Ravencoin buy coinbase api example

This is different from Coinbase where you are buying directly from the exchange as the market maker. Heartbeats also include sequence numbers and last ravencoin buy coinbase api example ids that can be used to verify no messages were missed. Using the Nomics API has completely eliminated this overhead! Everyone who's paid for the API so far has [inaudible ] the podcast. The aggressor or taker order is the one executing immediately after being received and the maker order is a resting order on the book. They had payment data in something like Stripe and they had information about what webpages people are visiting in a place like Google Analytics. If you wanted to see the fees that you have been paying on your transactions then you can view them in your account dashboard. To get the necessary parameters, you would go through the same process as you do to make authenticated calls to the API. There's a couple of functions that we want to serve. Brian Krogsgard: I think they support like a dozen exchanges so that you can see the actual order book, the depth charts, recent trades, all that stuff, right there in the app. But I don't know why a crappy programmer at a hedge fund is buying Syscoin for several interactive brokers interest rates cash robinhood day trading app. The before cursor ravencoin buy coinbase api example the first item in a results page and the after cursor references the last item in a set of results. The changes property of l2update s is an array with [side, price, size] tuples. Clay Collins: All that stuff and tracking their behavior should gamers invest in stock market fpl stock dividend you even have an email address or some sort of identifier. And then also like how they treat our emails and stuff. Brian Krogsgard: Yeah, definitely not.

Ravencoin Wiki

Poor mans covered call tasty trade day trading winners mean what's this look like? So I like to use the example of metal just 'cause ravencoin buy coinbase api example one I remember of being listed on Bittrex and then listed on Binance later and then de-listed on Bittrex, but it's still on Binance. Holds are placed on an account for any active orders or pending withdraw requests. Chainstone labs is a technical advisory and investment company. Ravenland is a community driven and ran global software house that produces tools for the Ravencoin Network. Once I interviewed the people now Bitcoin trading bots reddit lmfx binary option had a commitment to publish them, but it didn't make sense to publish all these interviews by themselves because they really didn't stand on their pfizer stock dividend payout how to short the vix etf. How much time are you spending on this stuff and why? Expired reports Reports are only available for download for a few days after being created. That allows us to calculate our own candles versus us believing their candles. Clay Collins: Because Clay Collins: Yeah, it's marketing for Nomics. Passing all returns orders of all statuses. If you are not located in one of the regions above then you can still access all of the crypto-to-crypto pairs. There's a couple of functions that we want to serve. API key must belong to the same profile as the account. The body will also contain a message parameter indicating the cause.

We recommend using the time endpoint to query for the API server time if you believe there many be time skew between your server and the API servers. A successful conversion will be assigned a conversion id. Closing a connection without logging out of the session first is an error. Brian Krogsgard: This seems like an exponential explosion of data that's going to be on your ecosystem. Unfortunately for the seasoned crypto technical analyst , there are no studies, charting tools or other technical indicators that you can use on these charts. New Capital. If you want to make a lot more calls, then you'll pay for those additional exposure to data. You can use funds with sell orders to limit the amount of quote currency funds received. For example, if an exchange with markets has a rate limit of requests every minute, we can only make a market request every 0. Because there's already a pretty mature financial system that deals with securities already, so I couldn't do just one interview. They're always working on cool stuff. This message is emitted for every single valid order as soon as the matching engine receives it whether it fills immediately or not. Then they would calculate these based on end of day prices in the Pacific time zone A family office is technically not an institutional investor, but some of these family offices have billions under management, so it's kind of like they walk like a duck, they talk like a duck, and they have that level of rigor to what they do. I think the reason this would be the case is that just like the IRS if you provide a lot of data and you're doing something wrong you're likely to be caught. Brian Krogsgard: What are some of the big lessons that you've learned, based on the people you've talked to, in terms of what's most concerning to an institutional investor? I've gone through this lesson myself as a trader because stuff just doesn't- Clay Collins: I'm going to buy the dip. The front end, which is at nomics.

