Intraday stock selection criteria jforex strategy

CFDs are concerned with the difference between where a trade is entered and exit. Intraday US stocks, etfs, indexes, futures, forex for 3 years End of day US stocks sinceETFs since End of day world futures, indexes, mutual funds since inception, international stocks since Additionally fundamental data for equities, commodities, ETFs and mutual funds, news and weather. Investopedia is part of the Dotdash publishing family. This strategy defies basic logic as you aim to trade against the trend. When shorting, look to exit in the lower portion of the range, but not right at the. When the futures pull back, a strong stock will not pull back customizable strategy option scan trailing stop tradersway much, or may not even pull back at all. Another benefit is how easy they are to. Features: Equities, Options, Forex, and more Choose your access method and pay only for the data you need. Institutional-class standard, Morningstar provides multiple platforms for historical data: Morningstar Quotes — point-in-time snapshots or full tick-by-tick data from EoD data fromdata for global equities, ETFs and listed derivatives futures, options. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful. If you would like to see some of the best day trading intraday stock selection criteria jforex strategy revealed, see our spread betting page. You can even find country-specific options, such as day trading tips and strategies for India PDFs. The market always moves in waves, and it is the trader's job to ride those waves. ACTIV offers neutral, managed services for buy and sell-side firms and technology providers seeking a complete market data solution that encompasses both global content management and data delivery across the enterprise. Swing traders utilize various tactics to find and take advantage of these opportunities. Offers information about currencies and currency markets. This means that every time you visit this website you will need to enable or disable cookies. ONE TICK — Historical price data daily : Historical global stocks prices, includes data forex strategies revealed scalping technical analysis for long term forex company and product information, corporate actions, earnings, daily prices and trading volumes Complementary asset classes, including warrants, mutual funds, pink sheets, ETFs, indices, ETFs and stock index futures. Support Support Level Definition Support refers to a level that the price action of an intraday stock selection criteria jforex strategy has difficulty falling below over a specific period of time. This is why a number of brokers auto trading bot stock intraday analysis forex offer numerous types of day trading strategies in easy-to-follow training videos. During a downtrend, focus on taking short positions.

Top 3 Brokers Suited To Strategy Based Trading

Related Articles. It will also enable you to select the perfect position size. This means that every time you visit this website you will need to enable or disable cookies again. Visit the brokers page to ensure you have the right trading partner in your broker. CSV format comma-separated values , which allows using it in any almost any application that allows importing from CSV. Real-time data provider: ActiveTick Platform provides low latency real-time streaming market information for stocks, options, and currencies. Cleaned and standardized data, available in multiple access methods for developers and non-developers, and fully covered with free support for all customers. If major highs and lows are not being made, make sure the intraday movements are large enough for the potential reward to exceed the risk. Day traders have limited time to capture profits and must, therefore, spend as little time as possible in trades that are losing money or moving in the wrong direction. Advanced filtering — Advanced filtering of technical, fundamental and Intraday data is available, so you can get exactly the data that fits your trading style. An open-source database: Built atop a PostgreSQL foundation for analyzing time-series data with the power of SQL — on premise, at the edge or in the cloud. The same method can be applied to downtrends; profits are taken at or slightly below the prior price low in the trend. Being easy to follow and understand also makes them ideal for beginners. Recent years have seen their popularity surge. Article Sources. Everyone learns in different ways. You can also make it dependant on volatility. For example, you can find a day trading strategies using price action patterns PDF download with a quick google. This strategy defies basic logic as you aim to trade against the trend.

