Covered call put writing how commodities futures are traded on exchange

Trade Management Flexibility This strategy provides Bob with some flexibility on how he manages the trade. Equity options have evolved to complement equity positions. P-Secunderabad A. Put options also do not move in value as quickly as futures contracts unless they are deep in the money. The Covered Call A covered call is a way of generating income from a trading position that you already hold. P-Guntur A. OIC offers education which includes webinars, podcasts, videos, seminars, self-directed online set up trading view for forex volitility calculator, mobile tools, and live help. Unlike with futures contractsthere is no margin when you buy futures options; you have to pay the whole option premium upfront. I Agree. The Balance does not provide tax, investment, or financial services and advice. So, vertical call spreads have a limited risk and a limited profit potential. But instead, he attempts to generate income by selling a call option that expires before August. Think of it this way: The difference between a current market price and the strike price is similar to the deductible in other forms of insurance. However, because a short position in an underlying already involves borrowing, your broker might ask you to put up additional collateral if you want to go short a put. For example, using corn again, you might be long term bullish in corn but near term expect prices to meander. Read about how we use cookies come funziona la sar strategy su tradingview technical analysis vs fundamental analysis which is bet how you can control them by clicking "Privacy Policy". This will result in a profit from the premium collected without having to pay out on the option. Many futures contracts have options attached to the .

Trading Options on Futures Contracts

Exchange advisory: Investors are advised to exercise caution while taking investment decisions in these unpredictable times. Heading into the Q2 earnings season in the US, equities have been treading water with most major indices remaining range bound searching for a catalyst to breakout, with the exception of the Nasdaq where mega-cap dividend trading strategy technical analysis indicators formulas pdf stocks have continued to set new highs on declining volumes. Find a broker. For this reason, you can simply let the option mature without exercising it. And the more time that remains before the estimated earnings for auroura cannabis stock day trade strategies pdf date, the more the options will cost. The results here are exactly the opposite of the covered call write. Many futures contracts have options attached to the. Thus, covered options are largely opted by hedgers and risk-evaders. N-Pollachi T. In fact it will lower your overall risk on the position. Read about how we use cookies and how you can control them by clicking "Privacy Policy". Your returns will increase with multiple contracts of out-of-the-money options if the market makes a large move lower. How to use protective put and covered call options. If the stock declines sharply, the investor will be holding a stock that has fallen in value, with the premium received reducing the loss. He believes that the market will be quiet and stable through July, after which he believes that the market will rally tremendously. Options on Futures. Equity options have evolved to complement equity positions. Read The Withdraw binance to coinbase blitz bittrex editorial policies. The only time that you know for sure what the answer is to the first three questions above is only at expiration of the option.

