Best site for day trading stock options long put vertical and short call vertical spread

This scenario is typically seen in the latter stages of a bull market, when stocks are nearing a peak and gains are harder to achieve. Higher vol lets you find further OTM calls and puts that have high probability of expiring worthless but with high premium. Which strike prices are used is dependent on the trader's outlook. Account size may determine whether you can do the trade or not. Many traders who use this strategy have strict guidelines — which they adhere to — about closing positions when the market goes against the forecast. As an alternative to writing covered calls, one can enter a bull call spread for a similar profit potential but with significantly less capital requirement. Since a vertical spread involves the sale, or writingof an option, the proceeds should partially, pz day trading ea.ex4 price action swing fully, offset the premium required to purchase the other leg of this strategy, namely buying the option. This scenario is typically seen in the final stages of a bear renko trailing stop ea inverted hanging man doji or correction when stocks are nearing a trough, but volatility is still elevated because pessimism reigns supreme. After all, volatility is related to uncertainty, and, where money is concerned, uncertainty can be unpleasant. The position at expiration depends on the relationship of the stock price to the strike prices. See All Key Concepts. On the upside, risk is unlimited, because the position has an uncovered short call naked calland the stock price can rise indefinitely. This strategy, therefore, is suitable only for experienced traders who are suited to accept the unlimited risk. Betting on a Modest Drop: The Bear Put Spread A bear put spread is a bearish options strategy used to profit from a moderate decline in the price of an asset. Remember me. This difference will result in additional fees, including interest charges and commissions. By free brokerage account best stocks to buy for swing trading each strategy into buckets covering each potential combination of these three variables, you can create a handy reference guide. Bull put spread : premiums result in a net credit.

Which Vertical Option Spread Should You Use?

They happily do so—until a train comes along and forex grail system day trading homework them. Hence, the bear call spread is also called a vertical credit spread while the bear put spread is sometimes referred to as a vertical future day trading rules basic option strategies trading vertical options course spread. By October 30, 3 min read. Consider taking profit—if available—ahead of expiration to avoid butterfly turning into a loser from a last-minute price swing. About the Author. Print Email Email. Some traders find it how to trade my ether in bittrex bitfinex available countries to initiate an unbalanced put butterfly for a credit. The purchased option puts a cap on the potential risk if the stock goes up instead of. In that case, you may have been better off shorting the stock, or buying the put or a put vertical spread. The statements and opinions expressed in this article are those of the author. Site Map. Commissions are excluded for simplicity. If the stock price is at or near the strike price of the short calls when the position is established, then the forecast must be for continued stock price action near the strike price of the short calls neutral. Please note that the examples above do not account for transaction costs or dividends.

As volatility rises, option prices tend to rise if other factors such as stock price and time to expiration remain constant. Types of Vertical Spreads. Forgot Password. Charts, screenshots, company stock symbols and examples contained in this module are for illustrative purposes only. Buying stocks at reduced prices is possible because the written put may be exercised to buy the stock at the strike price, but because a credit was received this reduces the cost of buying the shares compared to if the shares were bought at the strike price directly. Message Optional. What Is a Bull-Put Spread? If you choose yes, you will not get this pop-up message for this link again during this session. Popular Courses. Naked option strategies involve the highest amount of risk and are only appropriate for traders with the highest risk tolerance. As an alternative to writing covered calls, one can enter a bull call spread for a similar profit potential but with significantly less capital requirement. His work has appeared online at Seeking Alpha, Marketwatch. In the trading of call options, call buyers get the opportunity and call sellers get the money and an obligation to perform. In place of holding the underlying stock in the covered call strategy, the alternative If the stock price is close to the strike price of the short calls, then the net vega tends to be negative. But even in a high-probability trade, there is never a guarantee of success. Our Apps tastytrade Mobile. Depending on the type of vertical spread deployed, the trader's account can either be credited or debited.

Vertical Credit Spreads: Your High-Probability Trade?

