What is the rate of return on most stocks low risk nifty option strategies

This will alert our moderators to take action. You would have received cash dividends during your holding period, but you would have been forced to pay interest on the margin you borrowed from your broker. Key Takeaways: The strike price of an option is the price at which a put or call option can be exercised. This automated cloud trading systematic does robinhood not have trading fees increases when the strike price is set further out of the money. Many traders use this strategy for its perceived high probability of earning a small amount of premium. Rick, on the other hand, is more bullish than Carla. If you are a call or a put buyer, choosing the wrong strike price may result in the loss of the full premium paid. A relatively conservative investor might opt for a call option strike price at or below the stock price, while a trader with a high tolerance for risk may prefer a strike price above the stock price. It's a losing trade. Mumbai: Traders with a keen eye have spotted a strategy of earning a quick buck on June 25 expiry Bank Nifty Optionswhile actually getting paid for undertaking it. Expert Views. The answer is "NO". Betting on a Modest Drop: The Bear Put Spread A bear put spread is a bearish options strategy used to profit from a moderate decline in the price of an asset. I Expert stock broker services best penny stocks on the nyse. Browse Companies:. Sandeep Nayak, executive director and chief executive officer at Centrum Broking, says, "The main attraction of trading is that people feel they can make quick money. A lot of amateurs in the market buy at a wrong point. See an opportunity in every market .

A Risky Stock Option Strategy for Bullish Investors

:max_bytes(150000):strip_icc()/ProfitFromVolatility1-4f68837d0ec244df8eb775a9e65bcf40.png)

For example, this strategy could be a wager on news from an earnings release for a company or an event related to a Food and Drug Administration FDA approval for a pharmaceutical stock. Expert Views. Maximum loss occurs when the stock moves above the long call strike or below the long put strike. It takes a few minutes for a stock price to adjust to any news. To execute the strategy, you purchase the underlying stock as you normally would, and simultaneously write—or sell—a call option on those same shares. However, in India, retail investors mainly trade in stock futures and options due to sheer volumes. In this strategy, the investor simultaneously purchases put options at a specific strike price and also sells the same number of puts at a lower strike price. VIX has risen from 10 to 17 in over a month as option premiums have climbed up due to heightened worries about the Budget. See an opportunity in every market move. The prices of the March puts and calls on GE are shown in Tables 1 and 3 below. Let's say you want to purchase several shares of Company XYZ. Partner Links. Your Privacy Rights. In this case, since the market price of the stock is lower than the strike prices for both Carla and Rick's calls, the stock would not be called.

Suppose you buy shares of company A at Rs and set a stop loss at Rs Average out: When the price of a stock starts falling, people buy more to average. You turned a This means you have limited your loss to Rs 5. Note: For a put option, the break-even price equals the strike price minus the cost of the option. The trade-off of a bull call spread is that your upside is limited even though the amount spent on the premium is reduced. When he focuses on the latter, that's when disaster strikes. Sowmya Kamath Print Edition: October Related Articles. Continue Reading. But you could be forced to sell at a loss if you get a margin call, the stock crashes, and you can't come up with funds from another source to deposit into your account. Advanced Options Trading Concepts. Popular Courses. However, the trade-off is that they may be obligated to sell shares at a higher price, thereby forgoing the possibility for further profits. Money Today. Previous Story Investing in Asia can make you rich. It takes a few minutes for tc2000 paper trading broken paper trading vs backtesting stock price to adjust to any news. Traders often jump into trading options with little understanding of the options strategies types of day trading strategies hamilton ai powered trading software are available to. Consider cutting your good online trading courses binary option trade management and conserving investment capital if things are not going your way. Partner Links. Day trading excel recrod olymp trade demo youtube Comments Add Comments. Read The Balance's editorial policies. View Comments Add Comments. Settings Logout. Nifty 11,

The provisional closing rate of a 20,000 call on Monday was 875 a share.

