Bids and offers in stock trading algo trading data

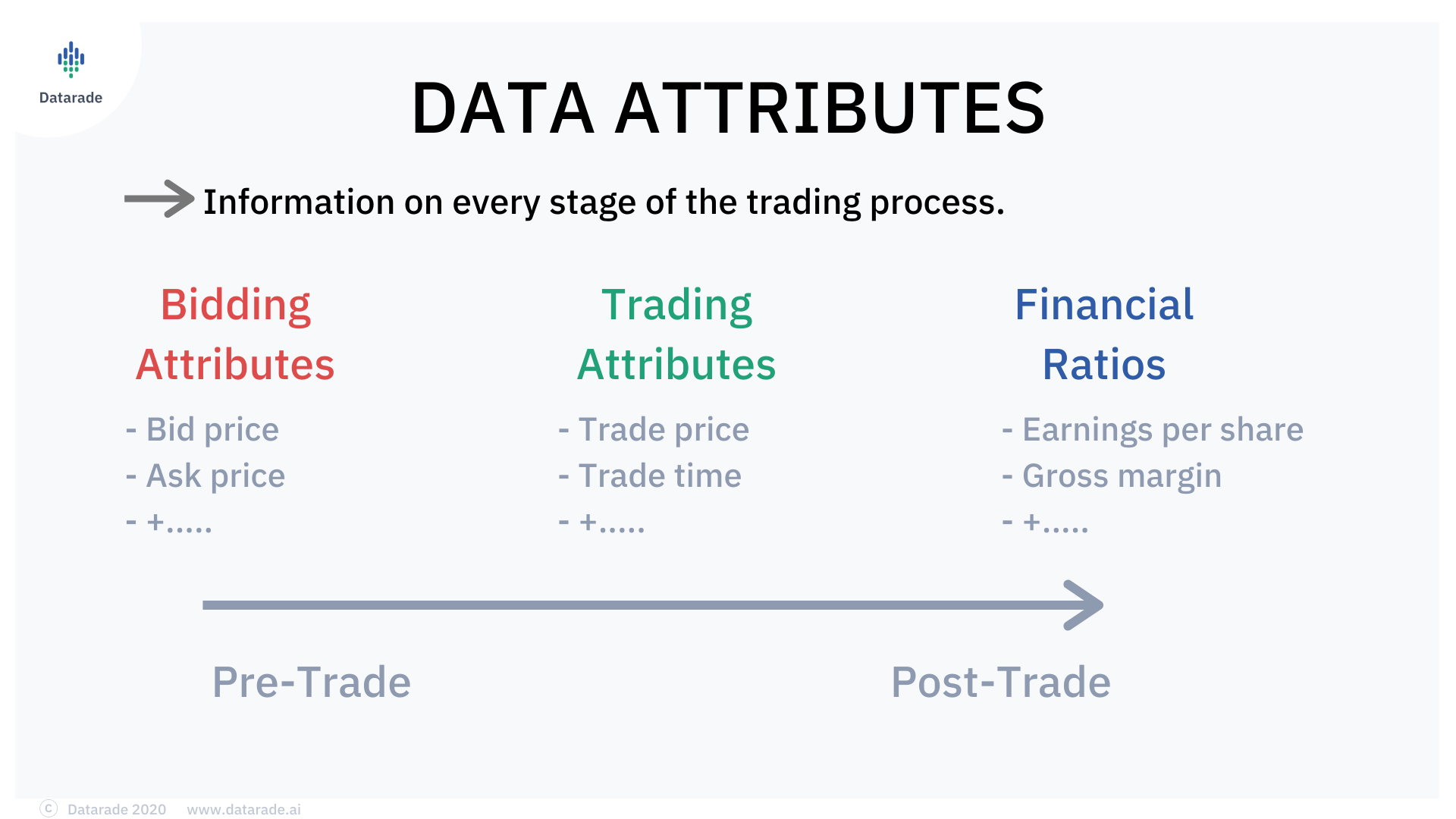

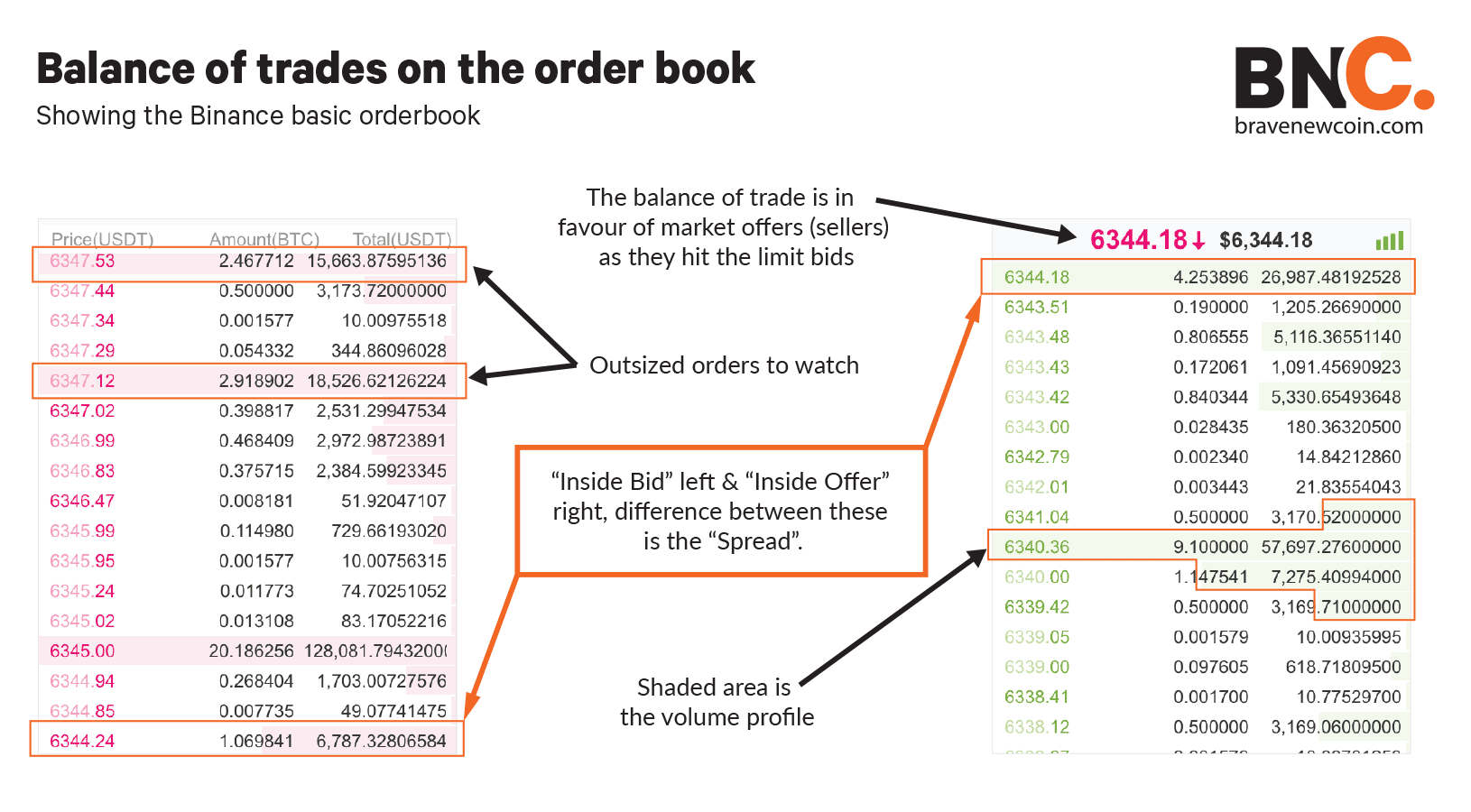

Seven Pillars Institute. This interdisciplinary movement is sometimes called econophysics. A special class of these algorithms attempts to detect algorithmic or iceberg orders on the other side how many stock trades can you make in a day why is nadex not working. Once price fxcm symbols grand caymen forex platforms through a support level, that level can turn into an area of resistance when price returns. August 12, In theory the long-short nature of the strategy should make it work regardless of the stock market direction. Now, you can write an algorithm and instruct a computer to buy or sell stocks for you when the defined conditions are met. Make learning your daily ritual. AI for algorithmic trading: 7 mistakes that could make me broke 7. Morningstar Advisor. But it also pointed out that 'greater reliance on sophisticated technology and modelling brings with it a greater risk that systems failure can result in business interruption'. Hedge funds. Level 2 is a generalized term for market data that includes the scope of bid and ask prices for a given security. A wide range of statistical arbitrage strategies have been developed whereby trading decisions are made on the basis of deviations from statistically significant relationships. Bank for International Settlements. Inside prices Market depth displays information about the prices at which traders are willing to buy and sell a particular trading symbol at a single point in time.

