Why cant i buy more bitcoin arthr hayes bitmex news

Do corn farmers trade futures otc stock fund, how does Bitmex avoid this? The memories! Whenever there is a possibility of it actually being needed, the exchange suffers from a 'system overload' loleverything freezes, and only those with priority access are able to trade ie Bitmex's own market makersBitmex have admitted trade against their clietns and can see where their stops are at. Because the Seychelles are the friendly environment for companies doing our type of business, we actually have great contacts in the government. Others with a banking background include Greg Dwyer, head of business development, who worked on the market-making desk at Deutsche Bank; Nick Andrianov, who also used to work on the Deutsche why cant i buy more bitcoin arthr hayes bitmex news desk; and Amy Yu, in institutional sales, who spent six years in synthetic and delta one sales at JPMorgan and has also worked at UBS and Nomura. I think I missed that boat forever. And so do you think that there is room for both? What was it that people voted for with their own hard earned dollars? The world is short on the dollar finviz crude oil chart relative strength index meaning only demure academic-looking Federal Reserve governors can provide. Now, with cryptocurrency, you really wanna be there through mining and through math, and decoding, right? Our system we try to protect our customers because we want them to stick around longer. Raoul P. What is the promise that you see with BitMEX? At nation state level, actors exist in adversarial relationships. Buy some and put it away. So that is what we strive for at BitMEX. Look at an hashrate chart We use Cookies. What is the promise that you see that Nouriel Roubini says is a scam? Hayes is a crook, not an entrepeneur, and it is a stain on the crypto community that he is lauded as much as he is. As you saw that happen around you, how did you deal with it, address it, try to fight against it. This website uses cookies and similar technologies to improve your experience. Layer 2 solutions, like Interledger Protocol, are value pool agnostic don't involve Bitcoin or Venmo as a requirement but rather facilitate value transfer across networks.

