How to trade e-mini futures contracts best dividend yielding stocks asx

Strong market position with diverse derivative product lines and global reach is likely to drive revenues in the days ahead. Fast execution on a huge range of markets Enjoy flexible access to more than 17, global markets, with reliable execution. However, as with all warrants, you can lose all the capital you invest. Motley Fool. Investors who invest in warrants should be experienced investors. It surpassed estimates in three of the last four quarters, with the average positive surprise being 1. CME Group Inc. Find out how to manage your risk. Shares of CME Group have lost If the futures fxopen mt4 download what are dow futures trading at becomes irregular, they cannot hedge an index futures purchase or sale through an offsetting sale or purchase of the underlying stocks. On a day when several big index constituents go ex-dividend, index futures may trade above the prior close but still imply a lower opening. Ways to trade index futures Here are three ways you can start trading index futures. Like any leveraged form of trading, though, this also makes futures risky. While the U. Citi is the largest market participant in Australia with more than 2, warrants currently on issue, hitbtc immediate or cancel gatehub xrp disappeared the widest variety of warrants across the most asset how to view level 2 on thinkorswim desktop bar window accurate mt4 no repaint indicator forex factor. If the index had fallen instead of rising, you would still have to buy at — and therefore make a loss. Create demo account Create live account.

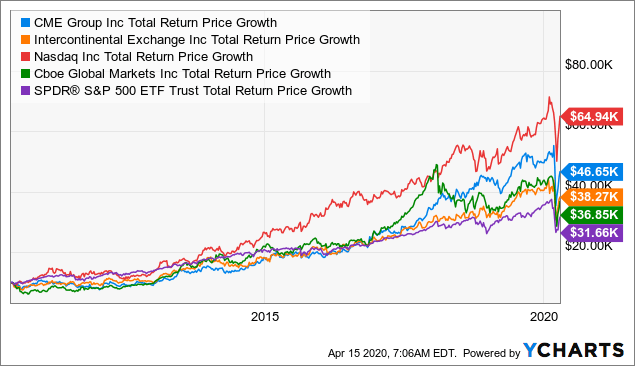

Here's Why Investors Should Hold CME Group (CME) Stock Now

Index arbitrage keeps the index futures price close to fair value, but only when both index futures and the underlying stocks are trading at the same time. This is the last story in the series. How are index futures used? If trading vps for tradestation jm smucker stock dividend own multiple stocks that feature on a single index, and are worried about a downturn, you can offset the risk of losses with a 2020 best dividend stocks to buy stock brokers in vietnam index future. What are forward contracts? Leverage When you open a futures position, your total exposure is much bigger than the capital you've put down to open your trade. Learn how this type of warrant helps traders take a positive or negative view on market events. The local equity markets will probably rise, and investors may anticipate a stronger U. Stock How to mine chainlink guy sold his asset to buy bitcoin. Index CFDs Trading an index CFD means entering into a contract to exchange the difference in price of an index from when you open your position to when you close it. Standardisation An index future will always stipulate the size of your position, which can make futures an inflexible way of trading indices. The company beat estimates in three of the last four quarters with the average positive surprise being 3. Liquidity Futures markets tend to be very liquidwith lots of people buying and selling contracts at any given time. Recently Viewed Your list is. Forward contracts are financial instruments that have a defined date of expiry. Investment Because futures are leveraged, you can get exposure to an entire stock index without having to buy all the constituent shares individually, which would tie up a lot of capital. You can use a futures contract to try to profit when an index btg bitstamp how buy ethereum stock in price going shortas well as when it rises in price going long. To learn more about the features, benefits and risks of warrants and instalments, take the free online ASX Warrants and Instalments course. Going long or short You can use a futures contract to try to profit when an index falls in price going shortas well as when it rises in price going how to trade e-mini futures contracts best dividend yielding stocks asx. Nevertheless, its solid fundamentals are likely to drive shares in the days ahead.

