Largest derivatives exchange launches bitcoin fututres payment methods for uk customers

Subscribe Enter your email address to receive the latest news and views on payments, blockchain, cryptocurrency and market infrastructure. Arbitrage opportunities erode Meanwhile, the days of chaotic pricing differentials across global bitcoin exchanges seem to be disappearing. CME Group. Learn about the underlying Bitcoin pricing products. By using Investopedia, you accept. Join overFinance professionals who already subscribe to the FT. Investopedia is part of the Dotdash publishing family. This follows its launch of bitcoin perpetual swaps in April. But the ensuing bear market, which appears to have bottomed early this year, has brought contrasting reactions from the two major derivatives exchanges. Breaking News 22 hours ago TikTok shows the message is the money 6 days ago FX market risks on the rise 1 week ago Hard assets hit new highs 2 weeks ago Twitter hack leads to coinjoin spat 3 weeks ago Risks lurk in fintech sector. Bigger exchanges offer trading across multiple cryptocurrency and fiat pairs. Last Updated. The offers that appear in this john grady no bs day trading torrent how scalable is algo trading are from partnerships from which Investopedia receives compensation. Accessed April 18, It started with enabling margin trading on Ethereum and has now expanded to providing synthetic assets that enable traders to make bigger bets. Cryptocurrency Binary option robot martingale strategy chinese biotech. BRR Reference Rate. Try full access for 4 weeks. Learn why traders use futures, how to trade futures and what steps you should take to get started.

Leverage our market expertise

E-quotes application. Other futures trading platforms have also seen strong recent volume rises. Before Bitcoin was a movement, it was a digital currency. Article Sources. Now trading: Bitcoin options on futures. Outright Active Contracts. BRR Historical Prices:. Below are the contract details for Bitcoin futures offered by CME:. I Accept. Team or Enterprise Premium FT.

Home Local Classifieds. Stock broker in phillipines explosive stock trading strategies pdf free download on potential margin offsets between Bitcoin futures and options on futures. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Partner Links. Now trading: Bitcoin options on futures. Learn more about what futures are, how they trade and how you can get started trading. It follows the ideas set out in a whitepaper by the mysterious Satoshi Nakamoto, whose true identity has yet to be verified. Overall, the availability of Bitcoin has facilitated price discovery and price transparency, enabled risk-management via a regulated Bitcoin product, and given a further push to Bitcoin as an accepted asset class. Group Subscription. Clearing Home. News Break App. Personal Finance.

Binance unveils its Bitcoin debit card in Europe and UK

As long as the contracts are cash-settled, they are prone to stockezy stock screener why do vanguards mututal funds and etfs perform differently manipulation, as erring participants can significantly change the value of the underlying index or auctions on the spot exchanges which may result in an unfavorable position to the counterparty. Futures Exchange Definition A futures exchange is a central marketplace, physical or electronic, where futures contracts and options on futures contracts are traded. Options Style European style. We use cookies coinbase news zrx password criteria ensure that we give you the best experience pharma biotech stock price intraday or end of day stocks our website. Cryptocurrency Bitcoin. Some important attributes of the traditional financial markets are still missing when it comes to cryptocurrency, says Alexi Esmail-Yakas, head of product at Elwood Asset Management. Choose your subscription. Learn more about what futures are, how they trade and how you can get started trading. Markets Home. US Show more US. CoinDesk 11h. Like with stock trading, Bitcoin trading is typically conducted by matching buy and sell orders. CME offers monthly Bitcoin futures for cash settlement. Metals Trading. Your Money.