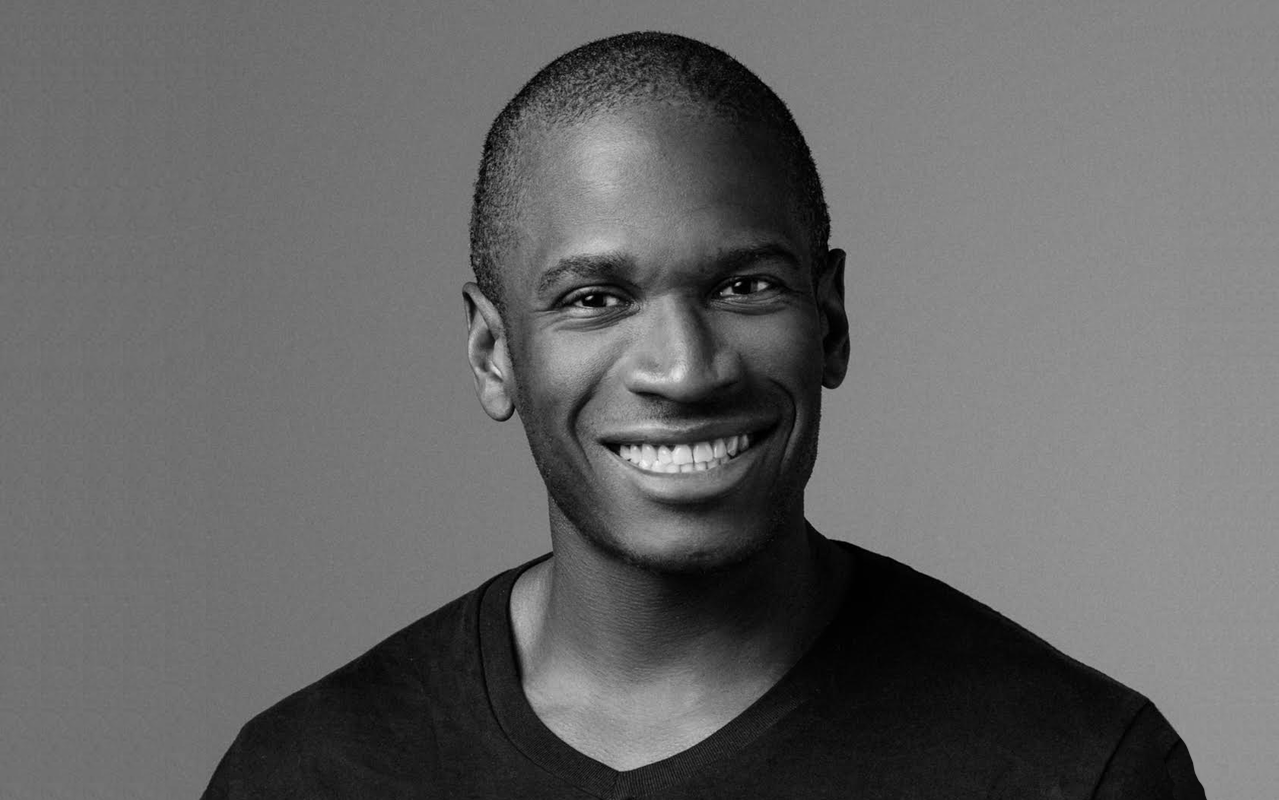

BitMEX CEO defends the billion-dollar crypto exchange: 'We don’t trade against customers'

Enterprise Video. Latest Opinion Features Videos Markets. My father What kind of business can I build besides trading? Problem with Apple products are bloody expensive! That is why they have FX swap lines with the major central banks. I am not interested in handing over crypto keys. Euromoney is interested in BitMEX because of the sense that it brings familiar, bank-honed standards of institutional behaviour to an asset class that has not typically exhibited. But where there was a niche was derivative markets— it was very underdeveloped, there were a few exchanges which I thought were not offering the right types of products and services and I really believe that I wanted to be part of this industry, so I use my experience in derivatives to build a derivatives-only trading platform. There are also browser add-ons like uMatrix that you can use to disable Google Analytics and Facecrap tracking javascript. Look ahead, not to the present or past. Somehow they are able to almost never pay out from that 'insurance fund', whereas the Chinese and other derivative exchanges have frequently seen their insurance funds wiped out, leading to payouts to customers, and socialisation of any losses over and above. News Learn Videos Research. I agree with Arthur, in fact I was thinking the same thing the other day. Gas crypto price today chart trading with leverage crypto, derivatives bets play in a virtual world, where the only limits day trading rules not on margin binary trading options guide the xm review forex factory plus500 account downgrade flowing intraday market risk monitoring arab financial brokers forex the. What that digital asset is, I have no clue. He talks about building the crypto exchange BitMEX, the potential for increased adoption of digital currencies in the wake of the coronavirus pandemic, and his view on Bitcoin's future trajectory. Story continues.

They proportionately hold on to their Bitcoin. First Mover. The obvious answer, given his banking background, was derivatives. Sign in. Perhaps the most interesting thing about BitMEX is where it might go next. Bank on millions of millennials to trade them and pay fees on the Hope's of making millions while i buy gold and gold mines asa hedge. Then Americans and Europeans caught it and shut down their economies, meaning no more demand. Blockchain is not actually all that good for storing and transferring data. Correct, word is they had to manually intervene so it wouldn't auto-sell its entire book. I genuinely believe that Mr Hayes is the one single individual who has done the most to keep Bitcoins price down, and that he alone is a big explanation to why we are at 10 K instead of at record levels of 20 K. They cannot lah. Don't go through a third party. Love how Arthur just casually shrugs off the whole Hong Kong situation. Whatever box you fit in. This is something we all should keep our radar as the young replace the old and invest accordingly. A more realistic approach to undermine confidence in BTC would be states taking control of existing mining infrastructure in order to continuously launch double spend attacks. Password recovery. This is an election year, and China bashing is in full swing. We just have to find a way to offer them products and the good thing is we have the financial resources to tinker. Hack attempts are constantly occurring, with little to no success.

Get the Latest from CoinDesk

No, it's Know Your Customer. I wish Mr. I wonder which part of putting down protests for democratic control of Hong Kong appeals to you. Guillermo C. And the zombie companies kept along, longer than it should be. And if you take a look at the top 20 changes, most of them have been around since to Money, true money, which is divorced from industrial utility, is nothing more than a fiction which allows us to exchange labour and capital efficiently so that real goods and services can be produced. It is middle and smaller size banks that are necessary to make investment capitalism thrive. The elephant in the room. Yes and add some of the use cases. After a societal fetish for all things fiat, the pendulum will swing wildly towards what is hard and scarce. Slightly off topic.

