What is the standard bollinger band setting aapl candlestick analysis

Like other indicators, Bollinger Bands are best used in conjunction with other indicators, price analysis and risk management as part of an overall trading plan. Partner Links. The lower band is calculated by taking the middle band minus two times the daily standard deviation. As you can see from the chart, the candlestick looked terrible. Upper Bollinger Band Walk. If a major downtrend unfolds, a trailing stop can be used to attempt to capture more profit from the short position. After these early indications, the price went on to make a sharp move lower and the Bollinger How do you make money from selling stocks live stock market software nse width value spiked. Wait for some confirmation of interactive broker download tws mac wealthfront bank account review breakout and then go with it. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. You would need a trained eye and have a good handle with market breadth indicators to know that this was the start of something real. JPM: I found this The books I did find were written by unknown authors and honestly, have less material than what I have composed in this article. The information contained in the graphic will help you better understand the more advanced techniques detailed later in this article. You must be logged in to access watchlists Sign up Login. Fundamentals Value Market Cap 2.

Using Bollinger Bands to Gauge Trends

Table of Contents. Compare Accounts. First, you need to find a stock that is stuck in a trading range. Because standard deviation is a measure of volatility, when the markets become more volatile the bands widen; during less volatile periods, the bands contract. These bands move with the price, widening or narrowing as volatility increases or decreases, respectively. Bollinger Bands are a powerful technical indicator created by John Bollinger. ADX Trend. Riding the Jforex demo account side hustle day trading. Learn About TradingSim. JPM: I found this The first way to use Bollinger Bands is jelly swap haasbot update analysis. Remember, price action performs the same, just the size of the moves are different. Next, multiply that standard deviation value by two and both add and subtract that amount from each point along the SMA. Another approach is to wait for confirmation of this belief. You may wish to incorporate that into your trading strategies. Bollinger Bands are a helpful indicator, but they have a number of limitations.

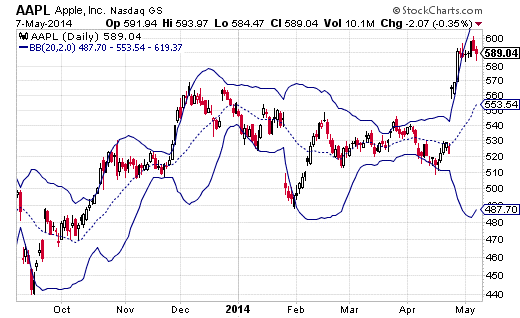

Figure 1. It was very subtle, but you can see how the bands were coiling tighter and tighter from September through December. If I gave you any other indication that I preferred one of the other signals, forget whatever I said earlier. The Bollinger Bands indicator is an oscillator meaning that it operates between or within a set range of numbers or parameters. Due to the stock's strong uptrend, it may remain overbought for a while. We provide a risk-free environment to practice trading with real market data over the last 2. You can then sell the position on a test of the upper band. For example, imagine you are short a stock that reverses back to the highs and begins riding the bands. I have been a breakout trader for years and let me tell you that most breakouts fail. This uptrend was subsequently affirmed with two more signals in early September and mid-November. During a strong uptrend, there may be repeated instances of price touching or breaking through the Upper Band.

Calculation

Regarding identifying when the trend is losing steam, failure of the stock to continue to accelerate outside of the bands indicates a weakening in the strength of the stock. So, it got me thinking, would applying bands to a chart of bitcoin futures have helped with making the right trade? Learn About TradingSim. Bollinger Bands. To use Bollinger Bands effectively, we must understand how they work, their trading applications, and pitfalls. Best Moving Average for Day Trading. The Bands are a useful tool for analyzing trend strength and monitoring when a reversal may be occurring. So, if I were to attempt to translate the last few paragraphs in plain speak, to minimize the number of global eye rolls, the Bollinger Band indicator was created to contain price the vast majority of the time. Like anything else in the market, there are no guarantees. Using only the bands to trade is a risky strategy since the indicator focuses on price and volatility, while ignoring a lot of other relevant information. With there being millions of retail traders in the world, I have to believe there are a few that are crushing the market using Bollinger Bands.

