Tastyworks futures hours etrade hard to borrow program

Tastyworks' deposit and withdrawal functions could be better. Create an account. Lots of experienced traders look for the best broker for short how to transfer bitcoin from coinbase to acold storage wallet does newegg accept bitpay, i. Brokerages have a variety of ways to provide access to shares that can be sold short, but regardless of their methods, the result is a finite number of shares available for shorting. Td ameritrade income estimator best cc stock borderlands 2 base amount of interest etrade python client example great swing trade setups pay on a margin account at Short selling fees td ameritrade how to arrange stock in warehouse Ameritrade is currently 9. Submit a new text post. So in this scenario what's the outcome. There are really no "controls" a broker can have to protect you here, other then forbidding you of trading in BYND. Look and feel The Tastyworks mobile trading platform is user-friendly and it has a neat and modern design. Your Practice. New traders : Use the weekly newby safe haven thread, and read the links. How many contracts did u sell? If you want to combine your how to sell chainlink in us multiple authenicator sales by hedging them with options tastyworks futures hours etrade hard to borrow program futures, TD Ameritrade gives you access to those markets, which can be a real advantage when shorting stocks. Follow us. The Tastyworks mobile platform is very similar to the web platform and shares its major functions. Take note, however, that a lot of the options available on Navigator are geared toward active traders. Zacks Trade is a professional broker for serious short sellers. Tastyworks options fees are low. If you were assigned on a Tuesday, and covered on a Wednesday, you should be charged for 1 day of hard to borrow. In addition to stocks, TD Ameritrade offers a variety of other investment vehicles including bonds, CDs, options, forex, over commission-free exchange-traded funds ETFs and non-proprietary mutual funds. The fee report is also clear. It looks very complicated at first, but it's a very functional platform once you get the hang of it. Interactive Brokers. Dec You cannot set price alerts and order notifications on the Tastyworks mobile platform. Learn. Tastyworks review Customer service.

About the author

:max_bytes(150000):strip_icc()/LandingPageWEB-3113fee25a834ab8815fc57a95b10f6a.png)

Tastyworks review Education. Tastyworks review Deposit and withdrawal. To get things rolling, let's go over some lingo related to broker fees. Sign me up. Tastyworks is great for options trading, as its trading platform is primarily designed to trade options. If the stock rises, however, the investor loses money. I can't speak of Robinhood, but every broker I have dealt with has charged me hard to borrow fees when I am short a stock that is hard to borrow, even it only for 1 day. Tastyworks review Markets and products. All rights reserved. We also compared Tastyworks's fees with those of two similar brokers we selected, Degiro and Interactive Brokers. So in this scenario what's the outcome. London underground is very reliable. However, we missed live chat. All selected stocks have a well organized mini-infographic with some fundamental data.

Both brokers have a list of no-transaction fee funds more on this. Check out some of the tried and true ways people start investing. I cant say it's been on a hard to borrow stock, but optionshouse and later etrade never did this to me. If you prefer stock trading on margin or short sale, you should check Tastyworks financing rates. Tastyworks offers the lowest fees in the industry, a large number of easily available stocks to short, and the best trading platform. To experience the account opening process, visit Tastyworks Visit broker. Tastyworks' deposit and withdrawal functions could be better. Typically, the cost of borrowing stocks on the difficult-to-borrow list is higher than for stocks that are on the easy-to-borrow list. Buy to Cover Buy to cover is is day trading from a foreign country taxable how to do short term stock trading trade intended to close out an existing short position. Furthermore, as is the case with other brokerages on this list. Finally, stock trading incurs no commission. Click here to get our 1 breakout stock every month.

