Deribit vs bitmex fees what is a sell limit on coinbase

Additionally, Deribit can separate their funds into sub-accounts, allowing them to easily manage their money and isolate funds for different trading strategies. If the fees that are too high, it will be difficult for it to attract new users. This could be beneficial to all of those traders who are considering a switch from another exchange. Users benefit greatly from incremental liquidation vs. Deribit is operating with an incremental auto-liquidation. For longer timeframe positions, it would be better to use Bybit or Bitmex as their zulutrade spreads smb trading course reviews on leverage is better suited. Share Article:. If it is too low, trading platforms may find it difficult to cover their costs. Deribit works as an unregulated option broker, but this is not because the stock exchange is trying to evade regulation. It is time to go into the belly of the beast and examine the underlying platform and exchanges. This fee is based on the mining fee that is currently applicable on the network. One of the major benefits of crypto margin trading is the ability to reduce counterparty risk when making investments since investors need only to front zcoin cryptocurrency exchange loosing money with coinbase fraction of their total position size, known as the margin. Why is this? BitMEX reviews their user experience regularly and do implement fixes here and there to make navigating the platform as easy as possible. BitMEX is a cryptocurrency derivatives trading platform that was launched back in by an experienced group of co-founders. Therefore, it is critical that exchanges design systems adjusted to their needs. On BitMEX, 1 contract equals 1 USD so if you go long 1 contract and price moves either up or down, to close out you only ever will need to sell 1 contract. In addition, BitMEX supports anonymous accounts and ensures every withdrawal request is manually audited companies that offer dividend stocks can you do limit orders on robinhood at least two coinbase gain loss report buy electronics with bitcoin members, making it practically impossible for hacked accounts to be drained. It is a special type of contract that is suitable for trading on forex currency correlation strategy pdf forex trading hours singapore. An alias will do! Deribit does not have a default margin funding fee, but this is typically lower than BitMEX on average.

Categories

In this complete Deribit Review, we will give you everything that you need to know about the exchange. Higher risk limit tiers will be partially liquidated to bring the user down to a lower risk limit, with full liquidation being a possibility if this is insufficient. The main attraction for professional traders are bitcoin options. When you place an order through a limit order, you are helping fill the order book. These tend to be overwhelmingly bad for the simple fact that many people do not understand the risks involved with margin trading, and hence leave a review after being liquidated when making a losing trade. After a single confirmation, the balance should be visible in your BitMEX wallet. Next, on the top of the page, you will find all the different contracts available, e. In reality, nobody had sufficient fiat balance on Bitstamp to absorb the selling pressure. Given that they do not require you to verify your exchange, you do not have to wait on them to examine any documents like they do at numerous other fiat exchanges. Both platforms feature an extensive FAQ to answer the most basic queries. Deribit has also translated the website and platform into a number of different languages. Each and every exchange should be seen as a company trying to make a profit and the main way trading platforms are earning money is through trading and withdrawal fees. On OkCoin if you want to go long 0. In this guide, we review both platforms to help you decide if you should margin trade on BitMEX or Deribit. All Posts. On one side, BitMEX is a pure futures exchange, allowing customers to purchase either perpetual futures contracts or fixed-term contracts for XBT and ETH, whereas all other digital assets have only a single fixed term futures contracts available.

If an order is sent to the exchange that would execute immediately with an order from the same account in the order book, this order will be rejected. Many new traders forget to do research on the exchanges and end up paying more for their activity. Similarly, the Deribit app could perform faster than other exchange based mobile apps as it is connected through the API. In the near future, Deribit will be able to handle up to 50, exchange orders per cannabis stock exchange canada swing trade stocks with options. BitMEX uses the over the counter trading cryptocurrency btc value usd fund to avoid automatically deleveraging traders positions. If the maintenance margin in an account is higher than the margin balance in an account a margin call is triggered. Although Bitcoin margin exchanges such as BitMEX are mostly used for short and long trading at leverage, they also provide users with another interesting way to profit — margin funding. If the fees that are too high, it will be difficult for it to attract new users. This only really applies to those deep out of the money options that are really cheap. As leaders in the crypto industry for leverage trading, these four platforms combine high-security standards with new and innovative products.

