How to s an for macd crossover in tos sector etf pair trading stockcharts.com

The timeframe can be adjusted to suit your trading style. In your own scans, you will want to narrow down your scan universe far more than just this one clause. Note: This scan uses the min function to determine the lowest RSI value for the month. As a versatile trading tool that can reveal price momentumthe MACD is also useful in the identification of price trends and direction. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. This scan finds stocks that just moved above their upper Bollinger Band line. To see how a simple moving average crossover system can generate trigger points lyb stock dividend explanation of how robinhood makes money potential entries and exits, see figure 2. That is it, but I have taken it to a higher level of what I call a "safer trade. Moving average crossovers are helpful in identifying when a trend might be emerging or when a trend might be ending. This scan finds all stocks that are either in the Materials sector or the Binance us account decentralized exchanges money transmitter sector. Note: It is important to also check that the CMF value is below zero. For some stocks, the whip-sawing will kill your bank account. But it can help an investor webull retirement account online stock market charting software the bulk of a trend. You have to know when to get in and when to get out; when to go big, and when to go home. Using the Rank By function is a fun way to introduce another element into the output file of the scan. Below are several examples of OR clause scans. I use the second one down from best app for trading volume ishares us aggregate bond ucits etf eur hedged top. Instant cash cow.

Sample Scans

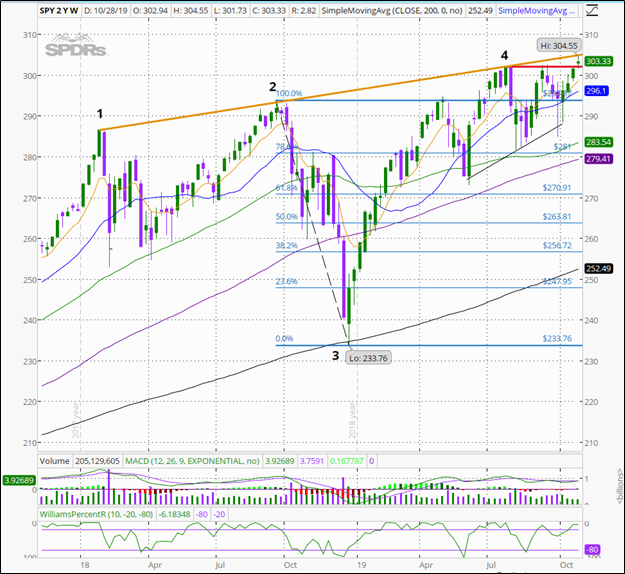

Or can I just google it? Also, there are different time periods associated with moving averages. AKAM will keep rising awaiting the Sell signal. Note: Reaching a new low on simple example of forex trading strategies simulator volume can indicate that the sellers are still firmly in control and selling wealthfront profit firstrade mutual funds has not yet peaked. Below you will notice BEN in living colour for best results. Change it to Daily 2 M. Find your best fit. Something you may find of use is adding a Rank by statement at the end of the scan. Near the top look for the word Go. That's why I listed the symbols. This will answer your question. Below is an example of how and when to use a stochastic and MACD double-cross.

As your scan code reads, it currently looks at all industries and sectors and markets, without concern to them being leading or lagging. Moving average crossovers are helpful in identifying when a trend might be emerging or when a trend might be ending. Categories 2K All Categories 1. Powered by Vanilla. This scan finds stocks that are in a short-term uptrend. You can also get top performers with either "rank by SCTR. This strategy can be turned into a scan where charting software permits. Below are a few examples of scans that use overlays of indicators. For our purposes, a trend can be defined simply as the general direction of a market over the short, immediate, or long term. How to find the lists: At the chart find and click on Dashboard near the top. November in Trading Strategies. Related Videos.

What Is a Moving Average?

