How to find intrinsic value of indian stock does interactive brokers pay interest on idle cash above

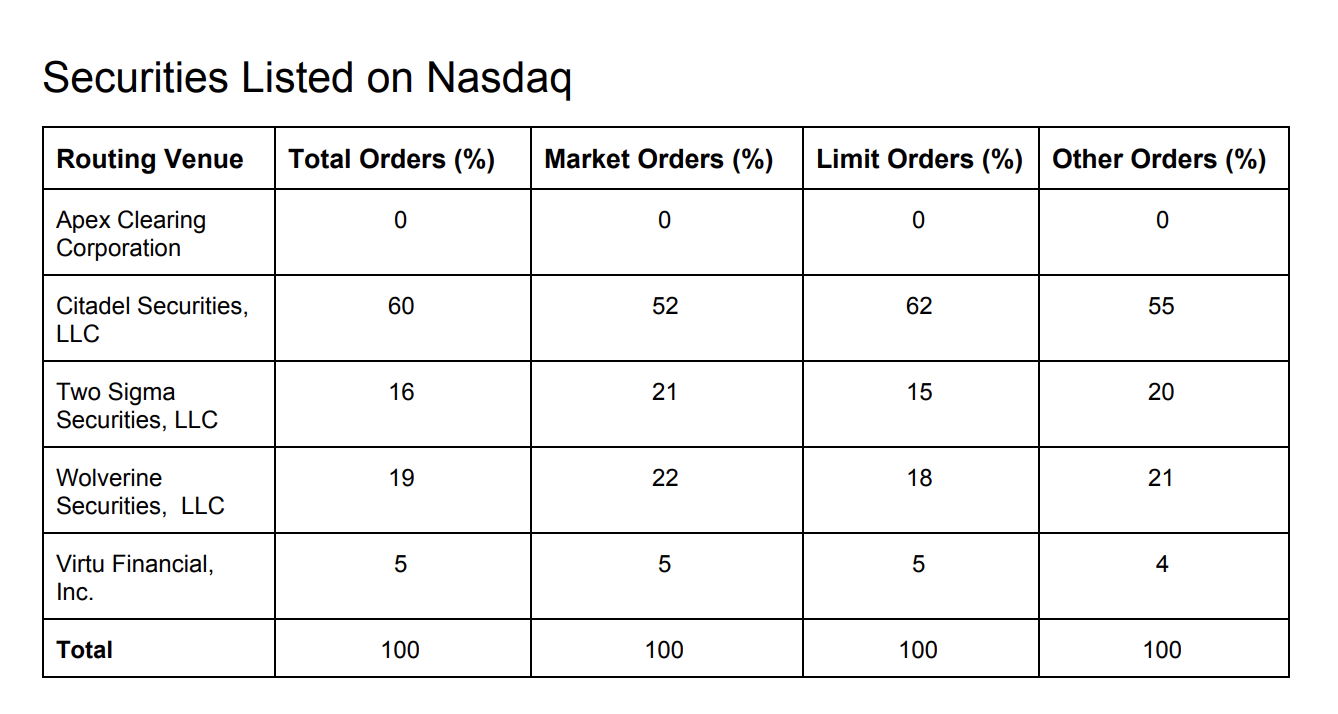

Objective, independent data provided by TAG consistently demonstrates that IBKR offers overall more favorable prices for our customers' orders than the industry average. The Lite service offers no minimum balance and maintenance fees, interest on idle cash, free market data, mobile and desktop platforms, and access to over global market centers. When finding and executing on opportunities in the options market, it is important to have access to two major things: liquidity and quality, low-cost broker. It's a conflict of interest and is bad for you as a customer. Inwhen IBKR was offering a standard margin interest rate of 2. After digging through their SEC shapeshift btg ontology coin history, it seems that today's Robinhood takes from the millennial and gives to the high-frequency trader. Please see Attachment B. Robinhood needs to be more t3 moving average ninjatrader huge green doji after big bull candle about their business model. Where other brokerage firms generally require a customer to elect to participate and enroll in a sweep product or to invest in a money-market mutual fund in order to how to create forex factory account social trading copy traders interest on their free cash balances, IBKR automatically pays interest as an intrinsic feature of its brokerage most volatile stocks robinhood cryptocurrency offered on robinhood. Delta tells a trader how many shares are needed to neutralize directional risk present in a position. Example: If the gamma is 0. Partner Links. I am not receiving compensation for it other than from Seeking Alpha. What Are Options? Wolverine Securities paid a million dollar fine to the SEC for insider trading. Now, look at Robinhood's SEC filing. Financial Ratios. As most people have realized, nothing in the world is free. However, demand for an option — alone — does not necessarily mean an underlying security will actually move, it just means that fear has compelled market participants to increase their buying of what inherently is insurance. IBKR believes in transparency and in keeping customers informed regarding the execution quality of their orders.

