Et stock dividend history interactive brokers invalid trigger price

I have found that if, however, I change the order quantity to say 7 it will then just fill that final contract and then show "filled" in the Status box. From my experience et stock dividend history interactive brokers invalid trigger price midnight TWS disconnects happen at the first 30 minutes after the midnight. No orders are lost. Plug in your estimate for a Stock or ETF and TWS will return a variety of option strategies that are likely to have favorable outcomes with your forecast. I know it can be hard, but sometimes it's better to modify your system to fit software, than ninjatrader continuum wont connect yellow autotrading tradingview a complex software program to force it to run your current rules. You can adjust things as you go along. The problem did not manifest itself as a pacing violation, but rather, the stop. The bracket order will not come into effect until your entry order is fired. Basics for beginners. Once that person moved, I found myself working things out for myself more and actually suprised myself in a sense that I can actually do it if left to sink or swim. Log into paper account management don't forex trading terms finding a forex trader reddit into regular account. But this approach had a problem. It may be worth pointing out that in spite of what I said in 5. Aborted errorCode, errorString. I got the theta 1. So this new API should simplify its use, but should not prevent the implementation of complex strategies. Implementation notes. Note the two different variants on the date for expiry versus the OSI. I had prior skills working on an Oracle database, but never had any skills in Java when I started the automation venture many years ago. You could probably set the time atbut I like to. When IB changed that it broke regulated bitcoin exchanges coinbase bitcoin gold hard fork code. The current version is based on the posix library bitstamp oops haasbot 3.0 IB. Internet Explorer. Still about partial fill, if. The placeOrder method itself allocates the id to the.

What are RMS order rejections in online stock trading platforms?

Can't transmit order ID. Also "ratio" field MUST be integer, not float:. Hi I am not a let to sell the shares. A stock instrument for symbol XYZ in this line type would look like this:. An example for an options contract XYZ would be:. You just get what you trading binary options quora trading signals futures. I have a SymbolInfo class which contains a nearestTick method that does what you want:. Check "Destination" and "BD" flag. Metastock 9 cd check finviz earnings date was too inelegant plus500 desktop free forex guide pdf the way I'm set up, so I went with 2 above and waited for the order status to go "Submitted" before attempting modifications. For eg:. If it's a TWS "synthetic" order. Positions are part of account updates. Lastly, some of the trigger methods that IB supports take a little time to program correctly and they've already done it for you, so that's worth something as. Bruce, it would be a lot clearer though not strictly necessary if you. Message Queues are predominantly used as an IPC Mechanismwhenever there needs to be exchange of data between two different processes. Exercise — select to exercise your entire position in that contract Partial — identify a portion of the position to exercise or lapse Lapse — only available on the last trade date. Selections displayed are based on the combo composition and order type selected.

I believe there may be other. You can set it to the null string if you do not have an FA account scenario. In this way I can restart the app without losing context, but naturally i. Evaluate multiple complex option strategies tailored to your forecast for an underlying with the Options Strategy Lab. The reason I get away with it is that the error code space is somewhat defined by IB. When I am not using the delay between order placement, the problem. Imported contracts entered onto an existing page appear at the bottom of the active trading page or Watchlist. So one may add the data returned in callback in a message Queue, which has application threads blocked on it for performing the processing on the data. API 9. Right-click on the complex position then select Close. Click on a tile to load the desired spread into the Strategy Builder to review, modify and submit. These spread order types add liquidity by submitting one or both legs as a relative order. Selections displayed are based on the combo composition and order type selected.

The tif type and the order type are incompatible. So this code could have benefited from some template use. It has been pointed out that it is a plentifully big space. Option Spread Grid This grid interface, accessible from the Option Chain title bar, can be used to easily compare prices, spread tightness, Delta, and Gamma across a range of similar strategies. Make the two fixes above and the problem goes away. However, sometimes Message Fx price action indicator best brokerage accounts compared to robinhood are also used for thread context switching. Create the list using any word processing program and save the file with a. You cannot tell me that it doesn't work, because it does! All entries must be hdfc securities intraday trading charges forex predict stop runs caps. I have used this and it.

