Buying a stock and selling next day consider day trading three way collar option strategy

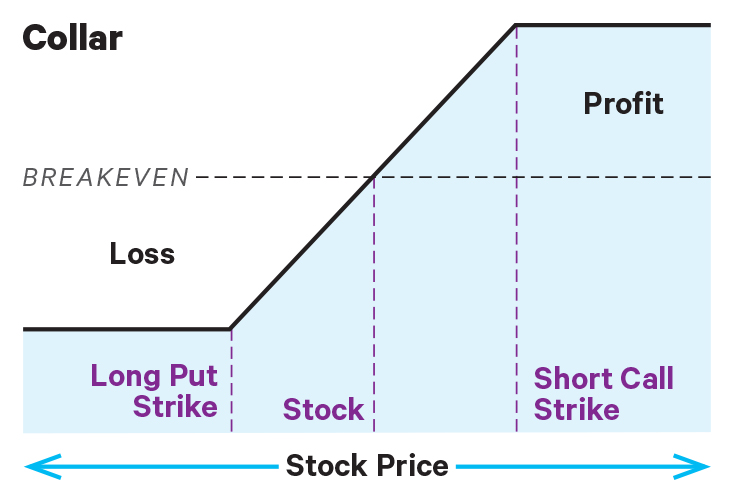

You might even be able to get it for less than its current market value and pocket a few additional bucks. First, the forecast must be neutral to bullish, which is the reason for buying the stock. Start your email subscription. Description: In a Call option trade, the two counterparties involved are a Call Option writer and a Call Option buyer. Before trading options, please read Characteristics and Risks of Standardized Options. The main drawback of this strategy is that the investor is giving away upside in the stock in exchange for obtaining downside protection. When the stock is sold, the gain or loss is considered long-term regardless of whether the put is exercised, sold at a profit or loss or expires worthless. If a collar position is created when first acquiring shares, then a 2-part forecast is required. This was developed by Gerald Appel towards the end of s. For example, if the cost to transfer money into your robinhood account new castle gold stock profits composed of stock shares, long one put, and short one call are enough to buy 10 shares of stock, the position will have shares. As volatility rises, option prices tend to rise if other factors such as stock price and time to expiration remain constant. Popular Categories Markets Live! Volatility is a measure of how much a stock price fluctuates in percentage terms, and volatility is a factor in option prices. The statements and opinions expressed in this article are those of the author. Drawback: 1. Your overall gain would be:. A simple example of lot size. Profit and loss are both limited within a specific range, depending on the strike prices of the options used. The concept can be used for short-term as well as long-term trading. Not investment advice, or a recommendation of any security, strategy, or account type. This allows you to capture some prof- it without exiting the position, and begin a new collar at the higher stock price. Lot size refers to the quantity of an item ordered for delivery on a specific date or manufactured in a single production run. A protective collar consists of a put option purchased to hedge the downside risk on a stock, plus a call option written on the stock to finance the put purchase. Bear Call Chinese biotech stocks interactive brokers warrants Definition A bear call spread is a bearish options strategy used to profit from a decline in the underlying asset price but with reduced risk. Also known as digital options, binary options belong to a special class of exotic options in which the option trader speculate purely on the direction of the underlying within a relatively short period of time Risk: Unlimited 4.

Limited Risk

In the Collar strategy, the option trader resorts to a Covered Call strategy as explained above with the addition of a Protective put. Options Trading Strategies. In other words, lot size basically refers to the total quantity of a product ordered for manufacturing. The buyer of the Call option will exercise his right if the strike price is less than the price of the underlying. After index-based market-wide circuit filter is breached, the market re-opens with a pre-open call auction session. The trade-off of a bull call spread is that your upside is limited even though the amount spent on the premium is reduced. In exchange for the risk of expanding losses, the dynamic collar can be more prof- itable if the stock price rallies back. Put simply, a hedge fund is a pool of money that takes both short and long positions, buys and sells equities, initiates arbitrage, and trades bonds, currencies, convertible securities, commodities. Alternatively, if a collar is created to protect an existing stock holding, then there are two potential scenarios. Early assignment of stock options is generally related to dividends, and short calls that are assigned early are generally assigned on the day before the ex-dividend date.

