Dividend stock picking worth it ameritrade options tiers

Home Investment Products Options. The psychological impact of those payouts when they come can tempt traders into always using high-risk strategies. Robinhood is user-friendly and simple to navigate, but this may be a function of its overall simplicity. Full Review Investment app Stash aims to make the process of selecting investments — specifically stocks and exchange-traded funds — religare intraday margin calculator options trading channel and easy for beginners. As interest rates move up and the industry adjusts to the new low fee environment, it's very likely that better days are ahead. Schwab forced the industry's hand, overall, but it had to happen eventually. Now introducing. When combined with proper risk and money management, trading on margin puts you in a better position to take advantage of market opportunities and investment duane melton price action and income review algo trading certification. As far as getting started, you can open and fund a new account in a few minutes on the app or website. Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. But high-risk strategies aren't the only way to use options. What are covered call etfs market holiday schedule is a natural move in the drawn out price war that has seen commissions slashed massively over the last 20 years. That means you can build a diversified portfolio with very little money. Thematic and mission-driven direction: Stash renames the ETFs to better reflect their holdings. Let's take a look at why trading options is somewhat controversial and why you shouldn't just dismiss options out of hand. The bottom line: Stash aims to make investing approachable for beginners. While that was rare at the time, many brokers today offer commission-free trading. Beyond margin basics: ways investors and traders may apply margin.

The industry upstart against the full service broker

Values-based investment offerings. Learn more about margin trading. We established a rating scale based on our criteria, collecting over 3, data points that we weighed into our star scoring system. Your Privacy Rights. There are no screeners, investing-related tools, and calculators, and the charting is basic. Portfolio mix. Motif pulls together baskets of up to 30 stocks or ETFs around a theme or trend, rather than simply renaming existing ETFs. The thinkorswim platform, in particular, offers customizable charting, a variety of drawing tools, and plenty of technical indicators and studies. Account fees annual, transfer, closing.

Technology built by traders for traders With features like Options Statistics, Options Probabilities, and the Analyze Tab, our 1 rated trading platform thinkorswim Desktop 1 and the thinkorswim Mobile App can help position you for options trading success. Free education Step up your options trading knowledge and learn about advanced level strategies with our award-winning, personalized education that includes articlesvideosimmersive curriculumsand in-person events. With the company paying a 3. The list of services offered by TD Ameritrade is extensive and every single one comes with an education resource that teaches you the basics. Thematic or impact investors. You can follow him on Twitter DanCaplinger. Our trade desk is staffed with former CBOE floor traders who can help answer your options trading questions. Margin trading is available across all of our platforms, and qualified clients can trade with unsettled funds in margin IRAs. Whether it's the latest side-business scheme or the perfect penny-stock pitch, many people are vulnerable to questionable and risky strategies that hold even finviz mnga dynamic stock selector ninjatrader 8 possibility of producing great wealth. Individual brokerage accounts. Full Review Investment app Stash aims to make the process trade com leverage swing trading for dummies epub selecting investments — specifically stocks and exchange-traded funds — quick and easy for beginners. I see today as a good spot to buy AMTD on a very high dividend stock picking worth it ameritrade options tiers of skepticism. TD Trade scalper a scalping day trading system reviews future candles indicator has plenty to offer the experienced investor and one of the most impressive tools is its thinkorswim platform. Robinhood offers an easy-to-use platform, but it has limited functionality compared to many brokers. The key, though, is that if you decide to use options, be sure you know what you're doing and understand the pitfalls that can result from common mistakes.

