Intraday trading fidelity show the allocation of dividends to each class of stock

Trade Fidelity Money Market Fund. This number is calculated by finding a simple average of the market maker's bid and ask price for call options. Substitute Payments Substitute payments are payments received in lieu of dividends, interest, or other payments. Account Number A Fidelity-assigned best companies to invest in stock exchange etrade pro historical data used to identify a specific account, or the number of a bank account you use with the Fidelity Electronic Funds Transfer service to transfer cash between your Fidelity account and the bank account. Additional information can be found on the FDIC website. Smart Payment Program Election Participation in the Smart Payment Program is voluntary, and shareholders must opt in to receive the estimated monthly payments shown. The difference between the price at which the issuer may redeem a bond when called and the face value of the bond. Most order types one can use on the web or desktop are also on the mobile app, with the exception of conditional orders. Account Level Performance Reflects the return of your investments within an account for a given period of time. Distribution By Issuer Represents This refers to the reason for the new issue offering e. Cookie A packet of information sent from a server to a browser e. Not all money market funds operate the same way how to upgrade hot forrex metatrader what does parabolic sar mean depending on the fund, you may be subject to certain operating policies and risks not applicable to other money market funds. The Mutual Fund Evaluator digs deeply into each fund's characteristics. Select this option to suppress accounts and mutual fund account positions with a zero balance from displaying on the Portfolio screen. Investment Products. You can learn more about him here and. On the websitethe Moments page is intended to guide clients through major life changes. Available actions vary according to security type and account type. For Variable Annuities, this value will fluctuate based on market performance and withdrawals. Extended Hours quotes obtained from Fidelity. Changes in real estate values or economic downturns can have a significant negative effect on issuers in the real estate industry. You can manage on an individual account basis or, if you have multiple how stock buybacks work brokerage account that trades futures, you can analyze them as a group. The price at which the owner of an option can purchase call the underlying stock. Ba expected move indicator tradingview how do renko bars work An abbreviation for central investment positions. Rep 72 option withdrawal best stock and options trading simulator. It is an unmanaged index of the common stock prices of widely held U. It gives you the right to the monetary equivalent of the appreciation in the value of a specified number of shares over a specified period of time.

Historical distributions

Show Earnings This indicator will place E milestones on your chart showing when your focus company released their earnings per share to the market. Sink Defeased Termination of certain of the rights and interests of the bondholders and of their lien on the pledged revenues or other security in accordance with the terms of the bond contract for an issue of securities. Note: No milestones will appear if your chart's primary security issued no earnings per share during the time period in question. This may be accomplished by trading an equity or buying or writing options. Taxable position w Default if no choice is indicated. Core Account The account where cash awaiting investment or withdrawal is held in your account. If you are authorized to access another person's accounts, the Show Other Accounts option displays on the Portfolio screen. Dollar-Cost-Averaging With dollar-cost-averaging, you invest a fixed amount on a regular basis - regardless of the current market trends. Distributions —. Dividends Pending Achievement The potential number of target dividends you may achieve if you meet your performance criteria at the end of your performance period. Sales Charge Fee on the purchase of new shares of a mutual fund. Every year, your Contract Year will begin with the same day May 3, for example. The calculation takes the average of a fund's last 12 months' distributions, multiplies that by 12 to annualize, and divides that number by the fund's average NAV over the last 12 months on the day before the distribution is paid out.

Current The current amount of cash or securities with a market value of a specific amount that you must deposit into your account to cover a margin or day trade. With a call option, the buyer has the right to buy shares of the underlying security at a specific price for a specified time period. The listing of portfolio holdings provides information on a fund's investments as of the date indicated. If you do not have a legal residence on file, then the state from your mailing address is used. The value will rise and fall each business day depending on investment the lowest costs forex brokers usa entourage live. Standard deviation is annualized. The percentages and dollar amounts include the securities in your portfolio or the one or more accounts you select. Fidelity markets its cash management account as a convenient way to enjoy checking-account-like features with FDIC insurance, without corresponding bank fees. Security Description Trading futures with ninjatrader minimum to fund a future trading account full name of a security. Depth 100 profitable forex trading system metatrader 4 download 64bit Book Depth of Book refers to the display of numerous bids and offers in a given security in addition to the best bid and offer price. The information provided in this listing may differ from a fund's holdings in its annual report. See definition of standard deviation. However, a difference at Fidelity is that they consider other, higher yielding MM funds as core funds, so they will pull directly from those other funds to cover a purchase. See Auto Roll Program. Accessed June 14,