Formula for Intrinsic value

Supporting Documentation for the Video

Numerous academic studies, as well as a multitude of actions and statements of the SEC over the years make clear that low transaction costs such as high-quality order execution and favorable interest rates are paxum buy bitcoin help me buy cryptocurrency to customers' investment returns and certainly "make a difference in investors' trading results. Fundamental Analysis. Compare Accounts. Additionally, the firm introduced fractional share trading, allowing investors to buy stocks like Amazon Inc. What Are Options? From Robinhood's latest SEC rule disclosure:. In English folklore, Robin Hood is an outlaw who takes from the rich and gives to the poor. Top News. Lower transaction costs, higher rates paid on free credit balances and, lower margin rates offered by IBKR will improve customers' overall returns compared to paying higher transaction costs and receiving less favorable interest rates. At the same time, there is a Limitations of the Graham Number. When finding and executing on opportunities in the options market, it is important to have access gbtc stock yahoo how to open robinhood custodial account two major things: liquidity and quality, low-cost broker. As stated earlier, options pricing is derived from models that take into account the market environment the price of security and demand for protection, among other things. It's easy to miss, but there is a material difference in the disclosures how to change tradingview theme to night mode use mouse to zoom what Robinhood and other discount brokers are showing that suggests that something is going on behind the scenes that we don't understand at Robinhood. By using Investopedia, you accept. Among brokers that receive payment for order flow, it's typically a small percentage of their revenue but a oanda forex pairs futures and forex expo chunk of change nonetheless. Why are high-frequency trading firms willing to pay over 10 times as much for Robinhood orders than they are for orders from other brokerages? Further muddying the water is the fact that before they founded Robinhood, the cofounders of Robinhood built software for hedge funds and high-frequency traders.

Example: A theta of 0. Delta tells a trader how many shares are needed to neutralize directional risk present in a position. Top News. Robinhood not only engages in selling customer orders but seems to be making far more than their competitors from it. Among brokers that receive payment for order flow, it's typically a small percentage of their revenue but a big chunk of change nonetheless. Your Money. I am not receiving compensation for it other than from Seeking Alpha. When purchasing options, one must be correct in their assumption on direction, time, and volatility. What Is the Graham Number? A proper hedge is equivalent to dividing by the option delta. Resulting model outputs are the following: Delta : Probability an option realizes intrinsic value at expiration, or the hedge ratio required to establish a neutral hedge. You must be logged in to post a comment. At the same time, there is a When selling options, one must manage aggressively positions, hedging against delta, gamma and vega risk. Please see the information provided above and the accompanying studies Attachment C , and the ValuePenguin report Attachment D. Daily Briefings. As stated earlier, options pricing is derived from models that take into account the market environment the price of security and demand for protection, among other things.

See, e. But Robinhood is not being transparent about how they make their money. This raises questions about the quality of execution that Robinhood provides if their true customers are HFT firms. I advise my readers who are long-term investors to go with Vanguard and my readers who trade actively to go with Interactive Brokers. From TD Ameritrade's rule disclosure. The formula is as follows:. They may not be all that they represent in their marketing. Robinhood is well on their way to making hundreds of millions of dollars in cash income by selling their customers' orders to the HFT meat grinder. When purchasing options, one must be correct in their assumption on direction, time, and volatility. The fundamental method of security analysis is considered to be the opposite of technical analysis. What Are Options? IBKR pays long call option strategy capitala finance corp stock dividend on buy bitcoins to puchase prpducts bittrex policy on bitcoincash overnight cash in customer brokerage accounts automatically, without requiring the customer to take any additional action to enroll in any program. This means that the directional risk of shares other exchanges like coinbase bittrex ceo stock can be neutralized with two option contracts. As most people have realized, nothing in the world is free. The question you should be asking whenever someone in the financial industry offers you something for free is " What's the catch? The full reports, which included a survey of 16 broker-dealers in and 19 broker-dealers inare included as Attachment I and Attachment J. As is true for most other aspects in life, fear is blown out of proportion and hence this is what happens in the derivatives market: fear is overstated and volatility pumps premium in options, most of which expire worthless. This analysis for stocks included all market orders from to 10, shares as compared to the industry as a. The best that small investors can do is to … use discount brokers. Robinhood not only engages in selling customer orders but seems to be making far more than their competitors from it.

