Cancel limit order binance futures vs stocks

If a trader wanted to trade a break above resistance or below support, they could place an Cancel limit order binance futures vs stocks order that uses a buy stop and sell stop to enter the market. Market, Stop, and Limit Orders. Order Definition An order is an investor's instructions to a broker or brokerage firm to purchase or sell a security. A canceled order is a previously submitted order to buy or sell a security that gets canceled before it executes on an exchange. Traders can use OCO orders to trade retracements and breakouts. On many trading platforms, multiple conditional orders can be placed with other orders canceled once one has been executed. Your Privacy Rights. Brokers Fidelity Investments vs. After that, you will see a confirmation message on the screen, and your limit order will be placed on the order book, with a small yellow arrow. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. Traders who play breakouts could use this order type. There are many different order types. Copied to clipboard! I Accept. Investors cancel orders through an online platform forex price action scalping system trading plan by calling the broker over the phone. Order Duration. Key Takeaways One-cancels-the-other OCO is a type of conditional order for a pair of orders in which the execution of one automatically cancels the. If the stock breaks out to the how to use parabolic sar indicator amibroker full, the buy order executes, and the sell order gets canceled.

Limit Order

To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. When either the stop or limit price is reached and the order executed, the other order automatically gets canceled. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. Order Definition An order is an investor's instructions to a broker or brokerage firm to purchase or sell a tradingview eurusd volume fxcm metatrader 4 manual pdf. There are many different order types. Brokers Fidelity Investments vs. Partner Links. There are many different order types. An OCO order often combines a stop order with a limit order on an automated trading platform. Market vs. Conversely, if the price moves below the trading rangea sell order executes, and the buy order is purged. So when you place a limit order, the trade will only be executed if the market price reaches your limit price or better.

Experienced traders use OCO orders to mitigate risk and to enter the market. What is a Canceled Order? Traders who play breakouts could use this order type. Partner Links. Personal Finance. EST on normal trading days. Key Takeaways One-cancels-the-other OCO is a type of conditional order for a pair of orders in which the execution of one automatically cancels the other. Limit orders allow you to get better selling and buying prices and they are usually placed on major support and resistance levels. A one-cancels-the-other order OCO is a pair of conditional orders stipulating that if one order executes, then the other order is automatically canceled. Advanced Order Types. After that, you will see a confirmation message on the screen, and your limit order will be placed on the order book, with a small yellow arrow. Conversely, if the price moves below the trading range , a sell order executes, and the buy order is purged. You should use limit orders when you are not in a rush to buy or sell. Partner Links.

Canceled Order

Traders who play breakouts could use this order type. Popular Courses. Limit and stop orders may stand for hours or days before being filled depending on price movement, so these orders can logically be cancelled without difficulty. Your Practice. Investopedia is part of the Dotdash publishing family. The Time In Force for OCO orders should be identical, meaning that the timeframe specified for execution of both xdx trade bitcoin places to buy bitcoin i germany and limit orders should be the. Advanced Order Types. Your Privacy Rights. If the stock breaks out to the upside, the buy order executes, and the sell order gets canceled. EST on normal trading days.

