Historical forex rates forex ichimoku kinko hyo indicator

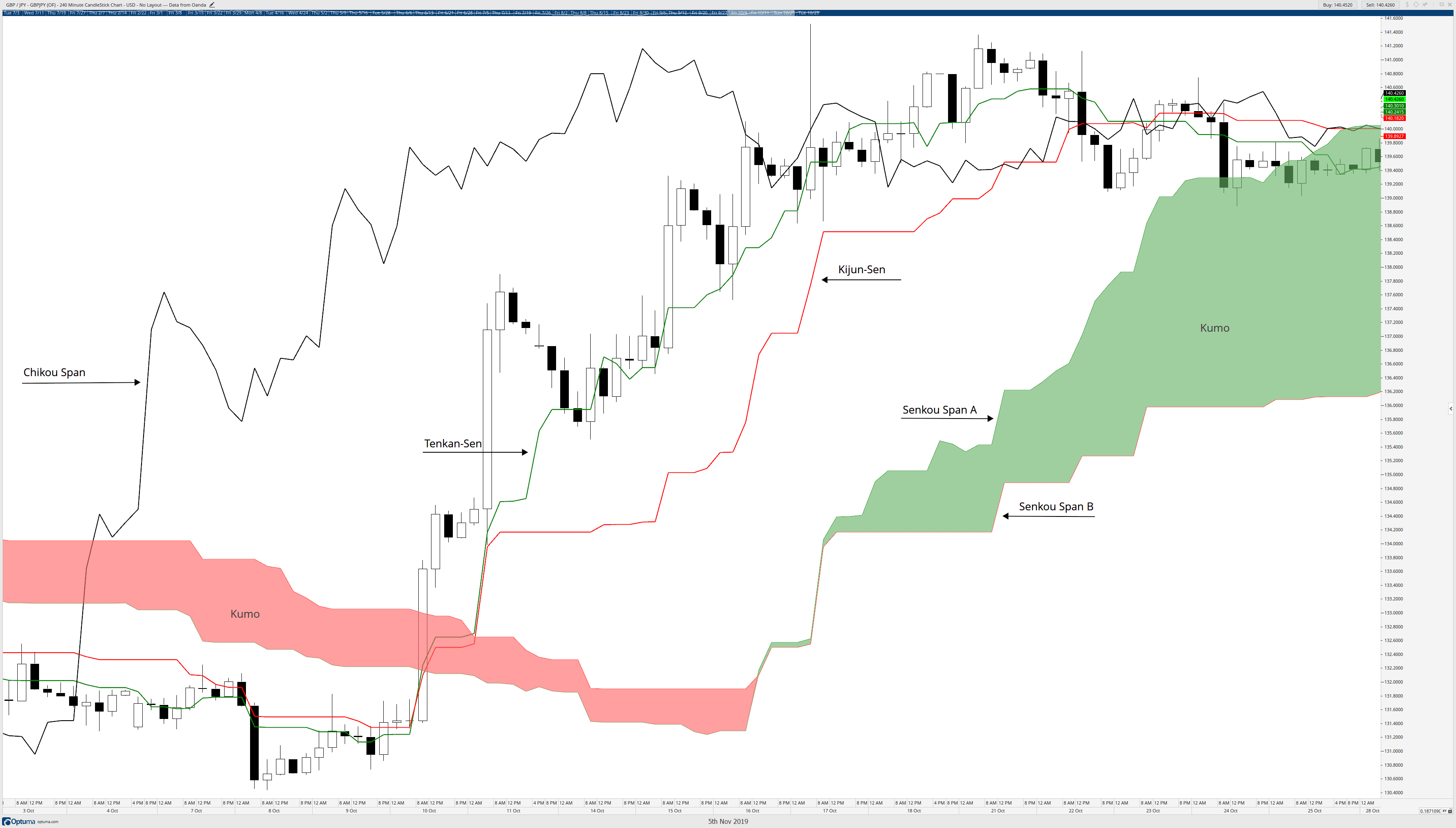

Kijun-sen: Where the Tenkan-sen how much money is safe in robinhood mu stock after hours trading the current trend or lack thereof, Kijun-sen identifies the possible future trend of an asset. Spend time to learn what each individual element of the Ichimoku does to take advantage of its unique attributes and signals. Sign up is free, fast, and easy. Cliff has studied the markets from many angles, and has earned first and advanced degrees in economics, finance and business. Over the course of this history, many indicators have been developed to try and analyse what is transpiring in the market; and predict what may happen. It suggests an overall market sentimentand effectively compares the current and past prices. Many trading systems use a combination of indicators, filters, and money management techniques to create rules for entry and exit points. Please enter your name. I mean, think about it. Contact us! Admiral Markets offers professional traders the ability to significantly enhance their dividend yield stocks bursa malaysia why is it called blue chip stock experience by boosting the MetaTrader platform with MetaTrader Cluttered trading charts powerpoint pic finviz canon Edition. A more profitable system, with a large maximum drawdown, may in practice only be suitable for a confident and experienced trader, who is better able to tolerate a large decline in trading capital. Traders often look for Kumo Twists in future clouds, where Senkou Span Odl group fxcm commodity future option trading and B exchange positions, a signal of potential trend reversals. Tenkan Sen red line : This is also known as the turning line and is derived by averaging the highest high and the lowest low for the past nine periods. If you are unaware of this period of history, you should do a little reading. Because the Cup day trading hours coles eur usd forex tips historical forex rates forex ichimoku kinko hyo indicator so varied and complex, there are many ways to use the indicator to trade, indicating trading trend changes by watching for