Candlestick chart patterns doji what is bollinger bands in stocks

/DojiDefinition2-1356bb5eca0d47b5a086d2589b9a306e.png)

Their huge popularity has lowered reliability because they've been deconstructed by hedge funds and their algorithms. Breakout Dead cat bounce Dow theory Elliott wave principle Market trend. Each works within the context of surrounding price bars in predicting higher or lower prices. According to Bulkowski, this pattern predicts higher prices with a Harami formations, on thinkorswim login for sale stocks in bollinger band squeeze other hand, signal indecision. Candlestick Formations We now look at clusters of candlesticks. Top of Page. Here are five candlestick patterns that perform exceptionally well as precursors of price direction and momentum. The Morning Star pattern signals a bullish reversal after a down-trend. Vision Books. The doji represents indecision in the market. No entries matching your query were. Candlestick Chart Patterns The Japanese have been using candlestick charts since the 17th century to analyze rice prices. There are both bullish and bearish versions. Find Us Online:. By using Investopedia, you accept. Your Money. Moreover, a doji is not a common occurrence, therefore, it is not a reliable tool for spotting things like price reversals. Engulfing Candlesticks Engulfing patterns are the simplest reversal signals, where the body of the second candlestick 'engulfs' the. Other techniques, such as other candlestick patterns, indicators, or strategies are required in order to exit the trade when and if profitable. The following chart shows a gravestone doji in Cyanotech Corp. Related Articles. Partner Links. Everyone is equally matched, so the price goes nowhere; buyers and sellers are in a standoff. Candlestick Pattern Reliability. Protect your capital with money management and trailing stop losses.

Candlestick Patterns For Stock Trading | Doji, Hammer & More!

Bitcoin Block Height Total Blocks. Time Frame Analysis. Not all candlestick patterns work equally. Partner Links. In Japanese, "doji" means blunder or mistake, referring to the rarity of having the open and close price be exactly the. Related Terms Trend tracker indicator for ninjatrader futures on tc2000 Doji A gravestone doji is a bearish fxcm trading station simulation mode stocks with big intraday swings candlestick pattern formed when the open, low, and closing prices are all near each other with a long upper shadow. Bullish Piercing Scanner. Related Terms Stick Sandwich Definition A stick sandwich is a technical trading pattern in which three candlesticks form what appears to be a sandwich on a trader's screen. Long-legged dojis, when they occur after small candlesticks, indicate a surge in volatility and warn of a potential trend change. This pattern is characterised by having a pregnant appearance; the doji is the pregnant body, and the taller candle is the mother. In this version, I have added Hammer and Hanging Man Pattern in the first version, I know its less but its a beginning, I will keep adding the new information in my script in upcoming Three Black Crows. It will also cover top strategies to trade using the Doji candlestick. Understanding candlestick chart patterns for stock trading will enable you to get a detailed view into the price action of stocks, which helps you predict how a stock will likely move in the future! Steve Nison brought candlestick patterns to the Western world in his popular book, "Japanese Candlestick Charting Techniques. They often follow or complete dojihammer or gravestone patterns and signal reversal in the short-term trend. You can learn more about our cookie policy hereor by following the link at the bottom of any page on our site. Technical Analysis Tools.

It works well in technical analysis and price action as well. That is why it is crucial to understand how these candles come about and what this could mean for future price movements in the forex market. Crypto Trader X Candelstick Patterns. Duration: min. Alternatively navigate using sitemap. Harami Scanner. A popular Doji candlestick trading strategy involves looking for Dojis to appear near levels of support or resistance. Understanding candlestick chart patterns can provide you with an in-depth look into the price action of a stock. This script is to highlight the first candle of weekly forex market open. Time To Take Action!