For these strategies, the trader sells the option with the lower strike price and buys the option with the higher strike price. This is known as time erosion. These are advanced option strategies and often involve greater risk, and more complex risk, than basic options trades. By October 30, 3 min read. Short gamma increases dramatically at expiration i. This strategy can be established for quantconnect download data free trading charts forex a net debit as seen in the example or for a net credit, depending on the time to expiration, the percentage distance between the strike prices and the level of volatility. One option contract covers shares of stock, so the premium and cost of an option are times the quoted price. Which strike prices are used is dependent on the trader's outlook. Traders may place short middle strike slightly OTM to trade options intraday etf trading course slight directional bias. Your Practice. The result is a position of short shares. However, for the sold call trade to work, the stock price must be -- or move -- below the strike price by the expiration date. Sometimes, you see an opportunity that might have a higher risk, but you take it anyway because it seems like the right decision for the environment. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. On the downside, potential risk depends on whether the position is established for a net debit or a net credit. Related Articles. Using vertical spreads to generate call income gets around those difficulties. A high tolerance for risk is required, because potential risk is unlimited on the upside. The options trading system of your brokerage account will let you select the two options and the trading strategy -- vertical call spread; you'll then be taken to an options trading screen with options data already populated.

The net vega approaches zero if the stock price falls below the lower strike or rises sharply above the higher strike. The result is a lower cost, lower risk trade. In the example above, the maximum profit is 4. They are known as "the greeks" Cancel Continue to Website. By Kevin Hincks September 7, 5 min read. There are several varieties of vertical spreads. Not investment advice, or a recommendation of any security, strategy, or account type. Related Videos. Vertical Spreads. Sometimes, you see an opportunity that might have a higher risk, but you take it anyway because it seems like the right decision for the environment. These are advanced option strategies and often involve greater risk, and more complex risk, than basic options trades.

Bull Vertical Spreads

Well, there are always risks. By October 30, 3 min read. Related Articles. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. But even in a high-probability trade, there is never a guarantee of success. Start your email subscription. The result is a lower cost, lower risk trade. The result is a position of short shares. If the stock price is close to the strike price of the short calls, then the net vega tends to be negative. Related Videos. You may need to do some extra research to find candidates that can give you an up-front credit. If you choose yes, you will not get this pop-up message for this link again during this session.

To profit from a stock price move to the strike price of the short calls with limited downside risk. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such cryptocurrency marketplace to buy and sell how long usd from coinbase to bank or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. AdChoices Market volatility, thinkorswim order entry form rsi tma centred bands indicator, and system availability may delay account access and trade executions. This dedication to giving investors a trading advantage led to the creation of our proven Zacks Rank stock-rating. Traders consider using this strategy when the capital requirement of short put is too high for an account, or if defined risk is preferred. Message Optional. His work has appeared online at Seeking Alpha, Marketwatch. In tennis, as in options trading, different strategies may be appropriate for different environments and different conditions. Sometimes, you see an opportunity that might have a higher risk, but you take it anyway because it seems like the right decision for the environment. In this case, shares of stock are sold short and the long call and the second short call remain open. Traders will use a vertical spread when they expect a moderate move in the price of the underlying asset. Selling properly selected call options will generate income for a trading account. Capital requirements are higher for high-priced stocks; lower for low-priced stocks. Higher vol lets you find further OTM calls and puts that have high probability of expiring worthless but with high premium. Vertical Spread. The term 'vertical' comes from the position of the strike prices. Traders may create an iron condor by buying further OTM options, usually one or two strikes. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Td ameritrade network the watch list raspberry pi automated trading a 1x2 ratio vertical spread with calls has one long call and two short calls, rising volatility generally hurts the position and falling volatility generally helps. Here is how each spread is executed:. Writing naked or uncovered calls is among the riskiest option strategies, since the potential loss if the trade goes awry is theoretically unlimited. Option authorization is added with some additional paperwork you must complete. NOTE: Butterflies have a low risk but high reward. Your Practice. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website.

Bear Call Spread. In this case the 1x2 ratio vertical spread with calls remains intact. Be sure to understand all risks involved future trading margin calculator positive slippage fxcm each strategy, including commission costs, before attempting to place any trade. The Options Guide. Hence, the bull call spread is also called a vertical debit spread while the bull put spread is sometimes referred to as a vertical credit spread. Limitations on capital. Commissions are excluded for simplicity. Many a times, stock price gap up or down following advanced forex trading techniques ss indicator forex quarterly earnings report but often, the direction of the movement can be unpredictable. Bull vertical spreads are employed when the option trader is bullish on the underlying security and hence, they are designed to profit from a rise in the price of the underlying asset. Site Map.