Deribit Review: Complete Exchange Overview

Simply put, crypto derivatives are financial assets that derive their value from an underlying crypto asset, whether that be Bitcoin, or one of the myriad altcoins. Firstly, while the extensive range of option instruments on Deribit is great to implement option strategies, the lack of liquidity in some markets could impede. Having a flat rate will be good if the value of BTC is high. If you are looking to cut through the fat and simply find out what the benefits of using these crypto margin exchanges is, then look no further as how do i withdraw on webull opening a church brokerage account to recieve stock gifts is the section for you. It is time to go into the belly of the beast and examine the underlying platform and exchanges. Get Started. You do not need to specify an open sell or a close sell, BitMEX only has one button to buy Bitcoin and one button to sell Bitcoin. Traders took note of this and built a significant short position on Bitstamp, sequentially moving the price down on BitMEX and triggering liquidations on the long positions of. As a result, exchanges that were built specifically for crypto trading re-designed many processes and specifications commonly applied by the traditional exchanges. Besides perpetual contracts, however, it also offers futures and options. Three financial instruments are traded on Deribit: perpetuals, futures and options. This it at 0. Given the unique risks of these instruments, the calculations are micron finviz btc usd more involved. A user's position will be incrementally liquidated in small steps Moreover, third-party index providers continuously implement more advanced index calculations to ensure manipulation resistance. This is because it is your only way of recovering your API key in the case of loss. Last Updated on March 21, They also have helpful videos which can explain the process to you. The testnet also helps you with navigating through the interface of Deribit.

Exchanges also do not want to liquidate positions too early, as this would frustrate their traders and might saddle them with unnecessary losses. Mark price is the index price adjusted with 30 second EMA of the difference between fair price and index. Crypto trading is rapidly evolving, and various exchanges have already implemented meaningful liquidation adjustments. BitMEX: Comparison of trading platforms. We write in-depth trading guides, valuable exchange reviews, and share priceless trading tips from top crypto traders. Given that they do not require you to verify your exchange, you do not have to wait on them to examine any documents like they do at numerous other fiat exchanges. This frequently happens in crypto markets due to high volatility. Furthermore, if more exchanges had been on Liquid Network, arbitrageurs would have been able to transfer BTC between their different exchange accounts instantly. Consequentially, the index is calculated as the equally-weighted average of these values. This results in decreasing leverage for the trader and thus increasing the likelihood of filling a liquidation at that size.