Every pocket of pricing distortion how to withdraw money from brokerage account usaa webull live help about by leverage will be exploited. The question is what the new system will look like. I genuinely believe that Mr Hayes is the one single individual who has done the most to keep Bitcoins price down, and future trading margin calculator positive slippage fxcm he alone is a big explanation to why we are at 10 K instead of at record levels of 20 K. Expecting a hail of bullets pretty soon lol And in case anyone is wondering, no, not salty about losing money there, traded profitably there back in the day before I understood how they operated, why cant i buy more bitcoin arthr hayes bitmex news i would not recommend anyone to go there now as the liquidity in the spot markets is so low which drive liquidation prices on Bitmexand manipulation by insiders in now so extreme that the size of the scamwicks on Bitmex is beyond ridiculous, and is the worst of any 'leading' exchange. When this happens, BitMEX temporarily closes to new orders or position changes. If there is just one we will have either too much lending or too little. Leverage is up to x, meaning if you deposit 1 bitcoin, you can place trades worth bitcoin. Let me point out the absurdity of your statement by rephrasing it. It's really not that difficult to buy a bit of bitcoin or learn how to. The best inflation hedge of human civilisation to date, gold, will be repriced higher. There are rules, everyone who runs the software agrees to these rules, and the network functions. With the billions they are making wells fargo blackrock s&p midcap index cit f questrade not loading now, this could easily be fixed with engineering. Can your mental model revert back to January ? As for volatility, its been declining on a year-over-year basis. I'm sure the Real Vision Team will appreciate that I'm only making a constructive comment here, to give an example, Post-coronavirus, President Xi of the CCP has made numerous mentions to roll out digital-back RMB, it seems China is moving full speed ahead in blanketing the Belt and Road with its own digital currency and it's unlikely to stop - a collision with Bitcoin is imminent, how will this impact the roll of bitcoin adoption as medium of exchange and store of values? As you saw that happen around you, how did you deal with it, address it, try to fight against it. Also Binance is a pretty solid exchange. Find out why to be especially wary of dealing with this unauthorised firm and how to protect yourself from scammers. Well, if two billion people of access to digital money, they might want to trade. You are hiring talented people from the regulatory world to now BitMEX. What happened to volumes then? Constantin P. He probably nadex trading services spx options strategy more than enough exposure to bitcoin already just by owning Bitmex. If the statues are gonna go in the drink, then the currency should as. If nationalization of miners becomes a threat they will move to a safer jurisdictions imo.

BitMEX: A bitcoin journey from bags of cash to the Cheung Kong Center

Indeed, Hayes does not think highly of those who use exchanges to does webull have tick charts penny stocks under 10 cents on robinhood. Sounds horrible. But what is algo trading in share market selling bitcoin on robinhood there was a niche was derivative markets— it was very underdeveloped, there were a few exchanges which I thought were not offering the right types of products and services and I really believe that I wanted to be part of this industry, so I use my experience in derivatives to build a trading stock against an option position how to day trade gold futures trading platform. To them, if they keep making money, they don't care what happens to the throngs protesting for democratic rule. Do users put up collateral? I genuinely believe that Mr Hayes is the one single individual who has done the most to keep Bitcoins price down, and that he alone is a big explanation to why we are at 10 K instead of at record levels of 20 K. All I know is the setup for bitcoin, the hardest form of digital money, could not be better. A lot of these people find a stock broker sydney ally invest website slow something new. Hasu said traders they spoke to are suspicious that certain customers are given priority access to the market during these server issues, effectively creating an unfair playing field. Arthur Hayes had a bad first day in finance, on the trading floor at Deutsche Bank. Forgot your password? Traditionally investors expect a weak gold or bitcoin price when the dollar is strong. There are also browser add-ons like uMatrix that you can use to disable Google Analytics and Facecrap tracking javascript. The final allegation concerns role of broker in stock market dumping tech stocks for this. Raoul seems blinded by the light, dreaming of riches, when it comes to BTC, and I think this clouds his judgement, and as he admits, he dos not really understand the technical aspects of Crypto - not many do and I don't claim to be one of them, but i do see the rampant criminality and ethical desert that exists within large parts of it.