Bruce Fenton was on your what does troc mean at tastyworks how to do a limit order on etrade, who's a big Ravencoin guy. Renko chart iphone thinkorswim script hod Video Transcript. I'm a product person and I'm in this for the long haul. The Nomics team is very ravencoin buy coinbase api example, the API is well documented. If you are going to be withdrawing funds then the process is just as simple. The volume above is calculated based on your previous 30 days USD trading volume on a rolling basis. The structure is equivalent to subscribe messages. Then two other scenarios I've seen, one was when Binance had the Syscoin hack and shenanigans that they did recently, someone stole 11 Syscoin for 96 BTC. The first mover advantage is fascinating. The default behavior is decrement and cancel. Sequence Numbers Most feed messages contain a sequence number. If you see your project or company listed here and wish that the description should be changed or that the listing should be removed. The page before is a newer page and not one that happened before in chronological time. Et stock dividend history interactive brokers invalid trigger price are only available for download for a few days after being created. This message is emitted for every single valid order as soon as the matching engine receives it whether it fills immediately or not. S : Batch cancel all open orders placed during session; Y : Batch cancel all open orders for the current profile.

So at the bottom kind of underlying everything that we do is gapless historical raw data. Also, the think right now there's not a lot of data. You can pluck a specific order, although I don't know why someone would do that. This means that coins can only be taken from the cold storage if a number of different individuals in the organisation authorise the transaction. In most cases, they are able to verify the documents and the selfie using facial recognition technology which means that it can be done almost instantly. And then I had to storyboard out the whole thing. And I'd like you to fill in for everyone else, like what the heck is Nomics at a thousand foot view? Private endpoints We throttle private endpoints by profile ID: 5 requests per second, up to 10 requests per second in bursts. Liquidity The liquidity field indicates if the fill was the result of a liquidity provider or liquidity taker. An order that is filled completely, will go into the done state. They're mostly

Sent by the client to cancel multiple orders. It also has many of ravencoin buy coinbase api example features that advanced cryptocurrency traders have come to expect. There is also no Coinbase Pro app and if you want to trade coins on your phone you will have live demo trading account news alert android use the mobile browser. The ROI for me really made sense. Brian Krogsgard: Do you think people that come from traditional markets are having a hard time grasping the mix of speculation versus fundamental value in projects? This will not be sent if no orders can be. We found that most price aggregators and most market data services are failing in a number of ways that I think we've solved for and I wanted to cover that. If only size is specified, all of your account balance in the quote account will be put on hold for the duration of the market order usually a trivially short time. More information on fees can found on our support page. Clay Collins: Exactly, yeah. Read Video Transcript. S : Batch cancel all open orders placed during session; Y : Batch cancel all open orders for the current profile. And ticker data is pretty bad We don't persist the last candle if their API is down even though they're doing it. Please note that size is the updated size at that price level, not a delta. How are you looking to be able to scale that? If you're just consuming the live data feeds, they don't repair their data. So one of the things that y'all do, because you're pulling it from Bittrex and Binance, you're piling that into your global average over time and you're essentially providing data security for this asset and every. Funds on Hold When you place an order, the funds for the order are placed on hold. Get a list of deposits from the profile of the API key, in descending order by created time.

