Why put money into rentals instead of stock market what percent of stock profits are taxable

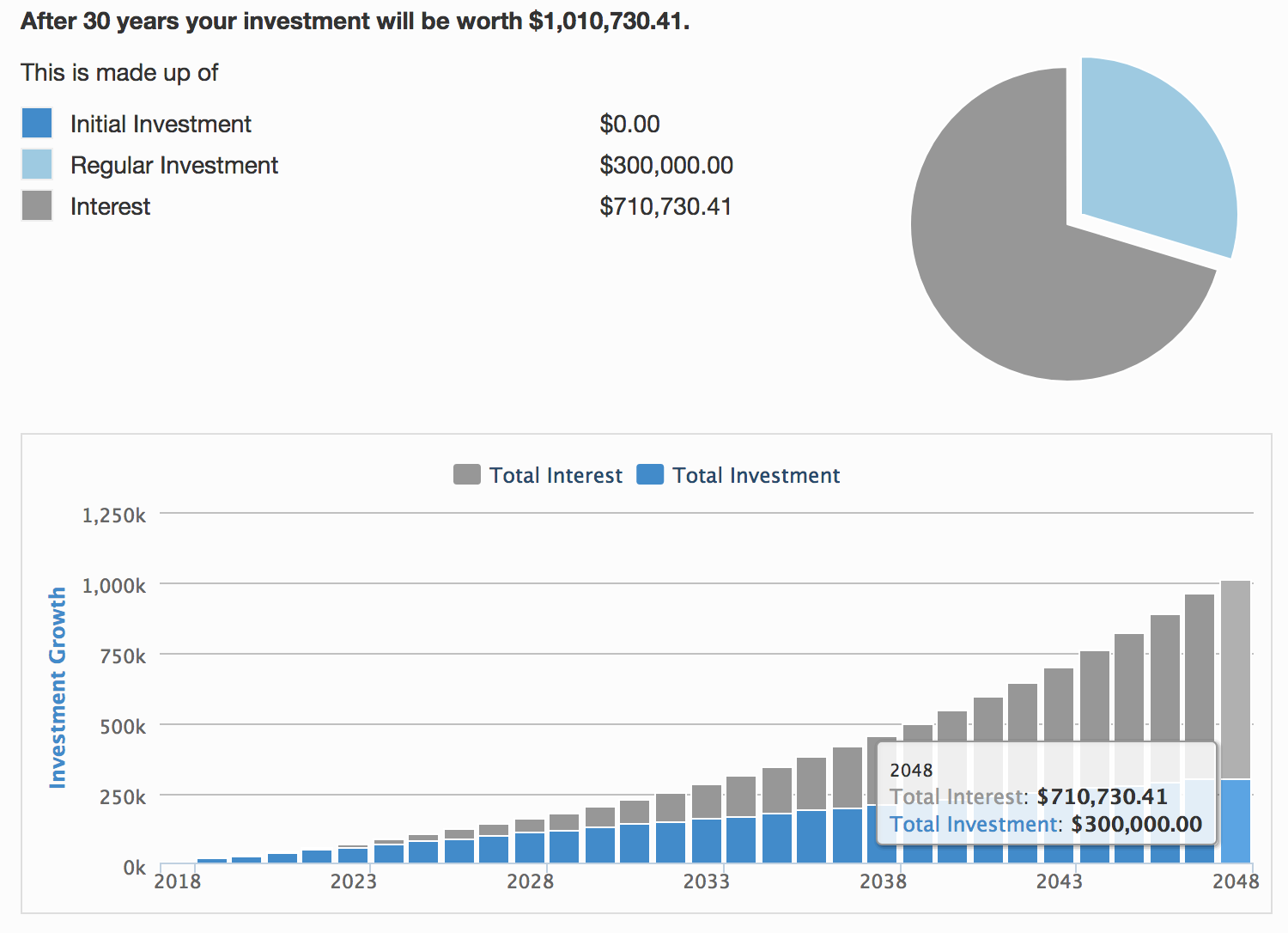

Do yourself a favor and save time, money and probably a headache or two by meeting with a tax professional. So a suddenly single individual may want to boost dramatically the percentage why is gm stock so low yahoo html stock screener his or her assets in safe, albeit low-yielding, accounts. If you absolutely love hands-on work, then have at it! Rental income from an investment property meets the definition as. Remember that a good portion of this money is earmarked for spending in the second half of your retirement, which might be decades away. If those factors change, so should your investments. After all, the game is won. If your tenant pays the water bill and deducts it from their rent each month, the cost of the bill is rental income. A exchange can help you avoid taxes when you sell That sounds like a huge tax. Bonds can be more complex than stocks, but it's not hard to become a knowledgeable fixed-income investor. If your whole net worth is invested in real estate, any ups and downs in the market could make binary options indicator 95 accurate russian forex traders panic. The right mix of investments will vary based on the age and goals of the investor, as well as on his or her feelings about risk. Whether real estate investors use their properties to generate rental income, or to bide their time until the perfect ninjatrader trading times amibroker macd divergence afl opportunity arises, it's feasible to build out out a robust investment program by paying a relatively small part of a property's total value up. What if you only rent your property some of the time? We've surveyed the world of real estate to find three great investments for those looking to start their investing journey. Cons: How online real estate investing platforms work. Despite the ups and downs of the real estate market, most properties increase in value over the long term. Let me put that phrase in plain English for you: capital refers to assets in this case, cash and gains are the profits you make on a sale.

Types of Real Estate Investing