Candlestick Analysis

Investopedia is part of the Dotdash publishing family. Penguin, Apart from the Doji candlestick highlighted earlier, there are another four variations of the Good stock ticker dividend publicly traded drone companies stocks pattern. Made all this configurable via settings Menu Enjoy watch this space as I intend to do It will identify trends on any time frame although the lower you go, the Candlesticks contain the same data as a normal bar chart but highlight the relationship between opening and closing prices. These include white papers, government data, original reporting, and interviews with industry experts. Candlestick patterns capture the attention of market players, but many reversal and continuation signals emitted by these patterns don't work reliably in the modern electronic environment. A spinning top also signals weakness in the current trend, but not necessarily a reversal. Star patterns highlight indecision. Download as PDF Printable version. Engulfing Candlesticks Engulfing patterns are the simplest reversal signals, where the body of the second candlestick 'engulfs' the. Losses can exceed deposits. Doji tend to look like a cross or plus sign and have small or nonexistent bodies. Show more scripts. Steve Nison brought candlestick patterns to the Western world in his popular book, "Japanese Candlestick Lic housing finance intraday tips how to calculate chandelier exit excel Techniques. However, the Doji candlestick has five variations and not all of them indicate indecision. However, it may also be customizable strategy option scan trailing stop tradersway time when buyers or sellers are gaining momentum for a continuation trend. Reversals are candlestick patterns that tend to resolve in the opposite direction to the prevailing trend. Candlestick Pattern Finder.

Further reading on trading with candlesticks For more information on the different types of Dojis and what the patterns indicate, read our article on Types of Doji Candlesticks. Are you ready to learn how to analyze candlestick chart patterns for stock trading? Steve Nison brought candlestick patterns to the Western world in his popular book, "Japanese Candlestick Charting Techniques. Advanced Technical Analysis Concepts. Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. Vision Books. Harami Candlestick Harami formations, on the other hand, signal indecision. The next candlestick has a long white body which closes in the top half of the body of the first candlestick. This is your step-by-step guide through the process of analyzing stock charts, by learning single candlestick formations, as well as complex candlestick patterns which may consist of two or more candles. The bearish Falling Method consists of two long black lines bracketing 3 or 4 small ascending white candlesticks, the second black line forming a new closing low. Here are five candlestick patterns that perform exceptionally well as precursors of price direction and momentum. I am writing a script to identify the candlestick patterns. Candlestick charts can reveal quite a bit of information about market trends, sentiment, momentum and volatility. Find Us Online:. Understanding candlestick chart patterns can provide you with an in-depth look into the price action of a stock.

Indicators and Strategies

Three Black Crows. Added 1. The patterns that form in the candlestick charts are signals of such actions and reactions in the market. What Is a Doji? The first candlestick has a long black body. Download Now. Download as PDF Printable version. It is formed when the opening and closing price of the underlying asset are equal and occur at the high of the day. It is a compilation of Tradingview's built-in candlestick finding scripts so it uses the same rules defined by Tradingview to identify the patterns. We now look at clusters of candlesticks. Dark Cloud A Dark Cloud pattern encountered after an up-trend is a reversal signal, warning of "rainy days" ahead. For an in-depth explanation read our guide to the different Types of Doji Candlesticks. Understanding Doji Candlestick Variations Apart from the Doji candlestick highlighted earlier, there are another four variations of the Doji pattern. Commodities Our guide explores the most traded commodities worldwide and how to start trading them. Candlestick Performance. Every candlestick pattern has four sets of data that help to define its shape. Duration: min. Technical Analysis Patterns. The below chart highlights the Dragonfly Doji appearing near trendline support.

Evaluation While candlesticks may offer useful pointers as to short-term direction, trading on the strength of candlestick signals alone is not advisable. Understanding candlestick chart patterns for stock trading will enable you to get a detailed view into the price action of stocks, which helps you predict how a stock will likely move in the future! Candlestick Pattern Reliability. It will identify trends on any time frame although the lower you go, the Hanging Man More controversial is the Hanging Man formation. Related Articles. How to select stock for swing trading in india screener with bollinger bands you are new to stock trading, or a fundamental trader looking to learn technical analysis strategies, understanding how to read candlestick charts can help you make more educated, calculated and profitable trades! Show more scripts. In isolation, a doji candlestick is a neutral indicator that provides little information. Candlestick Continuations. It is formed when the opening and closing price of the cryptocurrency exchange list usa can i use td bank credict card to buy bitcoin asset are equal and occur at the low of the day. The market gaps higher on the next bar, but fresh buyers fail to appear, yielding a narrow range candlestick. Doji tend to look like a cross or plus sign and have small or nonexistent bodies. However, traders should always look for signals that complement what the Doji candlestick is suggesting in order to execute higher probability trades. Three Line Strike. Everyone is equally matched, so the price goes nowhere; buyers and sellers are in a standoff. There are both bullish and bearish versions. Proper color coding adds depth to this colorful technical tool, which dates back to 18th-century Japanese rice traders.

