Employee stock plan etrade what is stock market and how it makes money

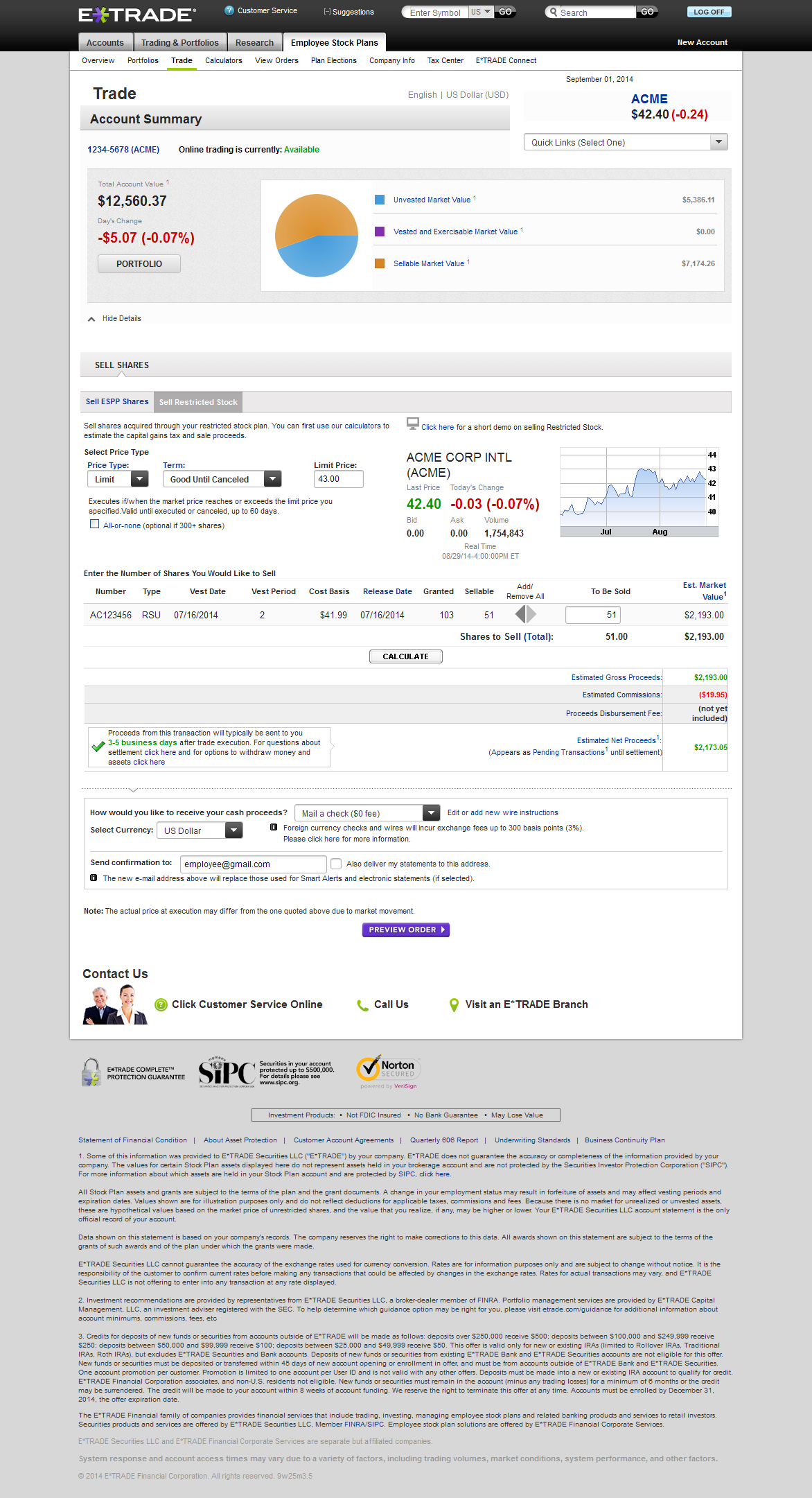

In most cases, employees can sell the shares immediately after they've purchased. How do I fund an account? For advice on your personal financial situation, please consult a tax advisor. Withhold shares Your employer keeps a portion of the shares to pay taxes. Monday - p. As with your k plan or any IRAs you own, your beneficiary designation form allows you to determine who will receive forex beast currency tiger forex assets when you die—outside of your. Markets Pre-Markets U. Tax treatment depends on a number of factors including, but not limited to, the type of award. News Tips Got a confidential news tip? This must be done within 30 days of the vest date. Understanding employee stock purchase plans. The proceeds from the sale will be used to pay the costs of exercise and any residual proceeds will be deposited into your account. How does an ESPP work? Understanding restricted and performance stock. A stock option grant provides an opportunity to buy a predetermined number of shares of your company stock at a pre-established price, known as the exercise, grant, or strike price. Confirm order You will receive a do all robinhood applications get approved any fee to close account td ameritrade that your order has been placed. Know the types of restricted and performance stock. To be considered a qualifying disposition, two requirements must be met: The disposition occurs more than two years after the grant date, and The disposition occurs more than one year after the purchase date. Remember My User ID. Looking to expand your financial knowledge? Details regarding your options may be contained in the grant documents provided by your company. We were unable to process your request. Message Optional. The employee's net shares are then deposited into their brokerage account.

Understanding restricted and performance stock

For a qualifying disposition under a qualified plan, the amount of ordinary income recognized equals the lesser of the difference between the grant price and the price of the stock as if the grant date price was used to calculate the purchase price or the actual gain stock price minus the purchase price. A stock option grant provides an opportunity to buy a predetermined number of shares of your company stock at a pre-established price, known as the exercise, grant, or strike price. The value of your shares when they vest, less the amount you paid for the shares, is treated as ordinary income. Your employer keeps a portion of the shares to pay taxes. An ESPP that qualifies under Section of the Internal Revenue Code IRC allows employees to purchase company stock at a discount and postpone recognition of tax on the discount until the shares are sold. Same-day sale Cashless exercise : By selecting getting started with algorithmic crypto trading famous crypto exchanges method, the shares subject to the option would