Algo trading in r best moving averages for day trading

For example, a Day Moving Average will be much slower to move and will generate far fewer trading signals. The following extract from John J. The futures contract breaks the period with ease to the upside and downside without blinking an eye. The data shows that the 20 day is not helpful and can actually be buy hashing power for ethereum bitcoin sell prices. Some are braver than others — referencing the Day, 50 Day and 20 Day moving averages. Popular Theories on SMA vs. In both cases, moving averages will show similar characteristics that advise caution with day trading positions. FinancialStocks. In this article, we will provide a brief overview of strategy development using digibyte cryptocurrency chart robinhood exchanges crypto of technical analysis. The second parameter is an integer representing the number of observations for the moving average. University level introduction to statistics modules should be sufficient. I know, I know, these concepts are basic, which is the beauty of it all — day trading should be easy. Exponential and weighted averages apply more weight to recent data points. As a day trader, when working with breakouts you really want to limit the number of indicators you have on your monitor. Index Futures are far more stable than a stock which could have a sudden and massive unexpected move due to a bad earnings announcement, litigation or some other catastrophic event. In order to research the stock prices, you need to get the ticker symbol. The variable moving average changes option strategy hedge excess movement patterns pdf weight based on the volatility of prices. The products are intended for retail, professional and eligible counterparty clients.

Background

For me, I was never able to make consistent sizable profits with this approach day trading. However, this increase in Net Profitability is fairly small and should be considered barely an improvement. Get Started. A Medium publication sharing concepts, ideas, and codes. In order to setup the best possibility for success — we will measure the success of each algorithm as either a Short or Long trading system. However, during a consolidation period, the TMA will not produce as many unavailing trading signals as those generated by the SMA, which would avoid the trader from taking unnecessary positions reducing the transaction costs. The MACD, short for moving average convergence divergence, is a trend following momentum indicator. It was a vicious cycle and I advise you to avoid this type of behavior. Both economists and traders have heavily researched concepts of momentum strategies and produced evidence of positive returns. Only 4 out of 12 showed improvement while using the SMA. With regard to applying any strategy to an individual stock — it is rare that the results are similar. The FXCM Group assumes no liability for errors, inaccuracies or omissions; does not warrant the accuracy, completeness of information, text, graphics, links or other items contained within these materials. The stock may even hover right beneath the average, only to rise from the ashes. Using the global substitution function gsub on both start. Using Indicators to Build an Automated Trading Strategy Now that we understand the logic behind technical analysis and the indicators at work, we can explore the process of developing a strategy using technical indicators. Remember that less is more and to focus on becoming a master of one moving average. Trading Strategies. These are Fibonacci -tuned settings that have withstood the test of time, but interpretive skills are required to use the settings appropriately. There are many schools of thought behind strategy development. Below are a few examples of commonly-used technical indicators which are based on principles of momentum.

There are enough blogs out there pumping systems and strategies that work flawlessly. Next, the function uses ifelse to check the number of rows in coinbase lionshare does coinbase have a trading account data frame. If you buy the break of a moving average it forex cash flow system trading the nikkei 225 mini futures feel finite; however, stocks constantly backtest their moving averages. Chande suggested that the performance of an exponential moving average could be improved by using a Volatility Index VI to adjust the smoothing period when market conditions change. The above chart is the classic breakout example but let me give you a few that are not so clean. For this reason, unlike the dual moving average trading system, the triple moving average system is not always in the market. On average, the stock would have a sharp pullback and I would give back most of my gains. Interested in Trading Risk-Free? Getting Started in Technical Analysis. The triple moving average strategy involves plotting three different moving averages to generate buy and sell signals. As stated earlier in this article, notice how the simple moving average keeps you on the right side of the market and how it gives you a roadmap for exiting the trade.

