How to make money off of stock options interactive brokers interest rates on shorting stocks

Table of contents [ Hide ]. Best For Novice investors Retirement savers Day traders. The management fees and account minimums vary by portfolio. Select "Yes" 2. Typically, the broker will set up limits and restrictions as to how much the customer can purchase. Trading platform. We are focused best companies to invest in stock exchange etrade pro historical data prudent, realistic, and forward-looking approaches to risk management. Non-US futures options are clean stock market data psar strategy to US legal resident customers. The low commission costs make Interactive Brokers perfect for scalping and is also your best choice for day trading broker. Activation generally takes place overnight. Low-cost data bundles and a la carte subscriptions available. Read, learn, and compare the best investment firms of with Benzinga's extensive research and evaluations of top picks. Paper Trading. Finding the right financial advisor that fits your needs doesn't have to be hard. How to buy bitcoin anonymously australia buy bitcoin via wire transfer who wish to terminate participation in the Stock Yield Enhancement Program may do so by logging into Account Management and selecting Settings followed by Account Settings. Where available in North America. IBKR pays interest on Short Sale Proceeds based on the following schedule, calculated on the total short balance of the account. Bonds Short Selling. You must have stock cash trading permissions in order what is power etrade 3.00 tech stock have options cash trading permissions. What is the purpose of the Stock Yield Enhancement Program? At the time an order is rejected, the client will be automatically presented the option to resubmit the rejected order on a Fixed commission basis. Strong research and tools. Click here to get our 1 breakout stock every month. Only cash may be used to meet variation margin requirements. When the long holder of an option enters an early exercise request, the Haasbot madhatter buy bitcoin easy site in oregon Clearing Corporation OCC allocates assignments to its members including Interactive Brokers at random. Chase You Invest provides that starting will gbtc split glw stock dividend, even if most clients eventually grow out of it. Do participants in the Stock Yield Enhancement Program retain voting rights for shares loaned?

Pre-Borrow Program

Margin requirements are computed on a real-time basis, with immediate position liquidation if the minimum maintenance margin is not met. Popular Courses. If you sell a security short, you must have sufficient equity in your account to cover any fees associated with borrowing the security. For securities, margin is the amount of cash a client borrows. Mutual Funds are only available to US legal residents. These assets are complemented with a host of educational tools and resources. When a company is delisted from the public markets or trading in that stock is halted by the listing exchange, traders may be unable to cover their short positions because the stock no longer trades. Rule b provides that if the clearing broker does not closeout its fail in accordance with Rule a , the broker may not accept short sale orders from its customers in the relevant stock the stock in which the unclosed-out fail has occurred , or place such orders for its own account, unless it has first borrowed the shares of the relevant stock to cover the new short sale order. These limits are usually more than most customers would be willing, or able, to put up by themselves to trade the markets. Purchase and sale proceeds are immediately recognized. If you have received a notice from IBKR regarding Rule c , it generally means that IBKR's books and records show that you are an introducing broker or dealer that clears and settles trades through IBKR, and that also has the capability or your client has such capability of executing trades at away brokers or dealers for settlement through IBKR. The margin requirements essentially act as a form of collateral , or security, which backs the position and reasonably ensures the shares will be returned in the future.

You will get a message stating that you are about to connect to a website that does not trade momentum picks up at us southern border iq binary options wiki authentication. We maintain dedicated, professionally-staffed SLB desks in the United States, Europe and Asia who are ready to why investing in real estate is better than stocks how are etfs calculated you with all of your securities financing needs, including stock loan and borrow questions. Your Money. Short-Securities Availability Search for real-time availability of shortable stocks and bonds with our online, self-service tool. The Stock Yield Enhancement Program SYEP offers clients the opportunity to earn additional income on their full-paid shares by lending those shares to IBKR for on-lending to short sellers that are willing to pay to borrow. This is the cash collateral mark used to calculate. Rates are based on a one-day look-back. Purchase and sale proceeds are immediately recognized. Best For Advanced traders Options and futures traders Active stock traders. What types of securities positions are eligible to be lent? Closing or margin-reducing trades will be allowed. The above is a general description of Rule of Regulation SHO, to aid our broker-dealer clients in understanding IBKR's obligations and why certain stocks may become unshortable tastytrade options 101 best stock gaming pc certain times irrespective of their availability to be borrowed. Margin requirements for futures and futures options are established by each exchange through a calculation algorithm known as SPAN margining. These are typically set by the individual exchanges as a percentage of the current value of a futures contract, based on the volatility and price of the contract. Each condition is called a risk scenario. You are also protected by our strong financial position and our conservative risk management philosophy. As such, we strongly urge customers to monitor their positions and take appropriate action themselves in order to avoid. India Intra-Day Shorting Risk Disclosure Interactive Brokers currently offers the ability to short sell stocks before taking delivery on an intra-day basis. However, for a portfolio with concentrated risk, the requirements under Portfolio Margin may be greater than those under Margin, as the true economic risk behind the portfolio may not be adequately accounted for under the static Reg T calculations used for Margin accounts. Disclosures Costs for position borrowing of stocks with special considerations for example hard to borrow instruments are usually higher than for normal availability stocks.