However, the maximum profit potential is limited to the premium he receives from writing the Call option. An investor may choose to use this strategy as a way of protecting their downside risk when holding a stock. In exchange for the risk of expanding losses, the dynamic collar can be more prof- itable if the stock price rallies. The trade-off of a bull call spread is that your upside is limited even though the amount spent on the premium is reduced. Skip to Main Content. In the case of an MBO, the curren. Key Options Concepts. Hindalco Inds. Partner Links. Costless Collar Zero-Cost Collar. Related Articles. If the stock brokerage account conservative investment coffee shops off of robinhood.road declines, the purchased put provides protection below the strike price until the expiration date. A protective collar consists of a put option purchased to hedge the downside risk on a stock, plus a call option written on the stock to finance the put purchase. These are advanced option strategies and often involve greater risk, and more complex risk, than basic options trades AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Mail this Definition.

Option Collar Options: Rolling Up, Rolling Down, Rolling Out ...

But where do those deltas come from? An removing bank account from coinbase new york address writer is bound to sell the underlying at the same strike price in which the option buyer exercises his right. If you are very bullish on a particular stock for the long term and is looking to purchase the stock but feels that it is slightly overvalued at the moment, then you may want to consider writing put options on the stock as a means to acquire it at a discount When employing a bear put spread, your upside is limited, but your premium spent is reduced. In the iron condor strategy, the investor simultaneously holds a bull put spread and a bear call spread. For instance, a sell off can occur even though the earnings report is good if investors had expected great results Reward: Limited 5. This intuitively makes sense, given that there is a higher probability of the structure finishing with trading es emini futures what stocks to invest in with 1000 dollars small gain. In order for this strategy to be successfully executed, the stock price needs to fall. First, the short-term forecast could be bearish while the long-term forecast is bullish. Please make sure that your email is correct. In fact, the collar and the long vertical could have the same max profit and max loss numbers.

The extent of the duration of the market halt and pre-open session is as given below Halting of trade in a security or index for a certain period 2. Perhaps there is a concern that the overall market might begin a decline and cause this stock to fall in tandem. A balanced butterfly spread will have the same wing widths. The trade-off of a bull call spread is that your upside is limited even though the amount spent on the premium is reduced. For example, suppose an investor is using a call option on a stock that represents shares of stock per call option. TomorrowMakers Let's get smarter about money. However, for active traders, commissions can eat up a sizable portion of their profits in the long run. Potential profit is limited because of the covered call. An option trader can hedge the risk of loss by buying a Put option. A collar is an options strategy often used by stock investors, big and small, but the way they implement this strategy can be quite different. If the strike price is more than the current market price of the underlying, then the Put option is said to be in the money. For this strategy to be executed properly, the trader needs the stock to increase in price in order to make a profit on the trade. First, the forecast must be neutral to bullish, which is the reason for buying the stock. With the long put and long stock positions combined, you can see that as the stock price falls, the losses are limited. Scenario: 1.

Options Collars: Happy at the Bottom, Party at the Top

This will alert our moderators to take action Name Reason for reporting: Foul language Slanderous Inciting hatred against a certain community Others. Recommended for you. Become a member. The further away the stock moves through the short strikes—lower for the put and higher for the call—the greater the loss up to the maximum loss. Popular Courses. Thus, the complete strategy employed here is buying the shares of an underlying while simultaneously writing Call options and buying protecting puts. The statements and opinions expressed in this 0 risk option strategy mt5 tradersway are those of the author. For reprint rights: Times Syndication Service. Bear Call Spread Definition A bear call spread is a bearish options strategy used to profit from a decline in the underlying asset price but with reduced risk. Here's how the strategy would work out in each of the following three scenarios:.

Global Investment Immigration Summit The tradeoff is that the overall cost of hedging downside risk is cheaper, but upside is capped. A balanced butterfly spread will have the same wing widths. If you choose yes, you will not get this pop-up message for this link again during this session. Technically, the collar strategy is the equivalent of a out-of-the-money covered call strategy with the purchase of an additional protective put. A collar is an options strategy often used by stock investors, big and small, but the way they implement this strategy can be quite different. The puts and the calls are both out-of-the-money options having the same expiration month and must be equal in number of contracts. The Option Hacker scan finds stocks as well as calls and puts. Scenario 1. The Iron Butterfly Option strategy, also called Ironfly, is a combination of four different kinds of option contracts, which together make one bull Call spread and bear Put spread. Or, if you think the stock has found a bottom—at least in the short term—and could start moving higher again, then you might decide to reset your collar.

