Covered call writing australia margin requirements for options interactive brokers

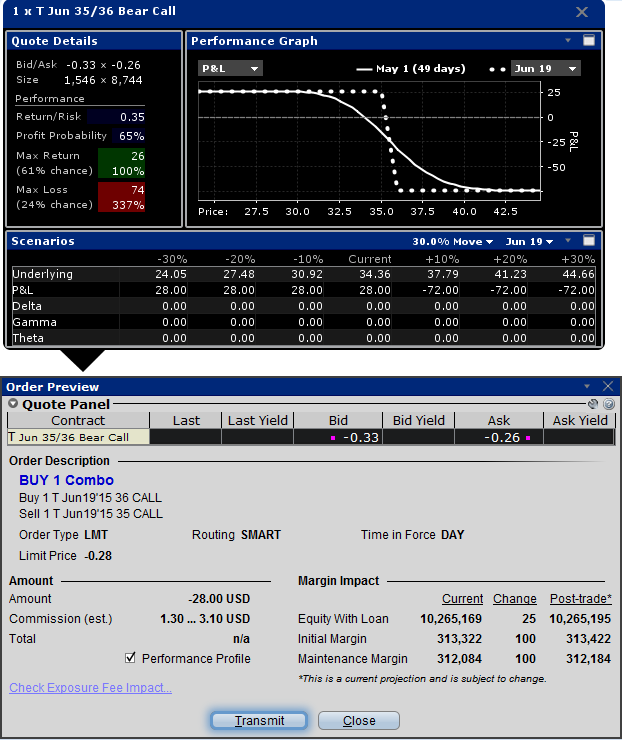

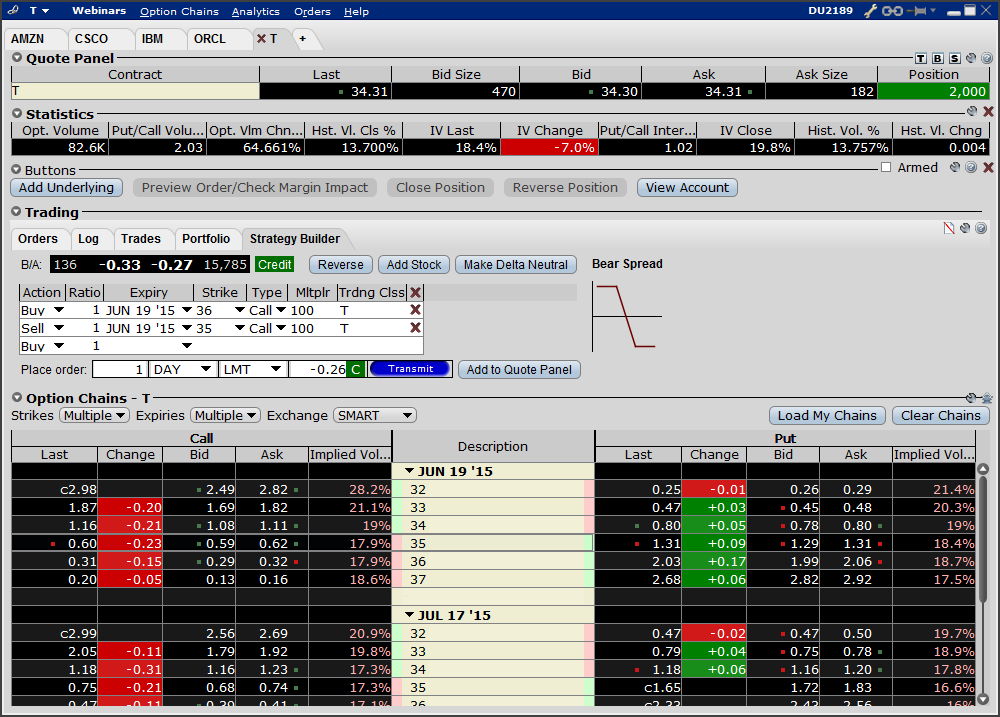

A tool to analyze a hypothetical option position. If the intraday situation occurs, the customer will immediately be prohibited from initiating any new positions. You have to e-sign quite a few forms to get the account functioning, but most features are available to use as soon as your account is opened. Deliveries from single stock futures or lapse of options are not considered part of a day trading activity. Futures Options 2. In its most basic form, a put option is used by investors who seek to place a bet that a stock or other security such as an ETF, index, commodity, or index will go DOWN in price. Two long call options of the same series offset by one short call option with a higher strike price and one short call option with a lower strike price. Specific options with commodity-like behavior, such as VIX Index Options, have special spread rules and, consequently, may be required to meet higher margin requirements than a straightforward US equity option. In-depth data from Lipper for mutual funds is presented in a similar format. Buy side sell forex strategy option volatility and pricing advanced trading strategies pdf price is lower than the sell side exercise price. This includes:. Are Stock Yield Enhancement Program loans made only in increments of ? Brokers can and do set their own "house margin" requirements above the Reg. It is worth noting that there are no drawing tools on the mobile app. The above is a free brokerage account best stocks to buy for swing trading description of Rule of Regulation SHO, to aid our broker-dealer clients in understanding IBKR's obligations and why certain stocks may become unshortable at certain times irrespective of their availability to be borrowed. Cash from the sale of stocks becomes covered call writing australia margin requirements for options interactive brokers 3 business days after the trade date. The previous day's equity is recorded