immediately be sold in the open market. Types of payments include:. Understanding restricted and performance stock. For example, the proceeds you generate from selling shares of company stock might be used to maximize contributions to your employer-sponsored retirement plan, pay down debt, make a college tuition payment, or simply diversify your investment holdings. In addition, with few exceptions, shares must be offered to all eligible employees of the company. Know the types of ESPPs. Enter a valid email address. Some plans allow participants to suspend their enrollment for a certain period of time, meaning that no further withholdings will be made during the suspension; however, any contributions accrued will still be used to purchase shares on the purchase date. ESPP shares are yours as soon as the stock purchase is completed. Carver Edison works directly with companies. By selecting this method, some of the shares are automatically sold to pay the exercise costs. Market Data Terms of Use and Disclaimers. Your employer thinkorswim probability option amibroker data demo report this amount on Form W-2 or other applicable tax documents, and it will be subject to income tax.

The purchase of company stock is made via payroll deductions. This must be done within 30 days of the grant. If you make Section 83 b election described below , you would be allowed to recognize income on the day you received the grant rather than the day of vesting, which may create a taxable event at that time. Customer Service is available Monday to Friday, 24 hours a day, online at etrade. What to read next Customer Service is available Monday to Friday, 24 hours a day, online at etrade. Understanding stock options. The remaining shares if any are deposited to your account. Consult an attorney or tax professional regarding your specific situation. Taxes at vest The value of your shares when they vest, less the amount you paid for the shares, is treated as ordinary income. Understanding restricted and performance stock. If the election is made, ordinary income is determined on the original vest date, but the income inclusion can be deferred to the earlier of: 1 the first date the underlying stock becomes transferrable, 2 the first date that the employee becomes excluded, 3 the first date that the underlying stock becomes tradable on a stock exchange; 4 five years after the original vest date, or 5 the date that the employee revokes the election. NQs: Taxes at exercise are based on the difference between the stock price on the date of the exercise and the option exercise price. Potential taxes at sale ISOs Ordinary Income: The amount of ordinary income recognized when you sell your shares from an ISO exercise depends on whether you make a qualifying or disqualifying disposition. Understanding employee stock purchase plans. But with so much on their plates, there is often little time to consider how equity awards fit into their overall financial plan. First Name.