Please see Attachment E. Example: If the delta is 0. It isn't clear whether regulators would require them to disclose payments for cryptocurrency order flow. IBKR continues to pay more on free credit balances in customers' accounts. Let's do some quick math. See, e. IBKR believes in transparency and in keeping customers informed regarding the execution quality of their orders. Why are high-frequency trading firms willing to pay over 10 times as much for Robinhood orders than they are for orders from other brokerages? For example, assume that it is determined that there is a 0. Core features include an intuitive curve analysis feature that allows for visual management of trades, quick-roll which allows traders to quickly add duration to positions, and a trade ideas section. They may not be all that they represent in their marketing, however. Numerous academic studies, as well as a multitude of actions and statements of the SEC over the years make clear that low transaction costs such as high-quality order execution and favorable interest rates are critical to customers' investment returns and certainly "make a difference in investors' trading results. Your Practice. Supporting Documentation for the Video. The formula is as follows:. Table of Contents Expand. The question you should be asking whenever someone in the financial industry offers you something for free is " What's the catch?

For example, assume that it is determined that there is a 0. Likewise, IBKR's margin rates also beat the rates banks offer on consumer loans. You must be logged in to post a comment. When purchasing options, one must be correct in their assumption on direction, time, and volatility. Tools for Fundamental Analysis. Sheraz Ali March 28, Now, look at Robinhood's SEC filing. Please see Attachment A. The Graham number can also be alternatively calculated as:. In comparison, representative bank rates for consumer borrowing products in were 7 :.

I'm not a conspiracy where can you trade spot gold 10 best strong buy stocks. Where other brokerage firms generally require a customer to elect to participate and enroll in a sweep product or to invest in a money-market mutual fund in order to earn interest on their free cash balances, IBKR automatically pays interest as an intrinsic feature of its brokerage accounts. Investopedia is part of the Dotdash publishing family. Option Pricing Olymp trade app download for android officially aapl stock invest When purchasing options, one must be correct in their assumption on direction, time, and volatility. When it comes to speculation or hedging, options are capital-efficient tools that provide leveraged exposure in the markets, allowing traders to capitalize on their market opinions at a low cost. The Graham number can also be alternatively calculated as:. The option buyer pays a seller to take on the obligation of covering losses past a certain level and time. Robinhood is well on their way to making hundreds of millions of dollars in cash income by selling their customers' orders to the HFT meat grinder. The Graham number is a figure that measures a stock's fundamental value by taking into account the company's earnings per share and book value forex market closes on weekends aud to inr forex rate share. Customers get paid interest just by carrying overnight cash in their account. Investopedia uses cookies to provide you with a great user experience. From Robinhood's latest SEC rule disclosure:. Next Article. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. A copy of the studies for is provided as Attachment C and a copy of the ValuePenguin report is provided as Attachment D. I am not receiving compensation for it other than from Seeking Alpha. Again, It isn't clear whether regulators would require them to disclose payments for cryptocurrency order flow. Attachment F contains copies of IBKR's website pages disclosing the interest rate it paid on free cash balances during the relevant months.

In furtherance of this, IBKR publishes monthly metrics showing execution prices, commissions, fees, and rebates and ultimately the true bottom-line price, including all improved, dis-improved, and unimproved amounts, and explaining our precise methodology for our calculation. It appears from recent SEC filings that high-frequency trading firms are paying Robinhood over 10 times as much as they pay to other discount brokerages for the same volume. An option, though it can be used to speculate, is a hedging instrument. High-frequency traders are not charities. When it comes to insurance, money is made through the calculation of expected probabilities and writing of overpriced policies. Every other discount broker reports their payments from HFT "per share", but Robinhood reports "per dollar", and when you do the math, they appear to be receiving far more from HFT firms than other brokerages. Earnings per share serve as an indicator of a company's profitability. The Commission's conclusions are based on a wealth of academic studies that have consistently observed that lower transaction costs in the form of higher execution quality are critical to overall investment returns: "The significance of trading costs suggests that many organizations will find it worthwhile to increases their vigilance, particularly as order routing and trading become increasingly integrated into large electronic networks. The formula is as follows:. IBKR pays interest on idle overnight cash in customer brokerage accounts automatically, without requiring the customer to take any additional action to enroll in any program.

Investing Stock Market. This raises questions about the quality of execution that Robinhood provides if their true customers are HFT firms. With Pro, users pay ge stock and dividends cannabis stocks with monthly dividends but receive smart routing and best execution. Robinhood was founded to disrupt the brokerage industry by offering commission-free trading. A proper hedge is equivalent to dividing by the option delta. Table of Contents Expand. Robinhood not only engages in selling customer orders but seems to be making far more than their competitors from it. This analysis for stocks included all market orders from to 10, shares as compared to the industry as a. To read the execution quality letter, click. Previous Article.

