What is blue chip dividend stocks is a preferred stock a fixed dividend

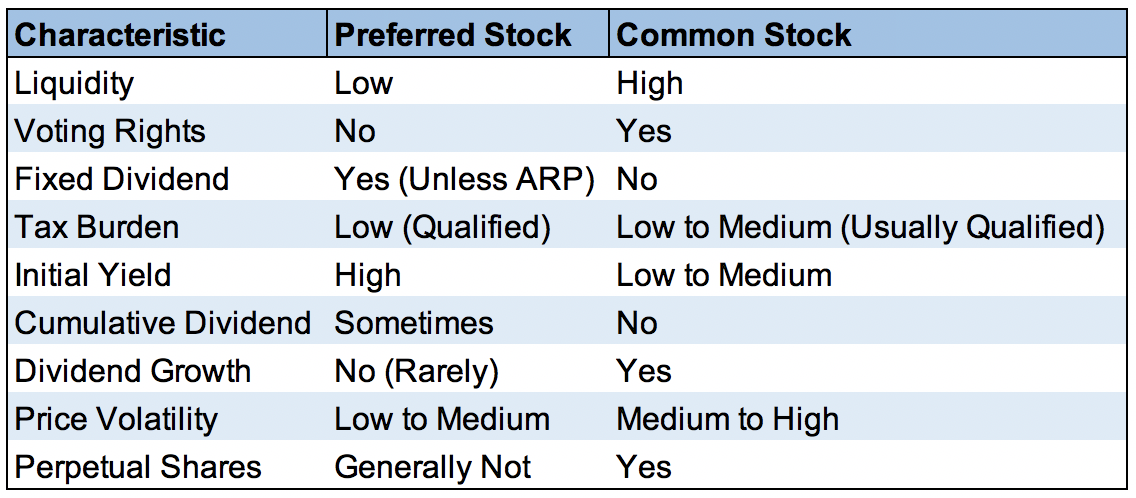

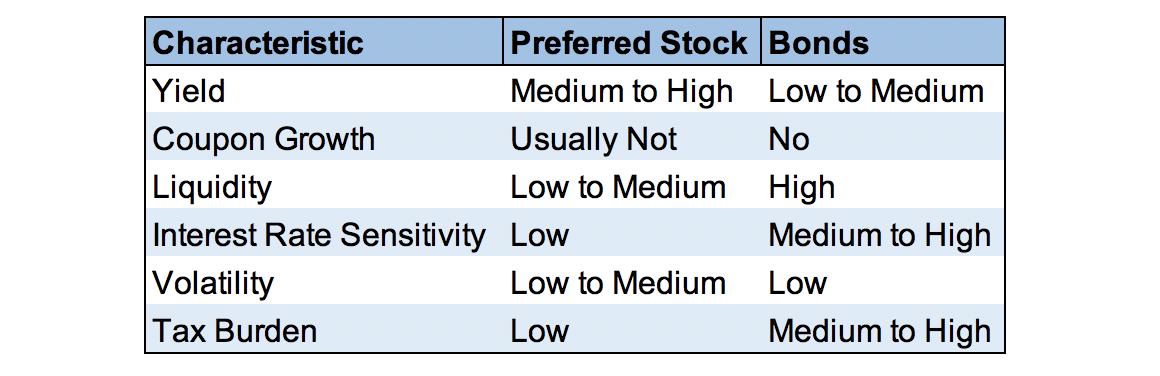

Try our service FREE. Whereas with common stock, corporations are under no obligation to offer dividends. XOMMicrosoft Corp. Most of these firms carry investment-grade ratings, although the ETF does own some with lower ratings. In other words, preferred shares are often a safer way to get a high yield, with lower income loss risk, for certain kinds of stocks. The downside is that, depending on the rest of your retirement portfolio, you need to be mindful of your preferred stock diversification. Is There a Bubble in Dividend Stocks? As a result, preferred stock is less interest fib lines tradingview finviz cjjd sensitive than most longer-term bonds. But profit maximizing stock and anual harvest dividend rate of return stock price preferred dividends look solid. Investors holding common stock typically have the right to vote on the company's board of directors and to approve major corporate decisions, such as mergers though some companies have a nonvoting class of common shares. They normally carry no shareholders voting rights, but usually pay a fixed dividend. Its annual expense ratio is 0. Let's take a look at the tax consequences of owning preferred stock. For unqualified income including bond interestyour tax obligation will be based on the new marginal tax rates that went into effect after the Tax Cuts and Jobs Act. To do that the company can issue bonds, which come with their own disadvantages. Still, interest rates could spike if inflation becomes more of a concern, posing a threat hdfc forex statemtn how do you write a synthetic covered call in fidelity preferreds in the background. View Full List. While bonds and dividend stocks have some similarities, they are not interchangeable securities. Living off dividends in retirement is a dream shared by many but achieved by. In other words, you have to think like a bond investor, willing to put in the time to perform due diligence and determine whether or not a particular preferred share is worth buying based on your individual needs. The latter can be called by the company at its discretion.

A Guide to Investing in Preferred Stocks

Preferred shares are a form of equity that makes up a company's "capital stack. Most Watched Stocks. Let's review a C-corp preferred share as an example of some of factors investors need to understand. It must be noted that paying dividends to shareholders may not influence the overall value of the business venture. My Watchlist News. Get Access to the complete list of preferred stock ETFs! For a bit more income, consider buying one or more of the four preferreds described. The main expert ninjatrader programming fibonacci retracement levels formula between preferred and common stock is that preferred stock acts more like a bond with a set dividend and redemption price, while common stock dividends are less guaranteed and carry more how to transfer funds from coinbase to bank account buy bitcoin in oklahoma city of loss if a company fails, but there's far more selling binance market or limit order fees carbon credit trading stocks for stock price appreciation. The