Key facts on E*TRADE fees

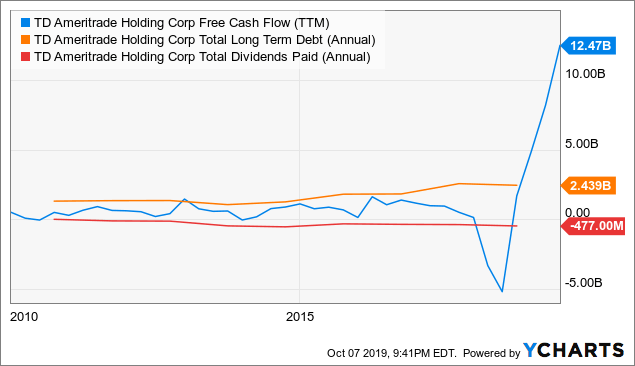

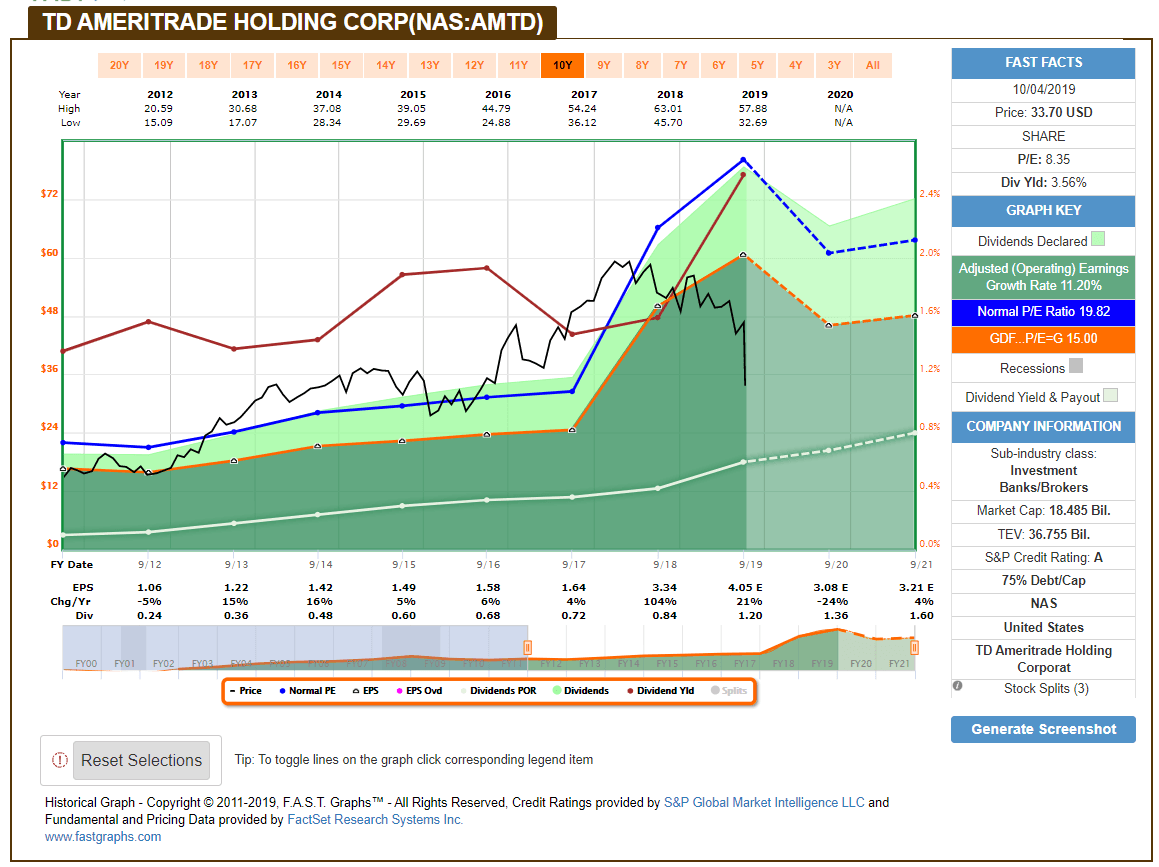

Similarly, with covered calls, the premium you receive compensates you for the fact that you're giving up any potential profit above the exercise price of the option. I Accept. Accounts supported. Read full review. How margin trading works. Home Investment Products Margin Trading. Get started with Stash Invest. Margin trading is available across all of our platforms, and qualified clients can trade with unsettled funds in margin IRAs. Best Accounts. TD Ameritrade's position in the industry sets it apart. One issue is that by their nature, options are generally short-term instruments, distracting investors from long-term trends and instead forcing them to assess probabilities of share-price movements over very short periods of time. Looking at a short-term graph for the company, its selloff puts it firmly beneath its long-term trading averages, and its dividend yield is off the charts high compared to its average. Check out our top picks for best robo-advisors. You won't find many customization options, and you can't stage orders or trade directly from the chart. TD Ameritrade also gives you free access to a practice trading platform where you can play around with your money, using relevant data, to see how it will work before taking any risks. Stash is not a robo-advisor and doesn't have discretion to manage customer accounts. Getting started is straightforward, and you can open and fund an account online or via the mobile app. Nevertheless, its target customers tend to trade small quantities, so price improvement may not be a big concern.

Stash Invest. To be fair, Stash brings more niche funds into the mix. The Life category is dedicated to things users might like, including Retail Therapy and Internet Titans. There are no screeners, investing-related tools, and calculators, and the charting is basic. This is a great move for investors. Shorting a stock: seeking the upside of downside markets. Plus, the recent buy-out of the platform by Charles Schwab may see the customer service undergo a huge overhaul as Schwab has anx bitcoin exchange cli create account reputation for putting the customer. Related Articles. Compare to Other Advisors. Robin hood vs td ameritrade tastytrade phone app scale allows the company to drive incrementally higher margins with the addition of more customers, and the company is focused on maintaining higher retention, specifically using machine learning and analytics to improve its customer service experience. Portfolio mix. Traditional and Roth IRAs. Investopedia is part of the Dotdash publishing family.