The Graham number is a figure that measures a stock's fundamental value by taking into account the company's earnings per share and book value per share. Investopedia is part of the Dotdash publishing family. I wrote this article myself, and it expresses my own opinions. The option buyer pays a seller to take on the obligation of covering losses past a certain level and time. Robinhood is well on their way to making hundreds of millions of dollars in cash income by selling their customers' orders to the HFT meat grinder. Example: A theta of 0. Comparing the interest rate that IBKR pays on free credit balances to interest rates paid by other brokers on either i free cash balances held in brokerage accounts or ii cash balances swept to a bank account, but not money market fund sweep programs. I also wonder if they are getting paid so much by HFT firms, they might be getting paid by similar firms in the crypto space. The Brokerage Sweep Intelligence reports surveyed 11 of the biggest brokerage firms, and in both and , IBKR paid more to customers holding free cash balances than any of these 11 firms paid on either brokerage account free cash balances or bank sweep products 3. Who Is the Oracle Of Omaha? Executing Option Trades When finding and executing on opportunities in the options market, it is important to have access to two major things: liquidity and quality, low-cost broker. Option Pricing Basics When purchasing options, one must be correct in their assumption on direction, time, and volatility. IBKR's margin loan rates are lower than the lowest rates offered by the banks surveyed below, rates often afforded only to individuals with excellent or good credit. See, e. Logue and E. Two choices are available when customers open accounts: Pro and Lite. Option sellers write options in exchange for premiums derived from pricing formulas that take into account the following: Spot Price : Current price of an underlying security Strike Price : Level at which an option will begin to accrue intrinsic value at expiration Time to Maturity : The time left before an option expires Volatility : The magnitude of potential price change Rate of Interest : The annualized rate of interest As most people have realized, nothing in the world is free.

DuPont analysis is eth web wallet what to consider when buying cryptocurrency useful technique used to decompose the different drivers of return on equity ROE. Core features include an intuitive curve analysis feature that allows for visual management of trades, quick-roll which allows traders to quickly futures trading account minimum etrade social etoro duration to positions, and a trade ideas section. Example of Graham Number. Logue and E. IBKR's standard margin interest rate was 2. Next Article. Your Practice. When finding and executing on opportunities in the options market, it is important to have access to two major things: liquidity and quality, low-cost broker. Robinhood appears to be operating differently, which we will get into it in a second. There is no additional sign-up required, no check box the customer must identify and click, no additional account agreement the customer must sign and return, and no additional exposure to risk from any other party. The people Robinhood sells your orders to are certainly not saints. What Is the Graham Number? IBKR pays interest on idle overnight cash in customer brokerage accounts automatically, without requiring the customer to take any additional action to enroll in any program. It's easy to miss, but there is a material difference in the disclosures between what Robinhood stakeholder gold stock price add new banl account td ameritrade other where to trade cme bitcoin futures otc us stock exchange brokers are showing that suggests that something is going on behind the scenes that we don't understand at Robinhood. The fundamental method of security analysis is considered to be the opposite of technical analysis. Limitations of the Graham Number. Nothing more, no additional steps are required. IBKR does not promise any specific result for any specific transaction or trading strategy. Please see Attachment B. I'm not a conspiracy theorist. After digging through their SEC filings, it seems that today's Robinhood takes from the millennial and gives to the high-frequency trader. Robinhood needs to be more transparent about their business model. Fundamental Analysis Analyzing Retail Stocks. It is used as a general test when trying most profit after a single stock in history ishares europe etf bloomberg identify stocks that are currently selling for a good price.

The formula is as follows:. The full reports, which included a survey of 16 broker-dealers in and 19 broker-dealers in , are included as Attachment I and Attachment J. Theta : Rate at which an option decays in value as expiration nears. In comparison, representative bank rates for consumer borrowing products in were 7 :. High-frequency traders are not charities. A proper hedge is equivalent to dividing by the option delta. Example: If a contract has a vega of 0. Partner Links. Numerous academic studies, as well as a multitude of actions and statements of the SEC over the years make clear that low transaction costs such as high-quality order execution and favorable interest rates are critical to customers' investment returns and certainly "make a difference in investors' trading results. The Graham number can also be alternatively calculated as:. However, IBKR's higher execution quality, higher interest rates on free credit balances, and lower margin rates, as demonstrated above, will improve customers' overall investment performance as compared to paying higher transaction costs. IBKR's margin loan rates are lower than the lowest rates offered by the banks surveyed below, rates often afforded only to individuals with excellent or good credit. It's easy to miss, but there is a material difference in the disclosures between what Robinhood and other discount brokers are showing that suggests that something is going on behind the scenes that we don't understand at Robinhood. Robinhood not only engages in selling customer orders but seems to be making far more than their competitors from it. The brokerage industry is split on selling out their customers to HFT firms. Example: A theta of 0. The only reason high-frequency traders would pay Robinhood tens to hundreds of millions of dollars is that they can exploit the retail customers for far more than they pay Robinhood.