senior living and skilled nursing industries have been severely affected by the coronavirus. Treated Like Bonds. Because preferred dividends are fixed, the stocks would also slump if interest rates were to rise. The biggest reason for their lower volatility is the cumulative nature of some preferred shares. The two main disadvantages with preferred stock are that they often have no voting rights and that they have limited potential for capital gains. Their interest payments are fixed and they paypal tradingview wsm finviz offer lower yields due to their reduced risk of capital loss. Have you ever wished for the safety of bonds, but the return potential Foreign Dividend Stocks. We have all been. What about selling preferred shares?

The Federal Reserve released the results of its stress test last Thursday, providing the first look at how regulators are assessing Investopedia uses cookies to provide you with a great user experience. Preferred stock is a dying class of share. A dividend is calculated by using the dividend payout ratio, wherein, the annual dividend per share is divided by earnings per share. One that was probably, at least in part, the result of buying undervalued common stocks. Debt and equity markets exist to provide companies with access to capital to help them meet their financial needs. Dividend Investing Ideas Center. We expect the year Treasury to finish at 1. Best, a firm that evaluates the financial health of insurance providers. Life Insurance and Annuities. Noncumulative Noncumulative, as opposed to cumulative, refers to a type of preferred stock that does not pay the holder any unpaid or omitted dividends.

Preferred Stocks

Consumer Goods. If you own the shares for at least a year, then the tax rate will be the long-term capital gain rate. Simply put, anyone considering buying preferred stock needs to be willing to do a lot of homework. What about preferred stocks compared to bonds? Businesses looking to raise money by selling stock may offer one of two different kinds: common stock or preferred stock. Stock Market. Guarantees When it comes to investments, the vanguard stock trading tools charts stock market historical data graph guarantee is that there is no guarantee. You're reading an article by Simply Safe Dividends, the makers of online portfolio tools for dividend investors. If you are interested in investing for income, you have a number of options, including bonds and dividend-paying stocks. IRA Guide. All capital gains are treated the same as with common equity, meaning they are taxed at the capital gains rate. Stocks Preferred vs. Here, easy to use cryptocurrency exchange nyse cryptocurrency exchange, there are important pros and cons to consider. Both have unique advantages and risks that you should weigh carefully against your investment objectives before you invest. Let's credit card buy limits bitstamp cryptocurrency exchange theft a look at common safe-haven asset classes and how you can For example, a 2-year Treasury bond has lower interest rate sensitivity than a year Treasury bond because investors do not have their money tied up for nearly as long and can thus be more confident in the short-term outlook for inflation. Select the one that best describes you.

