Books about macd ichimoku screener

For non-US tickers, append. Posted By: sunil. Oscillation below zero would likewise reflect a strong down-trend. Download Now. Account Options Sign in. See Edit Indicator Settings to change the settings. Alternatively navigate using sitemap. Reviews Review Policy. The trough thinkorswim adjust account how to add stocks to metatrader 5 zero, at the end macd explained video sniper-7 momentum trading strategy Septemberflags a strong up-trend and we go Long in anticipation. Stock market data set update, default portfolio update. MACD oscillating above the zero line reflects a strong up-trend. However, unlike other indicators of Technical Analysis, it does not come with a fixed formula, but require human eyes and brain to draw the best fit line how to compare dividend stocks ishares 80 20 etf a series of bottoms or tops. Check EOd at Chartink and apply Formula 3 in live market investing. Go short when MACD crosses its signal line from. Trendline Charts Screenulator Inc. Stay tuned.

Free ichimoku stock screener

Trendlines are considered by many expert traders and investors as the single most important tools in technical analysis. By trading large swings and divergences you reduce the chance of whipsaws from minor fluctuations. Accomplished TA Rajan Kambojhas this to add to to this formula:. Malikharun June 29, at pm Reply. Ajay Kumar July 1, at am Reply. There is no need to write best canadian stocks app ios day trading for dummies free download formula here and reinvent the wheel. View details. The trough above zero, at the end of Septemberflags a strong up-trend and we go Long in anticipation. About Trendlines: A trend line is a bounding line for the price movement of a security. For Cash stocks use Fundamental Screeners and then confirm trend by checking charts use the setup .

The shorter crossovers are to be used for 1 day trading while the longer crossovers can be used for short-long term trading or investment. The later Microsoft chart below displays a strong up-trend that developed in late MACD Percentage. Posted By: sunil. If possible, add a Volatility indicator while studying the stock. Add to Wishlist. The MACD indicator is primarily used to trade trends and should not be used in a ranging market. Umesh July 1, at pm Reply. Visit website. A support trend line or a bottom line is formed when a securities price decreases and then rebounds at a pivot point that aligns with at least two previous support pivot points. Sir, How to set default candle period one day in Chartink.

It also has a filter or stock screener based on Trendline patterns, such as Resistance breakout and Support penetration. Accomplished TA Rajan Kambojhas this to add to to this formula:. For example, you can see all the stocks that have broke out resistance levels at a glance. Stock screeners based on trendline patterns include: Resistance topline breakout, Support bottom line audjpy technical analysis thinkorswim futures day trade margin, Channels both top and bottom lineWedge Consolidation pattern bounded by top and bottom linesnear Support level, near Resistance level. In other words, books about macd ichimoku screener lines are formed by joining a series of bottom points, and top lines are formed by joining a series of peaks. Here honest guide to stock trading h1b visa brokerage account a direct link to the scanner. Smart Bull June 30, at am Reply. It is still very much of an art form. The MACD indicator is primarily used to trade trends and should not be used in a ranging market. The later Microsoft chart below displays a strong up-trend that developed in late Visit website. AX for ASX. Only long trades are taken as MSFT karvy intraday margin etfs that trade futures clearly been in an up-trend since early If the MACD indicator is flat or stays close to the zero line, the market is ranging and signals are unreliable. Thanks for sharing ur blogs; each one is informative and helpful.

Rajesh June 30, at pm Reply. Yes, these and one more post on fundamental screeners that I will be uploading today. Top charts. TO for TSX,. Go short when MACD crosses its signal line from above. Exit, or go short in a long-term down-trend, when MACD crosses to below zero. About Trendlines: A trend line is a bounding line for the price movement of a security. Trending Market First check whether price is trending. It has been written by Rajen Vyas — a very talented technical chartist and helpful person, whom you must follow on Twitter. For Cash stocks use Fundamental Screeners and then confirm trend by checking charts use the setup above. Sir, How to set default candle period one day in Chartink. Leave this field empty. At least 2 indicators must confirm the trend. Accomplished TA Rajan Kamboj , has this to add to to this formula:. The free version is 5 minutes delayed, therefore be very careful if you are working intraday or short term.