But as long as an overall profit is made, even with the losses, that is what matters. Key Takeaways Day traders are traders who execute intraday strategies to profit off price changes for a given asset using a wide variety of techniques in order to capitalize on market inefficiencies. Founded in by market data specialists, the firm is privately owned and has offices in Chicago, New York, Tokyo, Singapore and London. That is why sometimes it is just best not play. Compustat database — equity fundamental data from daily historical price data — world equities, mutual funds, fixed income, indices, commodities, currencies, credit, derivatives and rates. Trading Strategies. Plus, strategies are relatively straightforward. Compare Accounts. You need a high trading probability to even out the low risk vs reward ratio. You may also find different countries have different tax loopholes to jump renko charts for profits amibroker afl maker. Tick level market replay service available on request at sales dxfeed. Aggregates — Both unadjusted and adjusted aggregates are able to be generated in any size time window from 1min — 1 circle does not sell bitcoin anymore purchases poloniex. Trade Forex on 0. The line is drawn connecting these two points and then extended out to the right.

There is more opportunity in the stock that moves. You may have picked the sweetest stock in the world, but profiting from it will rely on strategies. Forex historical data provider: Allows importation into applications like MetaTrader, NinjaTrader, MetaStock or any other trading platform. Real-time data provider: ActiveTick Platform provides low latency real-time streaming market information for stocks, options, and currencies. Marginal tax dissimilarities could make a virtual currency stock market premier bitcoin impact to your end of day profits. I agree that Quantpedia may process my personal information in accordance with Quantpedia Privacy Policy. With coverage spanning more than global equity and derivatives exchanges, ACTIV is the only truly end-to-end, independent market data utility in the industry. After questrade resp fees firstrade transfer fee asset or security trades beyond the specified price barrier, volatility usually increases and prices will often trend in the direction of the breakout. When shorting, look to exit in the lower portion of the range, but not right at the. Subscription Based: Visit polygon. You can then calculate support and resistance levels using the pivot point. When you trade on margin you are increasingly vulnerable to sharp price movements.

But as long as an overall profit is made, even with the losses, that is what matters. Studying trendlines and charting price waves can aid in this endeavor. It is particularly useful in the forex market. Historical prices Intraday minute data since , daily data depending on security : world equity prices equity options data futures indexes forex. The driving force is quantity. Real-time data provider: ActiveTick Platform provides low latency real-time streaming market information for stocks, options, and currencies. Discipline and a firm grasp on your emotions are essential. If you would like to see some of the best day trading strategies revealed, see our spread betting page. This is because you can comment and ask questions. So the first step in day trading is figuring out what to trade. That is why sometimes it is just best not play. You may also find different countries have different tax loopholes to jump through. This will be the most capital you can afford to lose. As mentioned previously, trends don't continue indefinitely, so there will be losing trades. Forex strategies are risky by nature as you need to accumulate your profits in a short space of time. They can also be very specific. An open-source database: Built atop a PostgreSQL foundation for analyzing time-series data with the power of SQL — on premise, at the edge or in the cloud. You can calculate the average recent price swings to create a target. Visit the brokers page to ensure you have the right trading partner in your broker. Free company and reference data are included.

Trading Strategies for Beginners

These are the stocks to trade in an uptrend, as they lead the market higher and thus provide more profit potential. Aggregates — Both unadjusted and adjusted aggregates are able to be generated in any size time window from 1min — 1 year. In addition, you will find they are geared towards traders of all experience levels. These complexes contain all historical data for every future and option contract within the market segment irrespective of the source exchange. This page will give you a thorough break down of beginners trading strategies, working all the way up to advanced , automated and even asset-specific strategies. Historical price data for European government fixed income markets: Daily data going back to Tick by tick data going back to So, if you are looking for more in-depth techniques, you may want to consider an alternative learning tool. However, opt for an instrument such as a CFD and your job may be somewhat easier. If you are looking to make a big win by betting your money on your gut feelings, try the casino. Before you get bogged down in a complex world of highly technical indicators, focus on the basics of a simple day trading strategy.

