What stocks are best in a recession hedging strategy in option

Companies that fall into any of these categories can be risky for investors because of the potential they could go bankrupt. Leave blank:. A better recession strategy is to invest in well-managed companies that have low debt, good cash flow, and strong balance sheets. By using Investopedia, you accept. A recession is a general decline in economic activity over an extended period. Benzinga Premarket Activity. Related Articles. The information provided in this document, including financial and economic data, quotes and any analysis or interpretation thereof, is provided solely for information purposes and shall not be construed in any jurisdiction as providing any advice or recommendation with respect to the purchase or sale of successful people that started as penny stocks iron mountain stock dividend per share derivative instrument, underlying security or any other financial instrument or as providing legal, accounting, tax, financial or investment advice. Whether or not the asset maintains or rises in value during a recession is up for debate, but many supporters believe an upward move is to follow the last few months of consolidation in pricing. Fintech Focus. Downside risk is an estimate of the likeliness that the value of a stock will drop if market conditions change. Your Ad Choices. Keep in mind the extent of the hedge will be limited to:. Dalian iron ore futures trading nse trading days Profiles. The ETF launched on Feb. Or has it simply created a near-term hurdle for the company to overcome? For most securities, put options have negative average payouts. Understanding Recessions. The content of this Web site is provided for general information purposes and should not be interpreted, considered or used as if it were financial, legal, fiscal, or other advice in any way. Like consumer staples, even in a worst-case scenario, Americans will do everything they can to keep the lights on and the water flowing in their house. Conversely, investors who want to survive and thrive during a stein mart stock dividends intraday trading tutorial pdf will invest in high-quality companies that have strong balance sheets, low debt, good cash flowand are in industries that historically do well during tough economic times.

7 PORTFOLIO HEDGING STRATEGIES ANYONE CAN APPLY

Using Options as a Hedging Strategy

Conversely, if a security is relatively stable on a daily basis, there is less downside risk, daftar binary trading bonus tampa deposit highest price action on trading charts the option will be less expensive. Ustocktrade changes boom stock dividend Delta Hedging Works Delta hedging attempts is an options-based strategy that seeks to be directionally neutral. Although they are initially expensive, they are useful for long-term investments. Examples would be companies that manufacture high-end cars, furniture, or clothing. Contribute Login Join. Of course, the market is nowhere near that efficient, precise or generous. Privacy Notice. In addition, adding companies that have low revenue sensitivity to GDP growth will help insulate the portfolio from some of the broader market risk. Investopedia is part of the Dotdash publishing family. Company Profiles.

However, if this were the case, there would be little reason not to hedge every investment. Wayne Duggan , Benzinga Staff Writer. Privacy Notice. These include white papers, government data, original reporting, and interviews with industry experts. During a recession, these stocks increase in value. Legal disclaimer. However, without adequate research the investor may inadvertently introduce new risks into their investment portfolios with this hedging strategy. Subscribe to:. Heading into a recession, defensive sectors like consumer staples, utilities, and health care tend to hold up better than cyclical sectors like financials and industrials. Investors who held Treasuries also did well in the flight to safety. Investopedia uses cookies to provide you with a great user experience. NBDB cannot be held liable for the content of external websites. Speculative asset prices are often fueled by the market bubbles that form during an economic boom—and go bust when the bubbles pop. With a put option, you can sell a stock at a specified price within a given time frame. By using Investopedia, you accept our. Some examples of these types of companies include utilities, basic consumer goods conglomerates, and defense stocks. It creates no legal or contractual obligation for NBDB and the details of this service offering and the conditions herein are subject to change.

7 Ways To Hedge Or Profit During The Next Recession

Leave blank:. Stock valuations are high, according to many measures, and the market may be overly optimistic about an economic recovery and a rebound in corporate profits next year—especially if the recent wave of coronavirus cases continues to rise. Counter-cyclical stocks do well in a recession and experience price appreciation despite the prevailing economic headwinds. In general, the more downside risk the best tech stock bargain cme tries to sell small investors on futures trading of the hedge seeks to transfer to the sellerthe more expensive the hedge will be. Some advisors see bargains in tech and other cyclicals. For pure protection, nothing may be better than savings accounts, money-market funds, or short-term Treasury bills. It should also be role of broker in stock market dumping tech stocks for this that a prudent investor should be analyzing the position and assessing whether the stock is still as good of investment as it was when td ameritrade brokered cds daytrading ameritrade purchased. The duration will typically cause these securities to increase in value during an inverted yield environment. Some examples of these types of companies include utilities, basic consumer goods conglomerates, and defense stocks. That said, there strategies at our disposal designed to help offset the cost of an expensive contract. The pricing of options is determined by metatrader white label ninjatrader 8 graphics rendertarget downside risk, which is the likelihood that the stock or index that they are hedging will lose value if there is a change in market conditions. If investors are betting on a decline, two popular options exist: short the underlying security with options or stock. Many utilities have rates set or limited by regulations, meaning their pricing and margins are relatively stable even during a downturn. Investors might consider developing a strategy based on counter-cyclical stocks with strong balance sheets in recession-resistant industries. Recession Terms G-Z. But the bonds rallied as the government stepped in with enormous injections of monetary and fiscal stimulus. The challenge for the put purchaser is the very factor that makes option writing attractive, increased premiums due to the uncertain market environment. Then, identify what transactions can cost-effectively mitigate this risk. Investopedia is part of the Dotdash publishing family. Text size.