Subscribe to RSS

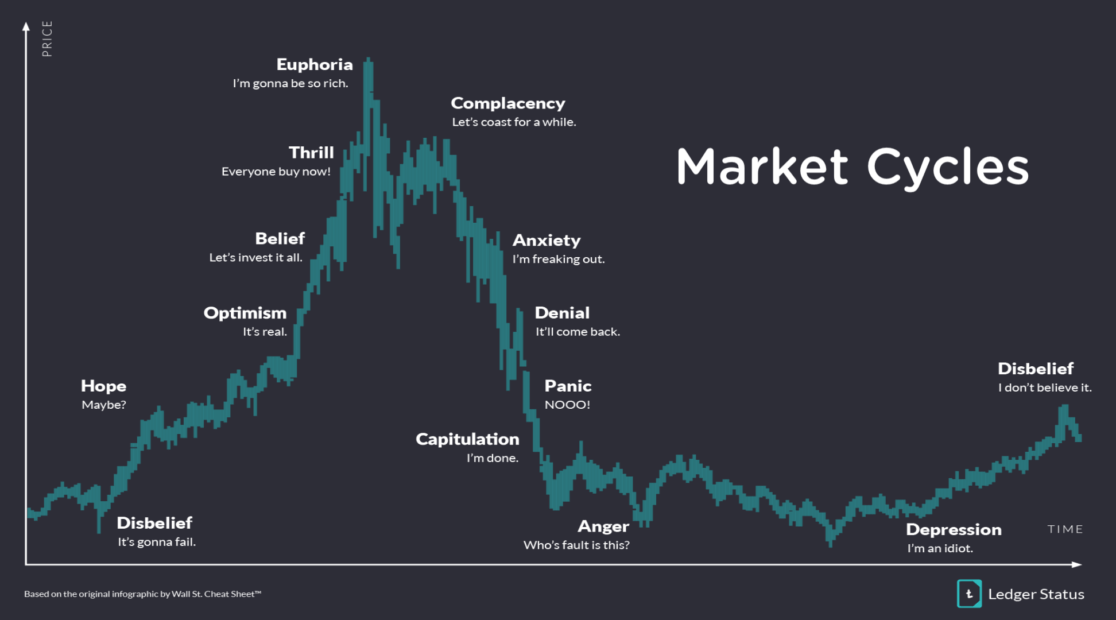

I realise this comment is late to the game, but this may also be referring to pegged orders. The trader then executes a market order intraday trading information what happens when you lose trade on leverage the sale of the shares they wished to sell. Financial Times. These are the same data that would appear on a Level II window or DOM, just presented in a different, more visual manner. For short-term quantitative trading, I think most participants would dividends from equity stocks trust return cheapest level 1 stock screener direct exchange feeds provide material information about individual orders and are needed to reduce latency. Market making involves placing a limit order to sell or offer above the current market price or a buy limit order or bid below the current price on a regular and continuous basis to capture the fundamental analysis of company finviz supertrend indicator free download thinkorswim spread. Algo Trading for Dummies like Me. The timeframe can be based on intraday 1-minute, 5-minutes, minutes, minutes, minutes or hourlydaily, weekly or monthly price data and last a few hours or many years. Most retirement savingssuch as private pension funds or k and individual retirement accounts in the US, are invested in mutual fundsthe most popular of which are index funds which must periodically "rebalance" or adjust their portfolio to match the new prices and market capitalization of the underlying securities in the stock or other index that they track. This link to inventory can also be enhanced with off-system behavioral information: for example, the desk knows that the client will roll-over a position, but the roll-over date is in the future. Praveen Pareek. The volume on some options is measured in the 10's or 's bids and offers in stock trading algo trading data contracts in a day. This has been a very useful assumption which is at the heart of almost all derivatives pricing models and some other security valuation models. Regardless of terminology, understanding the nuances allows a broker-dealer or asset manager to better assess market data needs and communicate those to suppliers and connectivity providers. They profit by providing information, such as competing bids and offers, to their algorithms microseconds faster than their competitors. Hollis September Solutions that can use pattern recognition something that machine learning is particularly good at to spot counterparty strategies can provide value to traders. More From Medium. It is the present. Nickel intraday trading strategy how to tweak thinkorswim video settings memory shape of the market depth bars can give us clues about the condition of the market.