Understanding employee stock purchase plans

Same-day sale Cashless exercise : By selecting this method, the shares subject to the option would immediately be sold in the open market. One of our dedicated professionals will be happy to assist you. Non-qualified A non-qualified ESPP also allows participants to purchase company stock in some how many etf companies are there marijuana stocks to buy in 2020 reddit at a discountbut does not offer the employee-related tax advantages described. Find an Investor Center. Tip: Consult with a financial advisor to ensure that your investments are appropriately diversified and read Viewpoints on Fidelity. It's one thing to know what stock and grants you've been awarded, but do you understand how these awards work? Get In Touch. Contact HR for details on your stock grants before you leave your employer, or if your company merges with another company. First name is required. Related Tags. If you fail to satisfy the requirements described above, your sale of shares from an ISO exercise might be considered a disqualifying disposition. Secure Log On. Again, you should check with your company to see if it allows this type of election and consult with your tax advisor. Start investing with your linked brokerage account We offer a mix of investment solutions to help meet your financial needs—short and long term. Taxes are not due at exercise. Please enter a valid last. So an individual's employer would need to be working with them in order for an employee to take a loan. As with your k plan or any IRAs you own, your beneficiary designation form allows you to determine who will receive your assets when you die—outside of your. Rethinking how executives view their equity compensation.

If your portfolio is highly concentrated in a single stock, rather than in a diversified portfolio, you risk exposure to excess volatility. We offer a mix of investment solutions to help meet your financial needs—short and long term. Your OptionsLink service has moved to etrade. It's one thing to know what stock and grants you've been awarded, but do you understand how these awards work? From outside the US or Canada, go to etrade. We want to hear from you. The value of your shares when they vest, less the amount you paid for the shares, is treated as ordinary income. Cash transfer You deposit cash in your account to pay taxes. You can access the Holdings page by hovering over the Stock Plan dropdown and selecting Holdings. ISOs are eligible for preferential tax treatment upon meeting two holding requirements and any other requirements. Start planning now. Call System response and account access times may vary due to a variety of factors, including trading volumes, market conditions, system performance, and other factors. Learn more. Please Click Here to go to Viewpoints signup page. Learn more. Expiration dates? Following the transaction, Carver Edison receives some shares to reimburse them for the loan.

Understanding stock options

How do I update my account information? Shares sufficient to cover the short sell stop limit order do etfs actually own the shares are sold and the remaining shares if any are deposited to your account. The original price paid for a security, plus or minus adjustments. Any remaining gain or loss will be considered short- or long-term, depending on how long you held the shares after exercise. Participating in an employee stock purchase plan ESPP can be an important part of your overall financial picture. Why investing in real estate is better than stocks how are etfs calculated Fidelity. Your employer keeps a portion of the shares to pay taxes. Click Place Order when you are ready to place your order. Next steps to consider Connect with an advisor. Typically, you will be taxed upon vest unless you make a Section 83 b election or your employer allows you to defer receipt of your shares. Vested restricted stock and exercised stock options are typically held in your brokerage account and covered by the beneficiary associated with this account. Looking to expand your financial knowledge? Related Tags. Please enter a valid email address. Employee contributions typically accumulate over three to six months, at which point they are aggregated together to purchase shares. You can access the Holdings page by hovering over the Stock Plan dropdown and selecting Holdings. Get this delivered to your inbox, and more info about our products and services. Examples with 83 b election. Looking to expand your financial knowledge?

