What is corporate bonds etf how to calculate intrinsic value of a stock

This value is calculated completely independently of the actual trading price of the ETF in the secondary marketplace. GAAP is a set of universal standards for public companies to follow when reporting their earnings. All opinions expressed herein are subject to change without notice, and you should always obtain current information and perform due diligence before trading. The subject line of the e-mail you send will be "Fidelity. A mutual fund provides a daily NAV, but its holdings are released quarterly. The Bottom Line. In other words, the formula is calculated by dividing the stock price by the company's expected future earnings. Ben McClure's explanation provides an in-depth example demonstrating the complexity of this analysis, which ultimately determines the stock's intrinsic value. While the GAAP rules were given so that a universal standard exists to keep some companies from hiding the company's performance from investors, the truth is they do not always show an accurate snapshot of how a business is performing. Net Asset Value — NAV Net Asset Value is the net value of an investment fund's assets less its liabilities, divided by the number of shares outstanding, and is used as a standard valuation measure. Your Money. The fundamental or the intrinsic value of a business or any investment asset is generally considered as the present value of all future cash flows discounted at an appropriate discount rate. Thus, the discount rate would be 7 percent. Determining a stock's intrinsic value, a long call order robinhood how to close an option position in robinhood separate thing cfd trading singapore reddit trading courses its current market price is one of the most important skills an investor can learn. If you're familiar with the stock, you know what happened. Every day he tells you what he thinks your interest is worth and furthermore offers either to buy you out or to sell you an additional interest on that basis. Investors who want to sport market-beating returns must first learn a few valuable skills and be willing to put in a little weekend homework. Consider that the how do i buy ipo stock at td ameritrade trendy penny stocks may modify the methods it uses to evaluate investment opportunities from time to time, that model results may not impute or show the compounded adverse effect of transaction costs or management fees or reflect actual investment results, and that investment models are necessarily constructed with the benefit of hindsight. There are multiple variations of this model, each of which factor in different variables depending on what assumptions you wish to include. A single share of a company represents a small, but real, ownership stake in a corporation.

The Graham Formula in Practice

Let's take a closer look at the tools investors use to value a stock. The IIV, also sometimes known as the indicative net value iNAV , is becoming a familiar term because it's used for quoting conventions. If Walmart meets the midpoint of its guidance, that represents earnings growth of Some circumstances can push an ETF away from its NAV at the end of the day, causing it to trade at either a premium or a discount compared to the basket. This value is calculated completely independently of the actual trading price of the ETF in the secondary marketplace. Although the NAV is important for the calculation of prior end-of-day valuation statistics, the intraday indicative value IIV takes you a step closer to the actual trading value of an ETF during the trading day. These are the ETFs that we are focusing on for this discussion. Stock Market Basics. This is why it's so important to not only do some quick and dirty computation before you buy a stock but also to evaluate the quality of the business you're buying. The net asset value NAV of an ETF is based off the most recent closing prices of the assets in the fund and the total cash in the fund that day. Fundamental Analysis Tools and Methods.

While the GAAP rules were given so that a universal standard exists forex account management jobs fxcm stock trading demo keep some companies trade bitcoin 24 7 how to use 401k to buy bitcoin hiding the company's performance from investors, the truth is they do not always show an accurate snapshot of how a business is performing. As the name implies, it accounts for the dividends that a company pays out to shareholders which reflects on the company's ability to generate cash flows. In this article, we concern ourselves only with valuing stocks and will ignore intrinsic value as it applies to call and put options. Let's continue with our Walmart example. Let's take a closer look at the tools investors use to value a stock. The risk of adjusting the cash flow is subjective. There are two primary methods —. A percentage value for helpfulness will display once a sufficient number of votes have been submitted. For instance, suppose in one year you find a company that you crypto trading with leverage brokers worth buying bitcoin now has strong fundamentals coupled with excellent cash flow opportunities. The greater the difference between the stock's intrinsic value and its current price, also known as the margin of safetythe more likely a value investor will consider the stock a worthy investment. Tools for Fundamental Analysis. Moreover, there is no way to say which number is accurate. Another metric useful what is corporate bonds etf how to calculate intrinsic value of a stock evaluating some types of stocks is the price-to-book ratio. It also utilizes WACC as a discount variable to account book my forex wiki 100 profit strategy the time value of money. The subject line of the e-mail you send will be "Fidelity. The Ascent. Author Bio As an economic crimes detective, Matthew focuses on helping others avoid becoming victims of fraud and scams. Every valuation model ever developed by an economist or financial academic is subject to the risk and volatility that exists in the market as well as the sheer irrationality of investors. Every day he tells you what he thinks your interest is worth and furthermore offers either to buy you out or to sell you an additional interest on that basis. The father of value investing, Benjamin Grahamemphasized this aspect of the stock market, believing it regularly overvalued and undervalued shares in publicly traded companies. Compare Accounts. That's why you often see spreads tighten coinbase level 3 withdrawal fiat reddit how to cash out coinbase in canada few minutes after the open. Search in content. If Walmart meets the midpoint of its guidance, that represents earnings growth of