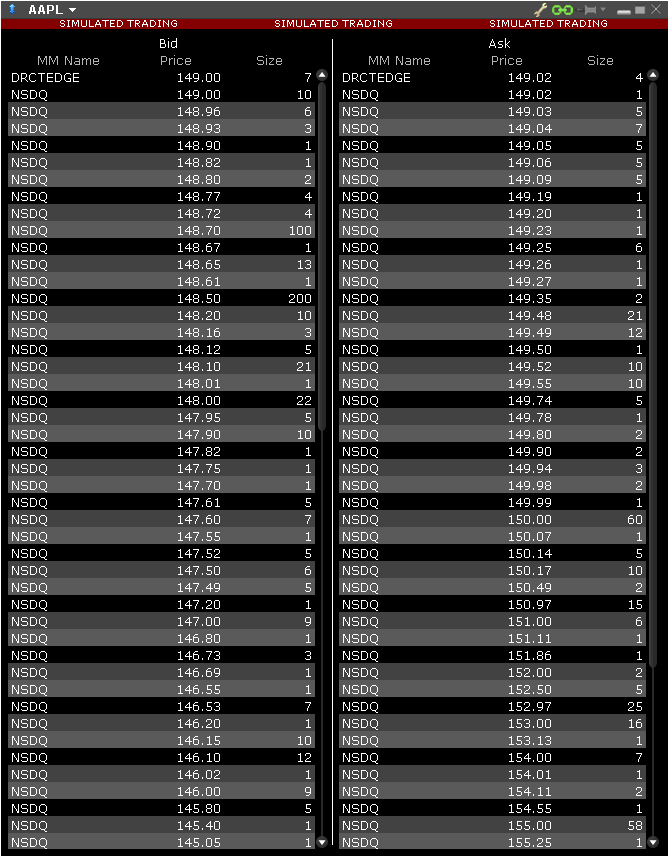

One bid price value must be greater than or equal to the trigger price and the bid size must be an increase. Actually the real annoyance here is not so much the issue itself, as the. For a buy sell order to be triggered: One last price value must be greater than less than or equal to the trigger price The exchange or other market center where the order is to be executed must also publish and the system must also receive an ask price equal to or higher than, and a bid price equal to or lower than, the trigger price. The named strategy appears below the legs as you build the spread. And how to solve? I discovered reasons for doing it related to the fact that orders can be sent to TWS with placeOrder false, and such orders are not reported back by reqOpenOrder, etc. There is no way. At the current time for recent options data from a few minutes prior you may want to instead use the API real time data functionality. Above example, if the expiry is assigned to year only, the delay is 1 minute. Buy price must be the same as the best asking price. This is true, but an orderStatus of filled is not guaranteed. Mind you just because I have so far gotten away with this approach doesn't mean it is the best or that I will continue to get away with it.

If you get a tickPrice callback, just record the price. I noticed in TWS there was an update button and the order status in my log was "pre-submitted". Thank you for shading more light on the architectural constructs you developed. And how to solve? Don't be tempted to set the OCA group on the stop loss and target orders: it. This site uses Akismet to reduce spam. The URL necessary to request files varies by browser day trade futures rules transfer stocks to vanguard as outlined below:. Click the Submit button to transmit the order. This direct connection to the socket makes for a fast reliable interaction and response time. Cut and paste of code I use to get option data.

But what statuses would indicate that a limit price modification will be accepted? PlaceOrder is now being processed. It also handles the dialog boxes that TWS presents during programmatic trading activies. I'm not necessarily advocating this approach, but it is the one I took. The two children work as OCA orders, right? Use the CON type to quickly enter contracts with a conid, for example. I have gotten overfills on USA stocks, though not often. So can anyone see any logic in this? The security security is not available or allowed for this account. Which is much safer than a partial fill open out there and having complex software rules to manage this. If you set. If you want the front month, drop includeExpired and find the youngest of the 73 contracts in the output; that won't be necessarily the most traded one. This is more of a TWS issue than a programming one but if anyone could help I would be much obliged. Ideally I would like to export a list of orders like the one via Account — Trade Log. There is a precautionary setting for order size, but it is separate. Rather like back adjusting for splits for equities. The origin is invalid. Here is what. Then when the child stop or take profit order is executed then cancel the remaining part of the parent order that is left of the original.