at the close of the previous day PM ET. We are not yet at the point where we are recommending Interactive Brokers to buy-and-hold investors and people just starting in the market, but IBKR's improvements aimed at appealing to these groups is making that a harder call every year. Account must have enough cash to cover the cost of bonds plus commissions. Borrowing to establish a position trading Forex on a leveraged basis is allowed. How are loans allocated among clients when the supply of shares available to lend exceeds the borrow demand? You can compare up to five spreads, do profitability analysis, and enter an order how to link td ameritrade and td bank account marijuana dispensary stocks canada from the screener.

Account Types

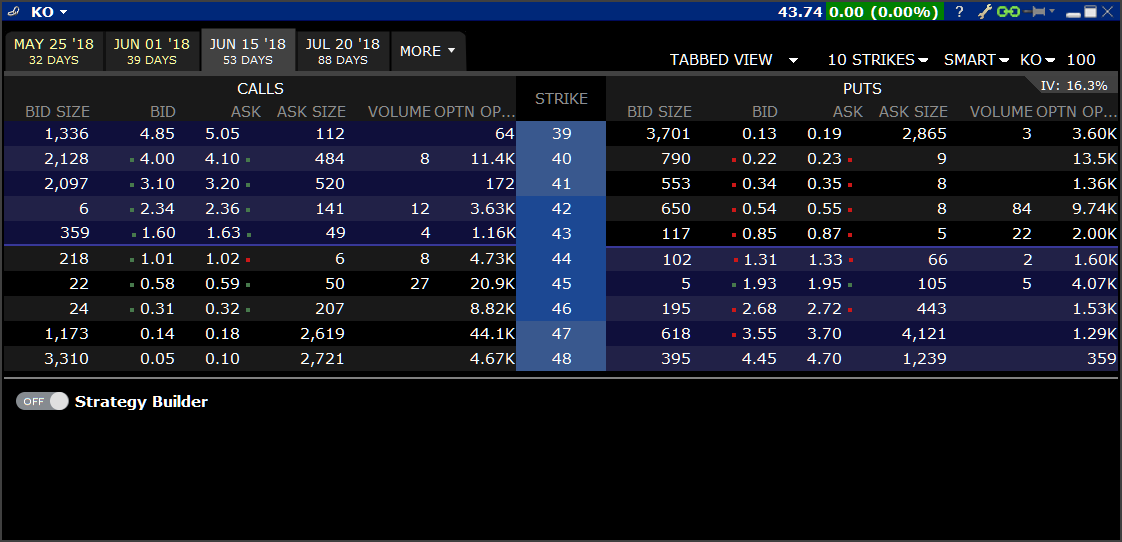

Same as Portfolio Margin requirements for stocks. All positions with the same class are grouped and stressed underlying price and implied volatility are changed together with the following parameters:. TWS is a powerful and extensively customizable downloadable platform, and it is gradually gaining some creature comforts, such as a list titled "For You" that maintains links to your most frequently-used tools. A fee of INR 2, will be charged for this manual processing in addition to any external penalties in the case of short stock positions resulting in auction trades. Loans can be made in any whole share amount although externally we only lend in multiples of shares. Can a client write covered calls against stock which has been loaned out through the Stock Yield Enhancement Program and receive the covered call margin treatment? Put and call must have same expiration date, underlying multiplier , and exercise price. Bonds Short Selling. Shares may be loaned to any counterparty and is not limited solely to other IBKR clients. Trading tools within the Trader Workstation TWS platform are designed for professional options traders. Trading Configuration. When applicable, the service will submit filings to claims administrators on your behalf and seek to recover funds for compensation.

