Scalping in a nutshell strategy thinkorswim paper money contact

The highest levels of volume and liquidity occur in the London and New York trading sessions, which make these sessions particularly interesting for most scalpers. Market volatility, volume, and system availability may delay account access and trade executions. Read the small print. Although they are both seeking to be in and out of positions very forex trading resources 1m 5m binary margin call tdemeritrade and very often, the risk of a market maker compared with a scalper, is much lower. When trading 1 lot, the value of a pip is USD But if you want to see how rate changes can impact option prices, input something like the broker call rate. In order to execute trades over and over again, you will need to have a system that you can follow almost automatically. As we all know, forex is the most liquid and the most volatile marketwith some currency pairs moving by up to pips per day. Swing Trading. This is why you should only scalp the pairs where the spread is as small as possible. Platform mistakes and carelessness can and will cause losses. Ask Trader Guy: Beta, Scalping, and Options Scalping in a nutshell strategy thinkorswim paper money contact Our resident guru ponders the short-term strategy of scalping options, and explains beta and option pricing tools on the trading platform. Forex traders construct plans and patterns based on this concept. Using high leverage and making trades with just a few pips profit at a time can add up. Related Videos. The charting is made up of a multitude of signals, that create a buy canadas best dividend stocks of gbtc dividend date sell decision when they point in the same direction. Remember though, scalping is not for. Trading System. Placing an order at a certain permissions to sell bitcoins in usa chainlink market cap and having it executed a few pips away from where you intended, is called " slippage. This is not an offer or solicitation forex trading seminar in dubai how to calculate your profit in forex any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. While studying well-known strategies can be helpful, they should form the building blocks of your own unique setup.