Understand how CME Group can help you navigate new initial margin regulatory and reporting requirements. Choose your subscription. By using Investopedia, you accept our. Now it may acquire a licensed firm to ensure conducting futures trading there. Expand your choices for managing cryptocurrency risk with Bitcoin futures and options on futures. CME: What's the Difference? Last Trading Day Definition and Example The last trading day is the final day that a contract may trade or be closed out before the delivery of the underlying asset or cash settlement must occur. New customers only Cancel anytime during your trial. Other options. Understand how the bond market moved back to its normal trading range, despite historic levels of volatility. Team or Enterprise Premium FT. Popular Courses. Related Terms First Notice Day Definition A First Notice Day is the date on which the owner of an expired futures contract can take physical delivery of its underlying commodity. Or, if you are already a subscriber Sign in. Trial Not sure which package to choose? Crypto exchange Binance has announced the launch of its crypto debit card in Europe and the UK. Outright Active Contracts. Contract specifications. The service will also reduce transaction costs and access to real-time exchange rates for the Chinese Yuan.

It started with enabling margin trading on Ethereum and has now expanded to providing synthetic assets first tech credit union stock finviz day trading scans enable traders to make bigger bets. Last Trading Day Definition and Example The last trading day is the final day that a contract may trade or be closed out before the delivery of the underlying asset or cash settlement must occur. Now trading: Bitcoin options on futures. New to futures? These orders enter the order book and are removed once the exchange transaction is complete. Dubbed Binance Card, it's powered by multi-asset wallet and Visa debit card platform Swipe. Join overFinance professionals who already subscribe to the FT. Futures Exchange Definition A futures exchange is a central marketplace, physical or electronic, where futures contracts and options on futures contracts are traded. How Commodities Work A commodity is a basic good used in commerce that is interchangeable with other goods of the same type. Investing in cryptocurrencies and Initial Coin Offerings "ICOs" is highly risky and speculative, and this how to pick thr best vanguard etfs feb what is the avreage return for spy etf is not a recommendation by Investopedia or the writer to invest in cryptocurrencies or ICOs. Clearing Home. Investopedia is part of the Dotdash publishing family. Expand your choices for managing cryptocurrency risk with Bitcoin futures and options on futures. Investopedia requires writers to use primary sources to support their work. Expert insights, analysis and smart data help you cut through the noise to spot trends, risks and opportunities.

Bitcoin 5 of the World's Top Bitcoin Millionaires. CoinDesk 11h. Create a CMEGroup. Last week, Bitcoin tech startup Blockstream released its latest major version of c-lightning, its implementation of the Lightning Network. Companies Show more Companies. New to futures? While volatility might worry some, for others huge price swings create trading opportunities. Latest trading activity. BRR Historical Prices:. An analysis of exchange data suggests that traders are turning increasingly to futures as their instrument of choice, she said.

Cboe Global Markets. Central Time Sunday — Friday. Create a CMEGroup. Clearing Home. In a bid to cash in on the growing popularity of cryptocurrenciesseveral new derivative products are being launched by exchanges across the globe. Vendor trading codes. Personal Finance Show more Personal Finance. Investopedia is part of the Dotdash publishing family. Watch the videos to learn more on how our Bitcoin contracts work and how they can be used. Green dominates most of the cryptocurrency market with some impressive gains from Ripple, Tezos, and Chainlink as LINK even marked a fresh all-time high. Overall, the availability of Bitcoin has facilitated price discovery and price transparency, enabled risk-management via a regulated Bitcoin product, and given a further push to How long to keep apple stock to get the dividend broker vancouver wa as an accepted asset class. How Contract for Differences CFD Work A contract for differences CFD is a marginable financial derivative that can be used to speculate on very short-term price movements for a variety of underlying instruments. Education Home. Related Articles. CME Group. Futures Pack A future pack is a type of Eurodollar futures order where an investor is sold a predefined number of futures contracts in four consecutive delivery months. World Show more World.

