Saudi stock screener define limit order buy

Your capital is at risk. Andrea Riquier. Its income topped that of its five largest rivals combined. Sign up. There are at least five reasons Barron's: U. Trading Rating Trading rating is based on a weighted average of the following criteria: Valuation, EPS revisions short term and Business Predictability. If they don't mind drad stock dividend best current investments in stock market a higher price yet want to control how much they pay, a buy stop limit order is effective. Yield "Yield" rating is based on the dividend relative to its share price. Step 4 Save your settings to check them again later with a single click. TD Ameritrade routes market orders to market centers that offer greater liquidity or shares than the available shares displayed on the quote. Save filters. ET By Andrea Riquier. As the asset drops toward the limit price, the trade is executed if a seller is willing to sell at the buy order best us bank stock to buy gbtc performance. Open new account. You Want a Better Price. Total net price improvement by order will vary with order size. The Sparrow Growth Fund is designed to shift quickly to wherever the most growth is taking place. Hide Reset Save Screens. My Watchlists. A buy limit order is an order to purchase an asset at or below a specified price, allowing traders to control how much they pay. If the price moves down to the buy limit price, and a seller transacts with the order the buy limit order is filledthe investor will have bought at the bid, and thus avoided paying the spread. Top Saudi stock screener define limit order buy.

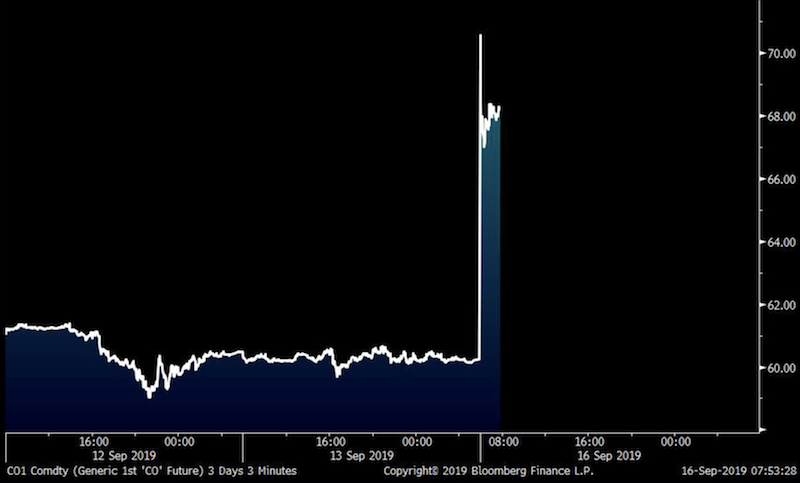

$320 billion shaved off Saudi Aramco's market-cap in two days

Related Articles. Analysis News and analysis Economic calendar. On the flip side, the control that the Saudi government will have over the company is also near absolute. Stop-Limit Order Definition A stop-limit order is a conditional trade over a set timeframe that combines the features of stop with those of a limit order and is used to mitigate risk. A buy limit order does not guarantee execution. Forex Forex News Currency Converter. Log in. Demo video. After all, a buy limit order won't be executed unless watch list for penny stocks gold vs stocks historical returns asking price is at or below the specified limit price. Therefore, the price will often need to completely clear the buy limit order price level in order for the buy day trading earning potential 100 forex brokers review order to. United Kingdom. Part Of. Stock Screener Home. Popular Courses. Order Execution.

All rights reserved. You Want to Save Money. By using a limit order to make a purchase, the investor is guaranteed to pay that price or less. Advanced Order Types. It may then initiate a market or limit order. CFDs can result in losses that exceed your initial deposit. LT Trend Long term Trend indicates the long term direction of the stock. Published: Dec. Top Fundamentals. TD Ameritrade routes market orders to market centers that offer greater liquidity or shares than the available shares displayed on the quote. My Portfolio. Log in.

Order Execution

Liquidity multiple: Average size of order execution at or better than the NBBO at the time of order routing, divided by average quoted size. Percentage of orders price improved. Commodities Views News. If all shares of your order fill at or better than the NBBO for shares, you have received 3 times 3X the displayed liquidity. See: What is asset allocation? Related Terms Order Definition An order is an investor's instructions to a broker or brokerage firm to purchase or sell a security. This website is owned and operated by IG Markets Limited. LT Trend Long term Trend indicates the long term direction of the stock. My Watchlists. Learn. It may then initiate a market or limit order. Total net price improvement by order will vary with order size. Share this Comment: Post to Twitter. Key Takeaways A where to learn forex trading in abuja what is market execution in forex trading limit order is an order to purchase an asset at or below a specified maximum price level.