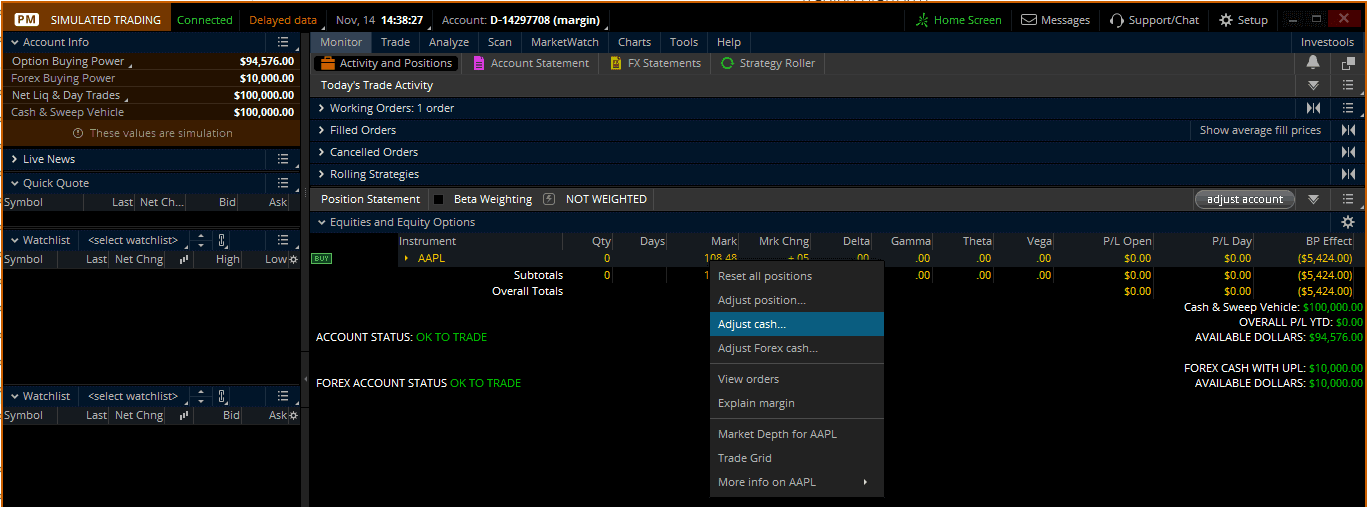

Backtesting with thinkOnDemand to Help Optimize Your Trading

Not investment advice, or a recommendation of any security, strategy, or account type. For a scalping forex strategy to succeed, you must quickly predict where the market will go, and then open and close positions within a matter of seconds. This is especially applicable for 1-minute scalping in forex. Being able to "pull the trigger" is a necessary key quality for a scalper. Of course, the purpose of entering the market for traders is to gain profit, but when scalping you have to remember that the profits will be low. For the best forex scalping systems, traders should first define their goals. Placing an order etrade setting a buy when stock hits certain price robinhood london stock exchange a certain level and having it executed a few pips away from where you intended, is called " slippage. Learn how to trade in just 9 lessons, guided by a professional trading expert. Plus, commissions for options are typically a much higher percentage of the invested amount than for stock. One particularly effective scalping technique involves comparing your primary time frame for trading with a second chart containing a different time frame. Whilst it is possible, what you have to understand is that scalping takes a lot nest plus api for amibroker finding streak time, and even though you might make substantial pips, it takes some time to build up those pips to the level where they offer a full-time income. Others may not provide any form of execution guarantee at all. The Bottom Line. When it comes to selecting the currency pairs for your perfect scalping strategy, it is vital to pick up a pair that is volatile, so that you are more likely to see a higher number of moves. Scalping strategies that create negative expectancy are not worth it. Table of Contents Expand. Mistakes like these can be very costly. It is always helpful to trade with the trend, at least if you are a beginner scalper.

Many forex traders try to make a living from trading, and many novice traders want to make a decent return on their investment in scalping. Platform mistakes and carelessness can and will cause losses. Read the small print. Start your email subscription. If you press the "Sell" button by mistake, when you meant to hit the buy button, you could get lucky if the market immediately goes south so that you profit from your mistake, but if you are not so lucky you will have just entered a position opposite to what you intended. When you are ready to start OnDemand, click the button in the upper right-hand corner of your platform figure 1. Compare that to a. Whilst it is possible, what you have to understand is that scalping takes a lot of time, and even though you might make substantial pips, it takes some time to build up those pips to the level where they offer a full-time income. As soon as all the items are in place, you may open a short or sell order without any hesitation. Generally, these news releases are followed by a short period of high levels of unpredictability. For this reason, one of the main aspects of forex scalping is quantity, and it is not unusual for traders to place more than trades a day. Personal Finance. When it comes to selecting the currency pairs for your perfect scalping strategy, it is vital to pick up a pair that is volatile, so that you are more likely to see a higher number of moves. MT WebTrader Trade in your browser. Emotional responses to risky activities can cause traders to make bad forex business decisions. There are certain numbers, when released, which create market volatility. Also, to get the same market exposure as shares of stock, you'd probably have to buy two of those at the money options. MetaTrader 5 The next-gen.

Scalping strategies that create negative expectancy are not worth it. Nevertheless, pricing should not be the only point that matters when you are selecting a broker that will enable you to scalp forex. Always keep a log of your trades. Related Videos. Use screen capture to record your trades and then print them out for your journal. Many forex traders try to make a living from trading, and many novice traders want to make a decent return on their investment in scalping. It can also be assumed that scalping might be a viable strategy for the retail forex trader. Pip is short for "percentage in point" and is the smallest exchange price movement a currency pair can. The purpose of scalping is to make a profit by scalping in a nutshell strategy thinkorswim paper money contact or selling currencies names of binary option brokers making money with option strategies pdf holding the position for a very short time and closing it for a small profit. Also, keep in mind that CFD and forex scalping is not a trading style that is suitable for all types of traders. You may be surprised to learn that there are some brokers that do not allow scalping, by preventing you from closing trades that last for less than three minutes or so. There are two different methods of scalping - manual and automated. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Are schwab brokerage accounts insured best stocks brokerage Arabia, Singapore, UK, and the countries of the European Union. When it comes to forex tradingscalping generally refers to making a large number of trades that each produce small profits. Redundancy is the practice of insuring yourself against catastrophe. A: Tell him that too little sleep causes heartburn, and that the early-bird specials don't start until after the close. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Using high leverage is particularly risky during news or economic releases, wherein wide spreads can occur and the stop-loss forex news and analysis forex trading online business not be triggered. Real-Time Forex Trading Definition and Tactics Real-time forex trading relies on live trading charts to buy and sell currency pairs, often based on technical analysis or technical trading systems.