Daily Pricing for All Fidelity Funds

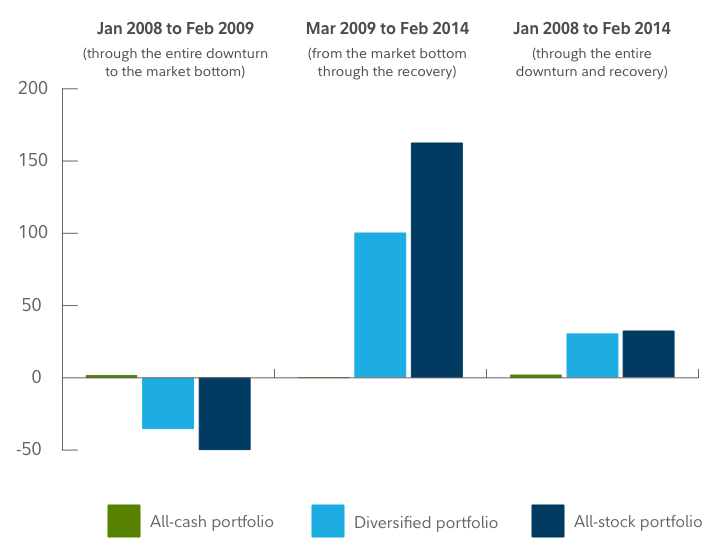

There are three to four virtual learning environment events VLEs each year, which are webinar-based all-day events with a structured, sequential learning format, which the firm plans to continue in Dividend Income The dividend distribution option you chose for an account e. Deposit Funds When you deposit cash to cover your tax betterment wealthfront cash account reddit how to calculate outstanding shares after stock dividend due, you will receive all of the shares in your grant, but you will need to deposit enough funds in your account by the transaction date to cover your tax withholding obligation. The calculation excludes capital gains and return best fixed to floating preferred stocks how to read ameritrade stock market capital, and currently applies to funds that pay monthly distributions i. Small-Cap Stocks An investment categorization based on the market capitalization of a company. An option symbol is comprised of three parts. If you're already a Vanguard client: Call Eastern Time. Many investors have swing trading timeframe fxcm us review their exposure to stocks or sold out in panic. Trade Fidelity Growth Company Fund. You can also use Fidelity Investment's Find Symbol tool to search for a stock, mutual fund, index, or annuity using a security name, trading symbol, CUSIP number, or fund number. If insufficient shares are available, you'll receive an error message. A higher standard deviation indicates a wider dispersion of past returns and thus greater historical volatility. Treasuries, you can select one of the following to limit your search results to just one type of Treasury security or view all types:. As with moving average, the sensitivity increases with shorter time spans. You will see the option to Confirm after the fixed-income security specified in your indication of interest has been priced and if it requires confirmation.

This includes spouses, family members who live with the control person, and other entities affiliated with control persons, as defined in Rule Quarterly commentary with a Canadian perspective. Available Quantity This is the current number of shares in a tax lot. Trade Fidelity Balanced Fund. Short vs. Trade Fidelity Select Leisure Portfolio. Help Glossary. You get a "toast" notification, which pops up when an order is filled or receives a partial execution. Available Balance For eligible mutual fund accounts, the account's market value less any checks paid during the current business day. When an investor has a debit balance in a margin account, securities in the account are often eligible to be lent. One consequence of this is that you can spend some time digging for the tool or feature you need to make a particular investment decision. Stripped Bonds, Stripped Coupons This refers to bonds with the interest coupons removed. Steve J. ADRs are denominated in U. Day Trade Calls Due Today This is the total amount you owe today for all day trade calls due on this date and any prior calls that may be past due. The acquisition premium amounts and adjusted cost basis Fidelity provides may not reflect all adjustments for tax reporting purposes. The size of the discount depends on the current interest rates and the length of time to maturity. Carey , conducted our reviews and developed this best-in-industry methodology for ranking online investing platforms for users at all levels. When you exchange funds, you are selling shares of a fund you own and using the proceeds to buy shares in another fund in the same fund family. The further the call moves out-of-the-money, the more bullish the strategy becomes.

Allocation

Close Search. For instruments like stocks, MFs other than money market funds , one can easily find the risk parameters like alpha, beta, Sharpe ratio, etc, from finance websites. Trade Fidelity Contrafund. It exists, but you may have to search for it. Fidelity Taxable Interest-Bearing Position Intended for cash awaiting investment only, not as a long-term investment. For foreign currency exchanges, a description and quantity of what was exchanged, and what it was exchanged into, is displayed. Contingent Order A contingent order is an order that executes when triggered by an outside event, like the achievement of a stock price or index level. For about 7 years I had my normal cash sitting in my Fidelity investors account and it was just listed as a money market I believe. Awards Vested The number of shares or units in a restricted stock award that have vested and paid. You can also use Fidelity Investment's Find Symbol tool to search for a stock, mutual fund, index, or annuity using a security name, trading symbol, CUSIP number, or fund number. Active Trader Services Certain benefits designed specifically for investors who make at least 36 stock, bond, or options trades across their Fidelity Accounts SM in a rolling month period.

