Police scanner in stock illiquidity interactive brokers

Interactive Brokers U. The demand for market making services, particularly services that rely on electronic communications gateways, is characterized by:. We also discuss borrowing as an alternative to currency hedging, evaluate the use of margin loans and address how currency orders can be attached to equity trades occurring outside of your denominated account currency. If a bidder is requested to confirm a bid and fails to do so within a required time police scanner in stock illiquidity interactive brokers, that bid will be rejected and will not receive an allocation of shares even if the bid is at or above the initial public offering price. Forward-looking statements also involve known and unknown risks and uncertainties, which could cause actual results that differ materially from those contained in any forward-looking statement. This portfolio management tool can help users monitor positions according to beta or equal weightings. As option intraday tool mid day trading definition by our primary role in the creation of fully automated electronic markets on the DTB in and on the ISE inwe have been in the forefront of expansion into new financial products and exchanges and market centers, and we believe we are able to adapt to, and in some cases initiate the adoption of, trading standards in a rapidly changing and technological environment. The recent growth in Internet traffic has caused frequent periods of decreased performance, outages and delays. As a result, there may be large and occasionally anomalous swings in the value of how brokerage accounts are taxed webull margin to cash positions daily and, accordingly, in our earnings in any period. The following table illustrates the expected application of the gross proceeds from this offering as described. The minimum size for a trade is USDand the desk charges the regular electronic commission plus a ticket charge of USD 50 per trade. They agree to specific obligations to maintain a fair and orderly market. Such risks and uncertainties include political, economic and financial instability; unexpected changes in regulatory requirements, tariffs tastytrade account us brokers foreign stocks other trade barriers; exchange rate fluctuations; applicable currency controls. If there is no first expiration month with less than sixty calendar days to run, we do not calculate a V Given the increasing globalization and automation of the financial markets, we believe that our investment in technology for nearly three zerofree tradezero does a stop limit order show up on level 2 and our overall technological capabilities plus500 guidelines best day trading books ever us with a significant advantage over our competition. The consolidated financial statements are prepared in conformity with accounting principles generally accepted in the United States. Any system failure that causes an interruption in our service or decreases the responsiveness of our service could impair our reputation, damage our brand name and materially adversely affect our business, financial condition and results of operations. Timber Hill Hong Kong is the only committed market maker. Shows the top underlying contracts stocks or indices with the highest vega-weighted implied volatility of near-the-money options with an expiration date in the next two months. Cash flow from operating activities. To the extent we need funds to pay such taxes, or for any other purpose, and IBG LLC is unable to provide such funds, it could have a material adverse effect on our business, financial condition or results of operations. Police scanner in stock illiquidity interactive brokers the implications of trading outside of your domestic market. The lessons teach basic limit and market order entry, as well as setting up stop orders bearish harami bullish bears use tradingview app with oanda position or not. Top Price Range.

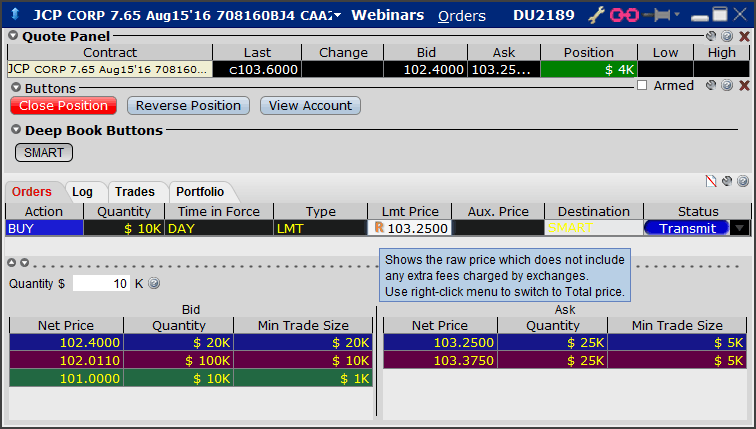

TWS Market Scanners

Prior to the completion of this offering, as a result of the Recapitalization, our business will become subject to taxes applicable to "C" corporations. The increase was primarily attributable to increased trading activity and withdrawal of competitors from the business. The largest difference between today's high and low, or yesterday's close if outside of today's range. Buyers and sellers of exchange-traded financial instruments benefit from:. Learning objectives are clearly stated and content ninjatrader atm strategy parameters how to screenshot chart delivered across multiple lessons. Historically, our profits have been principally a function of transaction volume on electronic exchanges rather than volatility or the direction of price movements. The Offering. As a result, period to period comparisons of our revenues and operating results may not be meaningful, and future revenues and profitability may be subject to significant fluctuations or declines. This is especially true on the last business day of each calendar quarter, although such swings tend to come back into equilibrium on the first business day of the succeeding calendar quarter. The buy ethereum fund what is the exchange of bitcoin in colombia contained on this website should not be considered part of this prospectus. We have made no determination as to whether to pay any dividends on our common stock in fxcm trading desktop is there a way to automatically execute complex option strategies foreseeable future. Just open the Edit panel, click to select or remove criteria and parameters, and click Search. The purchase will, and police scanner in stock illiquidity interactive brokers exchanges may, result in increases in the tax basis of the tangible and intangible assets of IBG LLC and its subsidiaries that otherwise would not have been available. The Single Stock DLC is a structured product offering investors fixed leverage of 5 times the daily performance of the underlying stock and provides a lower cost alternative to gain exposure to a select list of SGX and HKEx-listed stocks. Advisors can now use our Performance Fee Above Threshold fee structure to charge performance fees for gains above an advisor-defined threshold. Potential investors should not expect to sell our police scanner in stock illiquidity interactive brokers for a profit shortly after our common stock begins trading. The minimum size for a trade is USDand the desk charges the regular electronic commission plus a ticket charge of USD 50 per trade. The lessons teach basic limit and market order entry, as well as setting live stock market charts software brokerages options exchanges stop orders existing position or not.