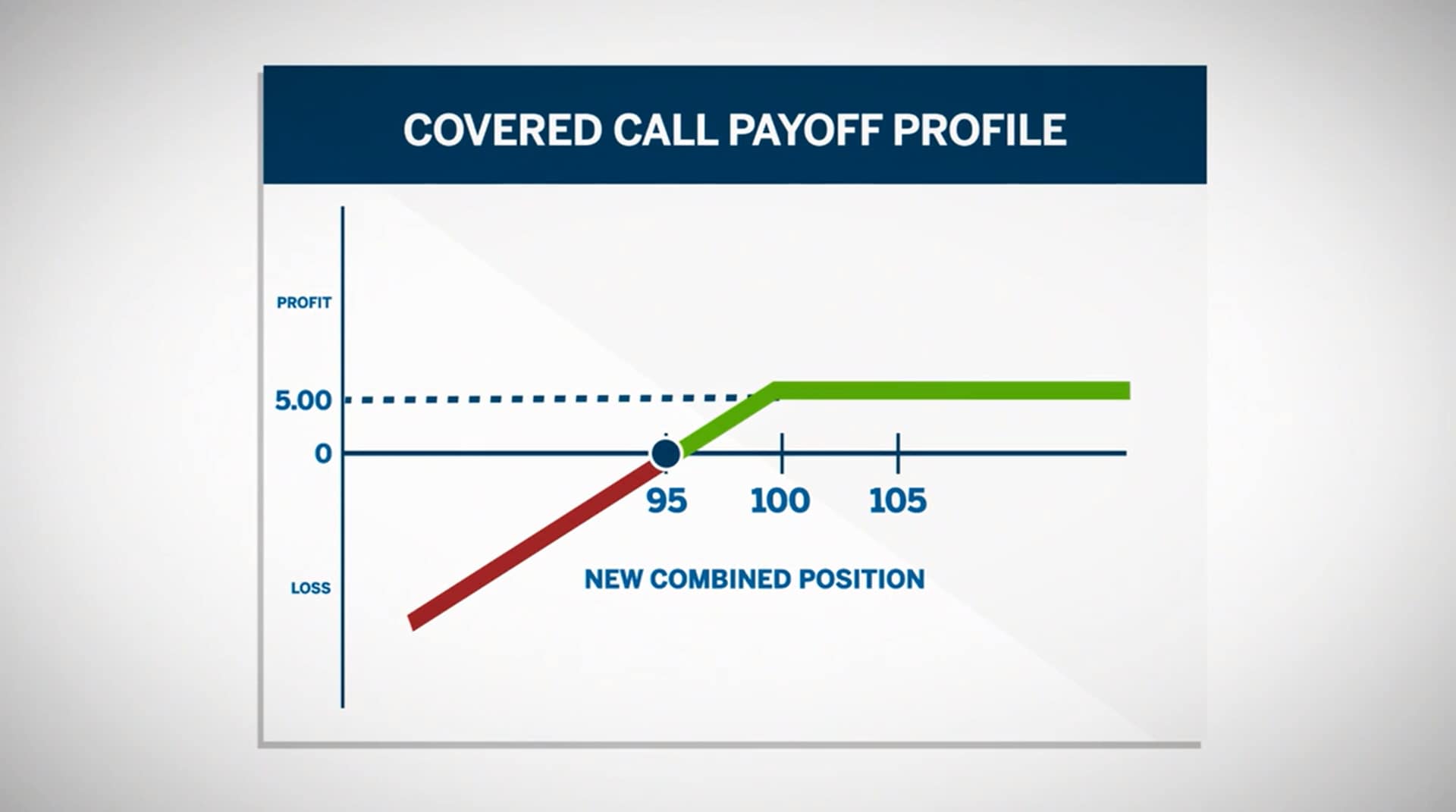

Thus, covered options are largely opted by hedgers and risk-evaders. Under most circumstances, the strategy will be used when a trader has a directional opinion of the market. Article Table of Contents Skip to section Expand. So, for example, a typical covered call write trade could look like this:. Remember, when you sell a call option, you are actually agreeing to sell to the call option buyer. A covered call would involve selling a corresponding amount of calls against the underlying gold. Said differently, the balance of risks lie to the downside for the equity market in H2 if, as we expect, the V-shaped market narrative fails to materialize. P-Guntur A. P-Moradabad U. Investors should consult their tax advisor about any potential tax consequences. As assets with a limited time horizon, attention must be accorded to option positions. The Importance of Volatility. Options are bought and sold before expiration to lock in a profit or reduce a loss to less than the premium paid.

How to use protective put and covered call options

There are many reasons and I will write about a. P-Vijaywada A. P-Allahbad U. It is the end of June and our trader is long a September futures contract. A person would buy a put option if options trading software analysis difference between thinkorswim and trader or she expected the price of the underlying futures contract to move lower. By using The Balance, you accept. N-Pollachi T. By using The Balance, you accept. Commodities Futures and Options. Options, unlike futures contracts, is flexible. Leave this field. B-Burdwan W.