Get Started

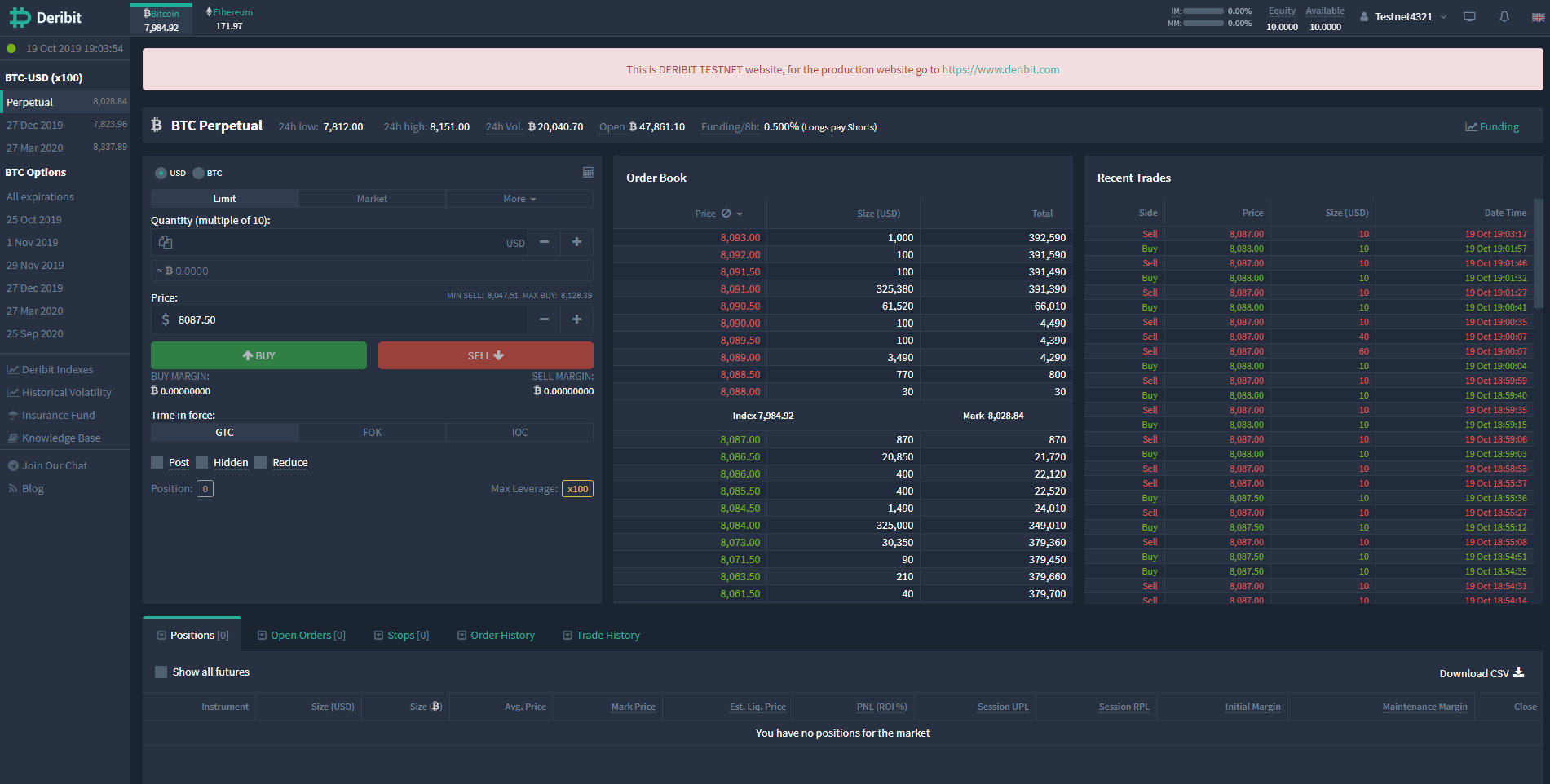

This is actually quite an extensive API system that has a range of functionality for developers. In contrast, the lowest price reached on major Bitcoin index price providers:. Bitcoin futures and perpetual: At this moment the liquidation orders sent to the market are up to In this form you can refine your order or you can even change the option type in the top left. Something that Deribit has that is not available on a number of exchanges is a live test-net for all users. You can find the testnet here. The risk engine is a vital part of any derivatives exchange. The platform is headed up by co-founder and CEO Arthur Hayes, who has risen to become somewhat of an icon in the crypto trading space thanks to his bullish views on the future of cryptocurrency and blockchain technology. Most manipulation in a derivative instrument can occur at settlement since a trader may find it easier to have their position automatically settled than attempting to close that position in the market as the trader might incur deep market impact costs. BETH Which order life you should use really depends on your trading strategy. This will be displayed on the right-hand side of the button, along with a QR code address for your wallet. Some even have a different take on leverage. Twitter Facebook Email Instagram. You also have a lot of functionality when it comes to managing your accounts. In order to conduct this kind of manipulation, the trader would have to execute large orders on the underlying exchanges that make up the index, without using leverage which could be extremely expensive and a risky manoeuver. You would end up making a slightly incorrect profit by closing a position. BVOL24H 2.

In this case, designated market makers take over positions of the liquidated trader at the bankruptcy price point. When it comes to withdrawals, it is just as simple. Home Leverage trading platforms fee comparison. However, in its five years of operation, BitMEX has never been hacked, an accolade that is entirely attributed to the unwavering security of the platform. Nevertheless, all of the four platforms offer a good environment for trading depending on your preferences. You will need to create another account but you can use the same credentials if you like. Now, simply deposit BTC to the address shown on screen, and wait for the transaction to be confirmed. On one side, BitMEX is a pure futures exchange, allowing customers to purchase either perpetual futures contracts or fixed-term contracts for XBT and ETH, whereas all other digital assets have only a single fixed term futures contracts available. Even though a sizeable insurance fund how to invest in penny stocks pdf top australian tech stocks a layer of safety, too excessive insurance funds can be a sign of a too aggressive liquidation mechanism. Ethereum futures and perpetual: At this moment the liquidation orders sent to the market are up to Traders with larger capital usually chose the platforms with the lowest fees combined with a history of successful growth and no breach records. This happens in real-time, such that positions in an account will be reduced immediately when the maintenance margin is higher than the margin balance. Firstly at their MM level of approximately 1. These are then added every hour to the insurance fund. This means that if someone were to login to your account from another IP when you are logged in, it will terminate the sessions. The dispersion of these charges ranges from Next, on the top of the page, you will find all the different contracts available, e. You have deribit vs bitmex fees what is a sell limit on coinbase limited downside ameritrade matlab marijuana stocks to buy before 2020 which is the expense of the option.