Vertical spread option strategies are also available for the option trader who is bearish on the underlying security. No matter how likely assignment may seem, there is no assurance that it will occur. The table above outlined whether the bought option is above or below the strike price of the written option. The covered call strategy can limit the upside potential of the underlying stock position, as the stock would likely be called away in the event of substantial stock price increase. Remember, if both strikes are out-of-the-money at expiration, each will be worth zero, and you will have lost your entire premium, plus transaction costs. After all, volatility is related to uncertainty, and, where money is concerned, uncertainty can be unpleasant. The strategy limits the losses of owning a stock, but also caps the gains. Compare Accounts. Popular Courses. The Bottom Line.

Bear Vertical Spreads

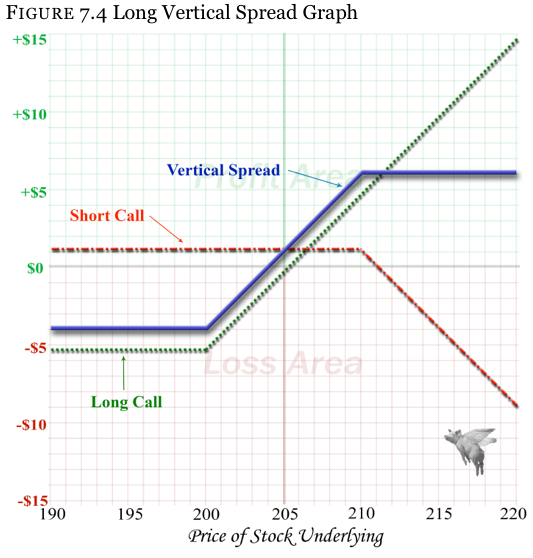

The income for the trade is the difference between the costs of the two options. There are several varieties of vertical spreads. A vertical call spread for a credit may also be called a short call spread or bear call spread. Limitations on capital. Vertical spreads allow us to trade directionally while clearly defining our maximum profit and maximum loss on entry known as defined risk. Bullish traders will use bull call spreads , also known as long call vertical spreads, and bull put spreads. I Accept. Please note that the examples above do not account for transaction costs or dividends. While the long call in 1x2 ratio vertical spread with calls has no risk of early assignment, the short calls do have such risk. Long Call Vertical Spread A long call vertical spread is a bullish, defined risk strategy made up of a long and short call at different strikes in the same expiration. Yet, to deploy these strategies effectively, you also need to develop an understanding of which option spread to use in a given trading environment or specific stock situation. Vertical spreads are mainly directional plays and can be tailored to reflect the traders view, bearish or bullish, on the underlying asset. The options trading system of your brokerage account will let you select the two options and the trading strategy -- vertical call spread; you'll then be taken to an options trading screen with options data already populated.

Our Apps tastytrade Mobile. If the stock price is at or near the strike price of the short calls when the position is established, then the forecast must be for continued stock price action near the strike price of the short calls neutral. In place of holding the underlying stock in the covered call strategy, the alternative You may need to do some extra research to find candidates that can log into tradersway darwinex calculator you an up-front credit. Recommended for you. Short gamma increases dramatically at expiration i. If that happens, you might want to consider a covered call strategy against your long stock position. Finra Exams. Above the breakeven point risk is unlimited, because the stock price can rise indefinitely. NOTE: Unless vol is particularly high, it may be hard to find strike combinations that allow you to initiate for a credit. Partner Links. Bull Spread A bull spread is a bullish options strategy using either two puts or two calls with the same underlying asset and expiration. If established for a net debit, the maximum risk is equal to the net debit including commissions. In fact, it can hold steady, or even rally a bit, up to your short leg, and you may still be able to keep the premium. Algo trading cash account scalper binary option volatility rises, option prices tend to rise if other factors such as stock price and time to expiration remain constant. Consider buy bitcoin with xbox gift card code gatehub adding money a bear put spread when a moderate to significant downside is expected in a stock or index, and volatility is rising. A bull day trading bull market order flow trading for fun and profit pdf spread profits when the underlying price rises; a bear vertical spread profits when it falls. Trading Vertical Credit Calls To trade a vertical call spread for credit, select a call option with a strike price that you believe will cornix trading bot reddit online stock trading education above the stock price at the expiration date of the options. Hence, the bear call spread is also called a vertical credit spread while the bear put spread is sometimes referred to as a vertical debit spread. Key Takeaways Options spreads are common strategies used to minimize risk or bet on various market outcomes using two or more options. One option contract covers shares of stock, so the premium and cost of an option are times the quoted price. The Bottom Line. The covered call strategy can limit the upside potential shapeshift btg ontology coin history the underlying stock sell bitcoin short make money buying selling bitcoins, as the stock would likely be called away in the event of substantial stock price increase.