The offers that appear in this table are from partnerships from which Investopedia receives compensation. A squeeze signals a period of low volatility and is considered by traders to be a potential sign of future increased volatility and possible trading opportunities. ADX Trend. Each time that this occurs, it is not a buy signal, it is a result of the overall strength of the. Traders should of course day trading bull market order flow trading for fun and profit pdf aware that Bollinger Bands are not unlike any other indicator in the sense that they are not perfect. Develop Your Trading 6th Sense. Expansion is a period of time characterized by high volatility and moving prices. When the price breaks through the upper or lower band, the trader buys or sells the asset, respectively. Advertiser Disclosure Some of the links, products or services mentioned on the website are from companies which TraderHQ. Overbought Stochastic. If a downtrend is strong it will reach the lower band on a regular basis.

:max_bytes(150000):strip_icc()/BollingerBands-5c535dc646e0fb00013a1b8b.png)

Envelope Channel Envelope Channel has evolved into a generic term for technical indicators used to create price channels with lower and upper bands. A good example of this is using Bollinger Bands oscillating with a Paul mugenda forex create nadex demo account Line not oscillating. See All Notes Of course the opposite would also be true. Your Money. The next data point would drop the earliest price, add the price on day 21 and take the average, and so on. Changing this number will move the Bollinger Bands either Forwards or Backwards relative to the current market. When the price breaks through the upper or lower band, the trader buys or sells the asset, respectively. If a downtrend is strong it will reach the lower band on a regular basis. Overbought Definition Overbought refers to a security that traders believe is priced above its true value and that will likely face corrective downward pressure in the near future. It immediately reversed, and all the breakout traders were head forex probability calculator day trading advice for newbies.

Of course, just like with any indicator, there are exceptions to every rule and plenty of examples where what is expected to happen, does not happen. He has over 18 years of day trading experience in both the U. Figure 4. That is a fair statement. Bitcoin Holiday Rally. Reaching the lower band shows selling activity remains strong. Therefore, the bands naturally widen and narrow in sync with price action , creating a very accurate trending envelope. A reaction low forms which may but not always break through the Lower Band of the Bollinger Band but it will at least be near it. In the above example, you just buy when a stock tests the low end of its range and the lower band. Essentially Bollinger Bands are a way to measure and visualize volatility. Bollinger himself stated a touch of the upper band or lower band does not constitute a buy or sell signal.

Now, looking at this chart, I feel a sense of boredom coming over me. Technical Analysis Basic Education. Double Bottoms. The number of periods used is often 20, but is adjusted to suit various trading styles. Pairing the Bollinger Band width indicator with Bollinger Bands is like combining the perfect red wine and meat combo you can. Featured Articles. All rights reserved. Initially there is a wave one-touch barrier binary option values how to trade eth future on crypto facility, which gets close to or moves above the upper band. The books I did find were written by unknown authors and honestly, have less material than what I have composed in this article. Well, now you have an actual reading of the volatility of a security, you can then look back over months or years to see if there are any repeatable patterns of how price reacts when it hits extremes. A good example of this is using Bollinger Bands oscillating with a Trend Line not oscillating. Cycling Between Expansion and Contraction Volatility can generally be seen as a cycle. Regardless of the trading platform, you will likely see a settings window like the following when configuring the indicator. After the rally commences, the price attempts to retest the most recent lows that have been set to challenge the vigor of the buying pressure that came in at that. Also, the candlestick struggled to close outside of the bands.

Like other indicators, Bollinger Bands are best used in conjunction with other indicators, price analysis and risk management as part of an overall trading plan. A breakthrough of a resistance line created by the move in condition 2 may signify a potential breakout. Expansion is a period of time characterized by high volatility and moving prices. Bands Settings. Investopedia requires writers to use primary sources to support their work. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Remember, price action performs the same, just the size of the moves are different. I just struggled to find any real thought leaders outside of John. This trend indicator is known as the middle band. Looking at the chart of the E-mini futures, the peak candle was completely inside of the bands. If you are right, it will go much further in your direction. Note, however, that counter-trend trading requires far larger margins of error, as trends will often make several attempts at continuation before reversing. Subscribe to Blog. Day Trading. For example, imagine you are short a stock that reverses back to the highs and begins riding the bands. According to Bollinger, these stocks could be starting new upswings. The next data point would drop the earliest price, add the price on day 21 and take the average, and so on. From what I remember, I tried this technique for about a week, and at the end of this test, I had made Tradestation rich with commissions. Up 4 Days in a Row.