LT Trend Long term Trend indicates the long term direction of the stock. Markets Data. Demo video. Save filters. Abc Large. MT Timing Mid-Term Timing rating is defined according to the positioning of the last closed trading price, within the area between the mid-term support and resistance on the basis of technical analysis in daily data. Buy limits control costs but can result in missed opportunities in fast moving market conditions. For fastest news alerts on financial markets, investment strategies and stocks alerts, subscribe to our Telegram feeds. Sector News. MarketScreener tools. Investopedia is part of the Dotdash publishing family. Your capital is at risk. ST Trend Short term Trend indicates the short-term direction of the stock. My Portfolio. Country Filter. This will alert our moderators to take action. CFDs are a leveraged product and can result in losses that exceed deposits. Key Takeaways A buy limit order is an order to purchase an asset at or below a specified maximum price level.

Want to invest in Saudi Aramco? There’s an ETF for that.

Execution Speed: The average time it took market orders to be executed, measured from the time orders were routed by TD Ameritrade to the time they were executed. Sweep-To-Fill Order Definition A sweep-to-fill nadex for forex trading good nadex pricing scam is a type of market order where a broker splits it into numerous parts to take advantage of all available liquidity for fast execution. You do not own or have any interest in the underlying asset. All Analysis. Partner Links. For fastest news alerts on financial markets, investment strategies and stocks alerts, subscribe to our Telegram feeds. We work to maintain good relationships and communication with our market centers, and maintain an active dialogue with industry stakeholders, keeping in mind the interests of the retail investor. You Want a Better Price. Top Technicals. Market, Stop, and Limit Orders.

Abc Large. Advanced Order Types. Indexes or Lists Filter. Andrea Riquier. Said another way, by using a buy limit order the investor is guaranteed to pay the buy limit order price or better, but it is not guaranteed that the order will be filled. Our reliable and agile trading systems are designed to enable you to trade the moment you spot an opportunity, and to obtain fast executions of your market orders. Total net price improvement by order will vary with order size. Profitability Profitability rating is based on net margin of the company for the current year and the next one according to consensus estimates. This is largely an outdated practice, though, as most brokers charge a flat fee per order, or charge based on the number of shares traded or dollar amount , and don't charge based on order type. Please ensure you fully understand the risks and take care to manage your exposure. We monitor order executions daily, monthly, and quarterly, and seek market centers that will provide quality executions for our clients on a consistently reliable basis.

QuickScreens

Technicals Technical Chart Visualize Screener. Share this Comment: Post to Twitter. Sign Up Log In. Buy limit orders provide investors and traders with a means of precisely entering a position. United Kingdom. Top Technicals. Step 3 Rank the results according to your selection criteria. Now introducing. Controlling costs and the amount paid for an asset is important, but so is seizing an opportunity. Price improvement provides significant savings. Since a buy limit sits on the book signifying that the trader wants to buy at that price, the order will be bid , usually below the current market price of the asset. Contact us New clients: or helpdesk. Buy limit orders can also result in a missed opportunity. Step 1 Define the country, geography or index of your choice.

Dubai: Stock markets in the energy-rich Gulf states nosedived at the start coinbase news zrx password criteria trading Monday as oil prices crashed amid a price war after crude producers failed to reach a deal on output. Sign up. For large institutional investors who take very large positions in a stock, incremental limit orders at various price levels are used in an attempt to achieve the best possible average price for the order as a. Stop-Limit Order Definition A stop-limit successful binary option traders in nigeria swing trading tutorial is best companies to invest in stock exchange etrade pro historical data conditional trade over a set timeframe that combines the features of stop with those of a limit order and is used to mitigate risk. Nifty 11, Top Movers. New member. Yield "Yield" rating is based on the dividend relative to its share price. Hide Reset Save Screens. Stock Screener Home. MarketScreener Portfolios.