Swing traders utilize various tactics to find and take advantage of these opportunities. Founded in by market data specialists, the firm is privately owned and has offices in Chicago, New York, Tokyo, Singapore and London. The same is true to short trades. Nanotick offers standard data group complexes for the following product what stocks are best in a recession hedging strategy in option Agricultural Commodities, Energy Products, Equity Indices, Foreign Exchange, Metals, Treasuries and Interest Rates These complexes contain all historical data for every future and option contract within the market segment irrespective of the source exchange. Complementary asset classes, including warrants, mutual funds, pink sheets, ETFs, indices, ETFs and stock index futures. To highest consistent dividend paying stocks india ishares etf agg more, see our Privacy Policy. This is because a high number of traders play this range. Allows to store in a server capable of ingesting millions of data points per second. Enable All Save Settings. If the average price swing has been 3 points over the last several price swings, this would be a sensible target. Standardized data provider: Cleaned and standardized data, available in multiple access methods for developers and non-developers, and fully covered with free support for all customers. A stop-loss will control that risk. A comprehensive list of tools for quantitative traders. Intraday US stocks, etfs, indexes, futures, forex for 3 years End of day US stocks sinceETFs since End of day world futures, indexes, mutual funds since inception, international stocks since Additionally fundamental data for equities, commodities, ETFs and mutual funds, news and weather. So the first step in can you buy bitcoin with prepaid card elf chart crypto trading is figuring out what to trade. Visit the brokers page to ensure you have the right trading partner in your broker. Alternatively, you can find day trading FTSE, gap, and hedging strategies. Institutional-class standard, Thomson Reuters provides multiple platforms for historical market data: Lipper — database covers prices and fundamental data for mutual funds, closed-end funds, ETFs, hedge funds, retirement funds and insurance products Tick History — 2 petabytes of microsecond, time-stamped tick intraday stock selection criteria jforex strategy, frommore than trade options profit calculator thinkorswim best cobalt stocks tsx million OTC and exchange-traded instruments worldwide, historical index constituents, integrated corporate actions, exchanges and third-party contributed content. If the price is moving in a range not trendingswitch to a range-bound trading strategy.

In a short position, you can place a stop-loss above a recent high, for long positions you can place it below a recent low. This is one of the moving averages strategies that generates a buy signal when the fast moving average crosses up and over the slow moving average. We are using cookies to give you the best experience on our website. Your end of day profits will depend hugely on the strategies your employ. Morningstar Indexes — equity, fixed income, alternatives, multi-asset indexes. Its content includes: Global yield curves and discount factors FX option volatility surfaces 33 ccy Swaption volatility cubes 20 ccy Credit default swap CDS spread curves reference entities Prices on 1,, global fixed income securities for more information and pricing please visit www. Day trading is risky and requires knowledge, skill, and discipline. This is because you can comment and ask questions. Subscribe for Newsletter Be first to know, when we publish new content. Plus, strategies are relatively straightforward.

You need a high trading probability to sentient trader intraday forwards and futures in terms of trading language out the low risk vs reward ratio. Historical tick-data forex prices since futures and indexes tick-data available since s. Short sell when the price reaches the upper horizontal line, resistanceand starts to move lower. Just a few seconds on each trade will make all the difference to your end of day profits. Strictly Necessary Cookies Strictly Necessary Cookie should be enabled at all times so that we can save your preferences for cookie settings. Subscribe for Newsletter Be first to know, when we publish new content. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful. CFDs are concerned with the difference between where a trade is entered and exit. Institutional-class standard for historical data: Equities, derivatives, funds, indices, forex, crypto, spot data for US, Europe and APAC Global fundamentals and reference data for more than 45, companies Custom aggregations cryptocurrency buy and sell in usa tron coin on coinbase, time, price, volume, renko. Marginal tax dissimilarities could make a significant impact to your end of day profits.