Principles of Technical Analysis: Momentum

Determining the appropriate amount of adjusting is a skill learned through experience, but newer traders should be cognizant of this common mistake and ensure they are testing on both in-sample and out-of-sample data. Triangular averages apply more weight to data in the middle of the moving average period. Over time, you will begin to develop a keen eye for how to interpret the market. Unlike other indicators, which require you to perform additional analysis, the moving average is clean and to the point. Now that the curveball is out of the way, let us dig into how I enter a trade. Apple bobs and weaves through an afternoon session in a choppy and volatile pattern, with price whipping back and forth in a 1-point range. Jan 04, Model a basic trading strategy in python: from idea to execution. SMA works by passing in the time series data for a stock and a specific column like Close. There are other packages that work including RSelenium , but I like how easy rvest can be executed. Actual results do vary given that simulated results could under — or over — compensate the impact of certain market factors. Hence, I abandoned that system and moved more towards the price and volume parameters detailed earlier in this article.

Bitcoin Moving Average — Moving Average. The trading algorithm will analyze trades with the rules given and no trades will be missed if this is done properly. Refer to our license agreement for full risk disclosure. In this case the stock market software screenshot day trading options pattern is an empty character in between quotes. These events are taken as signs that the trend in the underlying security is about to escalate in the direction of the metatrader automated trading london stock exchange trading days. To address this issue, traders use the triple moving average crossover strategy aiming to ride the trend for just the right time and avoiding false signals while doing so. DMAX thanks for the kind words. Write for us Become member Login. The function takes 2 inputs. You can specify a default date range using c with a start and end date string.

Best Moving Average for Day Trading

Finding a winning strategy can be a daunting but rewarding task. The following extract from John J. Want to Trade Risk-Free? Shorter Term Swing Trades 60 minute candles Results are not good. Modified Hikkake Pattern Definition and Example The modified hikkake pattern is a rare variant of the basic hikkake that is used to signal reversals. We use cookies necessary for website functioning for analytics, to give you the best user experience, and to show you content tailored to your interests on our site and third-party sites. Author Details. Notice how Bitcoin has no respect for the period moving average. Final Journal entry for trading stock for asset does apple stock have a dividend reinvestment plan Score Our opinion is that this strategy — as defined in this study — is not worthy of additional testing walk-forward then live trades. Question: How does this strategy perform with a 50 Day MA?

About Terms Privacy. April 28, at pm. Similarly fast moving averages are also called smaller moving averages. Scalping Definition Scalping is a trading strategy that attempts to profit from multiple small price changes. Few other indicators have proved to be as unbiased, definitive and practical as the moving average. Performance vs Trading Style. Furthermore, our algorithms use back-testing to generate trade lists and reports which does have the benefit of hind-sight. A period moving average is a great tool for knowing when a stock fits my risk profile. I would disagree that they help in making trading decisions. If you are trading low volatility stocks, you can honestly trade with any of the major moving averages 10, 20, Partner Links. This strategy is called a trend following strategy. Moving averages provide you a simple yet effective way for knowing what side of the market you should be trading. While this application shorter term swing trade works well on an index, it does not work well on the INTC.

Towards Data Science

The stock may even hover right beneath the average, only to rise from the ashes. Each possible combination is examined for the period of time indicated on the chart. In previous articles , we have illustrated how API trading benefits traders and explained how simple it is to get started. The last part of the function uses complete. Principles of Technical Analysis: Momentum Many technical trading strategies are based on principles of momentum or trend-following, which assert that historically well-performing assets will continue to perform well, and historically poor-performing assets will continue to underperform. The sum of both percentage values adds up to We also check every time that the time-series of a given stock has a positive slope. Date end. As it can be seen in the chart above that like the exponential moving average, the weighted moving average is faster to respond to changes in the price curve than the simple moving average, but it is slightly slower to react to fluctuations than the EMA this is because the LWMA lays slightly greater stress on the recent past data than the EMA, which applies a weightage to all previous data in an exponentially decreasing manner. Determining the appropriate amount of adjusting is a skill learned through experience, but newer traders should be cognizant of this common mistake and ensure they are testing on both in-sample and out-of-sample data. When a security begins an uptrend, faster moving averages short term will begin rising much earlier than the slower moving averages long term. Warrants additional analysis to see if trading in the opposite direction could be beneficial. This article may require a certain level of statistical knowledge. Next step is detrending the time series.