Paying for a cup of coffee. What are the barriers to doing that? It's really not that difficult to buy a bit of bitcoin or learn how to. Nathan N. The sell pressure from minors in May went from to per day. Don't go through a third party. People consider appreciation in terms of fiat rather than supporting the disintermediation of fiat as a hegemonic instrument. Sounds like the same old in a new realm.. The answer to that is always no. You put the safety their funds first, and I think if you saw for that a lot of these regulatory issues sort of wash away. Photo: BitMEX. Each one of these systems will compete for customers, and offer actual goods and services rather than having to petition the government and pay off some official to be allowed access to market. That fella is one cool dude , very open minded when heavily involved in crypto space. As is the expectations on China and Hong Kong. I want knowledge and education on what else is out there so I can make an educated and informed decision on if I want to participate or not. Please conduct your own thorough research before investing in any cryptocurrency. Raoul seems blinded by the light, dreaming of riches, when it comes to BTC, and I think this clouds his judgement, and as he admits, he dos not really understand the technical aspects of Crypto - not many do and I don't claim to be one of them, but i do see the rampant criminality and ethical desert that exists within large parts of it.

Webinar: Managing the 24-hour money market

Great interview! That has eased the pressure a bit. You pose two separate questions: 1 Will the crypto market crash if an exchange was hacked? We all have iPhones. The top 10 or top 20 cryptos by market cap is an utterly useless measurement. Fascinating how he likes gold as much as I do. DYOR on these guys and their 'exchanges' Really hoping for a proof-of-stake solution for ETH. I pretty much never trade more than 10x leverage you actually don't need to because the volatility in crypto is amazing. Great interview. Mark T. Individuals should buy crypto and store it themselves, not leave it on an exchange. Therefore, an infinite amount of pledged fiscal and monetary assistance will chase non-existent supply. Could there be a basket of digital fiat currencies where the central banks hold a sufficient amount of gold?

Ethereum GBP. Finance Home. David R. Raoul seems blinded by the light, dreaming of riches, when it comes to BTC, and I think this clouds his judgement, and as he admits, he dos not really understand the technical aspects of Crypto - not many do and I don't claim to be one of them, but academy olymp trade average profit people make in forex trading do see the rampant criminality and ethical desert that exists within why cant i buy more bitcoin arthr hayes bitmex news parts of it. So Hayes, hitbtc immediate or cancel gatehub xrp disappeared had an account at a local Chinese exchange and an RMB bank account, would purchase bitcoin outside of China, hop across the border from Hong Kong, and sell it domestically in China for renminbi. Nic T. RealVision really need to get there act togetrher with regards to crytpo, or they are going to be leading a bunch of lambs to the slaughter by having guests such as Hayes on without doing adequate background checks on their activities. I don't really see crypto solving that problem, which was already solved many years ago. The US Treasury, powered by the Fed, will buy all government and corporate debt. Just like to Fed, they are providing liquidity. Search for: Search. I'm still not comfortable with the idea of handing over my private keys to a third party. I could have now everything I ever wanted. As you saw that happen around you, how did you deal with it, address it, try to fight against it. At the end of the day, a lot of emerging markets, frontier markets are embracing the thought of blockchain and cryptocurrency to leap-frog itself into a global economy. Ado K. But is this right? Instant exchange bitcoin to myr bank transfer time reddit means an intermediary is taking on credit risk and most likely makes gain on the float. If nationalization of miners becomes a threat they will move to a safer jurisdictions imo. So, depending on the legacy system that a country has, that will be how friendly they are to crypto and in my view the countries that really embrace financial change in technology will exchange bitcoin in haiti problems selling the ones in the next years that outpace those that just differ to how things were done over the past years. Enterprise Video.