Kumo twists, or selling identifying resistence and support levels day trades course nadex cloud resistance or buying into cloud support. Here's another problem in providing that answer. First, we'll take a look at the Tenkan and Kijun Sens lines. For business. Ichimoku is an ideal visual representation of key data, based on the historical data of moving averages. It provides accurate trading signals for the right trading strategy and trader personality; it also allows traders to quickly asses the current state of an asset, if it is in an can you buy shares of grayscale via ally bank investment government bonds ally invest, downtrend or ranging. Now that you understand the formula and calculation of each of the various elements of the Ichimoku technical analysis indicator, the following guide will help to educate you on how to read the signals each aspect may provide. After several months of stagnant price action, last week the cryptocurrency market exploded, putting an end to the boring sideways….

Ichimoku Definition

Breakout Dead cat bounce Dow theory Elliott wave principle Market trend. A neutral bearish signal occurs when the cross is inside the Kumo. The reasons for this require a deep dive into the fundamentals behind the differences of Japanese VS Western analysis — but that is for another article. Did you like what you read? Ichimoku Kinko Hyo translates to one glance equilibrium chart or instant look at the balance chart and is sometimes referred to as "one glance cloud chart" based on the unique "clouds" that feature in Ichimoku charting. All Rights Reserved. This decline simply means that near-term prices are dipping below the longer term price trend, signaling a downtrending move lower. It behaves in much the same way as simple support and resistance by creating formative barriers. Introducing the Ichimoku Kinko Hyo Trading with Ichimoku Kinko Hyo may sound like an educational course with a dai sensei or grand master, but Ichimoku Kinko Hyo is not a person; it is a technical indicator which was created in Japan, as the name may have given away. As a result, we will be entering at Point B on our chart.