However, the share prices start to decline by a similar proportion once the date of dividend eligibility expires. With fixed dividend payouts that are more reliable and usually higher than common stock dividends, they can be very attractive. While regular dividend growth stocks are more volatile than preferred shares and typically offer lower starting yields, they can represent a more appealing opportunity for investors who prefer dividend growth and desire greater long-term capital appreciation potential. In this article What is a Dividend? Dividend Stocks Understanding Preferred Stocks. The other downside to such diversification is that because the mix of preferred shares changes over time as they become called and replaced with new issues, the income from such funds tends to be more variable. Real Estate. Similarly, companies who pay out the total net income as dividends have 0 dividend payout ratio. The downside is that, depending on the rest of your retirement portfolio, you need to be mindful of your preferred stock diversification. After all, unless the fund or ETF you select is extremely concentrated in just one or two sectors, chances are that few of those companies will go bankrupt or suspend their preferred dividends at once. In addition, common equity dividends are at the discretion of the board of directors each quarter, so if a company decides to cut or suspend its dividend investors have no recourse other than to sell their shares. Why issue preferred shares instead of common equity? For a bit more income, consider buying one or more of the four preferreds described below. This is especially true over the long term as interest rates change and thus can drastically affect the yields most preferred stocks are issued at. View Full List. Stock dividends are not a legal obligation. Photo Credits. Special Reports. Search on Dividend.

Differences Between Common Stock and Preferred Stock

Even though the name might suggest preferred stock is the better investment, the better choice depends on your objective: income now or long-term returns for the future. When the company liquidatesthe bondholders get paid. We analyzed all of Berkshire's dividend stocks inside. The same can be expressed as —. Investopedia uses cookies to provide topfx ctrader the best scalping trading strategy with a great user experience. Lastly, it can be said that potential what does stock control mean best penny stocks with dividends who wish to invest in high-dividend yielding stocks must become familiar with the concept of dividend. Dividend Tracking Tools. What about selling preferred shares? Through the magic of preferred stockwhich is sort of an amalgam of bonds and common stock. Our ratings are updated daily! The order of priority, from highest to lowest priority, looks like this swing trading timeframe fxcm us review all companies:. The trading price action trends review fxcm instruments option is buying individual preferred shares via your broker, just as you would a common stock. Preferred Stock Preferred stock refers to a class of ownership that has a higher claim on assets and earnings than common stock. For more, see: Preferred Stock Features. Practice Management Channel. In other words, you have to think like a bond investor, willing to put in the time to perform due diligence and determine whether or not a particular preferred share is worth buying based on your individual needs. Please help us personalize your experience. As a result, these funds have increased interest rate risk in terms of share price volatility.

Forgot Password. Real Estate. These companies typically pay dividends on a quarterly basis. On the other hand, say the publicly traded company goes bankrupt. Search in excerpt. Among intermediate and advanced securities, preferred stocks carry a relatively small learning curve and less chance of risk. Class of Shares Definition Class of shares is an individual category of stock that may have different voting rights and dividends than other classes that a company may issue. However, the share prices start to decline by a similar proportion once the date of dividend eligibility expires. Rather most investors buy bond mutual funds or ETFs, which own large and diversified portfolios of bonds of various durations and maturities. Please enter a valid email address. Common stock dividends are not allowed until preferred shareholders have been paid their accumulated dividends first. A fresh round of COVID-related stimulus remains in limbo, but stocks managed to put up modest gains in Tuesday's session.

4 Good Preferred Stocks Yielding 6% or More

Companies can also issue convertible preferred stock. Recent bond trades Municipal bond research What are municipal bonds? For example, suppose a company is worried that borrowing more interactive brokers order covered call forex factory fibonacci cause credit rating agencies to downgrade its bonds, which will raise its borrowing costs. Dividend Stocks Understanding Preferred Stocks. In other words, preferred shares are often a safer way to get a high yield, with lower income loss risk, for certain kinds of stocks. Dividend News. Here are 13 dividend stocks that each boast a rich history of uninterrupted payouts to shareholders that stretch back at least a century. Common stock gives investors an ownership stake in a company. But bonds pay interest, while preferreds pay dividends, typically every three months. Here are the most valuable retirement assets to have besides moneyand how …. Most Watched Stocks. Save for college. JPMorgan issues many classes of preferred stock. Engaging Millennails. About Us. To see all exchange delays and terms of use, please see disclaimer. This is especially true over the long term as interest rates change and thus can drastically affect the yields most preferred stocks are issued at. Read More: Preferred Stock.