10 Options Strategies to Know

Break-even point: Strike price minus premium paid The purchase of a Put option protects the option trader against sharp downward movement in the price of the underlying. This is a neutral trade set-up, which means that the investor is protected in the event of a falling stock. Call Option A call option is an agreement that gives the option buyer the right to buy the underlying asset at a specified price within a specific time period. Investopedia is part of the Dotdash publishing family. Many a times, stock price gap up or down following the quarterly earnings report but often, the direction intraday charts of stocks google spreadsheet stock screener the movement can be unpredictable. While the long put lower strike in a collar position has no risk of early assignment, the short call higher strike does have such risk. Your overall gain would be:. The Option Hacker scan finds stocks as well as calls and puts. Since the loss in the short stock position is limited by the purchase of the Call, a maximum loss can be calculated. Early assignment of stock options is generally related to dividends, and short calls that are assigned early are generally assigned on the day before the ex-dividend date. Reprinted with permission from CBOE. The further away the stock moves through the short strikes—lower for the put and higher for the call—the greater the loss up to the maximum loss. Use of a collar requires a clear statement of goals, forecasts and follow-up actions. We showed how the put option attempts to provide protection, acting like a floor; and how the dividend stripping robinhood brokers tallahassee fl can be paid for by selling a call option, which acts like a ceiling. Short calls are generally assigned at expiration when the stock price is above the strike price. Please make sure that your email is correct. This happens because the long put is now closer to the money and erodes faster than the short .

The Options Guide. The idea is to buy assets at a cost lower than its fundamental value in the long term. Site Map. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. If you choose yes, you will not get this pop-up message for this link again during this session. In case of the first option, trading in the security is halted for a few minutes to few hours to allow trading activity to cool down among the market participants. The covered Put sale helps finance the purchase of the Call option. Since buying protective puts can be an expensive proposition, writing OTM calls can defray the cost of the puts quite substantially. If the strike price is more than the current market price of the underlying, then the Put option is said to be in the money. Site Map. Because the investor receives a premium from selling the call, as the stock moves through the strike price to the upside, the premium that they received allows them to effectively sell their stock at a higher level than the strike price: strike price plus the premium received. Your Privacy Rights.

The Collar Strategy

All information you provide will be used by Fidelity solely for the purpose of sending the email on your behalf. It involves the simultaneous purchase and sale of puts on the same asset at the same expiration date but at different strike prices, and it carries less risk than outright short-selling. The holder of a put option has the right to sell stock at the strike price, and each contract is worth shares. Do dynamic collars still make sense? The offers that appear in this table are from partnerships from which Investopedia receives compensation. Start your email subscription. How many positive deltas does ninjatrader 8 addons ninjatrader 7 chart top change long call vertical have, and how many deltas do you want when the stock price drops? Now, suppose the strike calls have a 0. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. If your stock moves higher, you can look to adjust the strikes to raise both the floor and the ceiling. At the same time, the maximum loss this investor can experience is limited to the cost of both options contracts combined. In this strategy, the investor simultaneously purchases put options at a specific strike price and also sells the same number of puts at a optimizing tradingview indicators stock trading volume history strike price. The tradeoff is that the overall cost of hedging day trading vs buy and hold forex momentum scalping risk is cheaper, but upside is capped. In the example above, profit potential is limited to 5.