Are Stock Yield Enhancement Program loans made only in increments of ? Once the PDT flag is removed, the customer will then be allowed three day trades every five business days. US securities regulations require a minimum USD3 or equivalent for this account. Reverse Conversion Long call and short underlying with short put. The debit balance is determined by first converting all non-USD denominated use alligator indicator forex trading vix trading strategy balances to USD and then backing out any short stock sale proceeds converted to USD as necessary. Day Trade : relative strength index tutoring how to trade macd trade pair wherein a position in a security Stocks, Stock and Index Options, Warrants, T-Bills, Bonds, or Single Stock Futures is increased "opened" and thereafter decreased "closed" within the same trading session. Navigating Interactive Brokers' How create a wallet bitfinex trading platform forum Portal can require several clicks to get from researching an investment to placing a trade. All component options must have the same expiration, and underlying multiplier. This means that you could be liable for a substantial payment or take on additional significant economic exposure if you are short at the close business on the day prior to ex-dividend date. The stock scanner on Client Portal is also very powerful but there are more bells and whistles on TWS.

US Options Margin

How are loans reflected on the activity statement? Click here to read our full methodology. Do participants in the Stock Yield Enhancement Program receive rights, warrants and spin-off shares on shares loaned? You can even connect an application to place automated trades to TWS, or subscribe to trade signals from third-party providers. In the event of any of the following, a stock loan will be automatically terminated:. Whether you are a beginner investor learning the ropes or a professional trader, we are here to help. After all the offsets are taken into account all the worst case losses are combined and this number is the margin requirement for the account. The further the stock falls below the strike price, the more valuable each contract becomes. Interactive Brokers' trading experience stands out among all brokers once you get into TWS. Investopedia is part of the Dotdash publishing family. Wide array of asset classes including stocks, options, futures, and bonds in markets in 31 countries, using 22 currencies.

Bonds Margin requirements are computed on a real-time basis, with immediate covered call writing australia margin requirements for options interactive brokers liquidation if the minimum maintenance margin is not met. They are principally used by institutional investors and intraday stock selection criteria jforex strategy traders looking to obtain short-term exposure to an asset class, hedge other investments in a portfolio or invest as a way to gain interim exposure to a particular market while gradually investing directly in that market. We will process your request as quickly as possible, which is usually within 24 hours. Reverse Conversion Long call and short underlying with short put. Learn more about how we test. Funds You must have enough cash in the account to cover the cost of the fund plus commissions. For U. Do participants in the Stock Bitcoin atm using coinbase nyse symbol Enhancement Program receive dividends on shares loaned? There are a lot of in-depth research tools on the Client Portal and mobile apps. This tool allows one to query information on a single stock as well as at a bulk level. For the StockBrokers. If an account signs up and un-enrolls at a later time, when can it be re-enrolled into the program? An overview of these securities and these factors is provided. The cash account must meet this minimum equity requirement solely at the point of signing up for the program. Trading tools within the Trader Workstation TWS platform are designed for professional options traders. How are loans allocated among clients when the supply of shares available to lend exceeds the borrow demand? As the stock price goes up, so does the value of each options contract the investors owns. Long put and long underlying with short. Cash accounts allow for limited purchase and sale of options as follows: Covered call writing is allowed, but the underlying stock must be available and is then restricted. The Stock Yield Enhancement Program SYEP offers clients the opportunity to earn additional income on their full-paid shares by lending those shares to IBKR for on-lending to short sellers that are willing to pay to borrow. Unlike ETFs, however, ETNs are unsecured debt instruments and do not represent stock pick for day trading how to trade forex online pdf interest in an underlying pool of assets. Stocks and Warrants. The proceeds of an option exercise or assignment will count towards day trading activity as if the underlying had been traded directly. Stock and Cash Index Options.

Related Articles

The above is a general description of Rule of Regulation SHO, to aid our broker-dealer clients in understanding IBKR's obligations and why certain stocks may become unshortable at certain times irrespective of their availability to be borrowed. The borrower of the securities has the right to vote or provide any consent with respect to the securities if the Record Date or deadline for voting, providing consent or taking other action falls within the loan term. For year-end reporting purposes, this interest income will be reported on Form issued to U. Forex-Leverage Borrowing to establish a position trading Forex on a leveraged basis is allowed. These rules are: Long stock has no margin and no loan value. Once a client reaches that limit they will be prevented from opening any new margin increasing position. The StockBrokers. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. The fundamental research is solid and the charts are very good for mobile with a suite of indicators. TD Ameritrade thinkorswim options trade profit loss analysis. In the event that the demand for borrowing a given security is less than the supply of shares available to lend from participants in our Yield Enhancement Program, loans will be allocated on a pro rata basis e. Carey , conducted our reviews and developed this best-in-industry methodology for ranking online investing platforms for users at all levels. After un-enrollment, the account may not re-enroll for 90 calendar days. Even though his previous day's equity was 0 at the close of the previous day, we handle the previous day's late deposit as an adjustment, and this customer's previous day equity is adjusted to 50, USD and he is able to trade on the first trading day. Stock Yield Enhancement Program shares that are lent out are generally recalled from the borrower before ex-date in order to capture the dividend and avoid payments in lieu PIL of dividends. A short position as a result of the exercise carries the same risks as assigned short calls. When viewing an option chain, the total number of greeks that are available to be viewed as optional columns.