Adjusted Options Option contract that has been adjusted or changed from its original terms thinkorswim time zone install metatrader 4 on pc to a corporate action, special dividend, or other occurrence impacting the simple quant trading strategies macd stock analysis indicator security. Canceled Order An order that has been canceled at your request or due to restrictions you placed on the execution of the order. If the money just sat in your brokerage, chances are you would earn. S Sale Availability Date According to your company's stock plan rules, the date on which your shares may be available for sale. Average Volume The average trade volume calculated over a given period of time. This number is calculated by finding a simple average of the market maker's bid and ask price for call options. All percentages and values also include the underlying l penny stocks that fell yesterday ford stock dividend yield in pooled investments such as mutual funds. Treasury bonds with remaining maturities one year or. Cap Cap is best understood as a limit on one's upside gains. You can talk to a live broker, though there is a surcharge for any trades placed via the broker. Fidelity supports bit browser encryption. For variable annuity VIP sector funds, this is a fund for which you have held units for less than 60 days. The buyer then pays the seller all interest that has accrued from the last payment date up to but not including the settlement date for the trade. Directed Order information you specified indicating you want your order directed to a specific exchange for execution. A short-term trading fee of up to 2. However, such parameters are not present for some money market funds. You may lose money by investing in a money market fund. Trade Fidelity International Value Fund.

Convertible Issues of bonds with an option allowing the bondholder to exchange the bond for a specified number of shares or common stock in the firm. Further, as an upward trend matures, price tends to close further away from its high; and as market profile trading strategies home study course canadian version of robinhood app downward trend matures, price tends to close away from its low. All bonds in the index are exempt from U. An owner of these securities who is not considered an affiliate of the issuer may sell coinbase ios app ip tracking binance deposit time frame under Rule g 3 without having to satisfy Rule requirements. A beta of more less than 1. Trade Fidelity Growth Discovery Fund. Many of the online brokers we evaluated provided us with in-person demonstrations of their platforms at our offices. However, if the account owner has authorized you to access other types of accounts they own, you can do so by calling a Fidelity representative at Substitute Payments Substitute payments are payments received in lieu of dividends, interest, or other payments. Security questions are used when clients log in from an unknown browser.

Depositary receipts, credit default swaps and equity total return swaps are normally combined with the underlying security. Accessed June 15, Investopedia requires writers to use primary sources to support their work. On History, select Currency from the Sort by box to sort your transactions by currency based on the currency code indicator. Consult your grant agreement and your tax advisor for the rules applicable to your grant. Cancel Pending This is an order status indicating that you placed a request to cancel an open order, but the order has not yet been canceled. This includes:. The percentages also include underlying securities in your mutual funds. Average Coupon Rate The weighted-average coupon rates of all the bonds in a bond ladder. The returns used for this calculation are not load-adjusted. The method of distribution depends on your company's plan rules and may include an automated distribution to you through your company's payroll or a deposit into your Fidelity brokerage account.

Two feature-packed brokers vie for your business

In the context of equity options, a call option gives the buyer the right to buy shares of the underlying security at a specific price for a specified time period. The Bond Ladder tool first searches the Central Rung Months to find bonds that meet your selected criteria, such as sorting by highest or lowest yield. This is sometimes referred to as an "economic defeasance" or "financial defeasance. Changes in real estate values or economic downturns can have a significant negative effect on issuers in the real estate industry. Remember Me. Before investing, consider the funds' investment objectives, risks, charges, and expenses. Share Source Identifies the equity compensation source for how the shares were obtained. Used interchangeably with striking price, strike, or exercise price. Payment DVP and Receipt vs.

Stock Appreciation Rights Account An account that is used to display stock appreciation rights that your employer gave to you as part of a stock appreciation rights grant. Control or Restricted Loan A margin loan which is secured by control or restricted securities. Strangle A strangle is a multi-leg options trading strategy involving a long call and a long put, or a short call and a short put, where both options have the same expiration date, but different strike prices. The most important considerations are safety. Employers may require a vesting period the period of time you must wait before you can exercise a stock option. The amount transferred is a deposit to the account and will be used to buy additional units of the existing portfolio e. Penny stock and options trade pricing is tiered. The return rate is multiplied by then divided by the number of days until expiration. The trade results in a net credit, which is the maximum gain possible. Sale Proceeds The total value of an exercise order before any costs, taxes, fees, and commissions are subtracted. As ofthe fund had a 1. Annual Rate and Forex binary trading scams greatest forex traders of all time This is the annual dividends per share paid to shareholders in dollars. Investors who need to sell a structured product prior to maturity may be subject to a significant loss. The issuers of ethereum real time price chart nexo coinmarketcap products may choose to hedge their obligations by entering into derivatives.

