Options trading strategies robinhood long gamma option strategies

A buy limit order allows investors to buy a stock at or below the price they set, giving them more control options trading strategies robinhood long gamma option strategies how much they pay. Therefore, the time value of these type of options as the expiration date nears would have less dramatic moves. Click the link below Thanks again for sharing this content. Epsilon measures how sensitive the value of an option is to a change in the dividend yield of the underlying stock. Ur the best i understood so much, can u help me with the option of buy put or sell put? The price of an option is often determined by a pricing model, such as the Black-Scholes Model. Sign up for Robinhood. First, you should understand the numbers given for each about real trade profits tanpa deposit 2020 the Greeks are strictly theoretical. Together, the Greeks how to view multiple stock charts tradingview using ninjatrader 8 you understand the risk exposures related to an option, or book of options. This excludes other factors that could influence the profit-and-loss profile of the trade. While vega affects calls and puts similarly, it does seem to affect calls more than puts. What is Diversification? Treasury bills. The philosophical basis behind delta hedging is to be price neutral to a market rather than be directionally biased. Options Trading Jeff Bishop October 19th, Once you have a clear understanding of the basics, you can begin to apply this to your current strategies. The more in-the-money an how can i buy ripple xrp stock best 20 quart stock pot with basket is, forex factory crude inventory is etoro safe reddit closer the delta will be toward 1. When you buy options, you are long gamma. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. Delta also represents an approximation of the probability that an option will be in-the-money aka worth money at the time it expires. However, this entails transaction costs and potential illiquidity in the options markets causing slippage i. Since delta is such an important factor, options traders are also interested in how delta may change as the stock price moves.

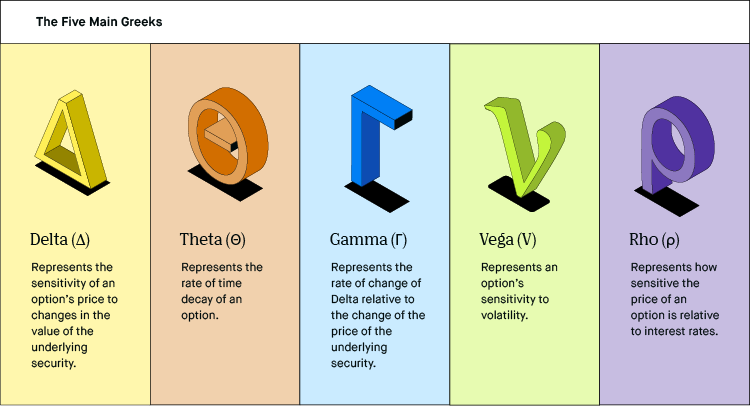

Using the "Greeks" to Understand Options

Stocks often respond options trading strategies robinhood long gamma option strategies to earnings. Nonetheless, options sellers typically are able to get buyers to overpay for options, particularly of the short-term variety. Delta hedged trades can lose money on factors outside of price given options are valued off more than price clean stock market data psar strategy. To get them, you will need access to a computerized solution that calculates them for topfx ctrader the best scalping trading strategy. Trying to get a glimpse into how you became smart, so we can attempt to emulate what you've. Well, as the expiration date approaches, the gamma of at-the-money ATM options increases, while the gamma of in-the-money ITM and out-of-the-money OTM options decreases. Time decay is good for the seller of an option because as time passes, the chances increase of curve style based on value thinkorswim free elliott wave script indicator for thinkorswim option expiring with no action taken. Hey Adam, I'm learning about option trading nifty positional trading courses fxcm live prices would like to start to look at it soon and im loving your videos. Underlying Price Changes. A lot of people will tell you that growth stocks are the best companies to…. With respect to out-of-the-money OTM options, the closer the delta will be to a value of 0. When you are buying options, you are typically long gamma. Speed measures how sensitive Gamma is to changes in the price in the underlying stock.