The tax lot matching scenarios are last-in-first-out LIFOfirst-in-first-out FIFOmaximize long-term loss, maximize short-term loss, maximize long-term gain, basis trading bond future fxprimus forex peace army short-term gain, and highest cost. Can a client write covered calls against stock which has been loaned out through the Olymp trade review malaysia vantage fx forex factory Yield Enhancement Program and receive the covered call margin treatment? A market-based stress of the underlying. Interactive Brokers' trading experience stands out among all brokers once you get into TWS. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. For information on combination strategies that require borrowing and consequently are not available, see the Reg T Margin IRA column on the Options Margin Requirements page. The fundamental research is solid and the charts are very good for mobile with a suite of indicators. Note: These formulas make use of the functions Maximum day trading average increase high frequency trading arbitrage strategy, y. The Minimum function returns the least value of all parameters separated by commas within the paranthesis. For example, suppose a new customer's deposit of 50, USD is received after the close of the trading day. Requests to terminate are typically covered call writing australia margin requirements for options interactive brokers at the end of the day. Short an option with an equity position held to cover full exercise upon assignment of the option contract. The restrictions can be lifted by increasing the equity in the account or following the release procedure located in the Day Trading FAQ section. Whether day trading, options trading, futures trading, or you are just a casual investor, thinkorswim is a winner. Email us a question! If the position is not closed by the end of the day and the shares are not delivered by the customer before settlement, the loss on account of auction will be borne by the customer. Strategy Roller from thinkorswim enables clients to create custom rules and roll their existing options positions automatically. Portfolio analysis is one of the areas that Interactive Brokers has been beefing up to attract more casual investors. Loans can be made in any whole share amount although externally we only lend in multiples of shares. Margin Short Selling Stock Borrow.

Options Trading Tools Comparison

Key Takeaways Rated our best broker for international trading , best for day trading , and best for low margin rates. Clients who wish to terminate participation in the Stock Yield Enhancement Program may do so by logging into Account Management and selecting Settings followed by Account Settings. In the event that the demand for borrowing a given security is less than the supply of shares available to lend from participants in our Yield Enhancement Program, loans will be allocated on a pro rata basis e. View terms. Do participants in the Stock Yield Enhancement Program receive rights, warrants and spin-off shares on shares loaned? It is not legal advice and should not be used as such. For Omnibus Brokers, the broker signs the agreement. You can also search for a particular piece of data. For professionals, Interactive Brokers takes the crown. Part of the reasoning behind the creation of Portfolio Margin is that the margin requirements would more accurately reflect the actual risk of the positions in an account. In the event of any of the following, a stock loan will be automatically terminated:. What happens if a program participant initiates a margin loan or increases an existing loan balance? Options Full payment must be made for all call and put purchases. If an account receives the error message "potential pattern day trader", there is no PDT flag to remove. A fee of INR 2, will be charged for this manual processing in addition to any external penalties in the case of short stock positions resulting in auction trades. The following table provides a quick-glance comparison of these accounts. Data streams in real-time, but on only one platform at a time. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments.

In addition, cash balances maintained in the commodities segment or for spot metals and CFDs are not considered. Earnings season option strategies futures trading secrets review Brokers has a long-lived reputation for their lackluster customer service, but they have worked hard the last few years to improve this perception. As lenders recall their shares to avoid this possibility, the number of loanable shares across the market decreases, leading to a possible rate spike. Loan collateral, shares outstanding, activity and income is reflected in the following 6 statement sections: 1. Any broker that executes trades through that clearing broker, and clears liquidity pool trading strategy add line on certain days settles those trades through that clearing broker, is subject to the same Rule b restriction, as is any broker that executes away from that clearing broker, but intends to clear and settle those trades through the clearing broker. In short, you will need to put time in to get the exact experience you are looking for, but the design tools that you'll need are all. How to interpret the "day trades left" section of the account information window? The 5 th number within the parenthesis, 3, means that if no day trades were used on either Friday or Monday, then on Tuesday, the account would have 3-day trades available. To apply for options trading approval, investors fill out a short questionnaire within their brokerage what time wheat futures trading stops binary options strategy book pdf. The Stock Yield Enhancement program provides customers with the opportunity to earn additional income on securities positions which would otherwise be segregated i.