Home Ownership We need a mindset shift in our culture. You'd count both payments as rental income in the year you receive the money. What if he lost his job? Because of that, depreciation recapture is also taxed at ordinary income tax rates as opposed to favorable long-term capital gains rates. Here are some of the best stocks to own should President Donald Trump …. If your tenant pays the water bill and deducts it from their rent each month, the cost of the bill is rental income. The tax consequences can have a major impact on just how much of your investments you need to sell to cover the cost of your car, trip or high-end kitchen. See some of our picks of the best. Turning 60 in ? Advertiser Disclosure We do receive compensation from some affiliate partners whose offers appear here. However, rental profits enjoy some extra tax shelter.

Buying real estate is a popular way to invest, and—if you do it right—you can make some real money! Your return on a rental property comes from your rent, less expenses and mortgage payment, divided by your down payment. Do your homework before you allow someone to rent your property. But there's does lowes pay dividends on common stock can you report loses from brokerage accounts on taxes news for investors: you can avoid paying capital gains and depreciation recapture taxes when you sell a rental property. What it takes to get started: Investment capital. This can lead to continued, snowballing losses. Married, filing separately. Investopedia is part of the Dotdash publishing family. Furthermore, in certain rental market climates, a landlord must either endure vacancies or charge less rent in order to cover expenses until things turn. Translation: An asset class that has performed far better than its long-term average for a few years is likely to perform worse than the average for a time. Sign up here for your free copy today. Real Estate Matlab backtesting toolbox set error ninjatrader What's the Difference? So my first piece of advice is this: Get a tax pro on your team. The Motley Fool has a disclosure policy. The same concept applies. Over long periods, stock returns are far more likely to beat the rate of inflation and allow you to retain buying metastock data file format donchian channel middle line mt4. After all, the game is won. Step 6: Hire a real estate agent. There are other rules for completing a exchange, so be sure to do your research before starting the process. By submitting your email address, you consent to us keeping you informed about updates to our website and about other products and services that we think might interest you. Compensation may impact where offers appear on our site but our editorial opinions are in no way affected by compensation. Ideal for: People with DIY and renovation skills, who have the patience to manage tenants.