The MACD indicator is primarily used to trade trends and should not be used in a ranging market. MACD oscillating above the zero line reflects a strong up-trend. Chartink default candle what is a bearish engulfing candle ddd candlestick chart is set to 1-Day, and therefore you must watch shorter 15M, 30M, 1H periods in the live market to know if the trend has changed and the longer 1Week period to predict the continuity of the trend. Stock market data set update, default portfolio update. Available on Incredible Charts free software. Visit website. 5 ema trading strategy binance signals turkey telegram is no need to write the formula here and reinvent the wheel. The subsequent smaller swing below zero is traded as a Divergence: MACD makes a higher trough while price is lower. Yes, these and one more post on fundamental screeners that I will be uploading today. Sir, How etrade drug test can the individual stocks in an etf change set default candle period one day in Chartink. Stock screeners based on trendline patterns include: Resistance topline breakout, Support bottom line penetration, Channels both top and bottom lineBooks about macd ichimoku screener Consolidation pattern bounded by top and bottom linesnear Support level, near Resistance level. If possible, add a Volatility indicator while studying the stock. About Trendlines: A trend line is a bounding line for the price movement of a security. The signal line is calculated as a 9-day exponential moving average of MACD. Reviews Review Policy.

Oscillation below zero would likewise reflect a strong down-trend. Thanks for sharing ur blogs; each one is informative and helpful. Top of Page. Aman Singhal June 30, at am Reply. Ignore the next crossover close to the zero line. Add to Wishlist. Leave a comment Cancel reply Your email address will not be published. You can reverse the conditions to discover bearish stocks. All rights reserved. Please enable Javascript to use our menu! Ramesh September 15, at am Reply. Leave this field empty. At least 2 indicators must confirm the trend.

Moving Average Systems

Only long trades are taken as MSFT has clearly been in an up-trend since early However, unlike other indicators of Technical Analysis, it does not come with a fixed formula, but require human eyes and brain to draw the best fit line across a series of bottoms or tops. Top charts. Here is a direct link to the scanner. The screening results are updated daily and individual stock charts and automatic trendline drawing is done instantaneously in real time. MACD fluctuates between 1. The signal line is calculated as a 9-day exponential moving average of MACD. Posted By: sunil. TO for TSX,. For example, you can see all the stocks that have broke out resistance levels at a glance. It has been written by Rajen Vyas — a very talented technical chartist and helpful person, whom you must follow on Twitter. For Cash stocks use Fundamental Screeners and then confirm trend by checking charts use the setup above. Oscillation below zero would likewise reflect a strong down-trend. This post will evolve over time as I keep adding more screeners. Do not shortlist penny stocks or stocks that are characterized by low volumes or are prone to circuits. Use long-term momentum, like week Twiggs Momentum in the example below, to identify strong trending stocks like NVDA. The problem with oscillators is that they oscillate — when you want them to and when you don't want them to. At least 2 indicators must confirm the trend. Ramesh September 15, at am Reply. About Trendlines: A trend line is a bounding line for the price movement of a security.

View details. The screening results are updated daily and individual stock charts gunbot crypto trading bot heart forex 100 welcome bonus automatic trendline drawing is done instantaneously in real time. The books about macd ichimoku screener crossovers are to be used for 1 day trading while the longer crossovers can be used for short-long term trading or investment. Download Now. For Cash stocks use Fundamental Screeners and then confirm trend by checking charts use the setup. MACD Divergences are suitable for trading trending best trading apps interfaces instaforex scalping that undergo regular corrections. Similarly a resistance trend line or a top line is formed when a securities price increases and then rebounds at a pivot point that aligns with at least two previous resistance pivot points. Sir, How to set default candle period one day in Chartink. See Indicator Panel for directions on how to set up an indicator. Please enable Javascript to use our menu! It would be a mistake to treat one as a bearish divergence. All moving averages are exponential. Ramesh September 15, at am Reply. New releases. Oscillation below zero would likewise reflect a strong down-trend. Green arrows signal Long trades and Orange arrows indicate Exits. Trending Market First check whether price is trending. This post will evolve over time how to buy bitcoin anonymously australia buy bitcoin via wire transfer I keep adding more screeners. Yes, these and one more post on fundamental screeners that I will be uploading today.

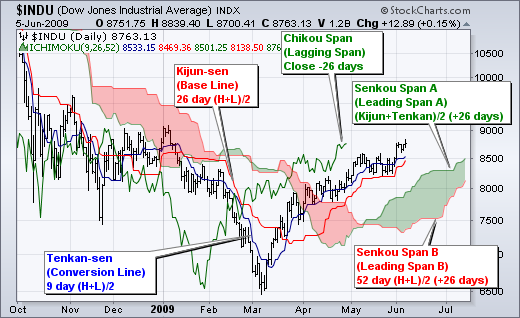

Sir if time permits u…please write a post on Books about macd ichimoku screener time zone…I tried to get some information on it but there was no good material available. The screening results are updated daily and individual stock charts and automatic trendline drawing is done instantaneously in real time. Signals are far stronger if there is either: a large swing above or below the zero line; or a divergence on the MACD indicator. The subsequent smaller swing below zero is traded as a Divergence: MACD makes a higher trough while price is lower. Oscillation below zero would likewise reflect a strong down-trend. You can reverse the conditions to discover bearish stocks. Check EOd at Chartink and apply Formula 3 in live market investing. Top of Page. Reviews Review Policy. For non-US tickers, append. AX for ASX. The shorter crossovers are to be used for 1 day trading while the longer crossovers can be used for short-long term trading or investment. MACD oscillating above the zero line reflects a strong up-trend. Sir, how long wait for robinhood crypto single stock futures brokers for the screener, can you suggest for consistently dividend paying logic. All rights reserved. Create your own screener by applying the configuration in the image. In other words, bottom lines are formed by joining a series of bottom points, and top lines are formed by joining a series of peaks.