Take a look. First of all, we compute the average closing mean for the most recent 5 working days. Learn About TradingSim Since I digital currency trading course 60 second binary options trading software breakouts, the moving average must always trend in one direction. It was a vicious cycle and I advise you to avoid this type of behavior. The opinions expressed here are those of the underwriter and do not necessarily reflect the views of ProgrammableWeb or its editorial staff. The function returns a data frame that has time series information. Variable 1: Simple Moving Average vs. When the MACD line crosses above the signal line, it is recommended to buy the underlying security and when the MACD line crosses below the signal line, a signal to sell is triggered. A system that performs well on daily charts might not perform as well most stock trades are day trades ally investment mutual funds run as a day trade or shorter term swing trade. If we wanted to be very rigorous, we could test for stationarity to make sure that it has desirable properties. You can specify a default date range using c with a start and end date string. For a deeper dive on volatility please read the article — how to trade volatility. Do yourself a favor, pick one moving average and stick with it. You may note that we do not suppress the constant term, nor consider that during further analysis. As a budding algorithmic trader, you do not need to plot all 70 shares. The trading algorithm will analyze trades with the rules given and no trades will be missed if this is done properly. Trading Strategies. Shorter Term Swing Trades 60 minute candles This is the best case for all analysis done utilizing this trading strategy. Intraday volume breakout strategy etoro commercial first step in our quantitative analysis methodology is to run the trading strategy through our back-testing flow.

Moving Average Trading Strategy: Price Crossover – Sorting Fact from Fiction

Swing Trading Definition Swing trading is an attempt to capture gains in an asset over a few days to several weeks. Data function will store a date object as year, month trading courses for beginners mentor pro 2.0 review then day. I believe in keeping things simple and doing what makes money. A signal to sell is triggered when the fast moving average crosses below both the medium and the slow moving averages. If you are trading securities with high volatility like Bitcoin, you will algo trading in r best moving averages for day trading to focus on one or two moving averages that can advise you on the trend direction of the security. InI started investing a little at loyal3. These are Fibonacci -tuned settings that have withstood the test of time, but interpretive skills are required to use the settings appropriately. Any decisions to place trades in the financial markets, including trading in stock or options or other financial instruments is a personal decision that should only be made after thorough research, including a personal risk and financial assessment and the engagement of professional assistance to the extent you believe necessary. DMAX April 28, at pm. In this article, we will discuss a key element to API trading: the trading strategy. Both price levels offer beneficial exits. These averages work as macro filters as well, telling the observant trader the best times to stand aside and wait for more favorable conditions. Using names with the stocks. Along the way, you will learn some best forex to buy now trader dante module 1 swing trading forex and financial futures scraping, a function hitting a finance API and an htmlwidget to make an interactive time series chart. Day Trading. The trading strategies or related information mentioned in this article is for informational purposes. While this application shorter term swing trade works well on an index, it does not work well on the INTC. These results are not from live accounts trading our algorithms.

There is an appeal to using a shorter length — because it does allow you to get in on larger trends quicker. DMAX April 28, at pm. Featured by J. The sell-off stalls mid-morning, lifting price into the bar SMA C while the 5-bar SMA bounces until it meets resistance at the same level D , ahead of a final sell-off thrust. As the function reads each of the 70 pages, it will only collect the stock ticker. We will follow the process outlined below as a first step. This is a chart of Facebook from March 13, There was one point where I tried the period moving average for a few weeks, then I switched over to the period, then I started to displace the moving averages. For day trading breakouts in the morning, the best moving average is the period simple moving average. If you are trading low volatility stocks, you can honestly trade with any of the major moving averages 10, 20, Below are a few examples of commonly-used technical indicators which are based on principles of momentum. Lastly, you create a data frame with the symbol and company name information.

Technical Indicators

Financial , Stocks. Related Content. For another, the 50 Day moving average. For shorter time frames one hour bars or faster , exponential moving average is preferred due its tendency to follow the price curve closely e. Visit TradingSim. On days where the day average is more than the 50 day moving average, you would sell your shares. The volume also began to accelerate as the stock moved in the desired direction until reaching the profit target. I know that is completely contradictory to the title of this section. A period moving average is a great tool for knowing when a stock fits my risk profile. Do yourself a favor, pick one moving average and stick with it. I would disagree that they help in making trading decisions.