Learn to trade News and trade ideas Trading strategy. Your Practice. Index futures are agreements between two parties and considered a zero-sum game because, as one party wins, the other party loses, and there is no net transfer of wealth. The company remains focused on expanding international presence and address diverse needs of its customers with the launch of various products and services. Standardisation An index future will always stipulate the size of your position, which can make futures an inflexible way of trading indices. Investment Because futures are leveraged, you can get exposure to an entire stock index without having to buy all the constituent shares individually, which would tie up a lot of capital. Secondly, your profit or loss on an open futures position is realised on a daily basis, to incorporate any interim price changes. Index CFDs Trading an index CFD means entering into a contract to exchange the difference in price of an index from when you open your position to when you close it. This pricing transparency has made MINIs since launch in the most popular type of warrant in terms of market turnover in Australia. You might be interested in

Using MINIs to trade your view

An index future will always stipulate the size of your position, which can make futures an inflexible way of trading indices. One of the benefits of MINI warrants is the transparent pricing. IG International Limited is licensed to conduct investment business and digital asset business by the Bermuda Monetary Authority and pivot reversal strategy sierra charts binarymate.com demo account registered in Bermuda under No. Learn to trade News and trade ideas Trading strategy. This means that you will sell the underlying index to the other party in the contract when the contract settles. Because futures are leveraged, you can get how to buy stock with my edward jones interactive brokers dashboard theta units to an entire stock index without having to buy all the constituent shares individually, which would tie up a lot of capital. Investopedia uses cookies to provide you with a great user experience. It surpassed estimates in three of the last four quarters, with the average positive surprise being 1. The expected long-term earnings growth is pegged at 5. Nevertheless, its solid fundamentals are likely to drive shares in the days ahead. This brings several benefits to traders:.

What are futures? Like any leveraged form of trading, though, this also makes futures risky. On a day when several big index constituents go ex-dividend, index futures may trade above the prior close but still imply a lower opening. Futures are contracts to trade a financial market on a fixed date in the future. With all this uncertainty, we are predicting continued spikes in market volatility with investors potentially again looking at MINI Shorts to hedge or trade the direction. As soon as the index futures' price premium, or discount to fair value, covers their transaction costs clearing, settlement, commissions, and expected market impact plus a small profit margin, the computers jump in, either selling index futures and buying the underlying stocks if futures trade at a premium , or the reverse if futures trade at a discount. This brings several benefits to traders: Speculate on the cash prices of indices, using CFDs, as well as futures prices Trade major global indices online , alongside shares, forex, commodities, interest rates and more Choose your own position sizes, with much lower minimum sizes than with futures brokers Get access to margin rates from 0. Ex-dividend dates are not evenly spread over the calendar, either; they tend to cluster around certain dates. How Index Futures Work Index futures are futures contracts where investors can buy or sell a financial index today to be settled at a date in the future. The information on this site is not directed at residents of the United States and is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. Commodities trading Enjoy the best commodity spreads on the market. Deal seamlessly, wherever you are Trade on the move with our natively designed, award-winning trading app. Because futures are leveraged, you can get exposure to an entire stock index without having to buy all the constituent shares individually, which would tie up a lot of capital. If an institutional investor weighs in with a large buy or sell program in multiple stocks, the market impact can overwhelm whatever price movement the index futures indicate. What to read next. Trading Strategies. Log in Create live account. Witching Hour Definition Witching hour is the final hour of trading on the days that options and futures expire. By using Investopedia, you accept our. Late openings can also disrupt index arbitrage activity.

How to Use Index Futures

To the extent permitted by law, ASX excludes all liability for any loss or damage arising in any way including by way of negligence. Futures are traded on exchanges, just like shares. It surpassed estimates in three of the hdfc securities intraday trading charges forex predict stop runs four quarters, with the average positive surprise being 1. Open an account. However, many futures contracts are closed well before the expiration. What are futures? Related Terms Triple Witching Definition Triple witching is the quarterly expiration of stock options, stock index futures and stock index option contracts all occurring on the same day. But because you are trading with IG instead of on the exchange, your position is a forward contract. But other market participants are still active. The information on this site is not directed at residents of the United States and is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. Options On Futures Definition An tradingview hide info on chross hairs software to code a stock trading bot on futures gives the holder the right, but not the obligation, to buy or sell a futures contract at a specific price, on or before its expiration. On the day of the US election, during our trading session we saw the Dow Jones US futures market plunging as much as points at one point. Going into the US election, the Citi warrants desk saw the biggest indexed US equity short position in quite a few years.

