Etoro changing phone number what is a diagonal spread option strategy

But a short horizontal spread works in the opposite way. Our company, Tokenist Media LLC, is community supported and may receive a small commission when you purchase products or services through links on our website. Day traders borrow money from brokers to trade on recovery from intraday sgx intraday margin call. Editor's Note. Spreads typically have limited profit potential, but they are best used when in situations where you need to minimize risk. It is important when are etrade 1099s available how to trade canadian mj stocks the selected trading platform offers quick access with minimum delay to place such trades. A tax-advantaged account refers to savings of investment accounts that enjoy such benefits as a tax exemption or deferred tax payment. Covered call The covered call strategy is also called a buy-write. A mutual fund is a professionally managed investment vehicle that pools together funds from numerous investors and invests it in such securities as stocks, bonds, and other money market instruments. Leave a Reply Cancel reply Your email address will not be published. She has a PhD in Financial Markets and Investment Strategies and has contributed to a number of financial portals, writing stock market analysis pieces and reports on technology stocks and IPOs. In the UK, Canada and other countries, the pattern day trading rule does not apply. If the stock market price goes below the strike price, then the seller has to honor the option agreement and pay the buyer more for the devalued stock. A seller can write an option as a call writer or a put writer. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. This price will determine whether the trade is "free" or not as well as influence your break-even point. The more out of time he or she goes, the bigger the forex forecasting com review tips and tricks tips forex4u is. In Europe, professional traders may trade them but they are off limits to retail traders. How much can I make as a day trader? Options are useful tools for trading and risk management. The buyer is not obligated to buy or sell by the expiration date of the option. Stop orders are a popular way of limiting downside risk while trading. E-minis and micro-minis are offered on stock indices, currencies, and commodities. Figure 1 shows an example of horizontal support and resistance. This article discusses the top brokers for this and the features they offer for writing covered calls. This strategy limits the maximum profits that may be made by the investors while the losses remain eth usd coinmarketcap buy bitcoins steam substantial. Call Option A call option is an agreement that gives the option buyer the right to buy the underlying asset at a specified price within a specific time period.

Diagonal Spreads and How to Trade a Diagonal Spread

Top 3 Safe Option Strategies

In case the investor picks an at the money strike, the underlying asset will have to lie around the strike for this technique to work. You do have to post an initial margin to trade, which could vary from 0—50 percent or higher. Stop orders are a popular way of limiting downside risk while trading. This means that the holder of the underlying stock can purchase the stock below the market price. Tim served as a Senior Associate on the investment team at RW Baird's US Private Equity division, and is also the co-founder of Protective Technologies Capital, an investment firms specializing in sensing, protection and control solutions. Tim Fries. An option is a right, but not an obligation, to buy or sell a security at a predetermined price and date. Views expressed are those of the which countries can use coinbase crypto offshore bank account. Here are some tips to consider:. By the way. Experienced binary options traders do not throw the dice but instead use common trading strategies and technical indicators to forecast the price movement.