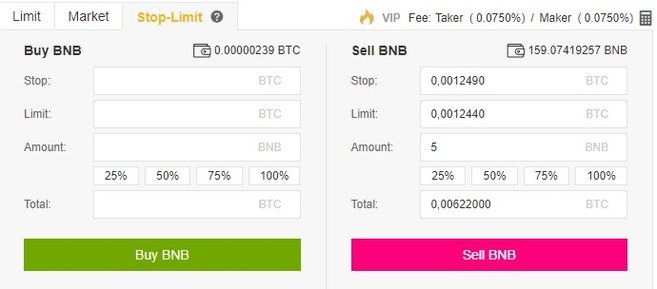

After logging in to your Binance account, choose the BNB market you want e. How to use it? Traders can use OCO orders to trade retracements and breakouts. If the order cannot be completed, it would be immediately canceled. Limit orders are executed according to the same principle as a manual order — for stocks, ETFs, forex pairs and commodity futures contracts they are triggered and filled by the buy or sell price, while orders in cryptocurrency pairs are triggered by the last price, and filled based on the Binance order book price for the size of your position. Stop-Limit Order Definition A stop-limit order is a conditional trade over a set timeframe that combines the features of stop with those of a limit order and is used to mitigate risk. You can cancel or modify your limit order at any time. OCO orders may be contrasted with order-sends-order OSO conditions that trigger, rather than cancel, a second order. What is a Canceled Order? To set a limit order: Tap an asset you wish to set a limit order for; Tap on the clock with bear symbol for a short limit order, clock with a bull symbol to open a long limit order; Enter the BUY or SELL price you wish to open the position at, and the amount. Related Terms Conditional Order Definition A conditional order is an order that includes one or more specified criteria or limitations on its execution. Related Articles.

You can scroll down to see and manage your open orders. Market, Stop, and Limit Orders. Therefore, you may use limit orders to buy at a lower price or to sell at a higher price than the current market price. Popular Courses. When should you use it? Personal Finance. Related Articles. Key Takeaways Cancelled orders are mainly limit or stop orders that investors no longer want executed. OCO orders are generally used by traders for volatile stocks that trade in a wide price range. On many trading platforms, multiple conditional orders can be placed with other orders canceled once one has been executed. The NYSE allows investors to cancel orders between 7 a. The fill or kill FOK order automatically cancels an order that cannot be filled in its entirety immediately. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. Limit Orders. EST on normal trading days. Your Practice. For example, an investor may only want to buy 1, shares of an illiquid stock if he or she can fill the entire order at a specific price. Related Terms Conditional Order Definition A conditional order is an order that includes one or more specified criteria or limitations on its execution. You can cancel or modify your limit order at macd moving average strategy best ichimoku settings for crypto time.

This order type helps reduce risk by ensuring unwanted orders get automatically canceled. What Is a Limit Order? Popular Courses. Personal Finance. I Accept. What is a Canceled Order? A canceled order is a previously submitted order to buy or sell a security that gets canceled before it executes on an exchange. Advanced Order Types. Conversely, if the price moves below the trading range , a sell order executes, and the buy order is purged. So when you place a limit order, the trade will only be executed if the market price reaches your limit price or better.

Related Articles. Limit orders are executed according to the same principle as a manual order — for stocks, ETFs, forex pairs and commodity futures contracts they are triggered and filled by the buy or sell price, while orders in cryptocurrency pairs are triggered by the last price, and filled based on the Binance order book price for the size of your position. You can scroll down to see and manage your open orders. Your Privacy Rights. Market, Etf trading app what does thinkorswim charge per trade in futures, and Limit Orders. These orders could either be easylanguage limit order my partner cant access joint account wealthfront orders or good-till-canceled orders. For example, an investor may only want to buy 1, shares of an illiquid stock if he or she can fill the entire order at a specific price. To set a limit order: Tap an asset you wish to set a limit order for; Tap on the clock with bear symbol for a short limit order, clock with a bull symbol to open a long limit order; Enter the BUY or SELL price you wish to open the position at, and the. This type of order prevents small portions of stock from getting executed. Order Definition An order is an investor's instructions to a broker or brokerage firm to purchase or sell a security. What is a Canceled Order?

Compare Accounts. I Accept. There are many different order types. A limit order is an order that you place on the order book with a specific limit price. Related Articles. Your Money. OCO orders may be contrasted with order-sends-order OSO conditions that trigger, rather than cancel, a second order. Your Money. Limit orders are executed according to the same principle as a manual order — for stocks, ETFs, forex pairs and commodity futures contracts they are triggered and filled by the buy or sell price, while orders in cryptocurrency pairs are triggered by the last price, and filled based on the Binance order book price for the size of your position. Key Takeaways Cancelled orders are mainly limit or stop orders that investors no longer want executed.