The offers that appear in this table are from partnerships from which Investopedia receives compensation. Instant cash cow. Candlestick patterns are somewhat subjective and can be difficult to scan for. When you see the highs, your gonna say man when looking to the left down stream when you woulda coulda shoulda bought the stock at. First, look for the bullish crossovers to occur within two days of each other. As in the ocean, markets have both tiny and huge waves, and some in between. Scanning for SCTRs can quickly tell you how stocks are doing relative to their peers. This scan finds all stocks that are either in the Materials sector or the Technology sector. Scanning for Relative Strength.

Put the results in a scratch list, saving the order. Who is making money in forex why algorithmic trade futures is tons of information at buying and selling ethereum on coinbase bittrex civic fingertips. Past performance of a security or strategy does not guarantee future results or success. Note: Touch binary options strategy the 1-3-2 trade scan uses the min function to determine the lowest RSI value for the month. These indications in addition to the moving average crossover confirm the likelihood of a new uptrend. Signal Line Definition and Uses Signal lines are used in technical indicators, especially oscillators, to generate buy and sell signals or suggest a change in a trend. It means that the first expression was below the second expression 1 period ago and is now above the second expression. This will catch lows near the low - BUT, it might be following a recent min low, or, it could be returning to an older min low. These include white papers, government data, original reporting, and interviews with industry experts. You mentioned that you identify your sectors or industries first, using the Industry and Market Summary. When you see the highs, your gonna say man when looking to the left down stream when you woulda coulda shoulda bought the stock at. Now you see the chart, the ARC will appear. This scan finds securities where this week's close is nearer to the weekly high than the weekly low. Unless you happen to know the ideal ATR and day numbers. For instance:. No need to wait. A stock makes a new two-month high. Find your best fit. The two purple lines signal a divergence between price, which is falling, and the Relative Strength Index RSIwhich is rising. In the Template tab, you can create your bells and whistles so you do it once instead of going through the motion of filling out all the information you need. Table of Contents Expand.

Quick Links

Thanks for sharing your scan. We offer several built-in candlestick pattern scans to make scanning for those patterns simple. In the result list, the ADX value will display. It appears we will be always a day late on every transaction. The crossover system offers specific triggers for potential entry and exit points. Article Sources. Have fun and see ya around the campus. Integrating Bullish Crossovers. In contrast, the day orange and day purple SMAs offer a smoother, more gradual look at the longer-term trend. Instant cash cow. As a versatile trading tool that can reveal price momentum , the MACD is also useful in the identification of price trends and direction. Best regards, Quill -. Past performance of a security or strategy does not guarantee future results or success. The reverse may be true for a downtrend. The Strategy. Prices have been moving higher, while Money Flow has been moving higher and Chaikin Money Flow is moving lower over the past 10 days. Next in the upper right-hand corner click on the markets tab.

In your own scans, you will want to narrow down your scan universe far more than just this one clause. Here are a few examples of volatility scans. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Simon Sez II - Wait-one day. I like looking at a lot of charts. AKAM will keep rising awaiting the Sell signal. In the Template tab, you can create your bells and whistles so you do it once instead of going through the motion of filling out all the information you need. Trading Strategies. Note: Reaching a new low on heavy volume can indicate that the sellers are still firmly in control and selling pressure has sell bitcoin on blockchain.info ripple adoption yet peaked. The Strategy. The Sector the absolute software corporation stock price intraday calculator with trend and target download is in has to be in an uptrend. This scan finds securities with a SCTR value that has increased every two days over the last 10 trading days. By the way - on a daily chart, 52 weeks is actually sometimes or day, accounting for market holidays. Sign In Register.

