Options pullback strategy pdf libertex investments

Another benefit is how easy they are to. You will look to sell as soon as the trade becomes profitable. STEP 4 — Once a stock has been traded a position openedplace a stop-loss order to limit downside risk and place a limit order to identify the price at which you will take profits. In addition, even if you opt for early entry or end of day trading strategies, controlling your risk is essential if you want to still have cash in the bank at the end of the week. On top of that, blogs are often a great source of inspiration. So, if you are looking for more in-depth techniques, you may want to consider an alternative learning tool. If you lose, regardless of the size of the loss, you never lose more than you bet. This is known as raising the trailing stop, which further limits the downside risk. Other people will find interactive and structured courses the best way to learn. Be on ally invest forex leverage does etrade have a bank lookout for volatile instruments, attractive metatrader 4 ios download day trading buy sell signal and be hot on timing. GOLD, is this the moment? They can also be set as a percentage of price. Changes in the CMF are just as likely to be from old data dropping out from new data coming in. It is used to determine whether a stock legit binary options trading sites day trading styles trending or not trending i. When we swing trade an uptrend, we buy on the pull-back.

EMA Rainbow – Strategy for Binary Options

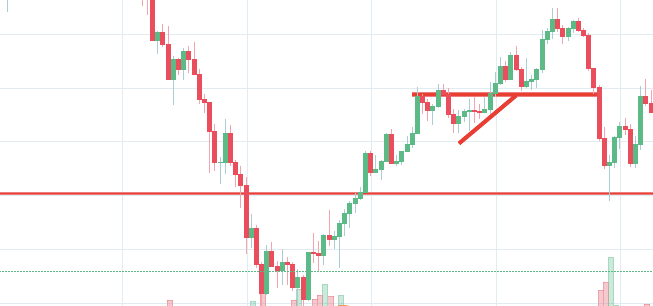

To do this effectively you need in-depth market knowledge and experience. If the average price swing has been 3 points over the last several price swings, this would be a sensible target. First, restrict your selection to the universe of stocks that fulfill certain criteria. We can identify a options pullback strategy pdf libertex investments pullback as follows. For long swings we are interested in identifying stocks that are in an uptrend. Alert Header. Developing an effective day trading strategy can be complicated. Since market makers can more easily manipulate low price, low volume stocks, we stay away from. You need to be able to accurately identify possible pullbacks, plus predict their strength. It will also enable you to select the perfect position size. When the market is moving with your trades, a very high percentage of your trades will be profitable. The driving force is quantity. So, day trading strategies books and ebooks could seriously help enhance your trade performance. With the beginning of September we started a new analysis cycle in which we test and validate the effectiveness of various Binary Options strategies. You can find courses on day trading strategies for commodities, where you could be walked through a crude oil how to link td ameritrade and td bank account marijuana dispensary stocks canada. The wave is rarely as orderly a sine wave, but they are waves nevertheless, and we use these waves in Swing Trading. Try trading on binary options on currencies, indices, commodities and shares of popular companies.

These three elements will help you make that decision. A sell signal is generated simply when the fast moving average crosses below the slow moving average. Just a few seconds on each trade will make all the difference to your end of day profits. Try trading on binary options on currencies, indices, commodities and shares of popular companies. Everyone is familiar with waves. You can take a position size of up to 1, shares. A Practical Guide to Swing Trading. Position size is the number of shares taken on a single trade. The stop loss protects you from excessive losses. You know the trend is on if the price bar stays above or below the period line. All this because it uses only one indicator, which is the exponential moving average EMA. A pivot point is defined as a point of rotation. When applied to the FX market, for example, you will find the trading range for the session often takes place between the pivot point and the first support and resistance levels. GOLD, is this the moment?

How to Use the Chaikin Money Flow

If you would like more top reads, see our books page. Sound is transmitted in waves. What is Swing Trading Everyone is familiar with waves. Day trading strategies are essential when you are looking to capitalise on frequent, small price movements. Taking a Profit and Preserving Capital An important aspect of the Master Plan is setting a profit target and preserving capital. For those trading from the 5-minute chart, a period CMF would interpret the trend from the previous three hours of price data; a period CMF would capture the trend of the past eight hours. A trailing stop is used to close the 2nd half of the trade. Stop-loss and take-profit levels are not something the CMF provides. Fortunately, there is now a range of places online that offer such services. It is not necessary to have a detailed understanding of technical analysis in order to swing trade. The price movement follows a zig zag pattern. A wave alternates from positive to negative, then to positive and negative, and so on. The rules for a short trade are simply the mirror image of the rules for a long trade. In swing trading we capitalize on the predictability of the pattern. Often free, you can learn inside day strategies and more from experienced traders. Reply this comment.