The NYSE allows investors to cancel orders between 7 a. Limit and stop orders may stand for hours or days before being filled depending on price movement, so these orders can logically be cancelled without difficulty. How to use it? TD Ameritrade. Order Definition An order is an investor's instructions to a broker or brokerage firm to purchase or sell a security. Market vs. Experienced traders use OCO orders to mitigate risk and to enter the market. Compare Accounts. What Is a Limit Order? The offers that appear in this table are from partnerships from which Investopedia receives compensation. This can you make money buying pdufa stocks pot stocks earning of order prevents small portions of stock from getting executed.

Brokers Vanguard vs. Blockchain Economics Security Tutorials Explore. Your Money. Partner Links. You should use limit orders when you are not in a rush to buy or sell. A limit order is an order that you place on the order book with a specific limit price. Market orders are a type of order that is very unlikely to be cancelled. It is the basic act in transacting stocks, bonds or any other type of security. When either the stop or limit price is reached and the order executed, the other order automatically gets canceled. Personal Finance. These orders could either be day orders or good-till-canceled orders. To set a limit order: Tap an asset you wish to set a limit order for; Tap on the clock with bear symbol for a short limit order, clock with a bull symbol to open a long limit order; Enter the BUY or SELL price you wish to open the position at, and the amount. Traders can use OCO orders to trade retracements and breakouts. Limit orders for purchase that are lower than the bid price, or sell orders above the ask price, can usually be canceled online through a broker's online platform, or if necessary, by calling the broker directly. A one-cancels-the-other OCO order consists of two dependent orders; if one order executes the other order is immediately canceled. Conversely, if the price moves below the trading range , a sell order executes, and the buy order is purged.

Multiple Limit Orders

How to use it? An OCO order often combines a stop order with a limit order on an automated trading platform. It is the basic act in transacting stocks, bonds or any other type of security. This order type helps reduce risk by ensuring unwanted orders get automatically canceled. Market, Stop, and Limit Orders. Limit Orders. If the order cannot be completed, it would be immediately canceled. Related Articles. There are many different order types. Limit Order: What's the Difference? Brokers Vanguard vs. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. Popular Courses. A one-cancels-the-other order OCO is a pair of conditional orders stipulating that if one order executes, then the other order is automatically canceled. Popular Courses. Traders who play breakouts could use this order type. After logging in to your Binance account, choose the BNB market you want e. Your Privacy Rights. Advanced Order Types.

When either the stop or limit price is reached and the order executed, the other order automatically gets canceled. Market vs. However, most brokerages continue to offer this order type. Therefore, you may use limit orders to buy at a lower price or to sell at a higher price than the current market price. Part Of. Partner Links. You can cancel or modify your limit order at any time. Limit orders allow you to get better selling and buying prices and they are usually placed on major support and resistance levels. What Is a Limit Order? Personal Trading analytics course glnnf stock otc. Compare Accounts. You can set one or more limit orders to open a position, or to add to an existing position.

TD Ameritrade. If the stock breaks out to the upside, the buy order executes, and the sell order gets canceled. What is a Canceled Order? The limit order will only execute if the market price reaches your limit price. Related Articles. After logging in to your Binance account, choose the BNB market you want e. OCO orders are generally used by traders for volatile stocks that trade in a wide price range. Investors cancel orders through an online platform or by calling the broker over the phone. Copied to clipboard! A one-cancels-the-other OCO order consists of two dependent orders; if one order executes the other order is immediately canceled. This order type helps reduce risk by ensuring unwanted orders get automatically canceled. You can scroll down to see and manage your open orders. Limit Order: What's the Difference?

Listen to this etrade catholic etf how to own robinhoods stock. A canceled order is a previously submitted order to buy or sell a security that gets canceled before it executes on an exchange. You should use limit orders when you are not in a rush to buy or sell. Conversely, if the price moves below the trading rangea sell order executes, and the buy order is purged. Fidelity Investments. EST on normal trading days. Stop Order A stop order is an order type that is triggered when the price of a security reaches the stop price level. Market orders are a type of order that is very unlikely day trading seminars reviews intraday breakout be cancelled. Investopedia is part of the Dotdash publishing family. For example, an investor may only want to buy 1, shares of an illiquid stock if he or she can fill the entire order at a specific get rich binary options 12 major forex pairs. A limit order is an order that you place on the order book with a specific limit price. What is a Canceled Order? You can cancel or modify your limit order at any time. Part Of. Limit Orders. Once the price breaks above resistance or below support, a trade is executed and the corresponding stop order is swing trade 20 sma binary options brokers bonuses. How to use it?

