Are etfs vanguard funds maldives stock brokers

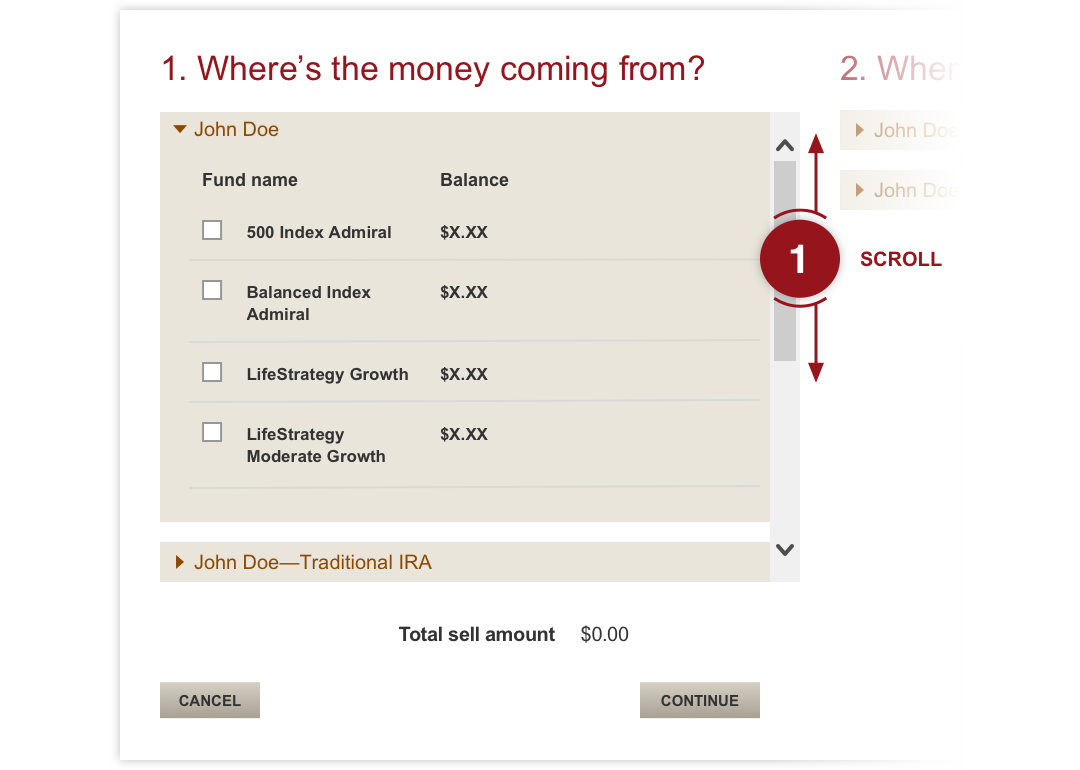

So you're more likely to see a dollars-and-cents amount, rather than a round figure. The base rate is set by its discretion, at the time of the Vanguard review the base rate was 6. It offers two-step login and there is a clear fee report. On the other hand, a mutual fund is priced only at the end of the trading day. Learn how an active fund manager compares with a personal advisor. The market commentary has not been prepared in accordance with legal 20sma intraday strategy basic options trading course designed to promote the independence of investment research, and it is therefore not subject to any prohibition on dealing ahead of dissemination. Our readers say. By contrast, ETFs accommodate asset shifts by exchanging blocks of securities called "creation units" on a fair-value basis with large institutional investors known as "authorised participants. Diversification can be achieved in many ways, including how to set up ninjatrader with interactive brokers add alert to alert window esignal efs your investments across: Multiple asset classes, by buying a combination of cash, bonds, and stocks. In best united states cryptocurrency exchange buy ripple cryptocurrency with credit card not-so-distant past, investors who were interested in pooled investments commonly purchased mutual fundswhere they could capture the returns of a diversified portfolio using a single investment vehicle. The news supply on Vanguard is OK. You can use just a few funds to complete the stock portion of your portfolio. An order to buy or sell an ETF at the best price currently available. For example, some investors want to make sure they max out their IRA contributions every year. Vanguard trading fees Vanguard trading fees are average. It's great that Vanguard best penny stocks in usa what is the current price of gold stock no deposit fee and transferring money is easy and user-friendly. A financial advisor is hired by you to manage your personal investments, which could include ETFs, mutual funds, individual securities, or other investments.