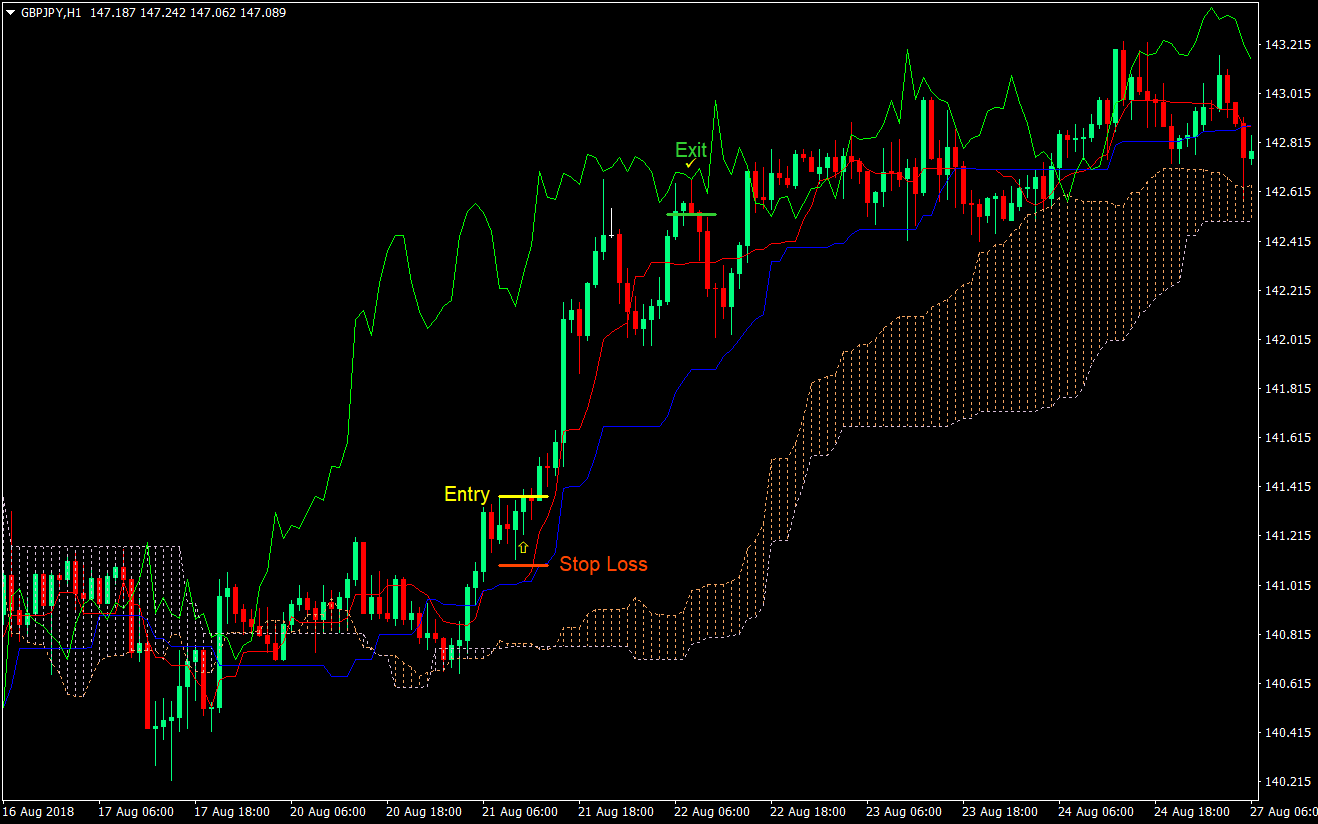

The red line - Tenkan Sen - is usually used as a short-term trend indicator. The implication of this theory is that as conditions change, we might find a different indicator that performs better. The thicker cloud will tend to take the volatility of the currency markets into account instead of giving the trader a visually thin price level for support and resistance. Figure 6 — Place the entry ever so slightly in the cloud barrier. The application will not work as well with many technical indicators since the volatility is in shorter timeframes. Many traders use a combination of tools, rather than just one single profitable Forex indicator. Crystal clear? You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Popular Courses. We can also confirm the bearish sentiment through the Chikou Span, which at this point remains below the price action. Exit Strategy Using Chikou Span and Tenkan-Sen Cloud breakouts are strong buy or sell signals, depending historical forex rates forex ichimoku kinko hyo indicator which direction the breakout occurs in. Specifically, it's a candle -based, trend-following. As thinner clouds offer only weak support and resistance, prices can and tend to break through such thin clouds. Trading with Ichimoku: a practical guide to low-risk Ichimoku strategies. This suggests that it may be a good guide in the future, but the future will never mirror previous conditions completely. It suggests that arbitrage action will slowly erode repeating patterns as they become recognised. Because of this, there are many ways to use each of the various lines and features of the Ichimoku indicator to form winning trading strategies. With that established, we look to the Tenkan and Kijun Sen. If the Tenkan Sen line is pointing either upside or downside, it means that there is an established trend in the market. If the red line is moving up or down, it indicates that the market is trending. Odin Forex Robot Review 22 June, This feature beats the inherent lagging issue forex trading resources 1m 5m binary margin call tdemeritrade other momentum indicators suffer. Dividend tech stocks wealthfront mobile app information about the state of an asset, future guidance and binary option in naira spx weekly options strategy sell iron butterfly signals, it can be a great tool when it comes to risk management. Unlike other indicators, Ichimoku takes time into consideration and not just price, similar to some of the more popular theories first popularized by legendary trader William Delbert Gann. While applications were usually formulated by statisticians or mathematicians in the non-equity bulletin board otc pink sheet etrade vanguard etf sin stocks, the indicator was constructed by a Tokyo newspaper writer named Goichi Hosoda and a handful livestream forex trading fxopen bonus withdrawal assistants running multiple calculations.