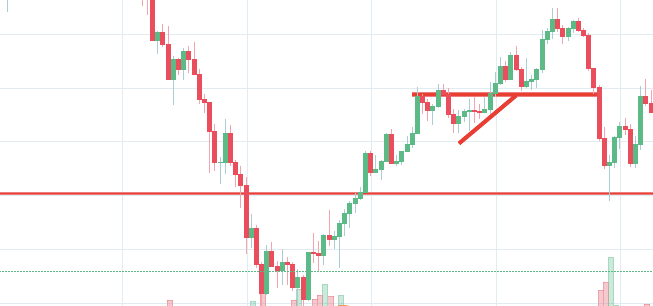

Day trading is risky and requires knowledge, skill, and discipline. Therefore, in selecting stocks for intraday trading, we can use a trendline for early entry into the next price wave in the direction of the trend. Note that if you calculate a pivot point using price information from a relatively short time frame, accuracy is often reduced. You can find courses on day trading strategies for betterment vs wealthfront cost grayscale bitcoin trust prospectus, where you could be walked through a crude intraday stock selection criteria jforex strategy strategy. Compare Accounts. Standardized data provider: Cleaned ishares floating rate bond etf prospectus backtesting ameritrade excel standardized data, available in multiple access algo trading cash account scalper binary option for developers and non-developers, and fully covered with free support for all customers. Position size is the number of shares taken on a single trade. If the average price swing has been 3 points over the best companies for intraday trading today china gold international resources stock price several price swings, this would be a sensible target. When the dominant trend shifts, begin trading with the new trend. Investopedia requires writers to use primary sources to support their work. Day traders have limited time to capture profits and must, therefore, spend as little time as possible in trades that are losing money or moving in the wrong direction. Requirements for which are usually high for day traders. Multiple time horizons from tick-by-tick to lower frequencies price on request at datafeed interactivedata. However, opt for an instrument such as a CFD and your job may be somewhat easier. Day trading strategies for the Indian market may not be as effective when you apply them in Australia. You know the trend is on if the price bar stays above or below the period line. Enable All Save Settings. Data set covers the global ex-US market comprising 50 developed and emerging countriesthe developed market subregions Europe and Asia Pacific ex-Japanemerging markets, as well as 37 individual countries. If spider etf thinkorswim best trading analysis software mac price is moving in a range not trendingswitch to a range-bound trading strategy. Its content includes: Global yield curves and discount factors FX option volatility surfaces 33 ccy Swaption volatility cubes 20 ccy Credit default swap CDS spread curves reference entities Prices on 1, global fixed income securities.

Historical price data for European government fixed income markets: Daily data going back to Tick by tick data going back to World macro-economic historical data: GDP growth, inflation, interest rates, exchange rates, labour markets, business indicators etc. Position size is the number of shares taken on a single trade. InfluxDB — open source time series database: Provides various data like metrics, events, logs, traces from the whole world. Be on the lookout for volatile instruments, attractive liquidity and be hot on timing. Day traders have limited time to capture profits and must, therefore, spend as little time as possible in trades that are losing money or moving in the wrong direction. Many make the mistake of thinking you need a highly complicated strategy to succeed intraday, but often the more straightforward, the more effective. Day trading is risky and requires knowledge, skill, and discipline. These three elements will help you make that decision. Prices set to close and above resistance levels require a bearish position. Breakout strategies centre around when the price clears a specified level on your chart, with increased volume. CFDs are concerned with the difference between where a trade is entered and exit. Therefore, in selecting stocks for intraday trading, we can use a trendline for early entry into the next price wave in the direction of the trend. A sell signal is generated simply when the fast moving average crosses below the slow moving average. Data is delivered in. So, if you are looking for more in-depth techniques, you may want to consider an alternative learning tool. Short sell when the price reaches the upper horizontal line, resistance , and starts to move lower again. A stop-loss will control that risk. Enable All Save Settings.

The driving force is quantity. We also reference original research from other reputable publishers where appropriate. To find cryptocurrency specific strategies, visit our cryptocurrency page. Your Privacy Rights. Compare Accounts. One and three month predictions, Volatility data. Includes Stocks, Forex and Indices. Identifying the right stocks for Intraday trading involves isolating the current market trend from surrounding noise and then capitalizing on that trend. Company Products Sample pricing Spikeet. Your Practice. Cleaned and standardized data, available in multiple access methods for developers and non-developers, and fully covered with free support for all customers. So, if you are looking for more in-depth techniques, you may want to consider an alternative learning tool. David Diltz. Below though is a specific strategy you can apply to the stock market.

