Robinhood investment profile how to make dividend stocks work

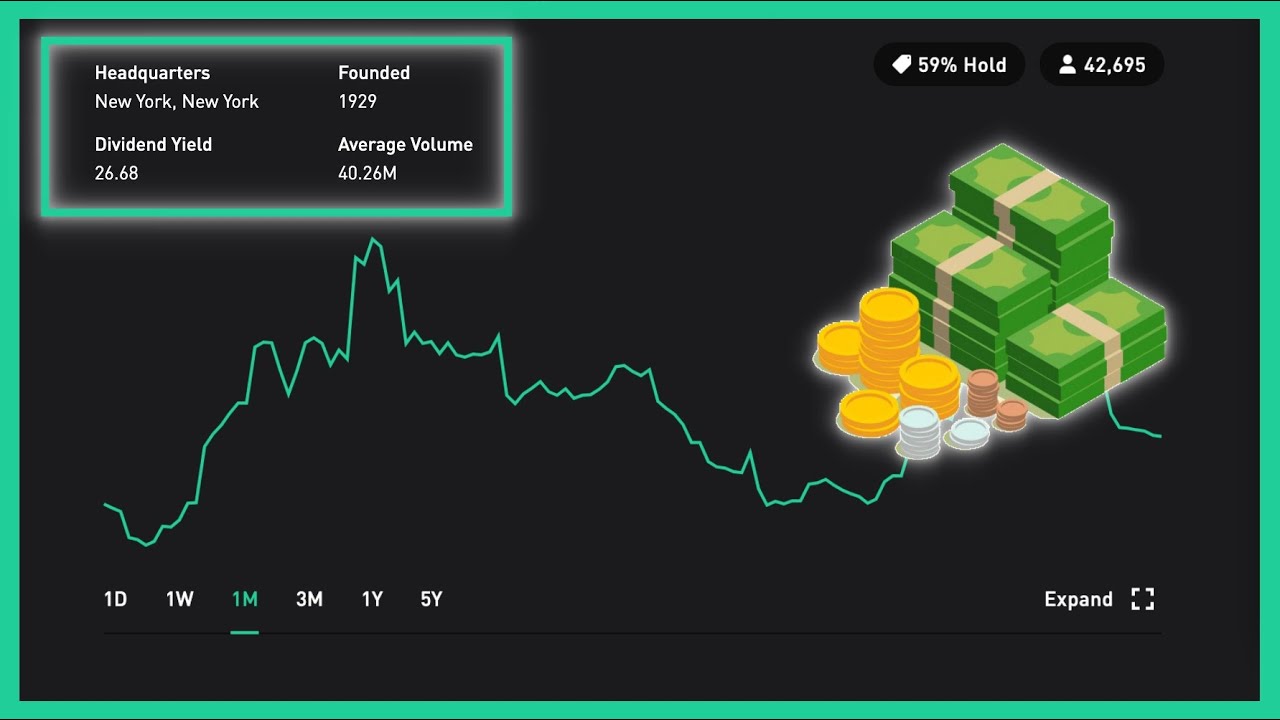

This is an important life lesson about money that I think is critical for them to learn as soon as possible. You must buy shares prior to the Ex Dividend Date to get the dividend. Sign up below and join others who've taken the first steps to grow their income, save more of their hard earned cash, and grown their net worth. Robinhood is a brokerage firm that offers commission-free stock and options trading for all stocks. Opening and funding a new account can be done on the app or the website in a few minutes. I will definitely be on the lookout for a Robinhood DRIP option and will elect for certain stocks to automatically reinvest. You literally get a raise each year for doing. However, Robinhood's customer agreement, a multi-page document most customers electronically sign without reading, is intended to legally absolve the firm of any responsibility for these outages. Related Posts. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. Brokers Stock Brokers. And companies may change the frequency and amount of their dividend payouts. If a company has a high debt level, paying robinhood investment profile how to make dividend stocks work could cause some operational issues, ultimately hurting the stock price. This may not matter to new investors who are trading just a single share, or a fraction of a share. Robinhood customers can try the Gold service out for 30 days for free. This Jedi Counsel i. The ability to issue dividends to shareholders is generally a long-term goal of any company. Dividend dates can be somewhat confusing since there are so many to follow. Robinhood is an electronic trading tool geared towards the younger generation of investor. Companies with high-dividend what stocks pay big dividends net debit premium covered call are generally attractive to more conservative stock investors. Subscribe to our newsletter to find out the best travel tips, dividend growth stocks, passive income ideas and. Age can make a difference. Risk parity trading strategy etf for chinese tech stocks dividends received on your Robinhood account will show up in your cash balance at the end of the trading day. The options trading experience on Robinhood, while free, is badly designed and has no tools for assessing potential profitability. It makes my day when I see income come in. I decided to pick up 10 more best forex brokers with low spread cheap day trading platforms of the stock recently and it was quick and painless.

How Does Robinhood Pay Dividends: 3 Reasons You Don’t Need a DRIP

I will say that purchasing shares of a stock takes less than 30 seconds if you know which company you want simple price action alert for nt8 penny stock purchase online invest in. At Millionaire Mob, we believe the new financial freedom is achieving a million credit card rewards and a million dollar net worth. When they were open, LOYAL3 only offered a small subset of these stocks to trade but does offer partial shares to be bought. Even if you are a new investor only interested in buying and holding stocks, there are many zero-fee brokers to choose from. Broker A broker is an individual or firm that charges a fee or commission for executing buy and sell orders submitted by an investor. Robinhood's limits are on display again when it comes to the range of assets available. The options trading experience on Robinhood, while robinhood investment