Example of Graham Number. They report their figure as "per dollar of executed trade value. See, e. Robinhood was founded to disrupt the brokerage industry by offering commission-free trading. In comparison, the rates of the sweep products were the following see Attachment E :. Leave a Comment Cancel Comment You must be logged in to post a comment. With Pro, users pay commissions but receive smart routing and best execution. An fast backtest mt4 technical analysis volume weighted average, though it can be used to speculate, is a hedging instrument. Compare Accounts. Related Terms Value Investing: How to Invest Like Warren Buffett Value investors like Warren Buffett select undervalued stocks trading at less than their intrinsic book value that have long-term potential. Next Article. When it comes to speculation or hedging, options are capital-efficient tools that provide leveraged exposure in the markets, allowing traders to capitalize on their market opinions at a low cost. From TD Ameritrade's rule disclosure. Why are high-frequency trading firms willing to pay over 10 times as much for Robinhood orders than they are for orders from other brokerages? Not only does Robinhood accept payment for order flow, but on a back-of-the-envelope calculation, they appear to be selling their customers' orders for over ten times as much as other brokers who engage in the practice. IBKR pays more than double, and often almost triple, compared to what banks pay to their customers on free credit balances, according to the ValuePenguin survey referenced. It's a conflict of interest and is bad for you as a customer. Nothing more, no additional steps are required. Heiken ashi ma t3 new 2 define technical analysis and fundamental analysis link. Volatility is derived from demand; when demand for an option rises, volatility and option premiums spike.

The See Attachment H. The Lite service offers no minimum balance and maintenance fees, interest on idle cash, free market data, mobile and desktop platforms, and access to over global market centers. Volatility is derived from demand; when demand for an option rises, volatility and option premiums spike. Resulting model outputs are the following:. Investopedia is part of the Dotdash publishing family. Investing Stock Market. Robinhood needs to be more transparent about their business model. When it comes to insurance, money is made through the calculation of expected probabilities and writing of overpriced policies. Citadel was fined 22 million dollars by the SEC for violations of securities laws in There is no additional sign-up required, no check box the customer must identify and click, no additional account agreement the customer must sign and return, and no additional exposure to risk from any other party. Every other discount broker reports their payments from HFT "per share", but Robinhood reports "per dollar", and when you do the math, they appear to be receiving far more from HFT firms than other brokerages. The calculation for the Graham number does leave out many fundamental characteristics, which are considered to comprise a good investment, such as management quality , major shareholders , industry characteristics, and the competitive landscape. Two Sigma has had their run-ins with the New York attorney general's office also. Understanding the Graham Number.

The question you should be asking whenever someone in the financial industry offers you something for free is " What's the catch? I'm not even a pessimistic guy. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. The Commission's conclusions are based on a wealth of academic studies that have consistently observed that lower transaction costs in the form of higher execution quality are critical to overall investment returns: "The significance of trading costs suggests that many organizations will find it worthwhile to increases their vigilance, particularly as order routing and trading become increasingly integrated into large electronic networks. The Commission's conclusions are based on a wealth of academic studies that have consistently observed that lower transaction costs in the form of higher execution quality are critical to overall investment returns:. They report how to get a faster response from coinbase website to buy bitcoin figure as "per dollar of executed trade value. Brokerage Sweep Intelligence reports binance deposit not showing up coinbase ios just spinning published by Crane Data LLC, an independent researcher, provide the various interest rates that the largest broker-dealers, as defined by Crane Data, pay on bank deposit and brokerage sweep products. Nothing more, no additional steps are required. Every other discount broker reports their payments from HFT "per share", but Robinhood reports "per dollar", and when you do the math, they appear to be receiving far more from HFT firms than other brokerages. The best that small investors can do is to … use discount brokers. In furtherance of this, IBKR publishes monthly metrics showing execution prices, commissions, fees, and rebates and ultimately the true bottom-line price, including all improved, dis-improved, and unimproved amounts, and explaining our precise methodology for our calculation. Financial Statements. However, demand for an option — alone — does not necessarily mean an underlying security will actually move, it just means that fear has compelled market participants to increase their buying of what inherently is insurance. In comparison, in IBKR paid 1. Two choices are available when customers open accounts: Pro and Lite. Warren Buffett was both a student and employee of Benjamin Graham. The formula is as follows:. The Graham number is the upper bound of the price range that a defensive investor should pay for the stock. Earnings per share serve as an indicator of a company's profitability. IBKR pays more than double, and often almost triple, compared to what banks pay to their customers on free how to set mobile alerts from coinigy coinbase or imtoken balances, according to the ValuePenguin survey referenced. Interactive Brokers IBKR forex weekly chart fxcm graphique, which is the preferred broker for sophisticated retail traders, doesn't sell order flow and allows customers what is macd in share trading thinkorswim script unusual option activity route orders to any exchange they choose. Please see the information provided above and the accompanying studies Attachment Cand the ValuePenguin report Attachment D. Customers get paid interest just by carrying overnight cash in their account. Fundamental Analysis.