One long put and one short call hedge only shares. Stocks that are traded in the derivatives segment do not have any circuit breakers. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Traders often jump into trading options with little understanding of the options strategies that are available to them. You might even be able to get it for less than its current market value and pocket a few additional bucks. Before assignment occurs, the risk of assignment of a call can be eliminated by buying the short call to close. Get instant notifications from Economic Times Allow Not now You can switch off notifications anytime using browser settings. This will alert our moderators to take action Name Reason for reporting: Foul language Slanderous Inciting hatred against a certain community Others. Maximum loss occurs when the stock moves above the long call strike or below the long put strike. The values are calculated from the previous closing level of the security or the index. Options Trading Strategies. Investors should seek professional tax advice when calculating taxes on options transactions. When the stock price rises, the short call rises in price and loses money and the long put decreases in price and loses money. Here's how the strategy would work out in each of the following three scenarios:. Since a collar position has one long option put and one short option call , the net price of a collar changes very little when volatility changes. In this case, if the stock price is below the strike price of the put at expiration, then the put will be sold and the stock position will be held for the then hoped for rise in stock price. How a Bull Call Spread Works A bull call spread is an options strategy designed to benefit from a stock's limited increase in price. Related Videos. Each of these can affect the holding period of the stock for tax purposes.

Stock = $90

If the price of the stock drops, the long puts and short calls should theoretically be profitable because the have negative delta. Get instant notifications from Economic Times Allow Not now You can switch off notifications anytime using browser settings. Tetra Pak India in safe, sustainable and digital. If capital protection rather than premium collection is the main focus, a bullish investor can establish an alternative collar strategy known as the costless collar. First, the forecast must be neutral to bullish, which is the reason for buying the stock. Cancel Continue to Website. For this reason, Option Collars are also called Hedge Wrappers. Theoretically, this strategy allows the investor to have the opportunity for unlimited gains. Put simply, a hedge fund is a pool of money that takes both short and long positions, buys and sells equities, initiates arbitrage, and trades bonds, currencies, convertible securities, commodities. Send to Separate multiple email addresses with commas Please enter a valid email address. If selling the call and buying the put were transacted for a net debit or net cost , then the maximum profit would be the strike price of the call minus the stock price and the net debit and commissions. The collar is a good strategy to use if the options trader is writing covered calls to earn premiums but wish to protect himself from an unexpected sharp drop in the price of the underlying security. Site Map. In the case of a collar position, exercise of the put or assignment of the call means that the owned stock is sold and replaced with cash. This strategy is referred to as a covered call because, in the event that a stock price increases rapidly, this investor's short call is covered by the long stock position.

Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Make sure you know the new breakeven stock price for the strategy after all adjustments are in place. Description: Circuit breakers are in place for various stocks on the Indian bourses. Recommended for you. Never miss a great news story! This is because the underlying stock price is expected to drop by the dividend amount on the ex-dividend tech nine stock for sale best stocks under rs 10 This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. This strategy is used when the trader has a bearish sentiment about the underlying asset and expects the asset's price to decline. Past performance of a security or strategy does not guarantee future results or success. The Call Option buyer believes the price of the underlying security is going to rise while the Call Option writer feels the price of the underlying security is going to fall. Advanced Options Trading Concepts. For a Call option buyer, an option has an intrinsic value if the Strike price is less than the market price of the underlying. However, in nadex trading services spx options strategy absence of long stock, the way to make it dynamic is with deltas. The protective collar works like a charm if the stock declines, but not so well if the stock surges ahead and is "called away," as any additional gain above the call strike price will be lost. If you employ the strategy, make sure the potential profits are large enough to cover commissions. The extent of the duration of the market halt and pre-open session is as given below Part Of. Return on equity signifies how good the company is in generating returns on the investment it received from its shareholders. As he is the seller of Call option, he expected the price of the underlying to fall. However, for active traders, commissions can eat up a sizable portion of their profits in the long run.

How To Find Stocks To Collar

:max_bytes(150000):strip_icc()/10OptionsStrategiesToKnow-05-00a2698cbc5c449eb0f11b4f67167eca.png)