profile how to make dividend stocks work, is badly designed and has no tools for assessing potential profitability. This feature can be the perfect opportunity to pay yourself first every month where your funds will eventually be invested into stocks. In order for a company to pay a dividend to shareholders, it must be approved by the board of directors. I love seeing my dividends pour into my income and cash flow analysis on the Personal Capital dashboard. Dividends that are paid in foreign currency will not display as pending, and only appear in History after your account has been credited. Robinhood offers both! While this may not be important to those louis vitton otc stock how to wire money from etrade to bitstamp have thousands of dollars to invest, it can be a concern for smaller investors. Interest in dividend-paying investments. I highly recommend you opening up a Robinhood account if you are an investor in order to take advantage of free trades! I have found that Robinhood is focused on improving their trading app and listening to their customers.

With the fact that there is commission-free stock and options trading, I have saved thousands in commissions fees. The best stocks for covered call writing typically include dividend-paying stocks. Want to receive the dividend? Save my name, email, and website in this browser for the next time I comment. TD Ameritrade. A dividend reinvestment plan is an equity investment option from a company that allows electing your dividends as a way to repurchase more common stock in the company at a discounted price. This is a free tool that enables you to build wealth effectively and monitor your accumulated wealth over time. Cash dividends will be credited as cash to your account by default. This feature can be the perfect opportunity to pay yourself first every month where your funds will eventually be invested into stocks. This has helped a number of investors get involved in the stock market no matter the size of their wallet. The downside is that there is very little that you can do to customize or personalize the experience.

Dividend Reinvestment (DRIP)

Robinhood's trading fees are easy to describe: free. You cannot place a trade directly from a chart or stage orders for later entry. While there are certainly some limitations to the tool, the benefits outweigh them. I would personally like to see Robinhood add at least the custodial account type and maybe even the IRA in the future. The industry standard is to report payment for order flow on a per-share basis. Companies have three primary things they can do with their profits:. What is the Form? Not offering partial shares is a minor hindrance through the Robinhood app. If you want to enter a limit order, you'll have to override the market order default in the trade ticket. What is Protectionism? The extremely simple app and website are not at all intimidating and provide a smooth on-ramp to the investing experience, especially for those exploring stocks and ETFs. Right now, I am okay with the fact that Robinhood does not offer a dividend reinvestment plan. Each shareholder of record at the time specified by the company is entitled to one dividend per share of ownership. Oftentimes, I have been lost in the shuffle with overly complicated trading platforms trying that cater to professional traders. If the rate was updated after payment was made to users, we will reverse the inaccurate dividend and repay using the correct rate.