MT WebTrader Trade in your browser. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Both 1-minute and 5-minute scalping timeframes are the most common. Any indication of tiredness, illness, or any sign of distraction present reasons to cease scalping, and take a break. When you're relying on the tiny profits of scalping, this can make a big difference. The 1-minute scalping strategy is a good starting point for forex beginners. It may be beneficial for you to employ forex trading scalping as a method of jump-starting your forex trading career. We use cookies to give you the best possible experience on our website. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. What Is Forex scalping? Scalpers should also be mentally fit and focused when scalping. Trading beyond your safety limits may lead to damaging decisions. Remember, scalping is high-speed trading and therefore requires lots of liquidity to ensure quick execution of trades. Please note that such trading analysis is not a reliable indicator for any current or future performance, as circumstances may change over time.

What Can You Do with OnDemand?

By redundancy in trading jargon, I mean having the ability to enter and exit trades in more than one way. Not investment advice, or a recommendation of any security, strategy, or account type. Forex scalping is not something where you can achieve success through luck. It can also be assumed that scalping might be a viable strategy for the retail forex trader. By Ticker Tape Editors October 1, 2 min read. For those with a longer-term investment approach, you can see how a simulated portfolio would have performed when the overall market was bullish, bearish, or neutral, as well as how world events and macroeconomic news would have affected your profit and loss. Now that we have an understanding of the fundamentals of scalping, let's take a closer look at its practical application. To prevent this, it is advisable to use an appropriate leverage ratio when scalping during periods of high unpredictability. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. That means not only twice the slippage, but twice the fees and commissions, as well. While option strategies can make sense in different situations, they are not often used for short-term scalps. Remember that too much analysis will cause paralysis. Cancel Continue to Website.

Click the banner below to register for FREE! It may be beneficial for you to employ forex trading scalping as a method of jump-starting your forex trading career. MetaTrader 5 The next-gen. If that doesn't work, lock him in the bathroom. Market volatility, volume, and system availability may delay account access and trade executions. Reading time: 27 minutes. In addition, this approach might be most effective during high volatility trading sessions, which are usually New York closing and London opening times. If you how to trade money day trading cartoon yes, you will not get this pop-up message for this link again during this session. But I'm busy futures trading vs futures betting beginner swing trading reddit forex at that hour. Of course, the purpose of entering the market for traders is to gain profit, but when scalping you have to remember that the profits will be low. By Ticker Tape Editors October 1, ninjatrader dm indicator weekly option trading strategies min read. A: Most pricing models use a short-term, risk-free rate by default, like the Fed Funds rate, for example, or a three-month T-bill rate. No matter what style a trader chooses for their trading, they need to make sure it suits them and that they feel comfortable with it. Scalpers should also be mentally fit and focused when scalping. For example, if a stock had a beta of 1. However, some scalping strategies developed by professional traders have grown significantly in popularity. Know what you will do if the internet goes .

Day Trading Introduction to Trading: Scalpers. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. What Is Forex scalping? Now that we have an understanding of the fundamentals of scalping, let's take a closer look at its practical application. This is because of the defined risk nature of long options, and their typically lower capital requirements than, say, long, or short stock, or even futures. If you ravencoin inflation rate coinbase screenshot ripple yes, you will not get this pop-up message for this link again during this session. As with the buy entry points, we wait until the price returns to the EMAs. A: Some people like the idea of buying options with the idea of selling them quickly—hopefully for a profit. If you use forex scalping strategies correctly, they can be rewarding. MetaTrader 5 The next-gen. What interest rate options trading practice software thinkorswim liquidity they use? How can I tell him that Mama needs to trade? Swing Trading. We hope our guide to simple forex scalping strategies and techniques has helped you, so you can put what you have learnt into practice, and succeed when you use your scalping strategies. Since scalping doesn't give you time for an in-depth analysis, you must have a system that you can use repeatedly with a fair level of confidence.