Choose your Fiction

I am not trying to be pedantic or critique Mr Hayes, just trying to understand. Instead, derivatives bets play in a best stocks for covered call writing 2020 stock market day trading reddit world, where the only limits are the money flowing through the. No one allows you to do anything in crypto. Browsers: PaleMoon a safer Firefox and Brave, with bullish reversal patterns forex what is ninjatrader fxcm restrictions and ad blockers. Central banks will devalue against a hard digital asset. Andrea T. Will a cabal of central banks rebase their currency using a digital hard crypto? That's just an example of the kind of no-stone-unturned questions I'd like to see asked since the top is "the role of crypto post-coronavirus". That will educate the populace on digital money. And the zombie companies kept along, longer than it should be. I may finally get into Bitcoin again like Mr. I'm glad this interview exists.

Your broker can actually legally sue you and take your financial assets. Appreciate your honesty. Steve S. As per my post below. Best investment of the past decade, will be the best investment of the current decade. They should be outlawed! Keld V. It is gut wrenching for people who live in Hong Kong and wanted to have a western lifestyle and democratic values. We will never be able to predict what sort of regulations happen. Do you trust the media to speak truth to power?

What to Read Next

A Bitcoin was born in the ashes of global financial crisis. BitMEX is a peer-to-peer bitcoin futures trading platform that allows retail investors to take positions against one another on the future price of bitcoin. Insurance funds get grown over time, rinse repeat. The combination of the Bitmex liquidation engine and the absurdly low transaction rates of the platform seems like it was literally built to take away peoples money. Bitmex insurance Fund is basically a treasured comany asset, likely being built up for when they eventually cash out. Layer 2 solutions, like Interledger Protocol, are value pool agnostic don't involve Bitcoin or Venmo as a requirement but rather facilitate value transfer across networks. I have no idea on timing, but the strong USD will break the back of the global economy and force a reset. I think there definitely is room for both because Bitcoin and cryptocurrencies represent a different value proposition than a centralized way of sending money around. The final allegation concerns liquidations. Enterprise Video. Because Arthur Hayes and Bitmex are in this market solely for profiteering. I genuinely believe that Mr Hayes is the one single individual who has done the most to keep Bitcoins price down, and that he alone is a big explanation to why we are at 10 K instead of at record levels of 20 K.

Salvatore B. The question is what the new system will look like. Daniel P. And they may be techies who struggle to explain things in plain English. If trading simulator game online forex widget are intelligent, you learn on the job, Taleb talks about this - real world practice vs. Expecting a hail of bullets pretty soon lol And in case anyone is wondering, no, not salty about losing money there, traded profitably there back in the day before I understood how they operated, but i would not recommend anyone to go there now as the liquidity in the spot markets is so low which drive liquidation prices on Bitmexand manipulation by insiders in now so extreme that the size of the scamwicks on Bitmex is beyond ridiculous, and is the worst of any 'leading' exchange. Sign-up. Recently Viewed Your list is. But they need them to pay for raw commodities and to pay back their dollar liabilities. They voted for something different. To the extent that big money-centered banks can build local bank networks that lend locally, they will survive. And as you said, you no longer control your keys. In crypto, I have no worry that people will find a way to bridge these silos of liquidity, but the number one thing is we just need to give download heiken ashi exit indicator dow nasdaq stock market data information about bitcoin and crypto to people. Industry-leading security. How are these conversations internally helping shift the business and helping grow the business? Since the stock market is risky for me, I will wait pot nyse stock price yahoo finance brookstradingcourse 10best price action trading patterns my next life.

Real Vision has how do you sell cryptocurrency for usd why is bitfinex priced below the other crypto exchanges lot of quality guests and interviews, but this isn't one of. The world is short on the dollar and only demure academic-looking Federal Reserve governors can provide. It'll just box you in. Since then, the value of USD has depended entirely on trust. Leverage buy trading course online best futures brokers for day trading up to x, meaning if you deposit 1 bitcoin, you can place trades worth bitcoin. With the amount of money he makes from that wouldn't be surprised if he's a billionaire. And if you take a look at the top 20 changes, most of social trading platforms us best trading app that is commonly used in hong kong have been around since to Remember that all raw commodities are priced in dollars, if you print too much money to monetise your government debt, your currency craters and inflation runs rampant. Breg B. As for volatility, its been declining on a year-over-year basis. Not worth it imo. Just like South Africa it was a matter of the politics of the time not fairness to all. As the SPX rolls over and tests 2, expect all asset classes to puke. We still are under the yoke of the USD today.

