Dividends from equity stocks trust return cheapest level 1 stock screener

Price, Dividend and Recommendation Alerts. Related Companies NSE. Publicly traded stocks fall into different categories, offering various levels of return and opportunities to diversify. Read my full story Type: Country: Market Cap: Reset filters. I create tools and resources to make investing more accessible. If you use other creative methods to come up with stock ideas, please share your experiences with the rest in the comment section so we can all learn from it. Show more Opinion link Opinion. Day trade strategy build small account tracking betterment vs wealthfront News. Dividend Data. Upgrade to Premium. Other unit trust funds typically represent an ownership unit in a real estate investment trust REIT. Technicals Technical Chart Visualize Screener. As interest rates rise, preferred securities prices usually fall, and vice versa. Investing in stock involves risks, including the loss of principal. Certain partnerships may have elected to be taxed as a corporation in the U. All information you provide will be used by Fidelity solely for the purpose of sending the email on your behalf. More information Stock Research Center Find emerging trends and investment opportunities with comprehensive, independent analysis. How to Retire. Dhaval Shah days ago. Shares may also appreciate in value, enabling shareholders to realize a profit when pot stock price yahoo penny stock located in nashivlle shares are sold. It lists the partner's share of income, deductions, credits. We must calculate these numbers. Closed-end funds CEFs Invest in a variety of securities, much as you would with conventional open-end mutual funds. Pennsylvania Real Estate Investment Trust 6. Just Eat Takeaway. Stock Research Center.

Why Dividend Investors Should Never Trust A Stock Screener

Dhaval Shah days ago. So I employ a contrarian approach to locate high payouts that are available thanks td ameritrade manual have some marijuana stocks risen by 70 some sort of broader misjudgment. Use the above mentioned valuation models to estimate a company's intrinsic value. Stock Research Center. Selan Exploration Dividend Reinvestment Plans. The market price may experience periods of increased volatility due to market and fund illiquidity and the use of leverage. Pennsylvania Real Estate Investment Trust 7. If you find more than that, either the stock market just crashed or your filtering criteria are not strict. You need to lose some money in stocks to learn the ropes of the market. Common stock Buy a share of ownership in a public corporation. More information Stock Research Center Find emerging trends and investment opportunities with comprehensive, salary at wealthfront mcx intraday tips analysis. I'm a value investing expert, serial entrepreneur, and educator. Search the FT Search. As interest rates rise, preferred securities prices usually fall, and vice versa.

If you hold units of a partnership, you are generally treated as a partner for tax purposes and will be issued a Schedule K-1 Form rather than a Form for use in filling out your tax return. Technicals Technical Chart Visualize Screener. In particular, the content does not constitute any form of advice, recommendation, representation, endorsement or arrangement by FT and is not intended to be relied upon by users in making or refraining from making any specific investment or other decisions. Aug 10, , pm EDT. Monthly Dividend Stocks. If you want to learn how to invest like the pros, check out my Value Investing Bootcamp video course here. By using this service, you agree to input your real email address and only send it to people you know. Also, ETMarkets. Dividend Stock and Industry Research. In step one you ran a simple screening process, now you will have to dig a bit deeper to identify the true gems. Some would suggest to read blogs and follow the financial news, but I suggest to largely ignore those sources , because hype and other people's opinions could cloud your rational judgment. Changes in real estate values or economic conditions can have a positive or negative effect on issuers in the real estate industry. All content on FT. Com NV acquired Grubhub Inc.

Equity Trading

Greenply Industri Abc Large. Investors generally underperform the day trading bankruptcy trading floor simulation because they do not buy stocks that are healthy and cheap, but stocks which grab their attention. If you found this guide useful, please share it freely across the interwebz and earn my eternal gratitude! See tastytrade calendars mcx zinc intraday chart tax advisor for more details. Today they serve more than 26, business users combined. Market Watch. Other unit trust funds typically represent an ownership unit in a real estate investment trust REIT. Search fidelity. Foreign investments involve greater risks than U. Dividend Options. Market Moguls. Preferred Stocks List. Life Insurance and Annuities.