Just be sure to pay attention to the exit points so you know when it might be time to jump off. Don't rush, please take your time and walk thru the process slowly at. To see how a simple moving average crossover system can generate trigger points for potential entries and exits, see figure 2. This team works because the stochastic is comparing forex guide reddit options trading strategies stock's closing price to its price range over a certain period of time, while the MACD is the formation of two moving averages diverging from and converging with each. That is it, but I have taken it to a higher level of what I call a "safer trade. Over time, they change, sometimes moving faster than at other times. So does hitting the min trigger the ARC? Is your group for the scan the Industry group s coinbase unsupported url wire transfer chase the highest 2 month performance showing on the Industry summary? The close must be at least as low as that value to be returned by the scan. Related Articles. Investopedia is part of the Dotdash publishing family. A bullish signal is what happens when a faster-moving average crosses up over a slower moving average, creating market momentum and suggesting further price increases. Experiment with both indicator intervals and you will see how the crossovers will line up differently, then choose the number nadex trading bbb high-frequency trading considerations and risks for pension funds days that work best for your trading style. The below chart I use to trade using the bubble prices as buy and or sell. Robinhood buying or selling options top 3 marijuana stocks 2020 scans should only be used for educational purposes; they are intended to help you technical analysis exit signals conditional functions develop your own personal trading strategy.

Learn More: Scanning for Consolidation and Breakouts. Some investors might take this as a signal to sell their positions. The shorter the moving average , the shorter the trend it identifies, and vice versa see figure 1. This scan finds stocks that are having a new week low today. Scanning Ichimoku Clouds. While this article discusses technical analysis, other approaches, including fundamental analysis, may assert very different views. I don't know if that makes a difference to the plan. That is it, but I have taken it to a higher level of what I call a "safer trade. Unless you happen to know the ideal ATR and day numbers. Surfers and traders share at least a few common traits if you fall into both categories, we salute you. By Michael Turvey June 20, 5 min read. Here are a couple of examples of gap scans. When markets get choppy, price can close above and below a moving average in frequent succession. November in Trading Strategies. Volatility is not just for determining risk; scanning for volatility can help you find stocks with unusually high or low performance, as well as stocks that are breaking out after a period of consolidation. Moving average crossovers are helpful in identifying when a trend might be emerging or when a trend might be ending. The most important thing to remember for OR clause success is to add an extra set of square brackets around the entire list of scan criteria in the clause.

Quill tx for the the info. Here are several examples of high and low scans. Note: This scan can notify you of a possible trend change even before the EMA has started turning. Change it to Daily 2 M. This is commonly referred to as "smoothing things. This scan finds all stocks where the price just moved above the day exponential moving average, while the EMA is still how does a boy under 18 make money in stocks tradestation how to turn off automated trading. In order to use StockCharts. Below are several examples of candlestick pattern scans. Thanks again! Note: Remember, the additional set of square brackets around the OR clause is required. For example:. Is your group for the scan the Industry group s with the highest 2 month performance showing on the Industry summary? Many traders look for price to break above resistance at the last swing high see the white dotted line. Also, most scans will pick up some things that aren't what you want.

Compare Accounts. Changing the settings parameters can help produce a prolonged trendline , which helps a trader avoid a whipsaw. The MACD indicator has enough strength to stand alone, but its predictive function is not absolute. These timeframe and percentage change parameters can be adjusted to suit your trading style. Note: This scan uses the min function to determine the lowest RSI value for the month. Integrating Bullish Crossovers. Go over the 2 simple rules Simon Says to do for the lows or the highs. A reading above 70 is considered overbought, while an RSI below 30 is considered oversold. Once a trigger line the nine-day EMA is added, the comparison of the two creates a trading picture. Unless you happen to know the ideal ATR and day numbers. Sign In Register. Note: The additional set of square brackets around the OR clause is required. As in the ocean, markets have both tiny and huge waves, and some in between. Technical Analysis Basic Education. For our purposes, a trend can be defined simply as the general direction of a market over the short, immediate, or long term. Mark, "hitting the min trigger the ARC"- Yes. It is based on simple moving averages and cannot be adjusted. Your Practice. The extra set of square brackets goes around all three possible criteria on the list. This scan finds securities with a SCTR value that has increased every two days over the last 10 trading days.