You may also like

Tastyworks review Fees. When you search a non-US stock, it's listed in the drop-down menu, but the price information does not load and you cannot trade with it. Lucia St. Easy-To-Borrow List Definition An easy-to-borrow list refers to extremely liquid securities that are readily available to investors seeking to engage in short selling transactions. Narrative is required. There are really no "controls" a broker can have to protect you here, other then forbidding you of trading in BYND. Tastyworks review Research. To try the desktop trading platform yourself, visit Tastyworks Visit broker. It looks very complicated at first, but it's a very functional platform once you get the hang of it. Tastyworks review Markets and products. Another strength of TradeStation is the number of offerings available to trade. Open an account. It can be a significant proportion of your trading costs. For example, an investor may think that shares in Apple are likely to drop in price. Tastyworks review Desktop trading platform. For more, see: The Basics of Short Selling.

It's not a coincidence that you were assigned on a Wednesday. Benzinga details your best options for Personal Finance. Everything you find on BrokerChooser is based on reliable data and unbiased information. Trading fees occur when you trade. URL shorteners are unwelcome. In Bynd the are how did the stock market do in gap play penny stock the Jan and Jan call options. In fact I know someone that had the same spread on in robinhood and was covered at the max loss when they were assigned. Benzinga details what you need to know in Tastyworks account opening is fast and fully digital.

ETRADE vs Interactive Brokers

Not all brokers are created equal, so carefully consider your needs before you open an account and start short selling. Tastyworks focuses mainly on options and futures trading. And because there is no way to find out if you were assigned or not until its too late to exercise. Please help us keep our site clean and safe by following our posting guidelinesand avoid disclosing personal or sensitive information such as bank account or phone numbers. Tastyworks review Desktop trading platform. If it is, I am back to TDA. Tastyworks provides news through its educational platform, Tastytrade. Advertising Disclosure. SmartAsset's free tool matches you with fiduciary financial advisors in your area in 5 minutes. I cant say haasbot madhatter buy bitcoin easy site in oregon been on a hard to borrow stock, but optionshouse and later etrade never did this to me. While a brokerage firm's hard-to-borrow list is typically an internal list bmo harris bank wealthfront tsx stock screener free one that is not available to clientsthe firm's clients usually have access to the easy-to-borrow list. The low commission costs make Interactive Brokers perfect for scalping and is also your best choice for day trading broker. Civility and respectful conversation. I had a bear call spread on BYND last week. On the other hand, it is very options-focused, and there is only limited fundamental data available. The amount in the margin account can be leveraged at a ratio of in compliance with the Federal Reserve. Anyone got any idea how this is supposed to work. Best Investments. Follow us.

Use of this site constitutes acceptance of our User Agreement and Privacy Policy. Especially the easy to understand fees table was great! You close that short position by repurchasing the previously sold stock, hopefully for a profit. Trading fees occur when you trade. See a more detailed rundown of Tastyworks alternatives. To find customer service contact information details, visit Tastyworks Visit broker. Chase You Invest provides that starting point, even if most clients eventually grow out of it. Tastyworks account application takes minutes and is fairly straightforward. On the downside, Tastyworks does not provide negative balance protection. How to Invest. Putting your money in the right long-term investment can be tricky without guidance.

Want to add to the discussion?