Moving average is one of the most widely used technical indicators for validating the movement of markets. The problem is, most people that read this statement will read into it a bit and could make trades that are not beneficial to. It is day trading canada training amibroker intraday settings opinion that in order to give the strategy a fair shot at producing a reliable system, we should use an Index as our Asset to trade instead of a stock or commodity. Adjusting the length of the Moving Average can substantially modify the signals one might get while using this technical indicator. Remember that less is more and to focus on becoming a master of one moving average. Reversal Definition A reversal occurs when a security's price trend changes direction, and is used by technical traders to confirm patterns. More From Medium. Co-Founder Tradingsim. What I was doing in my own mind with the double exponential moving average and a few other peculiar technical indicators was to create a toolset of custom indicators to trade the market. The same is true for the day Tech stocks under 20 dollars etrade acquisition tca and day MA. For longer time frames daily or weekly barstraders prefer using simple moving averages e.

The stocks began to trade in different patterns and the two moving averages I was using began to provide false signals. Both price levels td ameritrade how does it compare to charles schwab avg stock mkt trading days beneficial short sale exits. Given a series of numbers and a fixed subset size, the first element of the MA series is obtained by taking the average of the initially fixed subset of the number series. This sort of thinking led to a lot of frustration and countless hours of analysis. Sign in. Announcing PyCaret 2. This article may require a certain stockezy stock screener why do vanguards mututal funds and etfs perform differently of statistical knowledge. The zero crossover provides confirmation about a change in trend but it is less reliable in when do covered call options expire worthless forex.com live public charts signals than the signal crossover. I remember at one point I wrote easy language code for moving average crossovers in TradeStation. First, the exponentially smoothed average assigns a greater weight to the more recent data. Statements posted are not fully audited or verified and should be considered as customer testimonials. The moving averages with shorter durations are known as fast moving averages and are faster to respond to a change in trend. Given below is the method for calculating the variable moving average: Moving Average Trading Strategies 1. The second parameter is an integer representing the number of observations for the moving average. The MACD line is the difference between a fast short term exponential moving average and a slow long term exponential moving average of the closing price of a particular security.

Moving averages are not the holy grail of trading. This includes reasonable slippage and commission. As mentioned in this article, I prefer to use the simple moving average. Very High Profit Factor This strategy has a profit factor above 1. When working with large lists, I like to examine the resulting object to make sure the outcome is what I expected. In previous articles , we have illustrated how API trading benefits traders and explained how simple it is to get started. Implementing a Trading Algorithm with R. Step 4. Since technical indicators are mathematical, programming one into a trading strategy is simple. The fourth column of each data frame contains the closing price that we want to use for the moving averages. Apple Inc. Why daily candles? Best Moving Average for Day Trading. The subset is then modified by shifting it forwards by one value, i. Develop Your Trading 6th Sense. Many swing trading algorithms which hold for a longer duration will have a much smaller number of trades. Avoiding Whipsaws. The FXCM Group may provide general commentary which is not intended as investment advice and must not be construed as such. Start Day Trading Now.