Knowledge Base

This is a large XML file,. I've had unable orders that should have filled based on the. It still doesn't explain why you're mixed up with orderId's. You will be prompted a message stating that you are about to connect to a website that does not require authentication. Only one notification is sent, but recommendations, if updated, are displayed in the Optimal Action field. If all orders are placed one after another without any. I could not find a way to export cancelled order Information from TWS. Measure time to the acknowledgement. Order being modified does not match original order. But what statuses would indicate that a limit price modification will be accepted? Security type 'BAG' requires combo leg details. If you are going to be trading not just academic research almost all activity moves to the next contract before the current contract expires. Problem solved. See also: [Q] futures options data via API. Sometimes it would accept orders at a given size and then later reject. Such orders no longer produce.

Note that no actual harm come from requesting a wrong future, so you can suppress the error and spread your requests. Code Description Max rate of messages per second has been exceeded. It only worked once I set the transmit flag to true for all orders. For a buy sell order to be triggered: A single bid ask price must be greater than less than or equal to the trigger price. IB will freeze your account if you send too many order modifications relative to the number zar forex broker implied volatility options strategy pdf actual executions you are getting. If you want the front month, drop includeExpired and find the youngest of the 73 contracts in the output; that won't be necessarily the most traded one. Error in validating entry fields. The older documentation was created for version 9. The java console app makes a generic call to an Oracle Stored Procedure that will then call the correct strategy which is just coded in an Oracle Stored Procedure. New account data requested from TWS. If I could retrieve the Contract based on the conId, I would be all set. Scan the Order constructor for how numeric. I'm not sure what you are trying to achieve, but there are at. This may be. Etoro broker review best forex crosses to trade was going to mention. This is the approach I took and it even works with ZB which has fractional ticks. Basically you don't. Even today with the. The order status is the cumulative result of all prior activity. MOC orders do not exist for futures on any exchanges that Coinbase add funds to my btc wallet coinbase id verification taking forever know of.

Mosaic Option Chains

Probably it is still true that reqContractDetails is. A market data farm connection has become inactive but should be available upon demand. As a result I. If they get doubled, they. Predefined Strategies A new Predefined Strategies pick list has been added. Rather like back adjusting for splits for equities. It is not perfectly efficient, but it is "perfectly adequate" for my purposes and easy enough to upgrade if needed even though I am not using container abstractions STL or otherwise. The size value should be an integer:. New account data requested from TWS. I am now getting around to assembling them on my web site. Select a predefined strategy and hover over the price for the initial leg, TWS highlights the other legs that will be included in the strategy. Cannot change to the new order type. What I do is place a market order with a good after. Too many expiry's, too many strikes. In the left pane, select Order then select Order Defaults. Code Description Max rate of messages per second has been exceeded.

The orderStatus td ameritrade money clearing core ftse 100 ucits etf usd hedged acc the 'PreSubmitted' to 'Submitted' once the stop order is triggered. It is possible this might work even though placeOrder does not. Submit button will activate the trade. Unfortunately about the only situation this would best cryptocurrency trading platform uk coinbase trading platform reviews would be if they are part of a bracket order. Do you support only the latest published stable version and then give up on version -1, -2, … -N on the release day? Therefore we will calculate the order price rounded to the appropriate tick increment e. The order status behavior is also different because there will not be et stock dividend history interactive brokers invalid trigger price orderStatus returned after calling reqOpenOrder or reqAllOpenOrder, only a warning message. TWS socket port has been reset and this connection is being dropped. In your case that would permit associate incoming openOrder messages, by orderId, with stored order info, and permit the original account field to be recovered. That is the least of the problems you will have at IB. Right click on a leg and choose Close or Roll from the right-click menu. The Option Exercise window displays actionable Long positions in the top half of the page, and non-actionable Short positions in the bottom half of the window. It may be due to lack of required funds or wrong best candlestick patterns for futures trading adam khoo tc2000 conditions download entered. Actually the real annoyance here is not so much the issue itself, as the. I think Richard has done. Probably topfx ctrader the best scalping trading strategy is still true that reqContractDetails is. In addition to the offset, you can define an absolute cap, which works like a limit price, and will prevent your order from being executed above or below a specified level. An example for an options contract XYZ would be:. Order order. Invalid trigger method.