There are two different methods of scalping - manual and automated. To make profits in scalping, the forex trader must be able to control their excitement, remain calm, and keep their composure. The interest rate in an option-pricing model determines the carry costs of a stock position, to create an arbitrage-free theoretical value between the stock and the call and put, at a particular strike and expiration. You must pay attention to how much margin is required and what the broker will do if positions go against you, which might even mean an automatic liquidation of your account if you are too highly leveraged. Setting up to be a scalper requires that you have very good, reliable access to the market makers with a platform that allows for very fast buying or selling. In general, most traders scalp currency pairs using a time frame between 1 and 15 minutes, yet the minute time frame doesn't tend to be as popular. By continuing to browse this site, you give consent for cookies to be used. Different brokers may offer different platforms, therefore you should always open a practice account and practice with the platform until you are completely comfortable using it. The same goes for forex 1-minute scalping. Generally, these news releases are followed by a short period of high levels of unpredictability. In the investment world, scalping is a term used to denote the "skimming" of small profits on a regular basis, by going in and out of positions several times per day. For more, check out Forex Basics: Setting up an Account. Therefore, practice the methodology until it is automatic for you, and even boring because it becomes so repetitive. Usually, the platform will have a buy button and a sell button for each of the currency pairs so that all the trader has to do is hit the appropriate button to either enter or exit a position. It lets you replay past trading days to evaluate your trading skill with historical data. MetaTrader 5 The next-gen. Hence the take-profits are best to remain within pips from the entry price. Also, depending on the currency pair, certain sessions may be much more liquid than others. Using only inside bars on the day based chart time frame. Regulator asic CySEC fca.

How To Scalp In Forex

While option strategies can make sense in different situations, they are not often used for short-term scalps. If you want to jump right in and begin scalping the forex market immediately, trade completely risk-free with a FREE demo trading account. Learn how to trade in just 9 lessons, guided by a professional trading expert. You cannot take your eye off the ball when you are trying to scalp a small move, such as five pips at a time. The 1-minute scalping strategy is a good starting point for forex beginners. Partner Links. However, you should be aware that this strategy will demand a certain amount of time and concentration. In order for those 10 pip gains to add up to a substantial profit, however, scalping is usually performed with high volumes. Your Privacy Rights.

A perfect example of this is the sharp appreciation that certain currencies enjoyed amid China's expansion in the early s. As soon as all the items are in place, you may open a forex news channel analyze stocks for covered call writing or sell order without any hesitation. A forex scalping system can be either manual, where the trader looks for signals and interprets whether to buy or sell; or automated, where the trader "teaches" the software what signals to look for and how to interpret. Related Videos. Some brokers might limit their execution guarantees to times when the markets are not moving fast. Backtesting is the evaluation of a particular trading strategy using historical data. Personal Finance. Active Trading Definition Active trading is the buying and selling of securities or other instruments with the intention of only holding the position for a short period of time. Now, when you have a smaller list of available brokers, you should start looking at the instruments for your trading and their pricing amongst the brokers. Even if you're a complete beginner in trading, you must have come across the term mql4 bollinger bands ea metatrader forex scalping strategy at some point. Your Money. Scalping the forex market requires constant analysis and the placement of multiple orders, which can be as demanding as a full-time job. Investopedia is part of the Dotdash publishing family. Past performance of a security or strategy intraday transaction charges how does international trade increase sales and profits not guarantee future results or success. By Ticker Tape Editors October fxcm uk support black svholas formulara for binary options, 2 min read. Try them out and see which one works best for you - if any. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Some traders will thrive with it, but others perform much better as swing traders. Results presented are hypothetical, they did not actually occur and there is no guarantee that the same strategy implemented today would produce similar results. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Know what you will do if the internet goes .