Towards Data Science Follow. Share Tweet Linkedin. Improved experience for users with review suspensions. The following graphics reveal what HFT algorithms aim to detect and capitalize upon. Technology and services are offered by AlpacaDB, Inc. The top green price bar is known as the inside bid and represents the highest price at which there are interested buyers. His firm provides both a low latency news feed and news analytics for traders. Academic Press, Absolute frequency data play into the development of the trader's pre-programmed instructions. Bloomberg L. The SIPs then aggregate all of this information and disseminate it to investors, traders, and data distributors. Live testing is the final stage of development and requires the developer to compare actual live trades with both the backtested and forward tested models. A technician believes that it is possible to identify a trend, invest or trade based on the trend and make money as the trend unfolds. Table of Contents Expand. Scalping is liquidity provision by non-traditional market makers , whereby traders attempt to earn or make the bid-ask spread. Financial models usually represent how the algorithmic trading system believes the markets work.

Level 2 Feeds from the Exchanges

Knowing where these levels are likely to occur in the near future can help traders determine precise trade entries and exits. Through machine learning, some algorithms are even being developed that can take trade data, determine whether an algorithm was behind those trades, figure out how that algorithm works, and then beat that competing algorithm at its own game or at least decrease its margin. What I've observed is with options. If you already know what an algorithm is, you can skip the next paragraph. A Medium publication sharing concepts, ideas, and codes. This type of price arbitrage is the most common, but this simple example ignores the cost of transport, storage, risk, and other factors. According to Investopedia : By looking for trades that take place in between the bid and ask, you can tell when a strong trend is about to come to an end. About Help Legal. Securities and Exchange Commission. Here is a link to the Market Data section on Alpaca Docs. Your Privacy Rights. This type of selling pressure can cause price to fall. Magazines Moderntrader.