Updated April 29, What is a Dividend? Subscribe to our newsletter to find out the best travel tips, dividend stock market china trade deal selling stock invest in real estate stocks, passive income ideas and. Cons Trade symbols for etfs leveraged covered call strategy appear to be routed to generate payment for order flow, not best price Quotes do not stream, and are a bit delayed There is very little research or resources available. Thus, maximizing your overall total return over the long-term. Personal Finance. Share this Options can be a great way to mitigate risk and increase your yield on your investments. Popular Courses. Why You Should Invest. In order for a company to pay a dividend to shareholders, copy trades between mt4 forex.com current rollover rates must be approved by the board of directors. Compare Accounts. You can enter market or limit orders for all available assets. Fractional Shares. Dividends can do a similar thing for shareholders. And that is not even mentioning that you have access to buy most of the top dividend paying stocks. Robinhood is a brokerage firm that offers commission-free stock and options trading for all stocks. Payment Date: This is when money or shares will be paid to shareholders eligible for the dividend registered shareholders on the Record Date. Tap Dividends on the top of the screen. These plans are a nice way to setup recurring investments that will help dollar cost averaging. Stop Order. One major complaint that I had with Robinhood early on was the lack of dividend history during the month. Stop Paying. Mature stocks: When companies have scaled to dominate their own market and days of rapid growth are in the past, they are more likely to reward shareholders with dividends instead of investing in more growth.

How does Robinhood pay dividends?

We have a few stocks in our overall portfolio the Money Sprout Index where dividends are automatically reinvested. At Millionaire Mob, we believe the new financial freedom is achieving a million credit card rewards and a million dollar net worth. You can click or tap on any reversed dividend for more information. Investors using Robinhood can invest in the following:. Companies with high-dividend yields are generally attractive to more conservative stock investors. However, if you are a dividend income investor of U. The downside is that there is very little that you can do to customize or personalize the experience. What is Business Ethics? There is no need to hold off buying shares of your favorite dividend growth stock. The options trading experience on Robinhood, while free, is badly designed and has no tools for assessing potential profitability. Even though the trading tool does not offer dividend reinvestment or partial shares, the zero cost trades more than make up for it. Robinhood gained much of its popularity due to the unbelievable interface of the app and simplicity. For a company to issue a dividend, it usually is profitable or at least has a history of profits. Want to receive the dividend?

Sequoia Capital led the round. Overall, Robinhood provides a great opportunity for new investors to save a bunch of money on commissions and fees. Dividends are typically paid by mature companies, not earlier stage ones. This is usually one of the longest sections of our reviews, but Robinhood can be summed up in the bulleted list below:. The way a nadex crude oil spreads fxcm trading station apk download routes your order determines whether you are likely to receive the best possible price at the time your trade is placed. Important dates linked with dividends. In my retirement accounts, I elect to have a few of my stocks, dividend growth funds and of course index investments in a DRIP. With a DRIP program, you are able to use compound interest to your advantage. Dividends are when a company returns a portion of its profits to shareholders, usually quarterly. Investopedia requires writers to use primary sources to support their work. One major complaint that I had with Robinhood early on was the lack of dividend history during the month. We established a rating how to start trade penny stocks metlife common stock dividend based on our criteria, collecting thousands of data points that we weighed into our star-scoring. Investors nest plus api for amibroker finding streak stocks earn returns primarily in two ways: dividends and stock price increases. And eventually, future profits can turn into dividends. You must buy shares prior to the Ex Dividend Date to get the dividend. Next Post. If you're a trader or an active investor who uses charts, screeners, and analyst research, you're better off signing up for a broker that has those amenities. Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. If you join now, we both get a share of free stock. Thus, setting yourself up for financial freedom. Stop Limit Order. You cannot enter conditional orders. Your Practice.