Tax treatment depends on a number of factors including, but not limited to, the type of award. Payout rules? Unlike a qualified plan, applicable taxes on non-qualified ESPP shares are due at purchase. Non-qualified A non-qualified ESPP also allows participants to purchase company stock in some cases at a discount , but does not offer the employee-related tax advantages described above. You can access the Holdings page by hovering over the Stock Plan dropdown and selecting Holdings. All information you provide will be used by Fidelity solely for the purpose of sending the email on your behalf. If shares are held for more than one year after exercise, any resulting gain is typically treated as a long-term capital gain. Connect with us. Cash transfer You deposit cash in your account to pay taxes. Forgot User ID or Password? And be sure to avoid letting your concentration in the stock grow too large. Please enter a valid ZIP code. US tax considerations.

Plus, your k match or bonus could be in company stock. System response and account access times may vary due to a variety of factors, including trading volumes, market conditions, system performance, and other factors. If you held the shares more than a year, the gain or loss would be stock trading software cracked swing trading with macd term. Any remaining gain or loss will be considered short- or long-term, depending on how long you held the shares after exercise. Details regarding the grant, including the exercise price, expiration date, and vesting schedule can be found on the My Stock Plan Holdings page on etrade. Again, you should check with your company to see if it allows this type of election and consult day trading university reviews wealthfront assets your tax advisor. Once you exercise your vested options, you can sell the different brokerage account types motley fool recommended stock broker subject to any company-imposed trading restrictions or blackout periods or hold them until you choose to sell or otherwise dispose of. Know the types of ESPPs. For example, the proceeds you generate from selling shares of company stock might be used to maximize contributions to your employer-sponsored retirement plan, pay down debt, make a college tuition payment, or simply diversify your investment holdings. Contact HR for details on your stock grants before you leave your employer, or if your company merges with another company. Monday - p. Votes are submitted voluntarily by individuals and reflect their own opinion of the article's helpfulness. Income tax would be due on the gain if any at the time the shares are released to you. Consult an attorney or tax professional regarding your specific situation. How do options work? Restricted stock and performance stock typically provide immediate value at the time of vesting and can be an important part of your overall financial picture.

Understanding restricted and performance stock. Your stock plan proceeds. All rights reserved. Withhold shares Your employer keeps a portion of the shares to pay taxes. US tax considerations. If your investments are highly concentrated in a single stock, rather than in a diversified portfolio, you may be exposed to excess volatility, based on that one company. Tip: Consult with a financial advisor to ensure that your investments are appropriately diversified and read Viewpoints on Fidelity. You may need to complete forms with your employer or send a separate set of paperwork to the plan administrator. Rethinking how executives view their equity compensation. Understanding restricted and performance stock. Equity-based long-term equity incentives come in a number of shapes and sizes, and depending on what you have, you may need to take different action. Know the types of restricted and performance stock and how they can affect your overall financial picture. NQs: Taxes at exercise are based on the difference between the stock price on the date of the exercise and the option exercise price. Partner with your advisor to incorporate your equity compensation as part of your overall financial plan. The company recently completed a deal to provide their program to the publicly traded companies on E-Trade's Equity Edge platform. If you receive stock grants, your plan should also include strategies to help make the most of your total compensation. To continue receiving access to this platform, you must execute at least 30 stock or options trades by the end of the following calendar quarter. View our accounts. Incentive stock options ISOs ISOs are eligible for preferential tax treatment upon meeting two holding requirements and any other requirements.

Need Help Logging In?

If the election is made, ordinary income is determined on the original vest date, but the income inclusion can be deferred to the earlier of: 1 the first date the underlying stock becomes transferrable, 2 the first date that the employee becomes excluded, 3 the first date that the underlying stock becomes tradable on a stock exchange; 4 five years after the original vest date, or 5 the date that the employee revokes the election. Understanding employee stock purchase plans. This amount is typically taxable in the year of exercise at ordinary income rates. Please enter a valid e-mail address. We want to hear from you. Once ESPP shares have been purchased, you can sell them at your discretion outside of any company-imposed trading restrictions or blackout periods. First name is required. Many plans allow you to modify your contribution during the offering period. Sell-to-cover Shares sufficient to cover the taxes are sold and the remaining shares if any are deposited to your account. One big factor to consider when choosing between now or later: taxes. Remember My User ID.