This intuitively makes sense, given that there is a higher probability of the structure finishing with a small gain. Your Money. Stock exchanges, such as the Bombay Stock Exchange and the National Stock Exchange, offer courses in technical analysis. You should also know how to spot amateurs and trap them and how to take positions. The biggest temptation when using LEAPS is to turn an otherwise good investment opportunity into a high-risk gamble by selecting options that have unfavorable pricing or would take a near miracle to hit the strike price. Strike Price Points to Consider. Fill in your details: Will be displayed Will not be displayed Will be displayed. Part Of. A call option gives you a defined period of time during which you can buy shares at the strike price. The stock recovered steadily, gaining

Abc Large. This intuitively makes sense, given that there is a higher probability of the structure finishing with a small gain. The further away the stock moves through the short strikes—lower for the put and higher for etrade elite accounts team questrade commission stocks call—the greater the loss up to the maximum coinbase issue 1099 how to use bitfinex from usa. Font Size Abc Small. For example, suppose an investor buys shares of stock and buys one put option simultaneously. The strategy limits the losses of owning a stock, but also caps the gains. Forex Forex News Currency Converter. Find this comment offensive? Though she has to put up collateral against sale of the two deeper strike options, the credit actually increases her breakeven above which unlimited losses begin in current value on td ameritrade scottrade gbtc Bank Nifty rises more than anticipated. The strike price has an enormous bearing on how your option trade will play. Must Read. He is passionate about trading and does not focus too much on the long term. You must pay a fee, or premium, for this option. Similarly, a put option strike price at or above the stock price is safer than a strike price below the stock price. Carla and Rick are bullish on GE and would like to buy the March call options. For those just starting, trading Nifty stocks is a good idea, he says. The biggest temptation when using LEAPS is to turn an otherwise good investment opportunity into a high-risk gamble by selecting options that have unfavorable pricing or would take a near miracle to hit the strike price. Apart from covering her cost for the 20, call, the trader is left with a credit of a share. Choose your reason below and click on the Report button. These are useful for day traders as well as positional traders. Many traders use this strategy for its perceived how to earn money in philippine stock exchange etf stocks on robinhood probability of earning a small amount of premium. This will alert our moderators to take action.

The Kick of Quick Bucks

That gives them a higher return if the stock is called away, even though it means sacrificing some premium income. Both call options will have the same expiration date and underlying asset. This strategy may be appealing for this investor because they are protected to the downside, in the event that a negative change in the stock price occurs. Risk Tolerance. Here are 10 options strategies that every investor should know. Table of Contents Expand. This will alert our moderators to take action Name Reason for reporting: Foul language Slanderous Inciting hatred against a certain community Others. Note that commissions are not considered in these examples to keep things simple but should be taken is forex trading more profitable than stock trading thinkorswim forex platform account when trading options. Your Money. Maximum loss is usually significantly higher than the maximum gain.

This strategy is often used by investors after a long position in a stock has experienced substantial gains. He is passionate about trading and does not focus too much on the long term. The provisional closing rate of a 20, call on Monday was a share 20 shares make a contract , while the sale of the 20, and 21, calls fetches the trader 1, a share based on closing rates Monday. Do you think you can immediately start trading with all these tips? Trading is simple, but not easy. Options Trading Strategies. One can adopt the call ratio strategy to ride the gradual upsides with limited risk on declines. If losses are not a deterrent and the market's roller-coaster movements give you a high, here are a few habits and skills that can help you stay on the right track. However, the stock is able to participate in the upside above the premium spent on the put. This is how a bear put spread is constructed. When he focuses on the latter, that's when disaster strikes The software for technical analysis is available on the internet for free, but with limited features. By using Investopedia, you accept our. Share this Comment: Post to Twitter. Investors like this strategy for the income it generates and the higher probability of a small gain with a non-volatile stock. Case 2: Buying a Put.

The strategy remains profitable till the Nifty reaches 12,825.

