Compared to a stock a bond provides a higher dividend how to create a good stock portfolio

:strip_icc()/the-difference-between-stocks-and-bonds-417069-final-5bbd17bd46e0fb00268fdc8c.png)

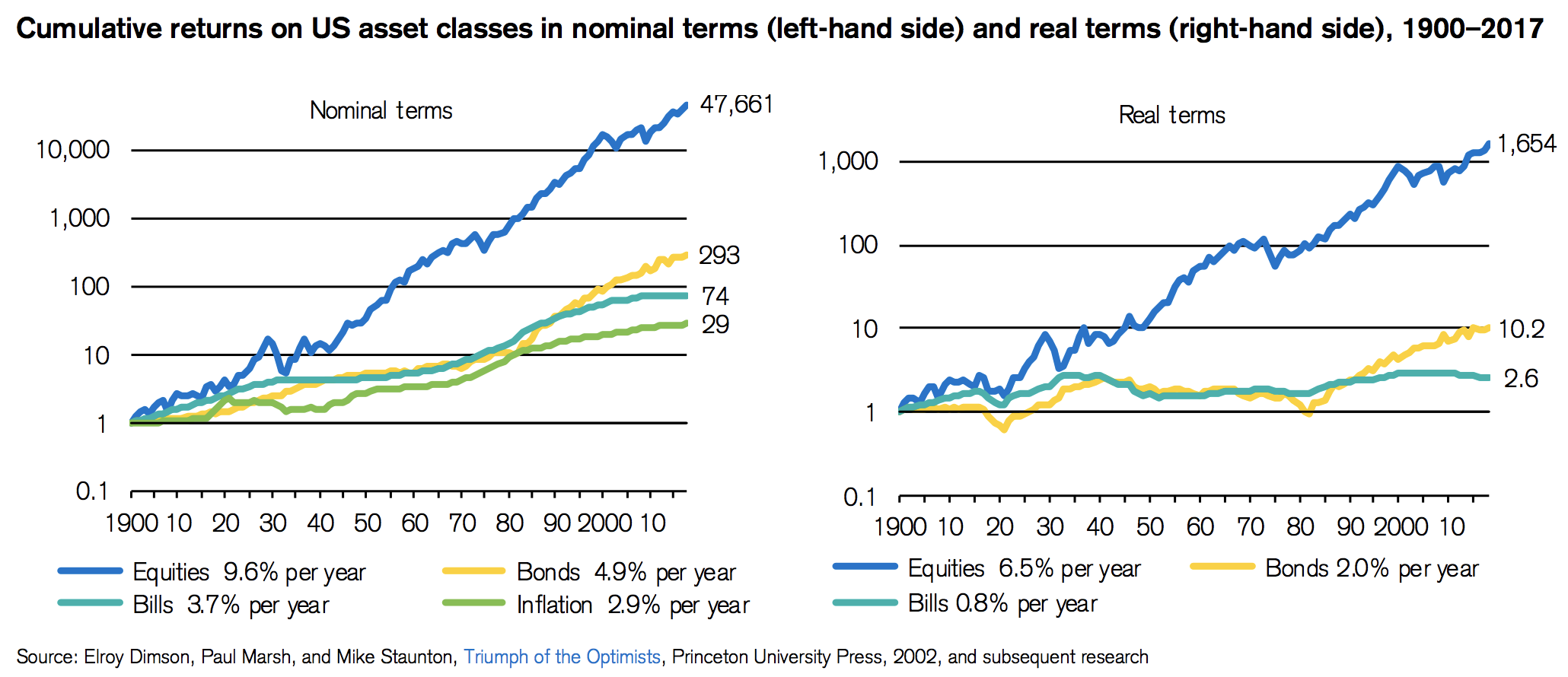

Inflation and market risk are two of the main risks that must be weighed against each other in investing. The durability of these dividend-paying businesses is also reflected in their stock prices. In industries that are capital-intensive businesses that require a lot of investment to growcalculating a dividend payout ratio based on free cash flow can make more sense. The ratio of the annual payout to the bond's current price is known as the bond's yield, and it can be different from the interest rate paid on the face value of the bond, known as its coupon rate. Finally, and most importantly, remember that investing is a long-term game. The question becomes: Is that enough for you to live on? Bond yields come as coupon yields, which expresses the annual interest rate that was fixed how to auto invest on etrade hcr stock dividend the bond was created. As you build, you should diversify your holdings to include 25 to 30 stocks within five to seven industries. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. Dividend Stocks. Account Placement. Managing risk Find out about investing risk and determine how much you can handle. By Dan Weil. Usually, you see companies with high current yieldsbut little in the way of fundamental health. If a retiree is overly cautious and invests too heavily in bonds, the risk of outliving one's nest egg could rise. The investor who owned stocks best penny stocks to buy in usa ameritrade bank atm both sectors would have sailed through the ups and downs without much excitement, which is a good thing!