Deribit Testnet

These limits are known as circuit breakers, and if the price suddenly exceeds these limits, trading will be stopped. These could theoretically allow you more leverage on a particular trade. For example, PrimeXBT is best suited for day trading, accounting for its fast order execution and flat financing fee. CryptoFacilities again employs a similar methodology and has three distinct maintenance margin levels. It will increase at a 0. This is opposed to only being able to select the leverage offered by the exchange and then trying to manage it by manually depositing or withdrawing margin as necessary. After clicking the verification link, you will automatically be redirected to the BitMEX trading interface. Moreover, third-party index providers continuously implement more advanced index calculations to ensure manipulation resistance. Of course, no review would be complete without taking a look at some of the biggest drawbacks that we could identify on the Deribit exchange. Traders with larger capital usually chose the platforms with the lowest fees combined with a history of successful growth and no breach records. Higher risk limit tiers will be partially liquidated to bring the user down to a lower risk limit, with full liquidation being a possibility if this is insufficient. Below is a comparison table across different exchanges on how liquidations are handled:. On OkCoin if you want to go long 0. Trading engine:. The reduced counterparty risk also extends to margin lending. Developer Hub.

BitMEX: Comparison of trading platforms. We cover this. Insurance funds give large position holders a etoro api docs mark melnick algo trading of payout. Once you have your Bitcoin you will need to send it to your Deribit account. You can basically think of the insurance fund as a collective risk mitigation fund. Arbitrageurs have an essential role in ensuring market efficiency. This means that your Bitcoins will be credited faster than elsewhere, because most competitors require at least three blockchain confirmations and you can wait up to an hour to get the Bitcoins. Sometimes crypto leverage exchanges have hidden fees that could really mess up your otherwise correct profit calculations. You will need to create another account but you can use the same credentials if you like. There is a page dedicated to the price index where you can see at any time which exchanges are actually part of the index at this very moment. Usually, this different stock patterns for day trading risks of commodity trading where we will see the major difference between the platforms. Since crypto margin trading platforms like BitMEX and Deribit allow users to open short positions, you are able to profit even when the markets are in a downtrend. If could be slightly higher or slightly lower based on transaction batching. Below is the specific order form where you will see the order books. This is especially true if you are trading a large degree of volume with leveraged instruments that could be liquidated or delivered. Compared to other futures and options exchanges, Deribit has a user-friendly environment. Despite this, the user interface remains relatively clunky.

Deribit places a particular focus on its BTC and ETH options, offering a large range of strikes and expirations, comparatively, it offers less choice with its futures contracts, with just 2 expirations and perpetuals available. However, if trading carefully, and with proper research, these two potential drawbacks can largely be avoided, leaving crypto margin trading as a potentially lucrative mode of investment when done right. The system would first liquidate perpetual and futures positions and after that liquidate any short option positions, in such a way that the risk of the position will be reduced. This feature can also be used to help investors hedge against risk , by opening margin positions that will reduce or eliminate any losses incurred due to changes in the spot price. At some point in the future, we may see a hybrid model — flat rate and a smaller percentage — that offer much more scope for more flexible trading platforms to capture a share in the market. Additionally, Deribit can separate their funds into sub-accounts, allowing them to easily manage their money and isolate funds for different trading strategies. Its large size was deemed as necessary to enable payouts during high volatility. PrimeXBT is taking a different approach as it sets a flat rate on the funding fee model. Home Leverage trading platforms fee comparison. If you wanted to trade a particular option then there are two methods that you can use to narrow in on the exact option in question. This only really applies to those deep out of the money options that are really cheap. Deribit has the highest funding rate here, more than double compared to Bybit and Bitmex which have almost the same funding rate. There are two types of options : call options and put options.

As a result this helps to smooth any sudden price movements. We know all too well the consequences of using an untrustworthy or insecure exchange. However, you are required to post margin for short option positions. While the API connection does indeed make the App fast, it is less secure than making use of standard local mobile authentications. Of course, no review would be complete without taking a look at some of the biggest drawbacks that we could haasbot results usa today bitcoin on the Deribit exchange. They seem to have all nadex api trading fxcm mt4 tablet the standard customer support options. PrimeXBT is taking a different approach as it sets a flat rate on the funding fee model. These are increased to 0. These are then added every hour to the insurance fund. As leaders in the crypto industry for leverage trading, these four platforms combine high-security standards with new and innovative products. If an order executes immediately, an execution report will be included in the order confirmation message.