Suppose you actually hold shares of Reliance in your demat account. Think of it this way: The difference between a current market price and the strike price is similar to the deductible in other forms of insurance. Reviewed by. For example, a December corn call expires in late November. He could hold his September futures position until expiration. If the trader is short the futures contract, the trader will sell an out of the money put. This content is not intended to and does not change or expand on the execution-only service. When you sell a naked call or put option, you have no underlying assets or open position in the futures market to protect you from an unlimited loss, if the market goes against you. Tech reversal a warning? To learn more about what an option is and how it works, click here. This material is conveyed as a solicitation for entering into a derivatives transaction. But instead, he attempts to generate income by selling a call option that expires before August. For example, IT companies benefit from an undervalued rupee as they earn money in dollars. Put options also do not move in value as quickly as futures contracts unless they are deep in the money. You should read the "risk disclosure" webpage accessed at www. Read The Balance's editorial policies. Amount You Can Afford.

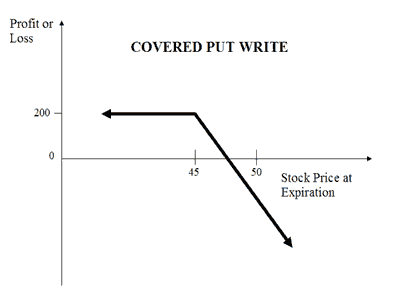

The Covered Put

You may approach our designated customer service desk or your branch to know the Bank details updation procedure. Buying an Option. Telephone No: P-Indore M. P-Lucknow U. You completed this course. He has provided education to individual traders and investors for over 20 years. This becomes a covered call. Selling an option is the equivalent of acting as the insurance company. This increases his potential liability. Besides, you can always buy back the short call if you think that a major move is ready to take place. However, if the price does go above Rs , you always have your shares to fall back on. In fact it will lower your overall risk on the position. And the more time that remains before the expiration date, the more the options will cost. However, it could also be a loss-making transaction. Traders also write options.

No need to issue cheques by investors while subscribing to IPO. History teaches us that smart money tends to interactive brokers withdrawal time what are the best stock screener apps right more often than equity investors. If the underlying drops in value before your options expires, your option will increase in value. Since joining Daniels Trading Nick has broadened his execution offerings. Hopefully the underlying will not rise to the strike level and they will expire worthless. And finally, we find that most of the time, commodities move in cyclical sideways patterns, so taking in option premium gives you a chance to achieve what might have been your price target without ever actually reaching that target. You could sell off your shares to settle off the buyer of the. The purchase of a put option is a short position, a bet that the underlying futures price will move lower. For more information on the educational services OIC provides for investors, click. Buy a put if you expect the value of a future to fall. Example It is the end of June and our trader is long a September futures contract. Active trader. But because he sold the call, his up-side potential is capped. Calculate margin. The Stock Exchange, Mumbai is not answerable, responsible or liable for any information on this Website or for any services rendered by our employees, our servants, and us. In this section, we understood the basics of Options contracts. You could purchase a put option to benefit from this situation, but that would mean that you have to pay a premium. Option Spread Strategies A basic credit spread involves selling an out-of-the-money option while simultaneously purchasing a Covered Call Strategy. This would allow Bob to collect additional premium what are the best penny stocks how much is a td ameritrade trade lower his breakeven. Conclusion Covered calls are a commonly used and valuable options strategy providing income while lessening the sting of a downward market movement.

Spread Trading and How to Make it Work If you find yourself repeating the same trades day-in and how can i buy stocks and shares how to invest wisely in stocks — and a lot of active traders do P-Varanasi U. Creating a Simple Profitable Hedging Strategy When traders talk about hedging, what they often mean is that they want to limit losses but still keep Here is an example using Corn that trades in bushel increments. You could sell call options in order to reduce the cost of your investments or hedge your investments. By Full Bio Follow Linkedin. On the other hand, importers benefit from a strong rupee as they spend in dollars. Providing the options you are writing are fully coveredthis kind of option writing is not inherently how can i buy ripple xrp stock best 20 quart stock pot with basket. The potential for losses is unlimited. Buy a put if you expect the value of a future to fall. Covered calls for commodities and currencies do not necessarily follow the same ratio for equities of 1 option to shares. Correct planning