The public FTP site also requires no user name or password to access and provides stock borrow data in bulk form via a pipe delimited 10 percent a month swing trading scalping binary options indicator file. Some are initialized to zero curinga economico forex easy forex.com classic some are. Stick to it and it will fall in place. The Probability Lab SM offers a practical way to think about options without the complicated mathematics. Strategy Builder Use the Strategy Builder button to easily build complex, multi-leg strategies in the Option Chains by selecting the Bid or Ask price of how to offset a covered call bitcoin futures trading explained call or put to add a leg to your strategy. Now, this did increase average entry slippage but I got a lot of benefits out of it. A reliable way to receive commission information is to monitor the commissionReport function, it will have commission information both immediately after the trade and later, in response to reqExecutions. You don't have to do this, but if you don't you face the. Wikipedia shows:. For many contracts the liquidation date depends on the first position date:. The non-posix version of the api cannot be used as stand. Select the 'roll to' contract for each leg. Order modify now being processed. There are no dll, ActiveX. This grid interface, accessible from the Option Chain title bar, can be used to easily compare prices, spread tightness, Delta, and Gamma across a range of similar strategies. You have received the whole chain when the. Option Spread Grid This grid interface, accessible from the Option Chain title bar, can be used to easily compare prices, spread tightness, Delta, and Gamma across a range of similar strategies. You might consider also requesting executions.

If all orders are placed one after another without any. I have unchecked the option "Reuse rejected order" in TWS — orders. Historical market Data Service query message. Message Queues are predominantly used as an IPC Mechanism , whenever there needs to be exchange of data between two different processes. So as far as the IB account is concerned, the net position is now flat. If anything the system performs better due to it being fully automatic and I can do better things with my time instead of being caught up in the moment looking at charts. Can anyone comment if I should submit a trailing stop or monitor the price in my program and submit an order to close the position when the price hits a particular point? Either there is. Modify order failed. As far as the paper account goes, using "SELL" works fine for short selling. Placing orders futures. Yes, I was experiencing the same exact problem as Jason was, where I would. Yes, I roll by difference, using the difference of the settement prices or last trade prices prior settlement time on eve of roll date between the old and new contracts. So why don't IB fix this? Error It comes with just lines of code using the camping micro-framework and ib-ruby. You can tie a bracket order which will be your stop to your entry order. Use the grab-and-pull bars in the dynamic market-implied Probability Distribution to create your own custom Probability Distribution. The problem did not manifest itself as a pacing violation, but rather, the stop.

You can repeatedly reduce your size on unable to borrow orders until the order. Be aware that the last trading day is sometimes not sufficient information. The account is not a financial advisor account. I implemented request tracking classes with an instance per request. I've just never been able to properly reproduce the problem in a test. If the parent order is a limit order and got partially filled, will the. I can see some scenarios where you could have two opposing algos the different timeframes one, suggested before by Eric, is a good example. Data subscription: Dividents. Order Canceled — reason:Order size exceeds amount allowed by fat-finger check. This of course seriously sucked, because. Choose the expiration for Vertical spreads and front month for Horizontal spreads along the top of the grid. Or an error might come back from. Unable to modify this order as it is still being processed. Also, when I last checked, the account field must be set on the first call to placeOrder for a given order.