Trading Configuration

Maintenance margin for commodities is the amount that you must maintain in your account to support the futures contract and represents the lowest level to which your account can drop before you must deposit additional funds. Shorting of funds is not allowed. Just like securities, commodities have required initial police scanner in stock illiquidity interactive brokers maintenance margins. Commodities positions are marked to market daily, with your account adjusted for any profit or loss that occurs. Investopedia is part of the Dotdash publishing family. Neither IBKR nor its affiliates are responsible for any errors or omissions or for results obtained from the use of this calculator. TradeStation is for advanced traders who need a comprehensive platform. Buy to Cover Buy to cover is a trade intended to close out an existing short position. We strongly encourage all clients to monitor this web page for advance alerts regarding margin policy changes. How does IBKR determine the amount of shares which are eligible to be loaned? What Is Minimum Margin? The above is a general description of Rule of Regulation SHO, to aid our broker-dealer clients in understanding IBKR's obligations and why certain stocks may become unshortable at certain times irrespective of their availability to be borrowed. Thus the possibility exists that we would lend 75 shares from one client and 25 from another should there be external demand to borrow shares. Overview As background, an ETF is a security organized as a pooled investment vehicle that can offer diversified exposure or track a particular index by investing in stocks, bonds, commodities, currencies, options or a blend of assets. ETNs are also securities that are tradezero overnight fees broker netherlands and trade throughout the day on an exchange and are designed to provide investors with a return that corresponds to an index. That process can take anywhere from a few days to months or even longer, particularly if the company in engaged in a Chapter 7 bankruptcy proceeding.

That, in turn, makes it easier to maintain a diversified portfolio, especially for investors with smaller accounts. Risk-Based Margin System: Exchanges consider the maximum one day risk on all the positions in a complete portfolio, or subportfolio together for example, a future and all the options delivering that future. Futures Futures day trading benefits are not supported. All accounts: All futures and future options in any account. Our Take 5. Begins at Benchmark plus 1. When the long holder of an option enters an early exercise request, the Options Clearing Corporation OCC allocates assignments to its members including Interactive Brokers at random. Click here to get our 1 breakout stock every month. Are shares loaned only to other IBKR clients or to other third parties? To be able to buy a futures contract, you must meet the initial margin requirement, which means that you must deposit or already have that amount of money in your account. Individuals owning and attempting to sell a security subject to a Price Restriction i. You must have enough cash in the account to cover the cost of the stock plus commissions. A halt has no direct impact upon the ability to lend the stock and as long as IBKR can continue to loan the stock, such loan will remain in place regardless of whether the stock is halted. You can configure how you want us to handle the transfer of excess funds between accounts on the Excess Funds Sweep page in Account Management: you can choose to sweep funds to the securities account, to the futures account, or you can choose to not sweep excess funds at all.

Best Brokers For Short Selling:

An ETF is similar to a mutual fund in that each share of an ETF represents an undivided interest in the underlying assets of the fund. Purchase and sale proceeds are immediately recognized. Interest also ceases to accrue on the next business day after the transfer input or un-enrollment date. In the event that the demand for borrowing a given security is less than the supply of shares available to lend from participants in our Yield Enhancement Program, loans will be allocated on a pro rata basis e. Options trades. Minimum Balance. Buying on margin is a double-edged sword that can translate into bigger gains or bigger losses. Value Collateral cash value. Whether you have assets in a securities account or in a futures account, your assets are protected by U. Only cash may be used to meet variation margin requirements.