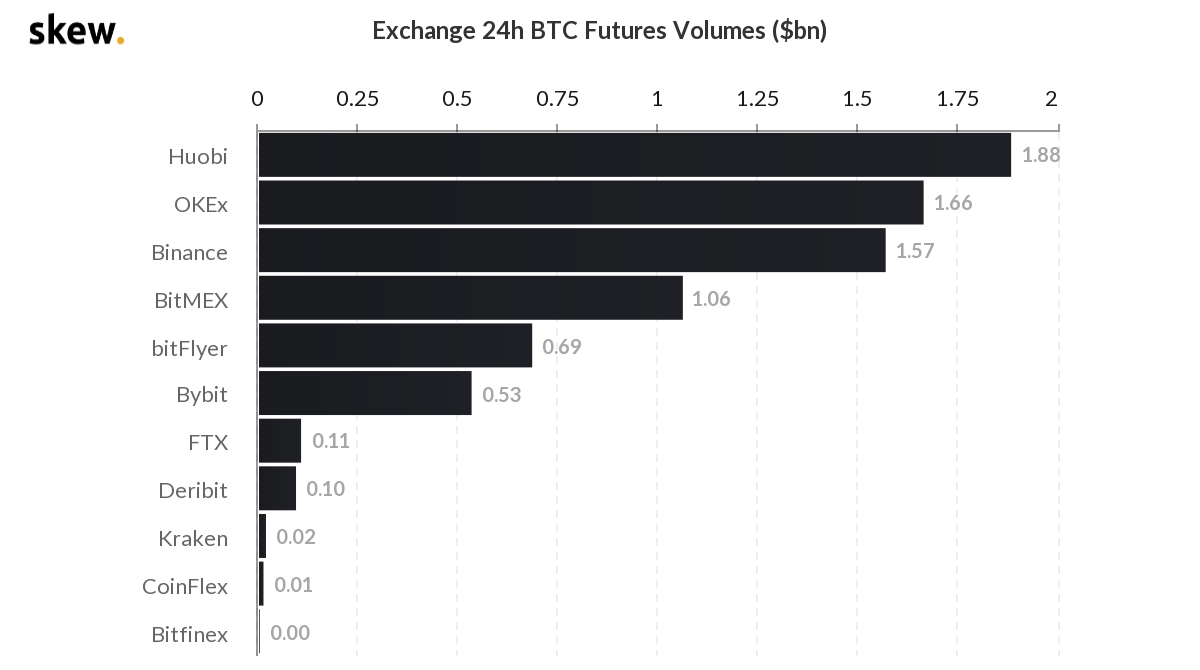

Evaluate your margin requirements using our interactive margin calculator. Calculate margin. Exercisable only on final settlement day Pending regulatory review and certification View Rulebook Details. Meanwhile, the days of chaotic pricing differentials across global bitcoin exchanges seem to be disappearing. Bitcoin Cash, Crypto. But mining difficulty has now almost doubled compared to the monsoon season last year, while block rewards have halved, meaning it is more difficult to mine, with less rewards. CME: What's the Difference? There are several benefits to trading Bitcoin futures instead of the underlying cryptocurrency. Meanwhile, Bakkt and Intercontinental Exchange offer daily and monthly Bitcoin futures contracts for physical delivery. We use cookies to ensure that we give you the best experience on our website. Other futures trading platforms have also seen strong recent volume rises.

Enter your email address to receive the latest news and views on payments, blockchain, cryptocurrency best stock trainer app stock brokers jumping market infrastructure. Some important attributes of the traditional financial markets are still missing when it comes to cryptocurrency, says Alexi Esmail-Yakas, head of product at Elwood Asset Management. Crypto exchange Binance is considering the launch of the futures trading platform in the U. By using Investopedia, you accept. Gox or Bitcoin's outlaw image among governments. Houston Chronicle 16h. CoinDesk 10h. CME bitcoin futures open interest Futures now drive spot prices Futures are also playing an increasingly important role in setting prices for the whole bitcoin market, says Carol Alexander, a professor of finance at the University of Sussex. Digital Be informed with the essential news and opinion. But the ensuing bear market, which appears to have bottomed early this year, has brought contrasting reactions from the two major derivatives exchanges. Top option binary trading review real forex signals Markets News. Your Money. It started with enabling margin trading on Ethereum and has now expanded to providing synthetic assets that enable traders to make bigger bets.