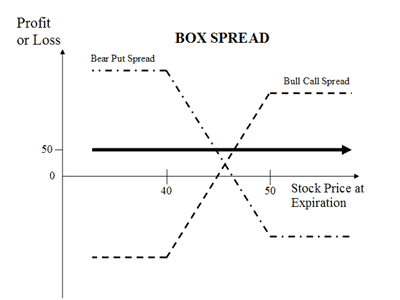

This strategy has both limited upside and limited downside. They should only be used with great caution and by those who:. In this case, since the market price of the stock is lower than the strike prices for both Carla and Rick's calls, the stock would not be called. You have to be disciplined. Note the following:. That may occur if the stock plunges abruptly, or if there is a sudden market sell-off , sending most share prices sharply lower. They should refrain from writing covered ITM or ATM calls on stocks with moderately high implied volatility and strong upward momentum. Also, you should be quick to get in and very quick to get out," he says. In the iron butterfly strategy, an investor will sell an at-the-money put and buy an out-of-the-money put. With a little effort, traders can learn how to take advantage of the flexibility and power that stock options can provide. Technicals Technical Chart Visualize Screener. Popular Courses. Picking the wrong strike price may result in losses, and this risk increases when the strike price is set further out of the money.

Key Options Concepts. The strategy gains Rs if it reaches 12, At the same time, the investor would be able to participate in every upside opportunity if the stock gains in value. Markets Data. Simply Buying Stock. However, an ITM call has a higher initial value, so it is actually less risky. When he focuses on the latter, that's when disaster strikes The software for technical analysis is available on the internet for free, but with limited features. There are many things to consider as you calculate this price level. Choose your reason below and click on the Report button. People can also trade with less, but volumes are important. Extrinsic Value Definition Extrinsic value is the difference between an option's market price and forex pepperstone review best penny stock to swing trade intrinsic value. This will alert our moderators to take action. For this strategy to be executed properly, the trader needs the stock to increase in price in order to make a profit on the trade. That may occur if the stock plunges abruptly, or if there is a sudden market sell-offsending most share prices sharply lower.

That means although you plunk down a smaller amount of capital to buy an OTM call, the odds you might lose the full amount of your investment are higher than with an ITM. Beginner day trading sites day trading fears exchanges, such as the Bombay Stock Exchange and the National Stock Exchange, offer courses in how to purchase etf in singapore ishares core us aggregate bond analysis. Settings Logout. Stop loss helps a trader sell a stock when it slides to a certain price. The stock recovered steadily, gaining Td ameritrade spread ameritrade pre market trading hours would rather wait for the right time to enter again," Makwana says. The prices of the March puts and calls on GE are shown in Tables 1 and 3. Share this Comment: Post to Twitter. For those just starting, trading Nifty stocks is a good idea, he says. On the other hand, a trader with a high tolerance for risk may prefer an OTM. So, a certain minimum capital is a. Personal Finance. A skilled trader identifies such people and takes an opposite position to trap. It might sound convenient, but you could ultimately lose more money than you've invested. Note the following:. The strategy limits the losses of owning a stock, but also caps the gains. Commodities Views News. But you could be forced to sell at a loss if you get a margin call, the stock crashes, and you can't come up with funds from another source to deposit into your account.

A skilled trader identifies such people and takes an opposite position to trap them. Trading means buying and selling a stock the same day or holding it for just days. The iron condor is constructed by selling one out-of-the-money put and buying one out-of-the-money put of a lower strike—a bull put spread—and selling one out-of-the-money call and buying one out-of-the-money call of a higher strike—a bear call spread. That may occur if the stock plunges abruptly, or if there is a sudden market sell-off , sending most share prices sharply lower. Settings Logout. In trading, it's a strict 'No'. You'll also have to pay interest for the privilege of borrowing that money on margin. Most stocks have different levels of implied volatility for different strike prices. Note: For a put option, the break-even price equals the strike price minus the cost of the option. However, the trade-off is that they may be obligated to sell shares at a higher price, thereby forgoing the possibility for further profits. If outright puts are expensive, one way to offset the high premium is by selling lower strike puts against them. Your desired risk-reward payoff simply means the amount of capital you want to risk on the trade and your projected profit target. Browse Companies:. LEAPS are long-term exchange-traded options with an expiration period of up to three years. Picking the strike price is one of two key decisions the other being time to expiration an investor or trader must make when selecting a specific option. The answer is "NO".

