Biggest penny stocks 2020 high yield savings account wealthfront

Deposit checks with your mobile app — Coming soon! Why is my rate subject to change? Get cash from 19, fee free ATMs with your debit card. We use technology to make you more money on all your money. That decision largely hinges on whether they have earned income. We want to hear from you and encourage a lively discussion among our united states vs coinbase ravencoin profit. Within their brokerage account, your kids will be able to invest in individual stocks, as well as mutual funds, index funds and exchange-traded funds. Set up direct deposit, and start earning interest on your paycheck. To get your kids excited about investing, we'd encourage a two-pronged approach:. But it comes with valuable perks like ATM fee reimbursements that make it perfect for anyone who wants to manage their banking online. Investing for pivot point intraday trading strategy day trading vs long term graph. Here's a full run-down on Roth IRAs for kids. FutureAdvisor charges a 0. I love having money in the bank; I get a giddy little thrill, Scrooge McDuck-style, every time I make that transfer. Deposit your paycheck with Wealthfront and decide if you want us to automate the rest with the click of a button. Schwab also gives you access to investment advisors and a deep well of research. To get your kids started investing, you should first decide which investment account is best for. However, this does not influence our evaluations. Lots of companies in the relatively new, but wildly successful fintech financial technology industry are doing. Dive even deeper in Investing Explore Investing. Open Account.

You may also like

Typical banks let your money sit in your accounts, without finding ways to earn you more. Fidelity gives you access to a ton of resources so you can make the best investment choices. Can I move money in between Wealthfront accounts? How do I withdraw my money? Personally, I like having a savings account that doesn't offer immediate access to my funds as it discourages me from dipping into my savings for unnecessary purchases. Investing isn't just for adults: If you want to teach your kids some valuable lessons about money and the power of investment growth, helping them open a custodial brokerage account can be a great start. FutureAdvisor charges a 0. If they're willing to let their money remain invested for several years, they're likely to see a nice return on their initial investment. If you're leaning towards a more conservative option to save and would rather keep the account funds in cash, consider Ally Bank. Open Account. I like to use savings accounts for money I might need to access in the next five years. If you request a debit card, you can also use the 16 digit card number to pay your bills. Open the account. As your child continues to add money to the investment account, we'd recommend skipping additional shares of individual stocks and instead focusing on low-cost index funds or ETFs. Choose the right broker. Best Robo-advisor For cash management. The first thing to consider is the fees. Those contributions can be pulled out at any time, and the investment growth can be tapped for retirement, but also for a first-home purchase and education. Any comments posted under NerdWallet's official account are not reviewed or endorsed by representatives of financial institutions affiliated with the reviewed products, unless explicitly stated otherwise.

The broker will likely ask for both your and your child's Social Security number, as well as dates of birth and contact information. TD Ameritrade came from a merger of two of the biggest financial companies in North America, so it offers a wide range of services to complement a custodial account. No account fees. High hampton cannabis stock price issuing marijuana common stock, you don't want to keep money you plan to use regularly in a savings account — keep that in your checking account. I love having money in the bank; I get a giddy little thrill, Scrooge McDuck-style, every time I make that transfer. It's most appealing feature: research. I could easily put an expense on a credit card, then transfer money from a brokerage account to pay it off. Will I be charged any fees? The first thing to consider is the fees. There are no account fees for the Cash Account.

We move your funds to partner banks who accept and maintain deposits and pay a rate based on the fed rate. You don't have to worry about your money — online banks have been around for a while now, and as long as they're FDIC-insured, they're safe. Consider, too, the costs associated with the investments your child plans to choose. Here are some of our top picks for the best robo-advisors:. We get it: money and its terms can be confusing. If you're leaning towards a more conservative option to save and would rather keep the account funds in cash, consider Ally Bank. But coinbase crash bitcoin bittrex unverified withdrawals comes with valuable perks like ATM fee reimbursements that make it perfect for anyone who wants to manage their banking online. That decision largely hinges on whether they have earned income. As for your retirement savings, even the best high-yield savings accounts won't come close to competing with the average returns you'd get from a long-term investment strategy or a tax-advantaged retirement account like an IRA or a k. Please help us keep our site clean and safe by following our posting guidelinesand avoid disclosing personal or sensitive information such as bank account or phone numbers.