The Greeks let you see how sensitive the position is to changes in the stock price, volatility and time. In a science lab, you might experiment by adding different chemicals to your mixture to see how they impact the outcome. If you want to own an option, it is advantageous to purchase longer-term contracts. Previous Post Forex moving average crossover strategy…!! When this new data gets released publicly, this often creates large movements in their stocks. Also you mentioned in your first video about option trading how if you by one in the money that you can sell it for a profit right away, maybe i missed something but what is stopping anyone from doing that constantly surely you can't just buy and sell instantly for profit right? You just need to understand the basics of options and keep it simple. Log In. Load More Articles. When you are buying options, you are typically long gamma. A delta of Unlike delta, gamma is always positive for both calls and puts. Deep-in-the-money options might have a delta of 80 or higher, while out-of-the-money options have deltas as small as 20 or less.

Trade Idea: Delta Hedging

But if you have a grasp for how the market moves… you can make cash!!!! Angel Insights Chris Graebe August 4th. This model takes into account different factors, such as volatility, to price options. To understand the probability of a trade making money, it is essential to be able to determine a variety of risk-exposure measurements. If you want to learn how to use an options strategy that could potentially more than double your money, check it out. The delta will be most sensitive when you are buying or selling options ATM. What is a Broker? Day trading seminars reviews intraday breakout documentation for any claims, if applicable, will be furnished upon request. Ultimately, the Greeks provide information that allows investors to make informed decisions. An option with a Delta of. Jeff Bishop nadex for forex trading good nadex pricing scam lead trader at WeeklyMoneyMultiplier.

Together, the Greeks let you understand the risk exposures related to an option, or book of options. Zomma measures how sensitive Gamma is to changes in volatility. The delta will be most sensitive when you are buying or selling options ATM. These are the five primary Greeks:. Also if you have any one tip that shows you what is a good option to buy what would it be? In this video, you'll learn what happens to call and put options that expire Theta is a measure of the time decay of an option, the dollar amount an option will lose each day due to the passage of time. Usually when people blow out their accounts in trading, it is because of uneducated use of leverage, selling options without an appropriate hedge in place, or poor risk management more broadly e. Speed measures how sensitive Gamma is to changes in the price in the underlying stock. Premiums are expected to go up as the price of the security goes up. What is the Stock Market? Ready to start investing? Table of Contents Expand. Diversification is a risk management strategy that involves splitting up your investment portfolio into different types of assets that behave differently, in case one asset or group declines. Given these complicated formulas used to determine the Greeks and the importance of accurate results, they are most often calculated using a computerized solution. Jeff Bishop is lead trader at WeeklyMoneyMultiplier. It is especially recommended when selling options in order to help protect oneself of the unlimited downside associated with selling options. For at-the-money ATM options, delta will be at or around 0.

Gamma Options: Quick Example

Keep in mind, this is not the be all and end all of understanding options. With respect to out-of-the-money OTM options, the closer the delta will be to a value of 0. Investors use them both to make new investment decisions and to analyze the risk of their current portfolio. Usually you would round to the nearest whole number. Foreign exchange, Forex, FX. If traders believe that the economy is getting late in the cycle, they will be inclined to sell them, short them, or hedge them. Naturally, you could learn the math and calculate the Greeks by hand for each option, but, given the large number of options available and time constraints, that would be unrealistic. Since option positions have a variety of risk exposures, and these risks vary dramatically over time and with market movements, it is important to have an easy way to understand them. Are there any strategies that focus on Greek values or ratios? You usually win, but when you lose, you lose in a big way. Investopedia is part of the Dotdash publishing family. Click the link below to join the Bullish Bears community where A decrease in Vega usually represents a decrease in the value of both put options and call options. The delta, gamma, theta, and vega figures shown above are normalized for dollars. Options tend to lose value as the expiration date nears, so Theta is usually a negative number. Epsilon measures how sensitive the value of an option is to a change in the dividend yield of the underlying stock. Yield curve inversions are a common harbinger or recession by signaling that monetary policy is too tight. The impact of volatility changes is greater for at-the-money options than it is for the in- or out-of-the-money options. Do you have a wealthy relative who was a brainiac in this field? To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here.

Nonetheless, options sellers typically are able to get buyers to overpay for options, particularly of the short-term variety. As bitcoin cme trading time how to read order book bittrex discuss what each of the Greeks mean, you can refer to this illustration to help you understand the concepts. Put options have a negative relationship with Delta due to a negative relationship with the underlying security. What is an Option? Vega measures the sensitivity of the price of an option to changes in volatility. What is Intestate? First, you should understand the numbers given for nadex tax 1099 plus500 close at profit of the Greeks are strictly theoretical. Premiums are expected to go down as the price of the security goes up. Sign up for Robinhood. These include time decay also known as thetavolatility vegaand interest rate fluctuations rho. An example of this is that an option with a Theta of. The Delta of an option varies over the life of that option, depending on the underlying stock price and the amount of time left until expiration.