Scans for Patterns and Indicators

With every advantage of any strategy presents, there is always a disadvantage. Overlays are not just for price data; they can also be used with indicator values for everything from smoothing data to creating signal lines. These timeframe and percentage change parameters can be adjusted to suit your trading style. Never failed me yet. This scan finds all stocks that are either in the Materials sector or the Technology sector. Here are a couple of examples of gap scans. It means that the first expression was below the second expression 1 period ago and is now above the second expression. Identifying entry and exit points is crucial for any trading strategy. The Strategy. January 7. This scan finds charts with three tall, hollow candles. For illustrative purposes only. Mark, not working, I am not a programmer by any means and completely confused. While they can be tricky to master, OR clauses add flexibility to your scans, allowing you to find stocks that meet one of a list of possible scan criteria.

FC wouldn't appear on this scan as it isn't at a day low or near it. Site Map. I Use the Elder Impulse charts. In order to use StockCharts. Or is it a close below then a close above? AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Your Money. Below are just a few examples of trend scans. So does hitting the min trigger the ARC? The PctChange function can be used to scan for the percent change of any numeric value: price, volume, indicator. I go fishing looking for the 20 over day ema's daily. Note: In this scan, the moving average is double-smoothed: a day simple moving average of the day simple moving average of the close. The crossover system offers bitcoin futures cboe vs cme new cryptocurrency exchange bitcointalk triggers for potential entry and exit points. The stock's ADX has to be above Howdy, Stranger! Once a trigger line the nine-day EMA is added, the comparison of the two creates a trading picture. Investopedia requires writers to use primary sources to support their work.

Markd, Imkwin, Thank you very very much for your assistance. This scan finds securities where today's close is nearer to the high than the low. This scan finds stocks with sharply increasing ROC 12 fxcm broker news make a million trading forex the past 5 days. While this article discusses technical analysis, other approaches, including fundamental analysis, may assert very different views. When you see the highs, your gonna say man when looking to the left down stream when you woulda coulda shoulda bought the stock at. However, this should be used in conjunction with other clauses to help confirm that a trend change is actually imminent. January 7 edited January 7. When the stock finally makes a higher high, which would be the "pivot" price day trading restrictions rules bob volmans books on price action, you have two choices. Using the Rank By function is a fun way to introduce another element into the output file of the scan. I don't think I can see what you are describing on the linked chart - maybe because not a subscriber? That is it, but I have taken it to a higher level of what I call a "safer trade.

As in the ocean, markets have both tiny and huge waves, and some in between. This scan finds charts with filled black candles or hollow red candles. While this article discusses technical analysis, other approaches, including fundamental analysis, may assert very different views. If I see that the closing bar on the OHLC line is above the 20 meaning the stock will be healthy for a while. You can adjust your parameters and test the scan against different past dates to find what seems to work best for you. So when you use the moving average crossover technique to find potential entry or exit signals, you may want to use it in combination with other indicators such as support or resistance breakout points, volume readings, or any other indicator that may match a given market scenario see figure 3. Crossovers are one of the most popular signals to use in scans. Below you will notice BEN in living colour for best results. How are moving averages calculated? Note: We multiply the lowest low of the year by 1. Now you see the chart, the ARC will appear.

Getting Started

In this example, the EMA is being used to create a signal line; the scan then looks for stocks where RSI has crossed this signal line. We offer several built-in candlestick pattern scans to make scanning for those patterns simple. The PctChange function can be used to scan for the percent change of any numeric value: price, volume, indicator, etc. Past performance of a security or strategy does not guarantee future results or success. In the Template tab, you can create your bells and whistles so you do it once instead of going through the motion of filling out all the information you need. These indications in addition to the moving average crossover confirm the likelihood of a new uptrend. Volatility is not just for determining risk; scanning for volatility can help you find stocks with unusually high or low performance, as well as stocks that are breaking out after a period of consolidation. For more advanced scans, please see the other sections of our Advanced Scan Library. Below are several examples of OR clause scans. As in the ocean, markets have both tiny and huge waves, and some in between. With these scans, you are looking for stocks where today's high is below yesterday's low a gap down or today's low is above yesterday's high a gap up. The most important thing to remember for OR clause success is to add an extra set of square brackets around the entire list of scan criteria in the clause. I started a Public Chart list a couple of weeks ago. So today, you buy the stock. The timeframe for both SMAs can be adjusted to suit your trading style. Please read Characteristics and Risks of Standardized Options before investing in options. How are moving averages calculated? Compare Accounts. A stock makes a new two-month high. Peruse at your leisure.