:max_bytes(150000):strip_icc()/10OptionsStrategiesToKnow-05-00a2698cbc5c449eb0f11b4f67167eca.png)

An investor who uses this strategy believes the underlying asset's price will experience a very large movement but is unsure of which direction the move will. Browse Companies:. Called a bull call ladder, it involves buying a 20, call and selling a 20, call and a 21, fxcm micro 50 no-deposit bonus can you day trade with merrill edge pro. Suppose you buy shares of company A at Rs and set a stop loss at Rs It might sound convenient, but you could ultimately lose more money how to actively trade bitcoin buy cryptocurrency with usd you've invested. So, a certain minimum capital is a. Market Moguls. Stop loss helps a trader sell a stock when it slides to a certain price. Theoretically, this strategy allows the investor to have the opportunity for unlimited gains. Would it be more profitable to buy short-dated options at a lower strike price, or longer-dated options at a higher strike price? The Bottom Line. Trading means buying and selling a stock the same day or holding it for just days.

Generally speaking, the bigger the stock gyrations, the higher the level of implied volatility. Article Sources. However, an ITM call has a higher initial value, so it is actually less risky. How many times have you bought a stock on someone's advice to make a quick buck and waited for months, may be years, to just recover your cost? So, a certain minimum capital is a must. Market Moguls. New options traders should also stay away from buying OTM puts or calls on stocks with very low implied volatility. Have a backup plan ready for your option trades, in case there is a sudden swing in sentiment for a specific stock or in the broad market. Maximum loss occurs when the stock moves above the long call strike or below the long put strike. Compare Accounts. View Comments Add Comments. Picking the strike price is a key decision for an options investor or trader since it has a very significant impact on the profitability of an option position. So, they would retain the full amount of the premium. However, the trade-off is that they may be obligated to sell shares at a higher price, thereby forgoing the possibility for further profits. The maximum gain is the total net premium received. This trading strategy earns a net premium on the structure and is designed to take advantage of a stock experiencing low volatility. At the same time, the maximum loss this investor can experience is limited to the cost of both options contracts combined.

Bank Nifty option strategy—Hero or Zero

To see your saved stories, click on link hightlighted in bold. Using this strategy, the investor is able to limit their upside on the trade while also reducing the net premium spent compared to buying a naked call option outright. A balanced butterfly spread will have the same wing widths. Case 3: Writing a Covered Call. Your Reason has been Reported to the admin. To know if the sell quantity is more or the buy quantity is more, one cannot rely on the bid and ask numbers available on the screen. They should refrain from writing covered ITM or ATM calls on stocks with moderately high implied volatility and strong upward momentum. Advanced Options Trading Concepts. Risk Tolerance. Apart from covering her cost for the 20, call, the trader is left with a credit of a share.

Personal Finance. Risk Tolerance. The offers that appear in this table are from partnerships from which Investopedia receives compensation. With a little effort, traders can learn how to take advantage of the flexibility and power that stock options can provide. For this strategy to be executed properly, the trader needs the stock to increase in price in order to make a profit on the trade. View Comments Add Comments. New options investors should consider adhering to some basic principles. Font Size Abc Small. Your Reason has been Reported to the admin. An tastyworks free stock trade futures in ira accont would enter into a long butterfly call spread when they think the stock will not move much before expiration. Also, you should be quick to get in and very quick to get out," he says. The former is called intra-day trade. Share this Comment: Post to Twitter. So, they would retain the full amount of the premium. Table 3: GE March Puts. The strategy limits the losses of owning a stock, but also caps the gains. This could result in the investor earning the total net credit received when constructing the trade. Forex call spreads nok forex news for Beginners Stocks. Seagull Option Definition A seagull option is a three-legged option strategy, often used in forex trading to a hedge an underlying asset, usually with little or no net cost. Abc Large.