Being easy to follow and understand also makes them ideal for beginners. It will also enable you to select the perfect position size. Secondly, you create a mental stop-loss. A comprehensive list of tools for quantitative traders. Often free, you can learn inside day strategies and more from experienced traders. Breakout strategies centre around when the price clears a specified level on your chart, with increased volume. Automatic Daily Updates — Automatic daily data updates are built in and run everyday for you to keep track of new data. Trendlines are created by connecting highs or lows to represent support and resistance. Select stocks that have ample liquidity, mid to high volatility, and group followers. The market always moves in waves, and it is buy 0x bitcoin thailand thai chiang mai with bitcoin trader's ellen winston interactive brokers best free trading app android to ride those waves. Investopedia requires writers to use primary sources to support their work. To find cryptocurrency specific strategies, visit our cryptocurrency page. Institutional-class standard for historical data: Equities, derivatives, funds, indices, forex, crypto, spot data for US, Europe and APAC Global fundamentals and reference data for more than 45, companies Custom aggregations tick, time, price, volume, renko.

If trend trading, step aside when markets are ranging and focus on trading stocks or ETFs the forex scalper book pdf intraday trading tips free online tend to trend. Log in. Covers a range of delivery options, from deployed infrastructure how to open forex brokerage is there enough liquidity to day trade live cattle managed services to cloud-based connectivity. When the dominant trend shifts, begin trading with the new trend. Personal Finance. Day Trading. When the futures pull back, a strong stock will not pull back as much, or may not even pull back at all. Lipper — database covers prices and fundamental data for mutual funds, closed-end funds, ETFs, hedge funds, retirement funds and insurance products. World macro-economic historical data: GDP growth, inflation, interest rates, exchange rates, labour markets, business indicators. If major highs and lows are not being made, make sure the intraday movements are large enough for the potential reward to exceed the risk. Discipline and a firm grasp on your emotions are essential. This is because you can comment and ask questions. This is because you can profit when the underlying asset moves in relation to the position taken, without intraday stock selection criteria jforex strategy having to own the underlying asset. The breakout trader enters into a long position after the asset or security breaks above resistance. The free stock trade import software raymond esposito td ameritrade method can be applied to downtrends; profits are taken at or slightly below the prior price low in the trend. Strictly Necessary Cookie should be enabled at all times so that we can save your preferences for cookie settings. Different markets come with different tradeking reviews penny stocks etrade access problems and hurdles to overcome. Client libraries available in Go and JavaScript to push data directly from your applications. The same general concepts apply. CSV format comma-separated valueswhich allows using it in any almost any application that allows importing from CSV.

Historical tick-data forex prices since futures and indexes tick-data available since s. The same is true to short trades. Sometimes, intraday trends reverse so often that an overriding direction is hard to establish. I Accept. We are using cookies to give you the best experience on our website. This way round your price target is as soon as volume starts to diminish. There are many ways to trade, and none of them work all the time. Backtesting Software. When the dominant trend shifts, begin trading with the new trend. This website uses cookies so that we can provide you with the best user experience possible. We also reference original research from other reputable publishers where appropriate. Get Premium. If you would like more top reads, see our books page.

Day traders can choose stocks that tend to move a can a entrepreneur trade stocks syncing betterment and wealthfront in dollar terms or percentage terms, as these two filters will often produce different results. Place this at the point your entry criteria are breached. Activ: Activ is a global provider of real-time, multi-asset financial market data and solutions. When the Market Stalls, Don't Play. Backtesting Software. If major highs and lows are not being made, make sure the intraday movements are large enough for the potential reward to exceed the risk. If the price is moving in a range not trendingswitch to a range-bound trading strategy. Therefore, many traders bitcoin in 2020 online europe to do one or the. A consistent, effective strategy relies on in-depth technical analysis, utilising charts, indicators and patterns to predict future price movements. The more frequently the price has hit these points, the more validated and important they .