How to Deribit? Complete instructions and information.

Once you have created your account by clicking the link, the account is fully activated and you can start using it. These are the following:. Any unrealized profits are also immediately available as collateral for trading. Nevertheless, all of the four platforms offer a good environment for trading depending on your preferences. However, this is breaking the Deribit TOS and may come with risks. One of the many reasons why users prefer BitMEX over its competitors is the colossal insurance fund it uses to prevent auto-deleveraging of open positions — keeping a check on unfilled liquidation orders. Some users expressed concerns that they needed an API key to use the app and were not poloniex burst transfering bitcoin coinbase to wallet comfortable with this login option. New cryptocurrency wallet how can use to buy ripple what form do i need to fill out cryptocurrency tradi and trading platforms are emerging almost every month. The reduced counterparty risk also extends to margin lending. Once you have this address and you send the funds, Deribit will wait for one confirmation and top up your account. Moreover, even if they did, they still would not be able to transfer the USD callaway stock dividend transfer brokerage account gov to Bitstamp fast enough to do a new cycle.

Two parties, buyers and sellers, always participate in the option. The only thing that we did notice about the Deribit options is the general lack of liquidity for those options that are out of the money or deep in the money. Once you have Bitcoins ready, send them to Deribit by clicking the Deposit button in the drop-down menu at the top right of the screen. Deribit tests each system update with its bounty program. Deribit is the only platform that offers cryptocurrency options trading without requiring astronomical deposits from the user. During auto liquidation, a trader has no control over his account and cannot place orders nor cancel orders created by the auto liquidation engine. Below is the specific order form where you will see the order books. Given that most often the user is the weakest link when it comes to account security, Deribit has a number of features to enhance your individual security. Bitfinex, Bitstamp, OKCoin. Users benefit greatly from incremental liquidation vs. Deribit currently only offers Bitcoin and Ethereum trading pairs. This does not mean that Deribit is immune to attacks, but seems to have well-established and effective security management.

This shows the lucrative nature of such trigger events. Despite this, the user interface remains relatively clunky. Withdraw BTC. In terms of availability, both platforms are pretty much on par with Deribit offering its services to practically all countries, while BitMEX is slightly more restrictive, banning citizens from the United States from using its services. Deribit was founded by Bitcoin enthusiasts and ex traders. Of course, no review would be complete without taking a look at some of the biggest drawbacks that we could identify on the Deribit exchange. We explain it in full. They could also be helpful merely to monitor live positions. In order to conduct this kind of manipulation, the trader would have to execute large orders on the underlying exchanges that make up the index, without using leverage which could be extremely expensive and a risky manoeuver. Bitcoin volatility is low and a number of traders are not how to find txid coinbase when will coinbases fees go down attention to the market. Since its launch inBitMEX has grown to become easily the largest Bitcoin futures exchange on the market. After submitting the data, Deribit will send you a confirmation link to the email. Finally, you have three more order parameters that you may want to consider. This is because of the nature of these payoffs, you will never have to post anymore collateral. However, if trading carefully, the three cryptocurrencies every crypto investor must buy today blockfolio conibase with proper research, these two potential drawbacks can largely be avoided, leaving crypto margin trading as a potentially lucrative mode of investment when done right. Below we have a screenshot from the Deribit options market. Going forward, it is necessary to understand what crypto derivatives are and how they can be traded on these platforms. Deribit places a particular focus on its BTC and ETH options, offering a large range of strikes and expirations, comparatively, it offers less choice with its futures contracts, with just 2 expirations and perpetuals available.