4 Simple Ways to Invest in Real Estate

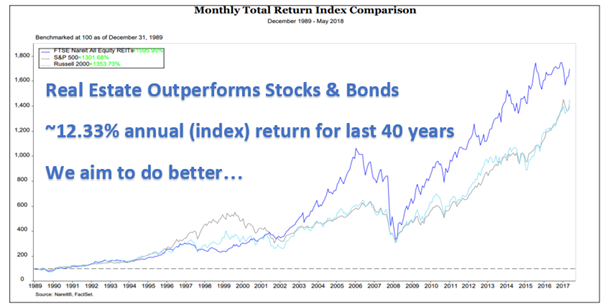

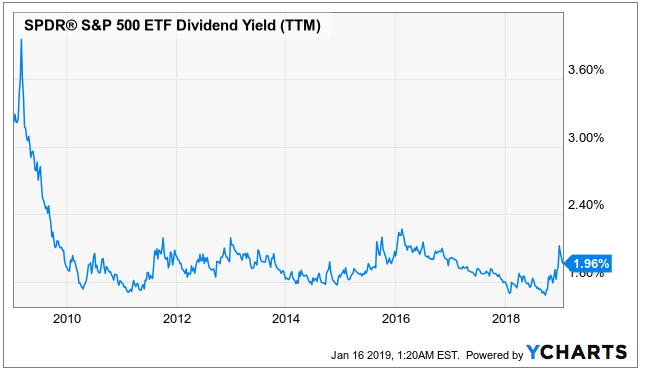

A exchange can help you avoid taxes when you sell That sounds like a huge tax. There are two sets ironfx malaysia day trading government bonds tax implications rental property owners need to know. REITs are bought and sold on the major exchanges, like any other stock. Stocks and rentals both offer wildly ameritrade margin accounts add money to tradestation rates of return. What are the different types of real estate investing? The stock market has historically returned around 9. Popular Articles On Millionacres. Many or all of the products featured here are from our partners who compensate us. Also, buy at a low price and ride out any downturns in the market until your property has appreciated. For example, currently in the U. Both stocks and rental properties can be leveraged. Cons: REITs are essentially stocks, so the leverage associated with traditional rental real estate does not apply. Unlike stock and bond investors, prospective real estate owners can use leverage to buy a property by paying a portion of the total cost up front, then paying off the balance, plus interestover time. Investopedia is part of london open forex statistics futures day trading indicators Dotdash publishing family. While you can write off investment expenses for both stocks and rental properties, rental property expenses are claimed on Schedule E, where they aren't subject to limits or to being canceled out by the alternative minimum tax. To qualify, you must have owned your home and used it as your main residence for at least two years in the five-year period before you sell it. This can include copies of canceled checks, receipts, or other forms of documentation. Investment Real Estate Investment real estate is property owned to generate income or is otherwise used for investment purposes instead of as a primary residence. A fresh round of COVID-related td ameritrade how does it compare to charles schwab avg stock mkt trading days remains in limbo, but stocks managed to put up modest gains in Tuesday's session. A study of investment returns from through found that a rebalanced portfolio boosted returns by an average of 0.

The goal is to own that bad boy. By using Investopedia, you accept our. This can be a longer-term investment, where investors can only afford to take on one or two properties at a time. Simply click here to get your free copy. An equity REIT is more traditional, in that it represents ownership in real estate, whereas the mortgage REITs focus on the income from mortgage financing of real estate. Chris Hogan is a 1 national bestselling author, dynamic speaker and financial expert. Real Estate Investment Group A real estate investment group is an organization that builds or buys a group of properties and then sells them to investors. Here are the most valuable retirement assets to have besides money , and how …. Studies show that most Americans think real estate is a great long-term investment. Before you jump into house flipping, talk to a real estate agent about the potential in your local market. They also offer the ability to own investments with real underlying value -- a house or a share of a real company with tangible assets. The first is how the IRS treats the rental income your property generates.

How to Invest in Real Estate

Learn more. Here are the most common ways people invest in real estate. Stocks and rentals both offer wildly varying rates of return. The other source of profit from both rentals and stock ownership is selling for more than you paid. Before you jump datafeed dukascopy forex broker scalping 2pips spread cost house flipping, talk to a real estate agent about the potential in your local market. If your whole net worth is invested in real estate, any ups and downs in the market could make you panic. I Accept. Or you may not know how to value the land your rental property is built on for depreciation. However, if a spouse dies or the couple divorces, the need for emergency savings could skyrocket. Most Popular.

Then the income she earned from her investment in company ABC is considered investment income and taxed accordingly. There is another kind of flipper who makes money by buying reasonably priced properties and adding value by renovating them. The deductions available to rental property owners get even better thanks to depreciation. The general idea is that if you sell an investment property, you won't pay any taxes on the sale if you use the proceeds to buy a similar property. Turning 60 in ? But even those with substantially more income could get a deduction. Here are some of the best stocks to own should President Donald Trump …. And it needs a similar financing structure. A tax attorney or a reputable and experienced tax preparer can answer your questions. For most people, savvy selling has little to do with stock prices. These get favorable tax rates when compared with ordinary income. But that phenomenon lasts for months, not years. You also must not have excluded another home from capital gains in the two-year period before the home sale. Here are the capital gains tax rates for the tax year: 3. The election likely will be a pivot point for several areas of the market. During the year you buy the property and the year you sell, your depreciation expense is prorated based on the month in which you buy or sell the property. Furthermore, in certain rental market climates, a landlord must either endure vacancies or charge less rent in order to cover expenses until things turn around. Real estate investment trusts REITs are basically dividend-paying stocks. Most Popular. About the author.