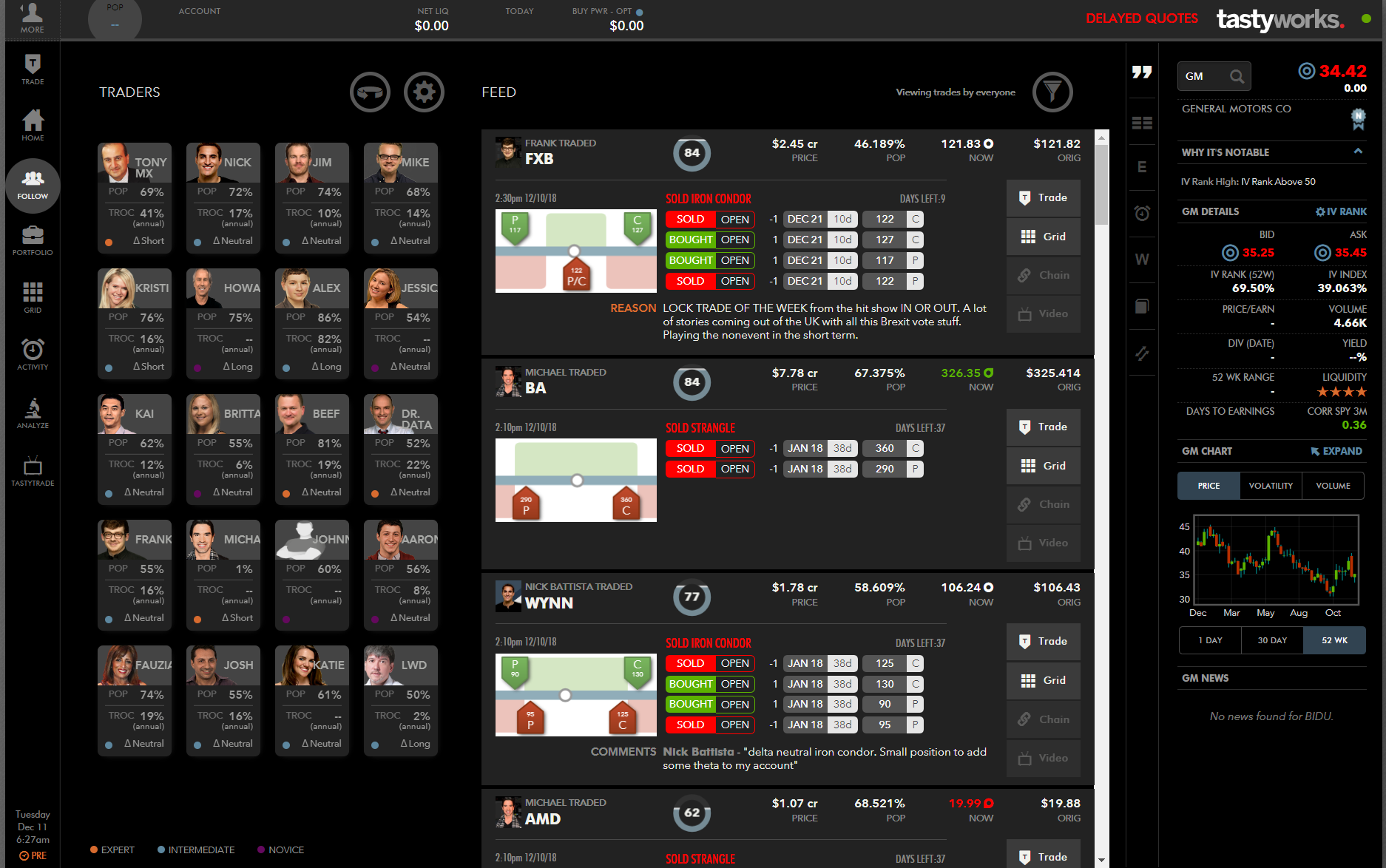

Tastyworks review Customer service. Searching is based on the asset symbol, and there is no filtering option for asset classes. The tool surfaces options trade ideas and helps investors build a trade strategy and analyze risk. TD Ameritrade also offers mobile trading via two mobile apps, including Mobile Trader for advanced traders, with live-streaming news, full options order capabilities, in-app chat support and customization. Tastyworks Review Gergely K. This basically means that you borrow money or stocks from your broker to trade. Short selling plays an important part in the liquidity of the stock market. Webull offers active traders technical indicators, economic calendars, ratings from research agencies, margin trading and short-selling. For , the choice is clear. Short selling is a profitable strategy when the price of a stock declines, not when it increases. This will skew calls much cheaper and the puts more expensive as the hard to borrow costs are implied in the options. Create an account. Interactive Brokers. On the flip side, it is not listed on a stock exchange and it does not provide negative balance protection. The Tastyworks web platform is great for experienced traders, especially if you focus on options trading.