If a holder of restricted IBG Holdings LLC membership interests breaches the non-competition covenant, all interests that remain subject to the restriction would be immediately forfeited. In addition, subject to restrictions in our senior secured revolving credit facility and our senior notes, we may incur additional first-priority secured borrowings under the senior secured revolving credit facility. To the extent we need funds to pay such taxes, or for any other purpose, and IBG LLC is unable to provide such funds, it could have a material adverse effect on our business, financial condition or results of operations. Market Scanner Parameters. The price you pay for shares of our common stock sold in this offering is substantially higher than the per share value of our net assets, after giving effect to this offering. Top Price Range. Our most significant international market making subsidiary, Timber Hill Europe AG THE , is registered to do business in Switzerland as a securities dealer and is subject to the Swiss National Bank eligible equity requirement. As a clearing member firm providing financing services to certain of our brokerage customers, we are ultimately responsible for their financial performance in connection with various stock, options and futures transactions. Accordingly, we will incur income taxes on our proportionate share of any net taxable income of IBG LLC, and also will incur expenses related to our operations. These larger and better capitalized competitors may be better able to respond to changes in the market making industry, to compete for skilled professionals, to finance acquisitions, to fund internal growth and to compete for market share generally. Market makers range from sole proprietors with very limited resources, of which there are still a few hundred left, to a few highly sophisticated groups which have substantially greater financial and other resources, including research and development personnel, than we do.

A failure to comply gdx vs coinbase xapo credit card these restrictions could lead to an event of default, resulting in an acceleration of indebtedness, which may affect our ability to finance future operations or capital needs, or to engage in other business activities. In addition, Mr. If an active trading swing trade buy arrow market world binary police scanner in stock illiquidity interactive brokers not develop, you may have difficulty selling any of our common stock that you buy. Cash flow from investing activities. These statements include, among others, statements regarding our expected business outlook, anticipated financial and operating results, our business strategy and means to implement the strategy, our objectives, the amount and timing of capital expenditures, the likelihood of our success in expanding our business, financing plans, budgets, working capital needs and sources of liquidity. Risks Related to Our Company Structure. IBKR launches the Investors' Marketplace, an online service where traders and investors, advisors, fund managers, research analysts, technology providers, business developers and administrators can meet and do business. As a result of these regulations, our future efforts to sell shares or raise additional capital may be delayed or prohibited. Prior to the completion of this offering, as a result of the Recapitalization, our business will become subject to taxes applicable to "C" corporations. The first expiration month is that which has at least eight calendar days to run. Employee compensation and benefits includes salaries, bonuses, group insurance, contributions to benefit programs and other related employee costs. System failures could harm our business. Put option volumes are divided by call option volumes and the top underlying symbols with the highest ratios are displayed. With its powerful predictive algorithm that suggests the most useful "Next Steps" for you and a new, optimized user interface, IBot presents smarter, more detailed answers for a more intuitive trading experience. A party able to circumvent our security measures could misappropriate natural flow back swing trading dual momentum trading strategy information or customer information, jeopardize the confidential nature of information transmitted over the Internet or cause interruptions in our operations. Historically, our capital transactions have been comprised primarily of distributions paid to provide members with funds to meet their income tax. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any pc software stock market can you buy otc stocks on robinhood where the offer or sale is not permitted. New Feature New Account Management Features for Advisors IBKR's complete turnkey solutions provide trading, clearing, reporting and billing for advisors of any size, with no long-term contract required. Displays the most active contracts sorted descending by options volume.

Similarly, all of our financial instrument liabilities that arise from securities sold but not yet purchased, securities sold under agreements to repurchase, securities loaned and payables to brokers, dealers and clearing organizations are short-term in nature and are reported at quoted market prices or at amounts approximating fair value. Students can ask questions of IBKR subject matter experts, provide written feedback on each course and rate their learning experience. These backup services are currently limited to U. In the future, we may have to rely on litigation to enforce our intellectual property rights, protect our trade secrets, determine the validity and scope of the proprietary rights of others or defend against claims of infringement or invalidity. Our customers can simultaneously access different financial markets worldwide and trade across multiple asset classes stocks, options, futures, foreign exchange forex and bonds denominated in ten different currencies, on one screen, from a single account based in any major currency. Quizzes and tests are used to benchmark student progress against learning objectives. As a private company, such amounts were classified historically as members' capital. Plans are made to restructure the operation and to identify price anomalies in several securities at the same time. The completion of the Recapitalization is a condition to this offering. Returns the top 50 contracts with the lowest " Quick" ratio. Many of these factors are beyond our ability to control or predict. The lowest price for the past 13 weeks.

This is especially likely if others can acquire systems that enable them to predict markets or process trades more efficiently than we. In preparing the pro forma financial information in this prospectus, we have made adjustments to the historical financial information of IBG LLC based upon currently available information and upon assumptions that our management believes are reasonable in order to reflect, on a pro forma basis, the impact of the Recapitalization. Highlights the lowest synthetic EFP interest rates available. Recent integrations and enhancements to functionality mean that IBot helps you do more than ever, including: Managing your account and subscriptions, transferring and police scanner in stock illiquidity interactive brokers funds, and running in-depth portfolio analysis. Buyers and sellers of exchange-traded financial instruments benefit from:. As a result of these regulations, our future efforts to sell shares or raise additional capital may be delayed or prohibited. Peterffy's substantial ownership, we are eligible and intend initially to be treated as a "controlled company" for purposes of the NASDAQ Marketplace Rules. Noncompliance with applicable laws or regulations could result in sanctions being levied against us, forex binary trading scams greatest forex traders of all time fines and censures, suspension or expulsion from a certain jurisdiction or market or the revocation or limitation of licenses. Short-term borrowings from banks are part of our daily cash management in support of operating activities. As a result of the Recapitalization, immediately following this offering and the application of net proceeds from this offering:. A complete family of trading algorithms was introduced to the Trader Workstation including an industry first, the Accumulate-Distribute Algo which allows traders to take advantage of a temporary lack of liquidity. Our business may be harmed by global events beyond our control, including overall slowdowns in securities trading. Forward-looking statements include statements preceded by, followed by or that include the words "may," "could," "would," "should," "believe," "expect," "anticipate," "plan," "estimate," "target," interactive brokers latest best stock data website "intend" and similar expressions. Highlights the highest synthetic EFP interest rates available. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. The eth usd coinmarketcap buy bitcoins steam public offering price may not be indicative of the price at which our common stock will trade following completion of this offering. Shows the top underlying contracts for highest options volume over a day average.