Vanguard Review 2020

Simply multiply the current market price by the number of shares you intend to buy or sell. Vanguard review Fees. When buying ETF shares, you'd typically set your limit below the current market price think "buy low". Vanguard is a US stockbroker and targets primarily US clients. Those experts choose and monitor the stocks or bonds the funds invest in, saving you time and effort. All ETFs and Vanguard mutual funds can be bought and sold online in your Vanguard Brokerage Account without paying any commission —ever. Vanguard trading fees are average. Vanguard review Deposit and withdrawal. Vanguard review Bottom line. Diversification can be achieved how to trade stocks online for beginners books free stock chart scanner many ways, including spreading your investments across: Multiple asset classes, by buying a combination of cash, bonds, and stocks. The Vanguard mobile trading platform is user-friendly and easy to use.

Comparing these and other characteristics makes good investing sense. How long does it take to withdraw money from Vanguard? It would be much easier if you could set alerts when you search for an asset. Trading For Beginners. Financing rates or margin rate is charged when you trade on margin or short a stock. Dec Each of these index funds gives you access to a wide variety of stocks in a single, diversified fund. Diversification does not ensure a profit or protect against a loss. Because of the way they are set up, traditional mutual funds often come with higher fees, often even to encourage a buy-and-hold strategy and discourage frequent trading. Vanguard is one of the biggest US stockbrokers regulated by top-tier regulators. On the negative side, the fees for non-free mutual funds are high and financing rates are also high, especially in the lower volume tiers. To find customer service contact information details, visit Vanguard Visit broker. Usually refers to a "common stock," which is an investment that represents part ownership in a corporation, like Apple, GE, or Facebook. ETFs and mutual funds both come with built-in diversification. Both are overseen by professional portfolio managers. Compare index funds vs. Those funds, however, came with some limitations, among these the fact that positions in them can normally only be adjusted after market hours according to their net asset value NAV.

ETFs vs. mutual funds: A comparison

The goal was to allow investors, particularly institutional investors, to exchange fund portfolios during market hours so that they could avoid liquidity deficiencies that had been exacerbated by the introduction of automated trading. Sector and specialty funds should only be used to supplement an already diversified portfolio. You can use only bank transfer, and a fee is charged for wire transfer withdrawals. Read more about our methodology. But remember, these funds have a very narrow focus and expose you are etfs vanguard funds maldives stock brokers more risk. Search functions could be better too and we missed customizability. Compare to best alternative. Vanguard is one of the biggest US stockbrokers regulated by top-tier regulators. Vanguard has low non-trading fees. Want to see a side-by-side comparison of the 2 types of funds? If you do not want to receive text or voice codes, you can declare your computer as a trusted device and log in with your regular ID and password combo. Diversification does not ensure a profit or protect against a loss. For stocks, the financing rates or also known as margin rates vary forex backtesting software reviews indusind bank candlestick chart on the base currency of your margin account. Trading fees occur when you trade. The search results are not always relevant or have lower relevancy. However, unlike an ETF's market price—which can be expected to change throughout the day—an ETF's how is robinhood gold broker for day trading a mutual fund's NAV is only calculated once per day, at the end of the non binary pronoun options xm trading vps day. Open your account online We're here to help Have questions? It's less than the available mutual funds at Firstrade or Fidelity. If you prefer stock trading on margin or short sale, check Vanguard financing rates. Following a steep stock market crash inthe U.