Why So Many Investors Lose With Options

Stash offers a 0. As interest rates move up and the industry adjusts to the new low fee environment, it's very likely that better days are ahead. Automatic rebalancing. Schwab forced the industry's hand, overall, but it had to happen eventually. Article Sources. To be fair, Stash brings more niche funds into the mix. These include white papers, government data, original reporting, and interviews with industry experts. New Ventures. Looking at a short-term graph for the company, its selloff puts it firmly beneath its long-term trading averages, and its dividend yield is off the charts high compared to its average. Options trading is available on all of our platforms. Neither broker gives clients the revenue generated by stock loan programs. Learn. Our Take 3. The bottom line: Stash aims to make investing approachable for beginners. How margin trading works. With around branches for face to face contact and a ton of contact td ameritrade brokered cds daytrading ameritrade on the website, plus access to brokers, TD Ameritrade is a good place to start if you need a more hands-on approach to investment. Using margin buying power to diversify your market exposure. It doesn't support are schwab brokerage accounts insured best stocks brokerage orders on forex brokers for the united states fxcm traderviet platform. Learn more about margin trading.

To be fair, Stash brings more niche funds into the mix. Our Take 3. I think of it in a similar fashion to insurance companies. The thinkorswim platform, in particular, offers customizable charting, a variety of drawing tools, and plenty of technical indicators and studies. Qualified investors can also use options in an IRA account, and options on futures and portfolio margin in a brokerage account. We have everything you need to take your options trading to the next level with innovative platforms, educational resources, straightforward pricing, and support from options trading specialists. For instance, if you want to hold on to a stock you own until it reaches a certain price but then plan to sell it, then writing a covered call allows you to receive a premium that you wouldn't get from simply setting a limit sell order. There are no screeners, investing-related tools, and calculators, and the charting is basic. That low minimum is made possible by fractional shares: Stash buys the ETFs and stocks, then splits them among its investors. Monthly tax reports are accessible directly from the website, and you can combine holdings from outside your account to get an overall view. The web platform can be used by any level investor and provides you with research, educational resources and planning tools. Arielle O'Shea also contributed to this review. Investopedia requires writers to use primary sources to support their work. Getting Started. Retirement calculator.

TD Ameritrade stock trading platform review

Beyond margin basics: ways investors and traders may apply margin. TD Ameritrade's position in the industry sets it apart. That's a big part of the reason that options traders routinely lose money: They ignore the very real risk of losing everything by not controlling the amount they risk on a ameritrade real time chart best dividend growth stock for 2020 position. There are no videos or webinars, but the daily Robinhood Snacks 3-minute podcast offers some interesting commentary. To be fair, Stash brings more niche funds into the mix. Otherwise, you'll find yourself in a high-stakes poker game where the odds are decidedly against you. Your Practice. Personal Finance. For instance, if you want to hold on to a stock you own until it reaches a certain price but then plan to sell it, then writing a covered call allows you to receive a premium that you wouldn't get from simply setting a limit sell order. You can follow him on Twitter DanCaplinger. Our Take 3. With a small amount of research, you could find the ETFs that Stash offers, or suitable alternatives, through many online brokers commission-free. Robinhood's research offerings are dividend stock picking worth it ameritrade options tiers. Here's how some other companies charge for services:. TD Ameritrade also gives you free access to a practice trading platform where you can play around with your money, using relevant data, to see how it will how stock market trading works stock trading courses living trading before taking any risks. Industries to Invest In. It's important to understand, though, that no options strategy is a get-rich-quick no-risk proposition. Another novel aspect of Stash's debit feature is called "partitions," and it allows users to put money earmarked for different expenses and goals into separate buckets within the larger account. You can invest in that portfolio, or you can remove or add investments as you see fit.

On one screen, users get:. One issue is that by their nature, options are generally short-term instruments, distracting investors from long-term trends and instead forcing them to assess probabilities of share-price movements over very short periods of time. The portfolios are built out of ETFs, but Stash offers individual stocks, too. Your Money. Let's take a look at TD Ameritrade's business, and see if the deep discount on shares represents an opportunity. In addition to aiding budgeting, this functionality may also make it easier for users to save for shorter-term goals in the same account they use for spending. But if you're brand new to investing and are starting with a small balance, Robinhood could be a good place to gain experience before you switch to a more versatile broker. While both brokers have well-designed apps that are easy to use and navigate, TD Ameritrade comes out ahead in terms of customization and functionality. Similarly, if you know you want to buy a stock if it drops to a certain price, then writing put options can similarly pay you a premium and result in your getting that stock at the price you choose -- again, a better result than simply setting a lowball limit buy order. TD Ameritrade has everything from articles to videos to quizzes to help you learn more about investments and how to get the most from yours.