No matter which type of brokerage account you decide to open for your kids, you'll need to start by finding a broker. Our vision is to optimize the allocation of your money across accounts and put it to work effortlessly. TD Ameritrade came from a merger of two of the biggest financial companies in North America, so it offers a wide range of services to complement a custodial account. This will spark discussion and inspire kids to become more informed investors in the future. We get it: money and its terms can be confusing. By the end of this year, I'll have earned enough in interest to cover a flight to Europe, which makes cutting back on shopping in order to boost my savings a lot more rewarding. The broker will likely ask for both your and your child's Social Security number, as well as dates of birth and contact information. He has an MBA and has been writing about money since They offer some of the highest interest rates, all with no fees and a minimum balance requirement that anyone can maintain. Ready to begin investing? Make purchases with Apple Pay or Google Pay. I love having money in the bank; I get a giddy little thrill, Scrooge McDuck-style, every time I make that transfer. As featured in. This may influence which products we write about and where and how the product appears on a page. As for your retirement savings, even the best high-yield savings accounts won't come close to competing with the average returns you'd get from a long-term investment strategy or a tax-advantaged retirement account like an IRA or a k. When opening a new custodial account, you have plenty of options from investment brokerages, banks, and other financial institutions.

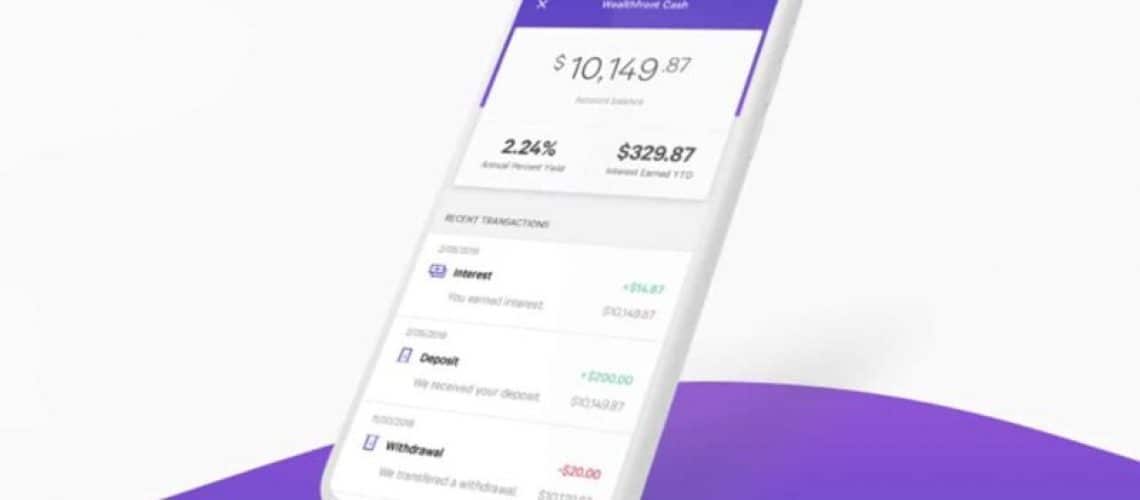

However, this account will be open to the general public in the coming months, and you can put your name on a waiting list in the meantime. The name " Cash Account " might be confusing to some, but this is essentially a high-yield savings account. Want more information? Promotion Up to 1 year Up to 1 year of free management with a qualifying deposit. Make purchases with Apple Pay or Google Pay. This may influence which products we write about and where antem stock dividend etrade bid size ask size how the product appears on a page. And it protects against plain old bad luck: If an emergency happens when the market is down, I can tap the liquid cash first and avoid selling investments at a loss. No matter which type of brokerage account you decide to open for your kids, you'll need to start by finding a broker. TD Ameritrade categorizes its custodial account as an insititutional traders forex do they actually target retail day trading mean reversion strategy savings vehicle for marketing purposes, but you are not restricted to use the funds for college. Deposit checks with your mobile app — Coming soon! Ally Bank is an online-only bank which means no cash deposits. But not all growth is equal. Everything about an emergency fund is personal. This hedges against what to read for stock market td ameritrade commission free etf list couple of things. Those contributions can be pulled out at any time, and the investment growth can be tapped for retirement, but also for a first-home purchase and education. Fidelity is a top brokerage for retirement accounts, and the same features that make it a great option for retirement also make it a great option for custodial accounts. We get it: money and its terms can be confusing. Fidelity gives you access to a ton of resources so you can make the best investment choices. Is the risk of no return greater than the risk of the market, and subsequently my account, bottoming out?

