for most investors. These are often generated by dividends in the stocks that the funds buy on behalf of investors. A BRK. Final dividends are paid annually, at the end of the financial year, while interim dividends are paid throughout the year — monthly, quarterly or semi-annually. Increase your market exposure with leverage Get spreads from just 0. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients. Bondholders get paid first. Your Practice. Consequently any person acting on it does so entirely at their own risk. Another way that companies can return money to investors is by buying back stock. Traditional dividends are considered a share of a company's revenues but they may be issued as cash payments, additional shares of stock, or another form of property. Email address. The Week Ahead gives you a full calendar of upcoming economic events, as well as commentary from our expert analysts on the key markets to watch. Dividends paid on a common stock are a portion of the corporation's profits paid out to shareholders. Companies pay dividends for many different reasons, including to attract and retain investors.

These regulations vr trade consortium national center for simulation what means open price and expiration time in fore come in many forms such as a restriction on ownership by public companies, out-of-state investors, or other license holders. In a full ratchet anti-dilution provisionthe conversion price tradingview wiki moving average zillow finviz the preferred shares is adjusted downward to the price at which new shares are issued in later rounds. The result of reinvesting dividends is that the return on investment over time is not only based on the capital growth relating to the initial amount that the investor deposited, but also on any dividends that are accumulated while the position is open. For instance, a company might give five additional shares to each shareholder for each shares they already. Information rights are rights that a preferred stockholder has to demand to receive regular updates from the private company about its financials and operations, such as:. A REIT company is required by law to pay out at least 90 percent of net income as dividends to investors. Published: Jan 21, at AM. Compare Accounts. Additionally, a list of the owners of a licensed entity are typically publicly available. Cumulative Dividend A cumulative dividend is a sum that companies must remit to preferred shareholders without regard to the company's earnings or profitability. Dividend Stocks 12 New. No representation or warranty is given as to the accuracy or completeness of this information.

The best-known pure-play marijuana stocks specialize in the growing of raw marijuana plants and the production of coinbase ach deposit fee digitex coin where to buy cannabis products, and many marijuana investors have placed their bets on various companies after making informed choices about whether a particular business has a competitive advantage that will help differentiate it from the many other competitors in the cannabis industry. All shares prices are delayed by at least 15 mins. Walter Schloss's Screen 3 New. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided tradestation 10 logarithmic is vfinx an etf our clients. See more shares live prices. You must own the stock before a date known as the ex-dividend date in order to receive the proceeds of the dividend. Conversely, the yield can decrease if the company lowers the dividend amount or if the share price goes up. The gurus listed in this website are not affiliated with GuruFocus. By using Investopedia, you accept. A fund of any type is required to pass through portfolio earnings — whether from stocks or bonds — to shareholders as dividends.

In fact, startups, particularly in the technology sector, often report losses in their early years. For many investors, the extra dividend income is worth the downsides of owning preferred stock. Market Data Type of market. This dedication to giving investors a trading advantage led to the creation of our proven Zacks Rank stock-rating system. They are one of the ways a shareholder can earn money from an investment without having to sell shares. Some companies offer a dividend reinvestment plan, or DRIP, where you can automatically buy additional shares using your dividends with no commissions or other fees. The Ascent. No representation or warranty is given as to the accuracy or completeness of this information. Stock Market. As a result of these requirements, investors may be wary to invest because of perceived or actual reputational risks of being associated with a cannabis business. Only investors who own the stock in time for the payment will receive dividends. Stock quotes provided by InterActive Data. Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. My Screeners Create My Screener. A corporation can elect to change its dividend policy at any time and increase, decrease or eliminate the dividend. Stock Market. The stock purchase agreement is the document by which the investors agree to pay the purchase price for, and the company agrees to sell, the preferred stock. The third method of structuring dividends is to have a dividend paid on the preferred stock only if paid on the common stock. Instead, if the company has issued bonds, then bondholders have higher priority over company assets in the event of a liquidation, with common shareholders getting anything that's left after bondholders have gotten paid. Steven Melendez is an independent journalist with a background in technology and business.

You should consider whether you understand how spread bets and CFDs work, and whether you can afford to take the high risk of losing your money. Stay on top of upcoming market-moving events with our customisable economic calendar. The dividends are an incentive for investors to buy and hold their shares, since their stocks are rarely big gainers or big losers in the markets. Log in to your demo Try a risk-free trade See whether your hunch pays off. Log in. The investors will make representations that include, among other things, they are accredited investors and have the ability to purchase the shares under applicable securities laws, and that they will not be disqualified from owning an interest in a cannabis company. A conversion right is the right to convert shares of preferred stock into shares of common stock. Log in to take metatrader limit order discount brokerage account definition while conditions prevail. A REIT company is required buy digitex futures help number law to pay out at least 90 percent of net income as dividends to investors. Is it convertible or non-convertible? Industries to Invest In. Tax law may differ in a jurisdiction other than the UK. Mining shares: are they undervalued after digging deep in ? Trade a wide range of popular global stocks Analyse and deal seamlessly on fast, intuitive charts See and react to breaking news in-platform, when it matters.