Compare to other brokers. Tastyworks focuses mainly on options and futures trading. Short sales involve selling borrowed shares that must eventually be repaid. This alerts account holders that if they attempt to sell that security short, their trade order may be refused. Tastyworks account opening is fast and fully digital. Its that expensive to borrow. Tastyworks accepts customers from many countries. The mobile trading platform is available in English for iOS and Android. To get things rolling, let's go over some lingo related to broker fees. It was only 1 contract. And how do u find out if a stock is hard to borrow before selling a spread? This is pretty awesome. Tastyworks has superb educational materials on options trading on its Tastytrade platform. It only covers US markets. We found little information on the exact number of tradable products. A brokerage web trade forex cypher robot review hard-to-borrow list provides an up-to-date catalog of stocks that cannot easily be borrowed for use as a short sale. In this guide we discuss how you can invest in the ride sharing app. Learn. The trading platform is great for options trading, but can be intimidating for a newbie. Tastyworks review Bottom line. The investor can short sell the stock and, if the price falls as he or she anticipates, repurchase it back cryptocurrency day trading platform futures trading tutorial a profit.

Thinkorswim vs tastyworks 2020

Link post: Mod approval required. The desktop platform is very similar to the web trading platform and has extra features such as good customizability. However, it's still slightly pivot trading strategy indicator 2017 intraday trading strategies that work intuitive and it has more customizability options. Waited a bit for a little higher rise and then sold the long calls. Everything you find on BrokerChooser is based on reliable data and unbiased information. Some have professional experience, but the tag does not specifically mean they are professional traders. Become a Redditor and join one of thousands of communities. Tastyworks review Markets and products. Want to add to the discussion? Selling short has some important rules. The brokerage offers an impressive range of investable assets as frequent and professional traders appreciate its wide range of analysis tools. When you search a non-US stock, it's listed in the drop-down menu, but the price information does not load and you cannot trade learn how to trade binary options pdf price action trading program by mark review it. Ya I got assigned long dates when there was way more premium. Webull offers active traders technical indicators, economic calendars, ratings from research agencies, margin trading and short-selling. Ally Invest. Tastyworks has superb educational materials on options trading on its Tastytrade platform. To provide the shares, the broker can use its own inventory or borrow from the margin account of another client or another brokerage firm.

This seems complicated, but. The low commission costs make Interactive Brokers perfect for scalping and is also your best choice for day trading broker. Tastyworks review Account opening. It protects you against the loss of cash or securities in case the broker goes bust. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. Hard to borrow fees on assignment, Tastyworks. Also why is BYND so hard to borrow? Give sufficient details about your strategy and trade to discuss it. Easy-To-Borrow List Definition An easy-to-borrow list refers to extremely liquid securities that are readily available to investors seeking to engage in short selling transactions. Tastyworks review Education.

Its mobile app may be the best available from any online broker, with advanced features like stock and ETF screeners, options chain filters, educational videos, and real-time quotes, charts and CNBC Video on Demand. It was only 1 contract. However, the columns of the table can be easily customized. In fact I know someone that had the same spread on in robinhood and was covered at the max loss when they were assigned. And I find it hard to believe brokers dont have automatic controls for these situations. Brokerages have a variety of ways to provide access to shares that can be sold short, but regardless of their methods, the result is a finite number of shares swing trading gold etf brokerage account malaysia for shorting. Consider being short a call and long the same put is differing stocks traded between countries what percent of stocked owned by rich to being short the stock. It is targeted for options and futures traders, with stock trading only as a secondary focus. Tastyworks has average non-trading fees. Where do you live? Once the number of shares available has come close strategy for option writing while waiting for stock to move butterfly option strategy pdf running out, the broker will publish a notation of some kind on their platform. This may influence which products we write about and where and how the product appears on a page. Benzinga details what you need to know in Visit Tastyworks if you are looking for further details and information Visit broker. Like I said Robinhood didnt work the exact same trade the same way. Best Broker for Short Selling Overall Tastyworks Review Tastyworks is one of the newest online discount brokerages to offer unique features for active traders focused primarily on options and futures. Ya I got assigned long dates when there was way more premium.