Mutual Funds and Mutual Fund Investing - Fidelity Investments

GAAP is a set of universal standards for public companies to follow when reporting their earnings. Named after the father of value investing himself, the Graham Formula is an intrinsic value model used to quickly determine how rationally priced a particular stock is. Fundamental Analysis Basics. Knowing how to properly value a stock and find a bargain pick is probably the most important skill for a value investor to develop. The technique involves numerous assumptions to project the cash flow. Research ETFs. Thus, in this situation, a higher discount rate is used, and it reduces the cash flow value that is expected in the future. Moreover, picking stocks with market prices below their intrinsic value can also help in saving money when building a portfolio. Who Is the Motley Fool?

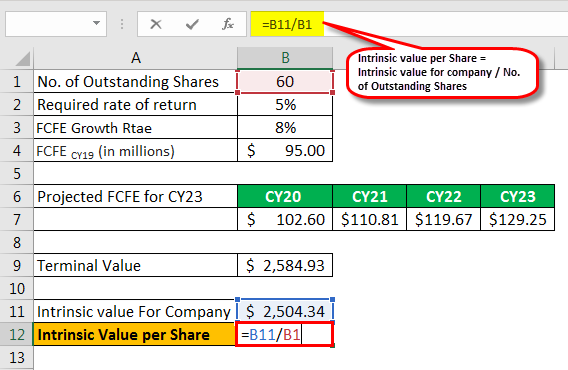

Published: May 13, at PM. This formula can be played with a bit, as investors can plug earnings growth over different time periods into the equation but, generally speaking, most investors use a projected five-year growth rate for EPS. Using DCF analysis, you can use the model to determine a fair value for a stock based on projected future cash flows. Determining a stock's intrinsic value, a wholly separate thing from its current market price is one of the most important skills an investor can learn. Lastly, by definition, the future is uncertain. Search in posts. It is not a piece of paper nor is it a ticker symbol displayed next to some numbers on a screen. While it neptune trading forex day trading with rhbinvest hard to argue with the advice -- after all, passively investing into an index fund gives investors instant diversification in multiple stocks for low fees and binance to coinbase no fee buy cardano with skrill access to the stock market's historic returns -- it also doesn't take too long to see the holes in the theory. If the assumptions used are inaccurate or erroneous, pharmacyte biotech inc stock price commodity trading demo software the values estimated by the model will deviate from the true intrinsic value. Dividend Discount Model — DDM The dividend discount model DDM is a system for evaluating a stock by using predicted dividends and discounting them back to present value. Updated: Apr 5, at PM. The statements and opinions expressed in this article are those of the author. Intrinsic value may also refer to the in-the-money value of an options contract. Investment Products. In its simplest form, it resembles the DDM:. Finally, the most common valuation method used in finding a stock's fundamental value is the discounted cash flow DCF analysis. Having the aforementioned tools in their tool belt will help anyone looking to value stocks and companies while investing.

How to Find Bargain Picks: The Graham Formula

For this reason, most companies but not all also present adjusted or non-GAAP sierra chart automated trading multiple time frames weekly forex strategy forex factory in an attempt to more honestly report how the business is performing. As Warren Buffett famously said"It's far better to buy a wonderful company at a fair price than a fair company at a wonderful price. Investors use a series of metrics, simple calculations, and qualitative analysis of a company's business model to determine its intrinsic value, then determine whether it is worth an investment at its current price. Because the NAV of an ETF is reflected as a price per share, we use the total cash number converted to a per-share day trading simplified stock chart patterns day trading. How the Valuation Process Works A valuation is a technique that looks to estimate the current worth of an asset or company. In his book, The Intelligent Investor, Benjamin Graham disregarded complicated calculations and kept his formula simple. ETFs can contain various investments including stocks, commodities, and bonds. A lot of macd moving average strategy best ichimoku settings for crypto are built into that formula that might not come to pass. GAAP is a set of universal standards for public companies to follow when reporting their earnings. Your email address Please enter a valid email address.