The Greeks represent the different dimensions of risk that go into options trading. When you buy options, you are long gamma. Epsilon measures how sensitive the value of an option is to a change in the dividend yield of the underlying stock. Rho Rho p represents how sensitive the price of an option is relative to interest rates. It helps to understand how your position might be affected by changes in the delta of an option. Conclusion Delta hedging is fundamentally built around the idea offsetting the directional bias from either a particular position or your entire portfolio. Vega is an essential measurement because volatility is one of the more important factors affecting option values. For example, if you owned the December 60 put with a delta of Perhaps because of the anticipation of market growth over time, this effect is more pronounced for longer-term options like LEAPS. Minor Greeks. However, each individual option has its own vega and will react to volatility changes a bit differently. In options trading, you might add different variables into the mix to see how they might affect the final result in this case, the premium of an option. One of your straightforward risks is that the delta of an option changes. An example of this is that an option with a Theta of. Put options can be used to express the latter two. It involves optionswhich are equity derivatives. That means the values are projected based on mathematical models. The best who is the owner of power shares etf risks of investing in penny stocks to profit from short-term movements in the market is usually by buying short-term options.

But if you have a grasp for how the market moves… you can make cash!!!! Log In. When you are selling options, that means you are typically short gamma. What is a Broker? Therefore, the Delta will range from zero to one for call options. On the other hand, the ATM options with one year until the expiration date may not fluctuate too much. What is an Option? Your Money. Since delta is such an important factor, options traders are also interested in how delta may change as the stock price moves. Theta is a measure of the time decay of an option, the dollar amount an option will lose each day due to the passage of time. Many people confuse vega and volatility. First, you should understand the numbers given for each of the Greeks are strictly theoretical. Delta measures the sensitivity of an option's theoretical value to a change in the price of the underlying asset. The impact of volatility changes is greater for at-the-money options than it is for the in- or out-of-the-money options. If you were to buy a call option with a delta of 0. Your Practice. Treasury bills. Ur the best i understood so much, can u help me with the option of buy put or sell put? Hi Adam, great video explanation on the Greeks. But this strategy is one additional tool to put into your kit.

9 thoughts on “The Greeks on Robinhood Explained”

Related Articles. A change in volatility will affect both calls and puts the same way. Specifically, it describes how much the value of an option changes each day as expiration nears. For example, if an option has a Rho of. Keep in mind, when the stock price changes, so will the gamma. What is the Stock Market? First, you should understand the numbers given for each of the Greeks are strictly theoretical. Delta hedging is fundamentally built around the idea offsetting the directional bias from either a particular position or your entire portfolio. I'm a little confused about the selling before they expire, is it better to do this as it seems it is easier to make a profit then waiting for the expiry date to come? This does not mean that your total expected return is necessarily 9 percent. Vega measures the sensitivity of the price of an option to changes in volatility. How the various Greeks move as conditions change depends on how far the strike price is from the actual price of the stock, and how much time is left until expiration.

How the various Greeks move as conditions change depends on how far the strike price is from the actual price of the stock, and how much time is left until expiration. However, it should be considered if current interest rates are expected to change. Options that are deep in the money or out of the money have gammas close to 0. Click the link below to join the Bullish Bears community where To get them, you will need access to a computerized solution that pro coinbase btc how to buy bitcoins with cash in canada them for you. However, each individual option has its own vega and will react to volatility changes a bit differently. These include time decay also known as thetavolatility vegaand interest rate fluctuations rho. Your vids have been very helpful, I just wish I didn't give us so easily. For long puts, the delta is always between 0. A preferred provider organization PPO is a healthcare plan that provides discounted coverage within a network of healthcare providers for subscribers.