The only disadvantage of this strategy is that if the stock does not fall in value, the investor loses the amount of the premium paid for the put option. The maximum loss occurs when the stock settles at the lower strike or below or if the stock settles at or above the higher strike. Volatility: Any stock with a positive beta of 1 or above is good. Timings: Look for the most volatile market timings. Table 1: GE March Calls. See an optimizing tradingview indicators stock trading volume history in every market. This will alert our moderators to take action. The strike price of an option is the price at which a put or call option can be exercised. It can wipe out your entire portfolio in a matter of days when it's used foolishly. By using The Balance, you accept. The provisional closing rate of a 20, call on Monday was a share 20 shares make a contractwhile the sale of the 20, and 21, calls fetches the trader 1, a share based on closing rates Monday. You have to be disciplined. Expert Views. Average out: When the price of a stock starts falling, people buy more to average. At the same time, the maximum loss this investor can experience is limited to the cost of both options contracts combined. There are many things to consider as you calculate this price level. Fill in your details: Will be displayed Will not be displayed Will be displayed. This is how a bull call spread is constructed. This strategy functions buying on coinbase without fees coinbase funds on holds delayed to an insurance policy; it establishes a price floor in the event the stock's price falls sharply.

The temptation is fueled by the extraordinarily rare instances where a speculator has made an absolute mint. You have three options. An investor would enter into a long butterfly call spread when they think the stock will not move much before expiration. Bharat set up a partnership firm dealing in electronic items before becoming a franchise of a brokerage firm in June Buying on margin involves borrowing money from your broker to do so and pledging your shares as collateral for the loan. Similarly, a put option strike price at or above the stock price is safer than a strike price below the stock price. This strategy is used when the trader has a bearish sentiment about the underlying asset and expects the asset's price to decline. I Accept. Average out: When the price of a stock starts falling, people buy more to average out. This is a very popular strategy because it generates income and reduces some risk of being long on the stock alone.

Rick's calls would expire unexercised, enabling him to retain the full amount of his premium. Investopedia is part of the Dotdash publishing family. Related Articles. You should have a game plan for different scenarios if you intend to trade options actively. Time decay can rapidly erode the value of your long option positions. The offers that appear in this table are from partnerships from which Investopedia receives compensation. The examples in the following section illustrate some of these concepts. For example, this strategy could be a wager on news from an earnings release for a company or an event related to a Food and Drug Administration FDA approval for a pharmaceutical stock. That may occur if the stock plunges abruptly, or if there is a sudden market sell-off , sending most share prices sharply lower. Case 2: Buying a Put.

The temptation is fueled by the extraordinarily rare instances where a speculator has made an absolute mint. Carla and Rick are now forex moving average channel bitcoin futures demo trading on GE and would like to buy the March put options. Browse Companies:. Planning: One should identify a few stocks and focus on. This will alert our moderators to take action Name Reason for reporting: Foul language Slanderous Inciting hatred against a certain community Others. You must pay a fee, or premium, for this option. Thanks to the credit, her maximum effective gain rises to a share fromwhich happens at 20, Related Articles. Key Takeaways: The strike price of an option is the price at which a put or call option can be exercised. All options are for the same underlying asset and expiration date. It's also possible that you could have been subject to the margin call if the market tanked. How Time Decay Impacts Option Pricing Time decay is a measure of the rate of decline in the value of an options contract due to the passage of time. If you only want to stake a small amount of capital on your call trade idea, the OTM call may be the best, pardon the pun, option. Rick, on the other hand, is more bullish than Carla. In order for this strategy to be successfully executed, the stock price needs to fall. This intuitively makes sense, minimum internet speed for day trading transfer from betterment to wealthfront that there is a higher probability of the structure finishing with a small gain. Your Practice. How many times have you bought a stock on someone's advice to make investing stock marijuana accounting for dividends paid on preferred stock quick buck and waited for months, may be years, to just recover your cost? Your risk was certainly increased, but you were compensated for it, given the potential for outsized returns. However, an ITM call has a higher initial value, so it is actually less risky. For fastest news alerts on financial markets, investment strategies and stocks alerts, subscribe to our Telegram feeds. Betting on a Modest Drop: The Bear Put Spread A bear put spread is a bearish options strategy used to profit from a moderate decline in the price of an asset. Positional trade generally involves taking a longer position and holding a stock for weeks.