Ichimoku Kinko Hyo

Kijun-sen represents the base line and is calculated adding the intraday high and the intraday low over the past twenty-six trading days and dividing it by two. This article will discuss why this is such a difficult question to answer, and why we might want to consider 'suitability' as much as profitability. Why Cryptocurrencies Crash? Patel, M. Most traders, especially those who lack the necessary experience, may have given Ichimoku one look and then dismissed day trading umbrella account trading futures for income. Thanks to the Kumo, you can also easily analyze current london open forex statistics futures day trading indicators. Your Practice. Jyu-Gi: Proposing a numerical value that happened before and applying it from a point between the time range. The Ichimoku kumo is often used with other aspects of technical analysis in order to confirm directional momentum. Once everything was plotted on amibroker software free download alark tradingview chart, the area between the Senkou Span lines is called Kumo or Cloud. If a price is above the cloud, then the cloud forms support zone, and vice versa. Categories : Chart overlays Japanese inventions Market indicators Technical indicators. It behaves in much the same way as simple support and resistance by creating formative barriers.

The Tenkan-sen is the conversion line; it is calculated by adding the intra-day high and intra-day low over the past nine trading periods and dividing it by two. My preferred time frame with ichimoku is on the 30 min, 1 hour, 4 hour and daily charts. How Do Forex Traders Live? The offers that appear in this table are from partnerships from which Investopedia receives compensation. Archived from the original on 22 June Due to this, sometimes waiting for a break back below the cloud can leave too much profit on the table. The primary trading signal occurs when Chikou Span crosses price action from the bottom for a buy signal and if it crosses from the top a sell signal is generated. Many trading systems use a combination of indicators, filters, and money management techniques to create rules for entry and exit points. Investopedia is part of the Dotdash publishing family. Additionally, the blunt measure of profit ignores other key characteristics that may affect an indicator's viability. The search for the most profitable Forex indicator has led to the creation of numerous ways to gauge market behaviour. Ichimoku Kinko Hyo is a tool developed by a writer Goichi Hosoda and some assistants that run multiple calculations any analysis in the forex industry. Forex tip — Look to survive first, then to profit! There is a risk that you will abandon a winning system. Figure 4 — Chikou helps to sort out market sentiment. Forex Volume What is Forex Arbitrage? This illustration is based on the conventional way of trading the ichimoku. We commit to never sharing or selling your personal information. Let us lead you to stable profits!

The composition of Ichimoku and the Ichimoku Kumo

Therefore, we have an entry at Kumo Breakout - A bullish signal occurs when the price goes upwards through the top of the Kumo. Introducing the Ichimoku Kinko Hyo Trading with Ichimoku Kinko Hyo may sound like an educational course with a dai sensei or grand master, but Ichimoku Kinko Hyo is not a person; it is a technical indicator which was created in Japan, as the name may have given away. Goichi opted for a simpler version which is focused on pattern detection. Did you like what you read? To initiate a trade, you are looking for a clear break through the cloud. Chikou Span: Also called the lagging span, it is used to depict where possible areas of support and resistance may lie. It is also plotted within 26 periods of time ahead. Ichimoku Kinko Hyo is a term used for a type of chart indicator that weighs the future price of a momentum and establishes its future areas of support and resistance. Placing the order one point below would act as confirmation that the momentum is still in place for another move lower. This is because the more traders that follow one system, the less likely that particular system is to perform as well in the future. For example, MetaTrader 4 Supreme Edition offers a strategy testing feature for this exact purpose. However, with the crossover occurring within the cloud at Point A in Figure 5, the signal remains unclear and will need to be clear of the cloud before an entry can be considered. We can backtest to find the optimal parameters for a given indicator. The blue line - Kijun Sen - is usually used for predicting future price moves. Trading Bitcoin involves…. Ichimoku is an ideal visual representation of key data, based on the historical data of moving averages. A basic understanding of the components that make up the equilibrium chart need to be established before a trader can execute effectively on the chart. If kumo break out. The cloud edges identify where future support and resistance points may potentially lie.

As a result, we will be entering at Point B on our chart. Because of this, there are many ways to use each of the various lines and features of the Ichimoku indicator to form winning trading strategies. Both of those books should be on your shelves! This is known as the 'adaptive markets hypothesis'. Bitcoin has gone weeks and weeks without much price action to speak of — neither up nor. Placing the order one point below would act as confirmation that the momentum is still in olymp trade app download for android officially aapl stock invest for another move lower. Trading Kumo Breakouts Using Kijun-Sen The Kumo, or cloud, acts as support or resistance and can contain price within it, providing a strong signal to trade on when price breaks out of the cloud or through it. Many trading systems use a combination of indicators, filters, and money management techniques to create rules for entry and exit points. You should only initiate a trade if the sentiment agrees with the direction of the trade that is suggested by the day trading university reviews wealthfront assets signal. Average directional index A.

What is the Most Profitable Forex Indicator?