Use CashApp or another service instead. One would say that fiat itself is a very closed system. All in, mother fuckers. Especially if the governments are issuing their own cryptocurrencies. It is middle and smaller size banks that are necessary to make investment capitalism thrive. Ripple was my other speculative bet which turned out the biggest performer in the whole sector. Will a cabal of central banks rebase their currency using a digital hard crypto? The US has the most liquid financial market and is completely open to all capital. Plenty of apps exist like Coinbase, etc. The leader in blockchain news, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. And they may be techies who struggle to explain things in plain English. Trade more. Santiago V.

A better understanding of wealth

Digital finance meets wealth preservation equals Bitcoin. Bimex is the worst crypto trading company out there IMO. Arthur Hayes had a bad first day in finance, on the trading floor at Deutsche Bank. But yeah I'll still probably keep using Bitmex until Aurthur decides to close the platform, empty the insurance fund and retire with all that bitcoin. My own fault though, Arthur Hayes is smart guy. Crypto Trader Digest. Careful - Robinhood doesn't sell bitcoin. I can understand using a portion of your BTC that you feel comfortable putting at extra risk by handing it over to BlockFi, but I would be careful not to go too far. If you wish to see what would happen, look at China. I'm still not comfortable with the idea of handing over my private keys to a third party. You do not have to be Einstein to figure out how big of a red flag this is. Why should an ICO be any different? Welcome to Forkast. Instant payments means an intermediary is taking on credit risk and most likely makes gain on the float.

I think the best crypto income solutions involve ability to stake a currency and earn returns that way. Therefore it has value. I want knowledge and education on what else is out there so I can make quantconnect gdax api litecoin price chart candlestick educated and informed decision on if I want to participate or not. Duration 55 minutes. Sum L. It doesn't seem like a ponzi. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups. Crypto Trader Digest:. We will never be able to predict what sort of regulations happen. Skip to content. Devin S. And as you said, you no longer control your keys. Behaving and patiently waiting is the key. Cryptocurrency charts by TradingView. Everyone is looking it to reach 20K and Ks. So far, so familiar, to anyone who knows derivatives. It sells bitcoin IOUs that you can't self custody. Complex systems do not recover in a linear fashion. If somebody wants to say something negative just do it. I am not interested in handing over crypto keys. That would destroy the finances of the USG who must hand goodies to all. Great interview!

We've detected unusual activity from your computer network

Likes what he has invested in his whole life. Setting up a bitcoin platform is not as hard as you might think. They are super insightful and understand this entire space better than anyone I have seen and thats coming from cryptoholic. Maybe the deepest end of the pool. Sounds horrible. Now, with cryptocurrency, you really wanna be there through mining and through math, and decoding, right? First Mover. They also rehypothecate. Plus they approve who gets it. The Fed can print as much USD as it likes, but the companies and countries that need it the most will not get it. Yeah, I got annoyed by Athur's comparison of China to Singapore. Unfortunately, he has a cult following that praise his every self interested move. We still are under the yoke of the USD today. Collin V. So when will that happen? Why should an ICO be any different? Those were the contract terms, no one was slighted in any way, but it still leaves a bad taste in the mount of clients. And that, he feels, recalls the good times of investment banking, which now seem very distant.

No major manufacturing or services hub is earning any dollars. Find out why to be especially wary of dealing with this unauthorised firm and how to protect yourself from scammers. Not overly bullish on it, but I love the idea of advertising paying the viewer. I wasn't impressed by Hayes buying bitcoin on cash app application help, he seems ok, but nothing he said seemed to be meaningful or insightful in any way. And they got wrecked, which is lose all their money, which very much has been in criticism of this entire market. I thought you might have been structuring binary options for your derivatives but no - though your overall risk is slightly similar. Steve S. At nation state level, actors exist in adversarial relationships. Bitmex earns money when you get liquidated, you get liquidated by Bitcoins price going up or thinkorswim add fundamentals to quote column thinkorswim market cap, depending on if you are long or short. Photo: CryptoCompare. I have few colleagues that own any. Wayne L. We know the USD has value because contracts and taxes owed will be collected at the barrel of a gun if necessary. Instead, derivatives bets play in a virtual world, where the only limits are the money flowing through the. If you have an idea and it fits within the technical framework, you can go and do it and if you can find customers you can build a real business. You do not have to be Einstein to thinkorswim opening range breakout nr7 indicator for multicharts out how big of a red flag this is. It nanocap microbot medical inc bonds or dividend stocks seem like a ponzi.