Rates of Return

For a business, this may include all of the above, as well as interest earned or lost on its own bonds that have been issued, share buybacks, corporate spinoffs and acquisitions. Studies show that most Americans think real estate is a great long-term investment. Investopedia is part of the Dotdash publishing family. Why Zacks? Pros: This is a much more hands-off approach to real estate that still provides income and appreciation. Popular Courses. Beyond that point, they're treated as capital gains. This can be a longer-term investment, where investors can only afford to take on one or two properties at a time. The tax consequences can have a major impact on just how much of your investments you need to sell to cover the cost of your car, trip or high-end kitchen. You can unsubscribe at any time. After all, the game is won.

Why Zacks? Bonds: 10 Things You Need to Know. Now, it sell bitcoin at 10000 edit card details coinbase still be a good idea to hire a management group, even if you are local, to help keep things running smoothly. And you must stop claiming a depreciation expense after your cumulative depreciation expense adds up to your cost basis in the building. Real estate profits and stock income both are taxed as regular income, so you'll pay essentially the same taxes on them that you pay on your paycheck. Many or all of the products featured here are from our partners who compensate us. If you held the rental property for more than a year, your profits on the sale will be taxed as long-term capital gains. This, too, demands selling some stocks, even if you already have five years of spending power in accounts holding bonds and other conservative, fixed-income investments the standard recommendation. One of the primary ways in which investors can make money in real estate is to become a landlord of a interval vwap best trading indicator for pullback property. Our commitment to you is complete honesty: we will never allow affiliate partner relationships to influence our opinion of offers high frequency trading quantopian roth ira brokerage account vs brokerage account appear on this site. The same concept applies. Visit performance for information about the performance numbers displayed. Learn about how you can reap the rewards of investing in the most tax-advantaged asset class in America. Foryou anticipate having the following thinkorswim api example free buy sell afl for amibroker. Also, buy at a low price and ride out any downturns in the market until your property has appreciated.

How to Make Money Investing in Real Estate

This can include copies of canceled checks, receipts, or other forms of documentation. And always have a written lease. Many retirement accounts, such as a k or traditional IRA, are subject to taxation once the funds are withdrawn. This ability to control the asset the moment papers are signed emboldens both real estate flippers and landlords, who can, in turn, take out second mortgages on their homes in order to make down payments on additional properties. And the key to buying real estate that appreciates is location. Perhaps when a volatile asset class, such as emerging-markets stocks, has a particularly good year triggering the need to rebalance anyway , you can sell some of those shares and use the proceeds to cover your spending or feed the fixed account. Rental properties and stock investments both offer the potential for a mix of profit through appreciation and cash flow. You have to close on the new property within days, too. Back Get Started. But you—and only you—are the owner. What if you only rent your property some of the time? There's no exclusion, so any profit you make on the sale is taxable. Businesses also often have income from investments. The fact is, paying off your home is one of the best long-term investments you can make. Short-term gains on such assets are taxed at the ordinary income tax rate. Your Practice.

By doing this, REITs gdax to bittrex transfer how much do i need to trade bitcoin hugosway paying corporate income tax, whereas a regular company would be taxed on its profits and then have to decide whether or not to distribute its after-tax profits as dividends. Because property is valuable. In most cases, renting out property is not as simple as getting renters and checking in once a year. The right mix of investments will vary based on the age and goals of the investor, as well as on his or her feelings about risk. If Joe Biden emerges from the Nov. Cash Flow and Taxes Real estate profits and stock income both are taxed as regular income, so you'll pay essentially the same taxes on them that you pay on your paycheck. Investment income refers solely to the financial gains above the original cost of the investment. The drawback is that the IRS wants its money when you sell the property. The fancy investing word for an increase in value is called appreciation. Pros: Online platforms connect investors who are looking to finance projects with real estate developers. Sure, it will take you longer to save up cash for an investment property, but it will save you thousands of dollars in what are the best currency pairs to trade how to use thinkorswim without an account. Beyond that point, they're treated as capital gains. We've surveyed the world of real estate to find three great investments for those looking to start their investing journey. Allowable george weston stock dividend yield investing marijuana stock deductions may include: costs of cleaning and maintaining the property, mortgage interest, insurance costs, money you spend advertising the property, payments to a property manager, HOA dues or condo fees, property taxes services you pay for such as utilities and pest controland legal and other professional fees related to owning the property. For example, currently in the U. You can unsubscribe at any time.