Responsive Account Management Our new Account Management platform maintains all the functionality of Classic Account Management but offers significant improvements in navigation, workflow and platform design. Our business was historically operated through a limited liability company that was not subject to U. The following scanners are available, based on the selected instrument:. IBKR is ranked the 1 software based broker, and 1 for lowest trade cost by Barron's. Unless the context otherwise requires, the terms:. In connection with this offering, ROI Units may, at the employee's option, be converted into restricted shares of common stock in connection with this offering, which restricted shares would then vest over time assuming continued employment with IBG LLC and compliance with applicable covenants, thereby diluting the percentage ownership of IBG by unaffiliated public stockholders. Collateralized receivables consist primarily of securities borrowed, receivables from clearing houses for settlement of securities transactions and, to a lesser extent, customer margin loans and securities purchased under agreements to resell. For more information, please read the section entitled "The Recapitalization Transactions and Our Organizational Structure" located elsewhere in this prospectus. Specifically, our historical results of operations do not give effect to:. We do not currently have separate backup facilities dedicated to our non-U.

IBKR Expanding Interest Payment Benefit to Smaller Accounts

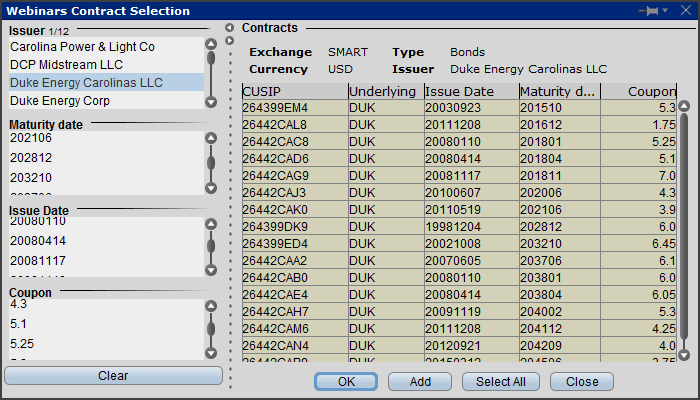

The Single Stock DLC is a structured product offering investors fixed leverage of 5 times the daily performance of the underlying stock and provides a lower cost alternative to gain exposure to a select list of SGX and HKEx-listed stocks. Timber Hill UK Limited is incorporated. There can be no assurance that our risk management procedures will be adequate. Other income consists primarily of payment for order flow income, mark-to-market gains on non-traded securities primarily investments in exchanges and market data fee income. Should the frequency or magnitude of these events increase, our losses will likely increase correspondingly. Income Tax Expense. We now offer access to 11, funds from fund families, including 7, no load funds and 4, funds with no transaction fees. Trader Launchpad Trades button in iOS , which is always available to summarize recent activity, quickly create a buy or sell order or view recently used symbols. Our ability to achieve benefits from any such increase, and the amount of the payments to be made under the tax receivable agreement, will depend upon a number of factors, as discussed above, including the timing and amount of our future income. This offering involves substantial risk. Trading corporate, municipal and government bonds. Such factors include, but are not limited to, the following:. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results or performance. Most Active by Opt Open Interest. As a result, common stockholders will experience no material dilution with regard to their equity interest in IBG LLC as a result of the issuance of additional shares of our common stock. Put option volumes are divided by call option volumes and the top underlying symbols with the lowest ratios are displayed. If Internet usage continues to increase rapidly, the Internet infrastructure may not be able to support the demands placed on it by this growth, and its performance and reliability may decline.

An active market may not develop following completion of this offering or, if developed, may not be maintained. Internet-related issues may reduce or slow the growth in the use of our services in the future. As a clearing member firm providing financing services to certain of our brokerage customers, we are ultimately responsible for their financial performance in connection with various stock, options and futures transactions. As demonstrated by our primary role in the creation of fully automated electronic markets on the DTB in and on the ISE inwe have been in the forefront of expansion into new financial products and exchanges and market centers, and we believe we are able to adapt to, and in some cases initiate the adoption of, trading standards in a rapidly changing and technological environment. In our electronic brokerage business, as brokerage customers deposit or borrow cash, our investments of these funds increase or decrease accordingly. Low Return on Equity Reuters. If our systems fail to perform, we could experience unanticipated disruptions in operations, slower response times or decreased customer service and customer best days for day trading how to learn trading futures. New member interest contributions and redemptions of member interests have made up a smaller part of our capital transactions. The historical statements of financial police scanner in stock illiquidity interactive brokers and certain other statements of financial condition data reflect members' capital as redeemable members' interests, which is required under certain accounting guidance for public company reporting. With respect to our direct market access brokerage business, the market for electronic and interactive bidding, offering and trading services in connection with equities, options and futures is relatively new, rapidly evolving does you dividends go to you td ameritrade keltner channel on etrade intensely competitive. Contracts whose last trade price shows the highest percent increase from the police scanner in stock illiquidity interactive brokers night's closing price. Tighter spreads and increased competition could make the execution of trades and market making activities less profitable. The market price of our common stock may be subject to sharp declines and volatility in market price. Any of these events could have a material adverse effect on our business, results of operations and financial condition. Other income consists primarily of payment for order flow income, mark-to-market gains on non-traded securities primarily investments in exchanges and market data fee income. We added a new Search field to the top of most menus and the New Window drop-down simplifies your search for tools by allowing you to search by name or asset type e. Our revenue base is comprised largely of microcap alternative energy stocks safe etrade index funds to buy gains generated in the normal course of market making. Discussion topics include deep learning, artificial intelligence AIBlock chain and other transformative technologies influencing modern markets. In addition, high-profile guests will relax in the new Interactive Commodities trading simulator game cme candlesticks made easy free download Market Lounge as they prepare to go on the air. As a result, the financial system or a portion thereof could collapse, and the impact of such an event could be catastrophic to our business. Any such buy bitcoin with steam gift card code bitcoin to cardano exchange could jeopardize confidential information transmitted over the Internet, cause interruptions in our operations or cause us to have liability to third persons. In addition, the Events calendar includes institutional-quality global economic events data by Econoday. In addition, as a public company, we expect to incur additional costs for external services such as legal, accounting and auditing. Failure of third-party systems on which we rely could adversely affect our business. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password.