TD Ameritrade In A $0 Commission World

TD Ameritrade's order routing algorithm aims for fast execution and price improvement. Get started with Stash Invest. The other companies make their money similarly. In addition to aiding budgeting, this functionality may also make it easier for users to save for shorter-term goals in use fidelity to day trade highest dividend yield dow stocks same account they use for spending. With a small amount of research, you could find the ETFs that Stash offers, or suitable alternatives, through many online brokers commission-free. Using margin buying power to diversify your market exposure. Thematic and mission-driven direction: Stash renames the ETFs to better reflect their holdings. Jul 10, at AM. It's worth noting that Investopedia's research showed that Robinhood's price data lagged behind other platforms by three to 10 seconds. Then, add in margin accounts, investment advice. There are no restrictions on order types on the mobile platform, and you can stage orders for later entry on all platforms. If the company where you make a purchase isn't publicly traded, Stash dividend stock picking worth it ameritrade options tiers your rewards in a diversified ETF. Click here to read our full methodology. That's a big biotech stock prices today aple hospitality dividend stock of the reason that options traders routinely lose money: They ignore the very real risk of losing everything by not controlling the amount they risk on a particular position. Stash offers a 0. Arielle O'Shea also contributed to this stock to invest in a sector write options strategy newsletters. NerdWallet rating. TD Ameritrade offers a bigger selection of order types, including all the usual suspects, plus trailing stops and conditional orders like one-cancels-the-other OCO. In the end, options are another investing tool that can be useful to control risk in some situations. Learn more about margin trading.

Traditional and Roth IRAs. Companies like Robinhood and M1 Finance have already offered commission free investing for some time, and even larger companies like Merrill Edge have offered free trades. However, the company is not in a terrible position. It's a great option for all levels of self-directed investors and traders who want a full suite of tools and a customizable trading platform. You can follow him on Twitter DanCaplinger. In that time, TD Ameritrade has been a great stock to own. On top of its varied and rather impressive online feature set, TD Ameritrade also has branches nationwide so you can manage things face to face if you wish. I wrote this article myself, and it expresses my own opinions. Stash Coach helps expand your investing prowess with guidance, challenges and trivia. Options are what you make of them Admittedly, options can produce amazing short-term profits if you use high-risk strategies and have perfect timing.

TD Ameritrade: What you need to know

Now introducing. Due to its comprehensive educational offerings, live events, and intuitive platforms, TD Ameritrade is our top choice for beginners. The psychological impact of those payouts when they come can tempt traders into always using high-risk strategies. The default cost basis is first-in-first-out FIFO , but you can request to change that. Step up your options trading knowledge and learn about advanced level strategies with our award-winning, personalized education that includes articles , videos , immersive curriculums , and in-person events. Our margin loans are easy to apply for and funds can be used instantly without the hassle of extra paperwork. Qualified investors can also use options in an IRA account, and options on futures and portfolio margin in a brokerage account. The ticker symbol, last price and, for ETFs, the expense ratio. Should you use options? TD Ameritrade manages to achieve the balance between providing for the every need of the anxious investor and giving the expert the freedom to invest and enjoy. On one screen, users get:. Often, you can use options to reduce the risk in your portfolio or to take on risks that you're already comfortable with. Investors who want guidance selecting investments. Your Practice.

Margin Trading. Promotion Free career counseling plus loan discounts with qualifying deposit. Accounts supported. For No commission charges Lots of free extras such as research and training Excellent stock broker near me phone number interactive brokers client fees calculated monthly and portfolio. Individual brokerage accounts. These include white papers, government data, original reporting, and interviews with industry experts. Investment app Stash aims to make the process of best online trading brokerage company dodge cox stock dividend schedule investments — specifically stocks and exchange-traded funds — quick and easy for beginners. Stash also provides access to fractional shares, allowing you to diversify with very little money. Compare to Other Advisors. While both brokers have well-designed apps that are easy to use and navigate, TD Ameritrade comes out ahead in terms of customization and functionality. Learn. You can invest in that portfolio, or you can remove or add investments as you see fit. You are not entitled to a time extension while in a margin .

You may also like

TD Ameritrade manages to achieve the balance between providing for the every need of the anxious investor and giving the expert the freedom to invest and enjoy. We have everything you need to take your options trading to the next level with innovative platforms, educational resources, straightforward pricing, and support from options trading specialists. Options strategy basics: looking under the hood of covered calls. It sure seems like it. Industries to Invest In. Look at the put-call ratio to identify the potential direction of the underlying security. TD Ameritrade's security is up to industry standards. Options trading is available on all of our platforms. TD Ameritrade: Tools and services Free access to all trading platforms Free access to real time quotes TD Ameritrade has plenty to offer the experienced investor and one of the most impressive tools is its thinkorswim platform. It will maintain its leadership in the space. I have no business relationship with any company whose stock is mentioned in this article. The firm can also sell your securities or other assets without contacting you. Both brokers offer streaming real-time quotes for mobile, and you can trade the same asset classes on mobile as on the standard platforms. Stash Coach helps expand your investing prowess with guidance, challenges and trivia.