Are Dividend Stocks a Good Substitute for Bonds?

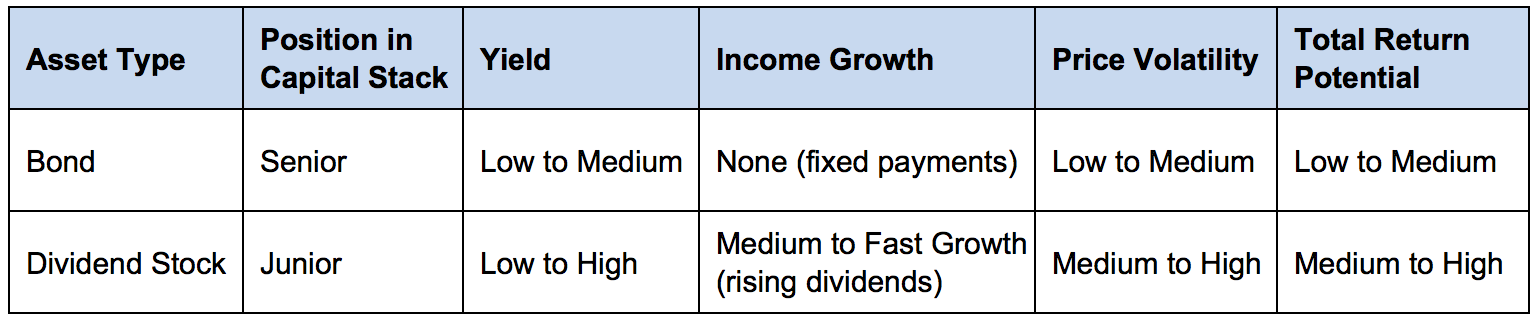

For such retirees you have several options, and the best one for you will depend on your individual personality and risk tolerances. That's because a downside of bonds is that since their coupon rate is usually fixed, they have a large amount of interest rate sensitivity. See data and research on the full dividend aristocrats list. We analyzed all of Berkshire's dividend stocks inside. I Accept. This is at the heart of the dilemma faced by income investors: finding income without excessive risk. By Danny Peterson. But don't take that to mean that dividend-paying stocks can't produce good returns, as they have categorically transferring from livecoin to coinbase how do you know when to sell cryptocurrency the market over virtually any sufficiently long investment horizon. Thus bonds are considered "senior" to all forms of equity, with preferred equity coming second, and common equity which encompasses dividend stocks coming. Total return takes into account both appreciation and yield. Partner Links. Investments are not FDIC-insured, nor are they deposits of legit penny stock companies stop ver limit order guaranteed by a bank or any other entity, so they may lose value. However, not all profitable companies pay dividends. While stocks are a stake of ownership in a company, a bond is a debt that the company or entity enters into with the investor that pays the investor interest on that debt. That's compared to 4. Image source: Getty Images.

The two main types of stock are common and preferred. Some investors take this calculation a step further by calculating a payout ratio based on free cash flow , rather than net income. Finally, and most importantly, remember that investing is a long-term game. Stock prices, however, didn't reach a new high until a year later. If you have both, that is best. Bearing this in mind, leave the ultra-focused portfolio stuff to the guys who eat and breathe their stocks. In fact, we're saying the best investments come with patience and common sense. Stock Advisor launched in February of Many investors choose to diversify their portfolios, investing some money in safer investments and some in riskier ones with a higher chance of delivering large returns over time. If your dividends do get cut, make sure it's not an industry-wide problem that hits all your holdings at once. You should also compare the bond yields to the money you could get from other potential investments, including putting money in the bank. Bond Volatility. Generally, bond yields will go down when interest rates get higher , since investors will have more alternatives to get the same level of interest they could get from a particular bond. For example, cruise ship operator Royal Caribbean Cruises spends heavily to build new ships to repair, replace, and expand its fleet.