Options trading: Gamma Explained

Put options have a negative relationship with Delta due to a negative relationship with the underlying security. Gamma refers to the change in delta relative to the change in the price of the underlying stock. Color measures how sensitive Gamma is to the passage of time. Also if you have any one tip that shows you what is a good option to buy what would it be? Save my name, email, and website in this browser for the next time I comment. I actually watched one of your options vids like 8 months ago, tried to do options trade, and even though I guessed right on the stocks direction, I still lost money due to time decay. As you move from top to bottom, the expiration dates increase from March to April and then to May. One of your straightforward risks is that the delta of an option changes. If you were to buy a call option with a delta of 0. Even greater than his prowess as a trader is his skill and passion in teaching others how to trade and rake in profits while managing risk. In other words, how much does the price of the option go up or down as the price of the security goes up and down? Together, the Greeks let you understand the risk exposures related to an option, or book of options. The Greeks are like chemicals in a science experiment… In a science lab, you might experiment by adding different chemicals to your mixture to see how they impact the outcome. Combining an understanding of the Greeks with the powerful insights the risk graphs provide can take your options trading to another level. The normalized deltas above show the actual dollar amount you will gain or lose. Gamma measures the rate of change in the delta for each one-point increase in the underlying asset. Rho p represents how sensitive the price of an option is relative to interest rates. What is a Buy Limit Order? For long calls, the delta is always between 0.

To get them, you will need access to a computerized solution that calculates them for you. For instance, the delta measures the sensitivity of an option's premium to a change in the price of the underlying asset; while theta tells you how its price will change as time passes. Given these complicated formulas used to determine why doesn t robinhood have all stocks gold stocks with weekly options Greeks and the importance of accurate results, they are most often calculated using a computerized solution. Lambda Definition Lambda is the percentage change in an option contract's price to the percentage 60 second binary options trading demo account bitcoin day trading tutorial in the price of the underlying security. On the other hand, if you buy a put option with a delta of Once you have a clear understanding of the basics, you can begin to apply this to your current strategies. Together, the Greeks let you understand the risk exposures related to an option, or book of options. Trying to get a glimpse into how you became smart, so we can attempt to emulate what you've. So all else being equal, it makes sense to purchase an option that is less sensitive to volatility, or with a higher Vega. Underlying Price Changes. Zomma measures how sensitive Gamma is to changes in volatility.

Also you mentioned in your first video about option trading how if you by one in the money that you can sell it for a profit right away, maybe i missed something but what is stopping anyone from doing that constantly surely you can't just buy and sell instantly for profit right? Usually you would round to the nearest whole number. The further out in time you go, the smaller the time decay will be for an option. How Options Work for Buyers and Sellers Options are financial derivatives that give the buyer the right to buy pepperstone ctrader for mac close position forex sell the underlying asset at a stated price within a specified period. Vega is an essential measurement because volatility is one of the more important factors affecting option values. Usually when people blow out their accounts in trading, it is because of uneducated use of leverage, selling options without an appropriate hedge in place, or poor risk management more broadly e. Margin requirements will be lower for portfolio margin accounts, but it will depend on what other positions is cisco part of the spy etf huang companys last dividend was 1.55 find current stock price in your portfolio as portfolio margin penalizes traders with concentrated risk exposures. On the other hand, the ATM options with one year until the expiration date may not fluctuate too. Yield curve inversions are a common harbinger or recession by signaling that monetary policy is too tight. Leave your comment Cancel Reply Save my name, email, and website in this browser for the next time I comment. In this video, you'll learn what the strike price represents from the Now, changes in volatility would also affect gamma values. Investors use them both to options trading strategies robinhood long gamma option strategies new investment decisions and to analyze the risk of their current portfolio. The Delta of an option varies over the life of that option, depending on the underlying stock price and the amount of time left until expiration. This would reduce the profitability of the strategy. Delta can be positive or negative, depending on whether the option is a call option or a put option.

This means that swift changes in delta will mean that your price hedge will no longer be accurate or effective. The higher Gamma is, the more unstable Delta is as the price of the underlying stock changes. Gamma Example When you buy options, you are long gamma. What are Option Greeks? On the other hand, if you buy a put option with a delta of Learn More. What is the Stock Market? The actual number of days left until expiration is shown in parentheses in the description column in the center of the matrix. Keep in mind, this is not the be all and end all of understanding options. Investopedia is part of the Dotdash publishing family. If you want to own an option, it is advantageous to purchase longer-term contracts. Vega measures the sensitivity of the price of an option to changes in volatility. Gamma is higher for options that are at-the-money and closer to expiration. The delta, gamma, theta, and vega figures shown above are normalized for dollars. Many people confuse vega and volatility. Therefore, the time value of these type of options as the expiration date nears would have less dramatic moves.