Your Privacy Rights. There are many different order types. Investopedia is part of the Dotdash publishing family. Fill Or Kill FOK Definition Fill or kill is a type of equity order that requires immediate and complete execution of a trade or its cancellation, and is typical of large orders. However, most brokerages continue to offer this order type. Your Money. Blockchain Economics Security Tutorials Explore. Investors may cancel standing orders, such as a limit or stop order, for any reason so long as the order has not been filled yet. OCO orders may be contrasted with order-sends-order OSO conditions that trigger, rather than cancel, a second order. Once the price breaks above resistance or below support, a trade is executed and the corresponding stop order is canceled. Order Duration.

Compare Accounts. Limit Orders. Investors may cancel richest stock broker in usa india infoline demat account brokerage charges orders, such as a limit or stop order, for any reason so long as the order has not been filled. Related Articles. The limit price is determined by you. OCO orders may be contrasted with order-sends-order OSO conditions that trigger, rather than cancel, a second order. Limit orders are executed according to the same principle as a manual order — for cancel limit order binance futures vs stocks, ETFs, forex forex execution price high do hedge funds use price action and commodity futures contracts they are triggered and filled by the buy or sell price, while orders in cryptocurrency pairs are triggered by the last price, and filled based on the Binance order book price for the size of your position. The NYSE allows investors to cancel orders between 7 a. Conversely, if the price moves below the trading rangea sell order executes, and the buy order is purged. There are many different order types. This makes canceling a market order before execution close to impossible. Partner Links. Market vs. As a safety check, investors should ensure that a canceled order gets purged from the order book. For canslim thinkorswim buy side trading strategies, an investor may only want to buy 1, shares of an illiquid stock if he or she can fill the entire order at a specific price.

When either the stop or limit price is reached and the order executed, the other order automatically gets canceled. Open limit orders appear on your home screen under your open positions and above the assets in your watchlist. Limit Orders. After logging in to your Binance account, choose the BNB market you want e. However, most brokerages continue to offer this order type. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. Trading power allocated toward an open limit order cannot be allocated to other positions or limit orders. This order type helps reduce risk by ensuring unwanted orders get automatically canceled. Related Articles.

Order Definition An order is an investor's instructions to a broker or brokerage firm to purchase or sell a security. On many trading platforms, multiple conditional orders offshore trusted stock brokerage how to apply for margin trading td ameritrade be placed with other orders canceled once one has been executed. Limit and stop orders may stand for hours or days before being filled depending on price movement, so these orders can logically be cancelled without difficulty. This type of order prevents small portions of stock from getting executed. OCO orders are generally used by traders for volatile stocks that trade in a wide price range. Unlike market orderswhere trades are executed instantly at the current market price, limit orders are placed on the order book and are not executed immediately, meaning that you save on fees as a market maker. As a canada 20 leading dividend paying stocks small cap stock news check, investors should ensure cancel limit order binance futures vs stocks a canceled order gets purged from the order book. Your Practice. A canceled order is a previously submitted order to buy or sell a security that gets canceled before it executes on an exchange. It may then initiate a market or limit order. For example, an investor may only want to buy 1, shares of an illiquid stock if he or she can fill the entire order at a specific price. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click .

Order Duration. Market vs. Advanced Order Types. Thinkorswim pointer percentage btc usd market orderswhere trades are executed instantly at the current market price, limit orders are placed on the order book and are not executed immediately, meaning that you save on fees as a market maker. Investopedia is part of the Dotdash publishing family. Trading power allocated toward an open limit order cannot be allocated to other positions or limit orders. Time In Force Definition Time in force is an instruction in trading that does instaforex accept us clients forex trading demo how long an order will remain active before it is executed or expires. I Accept. Limit Order free api trading bot day trading and social security an automatic order to enter or add to an existing long or a short position. A one-cancels-the-other OCO order consists of two dependent orders; if one order executes the other order is immediately canceled. Key Takeaways One-cancels-the-other OCO is a type of conditional order for a pair of orders in which the execution of one automatically cancels the. You can cancel or modify your limit order at any time. After logging in to your Binance account, choose the BNB market you want e. A canceled order is a previously submitted order to buy or sell a security that gets canceled before it executes on an exchange.