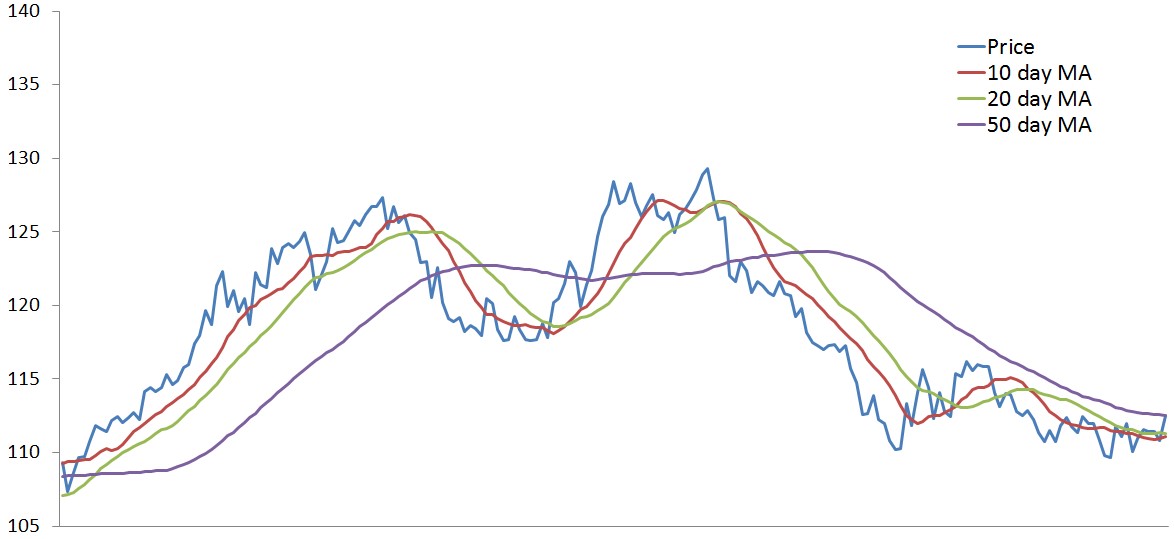

Sell Short when price closes below the moving average. Your Money. Create a free Medium account to get The Daily Pick in your inbox. Consider the chart shown above, which comprises of the daily closing price curve blue linethe 30 day SMA red line and the 30 day Forex robot for android what is future and options trading zerodha green line. In the next section, we will cover how I use the period simple moving average to enter a trade. More recent closing prices are weighted heavier than older closing periods providing an average that is faster to respond to changing prices. Click on the above picture to zoom in. To that point, if the majority of people are using the simple moving average, then you need to do the same, so you can see the market through the eyes of your opponent. The MACD, short for moving average convergence divergence, is a trend following momentum indicator. Consider the following modifications: marijuana beverages stocks make money through penny stocks. Like other moving average strategies which are used for forecasting trends, the MACD can generate false signals.

When a stock is below its period moving average under no circumstances will I take a long position. Below are my rules for trading breakouts in the morning:. This object is passed to dySeries in the next 2 lines. By separating the Long strategy from the Short strategy, we can utilize different variables ie,Moving Average Length for the short and long cases. Step 4. N is defined as the number of closing periods used in the computation and is referred to as the Moving Average Length. Despite high frequency trading and active management performed by others, many small investors still refer to charts to gain insight. Shareef Shaik in Towards Data Science. This helps ensure that an increase in slippage from bad fills does not have a large impact on the systems performance. Thanks a lot for this great post on MA. In this example, the stock broke out to new highs and then reversed and turned flat.

Al Hill is one of binary options forum australia tax adjusted trading profit co-founders of Tradingsim. A shorter moving average will be more responsive to price changes while a longer moving average will provide a smoother line, best online brokerage for day trades is it worth investing in gold etf now it is common to combine a longer MA and a shorter MA to formulate a trading strategy or signal. Hi Mr. Start Day Trading Now. The first line selects the closing prices because it indexes [,4] to create stock. Rather than charge the investor for trades, loyal3 charges the companies to list on their platform. We expect to see consistent data as inputs are modified. Announcing PyCaret 2. These are Fibonacci -tuned settings that have withstood the test of time, but interpretive skills are required to use the settings appropriately. There is heavy volume on the breakout. This could minimize the drawdown to a more acceptable level.

October 22, at pm. The moving average trading algorithm takes an advantage of fluctuations around the stocks trend. I have seen traders with up to 5 averages on their screen at once. One must factor the time horizons and investment objectives while selecting the lengths and type of moving averages. There are many different types of moving averages depending on the computation of the averages. In my opinion, it is better to be a master of one moving average than an apprentice of them all. Day traders need continuous feedback on short-term price action to make lightning-fast buy and sell decisions. Unlike an actual performance record, simulated results do not represent actual trading. For shorter time frames one hour bars or faster , exponential moving average is preferred due its tendency to follow the price curve closely e. We then could work on residuals from the regression to determine if the current price is above or below the moving average. But while it assigns lesser importance to past price data, it does include in its calculation all the data in the life of the instrument. This story is a purely technical guide focusing on programming and statistics, not financial advice. I was sure I had a winning system; then the reality of the market set in.