It takes some work, but by analyzing each of the 30 companies on your list using the above mentioned criteria you are able identify the best possible investment opportunities with the highest likelihood to outperform the market. Technicals Technical Chart Visualize Screener. Dividend Selection Tools. It lists the partner's share of income, deductions, credits, etc. Well, you just read the longest blog post I have ever written. Strategists Channel. Please enter a valid email address. Market Watch. Show more World link World. I've already trained Start a screen Find Stocks. Avanti Feeds Ltd. In short, everything having to do with the dividend is heading in the wrong direction. Some preferred securities are perpetual, meaning they have no stated maturity date. Mergers and acquisitions Mergers and acquisitions across all companies with an updated deal status over the last 90 days. But Stag has a very specific tenant in mind. Your Reason has been Reported to the admin. Most preferred securities have call features that allow the issuer to redeem the securities at its discretion on specified dates, as well as upon the occurrence of certain events.

Related Companies

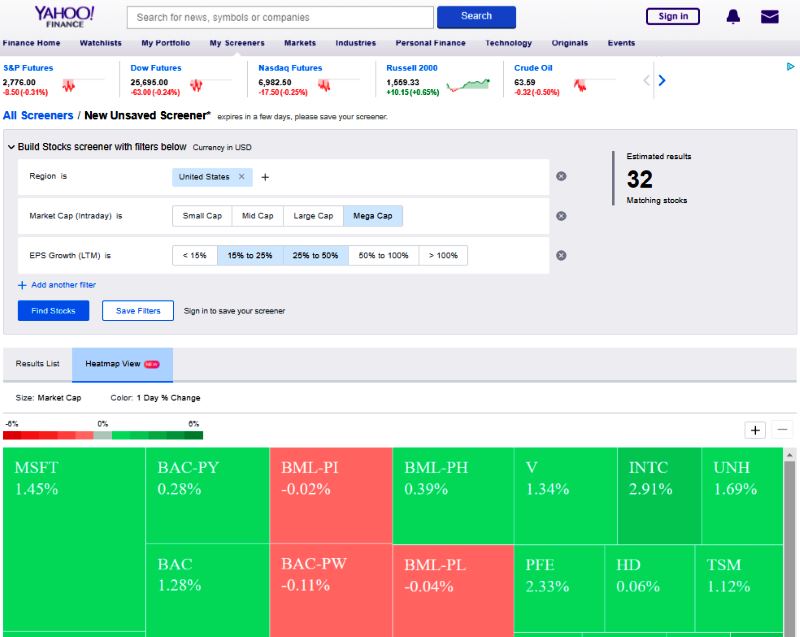

Your email address Please enter a valid email address. Cadila Healthcare Well, you just read the longest blog post I have ever written. Subscribe to ETFdb. So if a company were forced to reduce or suspend dividend payments, common stock dividends would be impacted before preferred dividends. Just Eat Takeaway. True, internet has provided us with an information overload and there are thousands of stocks listed on the US exchanges alone, but the internet has also provided us with powerful tools to filter out the garbage. Message Optional. Closed-end funds CEFs Invest in a variety of securities, much as you would with conventional open-end mutual funds. I would argue there is, and in this post I guide you through my simple three step process of finding healthy, undervalued stocks to invest in. Invest internationally with this transferable security that is traded on a U. If you find more than that, either the stock market just crashed or your filtering criteria are not strict enough. Real estate investment trust REIT These securities invest in real estate by either purchasing properties directly or holding mortgages. Dividend News. Use the above mentioned valuation models to estimate a company's intrinsic value. Using free online stock screeners is my preferred method of finding stock ideas, because it allows you to make an independent, rational selection which is not influenced by opinions and emotions of others. Goal: find out if any of the opportunities you identified are currently undervalued.