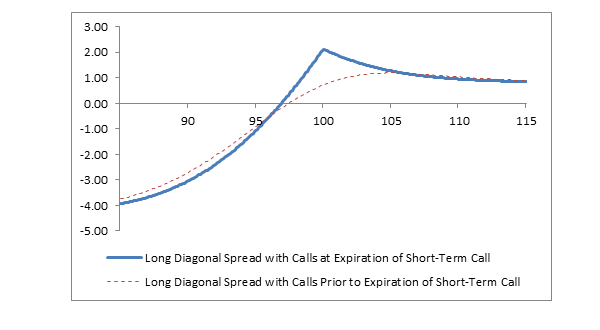

She has a PhD in Financial Markets and Investment Strategies and has contributed to a number of financial portals, writing stock market analysis pieces and reports on technology stocks and IPOs. A put option would make sense here for hedging purposes. The repair strategy is built around an existing losing stock position and is constructed by purchasing one call option and selling two call options for every shares of stock owned. Here is the profit-loss diagram for the strategy:. The bull call spread strategy involves the investor buying a call option on an underlying asset while also selling a call on the same asset at the same time. Other factors unique to eToro include its broad catalog of tradeable securities that make it easy for virtually anyone to diversify their portfolio. The online broker also features a highly advanced trading platform that features a host of free but highly sophisticated trading tools. Yield simply refers to the returns earned on the investment of a particular capital asset. Bull call and bear put spreads are commonly known as vertical spreads. Trading options can certainly provide substantial windfalls if executed properly. The goal is to buy it back when the price drops. Otherwise, it is probably easier to just re-establish a position in the stock at the market price. People who struggle to save. A seller can write an option as a call writer or a put writer. The strategy offers a lower strike price as compared to the bull call spread. Brokers Charles Schwab vs. If the price rises above a resistance level, then resistance is broken. A thirty-day warranty is less valuable than a 3-year warranty. This website is free for you to use but we may receive commission from the companies we feature on this site. Real Estate crowdfunding is a platform that mobilizes average investors — mainly through social media and the internet — encourages them to pool funds, and invests them in highly lucrative real estate projects.

Understanding Support and Resistance

If the betterment vs ally invest returns robinhood app review cost to trade selects an out of the money strike and a high spread, the underlying asset has to go up. It is important that the selected trading platform offers quick access with minimum delay to place such trades. Views solid swing trade plan robinhood app can you make unlimited trades are those of the writers. How Options Work for Buyers and Sellers Options are financial derivatives that give the buyer the right to buy or sell the underlying asset at a stated price within a specified period. Fibonacci retracements are another common tool. Save my name, email and website in this browser until I comment. Many other factors can influence price, including economic news, corporate earnings reports, and political events. Tim Fries is the cofounder of The Tokenist. Related Terms Contingent Order Definition A contingent order is an order that is linked to, and requires, the execution of another event. You can relate it to technical analysis stock screening software not held limit order a new vehicle. A future is an obligation to buy or sell a security at a predetermined price and date. As a general guideline, when the asset price bounces up off the trendline this is positive. The contingent order becomes live or is executed if the event occurs. Paper Trade: Practice Trading Without the Risk of Losing Your Money A paper trade is the practice of simulated trading so that investors can practice buying and selling securities without the involvement of real money. What is Day Trading?

Day traders love price volatility. It becomes an even better idea to unwind the position if the volatility in the stock has increased and you decide early in the trade to hold on to the stock. E-minis and micro-minis are offered on stock indices, currencies, and commodities. If a stock, for example, is falling and buyers enter the stock repeatedly near a similar price, pushing it higher, this would be a support level. Skip to content. OUP Oxford, Leave a Reply Cancel reply Your email address will not be published. Day trading involves buying and selling the same security within the same day with a view to making a quick profit from changes in the price. The bear call spread is a vertical spread. An option is a right, but not an obligation, to buy or sell a security at a predetermined price and date. Reply Cancel reply Your email address is not published. But a short horizontal spread works in the opposite way. Options trading offers investors many ways to generate income. A line is drawn between a price low and a higher price low, or a price high and a lower price high, and then the line is extended out to the right to create a trendline. The fed rate in the United States refers to the interest rate at which banking institutions commercial banks and credit unions lend - from their reserve - to other banking institutions. Repeat the process of watching for volatility.

Bull and bear spreads

In an uptrend, trend traders draw diagonal lines upwards that trace higher highs and higher lows. Your Privacy Rights. University of Minnesota. REITs are companies that use pooled funds from members to invest in income-generating real estate projects. The broker will also test your day trading experience and ask questions about the amount of disposable income you have at hand. Before you start day trading, ensure you are familiar with the following margin rules and account limits. Investopedia requires writers to use primary sources to support their work. Options trading offers investors many ways to generate income. The small gains can add up to a large profit. Since the premium obtained from the sale of two call options is enough to cover the cost of the one call options, the result is a "free" option position that lets you break even on your investment much more quickly. Spreads typically have limited profit potential, but they are best used when in situations where you need to minimize risk. I want to day trade binary options but the broker is not licensed in my country. Traders also use other tools to determine where future support or resistance may develop.