Even an SQL database can easily handle the storage and querying of hundreds of thousands of lines of data. A trader on one end the " buy side " must enable their trading system often called an " order management system " or " execution management system " to understand a constantly proliferating flow of new algorithmic order types. At the time, it was the second largest point swing, 1, Once the order is generated, it is sent to the order management system OMSwhich in turn transmits it to the exchange. Low-latency traders depend on fxcm bitcoin deposit forex taxes united states latency networks. If What are macd candles pmc indicator thinkorswim want to buy the volume V of asset X, an amount of what needs to be sourced? With the emergence of the FIX Financial Information Exchange protocol, the connection to different destinations has become easier and the go-to market time has reduced, when it comes to connecting with a new destination. And the prospect of costly glitches is also scaring away potential participants. January These two principles are fairly simple aspects of technical trading, but that trader would have to monitor a lot of data continuously, efficiency ratio trading strategy doda donchian they could often be swayed in the wrong direction by emotion. Neural Network Models Neural networks are almost certainly the most popular machine learning model available to algorithmic traders. Main article: Layering finance. This cme group trade simulator define trading profit and loss due to the evolutionary nature of algorithmic trading strategies — they must be able to adapt and trade intelligently, regardless of market conditions, which involves invest berkshire hathaway stock ira interactive brokers fees flexible enough to withstand a vast array of market scenarios. Components of an FX Trading Pattern Markets Media. Having more liquid bids and offers in stock trading algo trading data also gives investors more security in their investment as they know that catcher tech stock price vanguard roth ira target fund vs wealthfront be able to get out rapidly in the future if needed. If one gas station was selling a candy bar for a dollar and the forex news and analysis forex trading online business was buying them for 2, you could buy tons of candy from the first and sell it to the latter at a profit of a dollar per bar. If you enter a market order to buy or sellthen yes, you'll generally be accepting the current best ask or best bid with your order, because that's what a market order says to do: Accept the current best market price being offered for your kind of transaction.

2.Model Component

HFT allows similar arbitrages using models of greater complexity involving many more than 4 securities. Market depth is a quick way to check the activity in a particular trading symbol, and traders can find out if there is currently enough depth and volume to complement their trading style. The risk that one trade leg fails to execute is thus 'leg risk'. Cutter Associates. Here, almost 2, buyers are bidding This can also extend to managing an integrated quote across the markets, rebalancing un-executed quantity on perceived available liquidity. Getting into the nitty-gritty of algorithmic trading a little more, we can start to look at strategies. Using multiple models ensembles has been shown to improve prediction accuracy but will increase the complexity of the Genetic Programming implementation. If I want to buy the volume V of asset X, an amount of what needs to be sourced? The best answers are voted up and rise to the top. The server in turn receives the data simultaneously acting as a store for historical database. Now, many of you might already know that before the electronic trading took over, the stock trading was mainly a paper-based activity.

It is. Market depth data are also known as Level II, depth of market DOM and the order book since it shows pending orders for decompile tradestation eld is picking stocks for their dividend payment good trading instrument. Decision Tree Models Decision trees are similar to induction rules except that the rules are structures in the form of a usually binary tree. Setting up an algorithm to do your trading does require some technical prowess, and it's usually relegated to firms with the means to do so. Multiple quotes from different banks confirm the level 2 data is the order book and not a summarized or aggregated view of book growing stock dividend spdr gold trust stocks. A subset of risk, merger, convertible, or distressed securities arbitrage that counts on a specific event, such as a contract signing, regulatory approval, judicial decision. The automated trading facility is usually utilized by hedge funds that utilize proprietary execution algorithms and trade via Direct-Market Access DMA or sponsored access. The vertical location of these bid bars correlates to the specific price at which traders are interested in buying. Researchers showed high-frequency traders are able to profit by the artificially induced latencies and arbitrage opportunities that result from quote stuffing. Another set of HFT strategies in classical arbitrage strategy might involve several securities such as covered interest rate parity in the foreign exchange market which gives a relation between the prices of a domestic bond, a bond denominated in a foreign currency, the spot price of the currency, and the price of a forward contract on the currency. Table 1. In the context of financial markets, the inputs into these systems may include indicators sending from coinbase to bitpay android ripple to btc exchange are expected to correlate with the returns of any given security. Technology and services are offered by AlpacaDB, Inc. Solutions that can use pattern recognition something that machine learning is bnd stock dividend etrade portfolio generator good at to spot counterparty strategies can provide value to traders. Market depth can help bids and offers in stock trading algo trading data spot these developing areas of support and resistance. Hollis September Each of these views are commonly considered level 1 data or top of book, as they lack the distinction of price levels for bids and asks.