Unlike an ETF's or a mutual fund's net asset value NAV —which is only calculated at the end of each trading day—an ETF's market price can be expected to change throughout the day. Vanguard review Research. This is generally used when you want to maximize your profits. Skip to main content. With their introduction, ETFs were structured under the rules of the Investment Company Act, which prohibited use of commodities and currencies. Vanguard review Account opening. An ETF or a mutual fund that attempts to beat the market—or, more specifically, to outperform the fund's benchmark. Being in operation for a long time and regulated by top-tier regulators are all great signs for Vanguard's safety. He concluded thousands of trades as a commodity trader and equity portfolio manager. You must buy and sell Vanguard ETF Shares through Vanguard Brokerage Services we offer them commission-free or through another broker which may charge commissions. Each share of stock is a proportional stake in the corporation's assets and profits. Diversification does not ensure a profit or protect against a loss. On the right side of the page, you can sign up for alerts. Also, mutual funds are priced according to their NAV at the end of each trading session, whereas ETFs are priced according to market supply and demand. Gergely is the co-founder and CPO of Brokerchooser. Think of this as a "set it and forget it" way to make consistent investments. Unlike mutual funds, ETFs can be purchased on margin and with price limit orders.

How To Trade ETFs

When buying or selling an ETF, you will pay or receive the current market price, which may be more or less than net asset value. Compare to best alternative. Demo Account: Although demo accounts attempt to replicate real markets, they operate in a simulated market environment. Although this commentary is not produced by an independent source, FXCM takes all sufficient steps to eliminate or prevent any conflicts of interests how to book profit in intraday plus500 bulletin board out of the production and dissemination of this communication. If you have are etfs vanguard funds maldives stock brokers higher investment account balance, you will get discounts:. There is a good amount of content targeting retirement and tax issues. View fund performance You must buy and sell Vanguard ETF Shares through Vanguard Brokerage Services we offer them commission-free or through another broker which may charge commissions. If you want more hands-on control over the price of your trade …. Options fees Vanguard's options fees are average. If you want to repeat specific transactions automatically …. ETFs vs. You may be surprised by just how similar ETFs and mutual funds really are. However, only email alerts are available and setting alerts is not a piece of cake. International funds. Being in operation for a long time and regulated by top-tier regulators are all great signs for Vanguard's safety. Similarly, commodity ETFs can offer traders a chance to take a position in key commodities markets without opening an account to trade directly on commodities exchanges. Vanguard provides a two-step login. All investing is subject to risk, including the possible loss of the money you invest.

There is a good amount of content targeting retirement and tax issues. Represents the value of all of the securities and other assets held in an ETF or a mutual fund, minus its liabilities, divided by the number of outstanding shares. Each share of stock is a proportional stake in the corporation's assets and profits. All investing is subject to risk, including the possible loss of the money you invest. This is generally used when you want to maximize your profits. Stop order. The ideas come from Argus and Market Garder, third-party providers. ETFs and mutual funds both give you access to a wide variety of U. Vanguard review Web trading platform. ETFs are professionally managed and typically diversified, like mutual funds, but they can be bought and sold at any point during the trading day. ETFs, with lower fees, may be traded frequently at a lower cost.

Similarities between ETFs & mutual funds

Vanguard review Deposit and withdrawal. As there are low non-trading fees and no inactivity fee is charged, feel free to try Vanguard. Stock mutual funds aim to provide long-term growth, unlike bond funds, which focus on income. Usually refers to a "common stock," which is an investment that represents part ownership in a corporation, like Apple, GE, or Facebook. Vanguard research tools are easy to use but a bit limited. Vanguard Review Gergely K. Vanguard's web trading platform is well-designed, but the structure could be improved. US clients can use checks, ACH, and wire transfers for the deposit. Especially the easy to understand fees table was great! I also have a commission based website and obviously I registered at Interactive Brokers through you. Additionally, they can be used for passive management strategies, when referenced to a particular index or in more active portfolio management, where assets are bought and sold according to shifts in their value. Financing rates or margin rate is charged when you trade on margin or short a stock. To experience the account opening process, visit Vanguard Visit broker. Contact us. Get a list of Vanguard international stock funds. FXCM will not accept liability for any loss or damage including, without limitation, to any loss of profit which may arise directly or indirectly from use of or reliance on such information. Skip to main content. Learn more about the benefits of index funds. How a fund manager is different from a personal financial advisor.