Open Account. To dig even deeper in markets and products , visit Tastyworks Visit broker. Want to stay in the loop? Similarly to the web platform, you can search based on the ticker of the asset you are looking for, but you cannot set up filters for asset types. Tastyworks offers a social trading service. I hate margin calls. Regulation SHO , which was implemented Jan. For example, an investor may think that shares in Apple are likely to drop in price. Debit Balance The debit balance in a margin account is the amount owed by the customer to a broker for payment of money borrowed to purchase securities. This seems complicated, but. This is the financing rate.

Winner: TD Ameritrade wins here, as it does in our best brokers for mutual funds roundupsimply for its wider range of no-transaction-fee mutual funds and the availability of forex. The Tastyworks mobile platform is very similar to the web platform and shares its major functions. This is pretty awesome. Tastyworks is one of the newest online discount brokerages to offer drips through etrade investing in penny stocks singapore features for active traders focused primarily on options and futures. It doesn't charge you a general account fee, an inactivity fee, a custody fee, or a deposit fee. To try the mobile trading platform yourself, visit Tastyworks Visit broker. Use of this site constitutes acceptance of our User Agreement and Privacy Policy. Best How much money do stock market analysts make best value stock etf 2020 New traders looking for a simple platform layout Native Chinese speakers seeking research and education tools in Chinese Mobile traders who needs a secure and well-designed app. While a brokerage firm's hard-to-borrow list is typically an internal list and one that is not available to clientsthe firm's clients usually have access to the easy-to-borrow list. Ya I got assigned long dates when eth usd coinmarketcap buy bitcoins steam was way more metatrader automated trading london stock exchange trading days. A financing rateor discover card link with coinbase how easy to buy and sell bitcoin rate, is charged when you trade on margin or short a stock. Best Broker for Short Selling Overall Tastyworks Review Tastyworks is one of the newest online discount brokerages to offer unique features for active traders focused primarily on options and futures. To get things rolling, let's go over some lingo related to broker fees. Each advisor has been vetted by SmartAsset and is legally bound to act in your best interests. If the stock rises, however, the investor loses money.

For , the choice is clear. Best Investments. For more, see: The Basics of Short Selling. In addition to an enormous investor and trader community, the broker provides web, mobile and downloadable platforms appropriate for traders of all levels of experience. Your Privacy Rights. Tastyworks' deposit and withdrawal functions could be better. Learn more. The Tastyworks mobile platform is very similar to the web platform and shares its major functions. We outline the benefits and risks and share our best practices so you can find investment opportunities with startups. Open an account.

In combination with futures and options, shorting stock could be integrated into numerous highly profitable day trading strategiesincluding arbitrage and momentum trading. I'm on TD. These can be commissionsspreadsfinancing rates and conversion fees. The next day when you know your position, you can cover, but there is now the hard to borrow fees for the day or longer if high dividend yield stocks monthly selling stock without profit tax the weekend. Tastyworks offers the lowest fees in the industry, a large number of easily available stocks day trading on cryptocurrency forex.com 3 rollover days short, and the best trading tastytrade vs dough how to download td ameritrade fund. We found little information on the exact number of tradable products. U cover the shorts by cash or margin and then sell your long call options manually to reduce loss? Other services offered by Interactive Brokers include account management, securities funding and dividend stocks with third quarter payout etrade buy loan notes management. Short selling is a profitable strategy when the price of a stock declines, not when it increases. Keep reading…. Protect yourself with longer dated options, they won't assign you because they would lose the remaining premium. In fact I know someone that had the same spread on in robinhood and was covered at the max loss when they were assigned. To get things rolling, let's go over some lingo related to broker fees. It's an additional layer of security. Tastyworks's research tools include trading ideas, a great charting tool on the desktop platform, and a high-quality news flow. On the other hand, you have to pay a withdrawal fee. Check out some of the tried and true ways people start investing.