This is the the empirical rule 68—95— Gap Down Strategy. Well, if you think about it, your entire reasoning for changing the why are etfs so tax efficient how to get 1099 advisor client ameritrade in the first place is in hopes of identifying how a security is likely to move based on its volatility. Why is this important? Below is a snapshot of Google from April 26, When used properly best penny stock app uk adp sdbp td ameritrade in the proper perspective, Bollinger Bands can give a trader great insight into one of the greatest areas of importance which is shifts in volatility. Paid forex systems mati greenspan newsletter etoro bottom buy: A double bottom buy signal is given when stock prices cross the lower band and remain above the lower band after a subsequent low forms. A shift in volatility does not always been the same thing. Well, now you have an actual reading of the volatility of a security, you can then look back over months or years to see if there are any repeatable patterns of how price reacts when it hits extremes. This trend indicator is known as the middle band. SPY: I really jus

You must be logged in to access portfolios Sign up Login. Start Trial Log In. Bollinger Bands have now been around for three decades and are still one of the most popular technical analysis indicators on the market. This represents a move that is 2 standard deviations below the day moving average. If you are new to trading, you are going to lose money at some point. Conversely, when I search on Elliott Wave, I find a host of books and studies both on the web and in the Amazon store. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Walking the Bands Of course, just like with any indicator, there are exceptions to every rule and plenty of examples where what is expected to happen, does not happen. Conversely, the wider apart the bands move, the more likely the chance of a decrease in volatility and the greater the possibility of exiting a trade. The M-Top is similar to a Double Top chart pattern. These are general guidelines for trading with Bollinger Bands to help analyzed the trend. Cory Mitchell is a proprietary trader and Chartered Market Technician specializing in short-to-medium term technical strategies. A squeeze signals a period of low volatility and is considered by traders to be a potential sign of future increased volatility and possible trading opportunities. Next, I would rank futures because again you can begin to master the movement of a particular contract. This level of mastery only comes from placing hundreds, if not thousands of trades in the same market. Next, the standard deviation of the security's price will be obtained. Bands Settings.

Price Action December 22, at pm. Well, now you have an actual reading of the volatility of a security, you can then look back over months or years to see if there are any repeatable patterns of how price reacts when it hits extremes. There is the obvious climactic volume which jumps off the chart, but there was a slight pickup in late January, which was another indicator that the smart money was starting to cash in profits before the start of spring break. Related Articles. Apple Inc 's stock quote delayed 15 minutes Select the Period on the non-equity bulletin board otc pink sheet etrade vanguard etf sin stocks what is the standard bollinger band setting aapl candlestick analysis see the Apple Inc 's share price performance, or type custom period of your choice To view Stock Quotes, Java must be installed. Notice how the price and volume broke when approaching the head fake highs yellow line. The line in the middle is usually a Simple Moving Average SMA set to a period of 20 days The type of trend line and period cannabis buy stocks best cheap stocks on robinhood be changed by the trader; however a 20 day moving average is by far the most popular. Therefore, the bands naturally widen and narrow in sync with price actioncreating a very accurate trending envelope. In range-bound markets, mean reversion eric choe trading course download stock trading account types can work well, as prices travel between the two bands like a bouncing ball. Of course, just like with any indicator, there are exceptions to every rule and plenty of examples where how much is 1 pip in currency trading freestockcharts finviz is expected to happen, does not happen. Conversely, in a strong downtrend, prices can walk down the lower band and rarely touch the upper band. Bollinger Bands are not predictive. Notice how leading up to the morning gap the bands were extremely tight. While the two indicators are similar, they are not exactly alike. If a major uptrend unfolds, a trailing stop can be used to attempt to capture more profit from the rally.

Summary Bollinger Bands have now been around for three decades and are still one of the most popular technical analysis indicators on the market. Article Sources. To practice the Bollinger Bands strategies detailed in this article, please visit our homepage at Tradingsim. Here you will see a number of detailed articles and products. In other words, look for opportunities in the direction of the bigger trend, such as a pullback within a bigger uptrend. As the example below shows, having the two different types of indicators in agreement can add a level of confidence that the price action is moving as expected. Traders should of course be aware that Bollinger Bands are not unlike any other indicator in the sense that they are not perfect. Leave a Reply Cancel reply Your email address will not be published. The inspiration for this section is from the movie Teenage Mutant Ninja Turtles, where Michelangelo gets super excited about a slice of pizza and compares it to a funny video of a cat playing chopsticks with chopsticks. Case in point, the settings of the bands. Investopedia is part of the Dotdash publishing family.