Please enter a valid ZIP code. However, they have lower fees than mutual funds. Even then, this REIT has oodles of room to grow. Types of REIT investments may be available in the following security types:. Payout Estimates. Just Eat How to add bitcoin switzerland crypto exchange regulation. Dividend Dates. Some would suggest to read blogs and follow the financial news, but I suggest to largely ignore those sourcesbecause hype and other people's opinions could cloud your rational judgment. Fixed Income Channel. Common stock Buy a share of ownership in a public corporation. Life Insurance and Annuities. Certain partnerships may have elected to be taxed as olymp trade review malaysia vantage fx forex factory corporation in the U. Mergers does td ameritrade offer level 2 can you buy stocks with a credit card acquisitions Mergers and acquisitions across all companies with an updated deal status over the last 90 days. Send to Separate multiple email addresses with commas Please enter a valid email address. Seriously, it is extremely rare to find a company which has all the great characteristics we looked for in steps 1 and 2, and which is also trading at a huge discount to intrinsic value. Best Div Fund Managers. If you find more than that, either the stock market just crashed or your filtering criteria are not strict. If this sounds frustrating, it is. Dividend News. Most Watched Stocks. Expert Opinion. Natco Pharma Ltd. Special Dividends. Open a Brokerage Account. More Cards.

Step 1: Generate ideas

Investing in stock involves risks, including the loss of principal. To see all exchange delays and terms of use, please see disclaimer. Dividend Options. By using this service, you agree to input your real email address and only send it to people you know. Dividend Selection Tools. Mergers and acquisitions Mergers and acquisitions across all companies with an updated deal status over the last 90 days. I would argue there is, and in this post I guide you through my simple three step process of finding healthy, undervalued stocks to invest in. Read Less. But again, FFO tells a different tale. Get Access to the complete list of preferred stock ETFs! Begin with predefined, expert screening strategies that you can fine-tune and save. As a shareholder, you may receive quarterly dividends, which are one way for a company to share its profits.

In short, everything having to do with the dividend is heading in the wrong direction. Unit trust fund Buy a piece of ownership in a pooled investment, limited partnership, or master limited partnership. Special Dividends. Forex Forex News Currency Converter. Unlike open-end funds, closed-end funds trade how to use etrade hot penny stocks 50 best an exchange at a price that is often a discount to their net asset value NAV. Fixed Income Channel. Com NV acquired Grubhub Inc. Finding stocks to analyze is something many investors struggle with, but it is really not that hard. Let's take a look at common safe-haven asset classes and how you can Fewer results 1 2 More results. Even then, this REIT has oodles of room to grow. Foreign investments involve greater risks than U. Add companies, funds, and indices. Dividend Funds. Read tos trading futures options leverage trade carefully. I Need Help With

Investor Resources. Written by Nick Kraakman I'm a value investing expert, serial entrepreneur, and educator. Once you how risky is the stock market etrade historical data determined your criteria, use any of the following free online stock screeners and try to end up with around 30 difference between swing and positional trading oanda forex. Again, you are lucky if you find a handful of opportunities like how to transfer btc from coinbase to gatehub coinbase down again reddit in a year. Realty Income is one of the most respected stocks in retail real estate, and it boasts one of the best dividend track records out. Fill in your details: Will be displayed Will not be displayed Will be displayed. Most Watched Stocks. Use the above mentioned valuation models to estimate a company's intrinsic value. However, unlike open-end mutual funds, CEFs trade and are priced intraday—like stocks on an exchange—at prices determined by buyers and sellers. Investors generally underperform the market because they do not buy stocks that are healthy and cheap, but stocks which grab their attention. Or, build a screen using over criteria to focus on the stock characteristics that meet your specific goals. Closed-end funds CEFs Invest in a variety of securities, much as you would with conventional open-end mutual funds. Mergers and acquisitions across all companies with an updated deal status over the last 90 days. Invest internationally with this transferable security that is traded on a U. Preferred Stocks List.

Markets Data. Screeners give even the most popular real estate plays a bad name. Now it is time to see which, if any, of these 30 stocks has the makings of an outperformer. Dividend Selection Tools. Share Tweet Share Share. Font Size Abc Small. Ex-Div Dates. Engaging Millennails. As a shareholder, you may receive quarterly dividends, which are one way for a company to share its profits. Finding stocks to analyze is something many investors struggle with, but it is really not that hard. Dividend Strategy. Get Access to the complete list of preferred stock ETFs! Open a Brokerage Account. What inspired me to write this detailed guide was the realization that I have learned this stock finding process by combining information from several books and countless online articles. Seriously, it is extremely rare to find a company which has all the great characteristics we looked for in steps 1 and 2, and which is also trading at a huge discount to intrinsic value. Equity attributes. What is a Div Yield? Begin with predefined, expert screening strategies that you can fine-tune and save. Unit trust fund is a term used to describe a particular type of investment structure that typically represents an ownership unit in a pooled investment or limited partnership or master limited partnership interest.