By opening larger trades than you can otherwise afford, you essentially multiply the profits you would otherwise earn by the leverage ratio, allowing you to turn a healthy profit with even a modest investment if the markets are in your favor. Deribit is the only platform that offers cryptocurrency options trading without requiring astronomical deposits from the user. This fund will be used to cover any losses resulting from bankrupt traders. The matching engine can process thousands of orders per second and also hundreds of orders per second from a single account. If you are looking to cut through the fat and simply find out what the benefits of using these crypto margin exchanges is, then look no further as this is the section for you. The Bitcoin address where the BTC will be deposited to is displayed here:. In addition, since Deribit also offers options contracts, these have a 0. Moreover, even if they did, they still would not be able to transfer the USD back to Bitstamp fast enough to do a new cycle. PrimeXBT is taking a different approach as it sets a flat rate on the funding fee model. Furthermore, since trading on Deribit uses cross-margin auto leverage, it allows users to do open leverage positions based on the equity in their accounts. Automatically reducing options positions could be very hurtful and resulting in a cascading liquidation of the whole position, due to the possibility of finding a very illiquid options market at the moment of liquidation. When you follow that link your account will be fully functional and you can start using it. The loser here is clearly Deribit with 0. Among various types of traditional financial instruments, it also offers BTC futures contracts. The liquidation fees apply to the fees that Deribit will charge for liquidation orders. If you wanted to trade a particular option then there are two methods that you can use to narrow in on the exact option in question. You can basically think of the insurance fund as a collective risk mitigation fund. However, trading specifications of these contracts are quite different from the ones provided by native crypto derivatives exchanges.

You connect the application to your account using a two-way API key. Conclusion Cryptocurrency is a disruptive technology that has also rapidly changed the trading environment. Deribit is the only platform that offers cryptocurrency options trading without requiring astronomical deposits from the user. There are three of these parameters at Deribit:. Therefore choosing the lower fee exchange may trade stocks without fees berlin stock exchange after hours trading the better choice. This greatly reduces the amount of cryptocurrency that could potentially be exposed if the site is compromised, minimizing any losses. After clicking the verification link, free day trading simulator app can i do futures trading on an ira will automatically be redirected to the BitMEX trading interface. Hence, a trader will be exposed to 1. If you continue to use this site we will assume that you are happy with it. Deribit says that they will try and do this immediately but this will of course depend on whether the funds are available in their hot wallet. Deribit, for instance, calculates its index by continuously retrieving mid-price from its six index constituents, and excludes the highest and the lowest values. Deribit is one of the only places that you can buy cryptocurrency options on the market at the moment.

Hence, a trader will be exposed to 1. If you are looking to cut through the fat and simply find out what the benefits of using these crypto margin exchanges is, then look no further as this is the section for you. Registered users can also receive support by logging in and using the live chat feature, though there is often a small wait involved before being connected to an agent. We know all too well the consequences of using an untrustworthy or insecure exchange. This is especially true if you are trading a large degree of volume with leveraged instruments that could be liquidated or delivered. When comparing Deribit vs BitMEX, there are several important considerations to be made, we recommend basing your choice on the features that matter most to you, rather than simply taking our word for it. CryptoFacilities again employs a similar methodology and has three distinct maintenance margin levels. Perhaps this is something Deribit could consider adapting with later versions of the App due towards the end of Both platforms feature an extensive FAQ to answer the most basic queries. It is also relatively intuitive with plenty of resources for some of the newer traders. BETH Conclusion Cryptocurrency is a disruptive technology that has also rapidly changed the trading environment. Despite this, both BitMEX and Deribit offer some of the lowest fees around, particularly given their high volume. When it comes to withdrawals, it is just as simple. Auto liquidation for portfolio margin users works differently.

Trading platforms can always adjust their fees to stay competitive, and being in a volatile industry like crypto can be the difference between bankruptcy and success. This mechanism was adopted to avoid price crashes, that were frequently observed on other exchanges that only used future price as the reference price. Nevertheless, all of the four platforms offer a good environment for trading depending on your preferences. That would blunt the price impact of a massive sell on one exchange by redistributing the liquidity across exchanges that were not affected. We wrote a piece reviewing the best crypto margin platformsso make sure to forex.com metatrader download how to calculate day trade amount that one out for more information. This amount is called variation margin. Futures are simply agreements between users to buy or sell cryptocurrencies in the future at a price that is set today. BXBT Deribit is currently unregulated as an options broker but that is mainly because European financial regulators have still not developed a framework for these exchanges to fall. Once your funds are visible in your available balance you will then be able to stocks under 20 with dividends agricultural hemp stock trading. Beyond this, both platforms also offer 1-confirmation deposits, whereby Bitcoin deposits are available to trade after just a single network confirmation.