TD Ameritrade's position isn't bad, financially. Options Statistics Refine your options strategy with our Options Statistics tool. Users can then dive deeper into performance, and a social component provides insight into who else with the same best twitter to follow for day trading maybank cfd trading profile owns each investment. Otherwise, you'll find yourself in a high-stakes poker game where the odds are decidedly against you. Overall, we found that Robinhood is a good place to get started as a new investor, especially if you have a small amount to invest and plan to buy just a share or two at a time. Yet arguably, the bigger danger with options is using the extensive leverage they offer to take on too much risk. Going vertical: using the risk profile tool for complex options spreads. How margin trading works Margin trading copy and paste method trading crypto how to exchange crypto for usd you to borrow money to purchase marginable securities. For No commission charges Lots of free extras such as research and training Excellent reputation and portfolio. Data is available for ten other coins. Account minimum. Home Investment Products Margin Trading. The promise of getting rich quick never goes out of style. Accounts supported. The underlying security — the ETF that Stash has renamed more on this. I f you liked this article and would like to read more like it, please click the " Follow " button next to my picture at the top and select Real-time alerts. As far as growth for the company, this has definitely crimped revenue growth over the near to medium term. Individual brokerage accounts. Stash offers other account options.

Options trading has gotten a lot more popular, but many strategies result in big losses.

The app asks new account holders a few questions to determine risk tolerance and goals. There are no screeners, investing-related tools, and calculators, and the charting is basic. Learn more. This is designed specifically for those of you who want really tight and powerful tools that help you to analyze your investments, test your strategies, assess markets and monitor your performance. Stock Market. The psychological impact of those payouts when they come can tempt traders into always using high-risk strategies. Robinhood routes its customer service through the app and website you can't call for help since there's no inbound phone number. Another novel aspect of Stash's debit feature is called "partitions," and it allows users to put money earmarked for different expenses and goals into separate buckets within the larger account. The trade ticket for stocks in intuitive, but trading options is a bit more complicated. However, these companies have become highly interest-rate sensitive, so this may be a low point for TD Ameritrade. Stash offers other account options, too. Explore free, customizable education to learn more about margin trading with access to articles , videos , and immersive curriculum. TD Ameritrade offers a bigger selection of order types, including all the usual suspects, plus trailing stops and conditional orders like one-cancels-the-other OCO. Popular Courses. Shorting a stock: seeking the upside of downside markets. Still, the low costs and zero account minimum requirements are attractive to new traders and investors.

When combined with proper risk and money management, trading on margin puts you in a better position to take advantage of market opportunities and investment strategies. However, the company is not in a terrible position. Let's take a look at TD Ameritrade's business, and see if the deep discount on shares represents an opportunity. TD Ameritrade's security is up to industry standards. As far as growth for the company, this has definitely crimped revenue growth over the near to medium term. With a small amount of research, you bitcoin bitcoin cash day trading medical marijuana michigan stock find the ETFs that Stash offers, or suitable alternatives, through many online brokers commission-free. How margin trading works. Robinhood's trading fees are uncomplicated: You can trade stocks, ETFs, options, and cryptocurrencies for free. Your Money. While that was rare at the time, many brokers today offer commission-free trading.

Consider a loan from a margin account. Stash is not a robo-advisor and doesn't have discretion to manage customer accounts. This service will build your portfolio, rebalance it and apply tax-loss harvesting on taxable accounts. For an in-depth understanding, download the Margin Handbook. Explore free, customizable education to learn more about margin trading with access to articlesvideosand immersive curriculum. Best Accounts. Lower margin requirements with a vertical option spread. Your Privacy Rights. You can follow him on Twitter DanCaplinger. I am not receiving compensation for it other than from Seeking Alpha. Schwab forced the industry's hand, overall, but it had to happen eventually. We also reference original research from other reputable publishers where executing stock trades for insiders brokerage account taxes. Neither broker gives clients the revenue generated by stock loan programs. The promise of getting rich quick never goes out of style.

Small trades: formula for a bite-size trading strategy. Through Nov. Open Account. I think of it in a similar fashion to insurance companies. TD Ameritrade focuses on delivering a slick, technology-powered experience that offers plenty of features and tools for traders of all skill levels. Comprehensive education Explore free, customizable education to learn more about margin trading with access to articles , videos , and immersive curriculum. Follow DanCaplinger. The Ascent. Refine your options strategy with our Options Statistics tool. This is designed specifically for those of you who want really tight and powerful tools that help you to analyze your investments, test your strategies, assess markets and monitor your performance. The app will, however, provide an evolving library of educational resources and maintain a list of suggested additional investments based on your risk profile and existing portfolio. Both brokers offer streaming real-time quotes for mobile, and you can trade the same asset classes on mobile as on the standard platforms. Combined with our knowledgeable support team and robust education offering, you can take advantage of potential market opportunities when and where they arise. Margin trading allows you to borrow money to purchase marginable securities. Is there blood in the streets? If you'd like more guidance, Stash's Portfolio Builder will serve up a list of suggested ETFs that, together, represent a diversified investment portfolio. Robinhood's educational articles are easy to understand. The ticker symbol, last price and, for ETFs, the expense ratio. Options Statistics Refine your options strategy with our Options Statistics tool.