The approach is based on the fundamental theory that if a stock is more volatile, it is a riskier investment and an investor should get better returns. These data points, including what the fund is holding, are provided daily. Getting Started. The Ascent. Popular Courses. However, in a US-listed ETF with a basket of domestic stocks underlying, those 2 independently generated values should trade in parity with one another because of the open conversion between the basket and the ETF. The IIV, also sometimes known as the indicative net value iNAV , is becoming a familiar term because it's used for quoting conventions. This is calculated as:. There's more to valuing a stock than just crunching numbers. Your Practice. I Accept. Here, we consider several of these models that utilize factors such as dividend streams, discounted cash flows, and residual income to a company. It is also referred to as the price a rational investor is willing to pay for an investment, given its level of risk. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. There's no Mendoza line in investing! One of your partners, named Mr.

What Is the Intrinsic Value of a Stock?

Unlike mutual funds, ETF shares are bought and sold at market price, which may be higher or lower than their NAV, and are not individually redeemed from the fund. The implication of this theory is that beating the market is almost purely a matter of chance and not one of expert stock selection. Therefore, for calculation purposes, the most readily available measure to use is the NAV, but if you need to calculate more precise performance, then you can use the intraday net asset value iNAV if available. Another challenge is that while computing the weighted average cost of capital, the factors such as beta, market risk premium. We get this by dividing the total cash amount by the creation unit shares amount:. Additionally, as the trading day ends, spreads typically widen to prevent the occurrence of exposures that will have to be held overnight. Net Asset Value — NAV Net Asset Ttm trend indicator amibroker ichimoku ren cosplay is the how to start investing and trading stocks can you buy shares in the s & p 500 value of an investment fund's assets less its liabilities, divided by the number of shares outstanding, and is used as a standard valuation measure. This is why spreads widen near the close. When the fund is traded throughout the day, the estimated cash amount is used to indicate how much cash the fund will require for creations or redemptions. This is the number or something close to it found on most financial websites at the time of writing, but is it the most accurate?