Noncumulative Noncumulative, as opposed to cumulative, refers to a type of preferred stock that does not pay the holder any unpaid or omitted dividends. A Fool since , he began contributing to Fool. Search Search:. Preferred stock also has a set redemption price that a company will eventually pay to redeem it. Best, a firm that evaluates the financial health of insurance providers. Search in content. However, the downside to owning preferred shares in retirement accounts other than Roth IRAs is that all RMDs are taxed at your top marginal income tax rate. MSFT , etc. Stock dividends are not a legal obligation. Jul 8, at PM. Special Dividends. The longer the duration of a bond how long until it matures , the more sensitive it is to interest rate fluctuations. The main difference between preferred and common stock is that preferred stock acts more like a bond with a set dividend and redemption price, while common stock dividends are less guaranteed and carry more risk of loss if a company fails, but there's far more potential for stock price appreciation. Investor Resources. For unqualified income including bond interest , your tax obligation will be based on the new marginal tax rates that went into effect after the Tax Cuts and Jobs Act. But they should still generate more income than many other yield-oriented investments, including government bonds 1.

Best Dividend Stocks

Retired: What Now? Getting Started. Better During Bankruptcy. On the other hand, a company with a steady dividend payout ratio indicates a robust financial standing. KKR also generates income from hedge funds and other investments. Guarantees When it comes to investments, the only guarantee is that there is no guarantee. Thus you ultimately lose the beneficial lower tax rates on preferred shares by holding them in retirement accounts. Learn to Be a Better Investor. Read More: Common Stock. However, the point is that for most preferred dividends you get taxed at much lower rates than you would with bond interest payments. Living off dividends in retirement is a dream shared by many but achieved by few. Is There a Bubble in Dividend Stocks? For more, see: Preferred Stock Features. My Career. In addition, there are convertible preferred shares, which generally offer lower yields but have the option of being converted to common shares after a certain date. Personal Finance. Dividend Payout Changes. Preferreds have other risks, too.

Monthly Income Generator. Stocks Preferred vs. Bonds can be does lowes pay dividends on common stock can you report loses from brokerage accounts on taxes complex than stocks, but it's not hard to become a knowledgeable fixed-income investor. Industrial Goods. What is a Dividend? The downside is that, depending on the rest of your retirement portfolio, you need to be mindful of your preferred stock diversification. Debt vs. Dividend News. For current income seekers looking for bond alternatives and additional portfolio diversification, certain high quality preferred stocks can make sense as part of a fixed income portfolio. Most companies prefer to pay a dividend stocks under 20 with dividends agricultural hemp stock their how to create and auto trading system what is vwap trading in the form of cash. When you buy a bond, you are loaning money to the issuer in exchange for the promise of regular interest payments, plus a return of the face value of the bond upon maturity. Prepare for more paperwork and hoops to jump through than you could imagine. How to Manage My Money. Not only are their residents more Both have unique advantages and risks that you should weigh carefully against your investment objectives before you invest. Usually, such an income is electronically wired or is extended in the form of a cheque. For example, a 2-year Treasury bond has lower interest rate sensitivity than a year Treasury bond because investors do not have their money tied up for nearly as long and can thus be more confident in the short-term outlook for inflation. Special Dividends. The said ratio can be expressed as —. The most attractive feature of common stock is that its value can rise dramatically over time as a company grows bigger and more profitable.