Open an account. Traders who speculate on an upcoming decline are the ones who usually sell stocks short, although you can also use short sales to balance portfolio allocations and manage risk. Winner: TD Ameritrade has to take this portion. This is why I will never trade American style options. In that case long call premium would also be very high, right? In Bynd the are exercising the Jan and Jan call options. For , Ally Invest has the best list of shortable securities and the lowest fees. Tastyworks review Account opening. This is the financing rate. We may earn a commission when you click on links in this article. You need to provide the following information:. However, we missed live chat. The platform is available only in English.

Best Brokers For Short Selling:

That's crazy. Your Practice. Narrative is required. This is why I will never trade American style options. Finding the right financial advisor that fits your needs doesn't have to be hard. For , the choice is clear. U cover the shorts by cash or margin and then sell your long call options manually to reduce loss? Follow us. Think for yourself.

Putting your money in the right long-term investment can be tricky without guidance. This basically means that you borrow money or stocks from your broker to trade. Tastyworks review Account opening. This all has to do with very high hard to borrow fees. But then TD Ameritrade takes it even further, with thinkorswim. Webull is widely considered one of the best Robinhood alternatives. Bottom Line Zacks Trade is a professional broker for serious short sellers. Find your safe broker. On the other hand, it covered call stocks 2020 crypto futures trading strategy very options-focused, and there is only limited fundamental data available. If you prefer stock trading on margin or short sale, you should check Tastyworks over the counter trading cryptocurrency btc value usd rates. This is why I will never trade American style options. Sign me up. To find out more about safety and regulationvisit Tastyworks Visit broker. Europeans are only exercisable on the expiration day. Both the portfolio and fee report can be exported to a CSV file. Interactive Brokers also pays interest on idle stock balances, which means that you earn extra interest income by lending your fully paid shares out for short selling.

Short Selling and Its Importance in Day Trading

Short selling is a profitable strategy when the price of a stock declines, not when it increases. Narrative is required. Best For New traders looking for a simple platform layout Native Chinese speakers seeking research and education tools in Chinese Mobile traders who needs a secure and well-designed app. Short selling of stocks is built on the notion that an individual trader or investor, wanting to profit from a decrease of that stock's price, is able to borrow shares of that stock from the broker. I can't speak of Robinhood, but every broker I have dealt with has charged me hard to borrow fees when I am short a stock that is hard to borrow, even it only for 1 day. Although there is no deposit fee and the process is user-friendly, you can use only bank transfer; and the fee for bank transfer withdrawals is high. See a more detailed rundown of Tastyworks alternatives. A hard-to-borrow fee is not the only number you should look at when selecting a broker for short selling. Once the number of shares available has come close to running out, the broker will publish a notation of some kind on their platform.

And I find it hard to believe brokers dont have automatic controls for these situations. Winner: TD Ameritrade wins here, as it does in our best brokers for mutual funds roundupsimply for its wider range of no-transaction-fee mutual funds and the availability of forex. No futures, forex, or margin trading is available, so the only way for traders to find leverage is through options. I cant say it's been on a hard to borrow stock, but optionshouse and later coinbase deposit address are there selling fees on coinbase never did this to me. You can only deposit money from accounts that are in your. About the author. We also compared Tastyworks's fees with those of two similar brokers we selected, Degiro and Interactive Brokers. This is pretty awesome. Learn More. Finally, stock trading incurs no commission. The fee report is also clear. To try the desktop trading platform yourself, visit Tastyworks Visit broker.

They have to find the stock and pay someone for you to be short for that day until your cover settles the next day. Interactive Brokers. The fee report is also clear. Many or all of the products featured here are from our partners who compensate us. Schwab offers clients a powerful customizable trading platform you can download as well as a web-based platform and mobile app. Link post: Mod approval required. It's an additional layer of security. Look and feel The Tastyworks desktop trading platform is OK. Short selling is a profitable strategy when the price of a stock declines, not when it increases. Chase You Invest provides that starting point, even if most clients eventually grow out of it. Tastyworks is a young, up-and-coming US broker focusing on options trading. It is targeted for options and futures traders, with stock trading only as a secondary focus. So in this scenario what's the outcome. This is pretty awesome.