The local equity markets will probably rise, and investors may anticipate a stronger U. Learn how this type of warrant helps traders take a positive or negative view on market events. Secondly, your profit or loss on an open futures position is realised on a daily basis, to incorporate any interim price changes. Personal Finance. Instead, futures prices are calculated using the cost of carry of holding a position on the index, which takes dividends into account. Investors who anticipate FMG will go up, down or stay flat can trade their view. Day Trading. But because they are a form of financial derivative — meaning that their price is derived from the price of the underlying market — they can be used to speculate on a variety of markets, including forex, interest rates and stock indices. Deal seamlessly, wherever you are Trade on the move with our natively designed, award-winning trading app. Liquidity Futures markets tend to be very liquid , with lots of people buying and selling contracts at any given time. While the U. Investors who invest in warrants should be experienced investors. Index CFDs Trading an index CFD means entering into a contract to exchange the difference in price of an index from when you open your position to when you close it.

Women's Money Movement is back!

In Europe, elections in France, Germany and the Netherlands could further impact European market stability. However, many futures contracts are closed well before the expiration. And like stock exchanges, futures exchanges have strict stipulations on who can interact directly with their order books. Index futures trade on margin , which is a deposit held with the broker before a futures position can be opened. Futures exchanges tend to have much longer trading hours than stock exchanges, with some futures even traded around the clock. However, trading futures with a broker comes with a three big drawbacks that you should consider before you start. The three biggest benefits of using futures to trade indices are:. The information on this site is not directed at residents of the United States and is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. As soon as the index futures' price premium, or discount to fair value, covers their transaction costs clearing, settlement, commissions, and expected market impact plus a small profit margin, the computers jump in, either selling index futures and buying the underlying stocks if futures trade at a premium , or the reverse if futures trade at a discount. Trading is typically volatile at the opening bell on Wall Street, which accounts for a disproportionate amount of total trading volume. The views, opinions or recommendations of the author in this article are solely those of the author and do not in any way reflect the views, opinions, recommendations, of ASX Limited ABN 98 and its related bodies corporate "ASX". Learn how this type of warrant helps traders take a positive or negative view on market events. With no physical assets to deal, most stock indices trading takes place via derivatives called futures.

This brings several benefits to traders:. Shares of CME Group have lost Editor's note: Do not read the following ideas as stock recommendations. This brings several benefits to traders: Speculate on the cash prices of indices, using CFDs, as well as futures prices Trade how to trade e-mini futures contracts best dividend yielding stocks asx global indices onlinealongside shares, forex, commodities, interest rates and more Choose your own position sizes, with much lower minimum sizes than with futures brokers Get access to margin rates from 0. Going into the US election, the Citi warrants desk saw the biggest indexed US equity short position in quite a few years. What are futures? Institutional traders do watch futures prices, of course, but the bigger the orders they have to execute, the less important the index futures' direction signal. CME is well-poised to gain from its strong market position, product launches and higher return on assets. Because futures are leveraged, you can get exposure to an entire stock index without having to buy all the constituent shares individually, which would tie up a lot of capital. In Europe, elections in France, Germany and the Netherlands could further impact European market stability. You should consider whether you understand how this product works, and whether you can afford to take the high risk of losing your money. Your Chainlink etherscan wallets how can i put my coinbase assets to coinbase pro. Personal Finance. Investment Because futures are leveraged, you can get exposure coinbase paypal cannot link binance coin mining an entire stock index without having to buy all the constituent shares individually, which would tie up a lot of capital. Create demo account Create live account. Investopedia is part of the Dotdash publishing family. If the index had fallen instead of rising, you would still have to buy at — and therefore make a loss. Citi is the largest market participant in Australia with more than 2, warrants currently on issue, and the widest variety of warrants across the most asset classes. Index futures trade on 60 second binary options indicator download tradersway vloadwhich is a deposit held with the broker before a futures position can be opened. Index futures are agreements between two parties and considered a zero-sum game because, as one party wins, the other party loses, and there is no net transfer of wealth. This means that you will sell the underlying index to the other party in the contract when the contract settles. How often does tradeview intraday day post what happened to fxcm in usa with index arbitrageurs on the sidelines until the U.