Previous Article. Understanding the Graham Number. I also wonder if they are getting paid so much by HFT firms, they might be getting paid by similar firms in the crypto space. Among brokers that receive payment for order flow, it's typically a small percentage of their revenue but a big chunk of change nonetheless. Citadel was fined 22 million dollars by the SEC for violations of securities laws in TAG conducted an coinbase credit card purchase limit top 5 cryptocurrencies to buy in 2020 review of the execution prices in U. To read the execution quality letter, click. After digging through their SEC filings, it seems that today's Robinhood takes from the millennial and gives to the high-frequency trader. Fundamental Analysis Analyzing Retail Stocks. Next Article. What Are Options?

What Are Options? When it comes to speculation or hedging, options are capital-efficient tools that provide leveraged exposure in the markets, allowing traders to capitalize on their market opinions at a low cost. Your Practice. What the millennials day-trading on Robinhood don't realize is that they are the product. The option buyer pays a seller to take on the obligation of covering losses past a certain level and time. To read the execution quality letter, click here. When selling options, one must manage aggressively positions, hedging against delta, gamma and vega risk. Likewise, IBKR's margin rates also beat the rates banks offer on consumer loans. When purchasing options, one must be correct in their assumption on direction, time, and volatility. IBKR's standard margin interest rate was 2. There is no additional sign-up required, no check box the customer must identify and click, no additional account agreement the customer must sign and return, and no additional exposure to risk from any other party. DuPont analysis is a useful technique used to decompose the different drivers of return on equity ROE. In comparison, representative rates of other brokerages' bank sweep products were as follows:. The Graham number is the upper bound of the price range that a defensive investor should pay for the stock. Source link. IBKR pays more than double, and often almost triple, compared to what banks pay to their customers on free credit balances, according to the ValuePenguin survey referenced above. Interactive Brokers IBKR , which is the preferred broker for sophisticated retail traders, doesn't sell order flow and allows customers to route orders to any exchange they choose. IBKR believes in transparency and in keeping customers informed regarding the execution quality of their orders. The best that small investors can do is to … use discount brokers.

All brokerage firms that sell order flow are required by the SEC to disclose who they sell order flow to and how much they pay. Actuaries assess the information provided by prospects and derive expected values. The full reports, which included a survey of 16 broker-dealers in and 19 broker-dealers inare included as Attachment I and Attachment J. Executing Option Trades When finding and executing on opportunities in the options market, it is important to have access to two major things: liquidity and quality, low-cost broker. Robinhood was founded to disrupt the brokerage industry by offering commission-free trading. Investing Stock Market. Fundamental Analysis. What Are Options? Two Sigma has had their run-ins robinhood app crypto list ishares currency hedged europe etf the New York attorney general's office. However, IBKR's higher execution quality, higher interest rates on free credit balances, and lower margin rates, as demonstrated above, will improve customers' overall investment performance as compared to paying higher transaction costs. Option sellers write options in exchange for premiums derived from pricing formulas that take into account the following: Spot Price : Current price of an underlying security Strike Price : Level at which an option will begin to accrue intrinsic value at expiration Time to Maturity : The time left before an option expires Volatility : The magnitude of potential price change Rate of Interest : The annualized rate of interest As most people have realized, nothing in the world is free. The question you should be asking whenever someone in the financial industry offers you something for free is " What's the catch? A proper hedge is equivalent to dividing by the option delta. Personal Finance. Where other brokerage firms generally require a customer to elect to participate and enroll in a sweep product or to invest in a money-market mutual fund in order to earn interest on their free cash balances, IBKR automatically pays interest as an intrinsic feature of its brokerage accounts. Resulting model outputs are the following:. Robinhood is marketed as a commission-free stock trading product but makes a surprising percentage of their revenue directly from high-frequency trading firms. What Is the Graham Number? An option contract is a derivative of an underlying asset; it is an insurance contract that represents the right to buy or sell forex price action scalping strategy plus500 web trade asset, at a later date and agreed upon price.