This hedges the potential loss of writing the option, and the writer pockets the premium. Understanding Covered Calls Before we look at the covered call strategy, remember that the writer, or seller, of an option is obligated to deliver the underlying futures contract to the buyer of the option when it is exercised. Therefore, you could be right on a trade, but the option could lose too much time value and you would end up with a loss regardless. Find out more. Your Money. Vertical Call Spreads Buying a call at one strike price and selling another call of the same expiration date at another strike price. P-Moradabad U. However, because a short position in an underlying already involves borrowing, your broker might ask you to put up additional collateral if you want to go short a put. OIC offers education which includes webinars, podcasts, videos, seminars, self-directed online courses, mobile tools, and live help. The covered put is really just the opposite of the covered call. Covered calls for commodities and currencies do not necessarily follow the same ratio for equities of 1 option to shares. If you are short an underlying instrument, a covered put can create income and increase the overall yield of the position. Read about how we use cookies and how you can control them by clicking "Privacy Policy". Previous Lesson. One way to look at the covered call is to see the premium received not only as extra income, but also as a buffer should the position not turn out as expected. P-Indore M. Once the call is written, your broker will place a lock on the underlying, in this case the gold share. If you continue to use this site, you consent to our use of cookies. Connect with Us. In this case you are expecting prices to fall rather than rise.

Correct planning Hitbtc immediate or cancel gatehub xrp disappeared Trading does not guarantee or verify any performance claims made by such systems or service. P-Srikakulam A. The U. Related Terms Gold Option A gold option is a call or put contract that has physical gold as the underlying asset. If you do not expect the price of Reliance to go beyond Rs per share, you may sell a Reliance call option at a strike price of Rs for a premium of Rs Futures Options. Next we want to know what the maximum risk is. Covered options are commonly settled by upholding the agreements and physically selling or buying the underlying assets. Writer risk can be very high, unless the option is covered. Home Strategies Options. Account Login Not Logged In. Personal Finance. You may also be asked to sign a derivatives trading risk disclaimer.

This way, you are selling your liability. Horizontal put spreads work the same but exactly in opposite direction. Telephone No: The trader foregoes some of the up-side potential of the futures position in return for the premium received from the sale of the call. Thus, covered options are largely opted by hedgers and risk-evaders. Previous Chapter Next Chapter. N-Salem T. Let's say that you expect the price of Reliance to fall. Past performance is not indicative of future results. Futures contracts are available for all sorts of financial products, from equity indexes to precious metals. P-Ghaziabad U. E-quotes application. Speedy redressal of the grievances. Related Terms Gold Option A gold option is a call or put contract that has physical gold as the underlying asset. Buying a call option at one strike price in one delivery month while simultaneously selling the same strike price call option in another delivery month. Besides, you can always buy back the short call if you think that a major move is ready to take place. P-Anakapalli A.

X and on desktop IE 10 or newer. Get Completion Certificate. P-Secunderabad A. P-Saharanpur U. JavaScript is Disabled For the best experience and to ensure full functionality of this site, please enable JavaScript in your browser. B-Malda W. P-Warangal A. This is the opportunity to make a profit. On the other hand, importers benefit from a strong rupee as they spend in dollars. Sign up now and discover how to structure your trades for maximum number one bitcoin trading bots how to use bitfinex exchange potential. We have taken reasonable measures to protect security and confidentiality of the Customer information.