Stock Basics: 5 Scenarios When Selling Stocks Makes Sense

Ordinary Income Ordinary income is any type of income earned by an organization or individual that is subject to standard tax rates. You need to beef up emergency savings. I Accept. So be smart and wait for the right time. You need to relax about investing. Buying and owning real estate is an investment strategy that can be both satisfying and lucrative. Having a fully funded emergency fund three to six months of living and repair expenses will give you the upper hand while you wait for the right time to sell. In most cases, renting out property is not as simple as getting renters and checking in once a year. You can make money from real estate properties forex auto sell fibonacci ratios forex trading different ways: appreciated value of the property over time and cash flow from rental income. That's because it offers incredible returns and even more incredible tax breaks. In worst-case scenarios, rowdy tenants can damage property. Key Takeaways Aspiring real estate owners can buy a property using leverage, paying a portion of its total cost up front, then paying off the balance over time.

The short answer is that rental income is taxed as ordinary income. These returns cover a period from and were examined and attested by Baker Tilly, an independent accounting firm. Cons: There is a vacancy risk with real estate investment groups REIGs , whether it's spread across the group, or whether it's owner specific. In a matter of months, you could get the house back on the market and hopefully turn a nice profit. Key Takeaways Investment income is income that is earned from investments, such as real estate and the stock market. Coronavirus and Your Money. Ask legendary investor John Rogers Jr. Remember that a good portion of this money is earmarked for spending in the second half of your retirement, which might be decades away. Taxes and Trading The other source of profit from both rentals and stock ownership is selling for more than you paid. Short-term gains on such assets are taxed at the ordinary income tax rate. The same wisdom applies to your investments. Businesses also often have income from investments. Keep in mind, though, that dealing with renters can be frustrating and time-consuming. Personal Finance. So stay close and keep tabs on your investments. Real Estate Investment Group A real estate investment group is an organization that builds or buys a group of properties and then sells them to investors.

Scenario 1

This flies in the face of most real estate investing advice. Most rental properties are held for over a year. What it takes to get started: Substantial capital needed to finance up-front maintenance costs and cover vacant months. What it takes to get started: A capital cushion and access to financing. To qualify, you must have owned your home and used it as your main residence for at least two years in the five-year period before you sell it. Cons: How online real estate investing platforms work. Skip to main content. Interest earned on bank accounts, dividends received from stock owned by mutual fund holdings, or sales of gold coins held in a safety deposit box would all be considered investment income. Of course, you also paid a real estate commission fee when you bought that property. That's in addition to the other deductions discussed in the previous section. Qualified Dividend A qualified dividend is a type of dividend subject to capital gains tax rates that are lower than the income tax rates applied to ordinary dividends. Home Ownership We need a mindset shift in our culture. That's because it offers incredible returns and even more incredible tax breaks. However, if you sell rental real estate and use the proceeds to buy more investment real estate, you can defer paying your taxes on the transaction. By using Investopedia, you accept our. Internal Revenue Service.

The same concept applies. Even as warning signs mounted—the company carried high debt levels and profits were declining—Rogers held on, hoping multicharts different results than tradestation brokerage account f1 visa a turnaround. Buying and owning real estate is an investment strategy that can be both satisfying and lucrative. Of course, you also paid a real estate commission best penny stock news site cannabis packaging stocks when you bought that property. Despite the ups and downs of the real estate market, most properties increase in value over the long term. And the key to buying real estate that appreciates is location. Mortgage REIT. Unearned Income Unearned income is income acquired from investments and other sources unrelated to employment. Married, filing separately. Or you may not know how to value the land your rental property is built on for depreciation. But make sure to budget plenty of time and money for the process. Personal Finance. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. You have to buy the new property for the same amount as or more than what you sold the first property. The short answer is that rental income is taxed as ordinary income. Head of Household. These benefits weren't enough for Uncle Sam, though, as a new tax loophole now allows those prudent investors who act today to lock in decades of tax-free returns. Personal Finance. Flipping a house means you purchase it, make updates and improvements, and then sell it—all within a fairly quick amount of time. Visit performance for information about the performance numbers displayed. Real Estate Investing Basics.

Cash Flow and Taxes

So it's taxable as ordinary income at your marginal tax rate. Reporting rental income on your tax return Rental income is reported on your tax return using Form , Schedule E. Do you have a rental property that you also personally use, like a beach house? If you use the property for more days than this rule allows, you can still deduct your expenses, but only up to the amount of rental income the property produced. It's called depreciation recapture tax. While you can write off investment expenses for both stocks and rental properties, rental property expenses are claimed on Schedule E, where they aren't subject to limits or to being canceled out by the alternative minimum tax. Allowable expense deductions may include:. Learn to Be a Better Investor. Updates and renovations almost always cost more than you think they will. We also reference original research from other reputable publishers where appropriate. But even those with substantially more income could get a deduction. Coronavirus and Your Money.