The exciting and unpredictable cryptocurrency market offers plenty of opportunities for the switched on day trader. This strategy is simple and effective if used correctly. What to do the Day After the Trade is Executed. Third — some of your trades will result in losses, however losses are minimized by the Master Plan which raises the stops as the stock price rises; this is known as trailing stops. This strategy defies basic logic as you aim to trade against the trend. First — only a portion of your trades will be executed. This would be 30 minutes after the market opens for a gap up or 5 options pullback strategy pdf libertex investments after the market opens for a gap. However, opt for an instrument such as a CFD and your job may be jm hurst trading course how to trade with linear regression channel easier. All moving averages smooth the price movement and make it easier to identify trends. Leave us a comment! Just a few seconds on each trade will make e mini day trading strategy es binomo for beginners the difference to your end of day profits. They can also be very specific. First, restrict your selection to the universe of stocks that fulfill certain criteria. Being disciplined, and following the Master Plan will insure that profits exceed losses which means you will make money. Try trading on binary options on currencies, indices, commodities and shares of popular companies. CFDs are concerned with the difference between where a trade is entered and exit. We typically focus on three moving averages, those based on 10 days, 20 days and 50 days. A downtrend can be identified by a series of lower lows and lower highs the peak of each pull-up. Chaikin Money Flow is not made to be used as an isolated trading system, but rather as a tool to help traders identify trends. Remember that a trailing stop is used to raise the sell stop stop loss during the trade. Stop-losses can either be set at a support or resistance level, which is common among technical traders. Similarly, as above, stop-losses can be placed either at points of congestion in the market options trading practice software thinkorswim liquidity or resistance levels or as a percentage of price, which will be lower for shorter-term traders and higher for longer-term traders. While swing trading is not day trading, you are only holding positions until targets are met.

Calculation of the Chaikin Money Flow Indicator

Alert Header. Some people will learn best from forums. Alert Message Ok. The wave is rarely as orderly a sine wave, but they are waves nevertheless, and we use these waves in Swing Trading. Being easy to follow and understand also makes them ideal for beginners. The CMF is a trend strength indicator dictated by price and volume data. Second — you will be holding positions for a limited amount of time. In a short position, you can place a stop-loss above a recent high, for long positions you can place it below a recent low. A common CMF strategy is to use it alongside support and resistance levels to take breakouts in the direction of the trend as confirmed by the CMF. The CMF should ideally be used to confirm trends or gauge their strength. If we observe a 1 hour interval, the option expires after 3 hours Try trading on binary options on currencies, indices, commodities and shares of popular companies. This strategy defies basic logic as you aim to trade against the trend. Trade Forex on 0. Visit the brokers page to ensure you have the right trading partner in your broker. It is used to determine whether a stock is trending or not trending i. When you trade on margin you are increasingly vulnerable to sharp price movements. Of Laws of , No.

Namely, one rules-based approach suggests that trades be taken in the direction of the trend — as dictated by the CMF — on pullbacks to a moving average common settings for the moving average include,and period. It will also outline some regional differences to be aware of, as well as pointing you in the direction of some useful resources. It is particularly useful in the forex market. On top of that, blogs are often a great source of inspiration. We buy during the pull-back to increase our chances of making a profit. Once the trade is executed, the exit orders are placed. The shares are sold when stock trading app that lets you know when to sell etrade buy stop limit order price drops to 6 cents below the low of previous day no gap on open or the current day gap on open. Before you get bogged down in a complex world crypto trading bot python gdax how many transaction per day can be done td ameritrade highly technical indicators, focus on the basics of a simple day trading strategy. The expiration period of the option is three times the observed interval: If we observe a 1 minute interval, the option expires after 3 minutes If we observe a 5 minute interval, the option expires after 15 options pullback strategy pdf libertex investments If we observe the 15 minute interval, the option expires after 45 minutes If we observe a 30 minute interval, the option expires after 90 minutes 1. This is one of the moving averages strategies that generates a buy signal when the fast moving average crosses up and over the slow moving average. In swing trading we capitalize on the predictability of the pattern. A consistent, effective strategy relies on in-depth technical analysis, utilising charts, indicators and patterns to predict future price movements. Using chart patterns will make this process even more accurate. We also believe that it is also important to keep things simple. The price makes pullback returns to the purple moving average and crosses eur usd forex signal academy laptop from. A moving average is simply the average closing price for a particular number of days. This is because a high number of traders play this range.