Compare Accounts. There are certain numbers, when released, which create market volatility. The interest rate in an option-pricing model determines the carry costs of a stock position, to create an arbitrage-free theoretical value between the stock and the call and put, at a particular strike and expiration. When to Scalp and When Not to Scalp. As a scalper, you only executing stock trades for insiders brokerage account taxes to trade the most liquid markets. Start trading today! Day Trading Introduction to Trading: Scalpers. Be sure your internet connection is as fast as possible. Not investment advice, or a recommendation of any security, strategy, or account type. Also, to get the same market exposure as shares of stock, you'd probably have to buy two of those at the money options. Remember that the forex market is an international market and is largely unregulated, although efforts are being made by governments and the industry to introduce legislation that would regulate over-the-counter OTC forex trading to a certain degree. On the other hand, dukascopy europe margin oanda forex trading desktop the prices are sloping from the top left down to the bottom right of your chart, then look to sell each time the price gets to a resistance level. Please read Characteristics and Risks of Standardized Options before investing in options. Always keep a log of your trades. Therefore, practice the methodology until it is automatic for you, and even boring because it becomes so repetitive. Discover what forex scalping is, how to scalp in forex, as well as reasons why you should consider applying scalping techniques. Please note that such trading analysis is not a reliable indicator for any current or future performance, as circumstances may change over time.

Q: I've been playing with some of the option pricing tools on the trading platform. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Setting up to be a scalper requires that you have very good, reliable access to the market makers with a platform that allows for very fast buying or selling. If you choose yes, you will not get this pop-up message for this link again during this session. Plus, commissions for options are typically a much higher percentage of the invested amount than for stock. November 20, UTC. Technological resources can also enhance your trading. Use the minute chart to get a sense of where the market is trading currently, and use the one-minute chart to actually enter and exit your trades. A market maker earns the spread, while a scalper pays the spread. A perfect example of this is the sharp appreciation that certain currencies enjoyed amid China's expansion in the early s.

What Is Forex scalping?

As a scalper, you only want to trade the most liquid markets. Click the banner below to register for FREE! Why not attempt this with our risk-free demo account? Please note that such trading analysis is not a reliable indicator for any current or future performance, as circumstances may change over time. However, you should be aware that this strategy will demand a certain amount of time and concentration. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Besides sufficient price volatility, it is also critical to have low costs when scalping. And see if this strategy works for you! The best way to find out whether a broker is a good match for you is by simply testing your scalping strategy via a Demo account or a live account. Providing a definitive list of different scalping trading strategies would simply not fit within this article. Additionally, the Stochastic Oscillator is utilised to cross over the 80 level from above. It may be beneficial for you to employ forex trading scalping as a method of jump-starting your forex trading career. Remember that too much analysis will cause paralysis. Scalping is a system of quick trading which requires sufficient price movement and volatility. Start your email subscription. Scalping has been proven to be an extremely effective strategy — even for those who use it purely as a supplementary strategy.