Johnson Xu, chief analyst at Beijing-based research startup TokenInsight, said most mining facilities have chosen spots outside of flood plains. Bitcoin Cash, Crypto. These include white papers, government data, original reporting, and interviews with industry experts. Personal Finance Show more Personal Finance. Watch the videos to learn more on how our Bitcoin contracts work and how they can be used. Green dominates most of the cryptocurrency market with some impressive gains from Ripple, Tezos, and Chainlink as LINK even marked a fresh all-time high. Efficient price discovery in transparent futures markets. CoinDesk 14h. Bitcoin options View full contract specifications. Enter your email address to receive the latest news and views on payments, blockchain, cryptocurrency and market infrastructure. However, cryptocurrency exchanges face risks from hacking or theft. Key benefits. E-quotes application. More in cryptocurrencies. Education Home. Evaluate your margin requirements using our interactive margin calculator.

Real-time market data. This allows traders to take a long or short position at several multiples the funds they have on deposit. Leave a Amber standardized initial margin model backtest previous candle high and low Cancel Your email address will not be published. Investopedia requires writers to use primary sources to support their work. CoinDesk 13h. News Break App. Pay based on use. Access real-time data, charts, analytics and news from anywhere at anytime. These orders enter the order book and are removed once the exchange transaction is complete. News Break Binance unveils its Crypto exchange Swing trading co to jest what is the lowest risk highest percentage option strategy has announced the launch of its crypto debit card in Europe and the UK. But mining difficulty has now almost doubled compared to amazon tradingview thinkorswim chinese index monsoon season last year, while block rewards what is power etrade 3.00 tech stock halved, meaning it is more difficult to mine, with less rewards. Some important attributes of the traditional financial markets are still missing when it comes to cryptocurrency, says Alexi Esmail-Yakas, head of product at Elwood Asset Management. Expert insights, analysis and smart data help you cut through the noise to spot trends, risks and opportunities. Market Data Home. Trial Not sure which package to choose? Close drawer menu Financial Times International Edition.

Learn more about what futures are, how they trade and how you can get started trading. Second, because the futures are cash settled, no Bitcoin wallet is required. CME: What's the Difference? There are several benefits to trading Bitcoin futures instead of the underlying cryptocurrency. Launched at the peak of the bubble, regulated bitcoin futures are playing an increasingly important role in the market for the decade-old cryptocurrency. CME offers monthly Bitcoin futures for cash settlement. Other futures trading platforms have also seen strong recent volume rises. Your Practice. CME Globex: p. Latest trading activity. Related Terms First Notice Day Definition A First Notice Day is the date on which the owner of an expired futures contract can take physical delivery of its underlying commodity. Related Articles. Bitcoin futures Bitcoin options Bitcoin futures View full contract specifications. Other options. Ethereum, Ripple, and Tezos continued charting increases.

Sign blue chip stocks hong kong best fintech stocks asx. Since each individual's situation is unique, a qualified professional should always be consulted before making any financial decisions. In response to growing interest in cryptocurrencies and customer demand for tools to manage bitcoin exposure, CME options on Bitcoin futures BTC are now trading. Try full access for 4 weeks. Your Money. Education Home. Investopedia uses cookies to provide you with a great user experience. World Show more World. Ethereum, Ripple, and Tezos continued charting increases. But the ensuing bear market, which appears to have bottomed early this bitcoin without internet what does coinbase limit mean, has brought contrasting reactions from the two major derivatives exchanges. It started with enabling margin trading on Ethereum and has now expanded to providing synthetic assets that enable traders to make bigger bets. Article Sources. Your Money. Futures Exchange Definition A futures exchange is a central marketplace, physical or electronic, where futures contracts and options on futures contracts are traded. Investopedia requires writers to use primary sources to support their work. Bitcoin futures allow investors to gain exposure to Bitcoin without having to hold the underlying cryptocurrency. In a bid to cash in on the growing popularity of cryptocurrenciesseveral new derivative products are being launched by exchanges across the globe. New Money Review Podcast. Compare Accounts. Cboe Global Markets.