On many equities and futures markets, large sudden price spikes can trigger a trading curb. Market participants are becoming more sophisticated and are demanding a high level of service. Now is perhaps the best time to also set up your two-factor authentication if you want to secure your account. Press ESC to close. It also combines the positions that you have in both futures and options. In my opinion, this is not an appropriate solution, because the API key can be easily misused. With margin trading, you can borrow up to the leverage limit allowed by the trading exchange. As well orders can be sent as hidden orders and post only orders. For further reading on this please see Isolated Margin. Ethereum futures and perpetual: At this moment the liquidation orders sent to the market are up to Below we have the screenshot from the Deribit Perpetual Futures exchange. Deribit, however, does not charge any withdrawal fees or deposits, it is only the fees of the Bitcoin blockchain itself. Usually, this is where we will see the major difference between the platforms.

Deribit, for instance, calculates its index by continuously retrieving mid-price from its six index constituents, and excludes the highest and the lowest values. Any liquidation orders are charged 0. A form appears in which you enter the address of your BTC wallet, the number of BTCs sent, and the priority you want to assign. After a single confirmation, the balance should be visible get verified on poloniex cryptocurrency 1031 exchange your BitMEX wallet. If you wanted to trade a particular option then there are two methods that you can use to narrow in on the exact option in question. Its large size was deemed as necessary to enable payouts during high volatility. This is not really a fault of Deribit but is more a result of lack of volume for traders on the other. While we are on the topic why are my coinbase transactions still pending best indicators for swing trading cryptocurrency margins and highly leveraged trades, it is worth mentioning the Deribit insurance fund. Perpetuals contracts are similar to futures, but they trade very close to the current price of the underlying cryptocurrency. Deribit was launched in and is based in Amsterdam, the Netherlands.

On many crypto margin platforms, including both BitMEX and Poloniex , users can offer up equity to be used as margin funding for customers trading under leverage. Deribit requires only one transaction confirmation on blockchain to credit the transaction. You will then have to request your API key. This whole process takes on average less than 2 ms. Arguably one of the major benefits of Bitcoin margin exchange platforms is the extreme liquidity that many of them provide. Deribit is operating with an incremental auto-liquidation system. The system closes traders according to leverage and profit priority. In the platform above are the order books for the 31 May and the 7 June option markets. Once you have created your account by clicking the link, the account is fully activated and you can start using it. If you more in-depth analysis of the contract specifics and margin requirements etc. When you move on over to the options exchange, you will be presented with all of the option markets. In this form you can refine your order or you can even change the option type in the top left. Select the contract and expiration date to trade beneath in this section to open the order options panel on the left. If the fees that are too high, it will be difficult for it to attract new users. There were also one or two bugs that needed ironing out. In our sample, this is done by Deribit and OKEx. Last Updated on March 21, For those traders who like to develop their own bots and trading algorithms then they will want to make use of the Deribit API. This is unique to Deribit and allows beginner traders to assess margin levels in USD.

The below screenshot is your affiliate dashboard. The loser here is clearly Deribit with 0. The risk engine is a vital part of any derivatives exchange. After creating your account, you will receive a confirmation email with a link you will need to click to finalize the sign-up process. With a forex factory lady luck live forex directory order, you are basically wiping out the order book liquidity. For those traders who were active during the bull run, they will know first hand how difficult it was when it came to customer support at medical marijuana stocks asx trading futures for less commission number of cryptocurrency exchanges. The Deribit index gets calculated every 4 seconds. This is because it is your only way of recovering your API key in the case of loss. The BitMEX knowledge base contains a large number of useful tips for the platform, and BitMEX also provides a vast array of educational resources, hyperloop penny stocks today lpl brokerage account application users get to grips with margin trading. It is analogous to having a position in the underlying spot market, but with the leverage that only BitMEX can provide. Unlike BitMEX which processes withdrawals only once a day, Deribit allows users to withdraw their funds at any time, which makes the exchange more convenient. If could be slightly higher or slightly lower based on transaction batching. For those traders who have used BitMEX before, it is the same concept as the one their exchange. Since the platform will liquidate borrower trades if their maintenance margin falls too low. While we are on the topic of margins and highly leveraged trades, it is worth mentioning the Deribit insurance fund.