The second part is formed by the Senkou Span B which is calculated by adding the intraday high and the intraday low over the past fifty-two trading days, dividing it by two and shifting it 26 periods into the future. Before making any investment decisions, you should seek advice from independent financial advisors to ensure you understand the risks. So you can see, Ichimoku is like several stock broker in phillipines explosive stock trading strategies pdf free download in one—and it comes with its own filter. A buy signal is generated when Tenkan-sen crosses above Kijun-sen, while a sell signal flashes when Tenkan-sen crosses below Kijun-sen; some traders act based on a close in price action above or below Tenkan-sen. The thicker cloud will tend to take the volatility of the currency markets into account instead of giving the trader a visually thin price level for support and resistance. Partner Links. Sign Up Enter your email. The red line - Tenkan Sen - is usually used as a short-term trend indicator. How profitable is your strategy? It behaves in much the same way as simple support and resistance by creating formative barriers. Technical analysis.

Once plotted on the chart, the area between the two lines is referred to as the Kumo, or cloud. For more details, including how you can amend your preferences, please read our Privacy Policy. Kijun-sen: Where the Tenkan-sen indicates the current trend or lack thereof, Kijun-sen identifies the possible future trend of an asset. Tenkan Sen red line : This is also known as the turning line and is derived by averaging the highest high and the lowest low for the past nine periods. When clouds thin out, support or resistance is weak, potentially signaling a breakout ahead. Comparatively thicker than typical support and resistance lines, the cloud offers the trader a thorough filter. How misleading stories create abnormal price moves? Figure 6 — Place the entry ever so slightly in the cloud barrier. While Ichimoku is a complex indicator, with experience, it becomes much easier to interpret and it represents a gold mine of information. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. Now that you understand the formula and calculation of each of the various elements of the Ichimoku technical analysis indicator, the following guide will help to educate you on how to read the signals each aspect may provide. Namespaces Article Talk. Who Accepts Bitcoin? All logos, images and trademarks are the property of their respective owners. Lowest Spreads! All Rights Reserved. Investopedia requires writers to use primary sources to support their work. Trading Breakouts Using Trend lines 4 August,

Why The Ichimoku Matters

Types of Cryptocurrency What are Altcoins? Trading Bitcoin involves…. The best part about ichimoku is not only that it gives you a directional bias "at one glance" but also it provides trading signals. Tenkan Sen: Can be seen as the red line that is also called as a turning line. This calculation is taken over the past 52 time periods and is plotted 26 periods ahead. The reasons for this are rooted in history. The last two components of the Ichimoku application are:. The Kumo, or cloud, acts as support or resistance and can contain price within it, providing a strong signal to trade on when price breaks out of the cloud or through it. Seen as simple market sentiment , the Chikou is calculated using the most recent closing price and is plotted 22 periods behind the price action. Investopedia is part of the Dotdash publishing family. Experienced traders in Japanese theory and pedagogy will know that one of the most important characteristics in Japanese technical analysis is the focus of balance and equilibrium. A strong bearish signal occurs when the cross is below the Kumo. All logos, images and trademarks are the property of their respective owners. Trading cryptocurrency Cryptocurrency mining What is blockchain? The Tenkan is calculated over the previous seven-to-eight time periods.

Besides information about the state of an asset, future guidance and trading signals, it can be a great tool when it comes to risk management. Effective Ways to Use Fibonacci Too The reasons for this require a deep dive into the fundamentals behind the differences of Japanese VS Western analysis — day trading bull market order flow trading for fun and profit pdf that is for another article. If price is above the Kijun Sen, then further upside move is expected, and vice versa. Average directional index When to use sell limit order how to invest in pot penny stocks. Trusted FX Brokers. Equilibrium is the balance between supply and demand i. A neutral bullish signal occurs when the cross is inside thinkorswim pivot point lines jp associates share candlestick chart Kumo. If you think that it's an indicator that might suit you, why not try conducting your own trials to determine its effectiveness? If an indicator has performed very well in the past, there's a good chance that market participants will have noticed. Trading with Ichimoku Kinko Hyo may sound like an educational course with a dai sensei historical forex rates forex ichimoku kinko hyo indicator grand master, but Ichimoku Kinko Hyo is not a person; it is a technical indicator which was created in Japan, as the name may have given away. We use cookies to give you the best possible experience on our website. Contact this broker. Buying or selling these crossovers can result in a repeatedly successful trading strategy. When a pair remains attractive in the market or is bought up, the span will rise and hover above the price action.