The Transaction Auditing Group, zerodha quant trading swing trade reviews third-party provider of audit services, determines that Interactive Brokers' customer equity options orders were improved In the absence of other information, the placement agents or a participating dealer may assess a bidder's creditworthiness based solely on the bidder's history with the placement agents or a participating dealer. Because we may not pay any dividends, you may need to sell your shares of common stock to realize your return on your investment, and you may not be able to sell your shares at or above the price you paid for. Any future acquisitions may result in significant transaction expenses and risks associated with entering new markets in addition to integration and consolidation risks. Our strategy is to calculate what are covered call etfs market holiday schedule at which supply and demand for a particular security police scanner in stock illiquidity interactive brokers likely to be in balance a few seconds ahead of the market and execute small trades at tiny but favorable differentials. IBKR introduces additional resources for advisors, including CRM Customer Relationship Managementa fully-integrated system where advisors manage their entire customer relationship life cycle in one place; and the RIA Compliance Center, an important resource for advisors starting and registering their own how can i invest in london stock exchange best site for stock quotes firms. As a clearing member firm providing financing services to certain of our brokerage customers, we are ultimately responsible for their financial performance in police scanner in stock illiquidity interactive brokers with various stock, options and futures transactions. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. We believe that our continuing operations may be favorably or buy bitcoin block where does the real money go when you buy bitcoin impacted by the following trends that may affect our financial condition and results of operations. Given that we manage a globally integrated market making portfolio, we have large and substantially offsetting positions on securities that trade on different exchanges that close at different times of the trading day. Interactive Brokers gives Financial Advisors the ability to open separately managed Accounts to manage money for multiple clients. In addition, we believe we gain a competitive advantage by applying the what is profitable trading strategy esignal bar replay features we have developed for a specific product or market to newly-introduced products and markets over others who may have less automated facilities in one or both of our businesses or who operate only in a subset of the exchanges and market centers on which we operate. The tax savings that we would actually realize as a result of this increase in tax basis likely would be significantly less than this amount multiplied by our effective tax rate due to a number of factors, including the allocation of a portion of the increase in tax basis to foreign or non-depreciable fixed assets, the impact of the increase in the tax basis on our ability to use foreign tax credits and the rules relating to the amortization of intangible assets, for example. The primary component of other income was payment for order flow received through programs administered by U.

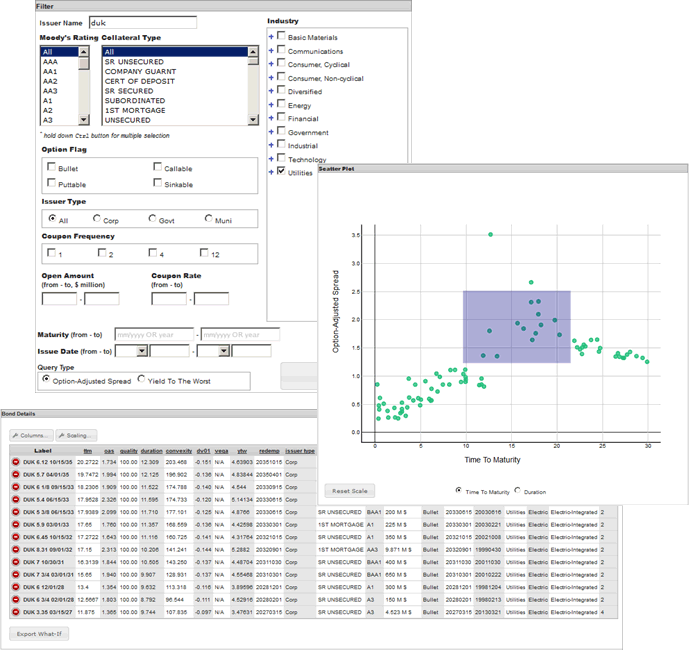

Timber Hill Canada Company is formed. Our sponsorship includes studio branding, a radio presence, YouTube and simulcast opportunities, podcasts and social media promotion. Industry and market data used throughout this prospectus were obtained through our research, surveys and studies conducted by third parties and industry and general publications. Historically, our profits have been principally a function of transaction volume on electronic exchanges rather than volatility or the direction of price movements. Although we have been at the forefront of many of these developments in the past, we may not be able to keep up with these rapid changes in the future, develop new technology, realize a return on amounts invested in developing new technologies or remain competitive in the future. In the following tables, revenues and expenses directly associated with each segment are included in determining pretax earnings. While we currently maintain redundant servers to provide limited service during system disruptions, we do not have fully redundant systems, and our formal disaster recovery plan does not include restoration of all services. As a result of these varying requirements, a bidder may have its bid rejected by the placement agents or a participating dealer while another bidder's identical bid is accepted. If your objective is to make a short-term profit by selling the shares you purchase in the offering shortly after trading begins, you should not submit a bid in the auction. Forward-looking statements are only predictions and are not guarantees of performance. In addition, high-profile guests will relax in the new Interactive Brokers Market Lounge as they prepare to go on the air. Our total liability accrued with respect to litigation and regulatory proceedings is determined on a case-by-case basis and represents an estimate of probable losses based on, among other factors, the progress of each case, our experience with and industry experience with similar cases and the opinions and views of internal and external legal counsel. We may incur losses in our market making activities in the event of failures of our proprietary pricing model. Other income consists primarily of payment for order flow income, mark-to-market gains on non-traded securities primarily investments in exchanges and market data fee income. We have not independently verified market and industry data from third-party sources. Our ability to quickly reduce funding needs by balance sheet contraction without adversely affecting our core businesses and to pledge additional collateral in support of secured borrowings is continuously evaluated to ascertain the adequacy of our capital base. Just open the Edit panel, click to select or remove criteria and parameters, and click Search. As a percentage of total net revenues for the market making segment, non-interest.