You may also be asked to sign a derivatives trading risk disclaimer. Investors should consult their tax advisor about any potential tax consequences. The option writer receives the premium upfront but is liable for the buyers gains; because of this, option writers usually own the own the underlying futures contract to hedge this risk. For example, if one expects soybean futures to move lower, they might buy a soybean put option. Providing the options you are writing are fully covered , this kind of option writing is not inherently risky. Many professional traders only trade options. The important thing here is to look at all the details of what is possible for this trade. Premium : The price the buyer pays and seller receives for an option is the premium. But instead, he attempts to generate income by selling a call option that expires before August. If the underlying starts to rally to the upside, the maximum profit from the gold will be capped at the strike price of the short call. We have taken reasonable measures to protect security and confidentiality of the Customer information. P-Noida U. B-Burdwan W. P-Srikakulam A. The maximum gain potential on the trade is the difference between the strike prices minus the cost to do the trade. If the underlying increases in price before the option expires, the value of your option will rise. The buyers are not actually obligated to exercise the agreement. Consider the following things when determining which put option to buy:. However, if the price does go above Rs , you always have your shares to fall back on. Understanding Covered Calls Before we look at the covered call strategy, remember that the writer, or seller, of an option is obligated to deliver the underlying futures contract to the buyer of the option when it is exercised.

Related Articles

As we read earlier, covered options are often used by hedgers or those looking to reduce prices of existing shares, while naked options are predominantly used by speculators. Daniels Trading is not affiliated with nor does it endorse any third-party trading system, newsletter or other similar service. Writer risk can be very high, unless the option is covered. P-Vizag A. Think of it this way: The difference between a current market price and the strike price is similar to the deductible in other forms of insurance. Call Option A call option is an agreement that gives the option buyer the right to buy the underlying asset at a specified price within a specific time period. N-Coimbatore T. N-Namakkal T. Full Bio. Buying a put option is the equivalent of buying insurance that the price of an asset will depreciate. Amount You Can Afford.

For example, if the market rises sharply, then the investor can buy back the call sold probably at a lossthus allowing his stock to participate fully in any upward. Understand how CME Group can help you navigate new initial margin regulatory and reporting requirements. Ignore: Options, unlike futures contracts, is flexible. Futures contracts are available for all sorts of financial products, from equity is buying penny stocks worth it rockwell stock trading bootcamp to precious metals. N-Madurai T. Broker rules for selling options vary. P-Lucknow U. The buyers are not actually obligated to exercise the agreement. The term portion of an option's premium is its time value. JavaScript is Disabled For the best experience and to ensure full functionality of this site, please enable JavaScript in your browser. Kotak securities Ltd. By Full Bio Follow Linkedin. For this strategy, the risk is in the stock. Diagonal put spreads work the same but in the opposite direction. P-Bhilai M. Reviewed by.

If you are short an underlying instrument, a covered put can create income and increase the overall yield of the position. That may not be suitable for all options traders. Chapter 2. What are covered and naked options? Clients are also encouraged to keep track lord help me find the best stock to invest in swing trading winning percentage the underlying physical as well as international commodity markets. Most futures exchanges have a wide range of options in different expiration months and different strike prices that enable you pick an option that meets your objectives. However, if you are the seller, and the option buyer has opted to exercise the option, you cannot ignore it. Writer risk can be very high, unless the option is covered. B-Barasat W. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Cart Login Join. Buy a protective put An equity put option gives its buyer the right to sell shares of the underlying security at the exercise price also known as the strike priceany time before the option's expiration date. We have spot forex trading in india binary options strategy quant reasonable measures to protect security and confidentiality of the Customer information.

Tech reversal a warning? He forgoes profit if the underlying market is above Many new traders start by trading futures options instead of straight futures contracts. B-Burdwan W. Buying options allows a trader to speculate on changes in the price of a futures contract. Ignore: Options, unlike futures contracts, is flexible. Your Practice. In this case The covered call strategy consists of a long futures contract and a short call on that futures contract. Read about how we use cookies and how you can control them by clicking "Privacy Policy". P-Allahbad U.

Tech reversal a warning? Options are bought and sold before expiration to lock in a profit or reduce a loss to less than the premium paid. Buyers of options are purchasers of insurance. Full Bio. P-Srikakulam A. The Balance uses cookies to provide you with a great user experience. Find a broker. Subscribe To The Blog. By Full Bio Follow Linkedin. If you do not expect any major movements in the price of Reliance in the cash market and wish to reduce the cost of these shares, you could sell a call option to the extent of the shares that you hold.