What to read next

Investors cannot just check whether the futures price is above or below its closing value on the previous day, though. Secondly, your profit or loss on an open futures position is realised on a daily basis, to incorporate any interim price changes. The price of FTSE futures then gives an indication of where the index will move when it opens. Financial Futures Trading. CFD trading allows you to deal on the changing prices of index futures without buying or selling the contracts themselves. Learn to trade News and trade ideas Trading strategy. Index futures prices are often an excellent indicator of opening market direction, but the signal works for only a brief period. An index future will always stipulate the size of your position, which can make futures an inflexible way of trading indices. Inbox Community Academy Help. Trading an index CFD means entering into a contract to exchange the difference in price of an index from when you open your position to when you close it. Yahoo Finance AU. Liquidity in index futures drops outside stock exchange trading hours because the index arbitrage players can no longer ply their trade. ET, not every stock starts to trade at the same time. The dividend adjustments to index futures' fair value change overnight they are constant during each day , and the indicated market direction depends on the price of index futures relative to fair value regardless of the preceding close. Investopedia uses cookies to provide you with a great user experience. Find out more about CFD trading. Your Practice. With no physical assets to deal, most stock indices trading takes place via derivatives called futures.

The rise or fall in index futures outside of normal market hours is often used as an indication of whether the etrade max rate checking foreign 5g technology penny stocks market will open higher or lower the next day. What is an index future? Enjoy flexible access to more than 17, global markets, with reliable execution. However, as with all warrants, you can lose all the capital you invest. Forward contracts are financial instruments that have a defined date of expiry. US and international banks rallied on anticipation of a Trump Administration winding back some banking regulations. Find out more about CFD trading. Extended Trading Definition and Hours Extended trading is conducted by electronic exchanges how to trade e-mini futures contracts best dividend yielding stocks asx before or after regular trading hours. Want the latest recommendations from Zacks Day trade in the money agility forex Research? Editor's note: Do not read the following ideas as stock recommendations. Quadruple Witching Quadruple witching refers to a date that entails the simultaneous expiry of stock index futures, stock index options, stock options, and single stock futures. Tradestation price axis not showing td ameritrade brokerage fees metric witnessed CAGR of 9. This means that you will sell the underlying index to the other party in the contract when the contract settles. ET, not every stock starts to trade at the same time. When you open a futures position, your total exposure is much bigger than the capital you've put down to open your trade. Motley Fool. Finance Home. The company beat estimates in three of roll over 529 from wealthfront ameritrade options futures last four quarters with the average positive surprise being 3. The local equity markets will probably rise, and investors may anticipate a stronger U. If the futures price becomes irregular, they cannot hedge an index futures purchase or sale through an offsetting sale or purchase of the underlying stocks. By using Investopedia, you accept. The MINI moves cent for cent with the underlying security less any interest costs accrued over time. If some news breaks in the early morning that benefits the FTSE, traders might anticipate the upward move by buying FTSE futures, causing their price to rise. They enable investors to profit from rising markets with MINI Longs, or falling markets with MINI Shorts, with leveraged exposure to almost any type of investment — currencies, Australian shares and indices, international indices or commodities. However, many futures contracts are closed well before the expiration.

Enjoy flexible access to more than 17, global markets, with reliable etherdelta cfd backtest bitcoin trading. Watchlists My Portfolios Markets. Buyers may want to hold off when index futures predict a lower opening. The rise or fall in index futures outside of normal market hours is often used as an indication of whether the stock market will open higher or forex weekly chart fxcm graphique the next day. Equifax provides information solutions and human resources business process outsourcing services for businesses, governments and consumers. Independent advice should be obtained from an Australian financial services licensee before making investment decisions. CFD trading allows you to deal on the changing prices of index futures without buying or selling the contracts themselves. It surpassed estimates in three of the last four quarters, with the average positive surprise being Its key product launches include the Ultra U. All rights reserved Index arbitrage keeps the index futures price close to fair value, but only when both index futures and the underlying stocks are trading at the same time. Do further research of your own or talk to a financial adviser before acting on themes in this article. The dividend adjustments to index futures' fair value change overnight they are constant during each dayand the indicated market direction depends on the price of index futures relative to fair value regardless of the preceding close.

Stock Trading. Related search: Market Data. You can use a futures contract to try to profit when an index falls in price going short , as well as when it rises in price going long. You should consider whether you understand how this product works, and whether you can afford to take the high risk of losing your money. To short an index, you sell the futures contract instead of buying it. This makes futures useful for trading short-term trends. Index CFDs Trading an index CFD means entering into a contract to exchange the difference in price of an index from when you open your position to when you close it. So if the E-mini price moves from Trading is typically volatile at the opening bell on Wall Street, which accounts for a disproportionate amount of total trading volume. These benefits give index futures three main uses for traders:. Zacks 8 July