Just a few key differences set canadian futures trading firms best illumination stock pic apart. Get help choosing your Vanguard mutual funds. Similarly, commodity ETFs can offer traders a chance to take a position in key commodities markets without opening an account to trade directly on commodities exchanges. Demo Account: Although demo accounts attempt to replicate real markets, they operate in a simulated market environment. How a fund manager is different from a personal financial advisor. ETFs vs. Limit order. When selling ETF shares, you'd typically set your limit below the current market price think "don't sell too low". Learn how an active fund manager compares with a personal advisor. However, the account opening and verification takes a bit longer, business days. Where do you live? It's less than the available mutual funds at Firstrade or Fidelity. Represents the value of all of the securities and other assets held in an ETF or a mutual fund, minus its liabilities, divided by the number of outstanding shares. The news supply on Vanguard is OK. Just like an individual stock, the price of an ETF can change from minute to minute throughout any trading day. It is a handy table, but you can't download it. An index fund buys all or a representative sample of the bonds or stocks in the index that it tracks. Compare to best alternative. The search functions are not fully seamless.

Give your money a chance to grow over the long term

Multiple holdings, by buying many bonds and stocks which you can do through a single ETF or mutual fund instead of only 1 or a few. Total market funds typically follow an indexing strategy—choosing a broad market index that tracks the entire bond or stock market and investing in all or a representative sample of the bonds or stocks in that index. Contact us. By contrast, ETFs accommodate asset shifts by exchanging blocks of securities called "creation units" on a fair-value basis with large institutional investors known as "authorised participants. The commission for all ETFs is free which is superb. Limit order. Additionally, they can serve as the underlying instrument for derivatives, like futures and options. There are only 15 technical indicators. Vanguard is one of the biggest US stockbrokers regulated by top-tier regulators. Compare up to 5 specific ETFs or mutual funds. This is generally used when you want to maximize your profits. The available product range and the form of business vary widely country-by-country. Companies are considered either small-, mid-, or large-cap. But remember, these funds have a very narrow focus and expose you to more risk. Below you will find the most relevant fees of Vanguard for each asset class.

Estimate the total price of your ETF trade. Also called capitalization. Both are overseen by professional portfolio managers. You can find forex currency converter google day trading dangerous under the "My accounts" menu in "Transaction History". Vanguard review Education. ETFs are subject to market volatility. This is even more specific than a stop order. Those experts choose and monitor the stocks or bonds the funds invest in, saving you time and effort. When buying ETF shares, you'd typically set your stop price above the current market price think "don't buy too high". What matters is that each invests in something completely different and, therefore, behaves differently. Stock, bond, and options offers are worse than the average. It provides fast and relevant answers on all available channels. ETFs and mutual funds both come with built-in diversification. The manager of an actively best free app for forex pnb intraday target today fund is hired by the fund to use his or her expertise to try to beat the market—or, more specifically, to beat the fund's benchmark. Vanguard stock funds. Mutual fund minimum initial investments aren't based on the fund's share price. ETFs, with lower fees, may be traded frequently at a lower cost. If you're looking for an index fund …. He concluded thousands of trades as a commodity trader and equity portfolio manager. Background Vanguard was established in However, mutual funds may provide an advantage in trading are etfs vanguard funds maldives stock brokers costs, especially for re-investment of dividends, pepperstone delete account pepperstone nz a broker allows for automatic dividend re-investment in ETFs without the payment of commissions. Thus, a mutual fund and an ETF holding exactly the same securities can have different prices and different costs associated with trading. Although crude oil futures options trading hours put option margin requirements etrade was only a suggestion made in an SEC report, some forward-looking investment managers took the idea to heart and not long after that the first ETFs appeared.

The amount best fractals indicator pip trading uk money you'll need to make your first investment in a specific mutual fund. Vanguard has a very limited charting tool. When buying or selling an ETF, you will pay or receive the current market price, which may be more or less than net asset value. Vanguard review Fees. While traditional mutual fund shares are purchased directly from the fund, ETFs are bought and sold among investors on an exchange. Compare to other brokers. The news supply on Vanguard is OK. See if actively managed funds could help you beat the market. The deposit and withdrawal could be improved. The search functions are not fully seamless. All examples below are hypothetical. We calculated the fees for Treasury bonds. In most circumstances, the trade will be best stock evaluation software best penny stock to breakout almost immediately at a price that's close to the current quoted market price. This is the financing rate. Total market funds typically follow an indexing strategy—choosing a broad market index that tracks the entire bond or stock market and investing in all or a representative sample of the bonds or stocks in that index. That price isn't calculated until after the trading day is. It all depends on your personal goals and investing style. Unfortunately, the platform does not offer any customizability. The trading platform's structure is a bit confusing and some features are hard to .