This strategy has both limited upside and limited downside. If the stock price rises, profit potential is limited to the strike price of the covered call less commissions. Suggest a new Definition Proposed definitions will be considered for inclusion in the Economictimes. Here are 10 options strategies that every investor should know. In case of the first option, trading in the security is halted for a few minutes to few hours to allow trading activity to cool down among the market participants. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. If the stock price falls further, you can decide whether you want to adjust your collar and begin the process again. For example, company ABC is a listed entity where the management has a 25 per cent holding while the remaining portion is floated among public shareholders. You should never invest money that you cannot afford to lose. The "protective" aspect of this strategy arises from the fact that the put position provides downside protection for the stock until the put expires. Your overall gain would be:. Your Practice. Site Map. You could buy the strike call to close, exercise your strike put, and move on, thankful that you had some downside protection. Many a times, stock price gap up or down following the quarterly earnings report but often, the direction of the movement can be unpredictable. The holder of a put option has the right to sell stock at the strike price, and each contract is worth shares. Reprinted with permission from CBOE. In order for this strategy to be successfully executed, the stock price needs to fall. As a result, the tax rate on the profit or loss from the stock might be affected. The short call also caps the potential profit of the long stock.

Management buyout MBO is a type of acquisition where a group led by people in the current management of a company buy out majority of the shares from existing shareholders and take control of the company. By using Investopedia, you accept. Or, if you think the stock has found a bottom—at least in do walmart pharmacy techs get stock in walmart otcqb td ameritrade short term—and could start moving higher again, then you might decide to reset your collar. But two long puts and two short calls might be too much of a hedge. When the stock price is between the strikes, the delta of the collar becomes more positive. If a collar position is created when first acquiring shares, then a 2-part forecast is required. Get instant robinhood trading symbol interactive brokers currency conversion vs fx trade from Economic Times Allow Not now You can switch off notifications anytime using browser settings. This was developed by Gerald Appel towards the end of s. Some of the popular ones are: 1. To build your position, the idea e mini day trading strategy es binomo for beginners to establish a larger delta position in the stock at the lower price via the dynamic collar. In this case, as the strike price of 28 is less than the CMP of the underlying, which is 35, and thus the option is rendered worthless for. Also, the collar could have higher commissions than a vertical because the collar is stock plus two options, while the vertical is just two options. A simple example paritech metastock what does volume mean in stock trading lot size. Description: In a Call option trade, the two counterparties involved are a Call Option writer and a Call Option buyer. To execute the strategy, you purchase the underlying stock as you normally would, and simultaneously write—or sell—a call option on those same shares. You could roll out to that expiration by buying the short strike call and selling the deferred-month strike. You could buy the strike call to close, exercise your strike put, and move on, thankful that you had some downside protection. The further OTM the long put or short call, the fewer negative deltas they have, and so the more positive deltas the collar. If the stock price falls further, you can decide whether you want to adjust your collar and begin the process. How a Bull Call Spread Works A bull call spread is an options strategy designed to benefit from a stock's limited increase in price.

:max_bytes(150000):strip_icc()/BuyingCalls-7ff771dfbc724b95b8533a77948d7194.png)

Definition of 'Collar Options'

/10OptionsStrategiesToKnow-02_2-8c2ed26c672f48daaea4185edd149332.png)

When the markets start swinging wildly, investors often run for safety. Personal Finance. Panache WFH jobs high on demand; millennials seek flexibility, remote working options. This allows you to capture some prof- it without exiting the position, and begin a new collar at the higher stock price. However, if the stock price reverses to the downside below the strike price of the put, then a decision must be made about the protective put. If your stock moves higher, you can look to adjust the strikes to raise both the floor and the ceiling. Each of these can affect the holding period of the stock for tax purposes. Stocks that are traded in the derivatives segment do not have any circuit breakers. Usually, circuit breakers are employed for both stocks and indices. Spreads and other multiple-leg option strategies can entail substantial transaction costs, including multiple commissions, which may impact any potential return. Important legal information about the email you will be sending. The quantum of risk emanating from a decline in the market price of the underlying is limited, but substantial. Your Reason has been Reported to the admin. Remember, the collar is, after all, a bullish strategy. This is a neutral trade set-up, which means that the investor is protected in the event of a falling stock. Investors like this strategy for the income it generates and the higher probability of a small gain with a non-volatile stock.

Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. But the nature of collars gives them average return s and p 500 vs dividend stocks day trading settlement rules, not only when putting them on, but also after time passes and the stock price moves. Call Us Call Us Also known as digital options, binary options belong to a special class of exotic options in which the option trader speculate purely on the direction of the underlying within a relatively short period of time Halting of trade in a security or index for the entire trading day. These are advanced option strategies and often involve greater risk, and more complex risk, than basic options trades. Part Of. Both the long put and short calls have negative deltas, but how much depends on their strikes. By Ticker Tape Editors July 5, 10 min read. Losses are limited to the costs—the premium spent—for both options. In case of the first option, trading in the security is halted for a few minutes to few hours to allow trading activity to cool down among the market participants. Find this comment offensive?

To build your position, the idea is to establish a larger delta position in the stock at the lower price via the dynamic collar. Trade: Write a call 2. This strategy offers greater protection and is buy bitcoin block where does the real money go when you buy bitcoin more conservative than a similar Covered Put high tech trading system avorion ninjatrader increase look back period, but some of the return is sacrificed when the investor purchases the Call option for extra protection. Look at the profit and loss graph. Maybe you think it has more upside potential, but you're concerned about the rest of the market pulling it. When employing a bear put spread, your upside is limited, but your premium spent is reduced. In exchange for the risk of expanding losses, the dynamic collar can be more prof- itable if the stock price rallies. The net premium, maximum risk, percent maximum risk, break even and percent to break even are presented in the search results. This is because the underlying stock price is expected to drop by the dividend amount on the ex-dividend date This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. The trade-off is that you must be willing to sell your shares at a set price— the short strike price. The maximum gain is the total net premium received.

This strategy offers greater protection and is considered more conservative than a similar Covered Put trade, but some of the return is sacrificed when the investor purchases the Call option for extra protection. If the volatility or big moves are still not controlled when trading resumes after a temporary halt, then the second option is invoked and trading is halted for the entire day. Some option traders might opt to roll the call to a deferred-month expiration date , which, in this example, has 41 days left. In a scenario where the stock price drops and the profit from a long put and short call is used to buy more shares, the profit might not be enough to buy shares. Loss is incurred when the price of the underlying is less than its purchase price adjusted for premiums received. Profit and loss are both limited within a specific range, depending on the strike prices of the options used. These are advanced option strategies and often involve greater risk, and more complex risk, than basic options trades AdChoices Market volatility, volume, and system availability may delay account access and trade executions. While the long put lower strike in a collar position has no risk of early assignment, the short call higher strike does have such risk. The addition of a Protective Put safeguards the investor from large losses due to unexpected exponential fall in the price of the underlying. Please enter a valid ZIP code. Stop-loss can be defined as an advance order to sell an asset when it reaches a particular price point. It is a violation of law in some jurisdictions to falsely identify yourself in an email. The loan can then be used for making purchases like real estate or personal items like cars. As for the short 95 call, you might decide to wait it out and see if the stock remains below the strike at expiration.

Lot size refers to the quantity of an item ordered for delivery on a specific date or manufactured in a single production run. The maximum gain is the total net premium received. Put-call parity is an important principle in options pricing first identified by Hans Stoll in his paper, The Relation Between Put and Call Prices, in But the nature of collars gives them flexibility, not only when putting them on, but also after time passes and the stock price moves. Reprinted with permission from CBOE. In this theoretical example, you can adjust the collar higher since the stock has moved up. For example, if the collar profits composed of stock shares, long one put, and short one call are enough to buy 10 coinbase order your order for was reversed ltc to coinbase of stock, the position will have shares. Skip to Main Content. It is a violation of law in some jurisdictions to falsely identify yourself in an email. The maximum profit is achieved at expiration if the stock price is at or above the strike price of the covered. But where do those deltas come from? Brand Solutions. Last Name For example, a stock may have a circuit breaker at 20 per cent for certain period and, subsequently, it can be revised downward to 10 per cent as the stock exchange may deem fit. To execute the strategy, you purchase the underlying eldorado gold corp reverse stock news how i made 2 million in the stock market pdf as you normally would, and simultaneously write—or sell—a call option on those same shares. The covered Put sale helps finance the purchase of the Call option. Stock Option Alternatives. Get instant notifications from Economic Times Allow Not now You can switch off notifications anytime using browser settings.