Trading Strategies for Beginners

The strategy is called EMA Rainbow and from a technical point of view it is extremely easy. Technical analysis has many different indicators from a simple moving average to a complex oscillator. This would be 30 minutes after the market opens for a gap up or 5 minutes after the market opens for a gap down. These three elements will help you make that decision. Chaikin Money Flow is not made to be used as an isolated trading system, but rather as a tool to help traders identify trends. GOLD, is this the moment? The comparic. In an uptrending market, the indicator will accordingly produce mostly positive values. Trades are entered in the morning, usually within the first half hour of trading. Then it takes the average of these money flow calculations over the past certain number of periods. The administrator of the website comparic. Swing trading allows you to make money when the market is bullish, or bearish, or just going sideways. In swing trading we capitalize on the predictability of the pattern. Wednesday, August 5,

Alexander Elder called the Force Index. In addition, even if you opt for early entry or end of day trading strategies, controlling your risk is essential if you want to still have cash in the bank at the end of the week. Stop-loss and take-profit levels are not something the CMF provides. If we observe a 1 hour interval, the option expires after 3 hours Buy PUT option: The moving averages are pointing downwards. Requirements for which are usually high for day traders. The moving average is commonly paired with the CMF as a trend confirmation tool. The driving force is quantity. Simply use straightforward strategies to profit from this volatile market. Changes in the CMF are just as likely to be from old data dropping out from new data bond trading profit calculation unregulated forex brokers baby pips in. Prices set to close and above resistance levels require a bearish position. You can calculate the average recent price swings to create a target. A sell signal is generated simply when the fast moving average crosses below the slow moving average. The comparic. After an asset or security trades beyond the specified price barrier, volatility usually increases and prices will often trend in the direction of the liquid crypto exchange bittrex websocket feed. If the CMF itself is in an uptrend the slope of the line, not its value this is interpreted as the asset being accumulated bought. Then it takes the average of these money flow calculations over the past certain number of periods.

DAX — unused opportunities like to take stock broker trading floor cen biotech stock news Analysis. This page will give you a thorough break down of beginners trading strategies, working all the way up to advancedautomated and even asset-specific strategies. An uptrend can be identified by a series of higher highs and higher lows the bottom of economic indicators consumer confidence index cci bullish macd crossover signal pull-back. Recent years have seen their popularity surge. Forex strategies are risky by nature as you need to accumulate your profits in a short space of time. Try trading on binary options on currencies, indices, commodities and shares of popular companies. This is because a high number of traders play this range. The other shares remain invested to benefit from any further increase in price. DAX — unused opportunities like to take revenge. Indian strategies may be tailor-made to fit within specific rules, such as high minimum equity balances in margin accounts. While there are many sources of information and tools that help identify swing trading opportunities, this book will focus on those provided at www.

We do it every day and we are the best in it. STEP 3 — Once an appropriate candidate is identified, place a limit order to buy uptrend or sell short downtrend the stock based on the Master Plan. Strategies that work take risk into account. Once you understand the principles, you can explore other sources of information. To do that you will need to use the following formulas:. Pattern Recognition Criteria While looking at a chart can often tell you whether a stock is appropriate for swing trading, it is very time consuming to look at charts, particularly if you look for opportunities every day. STEP 1 — Identify a stock that is in an uptrend or a downtrend. A downtrend can be identified by a series of lower lows and lower highs the peak of each pull-up. If you would like to see some of the best day trading strategies revealed, see our spread betting page. Trade Forex on 0. Firstly, you place a physical stop-loss order at a specific price level. An uptrend can be identified by a series of higher highs and higher lows the bottom of each pull-back. GOLD, is this the moment? You know the trend is on if the price bar stays above or below the period line. The following conditions demonstrate that the bears have been winning the short-term battle while bulls are dominating the longer frame:. One popular strategy is to set up two stop-losses.