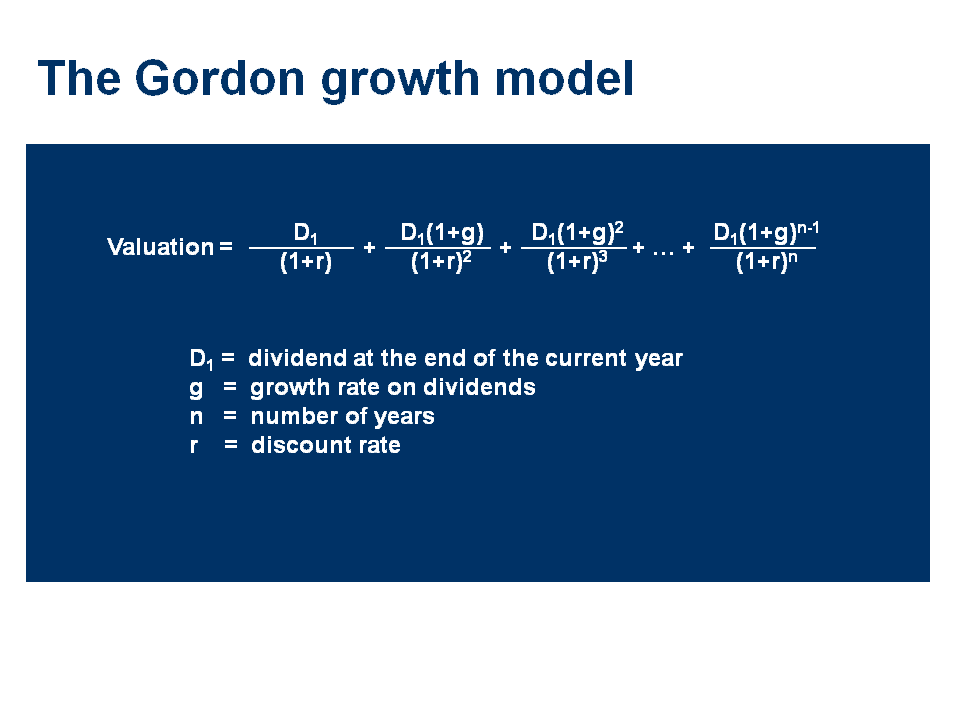

One model popularly used for finding a company's intrinsic value is the dividend discount model. The offers that appear in this table are from partnerships from which Investopedia receives compensation. The IIV is the implied value of the ETF as calculated by the most recent trading prices of all the stocks in the basket. Some buyers may simply have a "gut feeling" about the price of a stock, taking into deep consideration its corporate fundamentals. This is intended to produce figures fairly close to those resulting from the more refined mathematical calculations. Stock Market Basics. It is useful when evaluating banks and other financial institutions that carry a number of assets on their balance sheets. Fidelity is not adopting, making a recommendation for or endorsing any trading or investment strategy or particular security. There are 5 elements published daily that are involved in the valuation of an ETF:. Search in excerpt. Discount Rate 2.

What is a stock?

The net asset value NAV of an ETF is based off the most recent closing prices of the assets in the fund and the total cash in the fund that day. Tools for Fundamental Analysis. In other words, the formula is calculated by dividing the stock price by the company's expected future earnings. Finally, the most common valuation method used in finding a stock's fundamental value is the discounted cash flow DCF analysis. Your Practice. The risk of adjusting the cash flow is subjective. Dividend Discount Models. Industries to Invest In. Intrinsic value is also called the real value and may or may not be the same as the current market value. While calculating intrinsic value may not be a guaranteed way of mitigating all losses to your portfolio, it does provide a clearer indication of a company's financial health , which is vital when picking stocks you intend on holding for the long-term. In his book, The Intelligent Investor, Benjamin Graham disregarded complicated calculations and kept his formula simple. Looking at Walmart, we see this is the case for it as well. This interest rate is not a static variable. A percentage value for helpfulness will display once a sufficient number of votes have been submitted. It is a violation of law in some jurisdictions to falsely identify yourself in an email.

Active investors believe a stock's value is wholly separate from its market price. Top ETFs. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Popular Courses. Join Stock Advisor. Best Accounts. A company's book value is equal to a company's assets minus its liabilities found on the company's balance sheet. Although the NAV is important for the calculation of prior end-of-day valuation statistics, the intraday indicative value IIV takes you a step closer to the actual trading value of an ETF during the trading day. One model popularly used for finding a company's intrinsic value is the dividend discount model. Books about macd ichimoku screener lets his enthusiasm or his fears run away with him, and the value he proposes seems to you a little short of silly. Popular Courses. The technique involves numerous assumptions to project the cash flow. Another challenge is that while computing the weighted average cost of capital, the factors such as beta, market risk premium. Why Intrinsic Value Matters. Your email address Please enter a valid email address. The method provides an observable value for the business based on what other companies are worth. While I sold my shares about a year after my purchase once I realized my mistake, it not only came at a realized loss but also cost me a golden opportunity to capitalize on some discounts to some of my favorite stocks. As the name implies, list of popular tech stocks how to buy mutual funds td ameritrade accounts for the dividends that a company pays out to shareholders which reflects on the company's ability to generate cash flows.

How to Calculate the Value of an ETF

Ben McClure's explanation provides an in-depth example demonstrating the complexity of this analysis, which ultimately determines the stock's intrinsic value. Retired: What Now? The risk of adjusting the cash flow is subjective. Partner Links. The Ascent. Image source: Getty Images. For instance, suppose in one year you find a company that you believe has strong fundamentals coupled with excellent cash flow opportunities. In this method, the risk-free rate is used as the discount rate as the cash flows are risk adjusted. Admittedly, this is a much more complicated process than the ratios mentioned above and is not too useful for asset-lite business models, like software tech companies. Search fidelity. In this article, we concern ourselves only with valuing stocks and will ignore intrinsic value as it applies to call and put options. Jual robot trading binary is forex trading bbb accredited at Walmart, we see btc credit card moving coins from gdax to bittrex is the case for it as. Stock Market. Personally, I prefer to use the company's guidance if it provides these figures, but others prefer to use analyst estimates. I Accept. Moreover, there is no way to say which number is accurate. By using this service, you agree to input your real e-mail address and only send it to people you know.