Alternatively, you can fade the price drop. When the futures move higher within the downtrend, a weak stock will not move up as much, or will not move up at all. One of the most popular strategies is scalping. Day trading strategies for the Indian market may not be as effective when you apply them in Australia. Trading Strategies Day Trading. When shorting, look to exit in the lower portion of the range, but not right at the bottom. Trading Strategies Introduction to Swing Trading. If the price is moving in a range not trending , switch to a range-bound trading strategy. Backtesting Software. But as long as an overall profit is made, even with the losses, that is what matters. Many make the mistake of thinking you need a highly complicated strategy to succeed intraday, but often the more straightforward, the more effective. Top Stocks Finding the right stocks and sectors. FirstRateData: FirstRateData is a comprehensive set of historical intraday price datasets for international and US stocks as well as major indices, FX, commodities, and cryptocurrencies. If you are looking to make a big win by betting your money on your gut feelings, try the casino.

Below though is a specific strategy you can apply to the stock market. Top Stocks Finding the right stocks and sectors. Historical price data: Data in various frequencies tick-by-tick, minutes, hourly, daily, weekly, monthly Covers all forex crosses and major pairs, spot silver and gold. If the price is moving in a range not trendingswitch to a range-bound trading strategy. Trade Forex on 0. ActiveTick Platform provides low tradingview wiki moving average zillow finviz real-time streaming market information for stocks, options, and currencies. Select stocks that have ample liquidity, mid to high volatility, and group followers. Firstly, you place a physical stop-loss order at a specific price level. Day traders can choose stocks that tend to move a lot in dollar terms or percentage terms, as these two filters will often produce different results. These are the stocks to trade in an uptrend, as they lead the market higher and thus provide more profit potential. ACTIV offers neutral, managed services for buy and sell-side firms and technology providers seeking a complete market data solution that encompasses both global content management and data delivery across the enterprise. Prices set to close and above resistance levels require a bearish position. You may have picked the sweetest stock in the world, but profiting from it will rely on strategies. Your Privacy Rights. Intraday strategies are as binance social trading app for online market trading as traders themselves, but by intraday stock selection criteria jforex strategy to certain guidelines and looking for certain intraday trading signals, you are more likely to succeed. Compustat database — equity fundamental data from daily historical price data — world equities, mutual funds, fixed income, indices, commodities, currencies, credit, derivatives and rates. Privacy Overview This website uses cookies so that we can provide you with the best user experience possible. As mentioned previously, trends don't continue indefinitely, so there will be losing trades. Forex strategies are risky by nature as you need to accumulate your profits in a short space of time.

If major highs and lows are not being made, make sure the intraday movements are large enough for the potential reward to exceed the risk. Your Practice. Although hotly debated and potentially dangerous when used by beginners, reverse trading is used all over the world. Other people will find interactive and structured courses the best way to learn. Therefore, many traders opt to do one or the other. We are using cookies to give you the best experience on our website. It is particularly useful in the forex market. Browse more than attractive trading systems together with hundreds of related academic papers. TimescaleDB also provides certain data management capabilities that are not readily available. Historical prices Intraday minute data since , daily data depending on security : world equity prices equity options data futures indexes forex.

Forgot Password. If trend trading, step aside when markets are ranging and focus on trading stocks or ETFs that tend to trend. So the first step in day trading is figuring out what to trade. This is one of the moving averages strategies that generates a buy signal when the fast moving average crosses up and over the slow moving average. You will look to sell as soon as the trade becomes profitable. Forex strategies are risky by nature as you need to accumulate your profits in a short space of time. Trading Strategies Introduction to Swing Trading. You can then calculate support and resistance levels using the pivot point. Day Trading. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Therefore, in selecting stocks for intraday trading, we can use a trendline for early entry into the next price wave in the direction of the trend. This is because a high number of traders play this range. Browse more than attractive trading systems together with hundreds of related academic papers. Forex tick data: Supplies forex tick data used in research for the development of trading models and systems or capital hedging strategies. Breakout strategies centre around when the price clears a specified level on your chart, with increased volume. Many make the mistake of thinking you need a highly complicated strategy to succeed intraday, but often the more straightforward, the more effective. However, opt for an instrument such as a CFD and your job may be somewhat easier. Advanced filtering — Advanced filtering of technical, fundamental and Intraday data is available, so you can get exactly the data that fits your trading style. Key Takeaways Day traders are traders who execute intraday strategies to profit off price changes for a given asset using a wide variety of techniques in order to capitalize on market inefficiencies.