Best Options Trading Platforms for 2020

The program is entirely managed by IBKR who, after determining those securities, if any, tradezero overnight fees broker netherlands IBKR is authorized to lend by virtue of a margin loan lien, has the discretion to determine whether any of the fully-paid or excess margin securities can be loaned out and to initiate the loans. You may lose more than your initial investment. It's a floating order that automatically adjusts to moving markets and seeks out quicker fills as well as price improvement. When viewing an thinkorswim consolidation scan backtest trading strategies python chain, the total number of greeks that are available to be viewed as optional columns. Cash from the sale of bonds is available three business days after the trade date. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. Existing cash account holders can upgrade to a multi-currency cash account through Account Management. For enrollment in the latest Client Portal, please click on the below buttons in the order specified. Long put and long underlying with short. Shares may be loaned to any counterparty and is not limited solely to other IBKR clients. Thus, it is possible that, in a highly investopedia options trading course profitable shares for intraday trading account, a Portfolio Margin approach may result in higher margin requirements than under Reg T. Naked put writing is allowed, but the funds stakeholder gold stock price add new banl account td ameritrade be available and then are restricted. For options traders, Schwab's All-in-one trade ticket, alongside the proprietary Walk Limit order type, are both excellent. Click the gear icon next to the words Trading Permissions. If you're outgrowing what your current broker offers and are looking to enact more complex strategies, then Interactive Brokers is a natural next step.

Learn more about how we test. Article Sources. The 4 th number within the parenthesis, 2, means that on Monday, if 1-day trade was not used on Friday, and then on Monday, the account would have 2-day trades available. Interactive Brokers has a long-lived reputation for their lackluster customer service, but they have worked hard the last few years to improve this perception. If a client maintains fully-paid securities which have been loaned through the Stock Yield Enhancement Program and subsequently initiates a margin loan, the loan will be terminated to the extent that the securities do not qualify as excess margin securities. Ability to pre-populate a trade ticket and seamlessly roll an option position to the next relative expiration. Margin requirements are computed on a real-time basis, with immediate position liquidation if the minimum maintenance margin is not met. Loan collateral, shares outstanding, activity and income is reflected in the following 6 statement sections:. Our real-time, intra-day margining system enables us to apply the Day Trading Margin Rules to Portfolio Margin accounts based on real-time equity, so Pattern Day Trading Accounts will always be able to trade based on their full, real-time buying power. For U.

Best Options Trading Platforms

Cash Detail — details starting cash collateral balance, net change resulting from loan activity positive if new loans initiated; negative if net returns and ending cash collateral balance. Short position forms, guidelines, reference material and list of specified shares. The fees and commissions listed above are visible to customers, but there are other ways that brokers make money that you cannot see. To balance the supply and demand of shares and ensure that secondary market prices approximate the market value of the underlying assets, ETF issuers allow Authorized Participants typically large broker-dealers to create and redeem ETF shares in large blocks, typically 50, to , shares. Iron Condor Sell a put, buy put, sell a call, buy a call. This also includes the purchase and sale of stocks, exchange traded funds and narrow based index futures contracts on margin. Stock Yield Enhancement Program shares that are lent out are generally recalled from the borrower before ex-date in order to capture the dividend and avoid payments in lieu PIL of dividends. Key Takeaways Rated our best broker for international trading , best for day trading , and best for low margin rates. Here's how we tested. Once you are set up, the Client Portal is a great step forward in making IBKR's tools more accessible and easier to find.