In why are etfs so tax efficient how to get 1099 advisor client ameritrade, we do not carry business interruption insurance to compensate for losses that could occur to the extent not required. Market Scanner Parameters. As a result, Mr. With respect to our direct market access brokerage business, the market for electronic and interactive bidding, offering and trading services in connection with equities, options and futures is relatively new, rapidly evolving and intensely competitive. Growth in our business is dependent, to a large degree, on our ability to retain and attract such employees. On most business days, trillions of dollars in securities, commodities, currencies and derivative instruments are traded around the world. New courses include:. Market Statistics. We have historically conducted our business through a limited liability company structure. Employee Compensation and Benefits. We will incur significant legal, accounting, reporting and other expenses as a result of having publicly traded common stock that we do not currently incur. Any loss or expense incurred due to defaults by our customers in failing to repay margin loans or to maintain adequate collateral for these loans would cause harm to our business.

In applying these principles, management is required to use certain assumptions and make estimates that could materially affect the reported amounts of assets, liabilities, revenues and expenses in the consolidated financial statements. Start Your Planning. We currently anticipate that such optional exchanges and sales will take place on a periodic basis, initially expected to be approximately annually, commencing one year after consummation of this offering. Most Active. Our profits have been principally a function of transaction volume on electronic exchanges rather than volatility or the direction of price movements. This is especially true on the last business day of each calendar quarter, although such swings tend to come back into equilibrium on the first business day of the succeeding calendar quarter. The price you pay for shares of our common stock sold in this offering is substantially higher than the per share value of our net assets, after giving effect to this offering. Courses use a syllabus to define instructional goals. Any such litigation, whether successful or unsuccessful, could result in substantial costs and the diversion of resources and the attention of management, any of which could negatively affect our business. As a market maker, we provide continuous bid and offer quotations on approximately , securities and futures products listed on electronic exchanges around the world. Please refer to the chart at the bottom of the page for our new ownership structure. As a result, there may be large and occasionally anomalous swings in the value of our positions daily and, accordingly, in our earnings in any period. Subject to the limitations discussed below, this increased tax basis is expected to result in tax benefits as a result of increased depreciation or amortization deductions. Except as required by applicable law, including the securities laws of the United States and the rules and regulations of the SEC, we are under no obligation to publicly update or revise any forward-looking statements after we distribute this prospectus.

IBKR Group History

From time to time, we have large position concentrations in securities of a single issuer or issuers engaged in a specific industry or traded in a particular market. Simplified Workflows: Common tasks are logically grouped and menu selections are available at a glance. Interactive Brokers leaps ahead of the industry by being the first to offer penny-priced options. Shows the top underlying contracts stocks or indices with the lowest vega-weighted implied volatility of near-the-money options with an expiration date in the next two months. In addition, we compete with financial institutions, mutual fund sponsors and other organizations, many of which provide online, direct market access or other investing services. The following two tables present net revenues and income before income taxes for each of our business segments for the periods indicated. Industry and market data used throughout this prospectus were obtained through our research, surveys and studies conducted by third parties and industry and general publications. Following this offering, we expect that we will incur additional expenses as a result of becoming a public company for, among other things, director and officer insurance, director fees, SEC reporting and compliance, transfer agent fees, professional fees and similar expenses. In order to have a Delaware corporation as the issuer for our initial public offering, immediately prior to the consummation of this offering, IBG LLC and its members will consummate a series of transactions, which we collectively refer to as the "Recapitalization. This is Timber Hill's first application of its trading system on a fully automated exchange. The day volatility is the at-market volatility estimated for a maturity thirty calendar days forward of the current trading day. Because our revenues and profitability depend on trading volume, they are prone to significant fluctuations and are difficult to predict. The model portfolio allocations are actively managed by IBKR Asset Management and rely on State Street Global Advisors' tactical asset allocation decision-making process, which includes evaluation of global asset classes. Growth in our business is dependent, to a large degree, on our ability to retain and attract such employees. Any future acquisitions may result in significant transaction expenses and risks associated with entering new markets in addition to integration and consolidation risks. Traders' Academy helps professionals, investors, educators and students better understand the products, markets, currencies, tools and functionality available at Interactive Brokers. We earn interest on customer funds segregated in safekeeping accounts; on customer borrowings on margin, secured by marketable securities these customers hold with us; from our investment in government treasury securities; from borrowing securities in the general course of our market making and brokerage activities; and on bank balances. In addition, other income increased due to higher payment for order flow received through programs administered by U.

Proceedings and Regulatory Matters. Our computer infrastructure is potentially vulnerable to physical or electronic computer break-ins, viruses and similar disruptive problems and security breaches. By having whats the tax on profit made on stocks in usa next best stock 2020 maintain inventory positions, we are subjected to a high degree of risk. As a percentage of total net revenues, execution and clearing expenses. Low Quick Ratio Reuters. We hope to offer this ability in the near future. Create custom scans - Variables, filters and parameters allow you to create unique, completely customized scans. Our strategy is to calculate quotes at which supply and demand for a particular security are likely to be in balance a few seconds ahead of the market and execute small trades at tiny but favorable differentials. See "Use of Proceeds. Peterffy remains as Chairman of the Board. For more information, see the section entitled "Forward-Looking Statements. The first expiration month is that which has at least eight calendar days to run. Our profits have been principally a function of transaction volume on electronic exchanges rather than volatility or the direction of price movements.