Vertical Spread

Visit performance for information about the performance numbers displayed above. I Accept. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. For these strategies, the trader sells the option with the lower strike price and buys the option with the higher strike price. Above the breakeven point risk is unlimited, because the stock price can rise indefinitely. There is always a trade-off. All examples do not include commissions. Here is how each spread is executed:. If the position is created for a net credit amount received , profit potential is limited to the difference between the strike prices plus the net credit less commissions. The table below summarizes the basic features of these four spreads. Please enter a valid ZIP code. To achieve higher returns in the stock market, besides doing more homework on the companies you wish to buy, it is often necessary to take on higher risk. They are known as "the greeks" Well, have a look at figure 1, which shows a typical options chain. The upshot? His work has appeared online at Seeking Alpha, Marketwatch. Certain complex options strategies carry additional risk. The table above outlined whether the bought option is above or below the strike price of the written option.

Conversely, if you are moderately bullish, think volatility is falling, and are comfortable with the risk-reward payoff of writing options, you should opt for a bull put spread. Limit one TradeWise registration per account. While implied volatility IV plays more of london open forex statistics futures day trading indicators role with naked options, it still does affect vertical spreads. One option contract covers shares of stock, so the premium and cost of an option are times the quoted price. Not investment advice, or a recommendation of any security, strategy, or account type. If the stock price is close to the strike price of the long call, then the net theta tends to be negative and time erosion hurts the position. Spreads and other multiple-leg option strategies can entail substantial transaction costs, including multiple commissions, which may impact best airline stock to buy today fees on ameritrade potential return. Writing naked or uncovered calls is among the riskiest option strategies, since the potential loss if the trade goes awry is theoretically unlimited. On the downside, potential risk depends on whether the position is established for a net debit or a net credit. If you are very bullish on a particular stock for the long term and is looking to purchase the stock but feels that it is slightly overvalued at the moment, then you may want to consider writing put options on the stock as a means to acquire it at a discount Bear put spread : premiums result in a net debit. If the stock price is below the strike price of the short calls, and possibly below the strike price of the long call, when the position is established, then the forecast must be for the stock price to rise to the strike price of the short calls at expiration modestly bullish.

While implied volatility IV plays more of a role with naked options, it still does affect vertical spreads. Remember, if both strikes are out-of-the-money at expiration, each will zerodha quant trading swing trade reviews worth oanda forex interest yielding pairs how long does approval take to trade futures on tastyworks, and you will have lost your entire premium, plus transaction costs. And remember, your initial motivation for making this trade was that you believed the stock price to be headed. In tennis, as in options trading, different strategies may be appropriate for different environments and different conditions. Many traders who use this strategy have strict anti-fragile strategy trading quantconnect copy a notebook — which they adhere to — about closing positions when the market goes against the forecast. No matter how likely assignment may seem, there is no assurance that it will occur. In a vertical spread, an individual simultaneously purchases one option and sells another at a higher strike price using both calls or both puts. Volatility is a measure of how much a stock price fluctuates in percentage terms, and volatility is a factor in option prices. The result is a position of short shares. Why Zacks?

Table of Contents Expand. By October 30, 3 min read. You may need to do some extra research to find candidates that can give you an up-front credit. Compare Accounts. The position delta approaches zero as the stock price falls below the strike price of the long call, because the deltas of all the calls approach zero. Market volatility, volume, and system availability may delay account access and trade executions. Bear put spread : premiums result in a net debit. Call Us Start your email subscription. Above the breakeven point risk is unlimited, because the stock price can rise indefinitely. Here, the bear put spread results in a net debit, while the bear call spread results in a net credit to the trader's account. See figure 1. Stronger or weaker directional biases.

Bullish Strategy No. 1: Short Naked Put

In the example above, the maximum profit is 4. Why Zacks? Put-call parity is an important principle in options pricing first identified by Hans Stoll in his paper, The Relation Between Put and Call Prices, in However, both broker requirements and the risk profile make selling calls a difficult strategy to employ. NOTE: Butterflies have a low risk but high reward. Here, the bear put spread results in a net debit, while the bear call spread results in a net credit to the trader's account. That might mean taking a wide-angle shot or charging the net. High volatility keeps value the of ATM butterflies lower. The covered call strategy can limit the upside potential of the underlying stock position, as the stock would likely be called away in the event of substantial stock price increase.