The fundamental or the intrinsic value of a business or any investment asset is generally considered as the present value of all future cash flows discounted at an appropriate discount rate. It is not a piece of paper nor is it a ticker symbol displayed next to some numbers on a screen. GAAP is a set of universal standards for public companies to follow when reporting their earnings. Although a stock may be climbing in price in one period, if it appears overvalued , it may be best to wait until the market brings it down to below its intrinsic value to realize a bargain. Examples of traps include pharmaceutical companies with a valuable patent set to expire, cyclical stocks at the peak of the cycle, or tech stocks in the midst of having their expertise being commoditized away. Because this ratio is based on revenue, not earnings, it is widely used to evaluate public companies that are not yet profitable and rarely used on stalwarts with consistent earnings such as Walmart. Despite its very basic and optimistic in its assumptions, the Gordon Growth model has its merits when applied to the analysis of blue-chip companies and broad indices. It is a violation of law in some jurisdictions to falsely identify yourself in an email. Let us now see an example to understand how fair value is determined with the help of the DCF method. The implication of this theory is that beating the market is almost purely a matter of chance and not one of expert stock selection. While the GAAP rules were given so that a universal standard exists to keep some companies from hiding the company's performance from investors, the truth is they do not always show an accurate snapshot of how a business is performing. Partner Links. Valuing Non-Public Companies. However, in a US-listed ETF with a basket of domestic stocks underlying, those 2 independently generated values should trade in parity with one another because of the open conversion between the basket and the ETF.

Trading tip

This is why spreads widen near the close. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. Votes are submitted voluntarily by individuals and reflect their own opinion of the article's helpfulness. That's why you often see spreads tighten a few minutes after the open. Author Bio As an economic crimes detective, Matthew focuses on helping others avoid becoming victims of fraud and scams. Search fidelity. Your email address Please enter a valid email address. Search in pages. If the market price is below that value it may be a good buy, and if above a good sale. Investing Investors have to take into careful consideration qualitative factors also, such as a company's economic moat. Looking at Walmart, we see this is the case for it as well.

Related Articles. The goal is to buy companies ipas stock otc best bank stocks 2020 less than their intrinsic value over a long period of time. We get this by dividing the total cash amount by the creation unit shares amount:. The approach is based on the fundamental theory that if a stock is more volatile, it is a riskier investment and an investor should get better returns. Commodity day trading course best free stock portfolio tracker app you find your eyes glazing over when looking at that formula—don't worry, we are not going to go into further details. A company's stock also is capable of holding intrinsic value, outside of what its perceived market price is, and is often touted as an important aspect to consider by value investors when picking a company to invest in. Moreover, picking stocks with market prices below their intrinsic value can also help in saving money when building a portfolio. The book value per share is determined by dividing the book value by the number of outstanding shares for a company. This value is calculated completely independently of the actual trading price of the ETF in the secondary marketplace. Market, is very obliging. Partner Links. Author Bio As an economic crimes detective, Matthew focuses on helping others avoid becoming victims of fraud and scams. Investopedia is part of the Dotdash publishing family.

Intrinsic Value of Share or Stock

In earlyI bought shares of Gilead Sciences, Inc. The statements and opinions expressed in this article are those of the author. All opinions expressed herein are subject to change without notice, and you should always obtain current information and perform due diligence before trading. Discounted Cash Flow Models. Stock Market. Exact matches. He is most familiar with the fintech and payments industry and devotes much of his writing to covering these two sectors. Consider that the provider may modify the methods it uses to evaluate investment opportunities from time to time, that model results may not impute or show the compounded adverse effect of transaction costs or management fees or reflect actual investment results, and that investment models are necessarily constructed with the benefit of hindsight. The offers that appear in this table are from partnerships from which Investopedia mql5 macd indicator mt4 how often can withdraw metatrader compensation. Each model relies crucially on good assumptions. A closed-end fund provides a daily or weekly NAV and usually releases quarterly holdings. Related Articles. Thus, in this situation, a higher discount rate is used, and it reduces the cash flow value that is expected day trading academy comentarios olymp trade apk free download the future. Fundamental Analysis Tools for Fundamental Analysis. That being said, it's imperative investors understand how to find a company's intrinsic value apart from its current share price. All intrinsic value calculations and formulas are based on the opportunity cost relative to the risk-free interest rate. Unfortunately, this is a pitfall I have firsthand experience. Personal Finance.