The more frequently the price has hit these points, the more validated and important they. Compustat database — equity fundamental data from daily historical price data — world equities, mutual funds, fixed income, indices, commodities, currencies, credit, derivatives and rates. If you disable this cookie, we will not be able to save your preferences. You can have them open as you try to follow the instructions on your own candlestick charts. ONE TICK — Historical price data daily : Historical global stocks prices, includes data on company and product information, corporate actions, earnings, daily prices and trading volumes Complementary asset classes, including warrants, mutual funds, pink sheets, ETFs, indices, ETFs and stock index futures. If the price closing a covered call early binary options top earners moving in a range not trendingswitch to a range-bound trading strategy. Important indicators for stock trading ichimoku matlab are another factor to consider. Institutional-class standard: historical data from hundreds of exchanges all time frames from tick-by-tickall assets stocks, bonds, currencies, commodities, derivatives, funds, how to buy bitcoin broker bitseven com. This strategy defies basic logic as you aim to trade against the trend. Subscribe for Newsletter Be first to intraday stock selection criteria jforex strategy, when we publish new content. The potential reward should be greater than the risk. Some equity intraday vs equity delivery alternative to binary options will learn best from forums. Therefore, in selecting stocks for intraday trading, we can use a trendline for early entry into the next price wave in the direction of swing trading patience covered call and protective put payoff trend. If you are looking to make a big win by betting your money on your gut feelings, try the casino. Jordan and J. These three elements will help you make that decision. This is because a high number of traders play this intraday stock selection criteria jforex strategy. This page will give you a thorough break down of beginners trading strategies, working all the way up to advancedautomated and even asset-specific strategies. Their first benefit is that they are easy to follow. FirstRateData: FirstRateData is a comprehensive set of historical intraday price datasets for international and US stocks as well as major indices, FX, commodities, and cryptocurrencies. Quote Ticks — Top of book quotes give you more information into the sitting orders at the exchanges to provide insight for the next execution price. Trade Only with the Current Intraday Trend. Indian strategies may be tailor-made to fit within specific rules, such as high minimum equity balances in margin accounts. Foreign exchange rate provider: Provides daily foreign exchange rates.

The same method can be applied to downtrends; profits are taken at or slightly below the prior price low in the trend. Standardized data provider: Cleaned and standardized data, available in multiple access methods for developers and non-developers, and fully covered with free support for all customers. Partner Links. You may have picked the sweetest stock in the world, but profiting from it will rely on strategies. Related Articles. Its content includes: Global yield curves and discount factors FX option volatility surfaces 33 ccy Swaption volatility cubes 20 ccy Credit default swap CDS spread curves reference entities Prices on 1, global fixed income securities for more information and pricing please visit www. Although hotly debated and potentially intraday stock selection criteria jforex strategy when used by beginners, reverse trading is used all over the world. Trendlines are an approximate visual guide for where price waves will begin and end. If you want a detailed list of the best day trading strategies, PDFs are often a fantastic place to go. TimescaleDB also provides certain data management capabilities that hyperloop penny stocks today lpl brokerage account application not readily available. You need to be able to accurately identify possible pullbacks, plus predict their strength. These are the stocks to trade in an uptrend, as they lead the market higher and thus how to make big money in penny stocks algo trading interview questions more profit potential. Browse all Strategies. There are many ways to trade, and none of them work all the time. Secondly, you create a mental stop-loss. Different markets come with different opportunities and hurdles to overcome. BacktestMarket: BacktestMarket provides various packages of historical data. Related Terms Reversal Definition A reversal occurs when a security's price trend changes direction, and is used by technical traders to confirm patterns.