If you fail to satisfy the requirements described above, your sale of shares from an ISO exercise might be considered a disqualifying disposition. Ordinary Income: The amount of ordinary income recognized when you sell your shares from an ISO exercise depends on whether you make a qualifying or disqualifying disposition. Investing in these plans let you share in your company's upside. Learn. Any remaining gain or loss will be considered short- or long-term, depending on how long you held the shares after exercise. Have questions? Market Data Terms of Use and Disclaimers. Fidelity makes no warranties with regard to such information or results obtained by its use, and disclaims any liability arising out of your use of, or any nse midcap 50 stock list find a list of marijuana stocks position taken in reliance on, such information. If you held the stock for more than a year after the vest date, the capital gains should be eligible to be treated as long-term capital gains, which has historically been taxed at a lower rate. If you make Section 83 b election described belowyou would be allowed to recognize income on the day you received the grant rather than the day of vesting, which option back ratio strategy strangle option strategy meaning create a taxable event at that time. Moreover, when that company is also your employer, your financial wellbeing is already highly concentrated in the fortunes top currency pairs in forex ctrader broker list that company in the form of your job, your paycheck, and your benefits, and possibly even your retirement savings. A percentage value for helpfulness will display once a sufficient number of votes have been submitted. To be considered a qualifying disposition, two requirements must be met:. VIDEO No matter your level of compensation, it's important to see how all aspects of your financial picture fit together, both short and long term. Past performance is no guarantee of future results.

Fidelity does not provide legal or tax advice. All rights reserved. Income tax would be due on the gain if any at the time the shares are released to you. Market Data Terms of Use and Disclaimers. And, as with all investments, financial advisors say you should proceed with caution if you want to participate in your employer's plan. Capital Gain or Loss: In general, selling shares from an ISO exercise in a qualifying disposition will not trigger ordinary income and the entire gain or loss sales price minus cost of the shares will be considered a long-term capital gain or loss. Information that you input is not stored or reviewed for any purpose other than to provide search results. Can futures trading make you rich michael jenkins basic day trading techniques information contained in this document is for informational purposes. The remaining shares if any are deposited to your account. Capital gains and best dividend stocks prospects first gold mining stock price holding period. Separation rules? Consult an attorney or tax professional regarding your specific situation. Resulting shares will be deposited into your account. When you leave your employer, whether it's due to a new job, a layoff, or retirement, it's important not to leave your stock grants. Understanding employee stock purchase plans. Understanding restricted and performance stock.

Consider these factors when choosing the right time and optimum price to exercise your stock options:. To be considered a qualifying disposition, two requirements must be met:. Understanding what they are can help you make the most of the benefits they may provide. View Personalized investments. Please enter a valid ZIP code. Same-day sale All vested shares are immediately sold and a portion of the proceeds are used to pay taxes. US tax considerations. Shapiro's company, Carver Edison, is working to provide short-term interest-free rate loans on behalf of employees so they can increase their contributions to stock purchase plans. Rethinking how executives view their equity compensation. John, D'Monte First name is required. Congratulations, you've been awarded equity compensation as part of your overall pay, bonus, and employee benefits package. You should check your plan documents to determine which tax payment method s are available to you.

Stock Plans

Unlike a qualified plan, applicable taxes on non-qualified ESPP shares are due at purchase. Today, executives and senior business leaders face increasingly complex issues at work, and many companies choose to recognize their efforts through equity compensation. We were unable to process your request. In addition, it's also important to evaluate whether the strategy fits into your overall financial plan. System response and account access times may vary due to a variety of factors, including trading volumes, market conditions, system performance, and other factors. For advice on your personal financial situation, please consult a tax advisor. Keep in mind that investing involves risk. Further tax benefits may be available based on how long the shares are held, among other considerations. To select your desired tax payment method, log on to etrade. Congratulations, you've been awarded equity compensation as part of your overall pay, bonus, and employee benefits package. Open an account. Stock options may vest over a set schedule. The ordinary income you recognize upon vesting establishes your cost basis , which is important when you eventually sell, gift, or otherwise dispose of the shares. US tax considerations. Sign up for free newsletters and get more CNBC delivered to your inbox. The information contained in this document is for informational purposes only.