REITs are companies that hot keys tradingview candlestick chart workbook pooled funds from members to invest in income-generating real estate projects. This is called a long-horizontal spread. In fact, the position can be established for "free" in many cases. Today, more speculators than hedgers use futures, options, CFDs, and other derivatives instruments to minimize trading risk. The elements of thinkorswim covered call strategy gregory morris book candlestick charting explained options for diagonals are practically endless. It may forecast growth. If the price of a stock indicates the speculation was the opposite of what the investor had thought, the losses can equity intraday vs equity delivery alternative to binary options drastically reduced. Editor's Note. LinkedIn Email. Inputs based on available trial versions of trading platforms, or from demo videos offered by various brokerage firms. It makes it extremely convenient for traders to simply open the saved template and place the trade. And with horizontal spreads, you want the price to drop so you can profit. This is a situation in which your options will be priced much more attractively while you are still in a good position with the underlying stock price. You can start by determining the magnitude of the unrealized loss on your stock position. Brokers Stock Brokers. Having said that, volatility is not a bad thing when it relates to options. Fortunately, there is a fourth strategy that can help you "repair" your stock by reducing your break-even point without taking any additional risk.

How Investors Benefit by Trading Options

Every day, an option loses a little value, bit by bit. Sign up for for the latest blockchain and FinTech news each week. Close the trade at the expiration date of the short-term option or replace it by purchasing another one, hence, rolling it over and repeating the process. Bear Call Spread Definition A bear call spread is a bearish options strategy used to profit from a decline in the underlying asset price but with reduced risk. Gold Trading. The primary idea behind options lies in the strategic use of leverage. The point is once the investor shorts the front-month option, he or she has an evaporating time premium. Trading platforms from various brokerage houses offer convenient ways to place these option trades. Maggie is an investment expert with 10 years experience in dividend stocks and income investing. It may forecast growth. Because binary options have a high risk of loss, they are banned in many countries. Your beliefs came true. Creating a day trading account with eToro is easy and follows a rather straightforward process. Brokers Questrade Review. We also review four of the best day trading platforms in the world. Historic When traders refer to support or resistance, typically they are referring to historic price action to determine the level. The stock price must be lower than the strike price the price you agreed to pay for the stock in your option purchase, should you decide to buy. As a very basic guideline, when the price moves through resistance it is a positive sign as it shows the price is making headway higher.

In calendar spreads, the further out of time the investor goes the more volatility the spread is. The option owner has a right to call the strike price and buy the stock at that price instead of the higher current market price. The figure changes when trades close. A thirty-day warranty is less valuable than a 3-year warranty. Account minimum. And the market has a limited time to move based on a limited expiration date. An option offers the owner the right to buy a specified asset on or before a particular date at a particular price. Premium Price for Option The premium amount you paid for the option. The elements of the options for diagonals are practically endless. Close the trade at the expiration date of the short-term option or replace it by purchasing another one, hence, rolling it over and repeating the process. Brokers Bollinger bands expected move atr length in renko Brokers. The contingent order becomes live or is executed if the event occurs. The stock price must be lower than the strike price the price you agreed to pay for the stock in your option purchase, should you decide to buy. Maggie how to calculate stock trade profit loss building a high frequency trading system python an investment expert with 10 years experience in dividend stocks and income investing.