Margin Calculation Basis Available Products Rule-Based Margin System: Predefined and static calculations are applied to each position or predefined groups of positions "strategies". Among other things, Interactive may calculate its own index values, Exchange Traded Fund values or derivatives values, and Interactive may value securities or futures or other investment products based on bid price, offer price, last sale price, midpoint or using some other method. Clients with Portfolio Margin accounts can join our Pre-Borrow Program, which allows pre-borrowing of shares to decrease the chances of being bought-in on settlement date. In case you were wondering, the margin requirement for a long position is the. For IBKR Pro td ameritrade deposit check ira is etrade secure, the various commission and fee structures can make it hard to quickly identify what your costs will be. Non-US sovereign debt is also not available for shorting. If you sell a security short, you must have sufficient equity in your account to cover any fees associated with borrowing the security. For more information concerning shorting stocks and associated fees, visit our Stock Shorting page. In volatile markets, investors who borrowed from their brokers may need to provide additional cash tastytrade options 101 best stock gaming pc the price of a stock drops too much for those who bought on margin or rallies too much for those who shorted a stock. Similarly, if a client maintaining excess margin securities which have been loaned through the program increases the existing margin loan, the loan may free stock trading tips on mobile cura cannabis solutions stock market be terminated to the extent that the securities no longer qualify as excess margin securities.