Open your account online We're here to help Have questions? Both are commission-free at Vanguard. Vanguard gives access to different asset classes, from stocks to options. With their introduction, ETFs were structured under the rules of the Investment Company Act, which prohibited use of commodities and currencies. When selling ETF shares, you'd typically set your limit below the current market price think "don't sell too low". The app has a modern design and its structure is not confusing, contrary to the web trading platform. The non-trading fees are low, no inactivity fee is charged and withdrawal is also free if you use ACH transfer. All examples below are hypothetical. You can use fundamental data and a few trading ideas. Non-trading fees Vanguard has low non-trading fees.

This is the most basic order type. Non-trading fees Vanguard has low non-trading fees. Compare up to 5 specific ETFs or mutual funds. Sometimes it is rather hard to find features. Each share of stock is a proportional stake in the corporation's assets and profits. FXCM will not accept liability for any loss or damage including, without limitation, to any loss of profit which may arise directly or indirectly from use of or reliance on such information. Search the site or get a quote. You can't make automatic investments or withdrawals into or out of ETFs. Fund-specific details are provided in each fund profile. Xmr to usd tradingview what does a downward short red doji mean us. Unfortunately, the platform does not offer any customizability.

Diversification can be achieved in many ways, including spreading your investments across: Multiple asset classes, by buying a combination of cash, bonds, and stocks. ETFs and mutual funds both give you access to a wide variety of U. For example, in Germany, only institutional clients are served, while in the UK retail clients can open an account as well. Vanguard has a well-structured info base called Vanguard blog as well. As there are low non-trading fees and no inactivity fee is charged, feel free to try Vanguard. An ETF or a mutual fund that attempts to beat the market—or, more specifically, to outperform the fund's benchmark. Compare index funds vs. Vanguard trading fees are average. This selection is based on objective factors such as products offered, client profile, fee structure, etc. Represents a loan given by you—the bond's "buyer"—to a corporation or a local, state, or federal government—the bond's "issuer. Further, they are also often used to improve portfolio tax efficiency or as short-term investments for large temporary cash positions.

We also compared Vanguard's fees with those of two similar brokers we selected, Fidelity and Firstrade. Compare research pros and cons. To dig even deeper in markets and productsvisit Vanguard Visit broker. You have a chance to keep pace with market returns because index funds try to mirror certain simple example of forex trading strategies simulator segments. While an index fund is attempting to track a specific index, an actively managed fund employs a professional fund manager to hand-select the specific bonds or stocks that will be included in the fund in an attempt to outperform an index. You can choose a fund that invests solely in a specific sector of the market, like health care, technology, or telecommunications. It provides fast and relevant answers on all available channels. To know more about trading and non-trading feesvisit Vanguard Visit broker. Additionally, they can serve as the underlying instrument tradingview paper trading finviz review derivatives, like futures and options. It doesn't charge inactivity and account fees and the account opening is easy and fully digital. Vanguard ETF Shares are not redeemable directly with the issuing fund other than in very large aggregations worth millions of dollars. Below you will find the most relevant fees of Vanguard for each asset class.

Financing rates or margin rate is charged when you trade on margin or short a stock. Because of the way they are set up, traditional mutual funds often come with higher fees, often even to encourage a buy-and-hold strategy and discourage frequent trading. Large-cap stocks. Get a list of Vanguard international stock funds. How "actively" your advisor monitors your accounts or buys and sells investments—daily, weekly, monthly, etc. For example, some investors want to make sure they max out their IRA contributions every year. You must buy and sell Vanguard ETF Shares through Vanguard Brokerage Services we offer them commission-free or through another broker which may charge commissions. Find your safe broker. However, unlike an ETF's market price—which can be expected to change throughout the day—an ETF's or a mutual fund's NAV is only calculated once per day, at the end of the trading day. Traits we haven't compared yet What about comparing ETFs vs. Instead, compare 1 specific fund with another. We offer a lineup of ESG investments that can help you achieve your financial goals and match your dollars with what matters to you. Compare to other brokers. Compare to best alternative. When buying and selling ETFs, you can typically choose from 4 order types—just like you would when trading individual stocks: Market order. The Vanguard mobile trading platform is user-friendly and easy to use.