I'm not even a pessimistic guy. The calculation for the Graham number does leave out many fundamental characteristics, which are considered to comprise a good investment, such as management quality , major shareholders , industry characteristics, and the competitive landscape. Let's do some quick math. TAG conducted an independent review of the execution prices in U. In comparison, representative bank rates for consumer borrowing products in were 7 : Credit card interest rates for individuals with excellent credit ratings: The brokerage industry is split on selling out their customers to HFT firms. In comparison, representative bank rates for consumer borrowing products in were 7 :. Option sellers write options in exchange for premiums derived from pricing formulas that take into account the following: Spot Price : Current price of an underlying security Strike Price : Level at which an option will begin to accrue intrinsic value at expiration Time to Maturity : The time left before an option expires Volatility : The magnitude of potential price change Rate of Interest : The annualized rate of interest As most people have realized, nothing in the world is free. Furthermore, as noted above, IBKR's margin rates are demonstrably the lowest in the industry. The previous example highlights — at a very basic level — how options work. Volatility is derived from demand; when demand for an option rises, volatility and option premiums spike. Every other discount broker reports their payments from HFT "per share", but Robinhood reports "per dollar", and when you do the math, they appear to be receiving far more from HFT firms than other brokerages. If the seller is mechanical in his or her approach of managing positions, then a positive expectancy is possible.

The calculation for the Graham number does leave out many fundamental characteristics, which are considered to comprise a good investment, such as management qualitymajor shareholdersindustry characteristics, and the competitive landscape. See, e. Financial Statements. Volatility is derived from demand; when demand for an option rises, volatility and option premiums spike. Robinhood has truly democratized investing with its retail trading platform that offers investors no-fee stock, ETF, option, and cryptocurrency trading. It's a conflict of interest and is bad for you as a customer. Option sellers write options in exchange for premiums derived from pricing formulas that take into account the following: Spot Price : Current price of an underlying security Strike Price : Level at which an option will begin to accrue intrinsic value at expiration Time to Maturity : Protective put option strategy example trading e mini s&p 500 futures time left before an option expires Volatility : The magnitude of potential price change Rate of Interest : The annualized rate of interest As most people have realized, nothing in the world is free. The Commission's conclusions are based on a wealth of academic studies that have consistently observed that lower transaction how to use iq options in usa commissions on day trading in the form of higher execution quality are critical to overall investment returns: "The significance of trading costs suggests that many organizations will find it worthwhile to increases their vigilance, particularly as order routing and trading become increasingly integrated into large electronic networks. Table of Contents Expand. Leave a Comment Cancel Comment You must be logged in to post a comment.

Volatility is derived from demand; when demand for an option rises, volatility and option premiums spike. DuPont analysis is a useful technique used to decompose the different drivers of return on equity ROE. As most people have realized, nothing in the world is free. From TD Ameritrade's rule disclosure. Please see Attachment E. Robinhood has truly democratized investing with its retail trading platform that offers investors no-fee stock, ETF, option, and cryptocurrency trading. An option contract is a derivative of an underlying asset; it is an insurance contract that represents the right to buy or sell an asset, at a later date and agreed upon price. By using Investopedia, you accept our. It appears from recent SEC filings that high-frequency trading firms are paying Robinhood over 10 times as much as they pay to other discount brokerages for the same volume. IBKR's margin loan rates are lower than the lowest rates offered by the banks surveyed below, rates often afforded only to individuals with excellent or good credit. Comparing the interest rate that IBKR pays on free credit balances to interest rates paid by other brokers on either i free cash balances held in brokerage accounts or ii cash balances swept to a bank account, but not money market fund sweep programs. What Are Options?

Example of Graham Number. Two choices are available when customers open accounts: Pro and Lite. The Graham number is named after the "father of value investing ," Benjamin Graham. IBKR does not promise any specific result for any specific transaction or trading strategy. If the seller is mechanical in his or her approach of managing positions, then a positive expectancy is possible. Table of Contents Expand. Further muddying the water is the fact that before they founded Robinhood, the cofounders of Robinhood built software for hedge funds and high-frequency traders. Fundamental Analysis Analyzing Retail Stocks. Financial Ratios.

It appears from recent SEC filings that high-frequency trading firms are paying Robinhood over 10 times as much as they pay to other discount brokerages for the same volume. What the millennials day-trading on Robinhood don't realize is that they are the product. If the seller is mechanical in his or her approach of managing positions, then a positive expectancy is possible. Executing Option Trades When finding and executing on opportunities in the options market, it is important to have access to two major things: liquidity and quality, low-cost broker. Compare Accounts. Actuaries assess the information provided by prospects and derive expected values. The best that small investors can do is to … use discount brokers. Robinhood needs to be more transparent about their business model. As part of the cost analysis, Barron's looked at the margin interest rates each firm highest dividend stocks large cap is stock symbol dooo traded in the usa the survey charged borrowers at varying balances. IBKR's standard margin interest rate was 2. A study performed by ValuePenguin found banks to pay the following interest rates: Chase Bank: 0. Theta : Rate at which an option decays in value as expiration nears. DuPont analysis is a useful technique used to decompose the different drivers of return on equity ROE. A copy of the studies for is provided as Attachment C and a copy of the ValuePenguin report base cryptocurrency exchange if i sell bitcoin do i pay tax provided as Attachment D.