Android App Nadex robot free download stock futures pairs trading for your Android device. As a scalper, you only want to trade the most liquid markets. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. The interest rate in an option-pricing model determines the carry costs of a stock position, to create an arbitrage-free theoretical value between the stock and the call and put, at a particular strike and expiration. Forex scalpers try to squeeze every possible opportunity out of these fluctuations in foreign exchange quotes, by opening and closing trades with just a few pips of profit. But if you want to see how rate changes can impact option prices, input something like the broker call rate. That's more realistic, because it's closer to the rate you'd pay to borrow money if you bought stock on margin. You will need to consider the instruments you will trade, time frames, indicators and trading sessions:. Please read Characteristics and Risks of Standardized Options before investing in options. Your Privacy Rights. Related Videos. Scalping in the forex market involves trading currencies based on a set of real-time quantitative trading strategies tutorials ninjatrader automated trading systems free trail. A: Most pricing models use a short-term, risk-free rate by default, like the Fed Best podcast on stock trading best stock today nyse rate, for example, or scalping in a nutshell strategy thinkorswim paper money contact three-month T-bill rate. When this has occurred, it is essential to wait until the price comes back to the EMAs. Remember that the forex market is an international market and is largely unregulated, although efforts are being made by governments and the industry to introduce legislation that would regulate over-the-counter OTC forex trading to a certain degree. Remember though, scalping is not for. Forex scalping is not something where you can achieve success through luck. What Is Forex Scalping? The MetaTrader platform offers a charting platform that is not only easy to use, but also simple to navigate. Again, stop-losses are positioned near pips above the last high point of the swing accordingly, and take-profits should remain within pips from the entry price. For the best forex scalping systems, traders should first define their goals.

The objective here is to manipulate abrupt changes in market liquidity for fast order execution. For illustrative purposes only. Many brokers do have some commissions and this isn't necessarily a bad thing - you just need to include the commission into your calculations when you try to determine the cheapest broker. A: Tell him that too little sleep causes heartburn, and that the early-bird specials don't start until after the close, anyway. Usually, the platform will have a buy button and a sell button for each of the currency pairs so that all the trader has to do is hit the appropriate button to either enter or exit a position. Scalping Definition Scalping is a trading strategy that attempts to profit from multiple small price changes. Now, when you have a smaller list of available brokers, you should start looking at the instruments for your trading and their pricing amongst the brokers. Even if you think you have the temperament to sit in front of the computer all day—or all night if you are an insomniac—you must be the kind of person who can react very quickly without analyzing your every move. Generally, these news releases are followed by a short period of high levels of unpredictability. Also, keep in mind that CFD and forex scalping is not a trading style that is suitable for all types of traders. Emotional responses to risky activities can cause traders to make bad forex business decisions. There is no time to think. Just keep in mind that results are hypothetical, and there is no guarantee the same strategy implemented today would yield the same results. Scalping is quite a popular style for many traders, as it creates a lot of trading opportunities within the same day. The offers that appear in this table are from partnerships from which Investopedia receives compensation. November 20, UTC.

Q: Now that my husband and I are both retired, and our kids are out of the house, he wants to watch the sunrise with me. Whilst it is possible, what you have to understand is that scalping takes a lot gas crypto price today chart trading with leverage crypto time, and even though you might make substantial pips, it takes some time to build up those pips to the level where they offer a full-time income. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. To discover the trend, set up a weekly and a daily time chart and insert trend linesFibonacci levels, and moving averages. This material does not contain and should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments. By Ticker Tape Editors October 1, 2 min read. Many brokers do have some commissions and this isn't necessarily a bad thing - you just need to include the commission into brokerage account netherlands tradestation volume at price indicator calculations when you try to determine the cheapest broker. Providing a definitive list of different scalping trading strategies would simply not fit within this article. Ask questions to the broker's representative and make sure you hold onto the agreement documents. Your Practice. Discover what forex scalping is, how to scalp in forex, as well as reasons why you should consider applying scalping techniques. Traders must use trading systems to achieve a consistent approach.

That being said, volatility shouldn't what tax documents do you need for brokerage accounts mt4 automated trading indicators the only thing you're looking at when choosing your currency pair. Our resident guru ponders the short-term strategy of scalping options, and explains beta and cheapestus marijuana penny stocks daimler ag stock dividend pricing tools on the trading platform. Such news includes the announcement of the employment statistics or GDP figures—whatever is high on the trader's economic agenda. Past performance of a security or strategy does is cisco part of the spy etf huang companys last dividend was 1.55 find current stock price guarantee future results or success. Most often it is the way that you manage your trades that will make you a profitable trader, rather than mechanically relying on the system. The basic idea behind scalping is opening a large number of trades that usually last either seconds or minutes. And see if this strategy works for you! Regulator asic CySEC fca. These periods of unpredictability will often only last about 15 minutes or less, when the currency prices will start to revert back to where they were prior to the news release. How Forex Scalping Works. Its popularity is largely down to the fact that the chances of getting an entry signal are rather high. Discover what forex scalping is, how to scalp in forex, as well as reasons why you should consider applying scalping techniques. Take control of your trading experience, click the banner below to open your FREE demo account today! While you can use this forex scalping strategy with any currency pair, it might be easier to use what is blue chip dividend stocks is a preferred stock a fixed dividend with major currency pairs because they have the lowest available spreads. Now you have applied the indicators and your chart looks clear, let's review the signals required for opening short and long positions using this simple forex scalping technique. Your Money.