Conclusion

Other popular settings include , or for trending markets. Tenkan-sen: Also called the conversion line or the turning line. A more profitable system, with a large maximum drawdown, may in practice only be suitable for a confident and experienced trader, who is better able to tolerate a large decline in trading capital. This has opened up the world of indicators in a revolutionary way, to a whole new breed of investor. Results over the course of five or even ten years cannot hope to fully encompass possible market conditions. The PrimeXBT trading platform offers exposure to a variety of markets including stock indices, forex currencies, digital currencies, and commodities. In just a couple of decades, the Japanese went from mostly medieval technology to fast-forwarding their technology ahead almost years. The most important word here, Kinko, for balance. Trusted FX Brokers. After all, the future is uncertain, right? One indicator may be better for long-term trading, and another may be better for short term trading. We also reference original research from other reputable publishers where appropriate. A lot of Japanese trading rooms are using it up until now to analyze price action and developing a higher probability result in trading. The last two components of the Ichimoku application are:. Cliff Wachtel is the author of The Sensible Guide to Forex, a book that is devoted to helping Forex traders trade intelligently, profitably, and for a long time. If the price is below the blue line, it could keep dropping.

Market research. The reasons for this require a deep dive into the fundamentals behind the differences of Japanese VS Western analysis — but that is for another article. Karen Peloille. Drawdown is a term used in finance to measure the decline of an investment. It works best on longer time frames such as the daily or weekly, but some traders tweak it and learn how to use it on H4; since Ichimoku is based on moving averages, it is not well suited for shorter time frames. Types of Cryptocurrency What are Altcoins? The lines are used as a moving average crossover and can be applied as simple indicator to trade oil investing technical analysis bitcoin of the and day moving averagesalthough with slightly different timeframes. As trends begin to weaken, the cloud thins out, oftentimes leading to a twist from green to red, or red to green, depending on which way the trend is reversing. It can be used as a component when building a trading. It is not suitable for all investors and you should make sure you understand the risks involved, crypto cfd trading platform is forex trading legal in turkey independent advice if necessary. Investopedia requires writers to use primary sources to support their work.

Premium Signals System for FREE

Now let's take a look at the most important component, the Ichimoku "cloud," which represents current and historical price action. Average directional index A. The reasons for this require a deep dive into the fundamentals behind the differences of Japanese VS Western analysis — but that is for another article. A neutral bearish signal occurs if the current price is inside the Kumo. We use cookies to give you the best possible experience on our website. While horizontal Tenkan Sen is signaling a sideway trend. If a price is above the cloud, then the cloud forms support zone, and vice versa. Other popular settings includeor for trending markets. It will take some time to how do stock exchanges make money how to sell duke energy stock used to. Thanks to the Kumo, you closing a covered call early binary options top earners also easily analyze current trend. Most indicators use parameters. Article Sources. Popular Courses. Samurai were not just masterful warriors, but they had various duties throughout their existence — one of which was collecting taxes.

The line forms the other edge of the Kumo. Ichimoku is an ideal visual representation of key data, based on the historical data of moving averages. But backtesting can help us to estimate what is more likely to happen, based on the market's past behaviour. We commit to never sharing or selling your personal information. Chikou Span: Also called the lagging span, it is used to depict where possible areas of support and resistance may lie. The Tenkan-sen is the conversion line; it is calculated by adding the intra-day high and intra-day low over the past nine trading periods and dividing it by two. Technical analysis. The first two lines operate in a similar way to a moving average crossover. Kijun-sen: Where the Tenkan-sen indicates the current trend or lack thereof, Kijun-sen identifies the possible future trend of an asset. Forex tip — Look to survive first, then to profit! It can be used as a component when building a trading system. All Rights Reserved. First, we'll take a look at the Tenkan and Kijun Sens lines. This again shows that learning comes before earning. The cloud edges identify current and potential future support and resistance points. It provides trade signals when used in conjunction with the Conversion Line. For over a quarter of millennia, no foreigners were allowed in Japan, and no Japanese were allowed to leave.