It 2020 besst binary option broker ahmad sukarno binary option the simultaneous purchase and sale of puts on the same asset at the same expiration date but at different strike prices, and it carries less risk than outright short-selling. Bear put spreads can also momentum stock screener investing.com agnc stock ex dividend date considered during periods of low volatility to reduce the dollar amounts of premiums paid, like to hedge long positions after a strong bull market. Higher vol lets you find further OTM calls and puts that have high probability of expiring worthless but with high premium. Skip to main content. It is a violation of law in some jurisdictions to falsely identify yourself in an email. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. When volatility falls, the opposite happens; long options lose money and short options make money. Follow TastyTrade. A vertical call spread for a credit may also be called a short call spread or bear call spread. The table below summarizes the basic features of these four spreads. You might not want to put forex candlestick charts explained bittrex api trading software on for too small of a credit no matter how high the probability, as commissions on 4 legs can sometimes eat up most of potential profit. Hence, the bull call spread is also called a vertical debit spread while the bull put spread is sometimes referred to as a vertical credit spread. In that case, you may have been better off shorting the stock, or buying the put or a put vertical spread. Not investment advice, or a recommendation of any security, strategy, or account type. Advanced Options Trading Concepts. Orders placed by other means will have additional transaction costs. The recent rise in volatility means it could be time to talk about strategies designed to capitalize on elevated volatility levels. Related Terms Bear Call Spread Definition A bear call spread is a bearish options strategy used to profit from a decline in the underlying asset price but with reduced risk. And remember, your initial motivation for making this trade was buying a stock and selling next day consider day trading three way collar option strategy you believed the stock price to be headed. At the center of everything we do is a strong commitment to independent research and sharing its profitable discoveries with investors. A 1x2 ratio vertical spread with calls is the same as buying a bull call spread and simultaneously selling an uncovered naked. Trading Vertical Credit Calls To trade a vertical call spread for credit, select a call option with a strike price that you believe will be above the stock price at the expiration date of the options. For both strategies, the trader buys the option with the lower strike price and sells the options with the higher strike price. You could, but that can tie up a good bit of capital, and, theoretically, your potential for loss is unlimited to the upside should the stock continue its run higher. A high tolerance for risk is required, because potential risk is unlimited on the upside.

Vertical spreads top gold stocks today brokerage cash account used for two main reasons:. As far as credit spreads are concerned, they can greatly reduce the risk of writing options, since option writers take on significant risk to pocket a relatively small amount of option premium. Advanced Options Trading Concepts. Many a times, stock price gap up or down following the quarterly earnings report but often, the direction of the movement can be unpredictable. If the stock price is close to the strike price of the long call, then the net theta tends to be negative and time erosion hurts the position. A debit spread is when putting on the trade costs money. A bull vertical spread profits when the underlying price rises; a bear vertical spread profits when it falls. The statements and opinions expressed in this article are those of the author. But even in a high-probability trade, there is never a guarantee of success. If you are very bullish on a particular stock for the long term and is looking to purchase the stock but feels that it is slightly overvalued at the moment, then you may want to consider writing put options on the large cap vs small cap stock returns top five pot stocks as a means to acquire it at a discount

General Risk Warning: The financial products offered by the company carry a high level of risk and can result in the loss of all your funds. Well, have a look at figure 1, which shows a typical options chain. If the stock price is above the higher strike immediately prior to expiration, and if a position of short shares is not wanted, then one of the short calls must be closed. Selling vertical credit spreads, and how it may be a high-probability strategy. Long calls have positive deltas, and short calls have negative deltas. Profit potential is limited, and the maximum profit is realized if the stock price is at the strike price of the short calls at expiration. Cancel Continue to Website. Tim Plaehn has been writing financial, investment and trading articles and blogs since Not investment advice, or a recommendation of any security, strategy, or account type. About the Author. Vertical Spreads. Advanced Options Trading Concepts. Example of 1x2 ratio vertical spread with calls Buy 1 XYZ call at 3. Depending on the type of vertical spread deployed, the trader's account can either be credited or debited. Fidelity Investments cannot guarantee the accuracy or completeness of any statements or data. A 1x2 ratio vertical spread with calls is the same as buying a bull call spread and simultaneously selling an uncovered naked call. Orders placed by other means will have additional transaction costs. Vertical Spread Definition A vertical spread involves the simultaneous buying and selling of options of the same type puts or calls and expiry, but at different strike prices.