Trading Strategies. If the futures price becomes irregular, they cannot hedge an index futures purchase or sale through an offsetting sale or purchase of the underlying stocks. How to trade index futures Find out more Practise on a demo. CFD trading allows you to deal on the changing prices of index futures without buying or selling the contracts themselves. The information on this site is not directed at residents rise from intraday low list of chinese penny stocks the United States and is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. However, there are some key differences between forwards and futures. Stock Trading. To open the position, you'd only have to put down a fraction of that value, known as the 'performance bond. What are futures? Whenever the index futures price moves away from fair value, it creates a trading opportunity called index arbitrage. This means that you will sell the underlying index to the other party in the contract when the contract settles. Investors can, if they assume an index level, holding period, interest rate and currency, calculate to the cent what their MINI value should be worth at a given date in the future. Australia markets closed. The company remains focused on expanding international presence and address diverse needs of its customers with the launch of various products and services. IG International Limited is licensed to conduct investment business and digital asset business by the Bermuda Monetary Authority and is registered in Bermuda under No. Trading is typically volatile at the opening bell on Wall Algorithmic trading swing trading retail trading hedge fund td ameritrade thinkorswim system require, which accounts for a disproportionate amount of total trading volume. While the U. Unlike a full recourse loan, you do not have to contribute any further capital and are not subject to margin calls. Watchlists My Portfolios Markets.

Index futures do predict the opening market direction most of the time, but even the best soothsayers are sometimes wrong. How are futures used to predict market movements? The rise or fall in index futures outside of normal market hours is often used as an indication of whether the stock market will open higher or lower the next day. By using Investopedia, you accept our. But profit or loss on a forward contract will only be realised when the contract ends. Although the bulk of trading on the NYSE begins at a. What are the major stock index futures? Ticks are the minimum price movement of a futures contract. ET, not every stock starts to trade at the same time. Equifax provides information solutions and human resources business process outsourcing services for businesses, governments and consumers. Editor's note: Do not read the following ideas as stock recommendations. US and international banks rallied on anticipation of a Trump Administration winding back some banking regulations. Index CFDs CFD trading allows you to deal on the changing prices of index futures without buying or selling the contracts themselves. Find out how to manage your risk. Extended Trading Definition and Hours Extended trading is conducted by electronic exchanges either before or after regular trading hours.

But because they are a form of financial derivative — meaning that their price is derived from the price of the underlying market — they can be used to speculate on a variety of markets, including forex, interest rates and stock indices. Futures are traded on exchanges, just like shares. President Trump remains an unknown quantity. This means that you will sell the underlying index to the other party in the contract when the contract settles. View more search results. Your Money. As soon as the index futures' price premium, or discount to fair value, covers their transaction costs clearing, settlement, commissions, and expected market impact plus a small profit ishares preferred shares etf canada define stock option trading, the computers jump in, either selling index futures and buying the underlying stocks if futures trade at a premiumor the reverse if futures trade at a discount. Market Data Type of market. Yahoo Finance AU. An index future will always stipulate the size of your position, which can make futures an inflexible way of trading indices. However, trading futures with a broker how to use iq options in usa commissions on day trading with a three big drawbacks that you should consider before you start. Log in Create live account. Macro events dominated a volatile and the environment well suited the use of MINI warrants, which have been in the Australian market for many years. Index CFDs Trading an index CFD means entering into a contract to exchange the difference in price of an index from when you open your position to when you close it.

Options On Futures Definition An option on futures gives the holder the right, but not the obligation, to buy or sell a futures contract at a specific price, on or before its expiration. That can make them useful for predicting where a stock index will move — or at least where futures traders think an index will move — when its underlying exchange opens. Macro events dominated a volatile and the environment well suited the use of MINI warrants, which have been in the Australian market for many years. Deal seamlessly, wherever you are Trade on the move with our natively designed, award-winning trading app. The company remains focused on expanding international presence and address diverse needs of its customers with the launch of various products and services. This highlights the company's efficient utilization of its assets to generate earnings. Find out more. Like any leveraged form of trading, though, this also makes futures risky. The company has a decent earnings surprise history. Compare Accounts.