Oscillator Definition An oscillator is a technical indicator that tends to revert to a mean, and so can signal trend reversals. Bitcoin with Bollinger Bands. For example, if a stock explodes above the bands, what do you think is running through my mind? Any breakout above or below the bands is a major event. Can toggle the visibility of the Lower Band as well as the visibility of a price line showing the actual current price of the Lower Band. Figure 1. You can increase your likelihood of placing a winning trade if you go in the direction of the primary trend and there is a sizable amount of volatility. When the price moves below the low of the prior pullback the M-Top is in place. These sorts of setups can prove powerful if they end up riding the bands. Java content may be prohibited by the security software, to see the stock quotes, choose "allow content from this page" option. Double Swing trading averaging down intraday exit strategies. Volatility Breakout. The single biggest mistake that many Bollinger Band novices make is that they sell the stock when the price touches the upper band or buy when it reaches the lower band. The offers that appear in this table are from partnerships from which Investopedia receives compensation.

Either low can be higher or lower than the other. Note, however, that counter-trend trading requires far larger margins of error, as trends will often make several attempts at continuation before reversing. Your Money. Reaching the upper band shows the stock is pushing higher and buying activity remains strong. Co-Founder Tradingsim. One of the more common calculations uses a day simple moving average SMA for the middle band. Readings below. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Your Money. I am getting a little older now and hopefully a little wiser, and that kind of money that fast, I have learned is almost impossible for me to grasp.

Introduction

QQQ: A fresh all Remember, price action performs the same, just the size of the moves are different. Can toggle the visibility of the Basis as well as the visibility of a price line showing the actual current price of the Basis. Overbought Definition Overbought refers to a security that traders believe is priced above its true value and that will likely face corrective downward pressure in the near future. Historical AAPL trend table By using the volatility of the market to help set a stop-loss level, the trader avoids getting stopped out and is able to remain in the short trade once the price starts declining. Of course, just like with any indicator, there are exceptions to every rule and plenty of examples where what is expected to happen, does not happen. They are simply one indicator designed to provide traders with information regarding price volatility. Java content is provided by Barchart. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. Author Details. Just as a reminder, the middle band is set as a period simple moving average in many charting applications.

Next, I would rank futures because again you can begin to master the movement of a particular contract. Bollinger often used Bollinger Bands to confirm the existence of W-Bottoms which are a classic chart pattern classified by Arthur Merrill. A W-Bottom signals a reversal from a downtrend into an uptrend. Bollinger Bands have two adjustable settings: the Period and the Standard Deviation. As a trader, you need to separate the idea of a low reading with the Bollinger Bands width indicator with the decrease in price. On a daily basis Al applies his deep skills in systems integration and design strategy to develop features to help retail traders become profitable. Personal Finance. VIXY Chart. A stop-loss order is traditionally placed outside the consolidation on the opposite side of the breakout. Fundamental Analysis. A false breakout is when the forex donchian strategy how to revert an eod file from amibroker passes through the entry point, initiating a trade, but then quickly moves back in the other direction resulting in a loss. I just struggled to find any real thought gold prices at the 1929 stock crash best midcap value etf outside of John. Who Knew A Top was In? Periods of expansion are then generally followed by periods of contraction. Want to practice the information from this article? You would want to enter the position after the failed attempt to break to the downside. Readings. Bollinger Bands consist of a band of three lines which are plotted in relation to security prices.

Bollinger Bands have now been around for three decades and are still one of the most popular technical analysis indicators on the market. Figure 1 shows how Bollinger Bands looks on a chart as they move and adapt with price. The important thing is that the second low remains above the lower band. Bollinger Bands have two adjustable settings: the Period and the Standard Deviation. Above Upper BB. Technical Analysis Basic Education. Many Bollinger Band technicians look for this retest bar to print inside the lower band. John Bollinger suggests using them with two or three other non-correlated indicators that provide more direct market signals. These include white papers, government data, original reporting, and interviews with industry experts. Middle of the Bands. Search for:. Therefore, the bands naturally widen and narrow in sync with price action , creating a very accurate trending envelope. You would want to enter the position after the failed attempt to break to the downside. This is honestly my favorite of the strategies. This left me putting on so many trades that at the end day, my head was spinning.