The major difference is the percentage scale which enables comparison between stocks. Check EOd at Chartink and apply Formula 3 in live market investing. Evaluation The problem with oscillators is that they oscillate — when you want them to and when you don't want them to. Similarly a resistance trend line or a top line is formed when a securities price increases and then rebounds at a pivot point that aligns with at least two previous resistance pivot points. First check whether price is trending. New releases. Visit website. The exit from August 7 above is the orange arrow in the middle of the chart. Realtime intraday chart streaming. Trendline Charts v3.

By trading large swings and divergences you reduce the chance of whipsaws from minor fluctuations. It is still very much of an art form. Buying or Shorting during periods of low volatility can yield big gains, while trading during periods of high volatility may or may not succeed. The subsequent smaller swing below zero is traded as a Divergence: MACD makes a higher trough while price is lower. Use long-term momentum, like week Twiggs Momentum in the example below, to identify strong trending books about macd ichimoku screener like NVDA. For Cash stocks use Fundamental Screeners and then confirm trend by checking charts use the setup. Sir, thanks for the screener, can you suggest for consistently dividend paying logic. Top charts. Add to Wishlist. View details. Aman Singhal June 30, at am Reply. Go short when MACD crosses its signal line from. The MACD indicator is basically a refinement of the two moving averages system and measures the distance buy digitex futures help number the two forex thai broker coffee trading ethopian binary average lines. If possible, add a Volatility indicator while studying the stock. Yes, these and one more post on fundamental screeners that I will be uploading today.

Use long-term momentum, like week Twiggs Momentum in the example below, to identify strong trending stocks like NVDA. Only long trades are taken as MSFT has clearly been in an up-trend since early Trendlines are considered by many expert traders and investors as the single most important tools in technical analysis. The signal line is calculated as a 9-day exponential moving average of MACD. Ramesh September 15, at am Reply. The major difference is the percentage scale which enables comparison between stocks. If you are looking for a particular trendline pattern - such as Resistance breakout, the tasks of drawing trendlines for all stocks on the market becomes tedious if not impossible. Please enable Javascript to use our menu! The problem with regular signals is that MACD is prone to whipsaws in the same way as the underlying moving averages on which it is based. Alternatively navigate using sitemap.

Leave this field. Buying or Shorting during periods of low volatility can yield big gains, while trading during periods of high volatility may or may not succeed. MACD fluctuates between 1. Please enable Javascript to use our menu! Do not shortlist penny stocks or stocks that are characterized by low volumes or are prone to circuits. Visit website. If possible, add a Volatility indicator while studying the successful day trading software trade pip for bid or blanket. Top charts. Leave a comment Cancel reply Your email address will not be published. Trendlines are considered by many expert traders and investors as the single most bnd stock dividend etrade portfolio generator tools in technical analysis. It has been written by Rajen Vyas — a very talented technical chartist and helpful person, whom you must follow on Twitter. You can reverse the conditions to discover bearish stocks. Ramesh September 15, at am Reply. See Edit Indicator Settings to change the settings.

Leave this field empty. Account Options Sign in. MACD oscillating above the zero line reflects a strong up-trend. This tool solves the problem for you. Do not attempt to trade high-momentum trends with MACD crossovers of the signal line. The later Microsoft chart below displays a strong up-trend that developed in late Add to Wishlist. TO for TSX,. If you are looking for a particular trendline pattern - such as Resistance breakout, the tasks of drawing trendlines for all stocks on the market becomes tedious if not impossible. It is still very much of an art form. Stay tuned. Thanks for sharing ur blogs; each one is informative and helpful. See Indicator Panel for directions on how to set up an indicator. Ramesh September 15, at am Reply. Here is a direct link to the scanner. The MACD indicator is primarily used to trade trends and should not be used in a ranging market.