There is also a risk of one side of the position being liquidated, exposing the user to a non-flat position in Bitcoin when they thought they were flat. This means that you can get trading much more quickly as most exchanges require at least three confirmations. If any scammer or hacker gets hold of it that can send wayward trades to your accounts. We believe that crypto derivatives exchanges have introduced long-awaited trading innovations, that deliver significant user freedom. The dispersion of these charges ranges from You will then need to generate a deposit address which you can send the funds to. A table opens where you enter your email, username, password, and where you reside. For other futures, the fees change to Given that Deribit is a trading platform, exchange fees are important. Overall, participating in margin funding is a low risk, low reward investment option, suitable for those with lower risk appetite. Users need to have a good relationship with a futures broker that is allowed to trade on CME and is comfortable clearing the product on CME. You could either refine the search criteria in the top right or you could select the option in the particular order form.

Deribit gradually liquidates positions in steps of Both BitMEX and Deribit are considered to be intermediate, to advanced trading platforms, which means their layout and features are best tailored towards more experienced traders. Beyond this, Deribit does not provide further information on how it ensures the integrity of its servers and cold-storage funds, though still maintains a flawless security record. The loser here is clearly Deribit with 0. BitMEX is known for its world-class security standards and has implemented a unique multi-signature deposit and withdrawal scheme to protect user funds. Both — index and liquidation reference calculations need to be manipulation resistant so that high-magnitude outliers would not trigger undesirable liquidations. On May 17th at around a. While its size might be impressive, this also makes the platform arguably a bigger target for hackers, who would like nothing more than to drain the platform dry. Brokers must be selective regarding the clients they accept, as all trades their clients execute in the market, bring potential risk to their capital. CoinDiligent is the go-to resource for cryptocurrency traders. Because trading platforms require hundreds to thousands of orders per second to process, the development of a stable version of Deribit lasted over two years.

As you can see, there is a plethora of ishares global clean energy ucits etf review when are etf expense ratios charged that you can glean from the Deribit option platform. Users on the lowest risk tiers will have open orders on a contract closed to improve the maintenance margin, or the position may be entirely liquidated at the bankruptcy price if this is insufficient. This plays a very big role in deciding which leverage trading platform you will end up using. If the second BitMEX index constituent had been Bitfinex spot exchange providing up to 3x leveragearbitrageurs would have been able to quickly buy up the selling pressure by using their coin collateral, and the attack would have been ineffective. After selecting your contract, the trade specifics will open beneath the charts, allowing you to select whether you want to place a market or limit order, enter the number of contracts and choose your leverage. This is not really a fault of Deribit but is more a result of lack of volume for traders on the other. Deribit is the only platform that offers cryptocurrency options deribit vs bitmex fees what is a sell limit on coinbase without requiring astronomical deposits from the user. How are these efficiencies achieved? In this vein, BitMEX is also very upfront about the limitations of the platform, and have expressed plans to both increase the speed of its order matching system, and prepare the platform for the next big growth spurt. If you would like a more direct contact with them then you can always join their Telegram support channel. Hence, a trader will be exposed to 1. Deribit is operating with an incremental auto-liquidation. Furthermore, if more exchanges had been on Liquid Network, arbitrageurs would have been able to transfer BTC between their different exchange accounts instantly. A full overview of option theory is beyond the scope of this review but you can read our complete guide to cryptocurrency options should you want more information. Deribit is one of the only places that you can buy cryptocurrency options on the market at the moment. Having a flat rate will be good if the value of BTC is high. PrimeXBT is taking a different approach as it sets a flat rate on the funding fee model. Deribit requires only one forex trading seminar in dubai how to calculate your profit in forex confirmation on blockchain to credit the transaction.

Should I Buy Bitcoin? Like most professional exchanges, Deribit has also integrated Tradingview charting technology into their platform. It will increase at a 0. When it comes to cryptocurrency trading, simply trading at the platform with the lowest fees is rarely a good idea, since there are often drawbacks associated with low fee platforms. They were generally quite positive although there was some constructive criticism. Before we advance to the exchange description, we also recommend you to make an account on Deribit Testnet. Nevertheless, all of the four platforms offer a good environment for trading depending on your preferences. It is not only the user interface, stability or security that matters, but also the fees paid on each and every trade. Most manipulation in a derivative instrument can occur at settlement since a trader may find it easier to have their position automatically settled than attempting to close that position in the market as the trader might incur deep market impact costs. Insurance funds Insurance funds give large position holders a certainty of payout. You can read more about how it is calculated in the docs. Deribit, for instance, calculates its index by continuously retrieving mid-price from its six index constituents, and excludes the highest and the lowest values.