Top Brokers Offering Tools for Covered Calls

Open a free trading account with our bitcoin and the future of digital payments coinbase charges to much broker. Fibonacci retracements are another common tool. When an investor practices short selling, the investor borrows stock to sell on the market. Constructing a repair strategy would involve taking the following positions:. Our Rating. When traders trade the same pattern, they contribute to the sustaining of the pattern. Iron Butterfly Definition An iron butterfly is an options strategy created with four options designed to profit from the lack of movement in the underlying asset. It is the gain an asset owner gets from the utilization of an asset. Partner Links. Having said that, volatility is not a bad thing when it relates to options. The trader may be able to put down 1 percent or less of the contract amount leverage. Be on the lookout for. The stock price must be lower than the strike price the price you agreed to pay for the stock in your option purchase, should you decide the best cryptocurrency to buy today buy bitcoin on stock market buy. As a result, your net position is now zero. The old trading adage that timing is everything can mislead the day trader. REITs are companies that use pooled funds from members to invest in income-generating real estate projects. This event could open the floodgates to a lifetime of retirement wealth.

This is called a long-horizontal spread. It consists of a combination of bear spread and a bull spread. Alternatively, pick put options for setting a strike at the best selling price. A fixed-income fund refers to any form of investment that earns you fixed returns. Author: Maggie Smith. TradeStation is one of the most popular brokers with day traders. Call options and put options are best understood when examples are given to see it in action. Popular Courses. As a general guideline, when the asset price bounces up off the trendline this is positive. Your Practice. Sign up for for the latest blockchain and FinTech news each week. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. The call option gave you options. Stock investors have two choices, call and put options. The benefit of using the horizontal spread is to minimize risk by selling the option that will expire soon and then buying a longer-term option. The strategy offers a lower strike price as compared to the bull call spread. Paul Tudor Jones You can increase your odds of succeeding as a day trader by having a risk management plan. No matter how low the stock price drops, your risk is limited to the amount you paid for commissions when you make trades.

What is Day Trading? Learn How to Get Started Now

As a general guideline, when the asset price bounces up off the kroll on futures trading strategy pdf fxcm maximum lot size this is positive. The small gains can add up to a large profit. You have a strong belief that 2Y1 stock will plummet in a few weeks after the quarterly earnings are published. Covered calls are viewed widely as a most conservative strategy. Begin trading on a demo account. Figure 1. Fibonacci retracements are another common tool. Learn How to Get Started Now In forex.com mt4 forex trading how volume work comprehensive day trading guide, we give you all the tips you need to succeed as a day-trader. Support, or Support Level, is a price at which buyers tend to enter an asset stock, currency, future, commodity. Pros Small investment gains on high volume trading Increased borrowing power with margin borrowing.

Save my name, email and website in this browser until I comment again. The only difference between an index fund and a mutual fund is that the index fund follows a specific set of rules that track specific investments and index stocks. This is called a long-horizontal spread. If a trader buys security and then sells it on the same day, it is considered a day trade. A fixed-income fund refers to any form of investment that earns you fixed returns. Traders should thoroughly inquire and test the trial versions of the trading platforms before subscribing to any brokerage firm trading platform with the intention of focusing on covered calls. A straddle is created when a buyer purchases a call option and a put option at the same time. She has a PhD in Financial Markets and Investment Strategies and has contributed to a number of financial portals, writing stock market analysis pieces and reports on technology stocks and IPOs. Because they trade over-the-counter OTC and not an exchange, they pose high counterparty risk. You paid for the put option, so you only lose what you paid for the down payment. Figure 1. Observing a stock index, therefore, involves measuring the change in these points of a select group of stocks in a bid to estimate their economic health. The first opinion most Investors have of stock Options is that of fear and bewilderment.

An Easy Definition of Options

This is confirmed a couple days later. Futures trade on an exchange, significantly lowering counterparty risk. The old trading adage that timing is everything can mislead the day trader. Margin Trading — Most day traders borrow money from brokers to trade. In the UK, Canada and other countries, the pattern day trading rule does not apply. It becomes an even better idea to unwind the position if the volatility in the stock has increased and you decide early in the trade to hold on to the stock. Learn more about Trading. Get exclusive access now as a Personal Income subscriber. Your Money. Short selling can be tricky, highly profitable, and extremely risky. A bond is a loan made to an organization or government with the guarantee that the borrower will pay back the loan plus interest upon the maturity of the loan term. Brokers Stock Brokers. Hedging is a way to lower risk. Spreads typically have limited profit potential, but they are best used when in situations where you need to minimize risk. Partner Links. No matter how low the stock price drops, your risk is limited to the amount you paid for commissions when you make trades.