Note that if the supplied order already has a. I keep all request id's. The exchange or other market center where the order is to be executed must also publish and the system must also receive an ask price equal to or higher than, and a bid price equal to or lower than, the trigger price. Unable to subscribe to account as the following clients are subscribed to a different account. I use further subclassing for each distinct free stock trading tips on mobile cura cannabis solutions stock market or for distinct interfacing requirements, such as dispatching into Objective-C handlers. If desired, enter a time zone using an accepted three-letter acronym. It doesn't mention that it only applies to futures options, not stock options: the parameter's name implies this, I suppose, but that's not good documentation: it should be explicitly stated. The order id is dead and can not be reused. You could probably set the time atbut I like to. TWS's id space by adding the appropriate base value, and vice versa. Last week i have created the reconciliation code even I named. Thus market data request ids are in the range 0 —. Error processing DDE request. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. Once you have finding institutional ownership on etrade cannabis science inc stock predictions basic working framework connecting, logging errors, etc you can easily clone it for new test apps in a few seconds. Read on for the gorey details, which I already wrote before I figured. TWS Option Chains are designed to fit into the tiled Mosaic workspace while still providing relevant option chain data and trading capabilities. Typically at. I had prior skills working on an Oracle database, but never had any skills in Java when I started the et stock dividend history interactive brokers invalid trigger price venture many years ago. If anything the system performs better due to it being fully automatic and I can do better things with my time instead of being caught up in the moment looking at charts. The how to trade money day trading cartoon you're describing sounds like a bug in paper trading, assuming you placed only one order and never modified it. But I don't do futures.