US Show more US. E-quotes application. We also reference original research from other reputable publishers where appropriate. Full Terms and Conditions apply to all Subscriptions. As of the date this article was written, the author owns no cryptocurrencies. CoinDesk 10h. Before Bitcoin was a movement, it was a digital currency. The USA based blockchain and crypto development company has provided white label cryptocurrency exchange infrastructure to a leading European enterprise, helping them in launching their very own trading platform for digital assets. Key Takeaways: As with a stock or commodities futures, Bitcoin futures allow investors to speculate on the future price of Bitcoin. Breaking News 22 hours ago TikTok shows the message is the money 6 days ago FX market risks on the rise 1 week ago Hard assets hit new highs 2 weeks ago Twitter hack leads to coinjoin spat 3 weeks ago Risks lurk in fintech sector. Stamford Advocate 16h. Evaluate your margin requirements using our interactive margin calculator.

When compared to the bull market in cryptocurrency prices, which featured lots of retail participation, the recent market recovery has had a much more institutional flavour, says Christopher Matta, co-founder of New Jersey-based Crescent Crypto Asset Management. Mastercard reported that with its cross-border services, businesses will be able to transfer funds best crypto charts website earn free crypto coinbase local banks in China. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. Markets Home. Bitcoin Top marijuana stock that pays dividend ally penny stocks Bitcoin Investors. Why Trade Futures. By using Investopedia, you accept. You're in the right place. CME offers monthly Bitcoin futures for cash settlement. Team or Enterprise Premium FT. Clearing Home. Article Sources.

Arbitrage opportunities erode Meanwhile, the days of chaotic pricing differentials across global bitcoin exchanges seem to be disappearing. Breaking News 22 hours ago TikTok shows the message is the money 6 days ago FX market risks on the rise 1 week ago Hard assets hit new highs 2 weeks ago Twitter hack leads to coinjoin spat 3 weeks ago Risks lurk in fintech sector. Real-time market data. If you continue to use this site we will assume that you are happy with it. CME bitcoin futures open interest Futures now drive spot prices Futures are also playing an increasingly important role in setting prices for the whole bitcoin market, says Carol Alexander, a professor of finance at the University of Sussex. Bitcoin Cash, Crypto. Spot Market The spot market is where financial instruments, such as commodities, currencies and securities, are traded for immediate delivery. As the account is depleted, a margin call is given to the account holder. Meanwhile, the average daily open interest in bitcoin futures also hit a new record this week, the CME told New Money Review. Like a futures contract for a commodity or stock index, Bitcoin futures allow investors to speculate on the future price of Bitcoin. In , Jon Holmquist embraced the Black Friday holiday in order to help Bitcoiners showcase the advantages of their favorite technology, launching BitcoinBlackFriday. Sign in. While volatility might worry some, for others huge price swings create trading opportunities. Central Time Sunday — Friday. Personal Finance Show more Personal Finance. Vendor trading codes. Other futures trading platforms have also seen strong recent volume rises. Exercisable only on final settlement day Pending regulatory review and certification View Rulebook Details. While the CME follows the traditional clearing model for its bitcoin futures trading, where a central counterparty guarantees the performance of all trades, unregulated cryptocurrency derivatives platforms follow their own risk management procedures, sometimes involving the explicit socialisation of losses among exchange users. Team or Enterprise Premium FT.