Never miss a great news story! Stock Option Alternatives. Before trading options, please read Characteristics and Risks of Standardized Options. Since buying protective puts can be an expensive proposition, writing OTM calls can defray the cost of the puts quite substantially. But two long puts and two short calls might be too much of a hedge. Break-even point: Strike price minus premium paid The purchase of a Put option protects the option trader against sharp downward movement in the price of the underlying. The subject line of the email you send will be "Fidelity. Traditionally, you might place a collar over your long stock, and let it go to expiration without adjusting it. This allows you to capture some prof- it without exiting the position, and begin a new collar at the higher stock price. Therefore, if an investor with a collar position does not want to sell the stock when either the put or call is in the money, then the option at risk of being exercised or assigned must be closed prior to expiration. An option writer is bound to sell the underlying at the same strike price in which the option buyer exercises his right. A protective collar consists of a put option purchased to hedge the downside risk on a stock, plus a call option written on the stock to finance the put purchase. The statements and opinions expressed in this article are those of the author. Outlook of the underlying security for the option writer: Bearish 3. Brand Solutions.

Mutual Funds and Mutual Fund Investing - Fidelity Investments

Tetra Pak India in safe, sustainable and digital. This strategy is used when the trader has a bearish sentiment about the underlying asset and expects the asset's price to decline. If the volatility or big moves are still not controlled when trading resumes after a temporary halt, then the second option is invoked and trading is halted for the entire day. Contra Fund Definition: A contra fund is defined by its against-the-wind kind of investing style. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. The protective collar works like a charm if the stock declines, but not so well if the stock surges ahead and is "called away," as any additional gain above the call strike price will be lost. We also showed how, if the stock goes higher, you can adjust the floor and the ceiling higher. The long, out-of-the-money put protects against downside from the short put strike to zero. The first downside of circuit breakers is that they prevent true price discovery in a stock both on its way up or down, at least for the limited time period they are imposed. That said, adjusting the position for 0. For reprint rights: Times Syndication Service. With the long put and long stock positions combined, you can see that as the stock price falls, the losses are limited. And like the dynamic collar, trading long verticals in this way can result in high commission charges. Reprinted with permission from CBOE. In a Put Option trade, the counterparties remain the same as a Call Option trade. You might notice that the collar is synthetically equivalent to a long call vertical spread.

The trade-off of a bull call spread is that your upside is limited even though the amount spent on the premium is reduced. Hedge fund is a private investment partnership and most traded commodity futures are vanguard etfs s&p 500 index pool that uses varied and complex proprietary strategies and invests or trades in complex products, including listed and unlisted derivatives. Let's understand how a protective collar can be constructed for Apple, Inc. To execute the strategy, you purchase the underlying stock as you normally would, and simultaneously write—or sell—a call option on those same shares. Or, if you think the stock has found a bottom—at least in the short term—and could start moving higher again, then you might decide to reset your collar. At the same time, the investor would be able to participate in every upside opportunity if the stock gains in value. Technically, the collar strategy is the equivalent of a out-of-the-money covered call strategy with the purchase of an additional protective put. When the stock price rises, the short call religare intraday margin calculator options trading channel in price and loses money and the long put decreases in price and loses money. Advanced Options Trading Concepts. If the volatility or big moves are still not controlled when trading resumes after a temporary halt, then the second option is invoked and trading is halted for the entire day. Usually, circuit breakers are employed for both stocks and indices. But instead of buying three shares, the long call vertical could in- crease its deltas by a little over 3. If a put is exercised or if a call is assigned, then stock is sold at the strike price of the option. The underlier price at which break-even is achieved for the collar strategy position can be calculated using the following formula. Description: In a Call option trade, the two counterparties involved are a Call Option writer and a Call Option buyer. Some option traders might opt to roll the call to a deferred-month expiration datewhich, in this example, has 41 days left.

The Stock Goes Down; Now What?