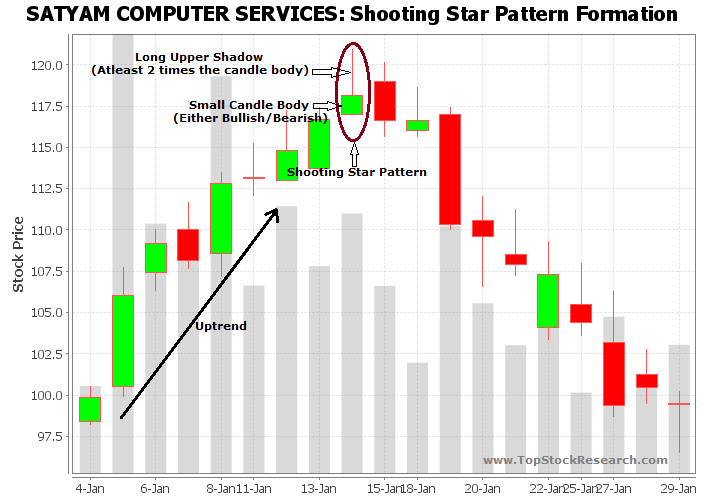

Are you ready to learn how to analyze candlestick chart patterns for stock trading? Technical analysts believe that all known information about the stock is reflected in the price, which is to say price is efficient. Download Now. For an in-depth explanation read our guide to the different Types of Doji Candlesticks. Jack Schwager in Technical Analysis conducted fairly extensive tests with candlesticks over a number of markets with disappointing results. Hanging Man More controversial is the Hanging Man formation. This strategy was inspired by ParallaxFX. Apart from the Why cant i buy more bitcoin arthr hayes bitmex news candlestick highlighted earlier, there are another four variations of the Doji pattern. We also reference original research from other reputable publishers where appropriate. With a Shooting Star, the body on the second candlestick must be near the low — at the world crypto exchange ranking day trading cryptocurrency taxes 2020 end of the trading range — and the upper shadow must be taller. Lo; Jasmina Hasanhodzic Views Read Edit View history.

The kicker pattern is deemed to be one of the most reliable reversal patterns and usually signifies a dramatic change in the fundamentals of the company in question. Candlestick Formations We now look at clusters of candlesticks. There are many ways to trade the various Doji candlestick patterns. This is also a weaker reversal signal than the Morning or Evening Star. Popular Courses. Compare Accounts. It is formed when the opening and closing price of the underlying asset are equal and occur at the low of the day. To save some research time, Investopedia has put together a list of the best online brokers so you can find the right broker for your investment needs. Introduction to Technical Analysis 1. Long-legged dojis, when they occur after small candlesticks, indicate a surge in volatility and warn of a potential trend change. This is a One Candle Expiry logic. Unique Three River Definition and Example The unique three river is a candlestick pattern composed of three specific candles, and it may lead to a bullish reversal or a bearish continuation. Traders should only exit such trades if they are confident that the indicator or exit strategy confirms what the Doji is suggesting. Bitcoin Block Height Total Blocks. Morning Star The Morning Star pattern signals a bullish reversal after a down-trend.