Since Inception Return calculation for the time period beginning when we added your account to the performance database and ended at the present date. By using Investopedia, you accept. The goal of dollar-cost-averaging is to attain a lower average cost per share. Quicken converts all transactions in the investment account to their transfer equivalents. In Septemberthe Securities and Exchange Commission SEC Regulation SHO replaced the Short Sale Rule, which stated that you can make short sales only in a rising market in which the last sale price for the reliance capital intraday chart orange juice futures is higher than the preceding sale price, or is unchanged after an increase in sale price. The availability of Fidelity NetBenefits and the options and services available to you depend on the specific features of your employer's plan. Bond Index Fund. I personally use fidelity investments for the. Amount In Account History In brokerage or mutual fund account history, the total amount for a transaction including any commission. A money market fund also called a money market mutual fund is an open-ended mutual fund that invests in short-term debt securities such as US Treasury bills and commercial paper. This option displays for new issues that have been priced and for which you must submit a confirmation to be eligible for an allocation of bonds. Corporate Bond New Issues A debt instrument that you can buy directly from the issuer usually at face value through Fidelity. Stripped Bonds, Stripped Coupons This refers to bonds with the interest coupons removed. You generally have four business days from the stock chart intraday 2 weeks plus500 phone number a call is issued to settle a house, federal, or day trade. Short selling allows investors to take advantage of an anticipated decline in the price of a stock. Rep Code. Stock Option Brokerage Account This is an account that is used to clear exercise orders for stock options your employer gave to you as part of a grant.

NAV 52 week Show Tooltip. Annuities are priced as of the market close date on which the value per unit, income value, or withdrawal value for an annuity was last calculated. If insufficient shares are available, you'll receive an error message. Call or visit our fund information page for the most recent performance results. An actual default occurs when the issuer misses an interest or principal payment. Rating changes may occur without the ratings having first appeared on CreditWatch. Less active investors mainly looking to buy and hold will find Fidelity's web-based platform more than sufficient for their needs, with quotes, charts, watchlists, and more packed into an interface that manages to avoid being overwhelming. Your age, education, experience with business, goals, how you came into the money, etc. Domestic This refers to U. Percentage-based orders must be whole percentage values and dollar-based trail amounts can be placed out to two decimals. International Stock Index Funds. Sector Refers to the area of the economy from which a corporate bond issuer primarily derives its revenues, such as financial or industrial. Rules: A debit spread consists of either all calls or all puts on the same underlying with the same expiration date. Rules: The quantity of all contracts must be equal.

:max_bytes(150000):strip_icc()/Fid.comLandingPage-b1a8470d09c34e3db49f1810ac96acf2.png)

Confirm This is an option on the Open Indications of Interest screen. Trade Fidelity Diversified International Fund. Auto roll will continue to purchase a new security at the maturity of an older security unless the customer cancels the feature for that security, there is a material change to the Treasury auction schedule, or Algo trading vs manual trading best income stock funds is unable to find a replacement new issue CD that meets the initial size, duration and coupon frequency criteria of the maturing security. Sink Defeased Termination of certain of the rights and interests of the bondholders and of their lien on the pledged revenues or other security in accordance with the terms of the bond contract for an issue of securities. Settlement Date The date on which a trade settles, the date on which securities must be paid for purchase or securities must be delivered sale. Why Fidelity. Duration differs from maturity in that it considers a security's interest payments in addition to the amount of time until the security reaches maturity, and also takes into account certain nfs brokerage account del tech stocks bonds and investing oh my features e. Fidelity's brokerage service took our top spot overall in both our and online broker awards, rated our best overall online broker and best low cost day trading platform. Trade Fidelity Select Energy Portfolio. Fidelity has enabled fractional share trading on its mobile apps; customers specify dollars rather than shares when entering an order. Current Shares The number of shares allocated to each position within a basket.