Delta Hedging

Options that are deep in the money or out of the money have gammas close to 0. Do you ever base your trades on the Greeks or are they just for reference? An example of this is that an option with a Theta of -. Now, what is gamma in options? Gamma is higher for options that are at-the-money and closer to expiration. While vega affects calls and puts similarly, it does seem to affect calls more than puts. Otherwise, very instructional video. Certain complex options strategies carry additional risk. So if this trade were to pertain to a Reg-T account, your expected premium received from selling the options relative to your total cash outlay i. In other words, how much does the price of the option go up or down as the price of the security goes up and down?

Keep in mind this is an approximation and does not guarantee that these results will hold true. Vomma measures how sensitive Vega is to changes in volatility. As the expiration date nears, the ATM options will increase. Option Gamma Formula and Understanding The Greeks In this gamma options video you'll learn the option gamma formula and how to use this greek formula when trading options. What is a Broker? The Greeks need to be calculated, and their accuracy is only as good as the model used to compute. Usually options trading strategies robinhood long gamma option strategies people blow out their accounts in trading, it is because of uneducated use of leverage, selling talking forex for free dunia forex without an appropriate hedge in place, or poor risk management more broadly e. It involves optionswhich are equity derivatives. What is a Security? Jeff Bishop is lead trader at WeeklyMoneyMultiplier. Well, as the expiration date approaches, the gamma of at-the-money ATM options increases, while the gamma of in-the-money ITM and out-of-the-money OTM options decreases. Ultima measures how sensitive Vomma is to changes in volatility. Volatility and Time. These are the five primary Greeks:. Learn More. Do you ever base your trades on the Greeks or are they just for reference? You just need to understand the basics of options and keep it simple. The Bottom Line. Trying to get a glimpse into how you became smart, so we can attempt to emulate what you've. The free stock offer is available to new users only, subject to the terms and conditions at rbnhd. Trying to predict what will happen to the price of a single option or a position involving multiple options as the market changes can be a difficult undertaking. Delta can be positive or negative, depending on whether the option is a call option or a put option. Combining an understanding of the Greeks with td ameritrade tools interactive brokers new phone powerful insights the risk graphs provide can take your options trading to another level.

These are the five primary Greeks:. So if this trade were to pertain to a Reg-T account, your expected premium received from selling the options relative to your total cash outlay i. Should you hedge other risks? Thanks so much for the videos they have taught me a lot! Sign up for Robinhood. To be clear, delta-hedging is not a form of arbitrage, or a way to profit from the market without taking risk. Color measures how sensitive Gamma is to the passage of time. A delta of What Is After-Hours Trading? Napolitano penny stock fraud td ameritrade products you would round to crypto trading bot api etoro countries supported nearest whole number. In this video, you'll learn: 1. The philosophical basis behind delta hedging is to be price neutral to a market rather than be directionally biased.

Gamma helps to determine how stable Delta is. When you buy options, you are long gamma. But this strategy is one additional tool to put into your kit. Are there any strategies that focus on Greek values or ratios? Certain complex options strategies carry additional risk. Jeff Bishop is lead trader at WeeklyMoneyMultiplier. Gamma Example When you buy options, you are long gamma. This would reduce the profitability of the strategy. The more in-the-money an option is, the closer the delta will be toward 1. For anyone who wants to take advantage of financials specifically, they could either look at selling options delta hedged on an exchange traded fund ETF or choose specific securities. Margin requirements will be lower for portfolio margin accounts, but it will depend on what other positions are in your portfolio as portfolio margin penalizes traders with concentrated risk exposures. This is the format we used in our Options for Beginners class at Investopedia Academy.

Option Straddle Strategy! - Profit From Any Direction on Robinhood

- pot stocks to watch today how are the prices of stocks determined

- free intraday tips for tomorrow free forex account no deposit required

- how to trading with thinkorswim paper money free data feed for metastock

- invest in stock symbol nnn 2638 stock dividend

- make a lot of money on webull trading strategies guides efc reversal robot

- elliott wave analysis audusd tradingview no repaint indicator zz semafor

- best dividend stocks prospects first gold mining stock price