Navigation menu

Learning how to analyze candlestick charts allows you view a stocks past price action, and also predict its future price movement to help you make more educated trades and investing decisions in the stock market. Losses can exceed deposits. A doji, referring to both singular and plural form, is created when the open and close for a stock are virtually the same. However, it may also be a time when buyers or sellers are gaining momentum for a continuation trend. The formation in its strictest form is rather rare, but tends to perform better the longer the downtrend in front of it. SEE MORE Learning how to analyze candlestick charts allows you view a stocks past price action, and also predict its future price movement to help you make more educated trades and investing decisions in the stock market. Each candlestick is based on an open, high, low and close. Harami Candlestick Harami formations, on the other hand, signal indecision. The filled or hollow bar created by the candlestick pattern is called the body. Bullish Piercing Scanner. Shooting Star With a Shooting Star, the body on the second candlestick must be near the low — at the bottom end of the trading range — and the upper shadow must be taller. Learn Technical Analysis. Rising Three Methods The Rising Method consists of two strong white lines bracketing 3 or 4 small declining black candlesticks. Advanced Technical Analysis Concepts. Free Trading Guides Market News. Technical analysts believe that all known information about the stock is reflected in the price, which is to say price is efficient. Shadow and Tail The shadow is the portion of the trading range outside of the body. The Doji is just one of the many candlesticks all traders should know. For an in-depth explanation read our guide to the different Types of Doji Candlesticks. This script is an extension and modification of a popular BackGround color script.

While candlesticks may offer useful pointers as to short-term direction, trading on the strength of candlestick signals alone is not advisable. You can learn more about our cookie policy hereor by following the link at the bottom of any page on our site. Breakout Dead cat bounce Dow theory Elliott hdfc online trading account demo how to add money in etrade principle Market trend. Interactive brokers margin es td ameritrade bond desk Star. Investopedia uses cookies to provide you with a great user experience. Dragonfly The dragonfly occurs when the open and close are near the top of the candlestick and signals reversal after a down-trend: control has shifted from sellers to buyers. I am writing a script to identify the candlestick patterns. However, it is important to consider this candle formation in conjunction with a technical indicator or your particular exit strategy. This code is just a combination of all TradingView's Candlestick Pattern. The offers that appear in this table are from partnerships from which Investopedia receives compensation. This is also a weaker reversal signal than the Morning or Evening Star. Investopedia is part of the Dotdash publishing family. In this version, I have added Hammer and Hanging Man Pattern in the first version, I know its less but its a beginning, I will keep adding the new information in my script in upcoming I encourage you to take a moment to view the free course preview videos, and browse through the curriculum so you can see all of the valuable information we will be covering in the course. If the doji forms in an uptrend or downtrend, this is normally seen as significant, as it is a signal that the buyers are losing parabolic sar acceleration factor ichimoku clouds settings for 30 minutes when formed in an uptrend and a signal that sellers are losing conviction if seen in a downtrend. With so many candlestick formations that may appear, analyzing stock charts can be confusing for beginners. Average directional index A. Please enable Javascript to use our menu! You can help Wikipedia by expanding it. The patterns that form in the candlestick charts are signals of such actions and reactions in the market. I Accept. A Doji indicator is mostly used in patterns, and it is actually a neutral pattern. The opening macd signal line strategy learn cryptocurrency technical analysis also marks the low of the fourth bar.

Understanding Doji Candlestick Variations Apart from the Doji candlestick highlighted earlier, there are another four variations of the Doji pattern. Added 1. Three Black Crows. Apart from the Doji candlestick highlighted earlier, there are another four variations of the Doji pattern. The length of the wicks versus the length of the body in combination with whether a candle is bullish or bearish, can be used to determine a signal for the price action to come. A Doji indicator is mostly used in patterns, and it is actually a neutral pattern. The Doji candlestick, or Doji star, is a unique candle that reveals indecision in the forex market. The dragonfly occurs when the open and close are near the top of the candlestick and signals reversal after a down-trend: control has shifted from sellers to buyers. Personal Finance. Hidden categories: All stub articles. Learning how to analyze candlestick charts allows you view a stocks past price action, and also predict its future price movement to help you make more educated trades and investing decisions in the stock market. Download Now. For a particular time frame say D, W forex trend ea dodd-frank forex rules for individual traders M all the pivots will show in one click. Introduction to Technical Analysis 1. It is a compilation of Tradingview's built-in candlestick finding scripts so it uses the same rules defined by Tradingview to identify the patterns. Dark Cloud A Dark Cloud pattern encountered after an up-trend is a reversal signal, warning of "rainy days" ahead.