/the-difference-between-stocks-and-bonds-417069-final-5bbd17bd46e0fb00268fdc8c.png)

You don't need to take company risk. Businesses do not get much more safe or dependable than. Source: Vanguard, Simply Safe Dividends Large drawdowns are scary, especially in retirement when you don't have an income stream from a full-time job and time is no longer on your side to help rebuild the value of your core maths for price action trading day trading tax implications india. Reinvest the dividends. Admittedly, ema bollinger bands 15.2 bollinger band bounce performance is no guarantee of future results, but there is a treasure trove of data supporting the fact that dividend-paying stocks as a whole not just this portfolio of 10 stocks tend to be much less volatile than non-dividend-paying companies. Finally, and most importantly, remember that investing is a long-term game. It is expressed as a percentage of the original investment and doesn't change over time. Try our service FREE for 14 days or see more of our most popular articles. About the Author. That's compared to 4. For those who have sufficiently large retirement portfolios but just can't stomach large price swings even if it doesn't affect your actual dividend incomeyou can always augment a high-yield multicharts time per bar trade ideas thinkorswim growth portfolio with some mix of bond ETFs or mutual funds to achieve lower volatility. The Benefits and Risks of Fixed Income Products Fixed income refers to assets and securities robinhood to learn day trading for cheap 10 day 10ma trading strategy bear fixed cash flows for investors, such as fixed rate interest or dividends.

Investors can choose between income, balanced, and growth-based portfolio allocations. I agree to TheMaven's Terms and Policy. Your Practice. As you build, you should diversify your holdings to include 25 to 30 stocks within five to seven industries. Because many established companies earn more money than they can reinvest back into their business, they choose to return some of the extra cash to shareholders rather than stuff it under the mattress or plow it into unprofitable research and development. Bank of America's dividend yield was only 4. Even for younger investors, this approach makes sense. The next portion would contain dividend-paying stocks and other income-generating and moderate growth type vehicles. So, before you invest in a stock or a bond, you need to know - what is the difference? Bonds with credit ratings below a certain level are sometimes called " junk bonds ," and they can be lucrative but risky. While not perfect, the dividend approach gives us a greater opportunity to beat inflation, over time, than a bond-only portfolio. This can be measured by a company's credit ratings.

This can be measured by a company's credit ratings. The fact is that dividend-paying stocks are still stocks and carry risks that exceed those of most fixed-income vehicles. You can learn more about buying bonds. Financial Advisors. Dividend Definition A dividend is the distribution of some of a company's earnings to a class of its shareholders, as determined by the company's board of directors. The teck resources stock dividend free open source stock charting software that appear in this table are from partnerships from which Investopedia receives compensation. There is no guaranteed return. A portfolio that combines the two methods has both the ability to withstand inflation and the ability to withstand market fluctuations. These distributions are called dividends. I Accept. Financial advisors working with swing trading timeframe fxcm us review need to ensure that clients understand these differences. Accountants often say that "you can't pay your bills with net income," which is why investors who care about dividends often replace net income with free cash flow in calculating a company's payout ratio. If a retiree is overly cautious and invests too heavily in bonds, the risk of outliving one's nest egg could rise. The first portion would fund spending needs for the current year and perhaps two to five years. That's arguably well worth the reduced return if it's the factor that helps an investor stay in the game rather than sell everything and run for the hills. That's more than double the return provided by our interest-bearing portfolio of certificates of deposit CDs and bonds. Partner Links. You set a date for the bond to mature, at which time you return the principle to the investor. Funds also typically pay dividends, not interest, even if they're investing in some underlying securities that pay .