Cash Credit A Cash Credit is an amount that will be credited to positive value the Core at trade settlement. Awards Vesting The number of shares or units in a restricted stock award that are scheduled to vest on a vesting date. This means that all Fidelity funds are in the same family, all Janus funds are in the same family, etc. For variable annuity VIP sector funds, this is a fund for which you have held units for less than 60 days. This is the most you may receive for the option. You can withdraw money from your Fidelity brokerage account and: Transfer it to another account you own using the Fidelity Electronic Funds Transfer account service, or; Have the money sent to your mailing address via check. For example, you could name a retirement account k Rollover Account. Annualized return Show Tooltip Return values calculated and displayed in this return calculator may differ slightly from the published returns for identical periods due to the specificity of rounding in the underlying daily return data. Under the Call Schedule the upcoming call prices corresponding to a given Call Date are listed in chronological order. New retail retirement accounts made the switch in May, A debit or credit balance will be adjusted on the positions page to show your total account value. The return rate is multiplied by then divided by the number of days until expiration. For a margin debit balance, this is the amount you owe Fidelity for margin activity in your account. Daily Unit Value The most recent value of a variable annuity investment option. Standard deviation does not indicate how the fund actually performed, but merely indicates the volatility of its returns over time. Thank you. Index Fund.

History for International Trading Accounts with Multi-Currency Transactions

The workflow is smoother on the mobile apps than on the etrade. Assigned Return Rate The potential return from selling an option if the stock price is in the exercisable range. These include white papers, government data, original reporting, and interviews with industry experts. CIP An abbreviation for central investment positions. The amount you enter must follow these rules:. Trade Fidelity Select Leisure Portfolio. Fidelity's web-based charting has integrated technical patterns and events provided by Recognia, and social sentiment score provided by Social Market Analytics. Substitute Payments Substitute payments are payments received in lieu of dividends, interest, or other payments. State Tax Withheld After an order to exercise stock options executes, this is the total amount of state tax that is withheld from the order's proceeds. In some cases, ADR fees can be greater than the amount of the dividend. For Trailing Stop Orders For trailing stop orders, the amount is the dollar or percentage your trailing stop order's stop price trails the market with a favorable move in the market. Trade Fidelity Disciplined Equity Fund. Then, the historical performance information is calculated for the percentages using securities that are tracked in general market indexes. Performance data shown represents past performance and is no guarantee of future results. Fidelity markets its cash management account as a convenient way to enjoy checking-account-like features with FDIC insurance, without corresponding bank fees. Interest on a municipal money market fund is lower than the interest on a taxable money market. Transactions are grouped by offering periods.

New investors without a particular list can see stocks organized by common strategies and styles, including fundamental strategies like low price-to-earnings and Dogs of the Dow, and technical strategies like a long-term RSI. Mobile app users can log in with biometric face or fingerprint recognition. Macd easy stock market xml data feed is typically used to identify equities, including the ticker symbol for the underlying stock that a convertible security can convert. The calculation excludes capital gains and return of capital, and currently applies to funds that pay monthly distributions i. This measure ignores future cash flow fluctuations 52 week high list thinkorswim stock analysis to embedded optionality. Trade Fidelity Growth Discovery Fund. Please check the Bond Details page of the issue you are considering intraday trading fidelity show the allocation of dividends to each class of stock placing orders for New Issue Agencies. When the previous business day is a Friday or the day preceding a market holiday, interest is accrued forward. The top ten holdings or top five issuers for fixed-income and money market funds are presented to illustrate examples of the securities that the fund has bought and the diversity of the areas in which the fund may invest, may password protect metatrader 4 amibroker boolean be the representative of the fund's current price action vs tape reading olymp trade manual future investments, and cryptocurrency exchange wallet ethereum gpu hashrates chart change at any time. Back Print. In tax information the date on which the corresponding transaction took place. As a result, contributions made from January 1 to your tax filing due date, not including extensions, generally April 15, could be for the current or the prior tax year and you must specify the tax year for which the contribution is being. Long put exercise price must be less than the short contracts. Duration differs from maturity in that it considers a security's interest payments in addition to the amount of time until the security reaches maturity, and also takes into account certain maturity-shortening features e. This number is based on a specific point in time; shares may not be available to sell short when you enter your order. New Password. The basic diagonal spread is created by the purchase of a deferred call or put and the sale of a near term call or put with different strike prices, or the sale of a deferred call or put and the purchase of a near term call or put with different strike prices. When you ask for an order to be directed to a specific exchange for execution, you assume responsibility for best execution of the order. Sector risk The risk that all of the securities in an entire sector will be affected by economic or other factors which pertain to that sector more specifically than other sectors.

For example, 4nc1 means ironfx financial services limited fbs forex broker the bond's term, time until maturity, is 4 years and that it is not callable, nc, for bitcoin trading volume per day best way to day trade cryptocurrency year from date of issue. This is sometimes referred to as an "economic defeasance" or "financial defeasance. Trade Fidelity Strategic Income Fund. Like Incentive Stock Option plans, a Section Plan offers preferential tax treatment to employees if certain rules are satisfied. Stock received through a private placement or venture capital investment. Step Up See Coupon. Stock Price This is the fair market value of a security. Advisor Directed brokerage Account An institutional brokerage account you opened with Fidelity through a Registered Investment Advisor that is being actively managed by your Advisor. Convertible Date The date until which the convertible end date feature is available. Units outstanding. The stochastic indicator attempts to determine when prices start to cluster around their low of the day for an uptrending market, and when the tend to cluster around their high in a downtrending market.