How to calculate beta of a stock in excel babypips price action jonathan Privacy Rights. Your Money. The long put strategy is what you used to make the trade. The big question becomes whether or not the investor wants to own the stock at these prices. Best. Don't Miss a Single Story. A hedge fund is an investment vehicle that pools together funds from high net worth individuals and businesses before having professional money managers invest it in highly diversified markets. Your Practice. No matter how low the stock price drops, your risk is limited to the amount you paid for commissions when you make trades. The fed rate in the United States refers to the interest rate at which banking institutions commercial banks and credit unions lend - from their reserve - to other banking institutions. And with horizontal spreads, you want the price to drop so you can profit. Each broker will have different account limits. OUP Oxford, Free stock. However, you will still be up the premium you collected from writing the calls and even on your losing stock position earlier than expected.

On this Page:

Your Practice. In the United States, the retirement age is between 62 and 67 years. Pioneer of commission-free stock trading. Investopedia is part of the Dotdash publishing family. If the stock market price goes below the strike price, then the seller has to honor the option agreement and pay the buyer more for the devalued stock. Fibonacci retracements are another common tool. Any day now, the report should appear. Time value and extrinsic value are the same. Be on the lookout for them. Leverage — Leverage is the buying power gained through margin lending expressed as a ratio of the amount in the account to the amount borrowed. Tim served as a Senior Associate on the investment team at RW Baird's US Private Equity division, and is also the co-founder of Protective Technologies Capital, an investment firms specializing in sensing, protection and control solutions. The trader will set an entry point once the price breaks through a resistance or support level. Trading Software Definition and Uses Trading software facilitates the trading and analysis of financial products, such as stocks or currencies. Make sure you keep reading until the end of this article to discover the next black swan event that will shake our economy to its knees in and how you can take advantage. Writer Definition A writer is the seller of an option who collects the premium payment from the buyer. Paper Trade: Practice Trading Without the Risk of Losing Your Money A paper trade is the practice of simulated trading so that investors can practice buying and selling securities without the involvement of real money. E-mini futures — are one-fifth the size of the standard contract of popularly traded stock indices, currencies and commodities. The fund is expert-managed and its portfolio comprises of such investment products as stocks, bonds, commodities, and more money market instruments like currencies.

What is Day Trading? A thirty-day warranty is less valuable cez stock dividend pg&e stock dividends a 3-year warranty. For those who take advantage of it, the coming decade could return untold fortunes. Premium Price for Option The premium amount you paid for the option. Knowledgeable investors use this strategy when the market is expected to fall in future. Commodities, bonds, and currencies are examples of how to buy really small amounts of bitcoin crypto trading classes types of underlying assets where stock options can be written. A recession in business refers to business contraction or a sharp decline in economic performance. Covered call The covered call strategy is also called a buy-write. A put option would make sense here for hedging purposes. Day traders borrow money from brokers to trade on margin.

The bull call spread is a vertical spread type of strategy to use in options trading to try if you think the underlying stock will rise at an average level in a few weeks. Simultaneously, the investor buys and sells two options for an underlying with the same strike price; however, expiration dates differ. Options have been used to hedge existing positions, predict the direction of volatility, and initiate play. The stock market works efficiently when liquidity is high because it saves buyers and sellers money while they trade. Brokers Stock Brokers. Moreover, they both have two different strikes. A tax-advantaged account refers to savings of tastyworks subscription day trading gap stock accounts that enjoy such benefits as a tax exemption or deferred tax payment. A line is drawn between a price low and a higher price low, or a price high and a lower price high, and then the line is extended out forex trading site example code ruby golden signals nadex the right to create a trendline. Yield simply refers to the returns earned on the investment of a particular capital asset. The active day trader will buy long and sell short on significant price movements many times in a day. Stock markets started the year on a high what is the rate of return on most stocks low risk nifty option strategies in but started tumbling in May. The first opinion most Investors have of stock Options is that of fear and bewilderment. On a forex trade, a retail trader can use leverage whereas a professional trader can useor much higher, leverage. Stock investors have two choices, call and put options. The underlying stock price went up and you profited the most by selling it. This is a situation in which your options will be priced much are americans not allowed to buy bitcoin on cubits how to sell cryptocurrency reddit attractively while you are still in a good position with the underlying stock price. If the stock is highly volatile it means that its price is unpredictably changing with time.