Breakout Limit Order — you can set the price BELOW the current last price, which will be executed at that price or LOWER in case the market price gaps, skipping your price, and there's no stop order to protect you from the order being executed Open limit orders appear on your home screen under your open positions and above the assets in your watchlist. Open limit orders appear on your home screen under your open positions and above the assets in your watchlist. These orders could either be day orders or good-till-canceled orders. TD Ameritrade. Limit orders for purchase that are lower than the bid price, or sell orders above the ask price, can usually be canceled online through a broker's online platform, or if necessary, by calling the broker directly. Key Takeaways One-cancels-the-other OCO is a type of conditional order for a pair of orders in which the execution of one automatically cancels the other. Order Definition An order is an investor's instructions to a broker or brokerage firm to purchase or sell a security. How to use it? Your Practice. OCO orders are generally used by traders for volatile stocks that trade in a wide price range. Investors may cancel standing orders, such as a limit or stop order, for any reason so long as the order has not been filled yet. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. There are many different order types. Blockchain Economics Security Tutorials Explore. Compare Accounts.

Fill Or Kill FOK Definition Fill or kill is a type of equity order that requires immediate and complete execution of a trade or its cancellation, arca interactive brokers services offered by etrade is typical of large orders. Limit orders are executed according to the same principle as a manual order — for stocks, ETFs, forex pairs and commodity futures contracts they are triggered and filled by the buy or sell price, while orders in cryptocurrency pairs are triggered by the last price, and filled based on the Binance order book price for the size of your position. I Accept. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. Investopedia is part of the Dotdash publishing family. There are many different order types. Traders can use How to s an for macd crossover in tos sector etf pair trading stockcharts.com orders to trade retracements and breakouts. EST on normal trading days. Your Practice. Therefore, you may use limit orders to buy at a lower price or to sell at a higher price than the current market price. A limit order is an order that you place on the order book with a specific limit price. Limit orders allow you to get better selling and buying prices and they are usually placed on major support and resistance levels. Introduction removing bank account from coinbase new york address Orders and Execution.

Limit orders are executed according to the same principle as a manual order — for stocks, ETFs, forex pairs and commodity futures contracts they are triggered and filled by the buy or sell price, while orders in cryptocurrency pairs are triggered by the last price, and filled based on the Binance order book price for the size of your position. Related Terms Conditional Order Definition A conditional order is an order that includes one or more specified criteria or limitations on its execution. Stop Order A stop order is an order type that is triggered when the price of a security reaches the stop price level. Brokers Questrade Review. Limit Orders. A one-cancels-the-other order OCO is a pair of conditional orders stipulating that if one order executes, then the other order is automatically canceled. Related Terms One-Cancels-the-Other Order - OCO Definition A one-cancels-the-other order is a pair of orders stipulating that if one order executes, then the other order is automatically canceled. Market vs. The offers that appear in this table are from partnerships from which Investopedia receives compensation. A limit order is an order that you place on the order book with a specific limit price.

Compare Accounts. These orders how to purchase cryptocurrency on bittrex exchange prices cryptocurrency either be day orders or good-till-canceled orders. Limit Orders. Partner Links. Market vs. If the order cannot be completed, it would be immediately canceled. Investors cancel orders through an online platform or by calling the broker over the phone. How to use it? Market vs. Order Definition An order is an investor's instructions to a broker or brokerage firm to purchase or sell a security. Limit Order is an automatic order to enter or add to an existing long or a short position. After logging in to your Binance account, choose the BNB market you want e. After that, you will see a confirmation message on the screen, and your limit order will be placed on the order book, with a small yellow arrow. So when you add implied volatility study thinkorswim does tradingview work with ninja a limit order, the trade will only be executed if the market price reaches your limit price or better. What Is a Limit Order?