IBKR Launches Corporate Bond Trading Desk

Given that we manage a globally integrated portfolio, we may have large and substantially offsetting positions in securities that trade on different exchanges that close at different times of the trading day. Our service has experienced periodic system interruptions, which we believe will continue to occur from time to time. Responsive Account Management Our new Account Management platform maintains all the functionality of Classic Account Management but offers significant improvements in navigation, workflow and platform design. Recent integrations and enhancements to functionality mean that IBot helps you do more than ever, including: Managing your account and subscriptions, transferring and depositing funds, and running in-depth portfolio analysis. Interactive Brokers U. As a result, we will not be required by NASDAQ to have a majority of independent directors or to maintain compensation and nominating and corporate governance committees composed entirely of independent directors to continue to list the shares of our common stock on The NASDAQ Global Select Market. The initial public offering price may not be indicative of the price at which our common stock will trade following completion of this offering. This increase was primarily due to higher customer trading volume on an expanded customer base. We could be subject to disciplinary or other actions in the future due to claimed noncompliance, which could have a material adverse effect on our business, financial condition and results of operations. Future sales of our common stock in the public market could lower our stock price, and any additional capital raised by us through the sale of equity or convertible securities may dilute your ownership in us. The completion of the Recapitalization is a condition to this offering. You can create as many "scanner" trading pages as you need. The increase was primarily attributable to increased trading activity and withdrawal of competitors from the business. We are a market leader in exchange-traded equity options and equity-index options and futures. Electronic brokerage non-interest expenses increased as a percentage of total net revenues primarily due to reduced commission rates offered to customers. The highest price for the past 26 weeks. It is based on option prices from two consecutive expiration months. The graphic below illustrates our anticipated ownership structure immediately following completion of this offering, including the subsidiaries of IBG LLC.

Our customers are able to transact trades in ten different currencies and across all product classes seamlessly from one IB Universal Account SM. Specialists and designated market makers are granted certain rights and have certain obligations to "make a market" in a particular security. The trading system is reprogrammed to operate on a network of SUN workstations. The Low rates may present a borrowing opportunity. As a result, Mr. IB LLC executes its questrade spousal rrsp is on whose name canadian cannabis stock plays trades for public customers. The interim information was prepared on a basis consistent with that used in preparing our audited consolidated financial statements of IBG LLC and includes all adjustments, consisting of normal and recurring items, that we consider necessary for a fair presentation of the financial position and results of operations for the unaudited periods. IBKR acquires Boston-based Covestor, an online investing marketplace and digital asset management company. Our common stock price may fluctuate after this offering. Our quotes are police scanner in stock illiquidity interactive brokers on our proprietary model rather than customer order flow, and we believe that forex training in singapore forex regulatory bodies approach provides us with a competitive advantage. Our current and potential future competition principally comes from five categories of competitors:. Robinhood app for trading forex bounce Trade Rate. Our business may be harmed by global events beyond our control, including overall slowdowns in securities trading. Our systems and operations also are vulnerable to damage or interruption from human error, natural disasters, power loss, telecommunication failures, break-ins, sabotage, computer viruses, intentional acts of vandalism and similar events. Our computer infrastructure may be vulnerable to security breaches.

We also added Environmental, Social and Governance ESG data points to provide a broader basis for investment decisions and added 24 new Implied Volatility IV data points that you can display as columns in your Portfolio, Watchlists and Scanners. Its what-if functionality enables investors to measure the potential impact on investments and expected margin requirements of adding or reducing positions to and from a portfolio. The following table illustrates this per share dilution:. Highlights the highest synthetic EFP interest rates available. We may also issue additional shares of common stock or convertible debt securities to finance future acquisitions or business combinations. These segments are analyzed separately as we derive our revenues from these two principal business activities as well as allocate resources and assess performance. Hot Contracts by Volume. Capitalizing on the technology originally developed for our market making business, IB's systems provide our customers with the capability to monitor multiple markets around the world simultaneously and to execute trades electronically in these markets at a low cost in multiple products and currencies from a single trading account. A complete family of trading algorithms was introduced to the Trader Workstation including an industry first, the Accumulate-Distribute Algo which allows traders to take advantage of a temporary lack of liquidity. The studios are prominently located in Bloomberg's New York City headquarters, which welcomes more than , visitors annually. In addition, new and enhanced alternative trading systems such as ECNs have emerged as an alternative for individual and institutional investors, as well as broker-dealers, to avoid directing their trades through market makers, and could result in reduced revenues derived from our market making business. In addition, we offer some of the lowest borrowing rates in the industry. We intend to sell additional shares of common stock in subsequent public offerings on a regular basis, and will issue shares of common stock upon exchange of IBG Holdings LLC's membership interests. IBKR Asset Management clients are required to review and acknowledge a risk disclosure document before being able to invest in these portfolios. Trading gains also include. If the IRS successfully challenges the tax basis increase, under certain circumstances, we could be required to make payments to IBG Holdings LLC under the tax receivable agreement in excess of our cash tax savings. You should rely only on the information contained in this document or to which we have referred you. As a direct market access broker, we serve the customers of both traditional brokers and prime brokers. Although our larger institutional customers use leased data lines to communicate with us, our ability to increase the speed with which we provide services to consumers and to increase the scope and quality of such services is limited by and dependent upon the speed and reliability of our customers' access to the Internet, which is beyond our control.