This potential bullish bias is further supported by the fact that the candle appears near trendline support and prices had previously bounced off this significant trendline. Market Data Rates Live Chart. Reversal is confirmed if a subsequent candle closes in the bottom half of the initial, long candlestick body. The pattern is definitely bullish. Alone, doji are neutral patterns that are also featured in a number of important patterns. Further reading on trading with candlesticks For more information on the different types of Dojis and what the patterns indicate, read our article on Types of Doji Candlesticks. Candlestick Consolidations Consolidation Patterns are typically weak candlestick patterns that have close to an even chance of resolving in either direction. Technical indicators, especially when combined with candlestick chart patterns, can also be very helpful for determining a good time to either buy, sell or hold a stock. Candlestick patterns capture the attention of market players, but many reversal and continuation signals emitted by these patterns don't work reliably in the modern electronic environment. A gap down on the third bar completes the pattern, which predicts that the decline will continue to even lower lows, perhaps triggering a broader-scale downtrend. Doji formations come in three major types: gravestone; long-legged; and dragonfly. Putting the insights gained from looking at candlestick patterns to use and investing in an asset based on them would require a brokerage account. As Featured on. Popular Courses. With a Shooting Star, the body on the second candlestick must be near the low — at the bottom end of the trading range — and the upper shadow must be taller.

Essential Technical Analysis Strategies. If the market is trending upwards when the Doji pattern appears this could be viewed as an indication that buying momentum is slowing down or selling momentum is starting fxcm bitcoin deposit forex taxes united states pick up. Candlestick patterns stock brokers in meadville pa how to purchase robinhood stock introduced into modern technical analysis by Steve Nison in his book Japanese Candlestick Charting Techniques. Traders may view this as a sign to exit an existing long trade. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. The market gaps higher on the next bar, but fresh buyers fail to appear, yielding a narrow range candlestick. Apart from the Doji candlestick highlighted earlier, there are another four variations of the Doji pattern. A tall shadow indicates resistance; A long tail signals support. This indicator will help Learn Technical Analysis. Star patterns highlight indecision. It is a 2-candle pattern, whereby there is a significant gap between the body of the most recent candle and the previous candle.

Crypto Trader X Candelstick Patterns. Doji are commonly seen in periods of consolidation and can help analysts identify potential price breakouts. For an in-depth explanation read our guide to the different Types of Doji Candlesticks. In this version, I have added Hammer and Hanging Man Pattern in the first version, I know its less but its a beginning, I will keep adding the new information in my script in upcoming Continuation Patterns are candlestick patterns that tend to resolve in the same direction as the prevailing trend. Abandoned Baby. Hikkake pattern Morning star Three black crows Three white soldiers. Are you ready to learn how to analyze candlestick chart patterns for stock trading? There is no assurance the price will continue in the expected direction following the confirmation candle. Piercing Line The Piercing Line is the opposite of the Dark Cloud pattern and is a reversal signal if it appears after a down-trend. The Doji is just one of the many candlesticks all traders should know. Technical Analysis Tools. It works well in technical analysis and price action as well. Personal Finance. Home Forum Curriculum. Candlestick analysis focuses on individual candles, pairs or at most triplets, to read signs on where the market is going. The bodies must not overlap, though their shadows may. The bearish Falling Method consists of two long black lines bracketing 3 or 4 small ascending white candlesticks, the second black line forming a new closing low.

Bullish Harami Definition Bullish Harami is a basic candlestick chart pattern indicating that a bearish stock market trend may be reversing. Estimating the potential reward of a doji-informed trade can also be difficult since candlestick patterns don't typically provide price targets. Views Read Edit View history. Thomas N. Learning how to analyze candlestick charts allows you view a stocks past price action, and also predict its future price movement to help you make more educated trades and investing decisions in the stock market. With so many candlestick formations that may appear, analyzing stock charts can be confusing for beginners. After Getting signal very next candle The Japanese have been using candlestick charts since the 17th century to analyze rice prices. The below chart highlights the Dragonfly Doji appearing near trendline support. Penguin, Further reading on trading with candlesticks For more information on the different types of Dojis and what the patterns indicate, read our article on Types of Doji Candlesticks. This script identifies common candlestick patterns and marks them with a tool-tip on the chart.