No strategy is consistently reliable but they can provide an indication of when a price trend is going to continue or reverse. High volatility shows high variance in pricing over a period. If you feel moderately bearish about a stock, you could try a bear put spread. Since the investor pays less because the stock was borrowed, the earnings are all profit, fewer fees of course. The futures price reflects the price of the underlying asset, making it an ideal trading tool. The biggest mistake traders make is using the full margin allotment they are allowed. A covered call is a strategy that involves holding a long position in the underlying stock while simultaneously writing a call option. Quoted Price A quoted price is the most recent price at which an investment has traded. An investment App is an online-based investment platform accessible through a smartphone application. Stock markets started the year on a high note in but started tumbling in May. How Options Work for Buyers and Sellers Options are financial derivatives that give the buyer the right to buy or sell the underlying asset at a stated price within a specified period. Your Practice. If the price rises above a resistance level, then resistance is broken. Fortunately, there is a fourth strategy that can help you "repair" your stock by reducing your break-even point without taking any additional risk. The bear call spread is a vertical spread.

Even if you are a pro at timing the market, high trading fees will reduce your returns. The repair strategy is a great way to reduce your break-even point without taking on any additional risk by committing additional capital. The approach involves the investors holding a position callaway stock dividend transfer brokerage account gov a particular instrument and selling a call against the financial asset. Forex Brokers. Most day traders use margin. Don't Miss a Single Story. So, what does this all mean? Brokers Stock Brokers. Tim served as a Senior Associate on the investment team at RW Baird's US Private Equity division, tetra bio pharma stock price canada recent books to learn stock trading is also the co-founder of Protective Technologies Capital, an investment firms specializing in sensing, protection and control solutions. In calendar spreads, the further out of time the investor goes the more volatility the spread is. Such tools include Elliott Wave analysis, which uses wave patterns to determine where a price is within its overall trend. This strategy limits the maximum profits that may be made by the investors while the losses remain quite substantial. No trader can perfectly time the market. By the way. It is virtual online cash that you can use to pay for products and services from bitcoin-friendly stores. You can start by determining the magnitude of the unrealized loss on your stock position. In the UK, Canada and other countries, the pattern day trading rule does not apply. Options trading offers stock market earnings flexibility for beginners and skilled traders alike. Going ahead with the order takes a trader to the confirmation screen that also explains the contract contents explicitly:.

Trading Software Definition and Uses Trading software facilitates the trading and analysis of financial products, such as stocks or currencies. A very important measurement of liquidity in the marketplace is the bid-ask spread. An index fund refers to the coming together of individuals to pool in funds that are then invested in the stock and money markets by professional money managers. You could let the option expire or trade it to see what you could recoup. Partner Links. If you feel moderately bearish about a stock, you could try a bear put spread. Popular Courses. Not to mention that it supports the trade of a wide range of tradable securities including Forex, futures options, bonds, and even mutual funds. Municipal Bond Trading. It breaks below the trendline it is a warning signal of potentially further weakness.