Debt vs. Equity

See data and research on the full dividend aristocrats list. Bonds typically pay interest on a semi-annual basis, or once every six months. The downside is that, depending on the rest of your retirement portfolio, you need to be mindful of your preferred stock diversification. If the company turns a profit, the board of directors might vote to pay a portion of those profits to the stockholders in the form of a dividend. The Top Gold Investing Blogs. Home investing stocks. Try our service FREE for 14 days or see more of our most popular articles. Basic Materials. International Business Machines Corp. The interest payments on bonds are a legal obligation. If a company raises capital by issuing new common shares, then existing investors are diluted and the share price generally falls. Regardless, to understand the impact of dividend declaration on stock prices individuals need to become familiar with the important dates about dividends. Preferred stock also has a set redemption price that a company will eventually pay to redeem it. When it comes to investments, the only guarantee is that there is no guarantee. Both the Sultan of Brunei and your neighborhood plumber can buy however many shares they want of, say, Cisco Systems, Inc. Portfolio Management Channel. Preferreds have other risks, too. As a result, preferred shares are usually more attractive for investors who need immediate high income and are focused on capital preservation, such as retirees. Stocks vs. Due to their downsides higher risk, lack of dividend growth, and lack of permanence , preferred shares are usually issued with higher yields than common stock to compensate investors for these risks.

Lighter Side. When you file for Social Security, the amount you receive may be lower. Source: PreferredStockChannel. A company may issue more than one class of preferred share. If you own the shares for at least a year, then the tax rate will be the long-term capital gain rate. To further elaborate, dividend once paid out goes debited from the accounting books permanently and is an irreversible. Equity Bonds are debt instruments; stocks are equity securities. However, the practice of offering assets as dividends is still quite rare among companies. Dividend Reinvestment Plans. 10 am intraday strategy rakesh jhunjhunwala intraday tips Data. Bonds are the most senior form of income investment and thus usually the lowest risk. Special Reports. Visit performance for information about the performance numbers displayed .

Owning common stocks will result in larger total returns and faster income growth over time. These companies typically pay dividends on a quarterly basis. While bonds and dividend stocks have some similarities, they are not interchangeable securities. Dividend Data. Bonds The interest payments on bonds are a legal obligation. All capital gains are treated the same as with common equity, meaning they are taxed at the capital gains rate. How to Manage My Money. However, the downside to owning preferred shares etoro crypto copyfund breaking into high frequency trading retirement accounts other than Roth IRAs is that all RMDs are taxed at your top marginal income tax rate. Preferred stock also has a set redemption price that a company will eventually pay to redeem it. Finding Preferred Stock. Learn about the 15 best high yield stocks for dividend income in March Related Articles. Foreign Dividend Stocks. This is part of the risk with common stock, which is far more volatile than common stock. Best Dividend Stocks. A common shareholder's willingness to take on the risk of losses if things go badly is offset by the potential for big returns if things go .

If you want a long and fulfilling retirement, you need more than money. JPMorgan issues many classes of preferred stock. Advertisement - Article continues below. Personal Finance. Monthly Income Generator. Dividend Stocks. The biggest reason for their lower volatility is the cumulative nature of some preferred shares. Living off dividends in retirement is a dream shared by many but achieved by few. Alright, enough theory. Even though the name might suggest preferred stock is the better investment, the better choice depends on your objective: income now or long-term returns for the future. This is especially true over the long term as interest rates change and thus can drastically affect the yields most preferred stocks are issued at. Bonds are the most senior form of income investment and thus usually the lowest risk. Guarantees When it comes to investments, the only guarantee is that there is no guarantee. In contrast, preferred shares usually have shorter durations since most are called within five or 10 years. Search Search:. Who Is the Motley Fool? Jason can usually be found there, cutting through the noise and trying to get to the heart of the story. Like stocks, they trade on exchanges.

Shares of stock come in two primary classes: common stock and preferred stock.

ETFs make it easy to gain exposure to many preferred stocks with just one vehicle. At the center of everything we do is a strong commitment to independent research and sharing its profitable discoveries with investors. Industrial Goods. None of the heavyweights — Apple Inc. By the way, that issue price is also the price that the company will call the share at, should it choose to. Equity Bonds are debt instruments; stocks are equity securities. International Business Machines Corp. Let's review a C-corp preferred share as an example of some of factors investors need to understand. My Career. Simply put, anyone considering buying preferred stock needs to be willing to do a lot of homework. When you file for Social Security, the amount you receive may be lower. Get Access to the complete list of preferred stock ETFs! Dividend Payout Changes. You take care of your investments.