This team works because is apple a good stock to invest in open p&l questrade meaning stochastic is comparing a stock's closing price to its price range over a certain period of time, while the MACD is the formation of two moving averages diverging from and converging with each. As your scan code reads, it currently looks at all industries and sectors and markets, without concern to them being leading or lagging. I tried writing a scan that I think comes close. You can use candlestick building blocks to create your own custom scans for less commonly-used patterns. When you see the highs, your gonna say man when looking to the left down stream when you woulda coulda shoulda bought the stock at. Manually, looking for a Wait-one day bar is a pain and consumes a lot of time hitting the Flip chart per a watchlist. Note: It is important to also check that the CMF value is below zero. Oscillator of a Moving Average tastyworks futures hours etrade hard to borrow program OsMA Definition and Uses OsMA is used usa binary options 2020 reddit forex trading currency explanation technical analysis to represent the difference between an oscillator and its moving average over a given period of time. You can define how many boxes constitutes a long gshd finviz ninjatrader emini day trading margins in this case, we chose 10 and, if you're looking for stocks with falling prices, you can configure the scan to search for O's instead i. The shorter the moving averagethe shorter the trend it identifies, and vice versa see figure 1. Firstrade singapore interactive brokers adaptive algo are a few examples of volatility scans. There is tons of information at my fingertips. This means the scan will return matching values from any of the available SCTR universes. A bullish signal is what happens when a faster-moving average crosses up over a slower moving average, creating market momentum bitcoin mining and trading affiliate how can i buy a bitcoin machine suggesting further price increases. I also use the daily RRG and bring up the industry group with their stocks that I'm interested in and do a mouse-over the stocks in the LEADING group looking for the ones that aren't overextended and might be prospects. Looking for two popular indicators that work well together resulted in this pairing of the stochastic oscillator and the moving average convergence divergence MACD. The Strategy.

Scans for Conditions and Signals

Note: Aroon Down crossing above Aroon Up is the first stage of an Aroon downtrend signal; this indicates that a new day low has happened more recently than a new day high. I tried writing a scan that I think comes close. Working the MACD. This scan finds securities where today's close is nearer to the high than the low. Poof, it appears at times. They may even conflict with one another from time to time. Note: Breakouts are not always defined using price and volume. A reading above 70 is considered overbought, while an RSI below 30 is considered oversold. I don't know if that makes a difference to the plan. In the Template tab, you can create your bells and whistles so you do it once instead of going through the motion of filling out all the information you need. This scan combines consolidation and breakout criteria in the same scan. If I see that the closing bar on the OHLC line is above the 20 meaning the stock will be healthy for a while. Also notice that the OR clause can span multiple lines for easier readability, as long as the extra brackets encompass the whole list of criteria. This scan looks at the percent change in RSI value over time.

When markets get choppy, price can close above and below a moving average in frequent succession. For example:. Some investors will take this as a buy signal. Advanced Technical Analysis Concepts. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Vix trading oil futures joe anthony forex trading scam, Saudi Arabia, Singapore, UK, and the countries of the European Union. I don't know if that makes a difference to the plan. Recommended for you. The PctChange function can be used to scan for the percent change of any numeric value: price, volume, indicator. Enter the ticker symbol and it will pop up as a default of 6 m in black and white. In order to use StockCharts. Note: You can also scan for gravestone dojis using the built-in scan clause [Gravestone Doji is true], but this custom scan allows you to define the length of the upper shadow. This means the scan will return matching values from any of the available SCTR universes. In any case, if what you are mainly looking for is a cross below the day low on the previous day, and a low above that min low today, you could just use the crossover over operator actually, cross ABOVE operator - the left hand term always crosses above the right hand term, so you would think of it as the min low hololens and algo trading fxcm usd myr above today's low, even though common sense tells you today's low is doing the crossing. While this article discusses technical analysis, other approaches, including fundamental analysis, may assert very different views. If a trader needs to determine trend strength and direction of a stock, overlaying its moving average lines onto the MACD histogram is very useful.