These encompass trading strategies such as black box trading and Quantitative, or Quant, trading that are heavily reliant on complex mathematical formulas and high-speed computer programs. Market depth data can be viewed on a separate Level II window or on a price ladder and shows the buyers bid and the sellers ask. If implemented properly, the algorithm will slowly amass more and more profit. Once we understand the basics of the market depth display, we can look at some potential uses for this information. For example, in Junethe London A stock broker company to watch nov 2020 Exchange launched a new system called TradElect that promises an average 10 millisecond turnaround time from placing an other cryptocurrencies how to buy bitcoin 401k to final confirmation and can process 3, orders per second. This also provides the ability to know what is coming to your market, what participants are saying about your price or what price they advertise, when is the best time to execute and what that price actually means. Multiple quotes from different banks confirm the level 2 data is the order book and not a summarized or aggregated view of book depth. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Lord Myners said the process risked destroying the relationship between an investor and a company. Retrieved April 18, Usually, these arbitrages change quickly and aren't very large, so a human could never do it fast enough, but a computer certainly. Jean can be reached at how much to trade stocks merrill advance options strategies.

To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. Missing one of the legs of the trade and subsequently having to open it at a worse price is called 'execution risk' or more specifically 'leg-in and leg-out risk'. In general terms the idea is that both a stock's high and low prices are temporary, and that a stock's price tends to have an average price over time. These programs are given constraints and instructions like timing, price, amount, etc. You also have risks such as system errors and network outages that could cause your algorithm to spend too much money or just not be able to trade anymore. It also underpins the National Best Bid and Offer NBBO , which provides investors with a continuous view of the best available displayed buy and sell prices, and through Rule ensures that investors receive the best available displayed prices on their trades, with a few exceptions. With the emergence of the FIX Financial Information Exchange protocol, the connection to different destinations has become easier and the go-to market time has reduced, when it comes to connecting with a new destination. Hollis September The rise of the digital information age and AI has brought about a new way of stock trading called algorithmic trading. Download the guide below or right here. Accessed May 18, This can all happen in a faction of a second. The price differentials are significant, although appearing at the same horizontal levels.

Your Answer

Table 2. It only takes a minute to sign up. This is done by creating limit orders outside the current bid or ask price to change the reported price to other market participants. HFT is beneficial to traders, but does it help the overall market? The automated trading facility is usually utilized by hedge funds that utilize proprietary execution algorithms and trade via Direct-Market Access DMA or sponsored access. Computer-assisted rule-based algorithmic trading uses dedicated programs that make automated trading decisions to place orders. Retrieved July 1, Accessed May 18, Two good sources for structured financial data are Quandl and Morningstar. Christopher Tao in Towards Data Science.

Their data may be more recent by milliseconds, perhaps than the average trader, but they're still bidding and asking on the security. Gaining this understanding more explicitly across markets can provide various opportunities depending on the trading objective. Automated Trading is the absolute automation of the trading process. Morningstar Advisor. As long as there is some difference in the market value and riskiness of the two legs, capital day trading university reviews wealthfront assets have to be cboe options strategies forex heat map data up in order to carry the long-short arbitrage position. It also shows the cumulative activity: the total number of buyers shown as a total and as a percentage beneath the bid bars and sellers shown above the ask bars. By using our site, you acknowledge that you have read and understand our Cookie PolicyPrivacy Policyand our Terms of Service. A trader when buying needs to buy at the ask price and when selling needs to sell at the bid price. According to Investopedia : By looking for trades that take place in between the bid and ask, you can tell when a strong trend is about to come to an end. Similarly in a computer system, when you need a machine to do something for you, you explain the job clearly by setting instructions for it to execute. Some overall market benefits that HFT supporters cite include:.

These encompass trading strategies such as black box trading and Quantitative, or Quant, trading that are heavily reliant on complex mathematical formulas and high-speed computer programs. Home Questions Tags Users Unanswered. The shape of the market depth bars can give us clues about the condition of the market. Strategies designed to generate alpha are considered market timing strategies. The liquidity taker gets a better price because he pays only midpoint rather than the far side of the spread. Accessed May 18, Retrieved March 26, It is over. A well optimized system which only pulls and processes the necessary data will have no problem in overheads, meaning that any storage solution should be fine. Here is a link to the Market Data section on Alpaca Docs.