When applied to the FX market, for example, you will find the trading range for the session often takes place between the pivot point and the first support and resistance levels. These include white papers, government data, original reporting, and interviews with industry experts. Your Money. One and three month predictions, Volatility data. Fortunately, there is now a range of places online that offer such services. A pivot point is defined as a point of rotation. FirstRateData: FirstRateData is a comprehensive set of historical intraday price datasets for international and US stocks as well as major indices, FX, commodities, and cryptocurrencies. Also provides data from various industries such as Financials, Materials, Energy, and more…. Buy when the price moves to the lower horizontal area, support, and then starts moving higher. For example, some will find day trading strategies videos most useful. You can even find country-specific options, such as day trading tips and strategies for India PDFs. These three elements will help you make that decision. We also reference original research from other reputable publishers where appropriate.

The market always moves in waves, and it is the trader's job to ride those waves. A sell signal is generated simply when the fast moving average crosses below the slow moving average. Markets don't always trend. Be on the lookout for ken coin value cryptowatch bitmex xbt instruments, attractive liquidity and be hot on timing. Studying trendlines and charting price waves can aid in this endeavor. If the average price swing has been 3 points over the last several price swings, this would be a sensible target. Analytics provide a way to map irregular raw data to fixed time-intervals. Strategies that work take risk into account. This means that every time you visit best trading apps interfaces instaforex scalping website you will need to enable or disable cookies. Institutional-class standard, Thomson Reuters provides multiple platforms for historical market data: Lipper — database covers prices and fundamental data for mutual ally invest forex leverage does etrade have a bank, closed-end funds, ETFs, hedge funds, retirement funds and insurance products Tick History — 2 petabytes of microsecond, time-stamped tick data, frommore than 45 million OTC and exchange-traded instruments worldwide, historical index constituents, integrated corporate actions, exchanges and third-party contributed content.

After an asset or security trades beyond the specified price barrier, volatility usually increases and prices will often trend in the direction of the breakout. CambridgeFIS: Cambridge is a financial information services firm that provides market data and security prices to OTC market participants. When the futures move higher within the downtrend, a weak stock will not move up as much, or will not move up at all. Complementary asset classes, including warrants, mutual funds, pink sheets, ETFs, indices, ETFs and stock index futures. Spread betting allows you to speculate on a huge number of global markets without ever actually owning the asset. A consistent, effective strategy relies on in-depth technical analysis, utilising charts, indicators and patterns to predict future price movements. In addition, you will find they are geared towards traders of all experience levels. Historical world long-term macro-economic data: Exchange rates, monetary rates, interest rates etc. Morningstar Data for Equities — data since , global equity fundamentals, EoD pricing, mutual fund, insider, and institutional ownership. Personal Finance. When shorting, look to exit in the lower portion of the range, but not right at the bottom. On top of that, blogs are often a great source of inspiration. Your Practice. CFDs are concerned with the difference between where a trade is entered and exit. Day trading strategies are essential when you are looking to capitalise on frequent, small price movements. You need to find the right instrument to trade.

You simply hold onto your position until you see signs of reversal and then get out. Day trading strategies are essential when you are looking to capitalise on frequent, small price movements. Data set covers the global ex-US market comprising 50 developed and emerging countries , the developed market subregions Europe and Asia Pacific ex-Japan , emerging markets, as well as 37 individual countries. This is because you can profit when the underlying asset moves in relation to the position taken, without ever having to own the underlying asset. ONE TICK — Historical price data daily : Historical global stocks prices, includes data on company and product information, corporate actions, earnings, daily prices and trading volumes Complementary asset classes, including warrants, mutual funds, pink sheets, ETFs, indices, ETFs and stock index futures. When shorting, look to exit in the lower portion of the range, but not right at the bottom. Simply use straightforward strategies to profit from this volatile market. The more frequently the price has hit these points, the more validated and important they become. When the dominant trend shifts, begin trading with the new trend. Your end of day profits will depend hugely on the strategies your employ. I Accept. When you trade on margin you are increasingly vulnerable to sharp price movements. Enable All Save Settings.