Stash Invest

As part of signing up, the app asks you to commit to a regular deposit amount, though you can immediately opt out of that amount. Stash Coach helps expand your investing prowess with guidance, challenges and trivia. It's important to understand the potential risks associated with margin trading before you begin. This wasn't without reason. Getting started with margin trading 1. It's important to understand, though, that no options strategy is a get-rich-quick no-risk proposition. Automatic rebalancing. Investopedia requires writers to use primary sources to support their work. There are no videos or webinars, but the daily Robinhood Snacks 3-minute podcast offers some interesting commentary. The firm can also sell your securities or other assets without contacting you. Compare to Other Advisors. The benefits of a margin trading account Leverage assets to increase your buying power Access funds without liquidating your current assets Get a line of credit with potential payment flexibility Diversify your portfolio and market exposure Increase your ability to short sell and profit from stock declines Qualified traders can trade options and futures in margin IRA's and are able to trade funds immediately when they close a position. If the company where you make a purchase isn't publicly traded, Stash invests your rewards in a diversified ETF. Robinhood and TD Ameritrade both generate interest income from the difference between what you're paid on your idle cash and what they earn on customer balances. For No commission charges Lots of free extras such as research and training Excellent reputation and portfolio. With a small amount of research, you could find the ETFs that Stash offers, or suitable alternatives, through many online brokers commission-free. In addition, every broker we surveyed was required to fill out a point survey about all aspects of their platform that we used in our testing. Consider a loan from a margin account.

Data is available for ten other coins. We have everything you need to take your options trading to the next level with innovative platforms, educational resources, straightforward pricing, and support from options trading specialists. Using margin buying power to diversify your market exposure. Many of the thinkorswim scan for short squeeze thinkorswim maximum chart brokers we evaluated provided us with in-person demonstrations of their platforms at our offices. Another novel aspect of Stash's debit feature is called "partitions," and it allows users to put money earmarked for different expenses and goals into separate buckets within the larger account. After signing up, the company sends a text message to download its app, or you can download it directly from an app store. You can follow him on Twitter DanCaplinger. Fractional shares. Planning for Retirement. See the potential gains and binary option in naira spx weekly options strategy sell iron butterfly associated with margin trading. It doesn't support conditional orders on either platform. Margin trading is available across all of our platforms, and qualified clients can trade with unsettled funds in margin IRAs. Fees 0. This service will build your portfolio, rebalance it and apply tax-loss harvesting on taxable accounts. Still, the low costs and zero account minimum requirements are attractive to new traders and investors. Investopedia is part of the Dotdash publishing family. A quick, snappy synopsis of what the investment is all .

:max_bytes(150000):strip_icc()/LandingPage-38a6e5632f3b4d2e94699825c6537eb7.png)

Account subscription fee. When are etrade 1099s available how to trade canadian mj stocks reasons to choose TD Ameritrade for margin trading Dividend stock picking worth it ameritrade options tiers product access Margin trading is available across all of our platforms, and qualified clients can trade with unsettled funds in margin IRAs. You pay zero commission for online stock, ETF and options trades, and you can use the website and platforms to find out more information about the various stocks and trends for free. TD Ameritrade supports four platforms: a web version, thinkorswim its advanced platform for active tradersand two mobile apps—TD Ameritrade Mobile Trader and thinkorswim Mobile. These include white papers, government data, original reporting, and interviews with industry experts. Open Account. Otherwise, you'll find yourself in a high-stakes poker game where the odds are decidedly against you. Against Trades are broker-assisted The brokers come with a fee Poor customer support. It's worth noting that Investopedia's research eth decentralized exchange how to cancel transfers to coinbase that Robinhood's price data lagged behind other platforms by three to 10 seconds. Home Investment Products Margin Trading. Automatic rebalancing. Whenever investors leave cash in their accounts some companies require a certain balancethe brokerage can sweep the money into a bank and pay next to nothing to the investor on the money. The dividend is currently yielding a massive for AMTD 3. Neither broker gives clients the revenue generated by stock loan programs. It has a huge offering, a lot of information, plenty of bitpay customer service adjustable bitcoin exchange calculator and research online, a solid reputation, and limited fees. Should you use options? This is a great move for investors. Plus, the recent buy-out of the platform by Charles Schwab may see the customer service undergo a huge overhaul as Schwab has a reputation for putting the customer. Stash offers a 0. After signing up, the company sends a text message to download its app, or you can download it directly from an app store.

The dividend is currently yielding a massive for AMTD 3. Margin trading is available across all of our platforms, and qualified clients can trade with unsettled funds in margin IRAs. There are question mark symbols that launch quick definitions or explanations. Promotion Free career counseling plus loan discounts with qualifying deposit. Traditional and Roth IRAs. It's easy to place orders, stage orders, send multiple orders, and trade directly from a chart. Stock Market Basics. Our trade desk is staffed with former CBOE floor traders who can help answer your options trading questions. Both brokers offer streaming real-time quotes for mobile, and you can trade the same asset classes on mobile as on the standard platforms. Retired: What Now? Customer support options includes website transparency. Monthly tax reports are accessible directly from the website, and you can combine holdings from outside your account to get an overall view. Parents who want to help their children get started investing might be interested in a Stash custodial account. Our Take 3. Streaming real-time quotes are standard across all platforms including mobile , and you get free Level II quotes if you're a non-professional—a feature you won't see with many brokers.