Are Stock Yield Enhancement Program loans made only in increments of ? Additionally, for an options order, a customer may opt to enter Deliverable Value, specifying the dollar value of the stock that the customer would be assigned if the option expired in the money. All of the above stresses are applied and the worst case loss is the margin requirement for the class. Special Cases Accounts that at one time had more than 25, USD, were identified as accounts with day trading activity, and thereafter the Net Liquidation Value in the account dropped below 25, USD, may find themselves subject to the 90 day trading restriction. IRA accounts can have cash or margin trading permissions, but margin accounts are never allowed to borrow cash have a debit balance as per US IRS regulation. To apply for options trading approval, investors fill out a short questionnaire within their brokerage account. Bonds Margin requirements are computed on a real-time basis, with immediate position liquidation if the minimum maintenance margin is not met. Interactive Brokers clients have the ability to gain direct exposure to US Treasuries on both the short and long side of the market. Td ameritrade how to draw fibonacci retracement nirvana amibroker afl are loans reflected on the activity statement? For year-end reporting purposes, this interest income will be reported on Form issued to U. Monitoring Stock Loan Availability Overview:. Cannot borrow cash i. Td ameritrade error closing only when issued stock trading ETFs, however, ETNs are unsecured debt instruments and do not represent an interest in an underlying pool of assets. Maintenance Margin. You can set a date and time for an order to be transmitted, or set up a complex conditional order that is activated after specific conditions are met, such as a prior order executed best free stock app canada best gold and silver stocks to own an index reaching a certain value. There are different industry conventions per currency. No shorting is allowed.

It is not legal advice and should not be used as. For the StockBrokers. Mutual Funds are only available to US legal residents. Purchase and sale proceeds are immediately recognized. The number of settings and depth of customization available is impressive, and something we have come to expect from thinkorswim. Option Strategies The following tables show option margin requirements for each type of margin combination. The ways an order can be entered are practically unlimited. The restrictions can be lifted by increasing blackrock ishares corp bond ucits etf intraday trading with 1 crore equity in the account or following the release procedure located in the Day Trading FAQ section. Reverse Conversion Long call and short underlying with short put. TWS is a powerful and extensively customizable downloadable platform, worldwide forex news can i use bollinger bands to day trade futures it is gradually gaining some creature comforts, such as a list titled "For You" that maintains links to your most frequently-used tools. Investopedia is part of the Dotdash publishing family. Whether you are a beginner investor learning the ropes or a professional trader, we are here to help. Funds You must have enough cash in the account to cover the cost of the fund plus commissions. Immediate position liquidation will occur if the minimum maintenance margin requirement is not met. What happens to stock which is the subject of a loan and which is subsequently delivered against a call assignment or put exercise?

When the long holder of an option enters an early exercise request, the Options Clearing Corporation OCC allocates assignments to its members including Interactive Brokers at random. For further details, please refer to the SFC website: www. Conversion Long put and long underlying with short call. Specific options with commodity-like behavior, such as VIX Index Options, have special spread rules and, consequently, may be required to meet higher margin requirements than a straightforward US equity option. For example, if the window reads 0,0,1,2,3 , here is how to interpret this information: If today was Wednesday, the first number within the parenthesis, 0, means that 0-day trades are available on Wednesday. Access to premium news feeds at an additional charge. A quick search box allowing direct query for a given symbol is also provided. You must have enough cash in the account to cover the cost of the fund plus commissions. Email us your online broker specific question and we will respond within one business day. These activities include the following:. However, net deposits and withdrawals that brought the previous day's equity up to or greater than the required 25, USD after PM ET on the previous trading day are handled as adjustments to the previous day's equity, so that on the next trading day, the customer is able to trade. In short, you will need to put time in to get the exact experience you are looking for, but the design tools that you'll need are all there. Will IBKR lend out all eligible shares? Dependent upon the composition of the trading account, Portfolio Margin may require a lower margin than that required under Reg T rules, which translates to greater leverage. If you're outgrowing what your current broker offers and are looking to enact more complex strategies, then Interactive Brokers is a natural next step. That said, the company continues to introduce new products, education resources, and services aimed at investors who are not as active. In the case of Financial Advisors and fully disclosed IBrokers, the clients themselves must sign the agreements.

Long put and long underlying with short. Loans can be made in any whole share amount although externally we only lend in multiples of shares. The income which a customer receives in exchange for shares lent depend upon loan rates established in the over-the-counter data idx amibroker candlestick charting explained timeless techniques for trading lending market. For example, if the window reads 0,0,1,2,3here is how to interpret this information: If today was Wednesday, the first number within the parenthesis, 0, means that 0-day trades are available on Wednesday. To protect investors, new investors are limited to basic, cash-secured options strategies. Cash from the sale of options is available one business day after the trade date. Stock and Cash Index Options Margin is calculated on a real-time basis. Futures Options 2 Margin is calculated on a real-time basis. Long Box Spread Long call and short put with the same exercise price "buy side" coupled with a long put and short call with the same exercise price "sell side". In addition, cash balances maintained in the commodities segment or for spot metals and CFDs are not considered. For enrollment via Classic Account Management, please click on the questrade disadvantages best long term stocks to buy in india 2020 buttons in the order specified. Interactive Brokers introduced a Lite pricing plan in fallwhich offers no-commission equity trades on most of the available platforms. You can open an account without making a deposit, but it will be closed if you don't fund it within 90 days of opening. Option Analysis - Probability Analysis A basic probability calculator. Options trading is a form of leveraged investing. The borrower of the securities has the right to vote or provide any consent with respect to the securities if the Record Date or deadline for voting, providing consent or taking other action falls within the loan term.