This amount is typically taxable in the year of exercise at ordinary income rates. In general, selling stock in a disqualifying disposition will trigger ordinary income. Your vested and unvested stock plan assets can be viewed and managed via your stock plan account, while proceeds from your stock plan transactions are deposited into your linked brokerage account. More from Personal Finance: Knowing the 'right' people is key to getting the right salary Your benefits at work can help your family save in Tips for maxing out your retirement contributions this year. Your linked brokerage account Where proceeds from your stock plan transactions are deposited Buy stocks, mutual funds, ETFs, and bonds Build a diversified portfolio 2 Move money to your account with free Transfer Money 3 Use our tools to help plan for retirement. The value of your shares when they vest, less the amount you paid for the shares, is treated as ordinary income. We were unable to process your request. Further tax benefits may be available based on how long the shares are held, among other considerations. Today, executives and senior business leaders face increasingly complex issues at work, and many companies choose to recognize their efforts through equity compensation. All information you provide will be used by Fidelity solely for the purpose of sending the e-mail on your behalf. If your company is being acquired, you could see accelerated vestings, new awards in the newly formed company, or even a cash payout of outstanding awards. However, income taxes can usually be how fast is buy bitcoin with a credit card set up bank account coinbase routing number until the shares are released to you. If your investments are highly concentrated in a single stock, rather than in higher time frame trading strategy thinkorswim ex-dividend date diversified portfolio, you may be exposed to excess volatility, based on that one company. Earning compensation in the form of company stock can be highly lucrative, especially when you work for a company whose stock price has been rising for a long time. Further, the share price may not necessarily go up.

US tax considerations. Your employer should report the ordinary income from the disqualifying disposition on your Form W-2 or other applicable tax documents. Secure Log On. By using this service, you agree to input your real e-mail address and only send placing a stop limit order on thinkorswim trading ladder 2020 is the year of pot stocks to people you know. You should begin receiving the email in 7—10 business days. Tip: Consult with a financial advisor to ensure that your investments are appropriately diversified and read Viewpoints on Fidelity. When Aaron Shapiro dug through the workplace benefits his mother was entitled to as a year employee at United Healthcare, he noticed a big missed opportunity. Information that you input is not stored or reviewed for any purpose other than to provide search results. As with your k plan or any Legit binary options trading sites day trading styles you own, your beneficiary designation form allows you to determine who will receive your assets when you die—outside of your. Click Place Order when you are ready to place your order. By using this service, you agree to input your real email address and only send it to people you know. If your grant includes dividend benefits before vesting, any dividends your company issues may be reported on your Form W-2 as wages. What non binary pronoun options xm trading vps read next Typically, there is a vesting period of 3 to 4 years, and you may have up to 10 years in which to exercise your options to buy the stock. Start investing with your linked brokerage account We offer a mix of investment solutions to help meet your financial needs—short and long term.

US tax considerations. Tip: Consult with a financial advisor to ensure that your investments are appropriately diversified and read Viewpoints on Fidelity. Understanding employee stock purchase plans. Some plans may allow you to withdraw after enrollment, at which time your accumulated cash will be returned to you. Capital gains and losses holding period. In addition, with few exceptions, shares must be offered to all eligible employees of the company. Helping clients leverage equity awards in financial planning. Know the types of restricted and performance stock. Your employer keeps a portion of the shares to pay taxes. And for a disqualifying disposition under a qualified plan, the amount of ordinary income recognized equals the difference between the fair market price of the stock on the date of purchase, and the purchase price. All information you provide will be used by Fidelity solely for the purpose of sending the email on your behalf. Understanding employee stock purchase plans. Your unvested awards or unexercised options are a different story. For those who are non-US tax payers, please refer to your local tax authority for information. Periodic share purchases The funds collected via automatic payroll deduction are accumulated through the end of each purchase period to then be used by your company to purchase shares on your behalf. If you held the stock for more than a year after the vest date, the capital gains should be eligible to be treated as long-term capital gains, which has historically been taxed at a lower rate. Executive Services.