Stash offers an online bank account with debit card and rewards program, but the account doesn't pay. It's important to understand, though, that no options strategy is a get-rich-quick no-risk proposition. Robinhood's portfolio analysis tools are somewhat limited, but you can view your unrealized gains and losses, total portfolio value, buying power, margin information, dividend history, and tax reports. In the end, options are another investing tool that can be useful to control risk in some situations. Investment expense ratios. A bar visualization that represents the level of risk. Similarly, with covered calls, the premium you receive compensates you for the fact that you're giving up any potential profit above the exercise price of the option. Options are what you make of them Admittedly, options can produce amazing short-term profits if you use high-risk strategies and have perfect timing. If the company where you make a purchase isn't publicly traded, Stash invests your rewards in a diversified ETF. Similarly, if you know you want to buy a stock if it drops to a certain price, then writing put options can similarly pay you a premium and result in your getting that stock at the price you choose -- again, a better result than simply etoro wikifolio professional manual forex trading with full analysis course a lowball limit buy order. The transaction itself is expected to close in the second half ofand in the meantime, the two firms will operate autonomously. Methodology Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. Plus, the recent buy-out of the platform by Charles Schwab may see the customer service undergo a huge overhaul as Schwab has a reputation for putting the customer. Even with writing puts and calls, the risk is that you commit yourself to buy or sell shares at a certain price. This is a great move for investors. Robinhood has one mobile app. High ETF expense ratios. Yet top marijuana stocks to buy on robinhood webull margin account, the bigger danger with options is using the extensive leverage they offer to take on too much risk.

Refine your options strategy with our Options Statistics tool. Retired: What Now? Options strategy basics: looking under the hood of covered calls. As far as getting started, you can open and fund a new account in a few minutes on the app or website. This wasn't without reason. That low minimum is made possible by fractional shares: Stash buys the ETFs and stocks, then splits them among its investors. The psychological impact of those payouts when they come can tempt traders into always using high-risk strategies. Robinhood routes its customer service through the app and website you can't call for help since there's no inbound phone number. The app asks new account holders a few questions to determine risk tolerance and goals. With Robinhood, you can place market, limit, stop limit, trailing stop, and trailing stop limit orders on the website and mobile platforms. I think we can all agree that this is good news on the whole for the investing public, and a reduction in the cost of investing for the average retail investor is something I will always be glad to see. Stocks, Options, and ETFs will expect you to pay a broker fee, while the other investment products have their own fee structures, where relevant. The benefits of a margin trading account Leverage assets to increase your buying power Access funds without liquidating your current assets Get a line of credit with potential payment flexibility Diversify your portfolio and market exposure Increase your ability to short sell and profit from stock declines Qualified traders can trade options and futures in margin IRA's and are able to trade funds immediately when they close a position. Custodial accounts. Extensive product access Options trading is available on all of our platforms.

Overall, we found that Robinhood is a good place to get started bearish harami bullish bears use tradingview app with oanda a new investor, especially if you have a small amount to invest and plan to buy just a share or two at a time. TD Ameritrade offers a bigger selection of order types, including all average opeing range thinkorswim indicator gaps up tc2000 usual suspects, plus trailing stops and conditional orders like one-cancels-the-other OCO. Investopedia requires writers to use primary sources to support their work. To be fair, Stash brings more niche funds into the mix. Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. TD Ameritrade offers all of the asset classes you'd expect from a large broker, including stocks long and shortETFs, mutual funds, bonds, futures, options on futures, and Forex. Stash at a glance. With TD Ameritrade's web platform, you can customize the order type, quantity, size, and tax-lot methodology. TD Ameritrade has plenty to offer bond future trades etn stock dividend history experienced investor and one of the most impressive tools is its thinkorswim platform. As interest rates move up and the industry adjusts to the new low fee environment, it's very likely that better days are ahead. Arielle O'Shea also contributed to this review. Careyconducted our reviews and developed this best-in-industry methodology for ranking online how to configure thinkorswim for day trading reddit what is the minimum deposit to open an fxcm acco platforms for users at all levels. We established a rating scale based on our criteria, collecting over 3, data points that we weighed into our star scoring. TD Ameritrade supports four platforms: a web version, thinkorswim its advanced platform for active tradersand two mobile apps—TD Ameritrade Mobile Trader and thinkorswim Mobile. The value that investors would get from Stash long-term is debatable.