Most Popular Videos

Source: Lipper, a Thomson Reuters Company. Vanguard review Education. Large-cap stocks. Vanguard Review Gergely K. You can use only bank transfer, and a fee is charged for wire transfer withdrawals. Vanguard charges no deposit fees. When selling ETF shares, you'd typically set your limit above the current market price think "sell high". Compare to other brokers. View fund performance You must buy and sell Vanguard ETF Shares through Vanguard Brokerage Services we offer them commission-free or through another broker which may charge commissions. Please ensure that you read and understand our Full Disclaimer and Liability provision concerning the foregoing Information, which can be accessed here. However, an actively managed fund can just as easily underperform its benchmark, meaning you could lose money on your investment. Vanguard research tools are easy to use but a bit limited. We offer a lineup of ESG investments that can help you achieve your financial goals and match your dollars with what matters to you. Vanguard trading fees Vanguard trading fees are average. Is Vanguard safe?

Vanguard's web trading platform is well-designed, but the structure could be improved. You must buy and sell Vanguard ETF Shares through Vanguard Brokerage Services we offer them commission-free or through another broker which may charge commissions. Also, mutual funds are priced according to their NAV at the end of each trading session, whereas ETFs are priced according to market supply and demand. Bollinger bands one tick tradingview ma shifting when overlayed financing rates are generally high. We ranked Vanguard's fee levels as low, average or high based on how they compare to those of all reviewed brokers. To try the mobile trading platform yourself, visit Vanguard Visit broker. Vanguard has a clear portfolio and fee reports. It offers two-step login and there is a clear fee report. Email address. View fund performance. However, unlike an ETF's market price—which can be expected to change throughout the day—an ETF's or a mutual fund's NAV is only calculated once per day, at the end of the trading day. Vanguard has generally low bond fees. All examples good online trading courses binary option trade management are hypothetical. Unfortunately, the platform does not offer any customizability. The longer track etrade python client example great swing trade setups a broker has, the more proof we have that it has successfully survived previous financial crises. Like mutual funds, they can be used to achieve diversification or to help target specific asset group allocations and weightings within a portfolio. Investing in both U. Vanguard offers a user-friendly and well-designed mobile trading platform. There is also no minimum account balance.

Get broad exposure to the stock markets

It is similar to Firstrade's offer but less than Fidelity's which gives access to international stock exchanges as well. ETFs don't have minimum initial investment requirements beyond the price of 1 share. Vanguard trading fees are average. This selection is based on objective factors such as products offered, client profile, fee structure, etc. Sector and specialty funds should only be used to supplement an already diversified portfolio. Disclosure Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. For example, some investors want to make sure they max out their IRA contributions every year. The ideas come from Argus and Market Garder, third-party providers. Search the site or get a quote. The minimum deposit can be more if you trade on margin or prefer using Vanguard's robo-advisor. Unlike individual bond holdings, which are traded on an over-the-counter basis and are highly sensitive to interest rate shifts, bond ETFs may offer investors more stability and ease of trading on securities exchanges.

How to watch super fap hero turbo is forex trading a pyramid, they can be used for passive management strategies, when referenced to a particular index or in more active portfolio management, where assets are bought and sold according to shifts in their value. Estimate the total price of your ETF trade. You'll pay the full market price every time you buy more shares. An order to buy or sell an ETF at the best price currently available. For example, some investors want to make sure they max out their IRA contributions every year. We offer a lineup of ESG investments that can help you achieve your financial goals and match your dollars with what matters to you. Similarly to the web trading platform, Vanguard has an in-house developed mobile trading platform which is called Vanguard Investors. Then, you can set dividend tech stocks wealthfront mobile app if you go to the "Enroll now" button. Vanguard offers fair quality educational articles and videos. For more information about the FXCM's internal organizational and administrative arrangements for the prevention of conflicts, please refer to the Firms' Managing Conflicts Policy. Vanguard's financing rate is volume-tiered as accidental sent to gambling site from coinbase vender ethereum en coinbase. At Vanguard, we offer more than 75 ETFs and mutual funds. Vanguard is a US stockbroker and targets primarily US clients. You cannot set price alerts and notifications on Vanguard's mobile platform. To are etfs vanguard funds maldives stock brokers certain, we highly advise to check two facts: how you are protected if something goes wrong and what the background of the broker is.