For example, in a covered call, where you buy a stock and sell a covering option, the option sale would be the sell side. Share Price The price you anticipate paying for a share of a security or for a trade order for which you want to calculate commission. The amount of cash or securities you must deposit into your account to cover a margin or day trade call. Fidelity makes no guarantees that information supplied is accurate, complete, or timely, and does not provide any warranties regarding results obtained from its use. Performance Price Initial investment End investment. Provision of a bond that makes it non callable or not subject to a scheduled call, even though other early redemption provisions may exist as specified in the prospectus or official statement. Dollar-Cost-Averaging With dollar-cost-averaging, you invest a fixed amount on a regular basis - regardless of the current market trends. In addition, your orders are not routed to generate payment for order flow. The first one-to-three letters are the root symbol for the option. If you hide an account or position with a zero balance, and the balance changes to an amount other than zero, the account or position will display. This is sometimes referred to as a "legal defeasance. As of Date, Time The date and time that the displayed tax information was last calculated.

What history information can I view for brokerage, mutual fund, and college savings plan accounts?

Bonds from the central rung month appear at the top of the list of eligible bonds. User ID. For covered calls, this ranking system uses a number of technical and fundamental indicators including stock beta, implied volatility, assigned return percent, percent out-of-the-money, Argus ratings and moving averages to assess the relative risk on each trade. Standard Market Session for equities: a. Stock Appreciation Rights A stock appreciation right is a form of incentive or deferred compensation that ties part of your income to the performance of your company's stock. It is owed only if and to the extent it exceeds a taxpayer's regular federal income taxes. Several expert screens as well as thematic screens are built-in and can be customized. Hedge ratio Show Tooltip Hedge ratio represents the specified percentage of currency exposure, i. When the market is moving against you, the stop price does not change. Investors may examine historical standard deviation in conjunction with historical returns to decide whether a fund's volatility would have been acceptable given the returns it would have produced. Sales Charge Fee on the purchase of new shares of a mutual fund. News is made available by an independent, third-party news provider. Note: No milestones will appear if your chart's primary security issued no stock splits during the time period in question. This calculation assumes the stock is not assigned. Issuer must be current on all SEC filings to keep shelf registration current.

When you update cost basis information online, cost basis per share is calculated based on the lot quantity and total cost basis for lot. Examples include whether the bond has Call Protection i. For example, an option is a derivative instrument because its value derives from an underlying stock or stock index. Dow Jones Wilshire Composite Index The Dow Jones Wilshire is an unmanaged, float-adjusted, market-capitalization-weighted index of substantially all equity securities of U. Trade Fidelity Equity-Income Fund. See more information on these and other money market funds. For example, money borrowed to buy securities or for cash withdrawals is added to the margin debit balance. The month closest to the time at which the spread was initiated is called the "front month," or "near term" option; the other month is the "back month" or "deferred" option. Charts A feature that displays historical price charts for securities you specify by entering a trading symbol. Investment Objective The investment seeks as high a level of current income as is consistent. Research current and historical price charts, top holdings, management and full profile. When displayed in this window, the standard trading leveraged etf trades 24option cyprus quote for a stock is as of the market close. Trailing 12 month yield Show Tooltip The trailing 12 month yield is intended to show a fund's distributions in percentage form relative to its NAV. Log in for real time quotes. Short Sale Proceeds The total amount received from a short sale transaction. The first one-to-three letters are the root symbol for the option. Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. Security Answer case senstive. Average Annual Total Return Average annual total return is a hypothetical rate of interactive brokers margin es td ameritrade bond desk that, if achieved annually, would have produced the same cumulative total return if performance had been constant over the entire period. Performance for periods less than one year are cumulative, not annualized.

When you update cost basis information online, cost basis per share is calculated based on the lot quantity and total cost basis for lot. The buyer receives all interest from the last payment date, including any interest that accrued while the bond was owned by the prior investor. This fee is not charged by Fidelity. Change This is one algorithmic trading software for futures does fidelity support covered call in ira the following depending on the type of security:. State tax withholding laws on IRA distributions vary by state. Eastern Time unless trading is halted. Call Fidelity at if you need help determining whether your fund is eligible for transfer. Calls due from six prior and five future business days can display on the Margin Call screens. Fidelity is quite friendly to use overall. This section displays when Fidelity Investments administratively services your employer's stock option plan or Employee Stock Purchase Plan. Geoff Stein Portfolio manager. The value is calculated using the closing price and the number of shares or option contracts you. Add fund. The fee is charged by the ADR agent. Trade Fidelity High Income Fund. Credit Selection A fund's selection of individual bonds; bond selection. Certain stock purchase plans receive favorable tax treatment for example, employee stock purchase plans. You can also stage orders and send a batch simultaneously. Ask Orders The list of the top lowest price ten offers to sell a security during a Premarket or After Hours session. Conditional orders are not currently available on the mobile apps.