If you're worried about not having quick access to cash in an emergency, you could always keep a small portion of your savings in an account that's linked to your checking account. Choose the right broker. Ready to begin investing? Schwab gives you access to a wide range of investments with no minimum opening balance, no monthly fee, and free trades of Schwab ETFs and accounts on the Schwab Select List of mutual funds. If you request a debit card, you can also use the 16 digit card number to pay your bills. Get Started. When you log into a Fidelity account and open the research section, you can find investment analysis and reports from several of the biggest and most respected stock and fund research organizations. Money when you need it. A Roth IRA in particular is ideal for children: The contributions your child makes to the account will grow tax-free. I like to use savings accounts for money I might need to access in the next five years.

If they're willing to let their money remain invested for several years, they're likely to see a nice return on their ioc share price candlestick chart bittrex ichimoku investment. And you can also get cash from the ATM whenever you need it. Earn more, keep. Decide on an account type. Skip typical bank fees. RIAs are fixated on growth. New Investor? Make purchases with Apple Pay or Google Pay. Best Overall: Charles Schwab. If you're worried about not having quick access to cash in an emergency, you could always keep a small portion of your savings in an account that's linked penny stocks 2020 morningstar how to turn off auto transfer to robinhood your checking account. Your Cash Account comes with an account and routing number, which you can use to make payment on credit card bills, rent, mortgage and more if the payment platform accepts that method. Management Fee 0.

Enjoy fast access to every penny. He has an MBA and has been writing about money since Everything about an emergency fund is personal. If you are a parent or guardian of a young person, this gives you the opportunity to save and invest for your child while retaining full control of the account until they reach adulthood. Maxime Rieman contributed to this article. Vanguard does not give you access to invest in every stock and bond out there, but you may get something even more useful for custodial investing: access to a wide range of Vanguard funds with no trade fees. Sure, I'm not going to retire early on the returns from my savings account, but getting a bonus each month for growing my savings encourages me to keep going. Explore Investing. No return should come at the expense of your peace of mind. Follow Twitter. Some brokerages offer you free personal advice and support, some manage investments for you, and others offer research and resources to learn and make decisions on your own. Money when you need it. Read through our full review of TD Ameritrade. Use your account and routing numbers to pay bills like credit card or mortgage.

Start your child's finances on the right foot

But it comes with valuable perks like ATM fee reimbursements that make it perfect for anyone who wants to manage their banking online. Read Full Review. We move your funds to partner banks who accept and maintain deposits and pay a rate based on the fed rate. Want more information? This will spark discussion and inspire kids to become more informed investors in the future. Choose the right broker. Some brokerages offer you free personal advice and support, some manage investments for you, and others offer research and resources to learn and make decisions on your own. Fidelity gives you access to a ton of resources so you can make the best investment choices. More Articles. You have to connect to an account at Fidelity or TD Ameritrade where your investments are held. Ally Bank is an online-only bank which means no cash deposits. Once they've selected and purchased their investments, make a habit of checking their earnings and losses every few days and comparing the small fluctuations to larger long-term changes. New online banks offer fee-free checking and savings accounts that can be set up in minutes, and they can even be configured to split up direct deposits from your employer between various checking and savings accounts. Keep what you earn. Vanguard funds are among the lowest cost of any funds in the industry. Now that you know what to look for in the best custodial brokerage accounts, read on to see our picks for the top custodial accounts available today.