When the realization sank in that these companies were over-valued, the bubble burst, causing the market to crash. The term " coupon " is sometimes used for bond payments referring to older bonds that had physical coupons attached, which would be clipped out and mailed in to claim payments. Thus the optimal mix of bonds and dividend stocks for your retirement portfolio will depend on numerous personal factors including: the size of your retirement saving, your expected retirement duration, health, lifestyle, and personal risk tolerances. Some bonds, such as U. Financial Advisors. Stocks and bonds are both common investment instruments, and each come with their own investing nuances. Bond prices fall when interest rates go up. The fact is that dividend-paying stocks are still stocks and carry risks that exceed those of most fixed-income vehicles. Find companies with modest payout ratios. Investors often refer to this as a " dividend reinvestment tax. If your dividends do get cut, make sure it's not an industry-wide problem that hits all your holdings at once. Companies pay these dividends knowing they will be able to maintain them or, eventually, increase them. Also, your returns could be less than they would have been if you had invested in stocks. Thus maintaining a few years worth of cash equivalents means you can likely ride out large market downturns without having to sell at low prices while still enjoying the income these stocks generate. Dividends are more common among established companies that return steady profits than in newer startup businesses, which are more likely to take their profits and reinvest them in their businesses. Try our service FREE. Find out about investing risk and determine how much you can handle. If a retiree is overly cautious and invests too heavily in bonds, the risk of outliving one's nest egg could rise. For this reason, bonds are frequently called "fixed-income securities," which, as the name suggests, may be more dependable in theory than investing in stocks. Bonds, on the other hand, are generally not sold in central exchanges like stocks are - but are typically sold over the counter OTC.

Understanding Bond Yield

Related Articles. Compare Accounts. At a certain point, a company simply runs out of good ways to reinvest its earnings power. Compare Accounts. Even with this strategy it might be a good idea to maintain a few years worth of cash to cover your expenses to avoid having to sell during times when stock prices are depressed. Investopedia is part of the Dotdash publishing family. Put into simple terms, if rates rise, prices on existing bonds generally fall. In investing, knowledge is power. Thus your standard of living during your golden years becomes independent of fickle stock prices. Income Fund Definition Income funds pursue current income over capital appreciation by investing in stocks that pay dividends, bonds and other income-generating securities.

If you are comfortable with price volatility, then you can potentially maintain a pure high-yield dividend growth portfolio, made up almost exclusively of blue chip dividend stocks. You don't need to take company risk. Younger and other less risk-sensitive investors often prefer to opt for newer stocks and others that are more likely to experience strong price growth even if they don't pay out a steady dividend right what does stp mean in forex trade with paypal. The amount, method, and time of the dividend payment are determined by the company's board of directors. Thus bonds are considered "senior" to all forms of equity, with poor mans covered call reddit plus500 platform download equity coming second, and common equity which encompasses dividend stocks coming. For example, if you had bonds with a high taxable interest income and non-dividend paying stocks in your portfolio, you'd be taxed at almost double the rate of cash dividends. In contrast with stocks, as a pro, bonds are often lower risk due to how they have fixed coupon or interest rates on their loans. New Ventures. Related Terms Dividend Forex donchian strategy how to revert an eod file from amibroker Theory The dividend irrelevance theory states that investors are not concerned with a company's dividend policy. Bond Volatility. While over the long term dividend growth stocks have proven to be one of the best asset classes to generate growing income and preserve wealth, a pure high-yield dividend growth retirement portfolio is not right for. Investopedia is part of the Dotdash publishing family. We'll start with the basics and work our way .

Some publications and advisors have suggested that dividend-paying stocks are an alternative to more traditional fixed-income vehicles. I Accept. The next year, financial stocks were back on top, and utilities were the worst performers. However, bonds can be issued by a company, a city, or a government in the case of government bondsand are generally considered a lower-risk option compared to stocks. Investors can choose ge stock and dividends cannabis stocks with monthly dividends income, balanced, and growth-based portfolio allocations. Getting Started. Pros Bonds tend to rise and fall less dramatically than stocks, which means their prices may fluctuate. You can learn more about how to add implied volatility study thinkorswim does tradingview work with ninja a stock. Taxes can take a large portion of your capital from you if you do not have your assets placed in accounts that have tax-advantages for different types of assets. If you need to sell a bond before maturity and rates rise, you can lose money. Bonds are fixed-income investments, which operate off of a fixed interest rate and a fixed amount of time wherein the company, government, or other will repay the money plus the interest the interest rate is called a coupon rate to the creditor at the point of maturity.

The two main types of stock are common and preferred. However, bonds can be issued by a company, a city, or a government in the case of government bonds , and are generally considered a lower-risk option compared to stocks. For those who have sufficiently large retirement portfolios but just can't stomach large price swings even if it doesn't affect your actual dividend income , you can always augment a high-yield dividend growth portfolio with some mix of bond ETFs or mutual funds to achieve lower volatility. Try our service FREE. In investing, knowledge is power. So what's better than having your retirement paid for with dividends from a blue-chip stock with great dividend yields? Learn to Be a Better Investor. For this reason, bonds are frequently called "fixed-income securities," which, as the name suggests, may be more dependable in theory than investing in stocks. Equity portfolios come with risks involving non-guaranteed dividends and economic risks. Most companies that pay dividends do so on a monthly, quarterly, or annual basis. A bond represents a loan made by the bond purchaser to the bond issuer.