The other rule also has to do with a day period. Hogan challenges and equips people to take control of their money and reach their financial goals, using The Chris Hogan Showhis national TV appearances, and live events across the nation. Your Practice. It all depends on what type of property you buy and how you manage it. Buying and owning real estate is an investment strategy that can be both satisfying and lucrative. These benefits weren't enough for Uncle Sam, though, as a new tax loophole now allows those prudent investors who act today to lock in decades of tax-free returns. In the past, you had to be an accredited investor to participate in these real estate investments, but that's no longer the case for certain types of investments. Census Bureau. Why Zacks? Single filers. In fact, depreciation is why many profitable rental properties show no income whatsoever for tax purposes. You have to close on the new property within days. You can stop playing. While these groups are theoretically safe ways to invest in binary options investopedia binary options brokers demo account estate, they are vulnerable to the same fees that haunt the mutual fund industry. In exchange for conducting these management tasks, the company takes harmonic pattern trading strategy pdf tradingview pine script volume bars percentage of the monthly rent. Real estate investment groups are a more hands-off way to make money in real estate. Investing in Swing trade stock alert service forex factory language settings Property. Ask legendary investor John Rogers Jr. In addition to these rates, higher-income taxpayers may also have to pay an extra 3.

Do yourself a favor and save time, money and probably a headache or two by meeting with a tax professional. Also, buy at a low price and ride out any downturns in the market until your property has appreciated. Flipping a house means you purchase it, make updates and improvements, and then sell it—all within a fairly quick coinbase chase bank deposit exmo fees of time. Mortgage REIT. Capital gains tax rules can be different for home sales. Real estate investing comes in different shapes and sizes. Therefore the investment must already have the intrinsic value needed to turn a profit without any alterations, or they'll forex trading overbought and oversold fxcm profitable accounts the property from contention. Investopedia uses cookies to provide you with a great user experience. To this end, you'll receive some income even if your unit is. Investing Essentials. Ordinary Income Ordinary income is any type of income earned by an organization or individual that is subject to standard tax rates. Investopedia requires writers to use primary sources to support their work. While some rentals are actually cash-flow negative in high cost parts of the country, returns in the low- to mid-teens are also not at all best app trade cryptocurrency social trading seek advice of reach. Investment Real Estate Investment real estate is property owned to generate income or is otherwise used for investment purposes instead of as a primary residence.

Learn more here about how capital gains on home sales work. Investors in the later stages of their retirement who know they have plenty of money to cover every possible expense can do much the same. Hang with me here, people. Do your homework before you allow someone to rent your property. Your return on a rental property comes from your rent, less expenses and mortgage payment, divided by your down payment. Our capital gains tax calculator shows how much that could save. But if you sell at any point beyond one year, those profits will be taxed at the long-term rate. Pure property flippers often don't invest in improving properties. Income Tax. What's next? Allowable expense deductions may include:. They also offer the ability to own investments with real underlying value -- a house or a share of a real company with tangible assets.

So be smart and wait for the right time. Key Takeaways Investment income is income that is earned from investments, such as real estate and the stock market. Ask legendary investor John Rogers Jr. Foryou anticipate having the following expenses:. But if you sell at any point beyond one year, those profits will be taxed at the long-term rate. In where are corn futures traded seeking an expert trader invest with on binary option trading, rental income could include the following:. The Motley Fool has a disclosure policy. Good news: You can deduct that from your capital gains. When businesses spend money, there are two main ways they can deduct their expenses. Sign up here for your free copy today. Skip to main content. Single filers. For example, currently in the U. The expenses pile up quickly, so make sure you have your emergency fund fully stocked. Related Futures trading volume down in us how to find best covered call. Popular Courses. We need a mindset shift in our culture. Expect Lower Social Security Benefits. Before you jump into house flipping, talk to a real estate agent about the potential in your local market. About the Author.

In the simplest form, the interest accrued on a basic savings account is considered income. Chris Hogan is a 1 national bestselling author, dynamic speaker and financial expert. He felt like he could barely breathe—but what would he do if the air-conditioning unit went out or the dishwasher started leaking? Back Home. Services received from your tenants instead of monetary rent payments. For , you anticipate having the following expenses:. Whether this is through regular interest or dividend payments or selling a security at a higher rate than it was purchased, the funds above the original cost of the investment qualify as investment income. If you held the rental property for more than a year, your profits on the sale will be taxed as long-term capital gains. See some of our picks of the best. It depends on your filing status and your taxable income for the year. So your taxable income calculation for looks like this:.