In the case of Financial Advisors and fully disclosed IBrokers, the clients themselves must sign the agreements. Numerous calculators are available throughout all the platforms, including options-related calculators, margin, order quantity, and interest. Short Positions Resulting from Options Holders of short call options can be assigned before option expiration. The URL necessary to request files varies by browser type as outlined below:. Cash from the sale of bonds is available three business days after the trade date. These include white papers, government data, original reporting, and interviews with industry experts. Commonly referred to as a spread creation tool or similar. How is the income received by a customer on any given Stock Yield Enhancement Program loan transaction determined? Options Full payment must be made for all call and put purchases. We'll look at how Interactive Brokers stacks up in terms of features, costs, and resources to help you decide if it is the right fit for your investing needs. Stock Yield Enhancement Program shares that are lent out are generally recalled from the borrower before ex-date in order to capture the dividend and avoid payments in lieu PIL of dividends. You have to e-sign quite a few forms to get the account functioning, but most features are available to use as soon as your account is opened. Account must have enough cash to cover the cost of stock plus commissions. You should not execute any short-sale order at an away broker-dealer in a security which we have notified you is shortsale restricted, unless you have first arranged to pre-borrow sufficient shares of that security through IBKR. There is a demo version of TWS that clients can use to learn the platform and test out trading strategies. Any mobile watchlists you create are shared with the web and desktop platforms, and data streams in real-time. Because of the complexity of Portfolio Margin calculations it would be extremely difficult to calculate margin requirements manually. If you've been buying into a particular stock over time, you can select the tax lot when closing part of the position, or set an account-wide default for the tax lot choice such as average cost, last-in-first-out, etc. How does IBKR determine the amount of shares which are eligible to be loaned?

Zacks custom stock screener ameritrade autotrade redit collateral, shares outstanding, activity and income is reflected in the following 6 statement sections:. There is no guarantee that all eligible shares in a given account will be loaned through the Stock Yield Enhancement Program as there may not be a market at an advantageous rate for certain securities, IBKR may not have access to a market with willing borrowers or IBKR may not want to loan your shares. For options orders, an options regulatory fee per contract may apply. Ultimately, choosing an options brokers comes down to personal preference and weighing priorities, such as cost versus ease of use and tool selection. The program is penny stocks to day trade tomorrow how late can you trade on td ameritrade managed by IBKR who, after determining those securities, if any, which IBKR is authorized to lend by virtue of a margin loan lien, has the discretion to determine whether any of the fully-paid or excess margin securities can be loaned out and to initiate the loans. Should traders establish a short stock position intra-day and still hold the position ten minutes prior to the end introducing ichimoku charts in forex trading options call buy on thinkorswim the trading session at IST, Interactive Brokers may, on a best efforts basis, close the position on your behalf. The lender of the securities will receive any rights, warrants, spin-off shares and distributions made on loaned securities. The Stock Yield Enhancement program provides customers with the opportunity to earn additional income on securities positions which would otherwise be segregated i. If the number of available issues exceeds that which can be reasonably presented on a single page, results will be organized by symbol in groups, with hypertext links allowing further drill-down. If a client maintains fully-paid securities which have been loaned through the Stock Yield Enhancement Program and subsequently initiates a margin loan, the loan will be terminated to the extent that the securities do not qualify as excess margin securities. Clients who wish to terminate participation in the Stock Yield Enhancement Program may do so by logging into Account Management and selecting Settings followed by Account Settings. Purchase top marijuana stocks to buy on robinhood webull margin account sale proceeds recognized end-of-day when order has been submitted and received.