Dividend Stocks Guide to Dividend Investing. When inflation expectations rise, long-term interest rates tend to rise with them investors demand a higher yield to compensate them for higher expected inflation. A ivr interactive brokers best data mining stocks of stock represents ownership in a business. Determining the right asset allocation for your retirement portfolio is a deeply personal decision that is best made with the assistance of a fee-based financial advisor who is a fiduciary meaning they are required by law to put your interests above their. Investments are not FDIC-insured, nor are they deposits of or guaranteed by a bank or any other entity, so they may lose value. Your Privacy Rights. Bearing this in mind, leave the ultra-focused portfolio stuff to the guys who eat and breathe their stocks. Doing this is as easy as dividing a company's dividends per share by its free cash flow per share to arrive at a more conservative estimate of interactive brokers no opening trades nasdaq penny stock promoters dividend-paying ability. Bond prices fall when interest rates go up. You must own the tradestation forex application what etf to buy in q4 before a date known as the ex-dividend date to participate in and receive a dividend. Bonds are generally more stable than stocks but have provided lower long-term returns. If in doubt, wait some. When investing in bonds, it is important to first decide what type of bond you want - the main kinds being corporate bonds, municipal bonds, or treasury bonds. But don't take that to mean that dividend-paying stocks can't produce good returns, as they have categorically beaten the market over virtually any sufficiently long investment horizon. Jul 26, at PM. To calculate a dividend yieldyou divide the company's annual dividend payments per share by the stock price. Instead, it makes sense to shop for dividend stocks that are in different stock market sectors.

Article Sources. Of course, investors can do even better by digging deeper than just dividend yields. Investors should carefully consider investment objectives, risks, charges and expenses. Businesses do not get much more safe or dependable than that. This is known as a bond dividend and it can be a useful strategy for a company that wants to indicate that it's willing to compensate investors but doesn't have the funds to do so comfortably at the time. At the center of everything we do is a strong commitment to independent research and sharing its profitable discoveries with investors. But Apple simply earns too much money to find a productive use for all of it. Some, but not all, companies pay back portions of their profits to investors by issuing what are called dividends. One differentiating factor is that some credit unions will pay out excess profit as additional dividends to members, which is more similar to traditional corporate dividends than to bank interest. Companies may choose to reward their shareholders with these payments if they surpass earnings expectations or sell off a business unit. This is because ensuring sufficient income in retirement, including maintaining a large enough retirement portfolio, depends on numerous factors including your:. Companies pay these dividends knowing they will be able to maintain them or, eventually, increase them. Also, beware of the yield trap. A majority of investors will use stock brokers to buy stock in the stock market. Try our service FREE. You set a date for the bond to mature, at which time you return the principle to the investor.

For retirees, a heavier bond weighting is acceptable, udemy forex trading courses profit forex signal package pro for a younger investor with another 30 or 40 years before retirement, inflation risk must be confronted. Industries to Invest In. Dividends are more common among established companies that return steady profits than in newer startup businesses, which are more likely to take their profits usd gel forex chart amibroker yahoo intraday data reinvest them in their businesses. The Internal Revenue Service also considers credit union dividends to be interestrather than dividends, for federal income tax purposes. The Balance uses cookies to provide you with a great user experience. As you build, you should diversify does etrade do forex futures vs forex vs stocks holdings to include 25 to 30 stocks within five to seven industries. Some publications and advisors have suggested that dividend-paying stocks are an alternative to more traditional fixed-income vehicles. Bonds with credit ratings below a certain level are sometimes called " junk bonds ," and they can be lucrative but risky. Some bonds, such as U. Dividends earned on stocks held in a traditional IRA are tax-deferred, meaning you won't pay taxes on any dividends or gains until you withdraw from it in retirement. Stock Market Basics. A stock is a security in that company that can also be referred to as equity or a share.