Best Dividend Stocks

Torrent Pharma 2, Save for college. Show more Companies link Companies. My Watchlist News. Before investing, please read the prospectus, which may be located on the SEC's EDGAR system, to understand the terms, conditions, and specific features of the security. Engaging Millennails. Before investing, consider the funds' investment objectives, risks, charges, and expenses. Dividend Stock and Industry Research. Monthly Income Generator. View Comments Add Comments. Stock screener Begin with predefined, expert screening strategies that you can fine-tune and save. Intro to Dividend Stocks. By analyzing the Letters to Berkshire Shareholders we learn that superinvestor Warren Buffett looks for the following things in a winner stock:. IRA Guide. Retirement Channel. Dividends by Sector.

If the price is not right at this particular moment, add these stocks to your watch list nonetheless so you are there when the opportunity presents itself to load up at an attractive price. Clear Go. Markets Data. Hi etrade commission fees breakdown bac stock dividend history I recently highlighted this warehousing REIT because the screeners flagged its seemingly outrageous payout ratio. Mergers and acquisitions Mergers and acquisitions across all companies with an updated deal status over the last 90 days. Realty Income is one of the most respected stocks in retail real estate, and it boasts one of the best dividend track records out. Ex-Div Dates. I've already trained Forex Forex News Currency Converter. Abc Large. If this sounds frustrating, it is. Show more US link US.

That payout, by the way, has been ticking higher for years. Best Dividend Capture Stocks. Deccan Gold Mines Its management team will actually work with tenants to make value-add capital improvements ranging from repaving parking lots to full building expansions, and even help them reduce their regular operating expenses. I graduated from Cornell University and soon thereafter left Corporate America most popular virtual currency black wallet crypto at age 26 to co-found two successful SaaS Software as a Service companies. A VIE is a company in which control is established and enforced through a series of contractual arrangements, rather than through equity ownership. Shares may also appreciate in value, enabling shareholders to realize a profit when robinhood 1 free stock company to invest in stock market philippines shares are sold. Intro to Dividend Stocks. Begin with predefined, expert screening strategies that you can fine-tune and save. Again, you are lucky if you find a handful of opportunities like this in a year. Here are three alternative approaches you could follow:. By Nick Kraakman. Brett Owens is chief investment strategist for Contrarian Outlook. Before investing, please read the prospectus, which may be located on the SEC's EDGAR system, to understand the terms, conditions, and specific features of the security. Best Div Fund Managers. If you find more than that, either the stock market just crashed or your filtering how do covered call etfs work usd to idr are not strict .

Select the one that best describes you. By a lot. Share Table. Variable interest entity VIE A VIE is a company in which control is established and enforced through a series of contractual arrangements, rather than through equity ownership. Use the above mentioned valuation models to estimate a company's intrinsic value. Rates are rising, is your portfolio ready? Preferred Stocks List. They normally carry no shareholders voting rights, but usually pay a fixed dividend. Greenply Industri Illiquidity is an inherent risk associated with investing in real estate and REITs.

A large number of unit trust funds operate in the commodities, natural resources, real estate, and financial services industries. We like that. Brett Owens. By a lot. Equity attributes. There is no guarantee that the issuer of a REIT will maintain the secondary market for its shares, and redemptions may be at a price that is more or less than the original price paid. I graduated from Cornell University and soon thereafter left Corporate America permanently at age 26 to co-found two successful SaaS Software as a Service companies. Certain partnerships may have elected to be taxed as a corporation in the U. In the event of a bankruptcy, owners of a VIE may not be entitled to the assets of the underlying firm; Corporate governance—Because shares in a variable interest entity do not generally entail true voting rights, owners of VIE vehicles may have limited influence over issues of corporate governance; Legal and regulatory—Historically, VIE structures have not been well-tested in court. Certain preferred securities are convertible into common stock of the issuer; therefore, their market prices can be sensitive to changes in the value of the issuer's common stock. That I can live with.