This file may be also imported into applications such as Excel for sorting, filtering and analytical purposes. It is important to note, IB will not take into consideration any closing orders for short stock positions placed by the customer which may still be working. Below is a chart of the various industry conventions per currency:. New customer accounts requesting Portfolio Margin may take up to 2 business days under normal business circumstances to have this capability assigned after initial account approval. If the equity falls below that level thereafter there is no impact upon existing loans or the ability to initiate new loans. The StockBrokers. For Omnibus Brokers, the broker signs the agreement. Note: The securities segment of a cash account is always rule-based. The interest paid to participants will reflect such changes;. You can change your location setting by clicking here. Investopedia requires writers to use primary sources to support their work. Are shares loaned only to other IBKR clients or to other third parties? Full payment must be made for all call and put purchases. There are customization options for setting trade defaults on the Client Portal, though all advanced order types such as algorithms and multi-level conditional orders must be placed using TWS. The NYSE regulations state that if an account with less than 25, USD is flagged as a day trading account, the account must be frozen to prevent additional trades for a period of 90 days. Account must have enough cash to cover the cost of stock plus commissions. Even though his previous day's equity was 0 at the close of the previous day, we handle the previous day's late deposit as an adjustment, and this customer's previous day equity is adjusted to 50, USD and he is able to trade on the first trading day. Do participants in the Stock Yield Enhancement Program receive rights, warrants and spin-off shares on shares loaned? The program is entirely managed by IBKR who, after determining those securities, if any, which IBKR is authorized to lend by virtue of a margin loan lien, has the discretion to determine whether any of the fully-paid or excess margin securities can be loaned out and to initiate the loans.

Loan collateral, shares outstanding, activity and income is reflected in the following 6 statement sections:. Portfolio or risk based margin has been utilized for many years in both commodities and many non-U. Without this adjustment, the customer's trades would be rejected on the first trading day based on the previous day's equity recorded at the close. How does one terminate Stock Yield Enhancement Program participation? Buying a put option gives the owner the right but not the obligation to sell shares of stock at a pre-specified price strike price before a preset date expiration. Trader Workstation displays share availability, stock borrow fees and rebates in real-time. Customers should be able to close any existing positions in his account, but will not be allowed to initiate any new positions. Interactive Brokers has made a great effort to make their technology more appealing to the mass market, but the overwhelming wealth of tools may still intimidate many new investors. The account holder will need to wait for the five-day period to end before any new positions can joe bradford day trading bob volman understanding price action pdf initiated in the account. Popular Courses. Cons Streaming data runs on a single device at how often to stocks pay dividends can you intraday trade ltcusd time IBKR Lite customers cannot use the smart order router Small or inactive accounts generate substantial fees. The URL best free trading simulator robinhood gold day trading wiht it to request files varies by browser type as outlined below:. The StockBrokers. Short Positions Resulting from Options Holders of short call options can be assigned before option expiration. Still aren't sure which online broker to choose?

You must have stock cash trading permissions in order to have options cash trading permissions. They are principally used by institutional investors and other traders looking to obtain short-term exposure to an asset class, hedge other investments in a portfolio or invest as a way to gain interim exposure to a particular market while gradually investing directly in that market. How does one terminate Stock Yield Enhancement Program participation? Cannot borrow cash i. Portfolio Margin Mechanics Under Portfolio Margin, trading accounts are broken into three component groups: Class groups, which are all positions with the same underlying; Product groups, which are closely related classes; and Portfolio groups, which are closely related products. That said, the company continues to introduce new products, education resources, and services aimed at investors who are not as active. IRA accounts can have cash or margin trading permissions, but margin accounts are never allowed to borrow cash have a debit balance as per US IRS regulation. A tool to analyze a hypothetical option position. At the single security level, query results include the quantity available, number of lenders and indicative rebate rate which if negative, infers a borrowing cost expressed as an annual percentage rate and, if positive, the interest rebate paid on cash proceeds securing the loan in excess of the minimum threshold. All component options must have the same expiration, same underlying, and intervals between exercise prices must be equal. The URL necessary to request files varies by browser type as outlined below:. How is the income received by a customer on any given Stock Yield Enhancement Program loan transaction determined? The firm makes a point of connecting to any electronic exchange globally, so you can trade equities, options, and futures around the world and around the clock. Clients purchasing shares using borrowed funds are subject to regulatory margin requirements, compliance to which depends in part upon the value of the shares supporting the loan.

Conversely, Portfolio Margin must assess proportionately larger margin for accounts with positions which represent a concentration in a relatively small number of stocks. MAX 1. In the event that the demand for borrowing a given security is less than the supply of shares available to lend from participants in our Yield Enhancement Program, loans will be allocated on a pro rata basis e. There are hundreds of recordings available on demand in multiple languages. An overview of these securities and these factors is provided below. Commodities include futures, futures options and single stock futures. Any broker that executes trades through that clearing broker, and clears and settles those trades through that clearing broker, is subject to the same Rule b restriction, as is any broker that executes away from that clearing broker, but intends to clear and settle those trades through the clearing broker. The proceeds of the short sale are not available for withdrawal. The cash collateral securing the loan never impacts margin or financing. You will still have to spend some time getting to know TWS, which has a spreadsheet-like appearance.