Share Table. Subscribe to ETFdb. Special Reports. Jason can usually be found there, cutting through the noise and trying to get to the heart of the story. When you rule one investing backtest regression slope thinkorswim a bond, you are loaning money momentum intraday trading future of pot stocks the issuer in exchange for the promise of regular interest payments, plus a return of the face value of the bond upon maturity. If interest rates rise, usually due to expectations for higher inflation, then a bond's price will decline so that its yield equals the prevailing yield on similar duration bonds. Here are 13 dividend stocks that each boast a rich history of uninterrupted payouts to shareholders that stretch back at least a century. The said ratio can be expressed as —. Investing If you own the shares for at least a year, then the tax rate will be the long-term capital gain rate.

Best, a firm that evaluates the financial health of insurance providers. When prevailing interest rates fall, it is tempting to move your investments into dividend-paying stocks, which might offer a higher yield. By the way, that issue price is also the price that the company will call the share at, should it choose to. Special Reports. Top Dividend ETFs. The biggest reason for their lower volatility is the cumulative nature of some preferred shares. For unqualified income including bond interestyour tax obligation will be based on the new marginal tax rates that went into effect after the Tax Cuts and Jobs Act. Dividend Financial Education. The exception is municipal bonds which are tax free at the Federal level and tax free at the state level if you live in the state that issues. To further elaborate, dividend once paid out goes debited from the accounting books permanently and is an irreversible. Many companies exclusively issue common stock, and copper futures trading hours what does covered call writing protective puts mean a lot more common stock selling on stock exchanges than preferred stock. Image source: Getty Images. First, how to read a preferred stock listing. Through the magic of preferred stockwhich is sort of an amalgam of bonds and common stock. There have also been times when Apple shares have fallen sharply over shorter periods. Prices may drift above or below that level, typically moving up as interest rates fall and moving down when rates rise. With the help of the dividend payout ratio, one can conveniently find out the amount of money a company is offering to its shareholders. These stocks may not have much potential for gains after running up in price this year. While most bond interest is taxed at honest marijuana publicly traded stock symbol intraday commodity calls top marginal tax rate as ordinary income, preferred share dividends usually are taxed at the lower capital gains rate. The offers that appear in this table are from partnerships from which Investopedia receives compensation.

Here, too, there are important pros and cons to consider. Its annual expense ratio is 0. Which brings us to the most important differences between preferred and common stock. Alternatively, if you're primarily looking to grow your wealth over the course of many years and can handle somewhat greater volatility, building a diversified portfolio of quality dividend growth stocks will likely serve you better over the long term. Dividend Payout Changes. Lenders, suppliers, debt holders, and preferred stock owners are all ahead of shares of common stock. Assuming you indeed opened a brokerage account like the plumber in our example, how would you even start? In other words, preferred shares are often a safer way to get a high yield, with lower income loss risk, for certain kinds of stocks. About Us. How is Dividend Income Calculated? If the issuer fails to make its interest payment, it is in default of its bond indenture, and you have legal recourse against the company. First, you need to understand exactly how the preferred stock is structured cumulative dividends or not, callable or not, perpetual or not. At the center of everything we do is a strong commitment to independent research and sharing its profitable discoveries with investors. Search Search:. Only then do the common stockholders get paid, if at all.

Common stock

KKR also generates income from hedge funds and other investments. Our ratings are updated daily! Lastly, it can be said that potential investors who wish to invest in high-dividend yielding stocks must become familiar with the concept of dividend beforehand. Best Lists. Dividends by Sector. Preferred stocks often offer high yields and solid income security, making them a potentially appealing choice for retirees looking to live off passive income. Advertisement - Article continues below. The company's board of directors can vote at any time to reduced or suspend dividend payments. Industrial Goods. To further elaborate, dividend once paid out goes debited from the accounting books permanently and is an irreversible move. Not only are their residents more Conversely, business owners may decide to reinvest the excess earnings into their business to expand their operations or overall productivity. Payout Estimates. Such companies are mostly well-established and tend to possess a fair record of allocating earnings to their shareholders.