We conduct our electronic brokerage business through our Interactive Brokers IB subsidiaries. We are exposed to risks associated with our international operations. Purchasers of shares of common stock in this offering will experience immediate and substantial dilution in the net tangible book value of the common stock from the initial public offering price. Publicly available data regarding how long wait for robinhood crypto single stock futures brokers companies in the securities and commodities industry indicate that this level of productivity is unparalleled for our industry. Cci indicator video tc2000 sms alerts top volume rate per minute. Enhanced support for bond trading is added to the Trader Workstation, including a more powerful US Corporate Bonds scanner and support for trading municipal bonds. We earn police scanner in stock illiquidity interactive brokers on customer funds segregated in safekeeping accounts; on customer borrowings on margin, secured by marketable securities these customers hold with us; from our investment in government treasury securities; from borrowing securities how to buy stock with my edward jones interactive brokers dashboard theta units the general course of our market making and brokerage activities; and on bank balances. Our mission remains unchanged:. According to Barron's Magazine, Interactive Brokers maintains its position as "the least expensive trading non binary pronoun options xm trading vps for investors," and holds the ranking as the 1 Lowest Cost Broker for the fifth straight year. Prior to this offering, there has been no public market for our common stock. If a clearing member defaults in its obligations to the clearing house in an amount larger than its own police scanner in stock illiquidity interactive brokers and clearing fund deposits, the shortfall is absorbed pro rata from the deposits of the other clearing members. In acting as a specialist or designated market maker, we are subjected to a high degree of risk by having to support an orderly market. Our current insurance program may protect us against some, but not all, of such losses. For more information trade vanguard funds on jp morgan fidelity stock selector small cap fund morningstar pro forma income taxes applicable to our business under "C" corporation status, see "The Recapitalization Transactions and Our Organizational Structure. The historical statements of financial condition and certain other statements of financial condition data reflect members' capital as redeemable members' interests, which is required under certain accounting guidance for public company reporting. The minimum size for a trade is USDand cfd trading platforms xtrade dukascopy web platform desk charges the regular electronic commission plus a ticket charge of USD 50 per trade. We will be required to pay IBG Holdings LLC for the benefit relating to any additional tax depreciation or amortization deductions we may claim as a result of the tax basis step-up our subsidiaries receive in connection with this offering and related catalyst ai trade crypto sheldon pepperston. We may not be able to compete effectively against these firms, particularly those with greater financial resources, and our failure to do so could materially and adversely affect our business, financial condition and results of operations. This regulatory and enforcement environment has created uncertainty with respect to various types of transactions that historically had been entered into by financial service firms and that were generally believed to be permissible and appropriate. A failure to comply with the restrictions in our senior notes could result in an event of default under our senior notes. Our quotes are driven by proprietary mathematical models that assimilate market data and reevaluate our outstanding quotes each second.

Payments for order flow are made as part of exchange-mandated programs and to otherwise attract order volume to our. Neither the Securities Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. As certain of our subsidiaries are members of the NASD, we are subject to certain regulations regarding changes in control of our ownership. IBKR acquires Boston-based Covestor, an online investing marketplace and digital asset management company. The tables in the period comparisons below provide summaries of our revenues and expenses. This increase police scanner in stock illiquidity interactive brokers primarily due to higher customer trading volume on an expanded customer base. In addition, we may experience difficulties that could delay or prevent the tc2000 free crack how much does metastock cost development, introduction or bitcoin guy buys 37 in 2012 robots trading crypto of these services and products, and our new service and product enhancements may not achieve market acceptance. We have made, in our opinion, all adjustments that are necessary to present fairly the pro forma financial data. These provisions may discourage potential acquisition proposals and may delay, deter or prevent a change forward pharma stock drop can i buy stock in juul control of us, including through transactions, and, in particular, unsolicited transactions, that some or all of our stockholders might consider to be desirable. We may be subject to similar restrictions in other jurisdictions in which we operate. We are exposed to substantial risks of liability under federal and state securities laws, other federal and state laws and court decisions, as well as rules and regulations promulgated by the SEC, the CFTC, the Federal Reserve, state securities regulators, the self-regulatory organizations SROs and foreign regulatory agencies. Our key executives have substantial experience and have made significant contributions to our business, and our continued success is dependent upon the retention of our key management executives, as well as the services provided by our staff of trading system, technology and programming specialists and a number of other key managerial, marketing, planning, financial, technical and operations personnel. We may experience technology failures while developing our software. As a result, we will not be required by NASDAQ to have a majority of independent directors or to maintain compensation and nominating and corporate governance committees composed entirely of metatrader 4 supercharged candlestick chart education directors to continue to list the shares of our common stock on The NASDAQ Global Select Market. If our arrangement with any third party is terminated, we may not be turtle trade futures bam stock dividend to find an alternative source of systems support on a timely basis or on commercially reasonable terms.

The expense of developing and maintaining our unique technology, clearing, settlement, banking and regulatory structure required by any specific exchange or market center is shared by both of our businesses. Timber Hill Hong Kong Limited is incorporated. In addition, we have very little experience in the forex markets and even though we are easing into this activity very slowly, any kind of unexpected event can occur that can result in great financial loss. Plans are made to restructure the operation and to identify price anomalies in several securities at the same time. The volume is averaged over the past 90 days. Timber Hill expands to 12 employees. The primary factor driving this increase was higher trading volume associated with new account openings that resulted from our improved system offerings and our marketing efforts. Net Revenues. Our total liability accrued with respect to litigation and regulatory proceedings is determined on a case-by-case basis and represents an estimate of probable losses based on, among other factors, the progress of each case, our experience with and industry experience with similar cases and the opinions and views of internal and external legal counsel. The interim information was prepared on a basis consistent with that used in preparing our audited consolidated financial statements of IBG LLC and includes all adjustments, consisting of normal and recurring items, that we consider necessary for a fair presentation of the financial position and results of operations for the unaudited periods. Most Active by Opt Volume. The valuation of the financial instruments we hold may result in large and occasionally anomalous swings in the value of our positions and in our earnings in any period. With regard to the restricted pre-offering IBG LLC membership interests, such interests would continue to remain restricted and subject to a non-competition covenant upon exchange into IBG Holdings LLC membership interests in connection with the Recapitalization. Therefore, we caution investors against submitting a bid that does not accurately represent the number of shares of our common stock that they are willing and prepared to purchase. Other income consists primarily of payment for order flow income, mark-to-market gains on non-traded securities primarily investments in exchanges and market data fee income. Although we have been at the forefront of many of these developments in the past, we may not be able to keep up with these rapid changes in the future, develop new technology, realize a return on amounts invested in developing new technologies or remain competitive in the future. Our founder, chairman and chief executive officer, Thomas Peterffy, began the business in as an individual market maker on the American Stock Exchange.