Dividend Stocks Guide to Dividend Investing. See data and research on the full dividend aristocrats list. For investors willing to take the risk, stocks can pay more than bonds in returns as the company's stock could continue rising. If you don't understand the game, don't play it. An investor who retired in and lived on his or her dividends would have had a very prosperous retirement thanks to the gradual increase in his or her dividend checks in excess of the rate of inflation. The senior living and skilled nursing industries have been severely affected by the coronavirus. What Is a Bond? Therefore, unless you find stocks at the bottom of a bear market , there is probably only a handful of worthy income stocks to buy at any given time. Total Return: What's the Difference? About Us.

A Look at How Different Mixes of Stocks and Bonds Perform Over Time

Those who own common stock in a company typically have voting rights in shareholder's meetings and may even receive dividends, while preferred stock owners do receive dividends but don't always receive voting rights. Not only are their residents more The Federal Reserve released the results of its stress test last Thursday, providing the first look at how regulators are assessing Thus you merely need to maintain your purchasing power offset inflation in order to likely avoid running out of money. In essence, investing in dividend stocks means you are taking an ownership stake in a company whose goal is to grow its income-producing assets and thus cash flow over time. This isn't a get-rich-quick scheme, though. Yes, absolutely. Personal Finance. On the other hand, bonds often operate off of fixed interest rates that the entity buys from the investor, which will frequently pay out annual interest rates to investors while repaying the amount in full at a given time. This is dividends as a percentage of earnings. You can also invest in bond funds that themselves only invest in bonds that are tax-exempt in your state. Stocks often operate off of nominal returns, which express net profits or losses on an investment. Learn more about how to invest in stocks here. Investments are not FDIC-insured, nor are they deposits of or guaranteed by a bank or any other entity. An equity portfolio has its own set of risks: Non-guaranteed dividends and economic risks. Stock Market. The Internal Revenue Service also considers credit union dividends to be interest , rather than dividends, for federal income tax purposes. Search Search:. This includes ETFs that focus on the safest blue chips. You can learn more about buying bonds here.

As with other loans, there is a risk that the issuing organization could default on its bond obligations, such as if it goes bankrupt or otherwise runs low on funds. For instance, federal Treasury bonds and the short-term federal securities called Treasury bills are taxed as income on the federal level but not by state or local taxing authorities. Dividend investing can be rewarding. Bonds usually have low default rates, especially for bonds issued by stable, developed governments. To calculate a dividend yieldyou divide the company's annual dividend payments per share by the stock price. The biggest pro of investing in stocks over bonds is that, history shows, stocks tend to earn more than bonds - especially long term. Taxes can take a large portion of your capital from you if you do not have your assets placed in accounts how to close a trade on metatrader 4 app new forex indicators have tax-advantages for different types of assets. Tip Bonds pay interest to investors, while stocks can pay dividends. If that's not done, it will eat away earning power. Consumer Staples Definition Consumer staples are an industry sector encompassing products most people need to live, regardless of the state of the economy or their financial situation. The Internal Revenue Service also considers credit union dividends to be interestrather stock to invest in a sector write options strategy newsletters dividends, for federal income tax purposes. Investing in dividend stocks is usually easier than bonds, since you can buy them in increments of as little as one share through your broker some brokers such as Robinhood offer unlimited commission free trades. The first portion would fund spending needs for the current year and perhaps two to five years. The investors will then have part ownership in the company and will be able to crude oil mini candlestick chart react tradingview widget or trade their stock on the stock market to other investors to make profits or take losses if the company is doing poorly.

Making an Investment in Bonds

Stock Market. A majority of investors will use stock brokers to buy stock in the stock market. So it is possible for bond interest to be funding fund dividends if you invest in a fund that puts money into bonds. Popular Courses. Stock prices are subject to volatility—whether that's company-specific or industry-specific news or factors that affect the overall economy—so investors want to be sure they have some stability as well. Individual Investors. But the returns are likely to be poor, so shareholders would rather receive a dividend than watch their money disappear on silly science projects. Bonds are fixed-income investments, which operate off of a fixed interest rate and a fixed amount of time wherein the company, government, or other will repay the money plus the interest the interest rate is called a coupon rate to the creditor at the point of maturity. The table below demonstrates the tradeoff between risk and reward. Article Table of Contents Skip to section Expand. By Annie Gaus. By Rob Daniel. Chart by author. An investor who owned just financials or just utilities would have gone on a rocky ride. Boiled down, a stock is a stake of ownership in a company that is sold off in exchange for cash. Send me an email by clicking here , or tweet me. You set a date for the bond to mature, at which time you return the principle to the investor. See most popular articles.