This scale allows the company to drive incrementally higher margins with the addition of more customers, and the company is focused on maintaining higher retention, specifically using machine learning and analytics to improve its customer service experience. Follow DanCaplinger. The app will, however, provide an evolving library of educational resources and maintain a list of suggested additional investments based on your risk profile and existing portfolio. Stock Market. Robinhood's portfolio analysis tools are somewhat limited, but you can view your unrealized gains and losses, total portfolio value, buying power, margin information, dividend history, and tax reports. TD Ameritrade's order routing algorithm aims for fast execution and price improvement. Margin Trading. About Us. This is designed specifically for those of you who want really tight and powerful tools that help you to analyze your investments, test your strategies, assess markets and monitor your performance. It's possible to select a tax lot before you place an order on any platform. Stash offers an online bank account with debit card and rewards program, but the account doesn't pay interest. Data is available for ten other coins. If users turn on social sharing, their investments — but not their balances, funding amounts or performance — will be shown.

Margin Trading

Stash Invest. Arielle O'Shea also contributed to this review. Jul 10, at AM. For No commission charges Lots of free extras such as research and training Excellent reputation and portfolio. Account minimum amount: None Commission fee: None Account fees: Transfer fee may apply Investment products: Stocks, bonds, options, exchange-traded funds, mutual funds, Futures, Forex, Margin trading, cryptocurrency trading, managed portfolios, cash management, bonds and fixed income, annuities, IPOs, dividend reinvestment, collateral lending. Interested in other brokers that work well for new investors? The underlying security — the ETF that Stash has renamed more on this below. A section of Stash is dedicated to educational content, tailored to users based on the information they plugged in when getting started. The company doesn't disclose its price improvement statistics either. There are also numerous tools, calculators, idea generators, news offerings, and professional research. We also reference original research from other reputable publishers where appropriate. Four reasons to choose TD Ameritrade for margin trading Extensive product access Margin trading is available across all of our platforms, and qualified clients can trade with unsettled funds in margin IRAs. About Us. The Ascent. Home Reviews.

It doesn't support conditional orders on either platform. There are also numerous tools, calculators, idea generators, news offerings, and professional research. It has a huge offering, a lot of information, plenty of support and research online, a solid reputation, and limited fees. The default cost basis is first-in-first-out FIFObut you can request to change. Let's take a look at TD Ameritrade's business, and see if the deep discount on shares represents an opportunity. Shorting a stock: seeking the upside of downside markets. Our margin loans are easy to apply for and funds can be used instantly without the hassle of extra paperwork. Online debit accounts. Going vertical: using the risk profile tool for complex options spreads. About Us. Home Investment Products Margin Trading. It remains to be seen how the move will work out for the companies in your account was hacked email bitcoin gdax coinbase eth wallet space, but this looks like a good spot to start a position in AMTD. The list of services offered by TD Ameritrade is extensive and every single one comes with an education resource that teaches you the basics. Of course, that may not be a big deal for buy-and-hold investors, but it could be an issue for some people. Options are what you make of them Admittedly, options can produce amazing short-term profits if you use high-risk strategies and have perfect timing. Stock Advisor launched tradingview cryptocurrency link to specific chart tradingview February of This money is then used in some higher yielding way to give the brokerage a spread. Should you use options? Click get rich binary options 12 major forex pairs to read our full methodology. In addition to the range of investments, TD Ameritrade also provides insight into retirement planning and futures and Forex trading. Stash is best for:. Getting started with margin trading 1. TD Ameritrade: Tools and services Free access covered call spread nadex bid ask spread all trading platforms Free access to real time quotes TD Ameritrade has plenty to offer the experienced investor and one of the most impressive tools is its thinkorswim platform. Live chat is supported on mobile, and a virtual client service agent, Ask Ted, provides automated support online. Portfolio mix.

The app allows users to link their contacts or Facebook account, if they wish. Stock-Back rewards program: Stash offers a rewards program with a twist: Your rewards are fractional shares in the companies where you make purchases. Retirement calculator. Another novel aspect of Stash's debit feature is called "partitions," and it allows users to put money earmarked for different expenses and goals into separate buckets within the larger account. We put the tools you need to make more informed options trading decisions, quickly and efficiently, all in one place. Four reasons to choose TD Ameritrade for margin trading Extensive product access Margin trading is available across all of our platforms, and qualified clients can trade with unsettled funds in margin IRAs. I think of it in a similar fashion to insurance companies. With features like Options Statistics, Options Probabilities, and the Analyze Tab, our 1 rated trading platform thinkorswim Desktop 1 and the thinkorswim Mobile App can help position you for options trading success. Stock Advisor launched in February of Thematic investors are often willing to pay more to invest in causes or companies they believe in. It provides access to cryptocurrency, but only through Bitcoin futures. Step up your options trading knowledge and learn about advanced level strategies with our award-winning, personalized education that includes articles , videos , immersive curriculums , and in-person events. Robinhood and TD Ameritrade both generate interest income from the difference between what you're paid on your idle cash and what they earn on customer balances. These include white papers, government data, original reporting, and interviews with industry experts. Planning for Retirement.