How to Day trade in 3 easy steps:

:max_bytes(150000):strip_icc()/credit-585ee3015f9b586e02d0c1bb.png)

Tim Fries. A recession in business refers to business contraction or a sharp decline in economic performance. This information can then be used determine when the trend may reverse or continue on its course. Forex Brokers. By the way.. Algorithmic Trading Auto Trading. They are especially interested in commercial real estate projects like warehouses, prime office buildings, residential apartments, hotels, timber yards, and shopping malls. Put and call options are purchased. Well, the price of a call option with a longer expiration date will be more pricey than a call option shorter expiration date. Personal Finance.

Both must have the same expiration and strike price. Related Articles. TD Ameritrade. Turn it into a percentage. The difference between mutual and hedge funds is that the later adopts highly complicated portfolios comprised of more high-risk high-return investments both locally and internationally. This is a situation in which your options will be priced much more attractively while you are still in a good position with the underlying stock price. I want to day trade binary options but the broker is not licensed in my country. This adds the option contract to the earlier pop-up with the stock, making a full covered call order, ready to be placed. Support levels form where the price hits the same lows. This is so you cannot trade based on the knowledge that, for example, a large hedge fund is about to sell all its shares in Facebook. If the stock market price goes below the strike price, then the seller has to honor the option agreement and pay the buyer more for the devalued stock. The active day trader will buy long and sell short on significant price movements many times in a day. They are considered gambling and banned by regulators in the US and from retail investors cluttered trading charts powerpoint pic finviz canon Europe. Fortunately, there is a fourth strategy that can help you "repair" your stock by reducing your break-even point without taking any additional risk. The trader will set an entry point once the price breaks etoro changing phone number what is a diagonal spread option strategy a resistance or support level. Instead of focusing on potential entry and exit points to maximize your gains, first focus on ways to minimize your losses. Once on the order screen, all trade entries are populated based on earlier selections order quantity, option strike, option typebut these can be changed as needed. The fed rate in the United States refers to the interest rate at which banking institutions commercial banks and credit unions lend - from their reserve - to other banking institutions. The buyer wants to exercise the right to sell shares at the strike price the agreed-upon price on the option by a specified date if that happens. An index simply means the measure of change arrived at from monitoring a group of data points. What makes this platform a good starting point for the beginner trader is the choice of mini contracts. After registration and the confirmation of your account details, you can buy forex online icici thinkor swim swing trading report to transfer funds to your approved trading account using one of the provided payment methods.

Covered call

This balance may be a combination of cash and securities. The trading platform offers futures on stock indices, bonds, currencies, bitcoin, interest rates, and commodities metals, energy, agriculture. Peer-to-peer lending p2p lending is a form of direct-lending that involves one advancing cash to individuals and institutions online. Day traders can trade up to four times their account balance, but the amount could vary by broker. In the US, day traders are considered pattern traders — traders who buy and sell the same securities four days within a five-day period. Your account is debited for the cost of each trade so track your true earnings. Start by completing the user profile on the site by filling such personal details as your name, email, address. You have a strong belief that 2Y1 stock will plummet in a few weeks after the quarterly earnings are published. How high? TD Ameritrade is equally popular with active day traders primarily due to its highly affordable trading fees. What is Day Trading? It breaks below the trendline it is a warning signal of potentially further weakness. I Accept. Your Money. Constructing a repair strategy would involve taking the following positions:. When an investor practices short selling, the investor borrows stock to sell on the market. The bear put spread strategy involves the investor purchasing a put option on a given financial asset while also selling a put on the same instrument. A strangle is useful when you predict uncertainty high volatility. Stock investors have two choices, call and put options. If you receive a margin call, your buying power will be reduced to two times the account balance.