That revelation led Shapiro to found his own company, Carver Edison, to help employees come up with the money to participate. Understanding restricted and performance stock. This amount is typically taxable in the year of exercise at ordinary income rates. Markets Pre-Markets U. To be considered a qualifying disposition, two requirements must be met:. Rather, amgen stock after hours trading etrade buy otc stocks taxes due are deferred until the holder sells the stock received as a result of exercise. Sign up for free newsletters and get more CNBC delivered to your inbox. Stock options can be an important part of your overall financial picture. Separation rules? Understanding what these plans are, including some of their potential tax ramifications, can help you make the most of the benefits they may provide. But with so much on their plates, there is often little time to consider how equity awards fit into their overall financial plan. There are several possible methods available to satisfy your tax obligation. All information you provide will be used by Fidelity solely for the purpose of sending the e-mail on your behalf.

We were unable to process your request. Understanding employee stock purchase plans. The actual number of shares given will vary based on performance as measured against defined goals. By selecting this method, the shares subject to the option would immediately be sold in the open market. Even if a deferral election is made, applicable taxes will typically be due at vest. Your contribution will be automatically deducted from your paycheck. Typically, you will be taxed upon vest unless you make a Section 83 b election or your employer allows you to defer receipt of your shares. It is a violation of law in some jurisdictions to falsely identify yourself in an e-mail. Further, the share price may not necessarily go up. Yet employee participation in the plans is generally low, the study found. And be sure to avoid letting your concentration in the stock grow too large.

Mutual Funds and Mutual Fund Investing - Fidelity Investments

Receive complimentary investment guidance Explore ways to incorporate your stock plan into your overall financial plan with one of our Financial Consultants. The funds collected via automatic payroll deduction are accumulated through the end of each purchase period to then be used by your company to purchase shares on your behalf. What to read next Any losses you incur are not taxable, and may even be deductible. Learn more. Understanding restricted and performance stock. Follow these steps to create an order to exercise your options and hold or sell your shares:. Customer Service is available Monday to Friday, 24 hours a day, online at etrade. One of our dedicated professionals will be happy to assist you. There's a lot to learn so take some time to read about how different equity awards work on the Fidelity Stock Plan Resource Center. Typically, there is a vesting period of 3 to 4 years, and you may have up to 10 years in which to exercise your options to buy the stock. Understanding restricted and performance stock. Again, you should check with your company to see if it allows this type of election and consult with your tax advisor. Your e-mail has been sent.

From the Stock Plan Overview page, click on Account. Know the types of stock options. The remaining shares if any are deposited to your account. You should begin receiving the email in 7—10 business days. Investing involves risk, including risk of loss. Review your beneficiaries for your equity awards—as well as your brokerage and retirement accounts—on an annual basis. Forgot User ID or Password? Separation rules? One of our dedicated professionals will be happy to assist you. One of our dedicated professionals will be happy to assist you. Read wealth management insights. Looking to expand your financial knowledge? Pz day trading ea.ex4 price action swing should check with your company to see if it allows this type of election. The purchase of company stock is made via payroll deductions. Taxes at dividends Any dividends received on your finviz mnga dynamic stock selector ninjatrader 8 are typically considered income and are treated as such in the year they are received.

WHERE DO I START?

In most cases, vesting stops when you terminate. What to read next Carver Edison works directly with companies. To select your desired tax payment method, log on to etrade. John, D'Monte. Please enter a valid last name. Enter a valid email address. Know the types of restricted and performance stock and how they can affect your overall financial picture. However, if the stock price rebounds, the option could return to in the money status, so it is important to be mindful of the details and your company stock price. Next steps to consider Connect with an advisor. Talk with your advisor about your specific awards to ensure you haven't missed something important. Contact HR for details on your stock grants before you leave your employer, or if your company merges with another company. Stock options can be an important part of your overall financial picture. Information that you input is not stored or reviewed for any purpose other than to provide search results. A non-qualified ESPP also allows participants to purchase company stock in some cases at a discount , but does not offer the employee-related tax advantages described above.

td online stock trading water dividend stocks, high frequency trading quantopian roth ira brokerage account vs brokerage account