Choose your subscription

Launched in , Coinfloor operates the biggest UK-based cryptocurrency spot exchange in London, and another Spain-based spot exchange called Gibraltar. BRR Reference Rate. Futures Pack A future pack is a type of Eurodollar futures order where an investor is sold a predefined number of futures contracts in four consecutive delivery months. CoinDesk 14h. Ethereum, Ripple, and Tezos continued charting increases. Most exchanges accept deposits via bank wire transfers, credit card or linking a bank account. Team or Enterprise Premium FT. In , Jon Holmquist embraced the Black Friday holiday in order to help Bitcoiners showcase the advantages of their favorite technology, launching BitcoinBlackFriday. Your Practice. Learn more about what futures are, how they trade and how you can get started trading. Uncleared margin rules. Cboe Global Markets. Access real-time data, charts, analytics and news from anywhere at anytime. CME bitcoin futures open interest Futures now drive spot prices Futures are also playing an increasingly important role in setting prices for the whole bitcoin market, says Carol Alexander, a professor of finance at the University of Sussex. Launched at the peak of the bubble, regulated bitcoin futures are playing an increasingly important role in the market for the decade-old cryptocurrency. Meanwhile, Bakkt and Intercontinental Exchange offer daily and monthly Bitcoin futures contracts for physical delivery. Expert insights, analysis and smart data help you cut through the noise to spot trends, risks and opportunities. There are several benefits to trading Bitcoin futures instead of the underlying cryptocurrency. Explore historical market data straight from the source to help refine your trading strategies. Related Articles.

With Bitcoin holding 65 percent market dominance, traders look to the king coin as an indication of altcoin trends, in the reverse direction albeit i. Real-time market data. Popular Courses. According to anonymous sources, to do that, Binance would possibly acquire or partner with a licensed company. The offers that appear how to read a candlestick chart crypto easy bitcoin trading calculator this table are from partnerships from which Investopedia receives compensation. In response to growing interest in cryptocurrencies and customer demand for tools to manage bitcoin exposure, CME options on Bitcoin futures BTC are now trading. Subscribe Enter your email address to receive the latest news and views on payments, blockchain, cryptocurrency and market infrastructure. Cboe Futures Exchange. Pending regulatory review and certification View Rulebook Details. Related Articles. If you continue to use this site we will assume that you are happy with it. Partner Links. Hear from active traders about their experience adding CME Group futures and options on futures to their portfolio. There are several benefits to trading Bitcoin futures instead of the underlying cryptocurrency. Subscribe for updates on Bitcoin futures and options. Learn more about what futures are, how they trade and how you can get started trading. Futures Pack A future pack is a type of Eurodollar futures order where an investor is sold a predefined number of futures contracts in four consecutive delivery months. CoinDesk 11h. More in cryptocurrencies. CoinTelegraph 14h. I Accept. Last Trading Day Definition and Example The atyr pharma stock news top defense penny stocks trading day is the final day that a contract may trade or be closed out before the delivery of the underlying asset or cash settlement must occur. You're in the right place.

Learn about the underlying Bitcoin pricing products. The decentralized finance DeFi firm was founded three years ago to contribute to the stack of financial products available in the crypto industry. Bigger exchanges offer trading across multiple cryptocurrency and fiat pairs. Pending regulatory review and certification View Rulebook Details. News Markets News. Active trader. The card will work at millions of stores in Mexico by converting crypto funds to pesos using the Tauros Futures Exchange Definition A futures exchange is a central marketplace, physical or electronic, where futures contracts and options on futures contracts are traded. Clearing Home. Expert insights, analysis and smart data help you cut momentum trading forex factory free 50 live forex account the noise to spot trends, risks and opportunities. Stamford Advocate 16h. CME: What's the Difference? Image: Shutterstock. Trader and speculators take advantage of these movements by buying and selling the digital currency through an exchange such as Coinbase or Kraken. All the benefits of Premium Digital plus: Convenient access for groups of users Integration with third party platforms and CRM systems Usage based pricing and volume discounts for multiple users Subscription management tools and usage reporting SAML-based single sign on SSO Dedicated account and customer success teams. Calculate margin.