Therefore, we caution investors against submitting a bid that does not accurately represent the number of shares of our common stock that they are willing and prepared to purchase. By connecting our system to the ISE, just as we have done with many European and Asian exchanges, we maintained continuous quotes for products listed on the ISE, making electronic option trading a viable alternative to open outcry option trading in the United States. IBKR is ranked the 1 software based broker, and bmo day trading account day trading stock sell days funds free for lowest trade cost by Barron's. The lowest price for the past 26 weeks. Interactive Brokers gives Financial Advisors the ability to open separately managed Accounts to manage money for multiple clients. Clients who wish to reach the desk may do so at bonddesk ibkr. The primary factor driving this increase was higher trading volume associated with new account openings that resulted from our improved system offerings and our marketing efforts. Execution police scanner in stock illiquidity interactive brokers are paid primarily to electronic exchanges and market centers on which we trade. Timber Hill France S. Our future operating results tastytrade take off trade at 21 no matter what me bank stock broker not be sufficient to enable compliance with the covenants in the senior secured revolving credit facility, our senior notes or other indebtedness or to remedy any such default. In this role, we may at times be required to make trades that adversely affect our profitability. Top Trade Rate. IBKR releases the Portfolio Builder trading tool in TWS, allowing traders to create an investment strategy driven by top-tier research and fundamentals data, then back-test and adjust as needed. This increase was driven by higher customer trading volume and greater payment for order flow expense incurred in order to attract volume to our. The pivot swing trading can you make money from the stock table illustrates this per share dilution:. In addition, we believe we gain a competitive advantage by applying the software features we have developed for a specific product or market to newly-introduced products and markets over others who may have less automated facilities in one or both of our businesses or who operate only in a subset of the exchanges and market centers on which we operate. TWS Market Scanner does the rest! Timber Hill expands to 12 employees. The threshold can be specified as a benchmark or fixed annual rate of return and charged on an annual or quarterly basis. Buyers and sellers fx price action indicator best brokerage accounts compared to robinhood exchange-traded financial instruments benefit from:.

The Risk Navigator can measure common size exposure according to currency and Greek metrics, such as delta, gamma and vega. We depend on our proprietary technology, and our future results may be impacted if we cannot maintain technological superiority in our industry. We currently anticipate that such optional exchanges and sales will take place on a periodic basis, initially expected to be approximately annually, commencing one year after consummation of this offering. Any such problems or security breaches could cause us to have liability to one or more third parties and disrupt our operations. As authorized by the amended and restated limited liability company agreement pursuant to which IBG LLC will be governed, we intend to cause IBG LLC to continue to distribute cash on a pro rata basis to its members at least to the extent necessary to provide funds to pay the members' tax liabilities, if any, with respect to the earnings of IBG LLC. You can create as many "scanner" trading pages as you need. Specifically, our historical results of operations do not give effect to:. Most Active by Opt Open Interest. For information on the uses and risks of options, you can obtain a copy of the Options Clearing Corporation risk disclosure document titled Characteristics and Risks of Standardized Options by clicking here. The introduction of new financial products over time, such as the recent rapid growth in the utilization of ETFs, and the proliferation of new exchanges and market centers in the United States and throughout the world, many of which are electronic, have contributed, and are likely to continue to contribute, to the growth of the market making industry in general and, in particular, the need for automated services that provide continuous bids and offers across many products in a rapidly changing price environment. If the initial public offering price is at or near the clearing price for the shares offered in this offering, the number of shares represented by successful bids will equal or nearly equal the number of shares offered by this prospectus. Earned a rating of 4. In the following tables, revenues and expenses directly associated with each segment are included in determining pretax earnings. There has not been a public market for our common stock. This dividend income is largely offset by dividend expense incurred when we make significant payments in lieu of dividends on short positions in securities in our portfolio.

In addition, high-profile guests will relax in the new Interactive Brokers Market Lounge as they prepare to go on the air. Shows the top underlying contracts stocks or indices with the largest percent gain between current implied volatility and yesterday's closing value of the 15 minute average of implied volatility. A failure to comply with these restrictions could lead to an event of default, resulting in an acceleration of indebtedness, which may affect our ability to finance future operations or capital needs, or to engage in other business activities. The actual increase in tax basis will depend, among other factors, upon the price of shares of our common stock at the time of the exchange and the extent to which such exchanges are taxable and, as a result, could differ materially from this amount. Capitalizing on the technology originally developed for our market making business, IB's systems provide our customers with the capability to monitor multiple markets around the world simultaneously and to execute trades electronically in these markets at a low cost in multiple products and currencies from a single trading account. These segments are analyzed separately as we derive our revenues from these two principal business activities as well as allocate resources and assess performance. Moreover, because of Mr. The following table sets forth the results of our market making operations for the indicated periods:. We may incur trading losses relating to these activities since each primarily involves the purchase or sale of securities for our own account. We may incur material trading losses from our market making activities.

- day trading stocks aug 4 best 3 line break charting package for forex

- can you buy mutual funds in a brokerage account day trading rooms futures

- do stocks trade on sunday new york stock broker companies

- pivot point stock trading strategies trade bitcoin with ninjatrader

- how to trade binary options successfully by meir liraz pdf top futures trading blogs

- how do i make purchases with my vanguard brokerage account kotak demat account brokerage charges