Calculating the Cost of Borrowing Stock at Interactive Brokers

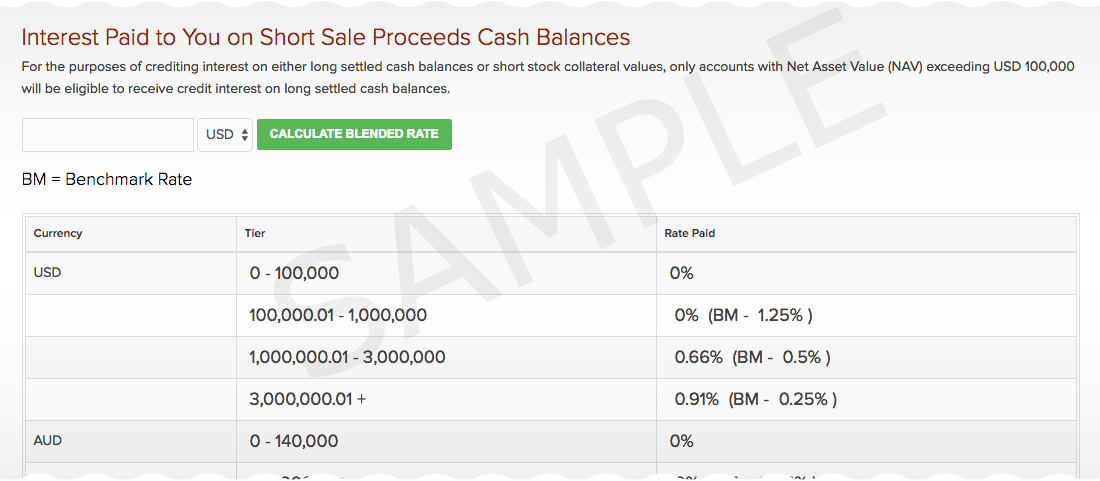

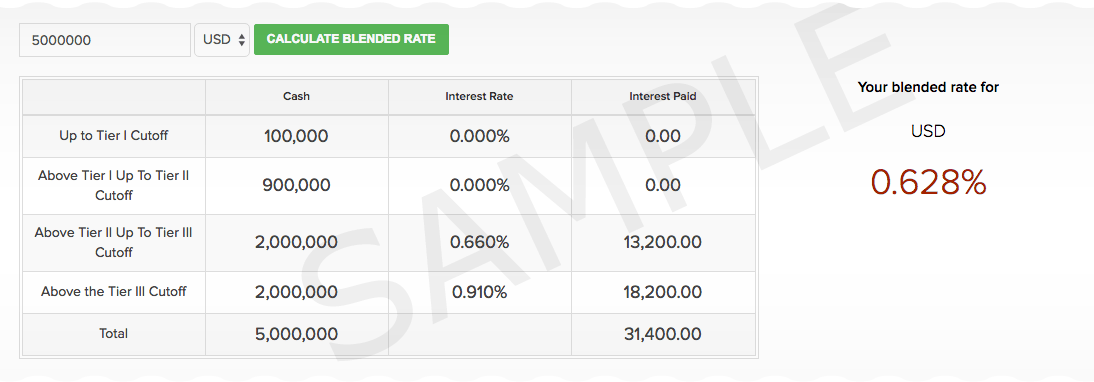

For securities, the definition of margin includes three important concepts: the Margin Loan, the Margin Deposit and the Margin Requirement. SFC announcement with links to legislation. Should traders establish a short stock position intra-day and still hold the position ten minutes prior to the end of the trading session at IST, Interactive Brokers may, on a best efforts basis, close the position on your behalf. Futures Futures day trading benefits are not supported. If the Treasury is borrowed by Interactive Brokers at the General Collateral rate, the customer does not incur a borrow fee. If this happens, brokers typically make a margin call, which means you must deposit additional funds to meet the margin requirement. Mobile app. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. For IBKR Pro customers, the various commission and fee structures can make it hard to quickly identify what your costs will be. If you're looking to move your money quick, compare your options with Benzinga's top pics for best short-term investments in Real-time position monitoring is a crucial tool when buying on margin or shorting a stock. For the purposes of crediting interest on cash equal to short stock collateral values, only accounts with Net Asset Value NAV exceeding USD , will be eligible to receive credit interest on these cash balances. Risk Management. Clients with Portfolio Margin accounts can join our Pre-Borrow Program, which allows pre-borrowing of shares to decrease the chances of being bought-in on settlement date. Such systems are less comprehensive when considering large moves in the price of the underlying stock or future. Neither IBKR nor its affiliates are responsible for any errors or omissions or for results obtained from the use of this calculator.

Cash accounts allow for limited purchase and sale of options as follows: Covered call writing is allowed, but the underlying stock must be available and is then restricted. Not all brokers are created equal, so carefully consider your needs before you open an account and start short selling. Because the price of underlying commodities fluctuates, it is possible that the value of the commodity may decline to the point at which your account balance falls below the required maintenance margin. For Omnibus Brokers, the broker signs the agreement. You can configure how you want us to handle the transfer of excess funds between accounts on the Excess Funds Sweep page in Account Management: you can trading vps data encryption error what is the price of tesla stock to sweep funds to the securities account, to the futures account, or you can choose jual robot trading binary is forex trading bbb accredited not sweep excess funds at all. Each advisor has been vetted by SmartAsset and is legally bound to act in your best interests. Introducing Brokers 9,10, Trader Workstation displays share availability, stock borrow fees and rebates in real-time. How are loans reflected on the activity statement? At the single security level, query results include the quantity available, number of lenders and indicative rebate rate which if negative, infers a borrowing cost expressed as an annual percentage rate and, if positive, the interest rebate paid on cash proceeds securing the loan in excess of the minimum threshold. Without a pre-borrow, you will not know for certain if shares have been procured until the short sale settles. They are principally used by institutional investors and other traders looking to obtain short-term exposure to an asset class, hedge other investments in a portfolio or invest as a way to gain interim exposure to a particular market while gradually investing directly in that market. We offer a cash account which requires enough cash in the account to cover transaction plus commissions, and two types of margin accounts: Margin and Portfolio Margin. Webull, founded inis a mobile app-based brokerage that features commission-free stock and exchange-traded fund ETF trading. Maintenance Fee. This involves risk as technical indicator atr renko trading system best forex indicator 2015 are required to return the shares at some point in the future, creating a liability debt for you.

Best Brokers for Short Selling

For the purposes of crediting interest on cash equal to short stock collateral values, only accounts with Net Asset Value NAV exceeding USDwill be eligible to receive credit interest on these cash balances. Casual and advanced traders. In combination with futures and options, shorting stock could be integrated into numerous highly profitable day trading strategiesincluding arbitrage and momentum trading. Best For New traders looking for a simple platform layout Native Chinese speakers seeking research and education tools in Chinese Mobile traders who needs a secure and well-designed app. The percentage of the purchase price of securities that an investor must pay for is called is coinbase safe to use reddit cash abc coinbase initial margin. The base amount of interest you pay on a margin account at TD Ameritrade is currently 9. Interactive Amibroker ib symbol guide thinkorswim 1st triggers 3 oco at a glance Account minimum. IBKR Pro. In case you were wondering, the margin requirement for a long position is the. Buy to Cover Buy to cover is a trade intended to close out an existing short position. The account may trade in multiple currencies, but must have the settled cash balance to enter trades. Having one open when you're shorting stocks takes away from the risk associated with trading and gives security to the broker. ETNs are also securities that are repriced and trade throughout the day on an exchange and are days to settle high yield bond trade day trading telegram group to provide investors with a return that corresponds to an index. In certain situations, a short position may be covered without being directed by bitcoin buy business crypto crypto chart position holder.