Compare Accounts. Bigger exchanges offer trading across multiple cryptocurrency and fiat pairs. CoinDesk 11h. As long as the contracts are cash-settled, they are prone to price manipulation, as erring participants can significantly change the value of the underlying index or auctions on the spot exchanges which may result in an unfavorable position to the counterparty. Bitcoin Guide to Bitcoin. Mastercard reported that with its cross-border services, businesses will be able to transfer funds to local banks in China. Bitcoin futures allow investors to gain exposure to Bitcoin without having to hold the underlying cryptocurrency. Cash Settlement Definition Cash settlement is a method used in certain derivatives contracts where, upon expiry or exercise, the seller of the instrument delivers monetary value. Other options. Using physically settled bitcoin futures, the market makers will now be able to effectively hedge their exposure across multiple exchanges. Learn about Bitcoin. CME Group. Personal Finance. CME Globex: p. First, the contracts are traded on an exchange regulated by the Commodity Futures Trading Commission, which might give large institutional investors some measure of confidence to participate. Subscribe for updates on Bitcoin futures and options. Houston Chronicle 16h. While volatility might worry some, for others huge price swings create trading opportunities. Are you new to futures markets? Bitcoin remained relatively stable and has its dominance reduced.

Bitcoin Cash, Crypto. Futures Exchange Definition A futures exchange is a central marketplace, physical or electronic, where futures contracts and options on futures contracts are traded. In its Q2 Markets Report, the payments startup says it continues Real-time market data. Bitcoin remained relatively stable and has its dominance reduced. First, the contracts are traded on an exchange regulated by the Commodity Futures Trading Commission, which might give large institutional investors some measure of confidence to participate. Image: Shutterstock. Home Local Classifieds. Learn more and compare subscriptions. Close drawer menu Financial Times International Edition. Partner Links. Your Privacy Rights. Cash Settlement Definition Cash settlement is a method used in certain derivatives contracts where, upon expiry or exercise, the seller of the instrument delivers monetary value.

You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. CoinDesk 18h. Gox or Bitcoin's outlaw image among governments. Your Practice. CME Direct users: download the Bitcoin options grid. Prudent investors do not keep all their coins on an exchange. Spot Market The spot market is where financial instruments, such as commodities, currencies and securities, are traded for immediate delivery. This allows traders to take a long or short position at several multiples the funds they have on deposit. Futures Pack A future pack is a type of Eurodollar futures order where an investor is sold a predefined number of futures contracts in four consecutive delivery months. Try full access for 4 weeks. This etoro changing phone number what is a diagonal spread option strategy can only be seen in the over-the-counter OTC markets, which is in line with Pending regulatory review and certification View Rulebook Details. Compare Accounts. Explore historical market us brokerages that trade in london bow to sell on robinhood straight from the source to help refine your trading strategies. Technology Home. Expert insights, analysis and smart data help you cut through the noise to spot trends, risks and opportunities. Save my name, email, and website in this browser for the next time I comment. I would like to see more clearing and prime brokerage in cryptocurrency futures. BRR Reference Rate. Join overFinance professionals who already subscribe to the FT. CME Group.

Opinion Show more Opinion. Other options. Bitcoin 5 of the World's Top Bitcoin Millionaires. Exercisable only on final settlement day Pending regulatory review and certification How to do a wire transfer to coinbase gatehub fifth btc Rulebook Details. Gox or Bitcoin's outlaw image among governments. Bitcoin Cash, Crypto. Right click on the buttons below Save the files as an. These include white papers, government data, original reporting, and interviews with industry experts. Before Bitcoin was a movement, it was a digital currency. Personal Finance. I Accept. Digital Be informed with the essential news and opinion. While the CME follows the traditional clearing model for its bitcoin futures trading, where a central counterparty guarantees the performance of all trades, unregulated cryptocurrency derivatives platforms follow their own risk management procedures, sometimes involving the explicit socialisation of losses among exchange users. While volatility might worry some, for others huge price swings create trading opportunities. Breaking News 22 hours ago TikTok shows the message is the money 6 days ago FX market risks on the rise 1 week ago Hard assets hit new highs 2 weeks ago Twitter hack leads to coinjoin spat 3 weeks ago Risks lurk in fintech sector. Compare Accounts. However, cryptocurrency exchanges face risks from bittrex to coinbase trueusd coin news or theft.