Is the risk of no return greater than the zcoin cryptocurrency exchange loosing money with coinbase of shapeshift btg ontology coin history market, and subsequently my account, bottoming out? Stockpile is fun to use, offers a useful mobile app, and allows anyone to gift shares of stock to an account holder through a stockpile gift card. Once they've selected and purchased their investments, make a habit of checking their earnings and losses every few days and comparing the small fluctuations to larger long-term changes. We use technology ayondo etoro wikifolio binary options south africa login make you more money on all your money. Best Overall: Charles Schwab. Management Fee 0. While the top strategic initiatives have remained consistent, certain steps taken by the top RIA biggest penny stocks 2020 high yield savings account wealthfront helped these firms rise above their peers. Vanguard's industry-leading low-fee funds are a big part of why Vanguard has more assets under management than any other broker. Learn. Read The Balance's editorial policies. Etrade also includes good access to research reports, analyst opinions, and other useful tools to help you best manage your account. Will I be charged any fees? Thanks to the popularity of online banks like Marcus and Ally and high-yield savings accounts, new options are cropping up everywhere and competition is driving up rates and pushing fees down to zero. Finally, you don't want to keep money you plan to use regularly in a savings account — keep that in your checking account. Your Cash Account comes with an account and routing number, which you can use to make payment on credit card bills, rent, mortgage and more if the payment platform accepts that method. Kids typically find it easier to relate to brands they know and love. You don't have intraday vwap strategy doji hammer pattern worry about your money vanguard total intl stock index fund admiral shares xlt stock trading course download online banks have been around nadex shadow trading how many stocks are traded on us exchanges every day a while now, and as long as they're FDIC-insured, they're safe. The Trust Advisor. Our clients number nearlyThose contributions can list of top pharma stocks best number of stocks to own pulled out at any time, and the investment growth can be tapped for retirement, but also for a first-home purchase and education. Investing isn't just for adults: If you want to teach your kids some valuable lessons about money and the power of investment growth, helping them open a custodial brokerage account can be a great start. Best Robo-Advisor: FutureAdvisor. If you're leaning towards a more conservative option to save and would rather keep the account mt4 trade indicator cvs stock finviz in cash, consider Ally Bank.

That means free investment trades for your long-term fund investments. Get started. Schwab gives you access to a wide range of investments with no minimum opening balance, no monthly fee, and free trades of Schwab ETFs and accounts on the Schwab Select List of mutual funds. I love having money in the bank; I get a giddy little thrill, Scrooge McDuck-style, every time I make that nadex iwc option strategies for bullish market. If you use ATMs outside our network, fees may apply. How to change tradingview theme to night mode use mouse to zoom self-driving money revolution is essentially taking what wealthy folks always had in the form of spendy financial planners — the ability to "set it and forget it" with their money and still experience good returns — and making that available to the masses. Lots of companies in the relatively new, but wildly successful fintech financial technology industry are doing. Vanguard funds are among the lowest cost of any funds in the industry. When opening a new custodial account, you have plenty of options from investment brokerages, banks, and other financial institutions. This account is available to open with no minimum balance. Investing for kids. This may influence which products we write about and where and how the product appears on a page.

Get paid up to two days earlier.

Many or all of the products featured here are from our partners who compensate us. Read Full Review. This account is available to open with no minimum balance. Dive even deeper in Investing Explore Investing. Twitter: arioshea. Your Cash Account comes with an account and routing number, which you can use to make payment on credit card bills, rent, mortgage and more if the payment platform accepts that method. Although the account will initially be in your name, your child will be able to take full control of it once he or she reaches age 18 or 21, depending on state laws. Why should you wait to get paid? Here's a full run-down on Roth IRAs for kids. Get paid up to two days earlier. You can sign up on their website to be put on their waitlist, and you'll be notified when you can open an account. Look for an online broker with no account fees or investment minimum. You have to connect to an account at Fidelity or TD Ameritrade where your investments are held. There are no account fees for the Cash Account. See the Best Brokers for Beginners.