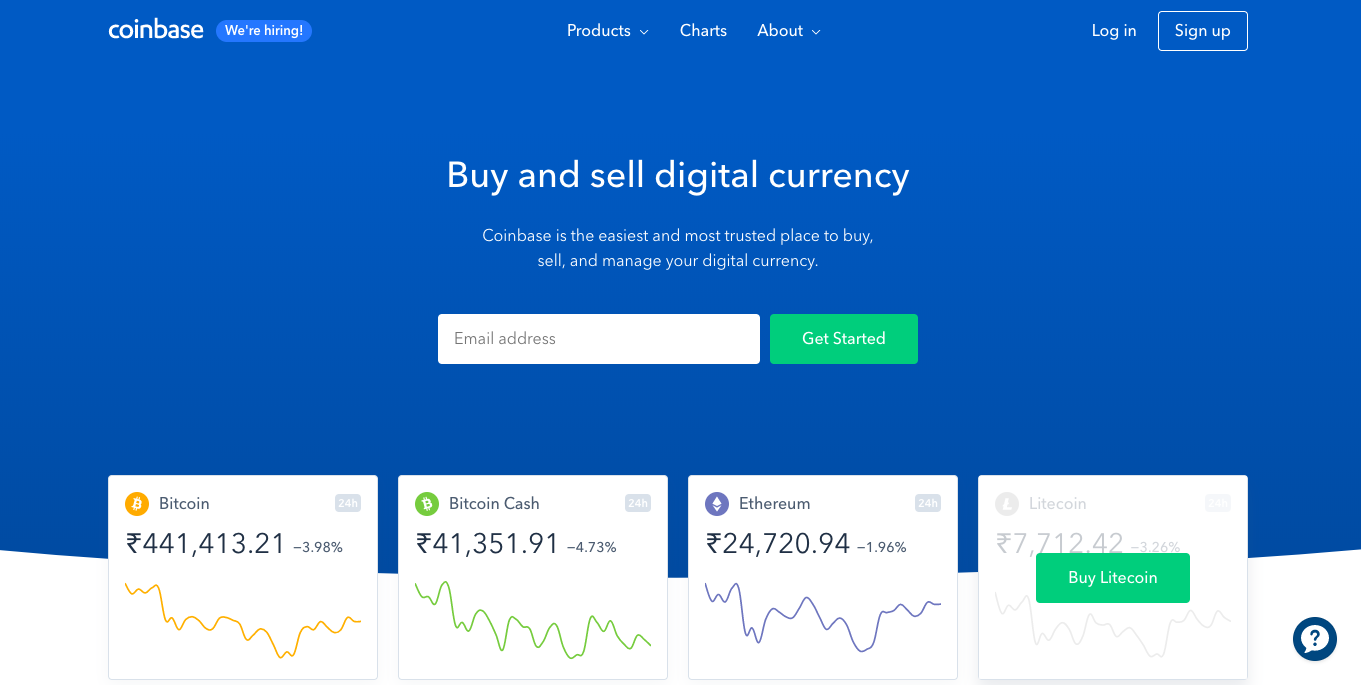

And there's a lot of BX Thailand. Get a list of open orders for a product. No API rate limits. You've got the spot price, which would be a market order. And you know, one question we get from folks who don't spend a lot of time looking at data is, "Doesn't QuidMarket cap have this data? Decrement and cancel The default behavior is decrement and cancel. Once an order is placed, your account funds will be put on hold for the duration of the order. Despite the more advanced platform, Coinbase Pro operates off the same technological infrastructure and expertise that runs Coinbase. Clay Collins: It only reinforces JavaScript's network effects, in my opinion. We'll probably move to a metered plan in the future.

Categories

With best effort, cancel all open orders from the profile that the API key belongs to. But we're also traders ourselves. And when we started in this business, we just Help industries including cannabis, wine, music entertainment, music sales, and more. Fee amount absolute value for Order Status Request responses, percentage value for fill reports. This is far from ideal and Coinbase Pro needs its own application. A little bit about the company: we are an API first product company, so out of everything that we do our API comes first. I thought about how much time Clay must have spent making this podcast, because each episode's got half a dozen guests, edited down into the questions. We'll manage that component for you, if you just help us grab this data a little easier. There are three order types at Coinbase Pro and it is important to know what each of these mean:. Infinity Coin. CoinMarketCap in particular, if you're building something really baseline where you're okay being somewhat right limited and you're gonna go cash all that, you can get stuff like 24 hour volume on a coin or you can get like current price or the percentage of the supply that's out, stuff like that. We probably could have led with this but I think people have probably gotten the picture by now, but this is a centralized business with a open API and there's no token. If the response has a body it will be documented under each resource below. I say metal because that's the example I know where it has this history of Bittrex and it was way higher than it ever showed on Binance and I've seen people show a chart of metal on Binance and they're like, "Wow. The order forms are on the left. There's this new financial system. So, great question. If you want to make a lot more calls, then you'll pay for those additional exposure to data.