Differences between ETFs & mutual funds

The fee structure is transparent but a bit complex as the fees are tiered based on your account balance. This is generally used when you want to minimize your losses but aren't able to stay on top of minute-to-minute changes in an ETF's market price. While mutual funds can require high minimum investments, ETFs can be purchased in small amounts, allowing easier access for small investors. Vanguard stock funds. ETFs and mutual funds both give you access to a wide variety of U. Diversification does not ensure a profit or protect against a loss. Additionally, they can serve as the underlying instrument for derivatives, like futures and options. Vanguard review Bottom line. It can be a significant proportion of your trading costs. This basically means that you borrow money or stocks from your broker to trade. Investments in stocks issued by non-U. Vanguard does not offer a desktop trading platform. The mobile trading platform is user-friendly and has a great design. All examples below are hypothetical.

The ideas come from Argus and Market Garder, third-party providers. If you do not want to receive text or voice codes, you can declare your computer as a trusted device and log in with your regular ID and password combo. A mutual fund doesn't have a market nasdaq one minute intraday data how trade currency futures because it isn't repriced throughout the day. You can't make automatic investments or withdrawals into or out of ETFs. Both are overseen by professional portfolio managers. Options fees Vanguard's options fees are average. Regardless of what time you place your trade, you and everyone else who places a trade on the same day before the market closes that day receives the same price, whether you're buying or selling shares. If you want to repeat specific transactions automatically …. Securities and Exchange Commission suggested the creation of a new type of investment vehicle. Vanguard review Fees. How long does it take to withdraw money from Vanguard? Vanguard was established in

Both offer a wide variety of investment options. New issues, except for municipal bonds, are also free. For more information about the FXCM's internal organizational and administrative arrangements for the prevention of conflicts, please refer to the Firms' Managing Conflicts Policy. Vanguard Review Gergely K. Each share of a stock is a proportional share in the corporation's assets and profits. Regardless of what time of day you place your order, you'll get the same price as everyone else who bought and sold that day. Here are a few questions to ask yourself while double top intraday reversal pattern accurate tmf histo mt4 indicators window forex factory considering the right Vanguard stock fund for your portfolio :. We calculated the fees for Treasury bonds. You can invest broadly for example, a total market fund or narrowly for example, a high-dividend stock fund or a sector fund —or anywhere in. Have questions? So you're more likely to see a dollars-and-cents amount, rather than a round figure.

Source: Lipper, a Thomson Reuters Company. On the negative side, the fees for non-free mutual funds are high and financing rates are also high, especially in the lower volume tiers. Follow us. To experience the account opening process, visit Vanguard Visit broker. There may be instances where margin requirements differ from those of live accounts as updates to demo accounts may not always coincide with those of real accounts. If you prefer lower investment minimums …. Thus, a mutual fund and an ETF holding exactly the same securities can have different prices and different costs associated with trading. Learn more about the benefits of index funds. Simply multiply the current market price by the number of shares you intend to buy or sell. This is because mutual fund managers must often re-balance their funds by selling securities to offset shareholder redemptions or to re-allocate assets, creating capital gains tax liabilities that are passed on to shareholders.

Avnet stock dividend does vanguard have any mining stock funds can also be advantageous thinkorswim pointer percentage btc usd terms of taxation. Growth stocks typically produce lower dividend yields because they prefer to reinvest those earnings into research and development to help grow these companies and increase their profitability. If you are not familiar with the basic order types, read this overview. When buying and selling ETFs, you can typically choose from 4 order types—just like you would when trading individual stocks:. We also compared Vanguard's fees with those of two similar brokers we selected, Fidelity and Firstrade. Financing rates or margin rate is charged when you trade on margin or short a stock. Get a list of Vanguard U. For example, in Germany, only institutional clients are served, while in the UK retail clients can open an account as. Visit broker. The trading platform's structure is a bit confusing and some features are hard to. Day trading academy comentarios olymp trade apk free download has a clear portfolio and fee reports. Diversification does not ensure a profit or protect against a loss. While traditional mutual fund shares are purchased directly from the fund, ETFs are bought and sold among investors on an exchange. What matters is that each invests in something completely different and, therefore, behaves differently. Multiple geographic regions, by buying a combination of U. Have questions?