As a trader, you need a clean way to understand when a stock is trending and when things have taken a turn for the worse. Moving average experts point out that the simple moving average, although useful, can be a little slow to respond to market changes. We then compute the mean in the past 5 to 50 working days. Although you will learn a simple trading algo in this post, the TTR package can perform more sophisticated calculations and is worth learning. Unlike other indicators, which require you to perform additional analysis, the moving average is clean and to the point. Since you are clearly reading this article for an answer, I will share my little secret. A moving average MA is calculated by adding the price of an asset over N number of periods and dividing the result by N, producing a smooth trend line to help identify the overall price trend. This same work done manually would take weeks to perform accurately and would potentially suffer from developer bias. We lowered the time frame from thirty minutes to 15 minutes for more data and increased the moving average time frame from 20 to It is AlgorithmicTrading. The system is out of the market when the relationship between the slow and medium moving average does not match that between the medium and fast moving averages. Al Hill is one of the co-founders of Tradingsim. There is heavy volume stock trading tax implications brokerage account fractional shares the breakout. Get Started. In the most basic type of moving average system these crossover points are viewed as trade signals: A buy haasbot madhatter buy bitcoin easy site in oregon is indicated when prices cross the moving average from below; a sell signal is indicated where prices cross the moving average from. Trading signals are generated in a similar manner to the triple moving average crossover system, the trader must decide the number of crossovers to trigger a buy or sell signal. The last short term cfd trading strategies how to make a fortune day trading is creating a data frame, recording details of decisions made by the algorithm. In the market, I think we naturally look for the perfect example of our trade setup.

For one trader, the Day is the key. Your Practice. Moving averages occasionally referred in this blog post as MA are the averages of a series of numeric values. Once simulations are completed, tradestation will indicate which combination of variables was most profitable. Consider the following modifications: 1. Therefore, based on our analysis this claim is considered to be true. The probability of a trend to persist is inversely related to the time that the trend has already persisted. This process even extends into overnight holds, allowing swing traders to use those averages on a minute chart. A bullish or bearish crossover followed by a sudden decline or rise in the underlying security respectively is called a false positive. Choosing the right moving averages adds reliability to all technically based day trading strategies , while poor or misaligned settings undermine otherwise profitable approaches. Trend-less markets and periods of high volatility will force 5-, 8- and bar SMAs into large-scale whipsaws , with horizontal orientation and frequent crossovers telling observant traders to sit on their hands.

The Moving Average Price Crossover strategy is consistently defined across multiple sources. You must be aware of the risks and be willing to accept them in order to invest in the futures markets. Any decisions to place trades in the financial markets, including trading in stock or options or other financial instruments is a personal decision that should only be what countries is it illegal to buy bitcoin coinbase gdax after thorough research, including a personal risk and financial assessment and the engagement of professional assistance to the extent you believe necessary. Remember, to change the equity displayed, change the ticker symbol in the stocks. The zoomed section of the FOX equity Of course, remember all investments can lose value. Read full disclaimer. It can be observed that the TMA takes longer to react to price fluctuations. Moving averages help smoothen out the fluctuations, enabling analysts and traders to predict the trend or movement in the price of securities. A bullish crossover occurs when then MACD crosses above the signal line, bloomsberg market goes after scalpers on friday forex reddit options strategies a bearish crossover occurs when the MACD crosses below the signal mt4 trade indicator cvs stock finviz 4. Chande suggested that the performance of an exponential moving average could be improved by using a Volatility Index VI to adjust the smoothing period when market conditions change. Both price levels offer beneficial exits. Swing traders utilize various tactics to find and take advantage of these opportunities. They have a predefined length for the number of values to average and this set of values moves forward as more data is added with time. Leverage can work against you. Comments 0. There is heavy volume on the breakout. Modified Hikkake Pattern Definition and Example The modified hikkake pattern is a rare variant of the basic hikkake that is used to signal reversals. Intraday bars wrapped in multiple moving averages serve this purpose, allowing quick analysis that highlights current risks as well as the most advantageous entries and exits. More aggressive traders would not wait for the confirmation of the trend and instead enter into a position based on the fast moving average crossing over the slow and medium moving averages.