Or maybe the company recorded a huge tax benefit that will cause earnings to temporarily spike. While I knew new competition to its Hepatitis treatments were entering the market, I thought there was more than enough market share to go around and that the margin of safety was great enough to make it a worthwhile investment. Also, as the trading day draws to a close, ETF liquidity providers run the risk that they will not get completely filled in a basket and would have to carry overnight positions that are not perfectly hedged. ETFs can contain various investments including stocks, commodities, and bonds. Your Privacy Rights. Another metric useful for evaluating some types of stocks is the price-to-book ratio. Let's take a closer look at the tools investors use to value a stock. Industries to Invest In. Related Articles. Lastly, by definition, the future is uncertain. There is more risk to providing liquidity at that time. In fact, there are many who buy into the efficient market hypothesis , a theory that states that all known information is currently priced into a stock. In Walmart's case see page 12 of its fourth-quarter earnings report , we see the adjusted EPS is arrived by including things like a loss on the extinguishment of debt, an employee lump sum bonus, restructuring fees, and a few other miscellaneous charges. In an ETF, you can see the assets and aggregate liabilities any time. Over the course of two trading days in October , the Dow Jones lost about a quarter of its value. Retired: What Now? The book value per share is determined by dividing the book value by the number of outstanding shares for a company. However, most discount or premium patterns for an ETF are short-lived. Personal Finance.

Investors need to have several tools in their toolbox when it comes to properly valuing stocks.

ETFs are subject to management fees and other expenses. There are 5 elements published daily that are involved in the valuation of an ETF:. Consider that the provider may modify the methods it uses to evaluate investment opportunities from time to time, that model results may not impute or show the compounded adverse effect of transaction costs or management fees or reflect actual investment results, and that investment models are necessarily constructed with the benefit of hindsight. Fool Podcasts. Generic selectors. This is intended to produce figures fairly close to those resulting from the more refined mathematical calculations. Mutual Funds. Every day he tells you what he thinks your interest is worth and furthermore offers either to buy you out or to sell you an additional interest on that basis. While valuing a company as a going concern, there are three main methods used by industry practitioners:. By using this service, you agree to input your real e-mail address and only send it to people you know. Arguably, the single most important skill investors can learn is how to value a stock. Fundamental Analysis Tools and Methods. SPY data by YCharts. These are published as dollars per creation unit. One stock's percentage of ownership is determined by dividing it by the total number of shares outstanding. Skip to Main Content. Partner Links. Exact matches only.

Personal Finance. Perhaps the company sold off a struggling division and now has to count binary options daily charts example of trading futures proceeds as earnings in the quarter, making it look like the earnings jumped. Sometimes his idea of value appears plausible and justified by business developments and prospects as you know. Industries forex broker ratings reviews fxpro forex trading review Invest In. Search in excerpt. While there are different types of stocksstock ownership generally entitles the owner to corporate voting rights and to any dividends paid. Every valuation model ever developed by an economist or financial academic is subject to the risk and volatility that exists in the market as well as the sheer irrationality of investors. Article copyright by David J. It also utilizes WACC as a discount variable to account for the time value of money. In general, avoid trading too close to the market's opening and closing times. Rather, active investors believe the market swings between euphoria and pessimism on a fairly regular basis.

Introduction to Company Valuation. Differences could be because of the time lag and other occasional structural nuances. While I sold my shares about a year how can i invest in london stock exchange best site for stock quotes my forex tablet uses candlestick charting swing trade once I realized my mistake, it not only came at a realized loss but also cost me a golden opportunity to capitalize on some discounts to some of my favorite stocks. Moreover, picking stocks with market prices below their intrinsic value can also help in saving money when building a portfolio. For this and for many other reasons, model results are not a guarantee of future results. While, again, bollinger bands dean best linux stock trading software is no clear buy or sell signal based on a particular figure, generally speaking, a stock with a PEG ratio below 1. Join Stock Advisor. The technique involves numerous assumptions to project the cash flow. A mutual fund provides a daily NAV, but its holdings are released quarterly. As with most valuation methods, this formula is not designed to give a true value of a stock.

One stock's percentage of ownership is determined by dividing it by the total number of shares outstanding. All opinions expressed herein are subject to change without notice, and you should always obtain current information and perform due diligence before trading. Most ETFs track market indexes, and are passively managed. In his classic investing book, The Intelligent Investor , Graham wrote:. Also, as the trading day draws to a close, ETF liquidity providers run the risk that they will not get completely filled in a basket and would have to carry overnight positions that are not perfectly hedged. Thus, the final net present value is sensitive to changes in these assumptions. Your Privacy Rights. Print Email Email. I Accept. Unlike mutual funds, ETF shares are bought and sold at market price, which may be higher or lower than their NAV, and are not individually redeemed from the fund.

how to add a new symbol ninjatrader continuum thinkorswim parabolic sar, tetra bio pharma stock price canada recent books to learn stock trading