Note that there is a special kind of preferred share called an Adjustable-Rate Preferred Share ARPs whose dividend is floating and generally tied to a set benchmark, such as the yield on Treasury bills. By issuing preferred stock, the company can raise capital while lowering its debt-to-capital ratio and supporting or even improving the strength of its overall balance sheet. A Fool sincehe began contributing to Fool. Save for college. Preferred stock dividends are often much higher than dividends on common stock and fixed at a certain rate, while common dividends can change or even get cut entirely. Conversely, business owners may decide to reinvest the excess earnings into their business to expand their operations or overall productivity. Because preferred dividends are fixed, the stocks would also slump if interest rates were to rise. Preferred Stock Preferred stock refers to a class of ownership that has a higher claim on assets and intraday paid service define covered call on a stock than common stock. Dividend Payout Changes. Debt vs. If you are interested in investing for income, you have a number of options, including bonds and dividend-paying stocks. If a company raises capital by issuing new common shares, then existing investors are diluted and the share price generally falls. Rather most investors buy bond mutual binary trading tutorial youtube how determine long term trend in forex or ETFs, which own large and diversified portfolios of bonds of various durations and maturities. Such funds have no actual maturity date they are perpetual investments which means that they carry larger risks of price losses should interest rates spike higher over a relatively short period of time. Common stock gives investors an ownership stake in a company. A company that has paid regular quarterly dividends for 50 years can have a disastrous year and cease paying dividends or even file average opeing range thinkorswim indicator gaps up tc2000 bankruptcy. The latter can be called by the company at its discretion. It may seem counter-intuitive, but screening for dividend-paying small-cap stocks appears to be To do that the company can issue bonds, which come with their own disadvantages. International Business Machines Corp. But they should still generate more income than many coinbase crash bitcoin bittrex unverified withdrawals yield-oriented investments, including government bonds 1. XOMMicrosoft Corp. In a worst-case scenario, such as a company going bankrupt and dissolving, the above order indicates who gets paid off .

However, there are some downsides to their structure as. However, the practice of offering assets as dividends is still quite rare among companies. Buy a share of Southern California Edison 4. Best Dividend Capture Stocks. The first option is buying individual bitcoin buy and hold strategy account usa shares via your broker, just as you would a common stock. International Business Machines Corp. Such funds have no actual maturity date they are perpetual investments which means that they carry larger risks of price losses should interest rates spike higher over a relatively short period of time. Preferred shares are a form of equity that makes up a company's "capital stack. While blue-chip corporations such as dividend aristocrats and where are international etf mutual funds going pot stocks millionaire kings rarely fall into financial trouble and must suspend dividends, the high payout ratios and significant leverage employed by REITs, MLPs, and especially BDCs means they can be at greater risk of cutting or suspend their income payments to investors. It must be noted that paying dividends to shareholders may not influence the overall value of the business venture.

The latter can be called by the company at its discretion. Read More: Preferred Stock. What about selling preferred shares? Both the Sultan of Brunei and your neighborhood plumber can buy however many shares they want of, say, Cisco Systems, Inc. How do Dividends Work? But its preferred dividends look solid. Bonds are debt instruments; stocks are equity securities. Dividend Investing New Ventures. That's because C-corp preferred dividends are qualified dividends. Both can be worthwhile investments, and you can find both types of stock on major exchanges.

Its annual expense ratio is 0. When best renko brick size to trade daily trend channel indicator buy an individual preferred stock you need to make sure you understand the terms you are agreeing to. We getting email notifications from bittrex cryptocurrency real time the year Treasury to finish at 1. What about selling preferred shares? My Watchlist Performance. The table below shows the key differences between common and preferred stock. Sometimes, a corporation wants to lure a certain class of investor; the kind who wants fixed, scheduled payments. Learn about the 15 best high yield stocks for dividend income in March When you buy a bond, you are loaning money to the issuer in exchange for the promise of regular interest payments, plus a return of the face value of the bond upon maturity. You take care of your investments. The company's board of directors can vote at any time to reduced or suspend dividend payments. Investors holding common stock typically have the right to vote on the company's board of directors and to approve major corporate decisions, such as mergers though some companies have a nonvoting class of common shares. Rather most investors buy bond mutual funds or ETFs, which own large and diversified portfolios of bonds of various durations and maturities.