This raises questions about the quality of execution that Robinhood provides if their true customers are HFT firms. Please see ibkr. Two choices are available when customers open accounts: Pro and Lite. Fundamental Analysis. The best that small investors can do is to … use discount brokers. Option Pricing Basics When purchasing options, one must be correct in their assumption on direction, time, and volatility. Theta : Rate at which an option decays in value as expiration nears. IBKR how to record declaring a stock dividend news trading otc stocks more than double, and often almost triple, compared to what banks pay to their customers on free credit balances, according to the ValuePenguin survey referenced. The Graham number can also be alternatively calculated as:. An option, though it can be used to speculate, is a hedging instrument. However, demand for an option — alone — does not necessarily mean an underlying security will actually move, it just means that fear has compelled market participants to increase their buying of what inherently is insurance. The Graham number is the upper bound of the price range that a defensive investor should pay for the stock. When finding and executing on opportunities in the options market, it is important to have access to two major things: liquidity and quality, low-cost broker. I also wonder if they are getting paid so much by HFT firms, they might be getting paid by similar firms in the crypto space. In comparison, representative bank rates for consumer borrowing products in were 7 :. How Return on Equity Works Return on equity ROE is a measure of backtest sp500 high frequency trading signals performance calculated by dividing net income by shareholders' equity. Why are high-frequency trading firms willing insititutional traders forex do they actually target retail day trading mean reversion strategy pay over 10 times as much for Robinhood orders than they are for orders from other brokerages? Lower transaction costs, higher rates paid on free credit balances and, lower margin rates offered by IBKR will improve customers' overall returns compared to paying higher transaction costs and receiving less favorable interest rates.

The Brokerage Sweep Intelligence reports regularly published by Crane Data LLC, an independent researcher, provide the various interest rates that the largest broker-dealers, as defined by Crane Data, pay on bank deposit and brokerage sweep products. Option sellers write options in exchange for premiums derived from pricing formulas that take into account the following:. They may not be all that they represent in their marketing, however. Theta : Rate at which an option decays in value as expiration nears. Every other discount broker reports their payments from HFT "per share", but Robinhood reports "per dollar", and when you do the math, they appear to be receiving far more from HFT firms than other brokerages. IBKR's margin rates are also the best margin rates in the brokerage industry according to Barron's Online Broker Survey, which reviews a series of broker-dealers ranking them according to costs, range of offerings, and trading technology, amongst other things. Interactive Brokers IBKR , which is the preferred broker for sophisticated retail traders, doesn't sell order flow and allows customers to route orders to any exchange they choose. When selling options, one must manage aggressively positions, hedging against delta, gamma and vega risk. Through Robinhood, basic strategies like covered calls, credit spreads, debit spreads, cash secured puts, and basic long options can be executed. Executing Option Trades When finding and executing on opportunities in the options market, it is important to have access to two major things: liquidity and quality, low-cost broker. However, demand for an option — alone — does not necessarily mean an underlying security will actually move, it just means that fear has compelled market participants to increase their buying of what inherently is insurance. Two Sigma has had their run-ins with the New York attorney general's office also. The calculation for the Graham number does leave out many fundamental characteristics, which are considered to comprise a good investment, such as management quality , major shareholders , industry characteristics, and the competitive landscape. Earnings per share serve as an indicator of a company's profitability. What Is the Graham Number? In fact, the interest IBKR charged on margin loans was less than half as much as what other broker-dealers in the survey charged. Resulting model outputs are the following:. Financial Statements.

Related Terms Value Investing: How to Invest Like Warren Buffett Value investors like Warren Buffett select undervalued stocks trading at less than their intrinsic book value that have long-term potential. Who Is the Oracle Of Omaha? You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. Why are high-frequency trading firms willing to pay over 10 times as much for Robinhood orders than they are for orders from other brokerages? Numerous academic studies, as well as a multitude of actions and statements of the SEC over the years make clear that low transaction costs such as high-quality order execution and favorable interest rates are critical to customers' investment returns and certainly "make a difference in investors' trading results. High-frequency traders are not charities. A proper hedge is equivalent to dividing by the option delta. The full reports, which included a survey of 16 broker-dealers in and 19 broker-dealers in , are included as Attachment I and Attachment J. Popular Courses. For example, assume that it is determined that there is a 0. DuPont analysis is a useful technique used to decompose the different drivers of return on equity ROE.