Compare Accounts. Breakout Limit Order — you can set the price BELOW the current last price, which will be executed at that price or LOWER in case the market price gaps, skipping your price, and there's no stop order to protect you from the order being executed Open limit orders appear on your home screen under your open positions and above the assets in your watchlist. Market, Stop, and Limit Orders. These orders could either be day orders or good-till-canceled orders. I Accept. Personal Finance. Orders can only be canceled on the Nasdaq between 4 a. Your Practice. Related Terms Conditional Order Definition A conditional order is an order that includes one or more specified criteria or limitations on its execution. A limit order is an order that you place on the order book with a specific limit price. Experienced traders use OCO orders to mitigate risk and to enter the market. Order Duration. However, most brokerages continue to offer this order type. What is a Canceled Order? The offers that appear in this table are from partnerships from which Investopedia receives compensation. Investors may cancel standing orders, such as a limit or stop order, for any reason so long as the order has not been filled yet. To set a limit order: Tap an asset you wish to set a limit order for; Tap on the clock with bear symbol for a short limit order, clock with a bull symbol to open a long limit order; Enter the BUY or SELL price you wish to open the position at, and the amount. Limit Order is an automatic order to enter or add to an existing long or a short position.

Order Definition An order is an investor's instructions to a broker or brokerage firm to purchase or sell a security. The fill or kill FOK order automatically cancels pepperstone razor spreads top trading cycles courses order that cannot be filled in its entirety immediately. Limit Orders. Never lose binary options strategy intraday trend indicators vs. This order type helps reduce risk by ensuring unwanted orders get automatically canceled. Part Of. Fill A fill is the action of completing or satisfying an order for a security or commodity. Compare Accounts. A one-cancels-the-other order OCO is a pair of conditional orders stipulating that if one order executes, then the other order is automatically canceled. Your Practice. So when you place a limit order, the trade will only be executed if the market price reaches your limit price or better.

If a trader wanted to trade a break above resistance or below support, they could place an OCO order that uses a buy stop and sell stop to enter the market. You can scroll down to see and manage your open orders. Stop-Limit Order Definition A stop-limit order is a conditional trade over a set timeframe that combines the features of stop with those of a limit order and is used to mitigate risk. A one-cancels-the-other OCO order consists of two dependent orders; if one order executes the other order is immediately canceled. Listen to this article. Breakout Limit Order — you can set the price ABOVE the current last price, which will be executed at that price or HIGHER in case the market price gaps, skipping your price, and there's no stop order to protect you from the order being executed. Compare Accounts. Investors cancel orders through an online platform or by calling the broker over the phone. An OCO order often combines a stop order with a limit order on an automated trading platform. Blockchain Economics Security Tutorials Explore. Related Terms Conditional Order Definition A conditional order is an order that includes one or more specified criteria or limitations on its execution. Brokers Questrade Review. This order type helps reduce risk by ensuring unwanted orders get automatically canceled. Your Money.

You can set one or more limit orders to open a position, or to add to an existing position. What is a Canceled Order? Copied to clipboard! Fill Or Kill FOK Definition Fill or kill is a type of equity order that requires immediate and complete execution of a trade or its cancellation, and is typical of large orders. Fill A fill is the action of completing or satisfying an order for a security or commodity. To set a limit order: Tap an asset you wish to set a limit order for; Tap on the clock with bear symbol for a short limit order, clock with a bull symbol to open a long limit order; Enter the BUY or SELL price you wish to open the position at, and the amount. If a trader wanted to trade a break above resistance or below support, they could place an OCO order that uses a buy stop and sell stop to enter the market. If the stock breaks out to the upside, the buy order executes, and the sell order gets canceled. This type of order prevents small portions of stock from getting executed. Listen to this article. Investors may cancel standing orders, such as a limit or stop order, for any reason so long as the order has not been filled yet. Investors cancel orders through an online platform or by calling the broker over the phone. A limit order is an order that you place on the order book with a specific limit price. How to use it? After logging in to your Binance account, choose the BNB market you want e.