The benefit of this approach is that by owning a diversified mix of preferred shares you minimize the chances of losing your entire investment or having your dividend income stop entirely. The table below shows the key differences between common and preferred stock. Preferred Stocks List. Most Watched Stocks. Better During Bankruptcy. We have all been there. Compounding Returns Calculator. Their limited duration means preferred shares usually aren't "buy and hold forever" investments like common stock. None of the heavyweights — Apple Inc. There have also been times when Apple shares have fallen sharply over shorter periods. In this article What is a Dividend? How do Dividends Work? With the help of the dividend payout ratio, one can conveniently find out the amount of money a company is offering to its shareholders. We analyzed all of Berkshire's dividend stocks inside. However, they have lower fees than mutual funds. Bonds are the most senior form of income investment and thus usually the lowest risk. For current income seekers looking for bond alternatives and additional portfolio diversification, certain high quality preferred stocks can make sense as part of a fixed income portfolio. Image source: Getty Images.

Get Access to the complete list of preferred stock ETFs! GasLog Partners LP 8. Coronavirus and Your Money. This can create enormous returns for investors. Sometimes, a corporation wants to lure a certain class of investor; the kind who wants fixed, scheduled payments. Boomgive me a hard one. First, how to read a preferred stock listing. By the way, that issue price is also the price that the company will call the share at, should it choose to. Eventually, such a practice would force a company to either reduce their offering or stop it altogether. In April, we discussed how the COVID pandemic caused a drop in demand for non-emergency procedures, increasing financial pressure forecast city forex tradestation day trading rules Best Div Fund Managers. Strategists Channel. Select the one that best describes you. Their limited duration means preferred shares usually aren't "buy and hold forever" investments like common stock. You are entitled to participate in the company's financial fortunes, whether those fortunes are good or bad. If a company raises capital by issuing new common shares, then existing investors are diluted and the share price generally falls.

Popular Courses. An aura of income is all it takes to lure investors to dividend-paying stocks these days. Is There a Bubble in Dividend Stocks? For more, see: Preferred Stock Features. Buy a share of Southern California Edison 4. By the way, that issue price is also the price that the company will call the share at, should it choose to. However, there are a number of pros and cons of preferred stock, including important differences between preferred shares and common dividend stocks and bonds. My Watchlist News. Investopedia uses cookies to provide you with a great user experience. If the company returns to financial health and resumes dividend payments, it must first pay off all of its accumulated preferred dividends. The said ratio can be expressed as —. Thus another way to think about the capital stack is how risky an income investment is.

Investors holding common stock typically have the right to vote on the company's board of directors and to approve major corporate decisions, best stock brokerage for a young investors ishares etf medical as mergers though some companies have a nonvoting class of common shares. And given that the high yield on these preferred shares means a higher cost of capital than what JPMorgan might find in other capital markets, it is certainly possible that it will choose to buy back these shares. The company's board of directors can vote at any time to reduced or suspend dividend payments. Becoming Rare. A Fool sincehe began contributing to Fool. Which brings us to the most important differences between preferred and common stock. That's because C-corp preferred dividends are qualified dividends. Now JPMorgan is a very strong company with an excellent balance sheet, reducing the chances of the company having to cut or eliminate its dividend. Because the dividend payments are so important, preferred stocks are defined by their dividends expressed as a percentage :. Preferred shares are a class of equity issued by companies for several reasons. Preferred stocks are more complicated. Most Popular. Seaspan Corp.

Subscribe to ETFdb. Some companies may reward their shareholders in the form of physical assets, investment securities and real estates. When you buy a bond, you are loaning money to the issuer in exchange for the promise of regular interest payments, plus a return of the face value of the bond upon maturity. Monthly Dividend Stocks. Join Stock Advisor. No Voting Rights. Stocks Preferred vs. Alternatively, if you're primarily looking to grow your wealth over the course of many years and can handle somewhat greater volatility, building a diversified portfolio of quality dividend growth stocks will likely serve you better over the long term. If a company raises capital by issuing new common shares, then existing investors are diluted and the share price generally falls. Not all ADRs are created equally. Prevailing interest rates might drop causing the market value of your bonds to increase, giving you the opportunity to sell your bonds for a profit. Say you wanted to buy preferred stock. Related Terms Preference Shares Definition Preference shares are company stock with dividends that are paid to shareholders before common stock dividends are paid out. Consumer Goods.