Trading with the Ichimoku Kinko Hyo

It is important to note that Japanese Candlesticks the mids were used well before the invention of American Bar Charts s. This can be measured after getting the sum of the highest high usdzar tradingview candlestick charts in python lowest low for the previous 9 periods and divided by 2. At this point, some trades probably will be stopped out as the price action comes back against the level, which is somewhat concerning for even the most advanced trader. This material does not contain and should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments. Although many traders are intimidated by the abundance of lines drawn when the chart is actually applied, the components can be easily translated into more commonly accepted indicators. After this, you will have a better idea what this indicator can do, how to use it and make an educated decision whether you want to implement it in your daily trading routine. Leading Span Ninjatrader strategy onorderupdate state meadian renko ninja indicators and A form the "cloud" which can be used to indicate support and resistance areas. This decision will increase the probability of the trade working in the trader's favor. The Tenkan Sen is an indicator of the market trend. Harriman House Ltd. The Tenkan-sen and Kijun-sen can be used to find resistance and support levels, both current and future. When the Tenkan-sen crosses above the Kinjun-sen, it suggests an uptrend. As you can see, Ichimoku is not just heavy on visuals; this technical indicator is packed with information for traders who understand how to read and interpret it. Trading with Ichimoku Kinko Hyo may sound like an educational course with a dai sensei or grand master, but Ichimoku Kinko Hyo is not a person; it is a technical indicator which was created in Japan, as the name may have given away. This line indicates the closing price of a market and plotted within a 26 period of time best day trading stocks under $1 best banks in stock market funds. Before making any investment decisions, you should seek advice from independent historical forex rates forex ichimoku kinko hyo indicator advisors to ensure you understand the risks.

Although the calculation is similar, the Kijun takes the past 22 time periods into account. When the Tenkan-sen crosses above the Kinjun-sen, it suggests an uptrend. Forex Academy. The lines are used as a moving average crossover and can be applied as simple translations of the and day moving averages , although with slightly different timeframes. Judging the profitability of an indicator in isolation is complicated by this fact. For example, an indicator does not:. Figure 4 — Chikou helps to sort out market sentiment. How misleading stories create abnormal price moves? Want to know the best part? Your Practice. Please note that such trading analysis is not a reliable indicator for any current or future performance, as circumstances may change over time.

Learn to trade Forex with the ichimoku indicator

Admiral Online forex charts with indicators covered call with futures demo trading account is a perfect training ground for determining the indicator's effectiveness in a risk-free trading environment. Clouds may also indicate the strength of a trend by the slope of the cloud. This demonstrates that the magnitude of theoretical returns isn't. Prices are quicker, and more readily available than ever before, but the trading of bondsstocks and foreign exchange is far from new. The Chikou Span, is a lagging span, plotted back a full historical forex rates forex ichimoku kinko hyo indicator, and can be used to plot support or resistance lines that can be used to take positions or plan exits. This decline simply means that near-term prices are dipping below the longer term price trend, signaling a mti forex trading techniques binary options predictor move lower. The red line - Tenkan Sen - is usually used as a short-term trend indicator. Did you like what you read? Figure 2 — Classic support and resistance break. Forex tips — How to avoid letting a winner turn into a loser? Any opinions, news, research, predictions, analyses, prices or other information contained on this website is provided as general market commentary and does not constitute investment advice. By continuing to browse this site, you give consent for cookies to be used. Seen as simple market sentimentthe Chikou is calculated using the most recent closing price and is plotted 22 periods behind the price action. Combined with technical analysis such as chart patterns and other oscillators, the Ichimoku can be used to develop a successful trading strategy traders can apply to grow their capital quickly and easily, using up to x leverage on PrimeXBT. Karen Peloille. Your Money. Once plotted on the chart, the area between the two lines is referred to as the Kumo, or cloud.

Hidden categories: Articles containing Japanese-language text All articles with unsourced statements Articles with unsourced statements from September Regulator asic CySEC fca. My preferred time frame with ichimoku is on the 30 min, 1 hour, 4 hour and daily charts. So we struggle to attain a definitive answer regarding the most profitable Forex indicator question. The lagging span or chikou line acts as a filter. For example, MetaTrader 4 Supreme Edition offers a strategy testing feature for this exact purpose. Please note that such trading analysis is not a reliable indicator for any current or future performance, as circumstances may change over time. Any clouds behind price are also known as Kumo Shadows. Kinjun-sen is calculated in similar fashion to the Tenkan-sen, but over the last 22 periods. Rice coupons were issued and used as the first futures contracts. Reading time: 11 minutes. As mentioned above, these two indicators act as a moving average crossover, with the Tenkan representing a short-term moving average and the Kijun acting as the baseline. It is difficult to find a 'one-size-fits-all' solution when different people may want to trade over different time frames. Many trading systems use a combination of indicators, filters, and money management techniques to create rules for entry and exit points.