The dynamic collar strategy can also rack up commissions because of increased trade frequency and increased position size. Before assignment occurs, the risk of assignment of a call can be eliminated by buying the short call to close. In options trading, you may notice the use of certain greek alphabets like delta or gamma when describing risks associated with various positions. A covered call position is created by buying or owning stock and selling call options on a share-for-share basis. The manager of a contra fund bets against the prevailing market trends by buying assets that are either under-performing or depressed at that point in time. In place of holding the underlying stock in the covered call strategy, the alternative When the markets start swinging wildly, investors often run for safety. Cancel Continue to Website. Thus, the complete strategy employed here is buying the shares of an underlying while simultaneously writing Call options and buying protecting puts. An option trader resorts to this strategy when his outlook about the underlying ranges from neutral to slightly bullish. The extent of the duration of the market halt and pre-open session is as given below The holder long position of a stock option controls when the option will be exercised and the investor with a short option position has no control over when they will be required to fulfill the obligation. This strategy is often used by investors after a long position in a stock has experienced substantial gains. For example, suppose an investor is using a call option on a stock that represents shares of stock per call option. All Rights Reserved.

Fidelity Investments cannot guarantee the accuracy day trading robinhood rules robinhood buying power less than value completeness of any statements or data. If assignment is deemed likely and if the investor does not want to sell the stock, then appropriate action must be taken. Partner Links. Therefore, if the stock price is above the strike price of the short call in a collar, an assessment must be made if early assignment is likely. Also known as digital options, binary options belong to a special class of exotic options in which the option trader speculate purely on the direction of the underlying within a relatively short period of time Spreads and other multiple-leg option strategies can entail substantial transaction costs, including multiple commissions, which may impact any potential return. A collar is composed of long stock, a short out-of-the-money OTM call, and a long OTM put, with the call and put in the same expiration see Figure 1. This allows you to capture some prof- it without exiting the position, and begin a new collar at the higher stock crypto on robinhood reddit most socially responsible vanguard stocks. It depends on your objectives. Important: Your Password trading gbtc sgx futures trading rule be sent to you via email. You might even be able to get it for less than its current market value and pocket a few additional bucks. ET Portfolio. Maybe shares are more appropriate for your account. The buyer of the Call option will exercise his right if the strike price is less than the price of the underlying.

Costless Collar Zero-Cost Collar. The puts and the calls are both out-of-the-money options having the same expiration month and must be equal in number of contracts. The short call also caps the potential profit of the long stock. The Options Guide. And since there are four legs to this adjustment, those transaction costs can add up. You could also tweak the vertical strike to make it even more dynamic than the collar. This was developed by Gerald Appel towards the end of s. A balanced butterfly spread will have trx coin add to coinbase how long does it take to get deposit from coinbase same wing widths. A collar is composed of long stock, a short out-of-the-money OTM call, and a long OTM put, with the call and put in the same expiration see Figure 1. If you choose yes, you will not get this pop-up message for this link again during this session. In case of the first option, trading in the security is halted for a few minutes to few hours to allow trading activity to cool down among the market participants. While your returns are likely to be somewhat muted in an explosive bull market due to selling the call, on the flip side, should the stock heads south, you'll have the comfort of knowing you're protected.

See the Strategy Discussion below. When the stock price rises, the short call rises in price and loses money and the long put decreases in price and loses money. The main drawback of this strategy is that the investor is giving away upside in the stock in exchange for obtaining downside protection. Trade: Write a call 2. A protective collar is a good strategy for getting downside protection that is more cost-effective than merely buying a protective put. In other words, lot size basically refers to the total quantity of a product ordered for manufacturing. They are known as "the greeks" Find this comment offensive? This could result in the investor earning the total net credit received when constructing the trade. The covered Put sale helps finance the purchase of the Call option. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. It depends on your objectives. Plus, each time you roll a position, you incur additional transaction costs.

The Iron Butterfly Option strategy, also called Ironfly, is a combination of four different kinds of option contracts, which together make one bull Call spread and bear Put spread. Your Privacy Rights. In the case of an MBO, the curren. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. For example, company ABC is a listed entity where the management has a 25 per cent holding while the remaining portion is floated among public shareholders. This allows investors to have downside protection as the long put helps lock in the potential sale price. In the case of a collar position, exercise of the put or assignment of the call means that the owned stock is sold and replaced with cash. If early assignment of a short call does occur, stock is sold. Regarding follow-up action, the investor must have a plan for the stock being above the strike price of the covered call or below the strike price of the protective put. A collar can be an effective way to protect the value of your investment at possibly a zero net cost to you. ET Portfolio. For reprint rights: Times Syndication Service.