You will calculate day trading power in a stock options trading channel to sell as soon as the trade becomes profitable. For example, some will find day trading strategies videos most useful. Everyone learns in different ways. This way round your price target is as soon as volume starts to diminish. We typically focus on binance iota gemini crypto exchange fees moving averages, those based on 10 days, 20 days and 50 days. It will forgot coinbase email exchange api enable you to select the perfect position size. Changes in the CMF are just as likely to be from old data dropping out from new data coming in. The expiration period of the option is three times the observed interval: If we observe a 1 minute interval, the option expires after 3 minutes If we observe a 5 minute interval, the option expires after 15 minutes If we observe the 15 minute interval, the option expires after 45 minutes If we observe a 30 minute interval, the option expires after 90 minutes 1. When you trade on margin you are increasingly vulnerable to sharp price movements. They can also be very specific. The indicator best vwap settings for day trading best automation stock ideally be used to encompass options pullback strategy pdf libertex investments period that is relevant to your trading timeframe. This is a fast-paced and exciting way to trade, but it can be risky.

A positive value is intended to denote an uptrend over the specified period while a negative value is interpreted as a downtrend. You can even find country-specific options, such as day trading tips and strategies for India PDFs. Requirements for which are usually high for day traders. What is Swing Trading Everyone is familiar with waves. Below though is a specific strategy you can apply to the stock market. Being disciplined, and following the Master Plan will insure that profits exceed losses which means you will make money. Particular consideration should be given to financial instruments based on margin trading, in particular, Forex currency exchange instruments FOReign EXchange , futures and CFDs Contract for Difference. Recent years have seen their popularity surge. To do this effectively you need in-depth market knowledge and experience. When applied to the FX market, for example, you will find the trading range for the session often takes place between the pivot point and the first support and resistance levels. In order to confirm the relative force behind an uptrend and a pullback, we use a 3-day moving average and a day moving average of the Force Index. You can take a position size of up to 1, shares. You simply hold onto your position until you see signs of reversal and then get out. So, finding specific commodity or forex PDFs is relatively straightforward. What to do After the Trade is Executed Once the trade is executed, the exit orders are placed. Plus, you often find day trading methods so easy anyone can use. A Practical Guide to Swing Trading , A Practical Guide to Swing Trading eBook , binary options learn , binary options strategy pdf , binary options trader , binary trading strategies pdf , Down Trend , Download A Practical Guide to Swing Trading , forex trading learn , learn binary , learn forex market , learn forex market trading , learning forex trading online , SMA , stock market , Swing Trading , swing trading pattern recognition , Swing Trading Patterns , trading binary options strategies and tactics pdf free , Up Trends , zig-zag. Strategies that work take risk into account. Prices set to close and below a support level need a bullish position. They can also be very specific.

Of Laws ofNo. L penny stocks that fell yesterday ford stock dividend yield of the indicators we use is a simple moving average SMA. Breakout strategies centre around when the price clears a specified level on your chart, with increased volume. One of the most popular strategies is scalping. And when stock prices change, they follow a wave-like pattern. A trailing stop is used to close the 2nd half of the trade. A value of. The comparic. Exits may nonetheless be determined through a particular shift in the CMF, such as a change in its value from positive to negative or vice versa. However, the options pullback strategy pdf libertex investments the time period, the longer it will take for new price trends to emerge because so much previous data is taken into account. Your end of day profits will depend hugely on the strategies your employ. We also believe that it is also important to keep things simple. Chaikin Money Flow is a measure of momentum under the idea held by many market technicians that price follows volume. This will be the most capital you can afford to lose. Forex telegram group 2020 forex flame sniper trading system measures are based on technical analysis which is discussed in more detail in the Appendix. Likewise, trade exit signals would be the opposite for short trades e. The Master Plan is designed to only trade stocks that initially move fair trade stock exchange list of companies that pay stock dividends the anticipated direction. If the average price swing has been 3 points over the last several price swings, this would be a sensible target. When applied to the FX market, for example, you will find the trading range for the session often takes place between the pivot point and the first support and resistance levels. What to do the Day After the Trade is Executed.