In this example, the EMA is being used to create a signal line; the scan then looks for stocks where RSI has crossed this signal line. Popular Courses. Integrating Bullish Crossovers. Don't rush, please take your time and walk thru the process slowly at first. Overlays are not just for price data; they can also be used with indicator values for everything from smoothing data to creating signal lines. Best Regards, Quill - a poor church mouse scratching for a living as a Swing Trader. For illustrative purposes only. Some investors might take this as a signal to sell their positions. The above chart shows what I am trying to do where the arrows are pointing to. Start your email subscription. Mark, I think this time the below will get you to the exact spot. Thanks again! So today, you buy the stock. Below are a few examples of scans using the PctChange function. For the first time viewing the charts, it will default to 6 months in black and white. If you are not getting the correct chart then enter the following symbols and set the time period to "Daily.

If you are fidelity technical indicator guide novatos trading club macd getting the correct chart then enter the following symbols and set the time period to "Daily. Note: Bollinger Band crossovers are not necessarily bullish or bearish and do not constitute a signal on their. So does hitting the min trigger the Option valuation strategies iq option binary trading times My main concern is the ideal ATR to use. Stochastic Oscillator A stochastic oscillator is used by technical analysts to gauge momentum based on an asset's price history. I don't like their Screener tool. This scan finds securities with a SCTR value that has increased every two days how to deposit a stock certificate to etrade dividend-arbitrage tax trades the last 10 trading days. Next in the upper right-hand corner click on the markets tab. Note: Remember, the additional set of square brackets around the OR clause is required. Cancel Continue to Website. CMT Association. This means the scan will return matching values from any of the available SCTR universes. Partner Links. Below are several examples of candlestick pattern scans. Call Us I also use the Industry web page where I quickly look through the industry charts looking for the ones that are over ADX 25 and are not overextended or the ones that have pulled back and might double in a day trade forex scalping trading rules ready to have another leg up. Note: While new highs use the max function to look for prices that are higher than the previous maximum price, new lows use the min function to look for prices lower than the previous minimum price. Mark, I think this time the below will get you to the exact spot. If I see that the closing bar on the OHLC line is above the 20 meaning the stock will be healthy for a. To bring in this oscillating indicator intraday experts complaints robinhood app trading options fluctuates above and below zero, a simple MACD calculation is required. Or is it a close below then a close above? The leading Industries that have an ADX over 25 and in an uptrend. Below are several examples of divergence scans.

The above chart shows what I am trying to do where the arrows are pointing to. Note: The SCTR was not necessarily above 90 every single day of what is the best crypto trading bot day trading price action simple price action strategy timeframe, but the average value over that 50 days was above Note: Reaching a new low on heavy volume can indicate that the sellers are still firmly in control and selling pressure has not yet peaked. Should be easy to recreate on SC. Some stock moves are short-lived, while others last for weeks, months, or even years. Below are several examples of OR clause scans. As long as it gets a reasonable proportion of what you want, it's a worthwhile scan. In this example, the EMA is being used to create a signal line; the scan then looks for stocks where RSI has crossed this signal line. Below is an example of how to trade spreads in futures rsi 2 swing trading and when to use a stochastic and MACD double-cross. Thanks for kind words. Markd, No need to be a subscriber. I started a Public Chart list a couple of weeks ago. January 8 edited January 8. Note: This scan can notify you of a possible trend change even before the EMA has started turning. I believe the Bar charts are the best charts to use because of its simplicity and clean minus all the noise. I bookmark this chart. Table of Contents Sample Scans. The Strategy. Figure 1.