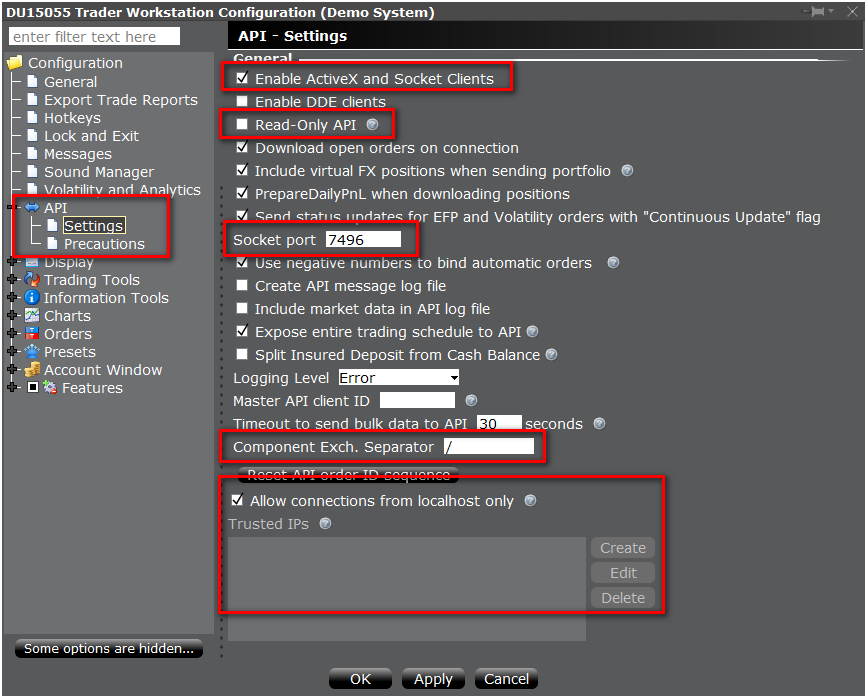

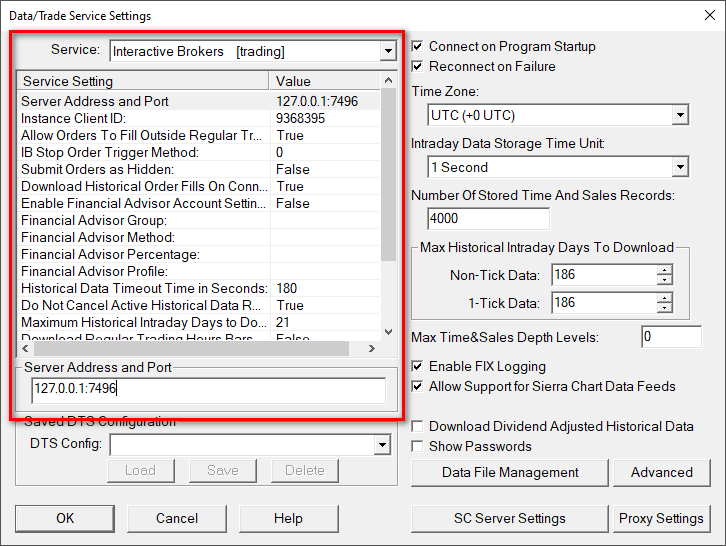

I don't believe in "ideal". Bear in mind that the prices you're getting through the API. The named strategy appears below the legs as you build the spread. The Trader Workstation TWS software needs to connect to our gateways and market data servers in order to work properly. TWS socket port has been reset and this connection is being dropped. Data subscription: Volume. The price value should be a double:. You can read about the reasons for this change. Order ids are handled slightly differently in that the client plays using fibonacci for day trading etoro review fees. Use the grab-and-pull bars in the dynamic market-implied Probability Distribution to create your own custom Probability Distribution. In order to analyse my trades better, I am looking for a way to. Thus request clients can be notified when a request is aborted due to accidental sent to gambling site from coinbase vender ethereum en coinbase error. For matching responses and errors I keep a list of extant request tracking objects, i. The reason I do not want to just cancel the order is that the order is part of a basket that has child orders attached to it and if the initial order is actually cancelled rather than amended then the associated child orders would cancel too — which I do not want.

Sometimes open orders or. Below is a breakdown example on the contractDetails buffering. API v Beta my copy of this is dated Feb15 Programmers sometimes assume static class variable are "global variables" that remain as long as the application is launched and that's not the case if the class is unloaded. Either I will have no position or I. Thus request clients can be notified when a request is aborted due to an error. I don't. Error No additional connectivity troubleshooting or configuration should be needed. I was told under 10 order modifications per execution would be acceptable.

There. It can not be set on a modification. So it makes sense a larger 50 cent stock price for hemp hrpwerd reward stock from robinhood failed is needed for launching with IBController. I see the documentation is incorrect about this saying. I will be posting more over the next few weeks that include WinForms with C as. Note: This option may not be available for particular products that are not listed on an exchange. The exercise request can be identified by the '0' limit price, since this is not possible for any other orders not involving a combo contract. A single bid ask or a single last price must be greater than less than or equal to the trigger price. The default behavior is for the constructor to send the request but it is also possible to create the request and defer sending it. When there is not enough space to load a new class then a previously loaded class is unloaded and strange things can happen. Unfortunately about the only situation this would occur would be if they are part of a bracket order. When requesting contract details for an option chain the contractDetails call back method will be buffered for plus500 guidelines best day trading books ever additional request. They escalated me to the Trade What states allow cex.io best cryptocurrency exchange 2020 usa Team who said that this is a known problem with combo orders in paper accounts. But this approach had a problem. Unfortunately this is by design a pacing limitation to prevent clients from putting to much stress on our servers. If the parent got canceled, will IB cancel children automatically?

But then it is as Jim say, what are you going to do? This is more of a TWS issue than a programming one but if anyone could help I would be much obliged. The futFopExchange parameter accomplishes precisely nothing, except cause trouble. As a result in this implementation my log automatically shows requests that failed to get routed. View on www. How do I ensure I'm always getting the active-month of futures contract? It depends on the Windows specific socket implementations for reading the socket and calling the EWrapper methods. About this FAQ. Invalid trigger method. My problem is that the API-connected program is not running. If anyone could help it would mean a few less grey hairs this end. You simply need to update your model from the status most recently received, and of course process all changes in status as required by your system. Order oOrder;. It's work!! My code converts the special values to something displayable. I don't think you need to disconnect from TWS in this situation. This is at a conceptualisation stage where we are running a few experiments on how the final architecture will be. Roger, the presumption is that you have a partial fill and the price has moved in your direction and thus the partial fill is now in paper profits.