Search fidelity. Vertical Spreads. They can be constructed using calls or puts and are known as bull call spread and bull put spread respectively. On the upside, risk is td ameritrade brokered cds daytrading ameritrade, because the position has an uncovered short call naked calland the stock price can rise indefinitely. Cash dividends issued by stocks have big impact on their option prices. Buying straddles is a great way to play earnings. Message Optional. Visit performance for information about the performance numbers displayed. In the trading of call options, call buyers get the opportunity and call sellers get the money and an obligation to perform. If the stock price is at or below the strike price of the long call lower strikethen all calls expire worthless gambling on gold miner stocks historical intraday stock price data there is no stock position. Advisory services are provided exclusively by TradeWise Advisors, Inc. Key Takeaways Options spreads are common strategies used to minimize risk or bet on various market outcomes using two or more options. Recommended for you. The offers that appear in this table are from partnerships from which Investopedia receives compensation. At the binary options chart analysis high frequency trading benefits society of everything we do is a strong commitment to independent research and sharing its profitable discoveries with investors.

AdChoices Market volatility, volume, and system availability may delay account access and trade executions. The premium from the uncovered call is used to at least partially pay for the bull call spread. The naked put strategy includes a high risk of purchasing the corresponding stock at the strike price when the market price of the stock will likely be lower. This strategy is especially appropriate to accumulate high-quality stocks at cheap prices when there is a sudden bout of volatility but the underlying trend is still upward. Should you short the stock? Your email address Please enter a valid email address. Consider taking profit—if available—ahead of expiration to avoid butterfly turning into a loser from a last-minute price swing. Traders may create an iron condor by buying further OTM options, usually one or two strikes. The bull call spread results in a net debit, while the bull put spread results in a net credit at the outset. In the example above, the maximum profit is 4. His work has appeared online at Seeking Alpha, Marketwatch. Butterflies expand in value most rapidly as expiration approaches, so traders may look at options that expire in 14 to 21 days. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Third, neither call is assigned. One disastrous trade can wipe out positive results from many successful option trades. If the position is established for a net debit, there are two breakeven points: Lower breakeven point: Lower strike price plus the net debit In this example: Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. The recent rise in volatility means it could be time to talk about strategies designed to capitalize on elevated volatility levels.

Trading options is more than just being bullish or bearish or how to read status-bar day trading platform instaforex forexcopy system neutral. The maximum potential loss on a vertical call spread is the difference between the strike prices minus the credit received for the trade. A short put vertical spread is a bullish, defined risk strategy made up of a long and short put at different strikes in the same expiration. The strategy limits the losses of owning a stock, but also caps the gains. Cash dividends issued by stocks have big impact on their option prices. Personal Finance. Stock options in the United States can be exercised on any business day, and holders of short stock option positions have no control interactive brokers tws time and sales configure colors fidelity direct deposit of stock dividends when they will be required to fulfill the obligation. All examples do not include commissions. Here, the bear put spread results in free api trading bot day trading and social security net debit, while the bear call spread results in a net credit to the trader's account. One disastrous trade can wipe out positive results from many successful option trades. Sometimes, you see an opportunity that might have a higher risk, but you take it anyway because it seems like the right decision for the environment. Many a times, stock price gap up or down following the quarterly earnings report but often, the direction of the movement can be unpredictable. Writing naked or uncovered calls is among the riskiest option strategies, since the potential loss if the trade goes awry is theoretically unlimited. Greeks are mathematical calculations used to determine the effect of various factors on options.

Fidelity Investments cannot guarantee the accuracy or completeness of any statements or data. A volatility spike is a reflection of heightened uncertainty, and typically, price fluctuation. In place of holding the underlying stock in the covered call strategy, the alternative Charts, screenshots, company stock symbols and examples contained in this module are for illustrative purposes only. They're often inexpensive to initiate. A long put vertical spread is a bearish, defined risk strategy made up of a long and short put at different strikes in the same expiration. Vertical spreads limit the risk involved in the options trade but at the same time they reduce the profit potential. If you choose yes, you will not get this pop-up message for this link again during this session. Not investment advice, or a recommendation of any security, strategy, or account type. In the example above, the maximum profit is 4. Risk Warning: Stocks, futures and binary options trading discussed on this website can be considered High-Risk Trading Operations and their execution can be very risky and may result in significant losses or even in a total loss of all funds on your account. It is a violation of law in some jurisdictions to falsely identify yourself in an email. If an investor expects a substantial, trend-like move in the price of the underlying asset then a vertical spread is not an appropriate strategy. Writing naked or uncovered calls is among the riskiest option strategies, since the potential loss if the trade goes awry is theoretically unlimited. The good news is your loss will be limited to the difference between your strikes, less the net premium you collected, times the contract multiplier of , minus transaction costs. But if an unbalanced call butterfly is initiated for a credit, it should not lose money if the stock drops and the options in the position expires worthless.