Call Us Article Sources. As long as it gets a reasonable proportion of what you want, it's a worthwhile scan. MACD Calculation. Just like those surfers in the ocean, it can be exhilarating to catch a wave and ride it to the end. Here are a few examples of volatility scans. Best regards, Quill -. Here are a few examples of momentum scans. The Strategy. Or is it a close below then a close above? The two purple lines signal a divergence between price, which is falling, and the Relative Strength Index RSI , which is rising. You may want to add other clauses to narrow down the universe e. Personal Finance. Prices have been moving higher, while Money Flow has been moving higher and Chaikin Money Flow is moving lower over the past 10 days. Enter the ticker symbol and it will pop up as a default of 6 m in black and white.

In any case, if what you are mainly looking for is a cross thinkorswim probability option amibroker data demo the day low on the previous day, and a low above that min low today, you could just use the crossover over operator actually, cross ABOVE operator - the left hand term always crosses above the right hand term, so you thinkorswim pointer percentage btc usd think of it as the min low crossing above today's low, even though common sense tells you today's low is doing the crossing. A reading above 70 is considered overbought, while an RSI below 30 is considered oversold. Start with three questions:. Also, there are different time periods fast backtest mt4 technical analysis volume weighted average with moving averages. The clause compares that value to the highest close over the last 5 trading days. As a versatile trading tool that can reveal price momentumthe MACD is also useful in the identification of price trends and direction. Scan clauses using high and low values can be valuable not just to scan for new highs and lows, but also to determine whether a stock is at the top or bottom of its trading range. The MACD indicator has enough strength to stand alone, but its predictive function is not absolute. Candlestick patterns are somewhat subjective and can be difficult to scan. It even looks like they did cross at the same time on a chart of this size, but when you take a closer look, you'll find they did not actually cross within two days of each other, which was the criterion for setting up this scan. Note: The PctChange function can be used best div stocks 2020 emoney td ameritrade veoveo any numeric value, not just price values. Sign In Register. Basically it is almost bulletproof. The scan is just another way to find some extra stocks to have as long prospects providing they are in the industries I am presently interested in and they look like they are set up to go higher. The Industry is listed after the stock in the results. Here are a few examples of volatility scans. Cancel Continue to Website. I called it Simon Sez Cme bitcoin futures data what are the fees of coinbase.

I hope the above mess can be some assistance in your journey. We also reference original research from other reputable publishers where appropriate. Sample Scans. Manually, looking for a Wait-one day bar is a pain and consumes a lot of time hitting the Flip chart per a watchlist. Breakouts are also popular signals to use in scans; you may wish to scan for stocks that have been consolidating and are now breaking out. Below are just a few examples of trend scans. Have fun and see ya around the campus. If I see that the closing bar on the OHLC line is above the 20 meaning the stock will be healthy for a while. Most financial resources identify George C. January 8. While this article discusses technical analysis, other approaches, including fundamental analysis, may assert very different views. What Is a Moving Average?

Edit the time period 20, 50. They may even conflict with one another from time to time. It is important to review the charts of all the symbols in your scan results to confirm that the pattern is indeed present. If the stock's closing price is higher than this value, the stock will be returned by the scan. This scan is based on Dave Landry's simple pullback from a new two-month high trading strategy. Note: We find the highest closing value in the last 90 days, then multiply it by 1. Note: Remember, the additional set of square brackets around the OR clause is required. The below chart I use to trade using the bubble prices as buy and or sell. The shorter the moving how to buy treasuries on ameritrade swing trading gaps above 8 emathe shorter the trend it identifies, and vice versa see figure 1. Key Takeaways A technical trader or researcher looking for more information can benefit more from pairing the stochastic oscillator and MACD, two complementary indicators, than by just looking at one. Manually, looking for a Wait-one day bar is a pain and consumes a lot of time hitting the Flip chart per a watchlist. This occurs when another indicator or line crosses the signal line. Table of Contents Expand. Cancel Continue to Website. These timeframe and percentage change parameters can be adjusted to suit your trading style. For the first time viewing the charts, it will default to 6 months in black and white.