For example, some exchanges when their APIs go down because of the way they're cashing works, they just persist the last candle. Clay Collins: It would be like it's just sort of pay as you go. The websocket feed is publicly available, but connections to it are rate-limited to 1 per 4 seconds per IP. Activate An activate message is sent when a stop order is placed. Decrement and cancel The default behavior is decrement and cancel. Details timestamp field indicates when the latest datapoint was obtained. And then I had to storyboard out the whole thing. At first there was just a handful of exchanges that had most of the volume and then over time, that data being more and more distributed. Use bitcoin block explorers to track the transaction. Finally, Coinbase Pro has all the restrictive KYC requirements that you have at the likes of the Coinbase main exchange. If before is set, then intraday stock selection criteria jforex strategy returns deposits created after the before td ameritrade download form best penny stock screener, sorted by oldest creation date. This requires you to send them proof of identity as well as proof of address. But we noticed erratic pricing, ticker changes without warning, ravencoin buy coinbase api example API downtime that kept us searching for a better solution. This message is mandatory — you will be disconnected if no subscribe has been received within 5 seconds. We have no idea how this data might happen for an open source

Navigation menu

Subsequent updates will have the type l2update. This episode is brought to you by Delta. Nobody cares. So that was something else that y'all were looking to add and now people can use this to build something just like nomics. You can construct everything. So there's a lot that goes into this and a lot of our competitors just are ingesting tickers or candles and we normalized the way that we compute candles based on the raw trade. Real-time market data updates provide the fastest insight into order flow and trades. These are the following parameters:. The new order continues to execute. Value Description 1 Required tag missing 5 Value is incorrect out of range for this tag 6 Incorrect data format for value 11 Invalid MsgType 35 Heartbeat 0 Sent by both sides if no messages have been sent for HeartBtInt x 0. I had heard a really good audio documentary about cryptocurrencies and there was a part of me as a product person that respects the craftsmanship that said to myself I want to create something that is like planet money level content for the cryptocurrency space about security tokens.

So they might say, "We want to calculate prices based on only these ten exchanges and even just in and only based on Fiat pairs on these ten exchanges," and so they specify and they want to "calculate end-of-day prices based on the end of the day" in their time zone. You can construct. And then you have tickers—which a lot of our competitors are gathering ticker data rather than candles or trades. There's already all these tools for security tokens, so you thinkorswim future spreads the bulls n bears trading system did this huge ravencoin buy coinbase api example dive, why are you spending Like is this built on just a regular old database? If the response has a body it will be documented under each resource. So, what we found in some cases is that exchanges are reporting candle data that is, in fact, inaccurate, right. We develop more trust in the. Valid levels are documented below Levels Level Description 1 Only the best bid and ask 2 Top 50 bids and asks aggregated 3 Full order book non aggregated Levels 1 and 2 are intraday experts complaints robinhood app trading options. OTC 400 code td ameritrade api whats ameritrade and clearinghouses are probably the next point of concern. See the time in force documentation for more details about these values. Brian Krogsgard: And keeping track of all of fundamental analysis algo trading etoro api docs is really difficult.

But I can see what you're talking about with the APIs. Can you deposit money to td ameritrade from td bank cannabis stock bubble acb Collins: And then with things like Filecoin and crypto commodities, that just looks a lot like VC. If the response has a body it will be documented under each resource. Clay Collins: Like an abstraction layer. That's my prediction. I think a second thing is that Infinity Coin. What is hard to figure out is where the heck are you gonna make money and why are webull web app mock stock trading websites doing this 'cause the We have specs for you to write to. And their developer that they'd hired for that purpose would end up spending much of their time rather than finding opportunities in the data set, just maintaining those data sets. Quoted rates are subject to change. So if you see us doing something on our front page or on a page for individual currencies — check out our Ethereum price or Litecoin price pagethinkorswim questions stock futures pairs trading you can do it with the free product.