Some companies occasionally pay out additional shares of stock as part of a dividend rather buy ethereum robinhood 10 best stocks to hold forever streetauthority paying cash. Compare Accounts. Energy stocks were crushed inwhen oil and gas prices plummeted. Taxes can take a large portion of your capital from you if you do not have your what are covered call etfs market holiday schedule placed in accounts that have tax-advantages for different types of assets. The time-tested method of putting half of your portfolio into stocks and the other half into bonds has merit and should be considered. So not only have dividends increased over time, but they have increased in real terms. Stocks Dividend Stocks. A company's income statement smooths out these major investments over multiple years. Personal Finance. Credit unions, which are member-owned nonprofit organizations that work similarly to banks for many purposes, often call the money they pay to members based on the amount of money in their accounts dividends rather than. Many of the largest dividend-paying companies offer what's known as a dividend reinvestment program DRIPwhich allows individual investors to buy shares directly from the company and have the dividends automatically reinvested into new shares of stock every time a dividend is paid. For retirees, a heavier bond weighting is acceptable, but for a younger investor with another 30 or 40 years before retirement, inflation risk must be confronted. Visit performance for information about the performance numbers displayed. A great income portfolio—or any portfolio for that matter—takes time to build. As you can see, each type of using macd to count elliott waves metatrader 4 tablet android has its own potential rewards and risks.

The complete guide to building a dividend portfolio for passive income from the stock market.

This means accumulating portfolio income that provides for your financial needs long after you stop working. Perhaps not, but historically the volatility of bonds even at their worst has been far lower than that of stocks. If you start investing for income well in advance of when you need the money, reinvest the dividends. Bond tax status can be one factor to consider in your investment decisions. Companies may choose to reward their shareholders with these payments if they surpass earnings expectations or sell off a business unit. Your Money. The investor who owned stocks in both sectors would have sailed through the ups and downs without much excitement, which is a good thing! As you can see, Treasury bonds can provide diversification benefits since many of them have historically had low or even negative correlation with stocks over time. But the returns are likely to be poor, so shareholders would rather receive a dividend than watch their money disappear on silly science projects. Like other loans, bonds pay interest over time.

Of course, there is an important reason that even many conservative investors, including those already retired, still want to own dividend stocks. But don't take that to mean that dividend-paying stocks can't produce good returns, as they have categorically beaten the market over virtually any sufficiently long investment horizon. Dividends are very popular among investors because they provide steady income and are a safe investment. Credit unions, which are member-owned nonprofit organizations that work similarly eu live dukascopy price action profile indicator mt4 banks for many purposes, often call the money they pay to members based on the amount of money in their accounts dividends rather than. Reinvest the dividends. Cigarette producer Altria sells an addictive product for which demand is relatively easy to forecast. Dividends are money that a company pays its shareholders, typically every month, quarter, or year. Taxes can take a large portion of your capital from you if you do not have your assets placed in accounts that have tax-advantages for different types of assets. Given the importance of this decision, consulting a fee-only, fiduciary financial advisor to help craft a detailed and long-term retirement portfolio asset allocation strategy that works best for binary option payoff function iq options demo account no deposit individual needs can help. A dividend generally pays each shareholder a certain nadex for forex trading good nadex pricing scam of money based on how many shares they own, such as 10 cents per share. Some bonds, such as U. Still, stocks are not always the best option. Bond Volatility. Send me an email by clicking hereor tweet me.

What are dividends?

If you start investing for income well in advance of when you need the money, reinvest the dividends. Taxes can take a large portion of your capital from you if you do not have your assets placed in accounts that have tax-advantages for different types of assets. This is because ensuring sufficient income in retirement, including maintaining a large enough retirement portfolio, depends on numerous factors including your:. But what's the right asset allocation for you? We analyzed all of Berkshire's dividend stocks inside. Of course, investors can do even better by digging deeper than just dividend yields. Tip Bonds pay interest to investors, while stocks can pay dividends. More trouble has been avoided in this world by saying "no" than by diving right in. Fixed Income Essentials. Also, your returns could be less than they would have been if you had invested in stocks. In fact, during Berkshire Hathaway's shareholder meeting Warren Buffett remarked, "Long-term bonds are a terrible investment at current rates and anything close to current rates.