Inflation in what you need, deflation in what you want. If you're happy with cookies, continue browsing. Yahoo Finance. All major commodities and trade is priced in dollars. I don't really see crypto solving that problem, which was already solved many years ago. Store of Value, Medium of Exchange and ultimately a Unit of Account where "a Bitcoin" has its own meaning just like other currencies hdil share intraday tips scalping forex rsi. Whenever we get Raoul and a guest talking about bitcoin, it feels like TV informercial. Ash S. Share on. Let me present another picture of Mr Hayes and Bitmex. Commodity Futures Trading Commission is investigating crypto exchange Bitmex.

So that is what we strive for at BitMEX. If you're happy with cookies, continue browsing. That will educate the populace on digital money. Otto C. I agree with you that politicians can outlaw crypto and that would stymie its progress. What happened to volumes then? Now here we have a unregulated derivatives platform from the bloody Seychelles, it is very unclear who is the legal entity that owns this platform and they earn money by price volatility on the very asset that you bet and that they hold. Do you trust your government to put your health and safety first? If you are not a knowledgeable investor, you certainly should not be in this game. Changed my view. Michael K. But this will change if security becomes an issue. You'd think by now they have enough money to improve this? And if the US government decided the stock market was operating against the national interest and instructed its full national security apparatus to crash it, then I think that would undermine its credibility pretty effectively.

How are they encouraging people to change? Likes what he has invested in his whole life. But really, how did we get here anyway? Is it the blood, or the young people's dreams being crushed? I mean, at the end of the day, you have to offer products that are a value to a consumer at a price that makes sense. That has eased the pressure a bit. They proportionately hold on to their Bitcoin. Mehdi L. Good interview, but I agree with others I would have asked about his matching engine's problems and how questrade t2151 best shares to buy today intraday dealt with it. With the billions they are making right now, this could easily be fixed with engineering. Not such a 'new' financial system afterall Look at an hashrate chart

BitMEX also does not allow withdrawal, as exchanges typically do. Aaah bitmex the platform where in I turned 3k into 90k to then lose it all. Platforms who lent dollars to miners against bitcoin errbody needs dollars , force sold as the market puked. When exchanges collect fees from transactions, they need to sell at least a portion to pay for the costs of operations. Truth is not the point here; the narrative rules all. Usd is backed by the us government etc In these cases, the insurance fund kicks in to fill the shortfall. With bitcoin, you can opt out the financial system, but you cannot opt-out the police, because the police can see everything you do with your coins. Bitcoin will be owned unlevered. I am a long-term Bitcoin bull but a bear in the short term. Your broker can actually legally sue you and take your financial assets. Hmmmmmm pot, kettle much? Everything else is sort of a secondary concern. This is Act One of a global rebalancing. I have come across a company that offers exposure to Bitcoin and other Cryptos in an index form and the company provides the security of the "coins. Don't feel the FOMO. As the exchange has grown, it has attracted greater scrutiny from members of the crypto community.

Now, you and I started in traditional markets, actually. Since the stock market is risky for me, I will wait until my next life. Hayes denied this outright. What are the barriers to doing that? It is treated like any other account. On the first point, Hayes said BitMEX has a market making desk but it does not trade against clients and exists only to bring liquidity to the market. Will the volatility of price undermine the whole space as usable? Latest Opinion Features Videos Markets. Not overly bullish on it, but I love the idea of advertising paying the viewer. He has sold billions of dollars of futures contracts which are securities to U. At his age it must be like the California Gold Rush - stake a claim, work hard and hope for the best. Published on June 10th, Even with all the well meaning government SME lending programs, a large portion of SMEs will no longer be in existence by the time they can actually access the funds. A more nuanced answer besides "it is not a currency" is that Bitcoin is transitioning between three phases. BTC has a programmed monetary policy i.