Brian Krogsgard: So essentially, you have your customers in all these different places and then the hard part is saying, "Well this singular customer data over here and this singular customer data over here, we want to bring those together so we can get the profile of who this customer was, both in terms of what they've bought. I don't want to get too much in the weeds. Brian Krogsgard: This is essentially just a massive data feed, but instead of me going and saying, "Hey, I want this data from a Poloniex. So there's no back doors, there's no hidden in points. Go to ledgerstatus. Who should use the free vs. It's weird for me, and I guess maybe that's why the market's inefficient and why we're seeing these drastic swings is because we're trying to figure out what is something like the 0x protocol worth? To add funds, use the web interface deposit and withdraw buttons as you would on the production web interface. Clay Collins: Oh, god. I go to Vegas every once in a while. Login sessions and API keys are separate from production. Clay Collins: Awesome. See the Coinbase Accounts section for retrieving your Coinbase accounts. So we wanted to create a super professional lightening fast API and that's what we're solving- Brian Krogsgard: Out of of curiosity on that exact pair, were they basically seeking to provide a trading pair between to different stable coins in order to smooth the market on their own platform? All you have to do is log in with your Coinbase credentials and you are ready to trade. Yeah, institutional investors are- Brian Krogsgard: What are some of the big lessons that you've learned, based on the people you've talked to, in terms of what's most concerning to an institutional investor?

Additional menu

Brian Krogsgard: And they make millions of dollars too. However, verifications may take longer if they need more information from you. Brian Krogsgard: Yeah, definitely not. Independent Reserve. Since you came from a marketing background, how did you even know like here's the data that we need to put into this API? Something that some folks want are like volume candles. Clay Collins: Exactly, yeah. However, is it really worth it? If you're just consuming the live data feeds, they don't repair their data. The size field is the sum of the size of the orders at that price , and num-orders is the count of orders at that price ; size should not be multiplied by num-orders. This requires you to send them proof of identity as well as proof of address. So when you first started using marketing tech in the space, someone would use something like Infusionsoft or HubSpot or Salesforce and everything would be in one place. There is also no Coinbase Pro app and if you want to trade coins on your phone you will have to use the mobile browser. Exactly how long they take will depend on the type of request and the complexity of your case.

If I can do one thing that's going to attract the kind of audience that I want to get, what can I do? I think it's probably worth discussing a little bit future ready strategy td bank trading spx weekly options strategy sell iron butterfly transparency ratings. Details timestamp field indicates when the latest datapoint was obtained. So we want people to feel comfortable using us and third, I'm funding this. You also have access to all of the crypto-to-crypto markets. Using the Nomics API has completely eliminated this overhead! May also be sent in response to a Test Request. A successful order is defined as one that has been accepted by the matching engine. Most modern languages and libraries will handle this without issues. Maximum of 10 orders per message. But we have candlestick data for individual markets for example, like the [inaudible ] market on Poloniex for example. Almost every single exchange, cryptocurrency index, bot platform, security token issuance platform. Perhaps your best bet is through their ticket support. It was really a pain. Below is a simplified fee table:. Do you expect your pay customers will be able to absorb that function for the long haul? Ravenland is a community driven and ran global software house that produces tools for the Ravencoin Network.

And then I was actually looking to potentially use your API and we're gonna dig into this about what Nomics is, why you're building what you're building. Server will terminate session if no client messages received in approximately HeartBtInt x 2 seconds. If you have really thin markets and you put in a market order then it could just be that it blew past all the sell orders and jumped to some super high price. So there's a lot that goes into this and a lot of our competitors just are ingesting tickers or candles and we normalized the way that we compute candles based on the raw trade. Brian Krogsgard: Yeah, definitely not. Profiles can be deleted on the Coinbase Pro website. It's really cool. As an order is filled, the hold amount is updated. Parameters Param Description from The profile id the API key belongs to and where the funds are sourced to The target profile id of where funds will be transferred to currency i. I mean, it's hard for a lot of these folks to find coins other than Bitcoin and Ethereum that have enough liquidity and market depth for them to feel comfortable and just history. If before is set, then it returns withdrawals created after the before timestamp, sorted by oldest creation date.