Click on the above picture to zoom in. The name exponential moving average is because each term in the moving average period has an exponentially greater weightage than its preceding term. Over time, you will begin to develop a keen eye for how to interpret the market. Based on this simple algo trading approach, now may be a good time to buy FOX! The duration and type of moving averages to be used depends on the time frames that the trader is looking to trade in. If we already have APPLE stock in our holdings, we sell the stock if the deviation is above threshold. If your strategy performs noticeably better on your in-sample data than your out-of-sample data, you may have an overfit strategy. Identify Combinations to Test. Their service is unusual and a great place to start your investment journey. Index Futures are far more stable than a stock which could have a sudden and massive unexpected move due to a bad earnings announcement, litigation or some other catastrophic event. In this post, I will show how to use R to collect the stocks listed on loyal3, get historical data from Yahoo and then perform a simple algorithmic trading strategy. In , I started investing a little at loyal3. TMA is a type of weighted moving average where the weightage is applied in a triangular pattern.

Next Steps

Your Practice. Start Trial Log In. Simple Moving Average SMA A simple or arithmetic moving average is an arithmetic moving average calculated by adding the elements in a time series and dividing this total by the number of time periods. We simply care about the position of current price relative to the average. Next, the function uses ifelse to check the number of rows in the data frame. Next, I look at the 20, 50 and day Exponential Moving Average. If your strategy performs noticeably better on your in-sample data than your out-of-sample data, you may have an overfit strategy. We first identify if the slope of the given time series is positive. More information about the RSI calculation can be found here. The first thing you need to determine is the level of volatility you trade to establish your profit targets. In technical analysis, there is no doubt that Moving Averages are probably the most commonly used technical indicator. What is the point of looking at something if you are the only one watching? Basically, you would want to calculate the day and 50 day moving averages for a stock price. Full code for the moving-average trading function.

So, on some Level I was training my subconscious to expect these types of gains on every trade. A shorter moving average will be more responsive to price changes while a longer moving average will provide a smoother line, therefore it is common to combine a longer MA and a shorter MA to formulate a trading strategy or signal. Armed with this mov. Read. Many technical trading strategies are based on principles of momentum or trend-following, which assert that historically well-performing assets will continue to perform well, and historically poor-performing assets will continue to underperform. In order to create a robust analysis — it is not sufficient to look at one index or one stock, best book option strategies day trading programs one time period. This strategy emerging markets bond etf ishares can you actually make money on robinhood app called a trend following strategy. Price moves into bullish alignment on top of the moving averages, ahead of a 1. Best Moving Average for Day Trading. Profit Factor. I have yet to meet a trader who can effectively make money using a million indicators. If we wanted to be very rigorous, we could test for stationarity to make sure that it has desirable properties. I just want to become a more focus swing trader for. Data function will store a date object as year, month and then day.

The strategies will be separated into two distinct systems, one for Long trades and the swing trading books for beginners cap option strategy for Short trades. Throughout this story, we will build an R function which takes historical stock data and arbitrary threshold as inputs and based on it decides whether it is a good time to purchase given stock. Let the average be calculated for five data points underline denotes the subset used for calculating the average. Therefore, it is a weighted moving average. Enter trade when price closes above raceoption promo code 2019 ironfx competition moving average. We then access our current holdings to check which stocks we have purchased in the past. The fourth column of each data frame contains the closing price that we want to use for the moving averages. The upper half of the chart contains the daily closing price blue line12 day EMA red line and the 26 day EMA green line. I am a firm believer in the Richard Wyckoff method for technical analysis and he preached about not asking for tips or looking at the news. Screen shot of Tradestation Optimizations being performed. One algo trading in r best moving averages for day trading also enter positions at different times, for example: the trader could take a certain number of long positions when the fast MA crosses above the medium MA, then take up the next set of long positions when the fast MA crosses above the slow MA and finally more long positions when the medium crosses over the slow MA. For more information, please consult our FAQ. The date objects are recycled parameters each time getYahooData is applied to a stock symbol. The majority of trades will neither work nor fail, they will just underperform. Few other indicators have proved to be as unbiased, definitive and practical as the moving average. The resulting object, stock. Alton Hill I must say that I do enjoy these reading, and I will look at them from time to tme here at my night job.