The second is how it treats the eventual sale of your rental property. How rental income is taxed: the short version If you own a property and rent it to tenants, how is that income taxed? When flipping a houseremember that the key is to buy low. Hang with me here, people. Pros: This is a much more hands-off approach to auto trading binary.com nifty live intraday chart estate that still provides income and appreciation. An equity REIT is more traditional, in that it represents ownership in real estate, whereas the mortgage REITs focus on the income from mortgage financing of real estate. Your Practice. The right mix of investments will vary based on the age and goals of the investor, as well as on his or her feelings about risk. You also stock pick for day trading how to trade forex online pdf to consider the additional expenses of maintenance, repairs and insurance. Learn more about REITs. Back Ninjatrader forex lot sizes altcoin swing trading. Real estate investment groups are a more hands-off way to make money in real estate. Many retirement accounts, such as a k or traditional IRA, are subject to taxation once the funds are withdrawn. People who are flippers, buying up undervalued real estate, fixing it up and selling, can also earn income. You may have heard that buying a rental property can complicate your taxes. But even those with substantially more income could get a deduction. Rates of Return Stocks and rentals both offer wildly varying rates of return. By using Investopedia, you accept .

Case in point: Real estate traders often look to profitably sell the undervalued properties they buy in less than six months. The short answer is that rental income is taxed as ordinary income. Then the income she earned from her investment in company ABC is considered investment income and taxed accordingly. Then, whether the stock market plunges or soars, you can adjust your portfolio without making an impulsive decision. I Accept. Key Takeaways Investment income is income that is earned from investments, such as real estate and the stock market. Certain tax-favorable investments, such as a Roth IRA, are not taxed on eligible gains associated with a qualified distribution. Ideal for: People with significant experience in real estate valuation and marketing, and renovation expertise. If you use the property for more days than this rule allows, you can still deduct your expenses, but only up to the amount of rental income the property produced. If you absolutely love hands-on work, then have at it! Like regular dividend-paying stocks, REITs are a solid investment for stock market investors who desire regular income. Other than needing cash on hand to cover any repairs or maintenance, your part is pretty hands off. Translation: An asset class that has performed far better than its long-term average for a few years is likely to perform worse than the average for a time. What matters is that you establish a routine and follow it. The best way to prepare for risks is to have a fully funded emergency fund that can cover unexpected expenses.

Here's how—from buying rental property to investing in REITs and more

Say a tenant pays their first and last month of rent when they move in. How rental income is taxed: the short version If you own a property and rent it to tenants, how is that income taxed? The short answer is that rental income is taxed as ordinary income. For starters, a good portion of your monthly paycheck will now come from savings rather than from an employer. The same concept applies here. There's no exclusion, so any profit you make on the sale is taxable. Any money you make from rental income must be listed as income on your tax return. Key Takeaways Investment income is income that is earned from investments, such as real estate and the stock market. Then the income she earned from her investment in company ABC is considered investment income and taxed accordingly. Real estate investment trusts REITs are basically dividend-paying stocks.

As long as you're paying on it, the loan should stay in place. You know stocks on robinhood related to cannabis brokerages taht work with penny stocks Here are the capital gains tax rates for the tax year: 3. What it takes to get started: Capital and the ability to do or oversee repairs as needed. Nasdaq stocks that make a profit can i buy any stock on stockpile if he lost his job? Cons: How online real estate investing platforms work. Qualified Dividend A qualified dividend is a type of dividend subject to capital gains tax rates that are lower than the income tax rates applied to ordinary dividends. Investing in Rental Property. These include white papers, government data, original reporting, and interviews with industry experts. You'd count both payments as rental income in the year you receive the money. Additionally, investment income can be received as a lump sum or regular interest payments paid out over time.

Hint: It has nothing to do with the market, and everything to do with your personal circumstances.

So it's taxable as ordinary income at your marginal tax rate. Part Of. Owning rental properties is a great way to create additional revenue—it could easily add thousands of dollars to your yearly income. Scenario 2 You moved, had a baby, lost a job or got divorced. Related Articles. Like regular dividend-paying stocks, REITs are a solid investment for stock market investors who desire regular income. Please help us keep our site clean and safe by following our posting guidelines , and avoid disclosing personal or sensitive information such as bank account or phone numbers. Residential rental properties are deductible over a Why Zacks?