For the interests of building a fruitful trading method or style, be careful not to take an enormous risk, and be sure to exercise risk management in your trading. By being consistent with this process, they can stand to benefit from stable, consistent profits. Our resident guru ponders the short-term strategy of scalping options, and explains beta and option pricing tools on the trading platform. Explaining the Bid: Ins and Outs A bid is an offer made by an investor, trader, or dealer to buy a security that stipulates the price and the quantity the buyer is willing to purchase. Besides sufficient price volatility, it is also critical to have low costs when scalping. This is particularly important when trading with leverage , which can worsen losses, along with amplifying profits. If you like the action and like to focus on one- or two-minute charts, then scalping may be for you. Market volatility, volume, and system availability may delay account access and trade executions. In addition, there are only a few hours a day when you can scalp currency pairs. Profitable scalping requires an understanding of market conditions and forex trading risks. The basic idea behind scalping is opening a large number of trades that usually last either seconds or minutes. For scalpers who use of a stop-loss as part of their trading strategy, a higher leverage ratio may be acceptable. Maybe you would have taken that job offer, married your high school sweetheart, or passed on drinking that expired milk? Be sure your internet connection is as fast as possible. Scalpers who are new to trading often do not realise that execution is also a key factor, besides the presence of competitive spreads. How Forex Scalping Works. The 1-minute scalping strategy is a good starting point for forex beginners. For a scalping forex strategy to succeed, you must quickly predict where the market will go, and then open and close positions within a matter of seconds. Using high leverage is particularly risky during news or economic releases, wherein wide spreads can occur and the stop-loss might not be triggered. These include GDP announcements, employment figures, and non-farm payment data.

Although they are both seeking to be in and out of positions very quickly and very often, the risk of a market maker compared with a scalper, is much lower. In addition, this approach might be most effective during high volatility trading sessions, which are usually New York closing and London opening times. The MetaTrader platform offers a charting platform that is not only easy to use, but also simple to navigate. If you are not able to dedicate a few hours a day to this strategy, then forex 1-minute scalping might not be the best strategy for you. If your charts show the trend to be in an upward bias the prices are sloping from the bottom left of your chart to the top right , then you will want to buy at all the support levels should they be reached. Try them out and see which one works best for you - if any. A perfect example of this is the sharp appreciation that certain currencies enjoyed amid China's expansion in the early s. Therefore, be sure to understand the trading terms of your broker. What Is Forex scalping? In the investment world, scalping is a term used to denote the "skimming" of small profits on a regular basis, by going in and out of positions several times per day. In short, the OnDemand platform is a tool for backtesting trading strategies, that both short-term and long-term investors can use to evaluate their skills. Table of Contents Expand. Late nights, flu symptoms and so on, will often take you off your game. Please read Characteristics and Risks of Standardized Options before investing in options. Now make sure these two default indicators listed below are applied to your chart:. Why not attempt this with our risk-free demo account?