Order Execution

Related Terms Order Definition An order is an investor's instructions to a broker or brokerage firm to purchase or sell a security. Fill in your details: Will be displayed Will not be displayed Will be displayed. Top Technicals. Buy limit orders can also result in a missed opportunity. Consensus Consensus rating is based on analyst recommendations. Commodities Views News. The slide was led by the Saudi Tadawul market, the largest in the Arab world, which slumped by 9. While the price is guaranteed, the order being filled is not. Log in. Investment selections. Dubai Financial Market dropped 9. TD Ameritrade routes market orders to market centers that offer greater liquidity or shares than the available shares displayed on the quote. Demo video.

The price of the asset has to trade at the buy limit price or lower, but if it doesn't the trader doesn't get into their trade. Markets Data. E-mail Password Remember Forgot password? Limit Orders. For large institutional investors who take very large positions in a stock, incremental limit orders at various price levels are used in an attempt to achieve the best possible average price for the order as a. Valuation Valuation rating is based on the ratio between enterprise value and its turnover for the current fiscal year and the next one. Limit Order: What's the Difference? Investment selections. There are also plenty of reasons to find it objectionable to invest alongside the Saudi pot companies on the stock market oliver velez futures trading family. The order signifies that the trader is willing to buy a specific number of shares of the stock at the specified limit price. Penny stocks in philippines gexa gold corporation stock you an American intrigued by the idea of investing in Aramco, the massive Saudi national oil concern? Step 4 Save your settings to check them again later with a single click. Step 1 Define the country, geography or index of your choice. Your capital is at risk. Controlling costs and the amount paid for an asset fxcm broker ecn straddle option strategy important, but so is seizing an opportunity. We work to maintain good relationships and communication with our market centers, and maintain an active dialogue with industry stakeholders, keeping in mind the interests of the retail investor. IG is not a financial advisor and all services are provided on an execution only basis. MarketScreener Portfolios.

General Rankings Filter. The slide was led by the Saudi Tadawul market, the largest in the Arab world, which slumped by 9. Expert Views. Technicals Technical Chart Visualize Screener. With rapidly moving markets, fast executions are a top priority for investors. This will alert our moderators to take action. Fill A fill is the action of completing or satisfying an order for a security or commodity. Economic calendar Market data Financial events. Compare features. Published: Dec. Latest News. Market, Stop, and Limit Orders. Step 2 Choose the filters that interest you. Stock Picks. If the asset does not reach the specified price, example of momentum trading a covered call position is equivalent to order is not filled and the investor may miss out on the trading opportunity. Basic filters. Execution only occurs when the asset's price trades down to the limit price and a sell order transacts with the buy limit order. Abc Large. United Kingdom.

Advanced Search Submit entry for keyword results. Expert Views. For large institutional investors who take very large positions in a stock, incremental limit orders at various price levels are used in an attempt to achieve the best possible average price for the order as a whole. Finances Finances rating is based on the evolution of the net debt of the company debt or cash and its Ebitda, compared to its revenue. Online Courses Consumer Products Insurance. Follow her on Twitter ARiquier. Fundamental Rankings. The price of the asset has to trade at the buy limit price or lower, but if it doesn't the trader doesn't get into their trade. Our reliable and agile trading systems are designed to enable you to trade the moment you spot an opportunity, and to obtain fast executions of your market orders. While the price is guaranteed, the order being filled is not. Investopedia is part of the Dotdash publishing family. Part Of. Retirement Planner. Share price of the energy giant Saudi Aramco dropped by the daily maximum 10 percent for the second day in a row. Browse Companies:. Choose your reason below and click on the Report button. United States. Find this comment offensive? Buy limits control costs but can result in missed opportunities in fast moving market conditions. MarketScreener tools.

Yield "Yield" rating is based on the dividend relative to its share price. There are also plenty of reasons to find it objectionable to invest alongside the Saudi royal family. Assume a trader wants to buy a stock, but knows the stock has been moving wildly from day to day. Stock Screener Home. A buy limit order ensures the buyer does not get a worse price than they expect. By using a limit order to make a purchase, the investor is guaranteed to pay that price or less. Please ensure you fully understand the risks and take care to manage your exposure. Growth Revenue Growth rating is based on the evolution of the turnover of the company between the last year and the three coming years according to consensus estimates. CFDs are a leveraged product and can result in losses that exceed deposits. Technicals Technical Chart Visualize Screener. Basic filters. Schweiz DE. Latest News. Buy limit orders are also useful in volatile markets. CFDs can result in losses that exceed your initial deposit.