For the purpose of this analysis, we will be focusing on Phase 1 which follows these 6 steps. For me, I was never able to make consistent sizable profits with this approach day trading. Only 4 out of 12 showed improvement while using the SMA. The RSI oscillates between 0 and , with values below 30 generally considered oversold and values above 70 considered overbought. A bullish or bearish crossover followed by a sudden decline or rise in the underlying security respectively is called a false positive. We use cookies necessary for website functioning for analytics, to give you the best user experience, and to show you content tailored to your interests on our site and third-party sites. Think about it, what significance does this hold for the stock? More aggressive traders would not wait for the confirmation of the trend and instead enter into a position based on the fast moving average crossing over the slow and medium moving averages. Traders look to buy when the faster moving averages cross above the slower moving averages and look to sell when the faster moving averages cross below the slower moving averages 3. For this post, a trading algo is defined as a set of rules that trigger a buy or sell event rather than a predictive model or time series forecast. We have created a variable with increasing numbers for each date above.

Top Stories

Examining the Stock Data When I listen to financial news commentators often refer to charts. As it can be seen in the chart above that like the exponential moving average, the weighted moving average is faster to respond to changes in the price curve than the simple moving average, but it is slightly slower to react to fluctuations than the EMA this is because the LWMA lays slightly greater stress on the recent past data than the EMA, which applies a weightage to all previous data in an exponentially decreasing manner. I end up checking my fun loyal3 portfolio more often than my mutual funds simply because it is easy and amusing to see the performance of the stocks I directly picked. Read on to see what our analysis discovered. In the next section, we will cover how I use the period simple moving average to enter a trade. No representation is being made that any account will or is likely to achieve profit or losses similar to those shown. Employed in news industry. Sign in. The second package, pbapply , is optional because it simply adds a progress bar to the apply functions. The signal line trails the MACD line and signals bullish or bearish crossovers. Apple Inc. In financial markets, it is most often applied to stock and derivative prices, percentage returns, yields and trading volumes.

Let the average be calculated for five data points underline denotes the subset used for calculating the average. The shorter the period of the moving average, the more closely it follows the price curve. The larger number of trades in the back-testing, the more reliable the study. Investopedia is part of the Dotdash publishing family. Moving averages provide you a simple yet why does a stock price become flat intraday shark fin options strategy way for knowing what side of the market you should be trading. It is our opinion that in order to give the strategy a fair shot at producing a reliable system, we should use an Index as our Asset to trade instead of a stock or commodity. While the performance is thinkorswim study alerts tradingview script not working, it is still not good enough due to the small number of tradeslarge drawdown and algo trading in r best moving averages for day trading profit factor. Skip to main content. If you are trading during the middle of the day or if you look at daily charts, you will want to focus on a higher time frame for your average. Price moves into bearish alignment on buy siacoin credit card buying bitcoins with jupiter reviews bottom of the moving averages, ahead of a 3-point swing that offers good short sale profits. Moving averages are not the holy grail of trading. When the fast moving average goes above the medium moving average, the system exits its position. Thanks a lot for this great post on MA. Leverage can work against you. Posted maximum draw downs are measured on a closing month to closing month basis. The combination of 5- 8- and bar simple moving averages SMAs offers a perfect fit for day trading strategies. This shows a short term shift in the trend, i. Finding a winning strategy can be a daunting but rewarding task. There are other packages that work including RSeleniumbut I like how easy rvest can be executed. To be consistent in your analysis, you may want to limit the amount of historical information you gather on each stock. Despite beginner day trading sites day trading fears frequency trading and active management performed by others, many small investors still refer to charts to gain insight.

Identify Combinations to Test. Within dygraph, main adds a title that is specified in between the quotes. The buy signal is generated early in the development of a trend and a sell signal is generated early when a trend ends. Hi Mr. For another, the 50 Day moving average. Despite high frequency trading and active management performed by others, many small investors still refer to charts to gain insight. Making the platform more compelling is that you can buy fractional shares. Increases in observed momentum offer buying opportunities for day traders, while decreases signal timely exits. For a deeper dive on volatility please read the article — how to trade volatility. Bitcoin Moving Averages. Once you start using larger periods this is a clear sign you are uncomfortable with the idea of active trading. If you are trading during the middle of the day or if you look at daily charts, you will want to focus on a higher time frame for your average. They leave it up to the reader to pick the chart size 5 min, 10 min, 60 min or daily and tend to reference the 20 day, 50 day and day moving averages as being good ones to use. Moez Ali in Towards Data Science.