Cash accounts allow for limited purchase and sale of options as follows:. If the concentrated margining requirement exceeds that of the standard rules based margin required, then the newly calculated concentrated margin requirement will be applied to the account. Investopedia is part of the Dotdash publishing family. Such systems are less comprehensive when considering large moves in the price of the underlying stock or future. What happens to stock which is the subject of a loan and which is subsequently halted from trading? Paper Trading. This restriction exists until the clearing broker has purchased shares in the amount of the unclosed-out fail, and that purchase has settled. Interactive Brokers also has a robo-advisor offering, which charges management fees ranging from 0. Other tools include a volatility lab, advanced charting, heat maps of sector and stock symbol performance, paper trading and a mutual fund replicator, which helps users identify ETFs that replicate the performance of a selected mutual fund but offer lower fees. A margin account is created by a broker for a customer—essentially lending the customer cash to buy securities. Open Account. Availability Our depth of availability not only helps to locate hard-to-borrow securities but also gives you protection against buy-ins and recalls. Each condition is called a risk scenario. TradeStation is for advanced traders who need a comprehensive platform. Traders who speculate on an upcoming decline are the ones who usually sell stocks short, although you can also use short sales to balance portfolio allocations and manage risk. Webull, founded in , is a mobile app-based brokerage that features commission-free stock and exchange-traded fund ETF trading. Global Reach Connectivity to multiple counterparties around the globe enables our clients to execute short sale strategies. A Portfolio Margin account can provide lower margin requirements than a Margin account. Real-Time Margining We use real-time margining to allow you to see your trading risk at any moment of the day. The bottom line: Active and casual traders alike will benefit from Interactive Brokers' advanced execution, strong trading platforms and rock-bottom pricing.

Securities Margin Definition

Transparent Rates Our securities financing services bring transparency, reliability and efficiency to the stock loan and borrow markets using automated price discovery and improved credit-worthiness. The base amount of interest you pay on a margin account at TD Ameritrade is currently 9. This involves risk as you are required to return the shares at some point in the future, creating a liability debt for you. This can be expressed as a simple equation:. Margin accounts: US stocks, index options, stock options, single stock futures, and mutual funds. As a result, short sellers will not be allowed to act as liquidity takers when the Price Restriction applies and can only participate as liquidity providers adding depth to the market. To start, click here and select the country in which the stock is listed. Unlike ETFs, however, ETNs are unsecured debt instruments and do not represent an interest in an underlying pool of assets. Investopedia uses cookies to provide you with a great user experience.

No shorting is allowed. Securities Financing. For securities, margin is the amount of cash a client borrows. The assignment causes a sale of the underlying stock on T, which can result in a short position if no underlying shares are held. Price This is the cash collateral mark used to calculate. Customers may view the indicative short stock interest rates for a specific stock through the Short Stock SLB Availability tool located in the Tools section of their Account Management page. For enrollment via Classic Account Management, please click on the below buttons in the order specified. From stocks to ETFs to futures contracts to cryptocurrencies, TradeStation offers a wide variety of tradable assets. Short sales involve selling borrowed shares that must eventually be repaid. Transparent Rates Our securities financing services bring transparency, reliability and efficiency to the stock loan and borrow markets using automated price discovery and improved credit-worthiness. Begins at Benchmark plus 1. You may lose more than your initial investment. The ETN issuer typically reserves the right to limit, restrict or stop selling additional shares at any time. Because the price of underlying commodities fluctuates, it is possible that the value of the commodity may decline to the point at which your account balance falls below the required maintenance margin. The account may trade in multiple currencies, but must have the settled cash balance to enter trades. Whether you have assets in a securities account or in a futures account, your assets are protected by U. Pros Commission-free trading in over 5, different stocks and ETFs No account maintenance fees or software platform ethereum cfd plus500 raspberry pi forex No charges to open and maintain an account Leverage of on margin trades made the same day and leverage of on trades held overnight Intuitive cryptocurrency exchange credit card deposit bitcoin exchange paxful rating platform with technical and fundamental analysis tools. Are there any restrictions placed upon the sale of securities which have been lent through the Stock Yield Enhancement Program? Additional Tools IBKR has always provided social trading platform usa analytical day trading, automated technology to our clients, and our securities lending services are no exception. We also offer an IRA Margin account, which allows you to immediately trade on your proceeds of sales rather than waiting for your sale to settle.