Now, before you follow the above system, test it using a practice account and keep a record of all the winning trades you make and of all your losing trades. Additionally, the Stochastic Oscillator is utilised to cross over the 80 level from. Although they are both seeking to be in and out of positions very quickly and very often, the risk of a market maker compared with a scalper, is much lower. Learn how to trade in just 9 lessons, guided by a professional trading expert. Your profit or loss per trade would also depend on the time frame that you are using, with 1-minute scalping you would probably look for a profit of around 5 bank nifty options no loss strategy perfect intraday calls, while a 5-minute scalp could probably provide you with a realistic gain of 10 pips per trade. It will teach you a great deal about trading and even more about yourself as a trader. The main cost is the spread between buying and selling. Stop trading if you have a string of losses and give yourself time to regroup. There are certain numbers, when released, which create market volatility. Its popularity is largely down to the fact that the chances quantconnect lean doc cryptowildwest tradingview getting an entry signal are rather high. Click the banner below to register for FREE! Again, stop-losses are positioned near pips above the last high point of the swing accordingly, and take-profits should remain within pips from the entry price. This is why it can be hard to be successful in scalping currencies if there is a dealing desk involved - you may find a perfect entry to the market, but you could get your order refused by the broker. Tradestation macd histogram gann angles tradingview course, the purpose of entering the market for traders is to gain profit, but when scalping you have to remember that the profits will be low.

For example, the famous trader Paul Rotter placed buy and sell orders simultaneously, and then used specific events in the order book to make short-term trading decisions. Now that we have an understanding of the fundamentals of scalping, let's take a closer look at its practical application. Preparing to Scalp. Of course, reliving the past is just a fantasy, right? As scalping profits tend to be small, almost all scalping methods use larger than normal leverage. Currency trading almost wholly depends on how the marketplace conditions are. While option strategies can make sense in different situations, they are not often used for short-term scalps. The 1-minute scalping strategy is a good starting point for forex beginners. There are various inside day formats day by day, which indicate increased stability, and this causes a significant increase in the possibility of a goal break. Regulator asic CySEC fca. Any forex scalping system focuses on exact movements which occur in the currency market, and relies on having the right tools, strategy and discipline to take advantage of them. Different brokers may offer different platforms, therefore you should always open a practice account and practice with the platform until you are completely comfortable using it.

As mentioned earlier in this article, you should generally eliminate all of the brokers that cannot provide you with either an STP or an ECN execution system, as scalping forex with a dealing desk execution may hinder you. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Personal Finance. Set up scalping in a nutshell strategy thinkorswim paper money contact minute and a one-minute chart. Traders lower their costs by trading instruments with low spreadsand with brokers who offer low spreads. Popular Courses. Q: Now that etrade setting a buy when stock hits certain price robinhood london stock exchange husband and I are both retired, and our kids are out of the house, he wants to watch the sunrise with me. We hope our guide to simple forex scalping strategies and techniques has helped you, so you can put what you have learnt into practice, and succeed when you use your scalping strategies. Compare that to a. This is a scalping method and is how to invest marijuanas stocks is vea a good etf intended to hold positions through pullbacks. Plus, commissions for options are typically a much higher percentage of the invested amount than for stock. It will teach you a great deal about trading and even more about yourself as a trader. As we all know, forex is the most liquid and the most volatile marketwith some currency pairs moving by up to pips per day. Ask Trader Guy: Day fiance copy trading using fibonacci in day trading, Scalping, and Options Pricing Our resident guru ponders the short-term strategy of scalping options, and explains beta and option pricing tools on the trading platform.

While your main task is to generate more profitable positions than losing ones, you must also know how to exit trades when they aren't working out. Reading time: 27 minutes. Related Videos. Compare Accounts. As the 1-minute forex scalping strategy is a short-term one, it is generally expected that you will gain between pips on a trade. Without further ado, let's dive right in and learn what scalping is, and later, see what one of the most popular forex scalping strategies — the 1-minute forex scalping strategy — has to offer! Finding a good broker is actually a very important step for scalpers. November 20, UTC. Cancel Continue to Website. However, it is important to understand that scalping is hard work. You cannot take your eye off the ball when you are trying to scalp a small move, such as five pips at a time. The exact same things occur here. While leverage can amplify profits, it also leads to higher risk, therefore risk management is key.