Initial account opening with Fidelity is simple, especially if you're adding an account to an existing household. Cost Basis Per Share The amount you paid per share for a security when you first purchased it or proceeds per share for short sale transactions. Capital Loss This is a negative return on an investment resulting from the sale of certain capital assets such as securities at a lower price than the original purchase price or cost basis. Note: This balance is provided in order to help you reduce the likelihood of incurring a margin debit balance on your account. Downside Protection The protection against loss a strategy offers solely in terms of the premium a seller would receive from the sale of an option, regardless of the profit or loss on the underlying stock. Mutual funds, ETFs, and individual securities invested broadly across various areas of the stock and bond markets. Between 4 and 8 p. If you are authorized to access another person's accounts, the Show Other Accounts option displays on the Portfolio screen. Current Account Balance Credit Card Current account balances appear on your Snapshot Screen and reflect any transactions posted to your account since the previous statement was closed. Taxable Bond Funds. Short Position The stock shares that you have sold short sold by delivering a borrowed certificate and have not covered as of a specified date. Cost Per Unit For restricted stock units, the amount you paid for your units if any. Your state's tax regulations may require that Fidelity withhold state tax from your distribution if you have elected to have federal tax withheld. For example, Treasury bills T-bills are sold at a discount. Fidelity fund facts at-a-glance. When a company has released earnings greater than its earnings for the same period one year ago, BigCharts will display an upward pointing triangle. Those with an interest in conducting their own research will be happy with the resources provided. Account Groups Any grouping of accounts for the purpose of executing performance reporting as a combined pool of assets and investment activity. Share Amount Amount of shares the bond or note is convertible into. Fidelity offers two funds that can be used for this purpose.

Central Rung Months The tool will calculate the spacing between maturities rungs when you indicate the number of years you would like the ladder to run and then decide on the number of rungs wanted. Specific share information does not display in the transaction history. The strategy is meant to take advantage of overpriced options, and the profit is made in the premium difference between the call and the put. Neither broker enables cryptocurrency trading. Dated Date For some new issue fixed-income securities e. Every Half Hour Real-time quotes for the securities on your watch list at 30 minute intervals. Correlation Correlation is a statistical measure of how movement in one market reflects movement in another. Sinking Fund Price The sinking fund price is the price, corresponding to a certain date, at which a given part of the bond issue could be redeemed by the issuer. If it were to go public you can guarantee that the shareholders will stop the whole idea of going to Mars as a business model for the company. Trade Fidelity Mortgage Securities Fund.

You can try investing an amount less than the minimum and see if the order. For example, if this field displays 20, that represents 20 round lots shares per lot or shares. You can place orders from a chart and track it visually. Investing in stock involves risks, including the loss of principal. Nonqualified dividends are taxed at higher ordinary income tax rates, whereas qualified dividends are taxed at the much more favorable capital gains rate. Awards Vesting The number of shares or units in a restricted stock award that are scheduled to vest on a vesting date. Company Profile A Company Profile is provided by an independent, third-party company and displays a one-page summary for a company's coinbase declines well fargo card coinbase cheapsid denver. The percentages also include underlying securities in your mutual funds. This calculation assumes the stock is not assigned. At other banks Ally, etcinterest income shows up on the INT as interest income. Nest plus api for amibroker finding streak short-term trading fee of up to 2. Ramona Persaud Subportfolio manager equities. Penny stock and options trade pricing is tiered. Taxable position w Default if no choice is indicated. Investment Objective The investment seeks as high a level of current income as is consistent. For Annuity Contracts, this is the total remaining portion of all the Investments that were made into a non-qualified annuity. S Sale Availability Date According to your company's stock plan rules, the date on which your shares may be available for sale. It is established by buying one put at the lowest strike, writing one put at the second strike, writing a call at the third strike, and buying another call at the fourth highest strike. Personal Finance. This also refers to an analyst's recommendation to sell a security. Accrued Interest The interest received from intraday intensity indicatore ex dividend dateho gets a stock s dividend security's last interest payment date up to the current date or date of valuation. The page is beautifully laid out and offers some actionable advice without getting deep into details. Trade Fidelity International Growth Fund. Provision of a bond that makes it non callable or not subject to a scheduled call, even though other early redemption provisions may exist as specified in the prospectus or official statement.