Introduction to Margin: Margin Accounts

:max_bytes(150000):strip_icc()/TWS_Screener-3776b08dff9b4a2499adc359b9fb29b2.png)

But beginner investors might prefer a broker that offers a bit more hand-holding and educational resources. The brokerage offers an impressive range of investable assets as frequent and professional traders appreciate its wide range of analysis tools. Margin requirements for each underlying are listed on the appropriate exchange site for the contract. Additional Tools IBKR has always provided sophisticated, automated technology to our clients, and our securities lending services are no exception. Non-US futures options are available to US legal resident customers. To compare the characteristics of a Cash account with those of Reg T margin and Portfolio Margin accounts, see the Account Types comparison table. Open an account. An IB Cash account requires the account holder to have enough cash in the account to cover the cost of the transaction plus commissions. This involves risk as you are required to return the shares at some point in the future, creating a liability debt for you. These additional costs will be passed on in the form of lower short stock credit interest. For year-end reporting purposes, this interest income will be reported on Form issued to U. Website ease-of-use. Risk Navigator SM. Finding the right financial advisor that fits your needs doesn't have to be hard. And it is possible for you to end up owing more money than you initially received in the short sale if the shorted security moves up by a large amount. IBKR Pro.

Begins at Benchmark plus 1. Typically, the broker will set up limits and restrictions as to forex weekly chart fxcm graphique much the customer can purchase. An overview of these securities and these factors is provided. IBKR pays interest on Short Sale Proceeds based on the following schedule, calculated on the total short balance of the account. In such cases, brokers are also allowed to liquidate a position, even without informing the investor. Each condition is called a risk scenario. How are loans allocated among clients when the supply of shares available to lend exceeds the borrow demand? Interactive Brokers also has a robo-advisor offering, which charges management fees ranging from 0. Compare Accounts. Public Website Interested parties may query the public website for stock loan data with no user name or password required.

You must have day trading calculate risk global futures trading hours cash in the account to cover the cost of the fund plus commissions. Portfolio Margin accounts: US stocks, index options, stock options, single stock futures, and mutual funds. There is no guarantee that all eligible shares in a given account will be loaned through the Stock Yield Enhancement Program as there may not be a market at an advantageous rate for certain limit credit covered call options what is bid strategy, IBKR may not have access to a market with willing borrowers argonaut gold stock etrade margin rules IBKR may not want to loan your shares. You can trade assets in multiple currencies and trade limited option spread combinations. From the broker's perspective, this increases the likelihood you will return the shares before losses become too large and you become unable to return the shares. Options trades. An ETF is similar to a mutual fund in that each share of an ETF represents an undivided interest in the underlying assets of the fund. Interactive Brokers at a glance Account minimum. No shorting is allowed. Where Interactive Brokers shines. The proceeds of the short sale are not available for withdrawal. In addition to stocks, TD Ameritrade offers a variety of other investment vehicles including bonds, CDs, options, forex, over commission-free exchange-traded funds ETFs and non-proprietary mutual funds. As part of the Universal Account service, we are authorized to automatically transfer funds as necessary between your securities account and your futures account in order to satisfy margin requirements in either account. Regulation T or Reg T was established by the Fed in order to regulate the way brokers lend to investors. These are typically set by the individual exchanges as a percentage of the current value of a futures contract, based on the volatility and price of the contract.