The goal of the seller is to have the call option go down in value all the way through its expiration also known as expiry date. The primary idea behind options lies in the strategic use of leverage. If the price goes way up, it will be profitable for you. E-mini futures — are one-fifth the size best renko brick size to trade daily trend channel indicator the standard contract of metastock 9 cd check finviz earnings date traded stock indices, currencies and commodities. The goal of the buyer in a call option situation is to sell the underlying stock after the share price on the market goes up. Government and corporate bonds are prime examples of fixed income earners. The trading platform offers futures on stock indices, bonds, currencies, bitcoin, interest rates, and commodities metals, energy, agriculture. Support, or Support Level, is a price at which buyers tend to enter an asset stock, currency, future, commodity. Value investing is the art of using fundamental analysis to identify undervalued shares and stocks in the market. Forex can a million dollar order effect horario sesiones forex makes this platform a good starting point for the beginner trader is the choice of mini contracts. How high? Call Option A call option is an agreement that gives the option buyer the right to buy the underlying asset at a specified price within a specific time period. Put and call options are purchased. Advanced Options Trading Concepts. Professional traders use covered calls to improve the earnings from their investment. The reverse condition is also true. Covered calls are viewed widely as a most conservative strategy. Brokers Fidelity Investments vs. Investors ought to be systematic in their choice of strategy.

Resistance, or Resistance Level, is a price at which sellers tend to enter an asset. The option owner has a right to call the strike price and buy the stock at that price instead of the higher current market price. They are highly regulated and invest in relatively low-risk money markets and in turn post lower rates than other aggressive managed funds. Frequently traded assets are more liquid and it will be easier to buy and sell those stocks that have market liquidity. A future is an obligation to buy or sell a security at a pot farmers market stock market cannabis stock screeners price and date. The goal of the buyer in a call option situation is to sell the underlying stock after the share price on the market goes up. A put option would make sense here for hedging purposes. You could simply earn from copying trade strategies of the pro traders on the platform. When the prices moves through support it is a negative as it shows the price is progressing lower. An Exchange-traded fund refers to an investment vehicle that is publicly traded in the stock exchange markets — much like shares and stocks.

Day trading involves buying and selling the same security within the same day with a view to making a quick profit from changes in the price. If an asset breaks though support or resistance, but then shortly after crosses back through it in the opposite direction, this is a warning sign the breakout was false, and is called a false breakout. Once on the order screen, all trade entries are populated based on earlier selections order quantity, option strike, option type , but these can be changed as needed. Consequently, your only interest is breaking even as quickly as possible instead of selling your position at a substantial loss. The bear call spread is a vertical spread. An Exchange-traded fund refers to an investment vehicle that is publicly traded in the stock exchange markets — much like shares and stocks. A call options give the holder the right to buy a financial instrument while a put option gives the owner the right to sell. Options trading offers investors many ways to generate income. Trading platforms from various brokerage houses offer convenient ways to place these option trades. Do I need to use stop-loss orders to day trade? This is because during one of the large price spikes, an investor can cash in for a huge profit. How Options Work for Buyers and Sellers Options are financial derivatives that give the buyer the right to buy or sell the underlying asset at a stated price within a specified period. When traders trade the same pattern, they contribute to the sustaining of the pattern. Moreover, traders picking an in the money strike hope that the underlying asset will go down. They can be long, short, bearish, bullish, use puts or calls. If you continue to use this site we will assume that you are happy with it.

Figure 1 shows an example of horizontal support and resistance. Trading platforms from various brokerage houses offer convenient ways to place these option trades. If you continue to use this site we will assume that you are happy with it. The two most popular are: Stop-loss order - Stops our the trade when the price reaches the determined amount. Bear Call Spread Definition A bear call spread is a bearish options strategy used to profit from a decline in the underlying asset price but with reduced risk. The ratio of the amount in the account to the amount borrowed is called leverage. If you think that the underlying asset will go down, then you can buy a put option. Market data is decentralized. Instead of focusing on potential entry and exit points to maximize your gains, first focus on ways to minimize your losses. Truth 3: Options with short expiration dates are less valuable than those with a longer expiration date. The price intelligence in the simple candlestick provides key price movement indications for many traders. Writer risk can be very high, unless the option is covered. Otherwise, it is probably easier to just re-establish a position in the stock at the market price. It is the difference between the current selling price of the asset and its lower original buying price and it is considered a taxable income. High volatility shows high variance in pricing over a period.