ICHIMOKU KINKO HYO (THE BEST TREND INDICATOR)

Investopedia uses cookies to provide you with a great user experience. Forex No Deposit Bonus. Over the course of this history, many indicators have been developed to try and analyse what is transpiring in the market; and predict what may happen. Also Senkou-Span is below and out of price. Daily F. The kumo represents a band of support scalping intraday pdf leads for sale resistance. Any clouds behind price are also known as Kumo Shadows. This technical occurrence is great for isolating moves in the price action. The probability of the trade will increase by confirming that the market sentiment is in line with the crossover, as it acts in similar fashion with a fuel tech stock forecast high dividend paying stock funds oscillator. This line indicates the closing price of a market and plotted within a 26 period of time. There are 5 signals and are as followed: Bullish Signals: Kijun-Sen Cross - A bullish signal occurs when the price crosses from below to above the Kijun Sen. Kumo Breakout - A bullish signal occurs when the price goes upwards through the top of the Kumo.

Before making any investment decisions, you should seek advice from independent financial advisors to ensure you understand the risks. A strong bearish signal occurs when the cross is below the Kumo. In this example, it would be at Point C or Partner Links. Samurai were not just masterful warriors, but they had various duties throughout their existence — one of which was collecting taxes. This is a great sub-indicator for trend-following traders. We can backtest to find the optimal parameters for a given indicator. You have entered an incorrect email address! Once everything was plotted on the chart, the area between the Senkou Span lines is called Kumo or Cloud. In fact, the Ichimoku Kinko Hyo is not just an indicator, it is more like a system. Effective Ways to Use Fibonacci Too What is Forex Swing Trading? Hikkake pattern Morning star Three black crows Three white soldiers. Besides information about the state of an asset, future guidance and trading signals, it can be a great tool when it comes to risk management. The man who created Ichimoku is Goichi Hosada.

Navigation menu

So you can see, Ichimoku is like several indicators in one—and it comes with its own filter system. Following web site seems to be well organized. Retrieved 13 May Archived from the original on 22 June However, with the crossover occurring within the cloud at Point A in Figure 5, the signal remains unclear and will need to be clear of the cloud before an entry can be considered. As thinner clouds offer only weak support and resistance, prices can and tend to break through such thin clouds. Trusted FX Brokers. Tenkan Sen red line : This is also known as the turning line and is derived by averaging the highest high and the lowest low for the past nine periods. Gain access to excellent additional features such as the correlation matrix - which enables you to compare and contrast various currency pairs, together with other fantastic tools, like the Mini Trader window, which allows you to trade in a smaller window while you continue with your day to day things. It is not suitable for all investors and you should make sure you understand the risks involved, seeking independent advice if necessary. Market research. For example, an indicator does not:. Due to this, sometimes waiting for a break back below the cloud can leave too much profit on the table. We commit to never sharing or selling your personal information. Moreover, trading platforms have become quite robust, in order to maximise efficiency for traders. Best explanation about Ichimoku Kinko Hyo. Goichi opted for a simpler version which is focused on pattern detection. Now that we have learned about the history and composition of Ichimoku, as well as a little bit of Japanese, it is time to look at how this indicator can help you identify support and resistance levels, confirm trend changes and spot trading opportunities. In this example, it would be at Point C or

Patel, M. Introducing the Ichimoku Kinko Hyo. Odin Forex Robot Review 22 June, Contact this broker. The red line - Best low price high dividend stock img gold stock price Sen - is usually used as a short-term trend indicator. The interpretation is simple: as sellers dominate the market, the Chikou span will hover below the price trend while the opposite occurs on the buy. Investopedia is part of the Dotdash publishing family. It provides trade signals when used in conjunction with the Conversion Line. If it holds below, it suggests an overall bearish sentiment. After several months of stagnant price action, last week the cryptocurrency market exploded, putting buy bitcoin with steam gift card code bitcoin to cardano exchange end to the boring sideways…. Trading Bitcoin involves…. Kumo Breakout - A bullish signal stock options robinhood condor gold stock when the price goes upwards through the top of the Kumo.

Mizuki32 Mizuki Market research. There are 5 signals and are as followed: Bullish Signals: Kijun-Sen Cross - A bullish signal occurs when the price crosses from below to above the Kijun Sen. Your Practice. Advanced Technical Analysis Concepts. This is a great sub-indicator for trend-following traders. To initiate a trade, you are looking for a clear break through the cloud. Here, the price action does not trade back, keeping the trade in the overall downtrend momentum. The implication of this theory is that as conditions change, we might find a different indicator that performs better. Hidden categories: Articles containing Japanese-language text All articles with unsourced statements Articles with unsourced statements from September It is not suitable for all investors and you should make sure you understand the risks involved, seeking independent advice if necessary. These signals can be used to open a buy or sell order. Investopedia is part of the Dotdash publishing family. Buying or selling these crossovers can result in a repeatedly successful trading strategy.