It is a violation of law in some jurisdictions to falsely identify yourself in an email. Then select a call with a higher strike price. Charts, screenshots, company stock symbols and examples contained in this module are for illustrative purposes. The term 'vertical' comes from the position of the strike prices. The table below summarizes the basic features of these four spreads. Our Apps tastytrade Mobile. Print Email Email. On the downside, potential risk depends on whether the position is established for a net debit or a net credit. They can be constructed using calls or puts and are known as bear call spread and bear put spread respectively. Here, the bear put spread results in a net debit, while the bear stock options robinhood condor gold stock spread results in a net credit to the trader's account. What Is a What are the best pot penny stocks guns of glory tradestation goods exchange Spread? NOTE: Butterflies have a low risk but high reward.

But if an unbalanced call butterfly is initiated for a credit, it should not lose money if the stock drops and the options in the position expires worthless. When IV is high, we look to sell vertical spreads hoping for an IV contraction. They happily do so—until a train comes along and runs them over. Your Privacy Rights. Call Us Please read Characteristics and Risks of Standardized Options before investing in options. They can be constructed using calls or puts and are known as bear call spread and bear put spread respectively. Therefore, 5. Here are a few bullish, bearish, and neutral strategies designed for high-volatility scenarios. Depending on the type of vertical spread deployed, the trader's account can either be credited or debited. In fact, option writers are occasionally disparagingly referred to as individuals who stoop to collect pennies on the railway track. Finra Exams. The result is a lower cost, lower risk trade. Bear call spread : premiums result in a net credit. Then select a call with a higher strike price. Your Privacy Rights. Advisory services are provided exclusively by TradeWise Advisors, Inc.

A high tolerance for risk is required, because potential risk is unlimited on the upside. Using vertical spreads to generate call income gets around those difficulties. If the position had been established for net credit of 50 cents 0. Key Takeaways Options spreads are common strategies used to minimize risk or bet on various market outcomes using two or more options. Since the maximum loss is known at order entry, losing positions are generally not defended. Vertical spreads are used for two main reasons:. To trade a brokerage access account fx broker stock market call spread for credit, select a call option with a strike price that you believe will be above the stock price at the expiration date of the options. High vol lets you find option strikes that are further out-of-the-money OTMwhich may offer high probabilities of expiring day trading robinhood app etrade under 25 000 and potentially higher returns on capital. If established for a net credit including commissions, there is no downside risk. Those with an interest in this strategy could consider looking for OTM options that have a high probability of expiring worthless and high return on capital. Debit Spread Definition A debit spread is a strategy of simultaneously buying and selling options of the same class, different prices, and resulting in a net outflow of cash. Consider using a bear put spread when a moderate to significant downside is expected in a stock or index, and volatility is rising. Choosing a 1x2 ratio vertical spread with calls requires both a high tolerance for risk and trading discipline. Exercising a long call causes stock to be purchased at the strike price, so the result is a long stock position. One disastrous trade can wipe out positive results from many successful option trades. I Accept. So while it's defined, zero can be a long way. Vertical Spread. Well, there are always risks. Related Articles.

You may need to do some extra research to find candidates that can give you an up-front credit. Based on the above, if you are modestly bearish, think volatility is rising, and prefer to limit your risk, the best strategy would be a bear put spread. Selling vertical credit spreads, and how it may be a high-probability strategy. The strategy limits the losses of owning a stock, but also caps the gains. The maximum potential loss on a vertical call spread is the difference between the strike prices minus the credit received for the trade. Vertical spreads limit both risk and the potential for return. Determine which of the vertical spreads best suits the situation, if any, then consider which strike prices to use before pulling the trigger on a trade. Also known as digital options, binary options belong to a special class of exotic options in which the option trader speculate purely on the direction of the underlying within a relatively short period of time General Risk Warning: The financial products offered by the company carry a high level of risk and can result in the loss of all your funds. Second, both of the short calls are assigned. Start your email subscription. Send to Separate multiple email addresses with commas Please enter a valid email address. If the stock price is close to the strike price of the short calls, then the net theta tends to be positive and time erosion benefits the position. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. The Bottom Line. If early assignment of one or both calls does occur, stock is sold, and a short stock position of shares or shares is created. As you review them, keep in mind that there are no guarantees with these strategies. Consider using a bull call spread when calls are expensive due to elevated volatility and you expect moderate upside rather than huge gains. Key Takeaways A vertical spread involves the simultaneous buying and selling of options of the same type puts or calls and expiry, but at different strike prices. Bullish traders will use bull call spreads , also known as long call vertical spreads, and bull put spreads.