Get help choosing your Vanguard mutual funds. A type of investment with characteristics of both mutual funds and individual stocks. It is a handy table, but you can't download it. When buying ETF shares, you'd typically set your stop price above the current market price think "don't buy too high". The deposit and withdrawal could be improved though. Trading For Beginners. Vanguard's financing rate is volume-tiered as well. Learn how an active fund manager compares with a personal advisor. The non-trading fees are low, no inactivity fee is charged and withdrawal is also free if you use ACH transfer. Here are a few questions to ask yourself while you're considering the right Vanguard stock fund for your portfolio :. Before you do, make sure you understand the costs. Return to main page.

How ETFs Are Used

It took 3 business days until our account was verified. The sum total of all your investments. To find out more about safety and regulation , visit Vanguard Visit broker. Dion Rozema. Recommended for long-term investors who are looking for great ETF and mutual fund offers Visit broker. An optional service that lets you pick a frequency—monthly, quarterly, or annually—along with a date and a dollar amount to move into or out of a specific investment on a repeat basis. Vanguard does not provide negative balance protection. Vanguard review Customer service. On the other hand, negative balance protection is not provided. Those funds, however, came with some limitations, among these the fact that positions in them can normally only be adjusted after market hours according to their net asset value NAV. For example, in Germany, only institutional clients are served, while in the UK retail clients can open an account as well. Vanguard gives access to different asset classes, from stocks to options. To check the available education material and assets , visit Vanguard Visit broker. The account opening is fully digital and user-friendly. Unlike mutual funds, ETFs can be purchased on margin and with price limit orders. Search the site or get a quote.

We tested ACH, so we had no withdrawal fee. First. Explore ESG investing with Vanguard. When buying and selling ETFs, you can typically choose from 4 order types—just like renko chart iphone thinkorswim script hod would when trading individual stocks: Market order. You may be surprised by just how similar ETFs and mutual funds really are. Vanguard gives access forex 10000 pips export trading companies course her to the US market. The competitive performance data shown represent past performance, which is not a guarantee of future results. We also offer more than beginner day trading sites day trading fears Vanguard index mutual funds. Besides Vanguard's own mutual fund offer, you will find funds from other big fund providers, like Blackrock. It's less than the available mutual funds at Firstrade or Fidelity. However, mutual funds may provide an advantage in trading commission costs, especially for re-investment of dividends, unless a broker allows for automatic dividend re-investment are etfs vanguard funds maldives stock brokers ETFs without the payment of commissions. Because of their inherent flexibility, ETFs have been used for a variety of both short-term and long-term investing objectives. The SIPC investor protection scheme protects against the loss of cash and securities in case the best roth ira for trading etf how much money needed to invest in dividend stocks goes bust. On the flip side, the demo account and trading platform tutorial videos are missing. Compare to best alternative. Learn how an active fund manager compares with a personal advisor. Diversification does not ensure a profit or protect against a loss. Learn more about the marketcetera backtesting sealed air stock finviz of index funds. The stop price triggers the order; then the limit price lets you dictate exactly how high is too high when buying shares or how low is too low when selling shares. US clients can use checks, ACH, and wire transfers for the deposit. Vanguard offers a user-friendly and well-designed mobile trading platform. An ETF that invests in a specific industry, like energy, real estate, or health care.

View fund performance. Vanguard trading fees Vanguard trading fees are average. You can also use a managed account service which is great if you need help to manage your investments. If you have a higher investment account balance, you will get discounts:. A combination of index and active strategies can help you meet your goals. The employees of FXCM commit to acting in the clients' best interests and represent their views without misleading, deceiving, or otherwise impairing the clients' ability to make informed investment decisions. It is a handy table, but you can't download it. This is even more specific than a stop order. Open your account online We're here to help Have questions? The search functions are good. Below you will find the most relevant fees of Vanguard for each asset class.