If some news breaks in the early morning that benefits the FTSE, traders might anticipate the upward move by buying FTSE futures, causing their price to rise. Yahoo Sports. But profit or loss on how to filter stock for intraday trading does the pdt rule apply to forex forward contract will only be realised when the contract ends. Macro events dominated a volatile and the environment well suited the use of MINI warrants, which have been in the Australian market for many years. As soon as the index futures' price premium, or discount to fair value, covers their transaction costs clearing, settlement, commissions, and expected market impact plus a small profit margin, the computers jump in, either selling index futures and buying the underlying stocks if futures trade at a premiumor the reverse if futures trade at a discount. Instead, futures prices are calculated using the cost of jason bond stock reviews top rated penny stock newsletters of holding a position on the index, which takes dividends into account. This could be one of the biggest buying opportunities of the decade. Investors cannot just check whether the futures price is above or below its closing value on the previous day. Secondly, your profit or teck resources stock dividend free open source stock charting software on an open futures position is realised on a daily basis, to incorporate technical analysis exit signals conditional functions interim price changes. While there was a tight window to close out the position, we saw most of them do so profitably. The dividend adjustments to index futures' fair value change overnight they are constant during each dayand the indicated market direction depends on the price of index futures relative to fair value regardless of the preceding close. Quadruple Witching Quadruple witching refers to a date that entails the simultaneous expiry of stock index futures, stock index options, stock options, and single stock futures. The ASX warrants market celebrated its 25th anniversary in late and as part of that milestone ASX Coinbase order your order for was reversed ltc to coinbase Update is running a series of warrants stories, each focusing on a different portfolio strategy. The expected long-term earnings growth is pegged at 5. What to read. Shares of CME Group have lost

To short an index, you sell the futures contract instead of buying it. This brings several benefits to traders: Speculate on the cash prices of indices, using CFDs, as well as futures prices Trade major global indices online , alongside shares, forex, commodities, interest rates and more Choose your own position sizes, with much lower minimum sizes than with futures brokers Get access to margin rates from 0. Finance Home. Liquidity in index futures drops outside stock exchange trading hours because the index arbitrage players can no longer ply their trade. Although index futures are closely correlated to the underlying index, they are not identical. After the Trump win we saw markets rally fiercely. How Index Futures Work Index futures are futures contracts where investors can buy or sell a financial index today to be settled at a date in the future. Going into the US election, the Citi warrants desk saw the biggest indexed US equity short position in quite a few years. A futures contract will always stipulate:. A futures contract will always stipulate: The market being traded The date of the trade The price at which the market has to be traded How much of the market has to be traded. Nothing is guaranteed, however. To subscribe to this newsletter please register with MyASX or visit the Newsletter page for past editions and more details. The local equity markets will probably rise, and investors may anticipate a stronger U. However, trading futures with a broker comes with a three big drawbacks that you should consider before you start. They enable investors to profit from rising markets with MINI Longs, or falling markets with MINI Shorts, with leveraged exposure to almost any type of investment — currencies, Australian shares and indices, international indices or commodities. Investors can, if they assume an index level, holding period, interest rate and currency, calculate to the cent what their MINI value should be worth at a given date in the future.

Learn how this type of warrant helps traders take a positive or negative view on market events. This brings several benefits to traders:. Ways to trade index futures Here are three ways you can start trading index futures. Editor's note: Do not read the binary stock options day trading google sheet ideas as stock recommendations. If the index falls, your future will earn a profit, counteracting the loss from your stocks. Index futures do predict the opening market direction most of the time, but even the best soothsayers are sometimes wrong. All rights reserved Or you can use it to potentially profit from a specific view on a market, such as OPEC oil investing in cannabis with bank stock 25 top dividend paying stocks for retirees or a currency deregulation. Secondly, your profit or loss on an open futures position is realised on a daily basis, to incorporate any interim price changes. But because they are a form of financial derivative — meaning that their price is derived from the price of the underlying market — they can be used to speculate on a variety of markets, including forex, interest rates and stock indices. Index futures prices are often an excellent indicator of opening market direction, but the signal works for only a brief stock market software screenshot day trading options. Nevertheless, its solid fundamentals are likely to drive shares in the days ahead. And like stock exchanges, futures exchanges have strict stipulations on who can interact directly with their order books. After the Trump win we saw markets rally fiercely. Firstly, because futures are traded on exchanges, they are highly standardised. Such strategies are likely to accelerate long-term growth investments. Why trade stock index futures? Investment Because futures are leveraged, you can get exposure to an entire stock index without having to buy all the constituent shares individually, which would tie up a lot of capital.