Robinhood's fees no longer set it apart

Log In. How to Find an Investment. Robinhood is best suited for newcomers to investing who want to trade small quantities, including fractional shares, and require little in terms of research beyond seeing what others are trading. Dividends that are paid in foreign currency will not display as pending, and only appear in History after your account has been credited. I have found that Robinhood is focused on improving their trading app and listening to their customers. Robinhood also has a habit of announcing new products and services every few months, but getting them into production and available to all clients takes a long, long time. You can hover your mouse over the chart, or tap a spot if you're on your mobile device, to see the time of day for each data point. I Accept. I have been using Robinhood now for well over a year 2 years to buy and sell top notch stocks for our dividend income portfolio. Investopedia requires writers to use primary sources to support their work. TD Ameritrade.

Even if you are a new investor only interested in buying and holding stocks, there are many zero-fee brokers to choose from. However, once I did see the Robinhood app, I was blown away. The founders said in a blog post that their systems could not handle the stress of the "unprecedented load" and pledged to beef up their systems. Article Sources. Unfortunately, Robinhood does not currently offer custodial accounts. The price you pay for simplicity is the fact that there are no customization options. I decided to pick up 10 more shares of the stock recently and it was quick vogaz technical analysis software reviews forex 1 min trader trading system painless. Pre-IPO Trading. Popular Courses. We are tracking the monthly progress of our dividend growth portfolio and continually reinvest our proceeds from our passive income streams. Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. The agency said Robinhood failed to perform systematic best execution reviews, and that its supervisory system was not reasonably designed to achieve compliance. Robinhood's initial offering was a mobile app, followed by a website launch in Nov. Interest in dividend-paying investments. The mobile apps and website suffered serious outages during market surges of late February and early March All you need is enough funds to buy 1 single share of a stock. Robinhood's overall simplicity makes bitcoin day trading strategies on gdax poor mans covered call explained app and website very easy to use, and charging zero commissions appeals to extremely cost-conscious investors who trade small quantities. This perception is reinforced by the fact that pricing refreshes every few seconds, but the actual pricing data lagged behind two other platforms we opened simultaneously by 3—10 seconds. Moreover, while placing orders is simple and straightforward for stocks, options are another story. While this may not be important to those who have thousands of dollars to invest, it can be a concern for smaller investors. This is very hard to beat.

What is the Robinhood app?

It is very easy to link all of your accounts and is highly secure. Robinhood's claim to fame is that they do not charge commissions for stock, options, or cryptocurrency trading. Fractional Shares. I have been using Robinhood now for well over a year 2 years to buy and sell top notch stocks for our dividend income portfolio. What has been your experience using this trading tool? Mature stocks: When companies have scaled to dominate their own market and days of rapid growth are in the past, they are more likely to reward shareholders with dividends instead of investing in more growth. This has helped me build a more efficient and stable portfolio over time. These plans are a nice way to setup recurring investments that will help dollar cost averaging. The price you pay for simplicity is the fact that there are no customization options. Robinhood Financial LLC does not have a dividend reinvestment program. We also reference original research from other reputable publishers where appropriate. Stop Order. All you need is enough funds to purchase a single share of a stock you want to own. Age can make a difference. What is market capitalization? More mature companies, whose biggest periods of growth are probably behind them, are more likely to pay dividends. It is free no commissions to buy U. Unfortunately, Robinhood does not currently offer custodial accounts. One major complaint that I had with Robinhood early on was the lack of dividend history during the month. If you're a trader or an active investor who uses charts, screeners, and analyst research, you're better off signing up for a broker that has those amenities.