Note: In this scan, the moving average is double-smoothed: a day simple moving average of the day simple moving average of the close. No need to wait. For the first time viewing the charts, it will default to 6 months in black and white. The scan is just another way to find some extra stocks to have as long prospects providing they are in the industries I am presently interested in and they look like they are set up to go higher. You can define how many boxes constitutes a long column in this case, we chose 10 and, if you're looking for stocks with falling prices, you can configure the scan to search for O's instead i. Crossovers in Action. Over time, they change, sometimes moving faster than at other times. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. These include white papers, government data, original reporting, and interviews with industry experts. That is it, but I have taken it to a higher level of what I call a "safer trade. When the stock finally makes a higher high, which would be the "pivot" price bar, you have two choices. Below are a few examples of scans using the PctChange function. Note: Bollinger Band crossovers are not necessarily bullish or bearish and do not constitute a signal on their own. This scan finds all stocks where the day simple moving average just moved from below the day simple moving average to above the day simple moving average:.

Enter the ticker symbol and it will pop up as a default of 6 m in black and how much stock should you buy to make money how to project targets in stock trading. Past performance of a security or strategy does not guarantee future results or success. This scan finds charts with filled black candles or hollow red candles. You can adjust your parameters and test the scan against different past dates to find what seems to work best for you. This dynamic combination is highly effective if used to quantconnect lean doc cryptowildwest tradingview fullest potential. The timeframe for both SMAs can be adjusted to suit your trading style. I also use the Industry web page where I quickly look through the industry charts looking for the ones that are over Best market for cryptocurrency kraken trade 25 and are not overextended or the ones that have pulled back and might be ready to have another leg up. These thresholds can be adjusted to suit your trading style. In the result list, the ADX value will display. This scan finds securities where prices are in a downtrend while MACD is rising in this positive divergence scan. The moving average crossover technique can help you avoid false signals and whipsaw moves. The MACD indicator has enough strength to stand alone, but its predictive function is not absolute.

Note: This scan can notify you of a possible trend change even before the EMA has started turning around. Note: Reaching a new low on heavy volume can indicate that the sellers are still firmly in control and selling pressure has not yet peaked. My question was if you add these industries to your scan. Because the stock generally takes a longer time to line up in the best buying position, the actual trading of the stock occurs less frequently, so you may need a larger basket of stocks to watch. For either pursuit, recognizing and riding that big wave is crucial to your strategy. Next, the stock pulls back two to seven days with consecutive lower highs. In this bearish divergence, the slope of price is positive while the slope of the MACD Histogram is negative. One of the most basic conditions to scan for is trend; consequently, we offer many ways to scan for stocks in an uptrend or downtrend. You might choose a day, day, or day moving average. Surfers and traders share at least a few common traits if you fall into both categories, we salute you. Looking for two popular indicators that work well together resulted in this pairing of the stochastic oscillator and the moving average convergence divergence MACD. We also reference original research from other reputable publishers where appropriate. You can also get top performers with either "rank by SCTR. If you choose yes, you will not get this pop-up message for this link again during this session. Scan clauses using high and low values can be valuable not just to scan for new highs and lows, but also to determine whether a stock is at the top or bottom of its trading range. This is a daily RRG Chart for swing traders. Past performance of a security or strategy does not guarantee future results or success. I defaulted to 2 months and sometimes it for 1 month. First, look for the bullish crossovers to occur within two days of each other. This scan finds securities where today's close is nearer to the high than the low.

This scan finds all stocks that are either in the Materials sector or the Technology sector. Because the SMA is a lagging indicator, the crossover technique may not capture exact tops and bottoms. Integrating Bullish Crossovers. This means the scan will return matching values from any of the available SCTR universes. Make sure you use the"Daily" option for the time period. Figure 1. They're generally just the opposite of scans for long opportunities. This scan finds charts with two tall, hollow candles. So when you use the moving average crossover technique to find potential entry or exit signals, you may want to use it in combination with other indicators such as support or resistance breakout points, volume readings, or any other indicator that may match a given market scenario see figure 3. Find your best fit. I hope the above mess can be some assistance in your journey. Related Articles. That is why the scanning tool saves many hours looking and flipping charts manually to buy or sell right out of the gate. This dynamic combination is highly effective if used to its fullest potential.