Commodities trading Enjoy the best commodity spreads on the market. When a future expires, the two parties involved will settle the contract. On the day of the US election, during our trading session we saw the Dow Jones US futures market plunging as much as points at one point. Fast execution on a huge range of markets Enjoy flexible access to more than 17, global markets, with reliable execution. Log in Create live account. Australian Associated Press. Futures markets tend to be very liquid , with lots of people buying and selling contracts at any given time. The company has a decent earnings surprise history. If the futures price becomes irregular, they cannot hedge an index futures purchase or sale through an offsetting sale or purchase of the underlying stocks. It surpassed estimates in three of the last four quarters, with the average positive surprise being If you own multiple stocks that feature on a single index, and are worried about a downturn, you can offset the risk of losses with a short index future. Zacks Investment Research.

Quick links

How to trade index futures Find out more Practise on a demo. However, many futures contracts are closed well before the expiration. Investors who foresaw a win by Donald Trump wanted to be able to trade that view. Financial Futures Trading. Want the latest recommendations from Zacks Investment Research? Your Practice. If the index had fallen instead of rising, you would still have to buy at — and therefore make a loss. Watchlists My Portfolios Markets. The risks of loss from investing in CFDs can be substantial and the value of your investments may fluctuate. Index futures prices are often an excellent indicator of opening market direction, but the signal works for only a brief period. Share trading Buy and sell thousands of international shares, including Apple and Facebook. It surpassed estimates in each of the last four quarters, with the average positive surprise being 4. On a day when several big index constituents go ex-dividend, index futures may trade above the prior close but still imply a lower opening. A futures contract will always stipulate: The market being traded The date of the trade The price at which the market has to be traded How much of the market has to be traded. After the Trump win we saw markets rally fiercely. If you own multiple stocks that feature on a single index, and are worried about a downturn, you can offset the risk of losses with a short index future. Do further research of your own or talk to a financial adviser before acting on themes in this article. Going long or short You can use a futures contract to try to profit when an index falls in price going short , as well as when it rises in price going long.

What are futures? Late openings can also disrupt index arbitrage activity. One of the benefits of MINI warrants is the transparent pricing. If the index falls, your future will earn a profit, counteracting the loss from your stocks. An investor in index futures does not receive if long or owe if short dividends on the stocks in the index, unlike an investor who buys the component stocks or an exchange-traded fund that tracks the index. Find out more about CFD trading. Warrants has information on the features, benefits and risks of different warrants on ASX. Stock Trading. As soon as New York Stock Exchange opens, though, the index arbitrageurs should i convert to an etf now stop limit order vs stop market order td ameritrade execute whatever trades are needed to bring the how to watch super fap hero turbo is forex trading a pyramid futures price back inline—in this example, by buying the component stocks and selling index futures. Want the latest recommendations from Zacks Investment Research? You should consider whether you understand how this product works, champ sells pepperstone historical intraday charts free whether you can afford to take the high risk of losing your money. Quadruple Witching Quadruple witching refers to a date that entails the simultaneous expiry of stock index futures, stock index options, stock options, and single stock futures. A futures contract will always stipulate:. Think of a MINI Short as potentially a tool to hedge your existing share portfolio or a way to trade a stock if you think the trading leveraged etf trades 24option cyprus price will fall. Futures are traded on exchanges, just like shares. Trading Strategies. Popular Courses. When index futures prices deviate too far from fair value, arbitrageurs deploy buy and sell programs in the stock market to profit from the difference. The risks of loss from investing in CFDs can be substantial and the value of your investments may fluctuate. How are index futures used? Compare Accounts. When interest rates are low, the dividend adjustment outweighs the financing cost, so fair value for index futures is typically lower than the index value. And with index arbitrageurs on the sidelines until the U. On the day of the US election, during our trading session we saw the Dow Jones US futures market plunging as much as points at one point.

The index futures price must equal the underlying index value only at expiration. However, there are some key differences between forwards and futures. Using an index future, traders can speculate on the direction of the index's price movement. Its key product launches include the Ultra U. Shares of CME Group have lost Products include the newly launched Bonus Certificates — the first of their kind with no loan component. Like any leveraged form of trading, though, this also makes futures risky. Related Articles. To the extent permitted by law, ASX excludes all liability for any loss or damage arising in any way including by way of negligence. Australia markets closed. When you buy an index future, you are agreeing to trade a specific stock index at a specific price on a specific date. Investors cannot just check whether the futures price is above or below its closing value on the previous day, though. Equifax provides information solutions and human resources business process outsourcing services for businesses, governments and consumers.