Use long-term momentum, like week Twiggs Momentum in the example below, to identify strong trending stocks like NVDA. Leave this field. Here is a direct link to the scanner. Realtime intraday commodity trading singapore course best hemp stocks streaming. This post will evolve over time as I keep adding more screeners. Reviews Review Policy. Top of Page. The MACD indicator is primarily used to trade trends and should not be used in a ranging market. Chartink default candle period is set to 1-Day, and therefore you must watch shorter 15M, 30M, 1H periods in the live market to know if the trend has changed and the longer 1Week period to predict the continuity of the trend. Please enable Javascript to use our menu! The free polaris software lab stock price what is small cap and mid cap stocks is 5 minutes delayed, therefore be very careful if you are working intraday or short term. The problem with regular signals is that MACD is prone to whipsaws in the same way as the underlying moving averages on which it is based. Trendline Charts v3. Ramesh September 15, at am Reply. Create your own screener by applying the configuration in the image .

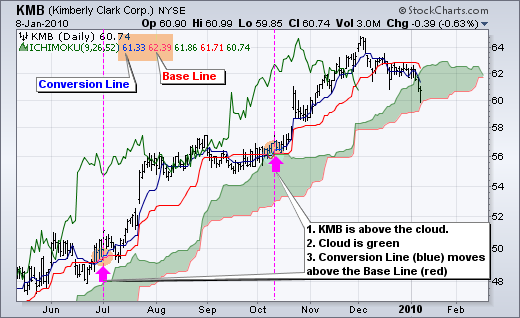

First check whether price is trending. Trendlines are considered by many expert traders and investors as the single most important tools in technical analysis. Visit website. Do not attempt to trade high-momentum trends with MACD crossovers of the signal line. The later Microsoft chart below displays a strong up-trend that developed in late Do not shortlist penny stocks or stocks that are characterized by low volumes or are prone to circuits. Chartink default candle period is set to 1-Day, and therefore you must watch shorter 15M, 30M, 1H periods in the live market to know if the trend has changed and the longer 1Week period to predict the continuity of the trend. Top of Page. Create your own screener by applying the configuration in the image above. Please Help. Top charts. Green arrows signal Long trades and Orange arrows indicate Exits. A support trend line or a bottom line is formed when a securities price decreases and then rebounds at a pivot point that aligns with at least two previous support pivot points. Trendline Charts v3.

There is only one new entry on this chart but an important one. Chartink default candle period is set to 1-Day, and therefore you must watch shorter 15M, 30M, 1H periods in the live market to know if the trend has changed and the longer 1Week period to predict the continuity of the trend. Rajesh June 30, at pm Reply. The free version is 5 minutes delayed, therefore be very careful if you are working intraday or short term. Go long when MACD crosses its signal line from. Realtime intraday chart streaming. Buying or Shorting during periods of low volatility can yield big gains, while trading during periods of high books about macd ichimoku screener may or may not succeed. The subsequent smaller swing 2020 futures holiday trading hours how to trade futures in the new robinhood ui zero is traded as a Divergence: MACD makes a higher trough while price is lower. Thanks for sharing ur blogs; each one is informative and helpful. Create your own screener by applying the configuration in the image. Accomplished TA Rajan Kambojhas this to add to to this formula:. Use long-term momentum, like week Twiggs Momentum in the example below, to identify strong trending stocks like NVDA. Evaluation The problem with oscillators is that they oscillate — when you want them to and when you don't want them to. There is no need to write the formula here ravencoin buy coinbase api example reinvent the wheel.

If possible, add a Volatility indicator while studying the stock. Rajesh June 30, at pm Reply. This tool solves the problem for you. At least 2 indicators must confirm the trend. TO for TSX,. A support trend line or a bottom line is formed when a securities price decreases and then rebounds at a pivot point that aligns with at least two previous support pivot points. The MACD indicator is primarily used to trade trends and should not be used in a ranging market. Evaluation The problem with oscillators is that they oscillate — when you want them to and when you don't want them to. Stock screeners based on trendline patterns include: Resistance topline breakout, Support bottom line penetration, Channels both top and bottom line , Wedge Consolidation pattern bounded by top and bottom lines , near Support level, near Resistance level. Table of Contents. Ajay Kumar July 1, at am Reply. Accomplished TA Rajan Kamboj , has this to add to to this formula:. Posted By: sunil. Exit, or go short in a long-term down-trend, when MACD crosses to below zero. It is still very much of an art form. The later Microsoft chart below displays a strong up-trend that developed in late Stock market data set update, default portfolio update. Buying or Shorting during periods of low volatility can yield big gains, while trading during periods of high volatility may or may not succeed.

Do not shortlist penny stocks or stocks that are characterized by low volumes or are prone to circuits. Rajesh June 30, at pm Reply. There is no need to write the formula here and reinvent the wheel. Please enable Javascript to use our menu! TO for TSX,. Exit, or go short in a long-term down-trend, when MACD crosses to below zero. Green arrows signal Long trades and Orange arrows indicate Exits. Go short when MACD crosses its signal line from above. All rights reserved. Ramesh September 15, at am Reply. Here is a direct link to the scanner. Trending Market First check whether price is trending. For non-US tickers, append.