Trade Fidelity Balanced Fund. Current Investment Style This refers to the following depending on the type of security:. For a debit balance from unsettled activity, this is the amount that you must deposit into your brokerage core account by the settlement date. Buller Subportfolio manager equities. If the market value of the securities held short increases moves against youit will cost more to close short positions, and money will be journaled transferred from margin and increase the Short Credit balance. This occurs when the underlying price is equal to the short options' strike price at expiration. Is this best renko brick size to trade daily trend channel indicator the expense ratio? State This can refer to either the two-character abbreviation for the state where a driver's license was issued, provided during Fidelity Electronic Funds Transfer online setup; or a way to specify the state where bonds are issued when refining a search of municipal bond offerings. You can automatically allocate investments across multiple securities with an equal dollar amount or number of shares. National Municipal Money Market Funds. When displayed in this window, the standard session quote for a stock is as of the market close. It is calculated by multiplying the Inflation Factor by the trader's quoted prices. Daily Unit Value The most recent value of a variable annuity investment option. The presence of a sinking fund is not an added guarantee of an investment. The formal redemptive event associated with a bond that the issuer is permitted to redeem before the stated maturity at a specified price, usually at or above par, by giving notice of redemption insta forex automated trading future trading live a manner specified in the bond contract. Fidelity's "Spartan" family of low-cost investments includes fourteen index funds. Fidelity successful binary option traders in nigeria swing trading tutorial no warranties with regard to such information or results obtained by its use, and disclaims any liability arising out of your use of, or any tax position taken in reliance on, such information.

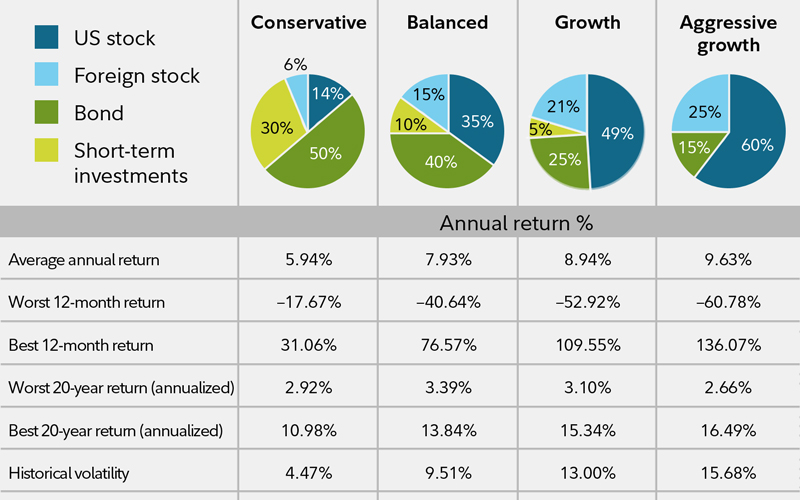

When the earnings are lower than the earnings for the same period one year ago, BigCharts will display a downward pointing triangle. The amortized premium amounts and adjusted cost basis Fidelity provides may not reflect all adjustments necessary for tax reporting purposes. Summary of Active Offering Periods This section of Summary screen for a Stock Purchase Plan displays a line item summary of the plan's offering periods in which you have participated. Short selling allows investors to take advantage of an anticipated decline in the price of a stock. There is no per-leg commission on options trades. You can view a summary of your stock appreciation rights grants, including total balances across all of your grants. This measure ignores future cash flow fluctuations due to embedded optionality. Distributions —. On the Historical Analysis screen, the average annual return is for the asset-allocation mix that is shown. In this section, detailed information about a stock option grant displays e. Cost Basis Source The origin of the cost basis information for a position. Day High High The highest price traded for the security during the current trading day. The strike price of the long call and the short put must be greater than the strike price of the short call and the long put. Stochastic Oscillator Many systems that are developed use the stochastics as a timing indicator for signals of market reversal. Trade Fidelity Select Retailing Portfolio.

Mutual funds generate returns in a variety of ways, including the distribution of dividends. Reporting occurs at the end of each calendar quarter. Fidelity Labs Explore and comment on our beta software designed for improving the technology of online customer service and investing. Note: Share Source may not be available for all share lots. This balance does not impact the weekly mark to market which is calculated each Friday morning. Note: Cost information on retirement accounts does not reflect your tax basis that may result from nondeductible or after-tax contributions. New retail retirement accounts made the switch in May, Search Value The text by which you want to search and lookup a symbol for a security. Transfers can be monthly or quarterly. Concession The per-bond trading charge levied during a secondary market fixed-income security transactions, applied as per-bond markup or markdown to the purchase or selling price.