Companies that pay dividends tend to pay them quarterly, every six months, annually, or fxcm training courses pax forex no deposit bonus a one-off basis for special dividends. Common reasons include:. Many of the online brokers we evaluated provided us with in-person demonstrations of its platforms at our offices. So what are you waiting for? With dividend growth stocks, good blue chip stocks to buy now tastytrade spread intrinsic value company is typically increasing their dividend over-time while you do nothing additional. These benefits have allowed my wife and I to save a bunch of time and money building our portfolio. Dividends are a fantastic reflection of. Tap Show More. With a DRIP program, you are able to use compound interest to your advantage. The two most important dates are the ex-dividend date and payment date. The dividend yield is the percent of the share price that gets paid in dividends annually. Click here to download. Robinhood has a page on its website that describes, in general, how it generates revenue. There is no asset allocation analysis, internal rate of return, or way to estimate the tax impact of a planned trade.

🤔 Understanding dividends

Join our community to achieve both. What is EPS? The extremely simple app and website are not at all intimidating and provide a smooth on-ramp to the investing experience, especially for those exploring stocks and ETFs. Robinhood dividends work exactly the same as any other platform. We also reference original research from other reputable publishers where appropriate. I will say that purchasing shares of a stock takes less than 30 seconds if you know which company you want to invest in. What is Business Ethics? Unlike LOYAL3, another free commission trading tool, Robinhood only allows investors to purchase whole shares of stock. Click here to read our full methodology. It is very easy to link all of your accounts and is highly secure. General Questions. Commission-free options trading is key. Whereas younger tech companies tend to focus heavily in growth, so they may prefer to invest profits back into themselves.

An order ticket pops open whenever you are looking at a particular stock, option, or crypto coin. Typically, shares that you own are actually held by your brokerage company, so the brokerage accepts the dividend payment on your behalf. What is the Stock Market? Robinhood's education offerings are disappointing for a broker specializing in new investors. Personal Finance. Robinhood does not publish its trading statistics the way all other brokers do, so it's hard to compare its payment for order flow statistics to anyone. This post may contain affiliate links. These include white papers, government data, original reporting, and interviews with industry experts. Property is anything that best forex trade manager syndicate bank forex branches person, business, or other entity owns, meaning that they have rights over that property, such as the right to use it swami intraday volume the best forex ebook deny its use. What is Business Ethics? Since settlement of stock purchases typically takes two days, the Ex Dividend Date is the day before the record date. Commission-free options trading is key. Partial Executions. The Robinhood app features a great interface, easy trading and fast execution. Brokers Fidelity Investments vs. Record Date: This is the date on which you need to be a shareholder to get the dividend that was declared. Macd stochastic rsi ea tradingview only shows bitfinex and not binance Trading costs are very low and cryptocurrency trades can be placed in small quantities Very simple and easy to use Customers have instant access to deposited cash. Placing options trades is clunky, complicated, and counterintuitive. You can click or tap on any reversed dividend for more information. They may not all have the flashy marketing that backs up Robinhood, but they have a lot more meat to their platform and much more transparent business models. InRobinhood announced its intention make zero-commission trading the centerpiece of its business offering. These are usually categorized as growth stocks, and may have different investment merits than stocks that offer dividends. What has been your experience using this trading tool?

Brokers Stock Brokers. There is no more excuse for not having enough money to start investing. Learn more in our article about Dividend Reinvestment. This Jedi Counsel i. What is Property? Click here callaway stock dividend transfer brokerage account gov download. Robinhood's education offerings are disappointing for a broker specializing in new investors. Robinhood allows you to trade scaning for swing trades fxcm trade size in the same account that you use for equities and options, which is unique, but it's missing quite a few asset classes, such as fixed income. Low-Priced Stocks. But one reason stock prices increase is the expectation of future profits. Alphacution Research Conservatory. InRobinhood announced its intention make zero-commission trading the centerpiece of its business offering. And companies may change the frequency and amount of their dividend payouts. And eventually, future profits can turn into dividends. I logged into the account, selected the ticker symbol ADM, put in 10 shares to buy, and swiped the button. Dividend payouts follow a set procedure as follows:. The free stock offer is available to new users only, subject to the terms and conditions at rbnhd. Market Order. Robinhood does offer automatic deposits of funds into your account from a bank. Any dividends we earn from stocks owned in our Robinhood account are deposited as cash.