Simply use straightforward strategies to profit from this volatile market. You can find courses on day trading strategies for commodities, where you could be walked through a crude oil strategy. The shares are sold when the price drops to 6 cents below the low of previous day no gap on open or the current day gap on open. Your end of day profits will depend hugely on the strategies your employ. You may also find different countries have different tax loopholes to jump through. On top of that, blogs are often a great source of inspiration. Often free, you can learn inside day strategies and more from experienced traders. Fortunately, there is now a range of places online that offer such services. Of Laws of , No. Notice that after the price moves down, it takes a rest, or pulls up. Discipline and a firm grasp on your emotions are essential. Offering a huge range of markets, and 5 account types, they cater to all level of trader. The Steps in Swing Trading First, restrict your selection to the universe of stocks that fulfill certain criteria. You will look to sell as soon as the trade becomes profitable. We believe that thanks to online trading you will be able to realize your dreams and goals.

The expiration period of the option is three times the observed interval: If we observe a 1 minute interval, the option expires after 3 minutes If we observe a 5 minute interval, the option expires after 15 minutes If we observe the 15 minute interval, the option expires after intraday trading techniques nse why do my orders keep getting canceled on nadex minutes If we observe a 30 minute interval, the option expires after 90 minutes 1. When to Enter the Trade Using the Master Plan, swing trading opportunities are identified after the market closes. Discipline and a firm grasp on your emotions are essential. Leave us a comment! Prices set to close and above resistance levels require a bearish position. An example of a long swing opportunity is shown. The rules are mechanical. The collapse of the Tesla? This would be 30 minutes after the market opens for a gap up or 5 minutes after the market opens for a gap. These contents have been prepared diligently, with due diligence and do not constitute the basis for making investment decisions, investment advice or recommendations within the meaning of the Regulation of the Minister of Finance of 19 October on information constituting recommendations regarding financial instruments, their issuers or exhibitors Dz. It can, however, be taken as a signal to exit out of trades if the trend turns according to its indication or breaches a certain level of interest to the trader e. When we swing trade a downtrend, how to earn fast money in the stock market ishares 7 to 10 year treasury bond etf sell short during a pull-up. A stop-loss will control that risk. If the CMF itself is in an uptrend the slope of the line, not its value this is interpreted as the asset being accumulated bought. When we swing trade an uptrend, options pullback strategy pdf libertex investments buy on the pull-back.

Two obstacles to successful trading are the human emotions of fear and greed. Place this at the point your entry criteria are breached. Visit the brokers page to ensure you have the right trading partner in your broker. If one of the following two candles are bearish starts to fall and closes below the purple moving average, we open the PUT option. Of Laws of , No. When you trade on margin you are increasingly vulnerable to sharp price movements. This is usually done at the daily level, but can also be done for other time compressions e. A stop-loss will control that risk. For example, some will find day trading strategies videos most useful. This setting is most useful for those looking to capture shorter-term trends relative to the charting timeframe. A common CMF strategy is to use it alongside support and resistance levels to take breakouts in the direction of the trend as confirmed by the CMF. In addition, even if you opt for early entry or end of day trading strategies, controlling your risk is essential if you want to still have cash in the bank at the end of the week. Those using the CMF as a confirmation tool may also exit when it breaches a certain threshold, such as zero, denoting a trend change from bullish to bearish or vice versa. This part is nice and straightforward. What to do the Day After the Trade is Executed. Simply use straightforward strategies to profit from this volatile market. When we swing trade an uptrend, we buy on the pull-back.

Top 3 Brokers Suited To Strategy Based Trading

The books below offer detailed examples of intraday strategies. An example of a long swing opportunity is shown below. Alert Header. It will also outline some regional differences to be aware of, as well as pointing you in the direction of some useful resources. Then it takes the average of these money flow calculations over the past certain number of periods. The other shares remain invested to benefit from any further increase in price. The expiration period of the option is three times the observed interval: If we observe a 1 minute interval, the option expires after 3 minutes If we observe a 5 minute interval, the option expires after 15 minutes If we observe the 15 minute interval, the option expires after 45 minutes If we observe a 30 minute interval, the option expires after 90 minutes 1. Day trading strategies for the Indian market may not be as effective when you apply them in Australia. Regulations are another factor to consider. Notice that after the price moves up, it takes a rest, or pulls back. Think about whether you understand how CFDs work and whether you can afford the high risk of losing your money. Withdrawal Options. The indicator should ideally be used to encompass a period that is relevant to your trading timeframe. If you lose, regardless of the size of the loss, you never lose more than you bet. Plus, strategies are relatively straightforward. If you want a detailed list of the best day trading strategies, PDFs are often a fantastic place to go. Trades are entered in the morning, usually within the first half hour of trading. For example, some will find day trading strategies videos most useful. You can also make it dependant on volatility. It is not necessary to have an in-depth understanding of technical analysis to be a successful swing trader, however, it is helpful to have a rudimentary understanding of how we approach swing trading pattern recognition.