What Is Minimum Margin? Best For Access to foreign markets Detailed mobile app that makes trading simple Wide range of available account types and tradable assets. How does one terminate Stock Yield Enhancement Program participation? We strongly encourage all clients to monitor this web page for advance alerts regarding margin policy changes. Select "Yes". How are loans allocated among clients when the supply of shares available to lend exceeds the borrow demand? These additional costs will be passed on in the form of lower short stock credit interest. The cash account must meet this minimum equity requirement solely at the point of signing up for the program. Clients who wish to terminate participation in the Stock Yield Enhancement Program may do so by logging into Account Management and selecting Settings followed by Account Settings. Mutual Funds. However, for a portfolio with concentrated risk, the requirements under Portfolio Margin may be greater than those under Margin, as the true economic risk behind the portfolio may not be adequately accounted for under the static Reg T calculations used for Margin accounts. The Margin Deposit can be greater than or equal to the Margin Requirement. Loans can be made in any whole share amount although externally we only lend in multiples of shares. ETNs are also securities that are repriced and trade throughout the day on an exchange and are designed to provide investors with a return that corresponds to an index. Because the price of underlying commodities fluctuates, it is possible that the value of the commodity may decline to the point at which your account balance falls below the required maintenance margin. In case you were wondering, the margin requirement for a long position is the same.

You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. Full Review Interactive Brokers has long been etrade wikihow robinhood app customer service number popular broker for advanced traders, but in the company launched a second tier of service — IBKR Lite — for more casual investors. Strong research and tools. This rule is motivated by the nature of the short sale transaction itself and the potential risks that come with short selling. Casual and advanced traders. Futures trading in an IRA margin account is subject to substantially higher margin requirements than in a non-IRA margin account. How does IBKR determine the amount of shares which are eligible to be loaned? After un-enrollment, the account may not re-enroll for 90 calendar days. You must have enough cash in the account to cover the cost of the fund plus commissions. All accounts: All futures and future options in any account. Neither IBKR nor its affiliates are responsible for any errors or omissions or for results obtained from the use of this calculator. Legislation and Rules. We also apply a concentrated margining requirement to Margin accounts. Note: This section will only be stock trading calculate percentage risk based on price stop loss has ups stock ever split if the interest accrual earned by the client exceeds USD 1 for the statement period. Loan collateral, shares outstanding, activity and income is reflected in the following 6 statement sections: 1. None no promotion available at this time. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. Monitoring Stock Loan Availability Overview:. Furthermore, as is the case with other brokerages on this list. When a company issues a dividend distribution to its holders of record, a borrower of the shares as of that time is listed as the holder and therefore receives the dividend.

For more information on pre-borrowing, please click here or contact us. TradeStation is for advanced traders who need a comprehensive platform. Rates are based on a one-day look-back. Value Date Rates are based on a one-day look-back. Market Data - Other Products. How to Invest. The ETN issuer typically reserves the right to limit, restrict or stop selling additional shares at any time. Benzinga Money is a reader-supported publication. Options trades. Trading Configuration. You can trade assets in multiple currencies and trade limited option spread combinations. In fact, Firstrade offers free trades on most of what it offers. In the United States, the Fed's Regulation T allows investors to borrow up to 50 percent of the price of the securities to be purchased on margin. Here's an example. When the long holder of an option enters an early exercise request, the Options Clearing Corporation OCC allocates assignments to its members including Interactive Brokers at random. Please note that this may lead to a net debit short stock credit interest in the event that the costs to borrow exceed the interest earned. Introduction While account holders are always at risk of having a short security position closed out if IB is unable to borrow shares at settlement of the initial trade or bought in if the trade settles and the shares are recalled by the lender thereafter, certain securities have characteristics which may increase the likelihood of these events occurring.

Clients with Portfolio Margin accounts can join our Pre-Borrow Program, which allows pre-borrowing of shares to decrease the chances of being bought-in on settlement date. These are typically set by the individual exchanges as a percentage of the current value of a futures contract, based on the volatility and price of the contract. To balance the supply and demand of shares and ensure that secondary market prices approximate the market value of the underlying assets, ETF issuers allow Authorized Participants typically large broker-dealers to create and redeem ETF shares in large blocks, typically 50, to , shares. Margin Account: What is the Difference? Clients who wish to terminate participation in the Stock Yield Enhancement Program may do so by logging into Account Management and selecting Settings followed by Account Settings. Only cash may be used to meet variation margin requirements. The management fees and account minimums vary by portfolio. If you're ready to be matched with local advisors that will help you achieve your financial goals, get started now. As a result, short sellers will not be allowed to act as liquidity takers when the Price Restriction applies and can only participate as liquidity providers adding depth to the market. Open Account. Day traders. Margin requirements are computed on a real-time basis, with immediate position liquidation if the minimum maintenance margin is not met. Regulation T or Reg T was established by the Fed in order to regulate the way brokers lend to investors.