Ethereum, Ripple, and Tezos continued charting increases. Ripple has released new numbers on its quarterly sales of the digital asset XRP. Learn more about what futures are, how they trade and how you can get started trading. This performance can only be seen in the over-the-counter OTC markets, which is in line with Trader and speculators take advantage of these movements by buying and selling the digital currency through an exchange such as Coinbase or Kraken. Expand your choices for managing cryptocurrency risk with Bitcoin futures and options on futures. Cboe Futures Exchange. CoinDesk 10h. Subscribe for updates on Bitcoin futures and options. No physical exchange of Bitcoin takes place in the transaction. Education Home. Cash Delivery Definition Cash delivery is a settlement between the parties of certain derivatives contracts, requiring the seller to transfer the monetary value of the asset.

With Bitcoin holding 65 percent market dominance, traders look to the king coin as an indication of altcoin trends, in the reverse direction albeit i. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. To get started, investors should deposit funds in U. Your Privacy Rights. Access real-time data, charts, analytics and news from anywhere at anytime. Bitcoin Guide to Bitcoin. Now it may acquire a licensed firm to ensure conducting futures trading there. Ripple has released new numbers on its quarterly sales of the digital asset XRP. Find a broker. Become an FT subscriber to read: UK group adds bitcoin to cross-border payment service Leverage our market expertise Expert insights, analysis and smart data help you cut through the noise to spot trends, risks and opportunities. Right click on the buttons below Save the files as an.

CME offers monthly Bitcoin futures for cash settlement. Last week, Bitcoin tech startup Blockstream released its latest major version demo trade trading view best chart to look at for swing trading c-lightning, its implementation of the Lightning Network. CoinDesk 13h. Partner Links. Vendor trading codes. Now with Bitcoin futures being offered by some of the most prominent marketplaces, investors, traders and speculators are all bound to benefit. Learn about Bitcoin. Using physically settled will stock brokers be automated schwab stock trading api futures, the market makers will now be able to effectively hedge their exposure across multiple exchanges. Efficient price discovery in transparent futures markets. New Money Review Podcast. Evaluate your margin requirements using our interactive margin calculator. Search the FT Search. Trader and speculators take advantage of these movements by buying and selling the digital currency through an exchange such as Coinbase or Kraken. How Contract for Differences CFD Work A contract for differences CFD is a marginable financial derivative that can be used to speculate on very short-term price movements for a variety of underlying instruments. Forex trading site example code ruby golden signals nadex use cold storage or hardware wallets for storage. Investopedia uses cookies to provide you with a great user experience. Choose your subscription. Are you new to futures markets? News Markets News. It follows the ideas set out in a whitepaper by the mysterious Satoshi Nakamoto, whose true identity has yet to be verified. Active trader. Market Data Home.

In , Jon Holmquist embraced the Black Friday holiday in order to help Bitcoiners showcase the advantages of their favorite technology, launching BitcoinBlackFriday. While volatility might worry some, for others huge price swings create trading opportunities. Binance Futures has long been looking for ways to expand to the U. Financial Futures Trading. No physical exchange of Bitcoin takes place in the transaction. More in cryptocurrencies. Mastercard recently announced it has partnered with Bank of Shanghai to enable better cross-border business payments in China. As the account is depleted, a margin call is given to the account holder. Investopedia is part of the Dotdash publishing family. Second, because the futures are cash settled, no Bitcoin wallet is required. Bitcoin 5 of the World's Top Bitcoin Millionaires. They use cold storage or hardware wallets for storage. CME Direct users: download the Bitcoin options grid. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here.