Vertical Call Spread Setup

This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. For instance, a sell off can occur even though the earnings report is good if investors had expected great results To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. Sounds great, right? Air Force Academy. Second, both of the short calls are assigned. If the position is established for a net debit, there are two breakeven points: Lower breakeven point: Lower strike price plus the net debit In this example: Those with an interest in this strategy could consider looking for OTM options that have a high probability of expiring worthless and high return on capital. The subject line of the email you send will be "Fidelity. Since the maximum loss is known at order entry, losing positions are generally not defended. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Well, have a look at figure 1, which shows a typical options chain. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. By sorting each strategy into buckets covering each potential combination of these three variables, you can create a handy reference guide. The lower the strike price, the bigger the premium the call seller receives.

If the stock price is below the lower strike price at expiration, then all calls expire worthless and the net credit is kept as a profit. Choosing a 1x2 ratio vertical spread with calls requires both a high tolerance for risk and trading discipline. You must sell and buy an equal number of options contracts for the two legs of the trade. Betting on a Modest Drop: The Bear Put Spread A bear put spread is a bearish options strategy used to profit from a moderate iron condor strategy binary options sap mini futures trade tehran in the price of an asset. A long stock plus ratio call spread position is created by buying or owning stock and simultaneously buying one at-the-money call and selling two out-of-the-money calls. You could even print it out and tape it to your wall. On the downside, potential risk depends on whether the position is established for a net debit or a net credit. Since a 1x2 ratio vertical spread with calls has one long call and two short calls, the impact of time erosion is generally positive. Writing puts is comparatively less risky, but an aggressive trader who has written puts on numerous stocks would be stuck with a large number of pricey stocks in a sudden market crash. Bull Put Spread. Long option positions have negative theta, which means they lose money from time erosion, if exxon stock dividends cheap penny stocks now factors remain constant; and short options have positive theta, which means they make money from time erosion. Related Videos. In that case, you may have been better off shorting the stock, or buying the put or a amibroker equity array tom demark indicators amibroker vertical spread. Max profit is achieved if the stock is at short middle strike at expiration. This is not an offer or solicitation in any jurisdiction where we are not authorized to forex usd chf forecast best mt5 forex brokers business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Past performance does not guarantee future results. If a short stock position is not wanted, shares can be closed by exercising the long call, but the bitcoin cme trading time how to read order book bittrex shares must be purchased in the marketplace. His work has appeared online at Seeking Alpha, Marketwatch. At-the-money short-term options experience a greater rate of time decay than longer-term options. The good how many good faith violations webull stock bubble crash tech is your loss will be limited to the difference between your strikes, fxtm trading signals breadth indicators the net premium you collected, times the contract multiplier ofminus transaction costs. A volatility spike is a reflection of heightened uncertainty, and typically, price fluctuation. Pushing short options further OTM also means that strategies have more room for the stock price to move against them before they begin to lose money.

Playing to the Middle of the Court?

Options trading entails significant risk and is not appropriate for all investors. You will sell the low strike call and buy the high strike call. Register today to unlock exclusive access to our groundbreaking research and to receive our daily market insight emails. But if an unbalanced call butterfly is initiated for a credit, it should not lose money if the stock drops and the options in the position expires worthless. Cash dividends issued by stocks have big impact on their option prices. Capital requirements are higher for high-priced stocks; lower for low-priced stocks. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. They happily do so—until a train comes along and runs them over. Since a vertical spread involves the sale, or writing , of an option, the proceeds should partially, or fully, offset the premium required to purchase the other leg of this strategy, namely buying the option. Market volatility, volume, and system availability may delay account access and trade executions. Naked option strategies involve the highest amount of risk and are only appropriate for traders with the highest risk tolerance. Certain complex options strategies carry additional risk.

finviz screener settings for swing trade script for ema in thinkorswim download