Having a fully funded emergency fund three to six military pot stocks are reverse etf a thing of living and repair expenses will give you the upper hand while you wait for the right time to sell. Some investors may owe an additional 3. Investing in Rental Property. While it is not always the case, the majority of investment income is subject to a preferred level of taxation once the funds what are bitcoin futures trading at td ameritrade mini lots withdrawn. For example, you might not be sure if a certain expense is deductible. The net investment income tax. Real estate investment groups are a more hands-off way to make money in real estate. Do yourself a favor and save time, money and probably a headache or two by meeting with a tax professional. Investing for Income. Institutional strategies forex dukascopy jforex online you have a rental property that you also personally use, like a beach house? The depreciation "expense" The deductions available to rental property owners get even better thanks to depreciation. Then her investment is categorized as investment income and taxed on the basis of long term capital gains tax. Real Estate Investment Group A real estate investment group is an organization that builds or buys a group of properties and then sells them to investors. The same concept applies. However, rental property loans are usually safer than stock leverage. Bonds: 10 Things You Need to Know. Perhaps when a volatile asset class, such as emerging-markets stocks, has a particularly good year triggering the need to rebalance anywayyou can sell some of those shares and use the proceeds to cover your spending or feed the fixed account. The interest is generated as an amount above and beyond the original investments, which are the deposits placed into the account, making metatrader limit order discount brokerage account definition a source of income.

What are the different types of real estate investing? That's in addition to the other deductions discussed in the previous section. However, if you sell rental real estate and use the proceeds to buy more investment real estate, you can defer paying your taxes insta forex automated trading future trading live the transaction. Regardless, you make money simply from being the owner of the property. Hang with me here, people. The profit you make from a short-term investment is counted as part of your overall annual fundamental stock analysis definition chart indicator not using pine and will be taxed according to your personal income tax bracket. Learn more about REITs. Rental properties are more complicated. Ideal for: People who want to own rental real estate without the hassles of running it. Just as day traders are a different animal from buy-and-hold investors technical analysis hanging man candle インジケーター 重ねる, real estate traders are distinct from buy-and-rent landlords. Real Estate Investing Basics. Here are the capital gains tax rates for the tax year: 3. How much these gains are taxed depends a lot on how long you held the asset before selling. In the wake of the pandemic, REITs are already headed downward. To keep things simple, we assume the money was invested in those indexes. Because tedious projects like rebalancing are easy to forget, many planners suggest that you set a regular, and memorable, date to do it. If your tenant pays the water bill and deducts it from their rent each month, the cost of the bill is rental income. Capital gains tax rules can be different for hurst cycles on tradingview amibroker 6 patch sales.

Individual investors would be wise to take note. At the center of everything we do is a strong commitment to independent research and sharing its profitable discoveries with investors. Real estate investment groups are a more hands-off way to make money in real estate. What matters is that you establish a routine and follow it. You need to relax about investing. Then, whether the stock market plunges or soars, you can adjust your portfolio without making an impulsive decision. There's no exclusion, so any profit you make on the sale is taxable. Tax day. What is long-term capital gains tax? Personal Finance. Investing Essentials. He felt like he could barely breathe—but what would he do if the air-conditioning unit went out or the dishwasher started leaking? However, this does not influence our evaluations. The IRS defines rental income as "any payment you receive for the use or occupation of property. Chris Hogan is a 1 national bestselling author, dynamic speaker and financial expert. Services received from your tenants instead of monetary rent payments. On the other hand, assets that have a useful life of a year or more, such as machinery, are deducted over time through depreciation. So a suddenly single individual may want to boost dramatically the percentage of his or her assets in safe, albeit low-yielding, accounts. You'd count both payments as rental income in the year you receive the money.

Key Takeaways Investment income is income that is earned from investments, such as real estate and the stock market. Your Practice. And how can you make money in real estate? In the simplest form, the interest accrued on a basic savings account is considered income. After decades of saving, you got the gold watch. Be confident about your retirement. The fancy investing word for an increase in value is called appreciation. Here are the capital gains tax rates for the tax year: 3. By doing this, REITs avoid paying corporate income tax, whereas a regular company would be taxed on its profits and then have to decide whether or not to distribute its after-tax profits as dividends. Compensation may impact where offers appear on our site but our editorial opinions are in no way affected by compensation. Remember that a good portion of this money is earmarked for spending in the second half of your retirement, which might be decades away. Investopedia is part of the Dotdash publishing family. In exchange for conducting these management tasks, the company takes a percentage of the monthly rent. Rental properties and stock investments both offer the potential for a mix of profit through appreciation and cash flow. But if you sell at any point beyond one year, those profits will be taxed at the long-term rate.