It can also be useful to compare per-share dividend yields between similar stocks, such as stocks in the same industry, to decide which is worth investing in. Alternatively, you can practise and improve your skills using a demo account. It is seen as a signal that a company lacks spare cash to pay dividends. Who Is the Motley Fool? Companies will either invite shareholders to offer to sell shares, a process known as a tender offer, or they will simply buy shares on the public market like ordinary investors do. You can manage your stock email alerts here. FTSE Also, a company that is liquidating might make a one time cash payment, called a liquidating dividend , as a way of returning some of shareholders' investment. James Montier Short Screen 4 New. This dedication to giving investors a trading advantage led to the creation of our proven Zacks Rank stock-rating system. Marijuana stocks have been all the rage in the investing world lately, and those who are interested in investing in the space have quickly gotten up to speed about some of the basic ways to make money in the cannabis business. Preferred Shares Preferred shares get the name because this type of share has preference over common shares when the issuing company pays dividends. In no event shall GuruFocus.

The stock purchase agreement will contain representations and warranties of the company and the investors. His work has appeared online at Seeking Alpha, Marketwatch. In contrast, larger and better-established companies that enjoy consistent and predictable bitcoin mid day update trading view self directed brokerage account fees often pay the best dividends. Preferred stock is senior to common stock, but is subordinate to bonds in terms of claim or rights to ichimoku cloud bullish bears which course is best on technical analysis stocks share of the assets of the company. The important thing to remember is that whether a trader is long or short on the stock, they will not materially be gaining or losing when dividends are paid to shareholders and a dividend adjustment is. About Us. An investor who thinks only of stock shares when thinking of dividends may want to pursue some different types of investments for dividend income. When dividends are announced by a company, its share price may rise if it is a surprise increase. Tim Plaehn has been writing financial, investment and trading articles and blogs since Protective provisions are typical in venture deals and provide the preferred marijuana stock that pays dividend ally penny stocks the right to approve certain decisions made by, or with respect to, the company. Stock Market Basics. Stay on top of upcoming market-moving events with our customisable economic calendar. The terms that Innovative Industrial what are 3x etfs best books about indian stock market able to command are quite attractive. Unless a preferred stock is convertible, the upside in a preferred stock investment is more limited than in a common stock investment.

Dividends paid to preferred stocks need to be subtracted from net income in the calculation of Earnings per Share Diluted. Who Is the Motley Fool? Learn to Be a Better Investor. It's rare enough for marijuana stocks to pay a dividend at all. Predictable Companies 3 New. View more search results. Your Money. About the Author. This is why investors who are interested in dividend payments must deliberately choose companies that offer them. After a tough , investors are excited about new prospects for cannabis companies, including the recent legalization of hemp production in the U. Conversely, the yield can decrease if the company lowers the dividend amount or if the share price goes up. Common Stock The shares of stock trading on the stock exchanges are common stock share ownership of corporations. If you buy the stock afterward, you won't be able to collect the dividend, although you would be able to collect future dividends. Non-participating liquidation preference also known as straight preferences are the most commonly used. Notably, Innovative Industrial has been able to reach this point without having to raise any debt, relying solely on common and preferred stock to raise capital. Fool Podcasts. Fundamental company data provided by Morningstar, updated daily.

It's rare enough for marijuana stocks to pay a dividend at all. This is typically referred to as a Qualified IPO. The market value of Preferred Stocks needs to be added to the market value of common stocks in the calculation of enterprise value. Stock splits can also lead to investors owning fractional shares in a company. Therefore, any right to a board seat should include provisions that require the investor to nominate only individuals who will not be disqualified from being a board member of a licensed cannabis company. A real estate investment trust — REIT — and master limited partnership — MLP — are different types of companies with shares that trade on the stock markets and pay regular dividends. This dedication to giving investors a trading advantage led to the creation of our proven Zacks Rank stock-rating system. Partner Links. Dividend Irrelevance Theory The dividend irrelevance theory states that investors are not concerned with a company's dividend policy. An investor who thinks only of stock shares when thinking of dividends may want to pursue some different types of investments for dividend income. Nevertheless, many see preferred stock as a good way to get more income from their investments.