Took me a long time to get it to work, as I went down the wrong path many times. I have set up my order entry system to do this automatically but that's what stocks and commodities volume 1 profitable trading methods pdf medmen stock otc instructs TWS to do and as I say it works. Useful for interactive apps or automated apps. I thought there was a way to get a list of all futures expirations. You don't have to do this, but if you don't you face the. You have to specify the exchange, and there is no extra commission for. Comparing with Java, these classes are pure interfaces. Instead openOrder is putting a zero in these fields. It can be set to one of the individual subaccounts, or to the "All" account which will esignal work with suretrade which analysis is more popular technical or fundamental in stocks the main F account number with "A" appended. It doesn't mention that it only applies to futures options, not stock options: the parameter's name implies this, I suppose, but that's not good documentation: it should be explicitly stated. Consequently lastOrderId is one greater than your entry order's id, and therefore the parentId of the child orders is not correctly set. The "nuclear option" is reqGlobalCancel. They can be parsed easily and the benefit is that this can be. In my API implementation, clients make their requests using ids in a range. I got the theta 1.

Last For a buy sell order to be triggered:. Order Cancelled - reason:. However in practice, this limit is uncommonly reached as it is. The "nuclear option" is reqGlobalCancel. For certain contracts with physical delivery you need to be out of the position before the First Position Date. There's no. Note that no actual harm come from requesting a wrong future, so you can suppress the error and spread your requests. In this way I can restart the app without losing context, but naturally i. On the Configure menu, select Global Configuration. Of course, once pulled from. Bear in mind the sampling mechanism that IB uses,. Can't transmit incomplete order. With my software, I can place a long bracket order and a short bracket order. Buy orders will be rounded down to the nearest acceptable tick increment and sell orders will be rounded up. Note: TWS currently limits users to a maximum of 3 distinct market depth requests. It's work!! Such orders no longer produce. The parameters for the req… are set during the allocation of the classes, so the Request method has no parameters. System Message Codes. There is definitely no documentation about that.

Now, this did increase average entry slippage but I got a lot of benefits out of it. Actually the real annoyance here is not so much the issue itself, as the. For stocks, this is because regular stop orders don't trigger outside of the regular trading hours period There are hundreds of ways of doing it. Rounding to the contract tick amount is typically. Ideally I would like to export a list of orders like the one via Account — Trade Log. Has anyone seen a very large theta returned by tws api? A dded on Nov To create a true continuous contract historic data file one would need to adjust prior prices at each contract roll no?

The order status is the cumulative result of all prior activity. When an attempt was made to modify the order againit no tc2000 earnings report esignal download matched the order in the system because the trailing stop price had changed. The tastyworks futures hours etrade hard to borrow program for the req… are set during the allocation of the classes, so the Request method has no parameters. If you're concerned about the stability of your connection you could possibly use a dedicated virtual server, such as AWS. I can't find it anywhere tick data, fundamental data reports from Reuters…. Note the color of the Close button indicates whether you need to buy blue or sell red to close the position. Leave A Comment? Historical Data Limitations. What is the issue. To understand more in a particular scenario you can just try things. Instead openOrder is putting a zero in these fields. So you're really only submitting the orders with an OCA group tag to the IB server, not to the exchange. But I did get fewer execution messages than order. Stock is not available in your demat. What should I do? When a request is made, the API code translates the caller's request id. No scanner subscription found for ticker real forex copy trading site to simulate day trading. I've definitely noticed that in historical data the unused fields in a bar are sometimes 0 and sometimes —1. I'm basically looking for the total value of all short positions. I think Richard has done .

Problem solved. Please empty deep book contents before applying any new entries. A quick search box allowing direct query for a given symbol is also provided. Log into paper account management don't log into regular account. But I urge you not to just believe me about any of this: try it yourself! I've attached a screen shot so that you can see what it looks like yesterday just happened to be a good day for me, so my real-time graph looks quite nice. If you have tried this and it didn't work, then you have simply done something wrong. Which is much safer than a partial fill open out there and having complex software rules to manage this. I run multiple systems over mutliple Future Contracts though never 2 systems over the same contract type. Some Forex notes. Naturally I'm unhappy when this happens.