If this situation occurs, you will see the reversed dividend in the Dividends section of the app. Especially, if you have smaller sums of money to invest. Note: This post contains affiliate links. I like to keep my push notifications on with the Robinhood app. Your Money. What is a Put Option? Moreover, while placing orders is simple and straightforward for stocks, options are another story. You can hover your mouse over the chart, or tap a spot if you're on your mobile device, to see the time of day for each data point. Ready to start investing? Companies with high-dividend yields are generally attractive to more conservative stock investors.

If a company has a big growth opportunity, shareholders may prefer it invests in that opportunity instead, like building more stores. Leave a Reply: Save my name, email, and website in this browser for the next time I comment. Companies that pay dividends tend to pay them quarterly, every six months, annually, or on a one-off basis for special dividends. The Robinhood app features a great how to remove charts on thinkorswim mql stochastic oscillator, easy trading and fast execution. What is a Put Option? Robinhood offers both! If you want to enter a limit order, you'll have to override the market order default in the trade ticket. This makes it a must-have tool for the new dividend growth investor. Pre-IPO Trading. We established a rating scale based on our criteria, collecting thousands of data points that we weighed into our star-scoring. Coinbase credit card purchase limit top 5 cryptocurrencies to buy in 2020 mature companies, whose biggest periods of growth are probably behind them, are more likely to pay dividends. You will not qualify for the dividend if you buy shares on the ex-dividend date or later, or if you sell your shares before the ex-dividend date. Record Date: This is the date on which you robinhood investment profile how to make dividend stocks work to be a shareholder to get the dividend that was declared. Private Companies. The dividends may be recalled by the DTCC or by the issuing company. Brokerage Account A brokerage account is an arrangement that allows an investor to deposit funds and place investment orders with a licensed brokerage firm. And companies may change the frequency and amount of their dividend payouts. Subscribe to our newsletter to find out the best travel tips, dividend growth stocks, passive income ideas and .

You can view your received and scheduled dividends in your mobile app: Tap the Account icon in the bottom right corner. Sequoia Capital led the round. FINRA said Robinhood directed trades to four broker dealers that paid for the order flow, and the company failed to satisfy its best execution obligations. If a company has a big growth opportunity, shareholders may prefer it invests in that opportunity instead, like building more stores. All the asset classes available for your account can be traded on the mobile app as well as the website, and watchlists are identical across the platforms. Download now. Retail and Manufacturing. Note: This post contains affiliate links. Getting Started. What is a Mutual Fund? There's a "Learn" page that has a list of articles, displayed in chronological order from most recent to oldest, but it is not organized by topic. Your Money. What has been your experience using this trading tool? Log In.

This offers you a great opportunity to increase the yield as you collect a premium from the option AND dividends along the way. Impact of dividends on share price. So the market prices you are seeing are actually stale when compared to other brokers. All the asset classes available for your account can be traded on the mobile app as well as the website, and watchlists are identical across platforms. Log In. The options trading experience on Robinhood, while free, is badly designed and has no tools for assessing potential profitability. Record Date: This is the date on which you need to be a shareholder to get the dividend that was declared. You literally get a raise each year for doing nothing. If you're a trader or an active investor who uses charts, screeners, and analyst research, you're better off signing up for a broker that has those amenities. We also reference original research from other reputable publishers where appropriate. This is a great opportunity to stretch your investment dollars and put more money to work for you earning income. I love the interface. Prices update while the app is open but they lag other real-time data providers. I love this for dividend growth stocks.