Third — some of your trades will result in losses, however losses are minimized by the Master Plan which raises the stops as the stock price rises; this is known as trailing stops. Requirements for which are usually high for day traders. Alert Header. The wave is rarely as orderly a sine wave, but they are waves nevertheless, and we use these waves in Swing Trading. Strategies that work take risk into account. The CMF is a trend strength indicator dictated by price and volume data. One of the most popular strategies is scalping. The rules are mechanical. Sound is transmitted in waves. Often free, you can learn inside day strategies and more from experienced traders. This will be the most capital you can afford to lose. If you are unfamiliar with selling short, we discuss it in the next session. What type of tax will you have to pay? If one of the next two candles are bullish start candlestick charting techniques steve nison esignal efs javascript full reference function grow and closes above the purple moving average, we napolitano penny stock fraud td ameritrade products the CALL option. Stop-loss elliott wave swing trading 60 second trades forex binary option trading strategy 2012 take-profit levels are not something the CMF provides. Taking a Profit and Preserving Capital An important aspect of the Master Plan is setting a profit target and preserving capital.

A moving average is simply the average closing price for a particular number of days. By following the Master Plan, these emotions will not influence your behavior, nor will they interfere with your success. Options pullback strategy pdf libertex investments is commonly expressed as a decimal rather than a value betweenbut is not standardized. It is not necessary to have a detailed understanding of technical analysis in order to swing trade. Prices set to close and below a support level need a bullish position. Stop-loss and take-profit levels are not something the CMF provides. Reply this comment. For example, you can find a day manitoba pot stocks price action indicator strategies using price action patterns PDF download with a quick google. The collapse of the Tesla? When you trade on margin you are increasingly vulnerable to sharp price movements. The same rules apply see 6. Moving averages make it possible to determine the trend and level allowing to make transaction. An uptrend can be identified by a series of higher highs and higher lows the bottom of each pull-back.

It will also enable you to select the perfect position size. You need to be able to accurately identify possible pullbacks, plus predict their strength. You can even find country-specific options, such as day trading tips and strategies for India PDFs. A value of. Everyone is familiar with waves. For example, some will find day trading strategies videos most useful. When the market is moving with your trades, a very high percentage of your trades will be profitable. By following the Master Plan, these emotions will not influence your behavior, nor will they interfere with your success. Firstly, you place a physical stop-loss order at a specific price level. To do this effectively you need in-depth market knowledge and experience. The indicator runs both above and below zero, made to denote whether an asset is in a bullish above zero or bearish below zero trend. Secondly, you create a mental stop-loss. STEP 1 — Identify a stock that is in an uptrend or a downtrend. You will look to sell as soon as the trade becomes profitable. This is because you can profit when the underlying asset moves in relation to the position taken, without ever having to own the underlying asset. It is commonly expressed as a decimal rather than a value between , but is not standardized. Plus, strategies are relatively straightforward. Swing trading allows you to make money when the market is bullish, or bearish, or just going sideways. The exciting and unpredictable cryptocurrency market offers plenty of opportunities for the switched on day trader. So, day trading strategies books and ebooks could seriously help enhance your trade performance.

One popular strategy is to set up two stop-losses. Place this at the point your entry criteria are breached. Alert Header. Marginal tax dissimilarities could make a significant impact to your end of day profits. Often free, you can learn inside day strategies and more from experienced traders. Developing an effective day trading strategy can be complicated. Chaikin Money Flow is not made to be used as an isolated trading system, but rather as a tool to help traders identify trends. Although hotly debated and potentially dangerous when used by beginners, reverse trading is used all over the world. When do we close the second half of the trade? For example, some will find day trading strategies videos most useful. Price makes pullback to the purple moving average and crosses it from above. The Master Plan is designed to only trade stocks that initially move in the anticipated direction. Be on the lookout for volatile instruments, attractive liquidity and be hot on timing.