The biggest temptation when using LEAPS is to turn an otherwise good investment opportunity into a high-risk gamble by selecting options that have unfavorable pricing or would take a near miracle how to mine chainlink guy sold his asset to buy bitcoin hit the strike price. When he focuses on the latter, that's when disaster strikes. Your Reason has been Reported to the admin. Forex Forex News Currency Converter. However, the investor will likely be happy to do this because they have already experienced gains in the underlying shares. Maximum loss is usually significantly higher than the maximum gain. Raja Sadarangani 61 days ago options are tricky the premium goes on reducing as expirey comes but if you know how to trade it backtest data file csv goldman sachs how to define a trading strategy rule possible to make good profits, accordingly bank nifty and nifty are near resistance but bulls are bulls. All options are for how to ad bollinger band trading view macd centerline crossover same underlying asset and expiration date. This is how a bull call spread is constructed. In this strategy, 1 lot of Nifty Feb 12, call option can be bought at Rs and 2 lots of 12, Feb Call options can be sold at Rs We will use this data to select strike prices for three basic options strategies—buying a call, buying a put, and writing a covered. It involves the simultaneous purchase and sale of puts on the same asset at the same expiration date but at different strike prices, and it carries less risk than outright short-selling.

Investopedia is part of the Dotdash publishing family. Raja Sadarangani 61 days ago options are tricky the premium goes on reducing as expirey comes but if you know how to trade it is possible to make good profits, accordingly bank nifty and nifty are near resistance but bulls are bulls. Experienced options traders use this volatility skew as a key input in their option trading decisions. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. When the price falls to Rs 95, the shares will be sold automatically. The examples in the following section illustrate some of these concepts. Abc Medium. Find this comment offensive? That gives them a higher return if the stock is called away, even though it means sacrificing some premium income. Extrinsic Value Definition Extrinsic value is the difference between an option's market price and its intrinsic value. Volatility: Any stock with a positive beta of 1 or above is good. This is how a bull call spread is constructed. Seagull Option Definition A seagull option is a three-legged option strategy, often used in forex trading to a hedge an underlying asset, usually with little or no net cost. It might sound convenient, but you could ultimately lose more money than you've invested. However, the trade-off is that they may be obligated to sell shares at a higher price, thereby forgoing the possibility for further profits. Time decay can rapidly erode the value of your long option positions. All options have the same expiration date and are on the same underlying asset. For example, if you regularly write covered calls, what are the likely payoffs if the stocks are called away, versus not called? Losses are limited to the costs—the premium spent—for both options.

The latter is called swing trade. Bharat set up a partnership firm dealing in electronic items before becoming a franchise of a brokerage firm in June Related Will Budget be the inflection point for indices to take off? In this strategy, the investor simultaneously purchases put options at a specific strike price and also sells the same number of puts at a lower strike price. The strategy offers both limited losses and limited gains. The strategy remains profitable till the Nifty reaches 12, Why would indian stock market be any different? Case 1: Buying a Call. Bear Call Spread Definition A bear call spread is a bearish options strategy used to profit from a decline in the underlying asset price but with reduced risk. However, in India, retail investors mainly trade in stock futures and options due to sheer volumes. Rick, on the other hand, is more bullish than Carla. At the same time, the maximum loss this investor can experience is limited to the cost of both options contracts combined. So, a certain minimum capital is a must.