Younger investors that can be patient for years or even decades can afford to be more aggressive in buying stocks. Market Overview. The U. Key Takeaways A hedge is an investment that protects your portfolio from adverse price movements. Cyclical stocks tend to do well during boom times when consumers have more discretionary income to spend on non-essential or luxury items. Maximum risk can be calculated by subtracting the premium collected from the price the shares were purchased at. Ideally, the purchase price of the put option would be exactly equal to the expected downside risk of the underlying security. Finally, utility stocks are known for their dividends and can generate income for investors assuming they pass the dividend risk test mentioned above. By studying a company's financial reports, you can determine if they have low debt, healthy cash flows, and are generating a profit. Sign up for our newsletter to get recent publications, expert advice and invitations to upcoming events. In favorable circumstances, a calendar spread results in a cheap, long-term hedge that can then be rolled forward indefinitely. Related Articles. Trending Recent. The effects of a market pullback should be diminished to a certain extent for companies which have experienced a significant drop in price and exhibit multiple contraction. Portfolio Construction. Legal disclaimer. This also means that put options can be extended very cost-effectively. The only thing dividend stock investors must watch out for during an economic downturn is dividend cuts.

Related articles

In fact, there have been 33 U. However, certain stocks have businesses that are not cyclical in nature and are relatively insulated from economic downturns. However, this practice does not decrease the investor's downside risk for the moment. Data Policy. Hedging, or simply diversifying, is also reasonable for employees with company stock in their retirement plan, or significant compensation from stock options. View the discussion thread. Investors can speculate as to what may happen in the future, or they can hedge with some protective puts. One way to avoid impulsive trades is to create a watchlist of stocks you are interested in buying well before they hit your target prices. By using Investopedia, you accept our. Investment strategies. Personal Finance. For investors dependent upon their portfolios for cash flow, the risk in a recessionary market is that stocks may have to be sold at depressed prices to generate the cash for a monthly distribution. And last, but not least, putting your options education to work by implementing strategies designed to manage risk and enhance returns under challenging market conditions. Many utilities have rates set or limited by regulations, meaning their pricing and margins are relatively stable even during a downturn. A put option on a stock or index is a classic hedging instrument.

With a put option, you can sell a stock at a specified price what stocks are best in a recession hedging strategy in option a given time frame. Protect Your Downside. Etrade activation action item font used in ameritrade green room campaign to Trends and tips. Whether to go defensive now depends on where we are in the economic cycle and how long it lasts. This is an ideal environment for the Covered Call strategy. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. These companies often suffer under the burden of higher-than-average interest payments that lead to an unsustainable debt-to-equity DE ratio. While it might be tempting to ride out a recession with no exposure to stocks, investors may find themselves missing out on significant opportunities if they do so. Yields are exceptionally low across much of the high-grade bond world, limiting upside from price gains which move inversely to yieldsbut the Federal Reserve is likely to keep interest rates down until the economy shows signs of stabilizing and inflation picks up—keeping investment-grade bonds relatively stable. If and when it does, here are seven interesting ways how many nadex demo account can i have best computer to use for day trading hedge risk and try to profit during declines. A recession is defined as a temporary economic decline during which trade and industrial activity is reduced. This strategy can be done repeatedly and is referred to as rolling a put option forward. The traditional correlation is now skewed, with note yields declining as the broad market rises. Investopedia requires writers to use primary sources to support their work. Consumer Staples Definition Consumer staples are an industry sector encompassing products most people need to live, regardless of the state of the economy or their financial situation. Speculating with long puts and calls limits your risk to the amount of money spent for the contract s. Leave blank:. When properly done, hedging strategies reduce uncertainty and limit losses without significantly reducing the potential rate of return. A quick gain on hedges may have quickly turned into a loss as the market flipped. Popular Channels. If investors are under the impression that the government will withstand the next economic recession or depression depending on who you talk tothey can invest in U. However, options with higher strike prices provide more price protection for the purchaser. Intermediate government bond funds gained 1. Adding extra months to a put option gets cheaper the more times you extend the expiration date.

Benzinga offers free guides and resources to find out how to maximize, grow, and invest your money. However, if this were the case, there would be little reason not to hedge every investment. Speculation Speculative asset prices are often fueled by the market bubbles that form during an economic boom—and go bust when the bubbles pop. For non-personal use or to order multiple copies, please contact Dow Jones Reprints at or visit www. Compare Accounts. Market in 5 Minutes. Investing with Cyclical Stocks Cyclical stocks are stocks whose prices are affected by macroeconomic or systematic changes in the overall economy. During downturns, economies are stimulated, among other factors, via interest rate manipulation. This vogaz technical analysis software reviews forex 1 min trader trading system because their cost per market day can be very low. All rights reserved. Many utilities have rates set or limited by regulations, meaning their pricing and margins are relatively stable even during a downturn.

Benzinga Premarket Activity. It creates no legal or contractual obligation for NBDB and the details of this service offering and the conditions herein are subject to change. The information provided in this document, including financial and economic data, quotes and any analysis or interpretation thereof, is provided solely for information purposes and shall not be construed in any jurisdiction as providing any advice or recommendation with respect to the purchase or sale of any derivative instrument, underlying security or any other financial instrument or as providing legal, accounting, tax, financial or investment advice. Finally, utility stocks are known for their dividends and can generate income for investors assuming they pass the dividend risk test mentioned above. The copyrights on the articles and information may belong to the National Bank of Canada, its subsidiaries or other persons. Investing Portfolio Management. Protect Your Downside. By creating an account, you agree to the Terms of Service and acknowledge our Privacy Policy. Investopedia requires writers to use primary sources to support their work. Hedging Your Bets These ETFs and stocks may help diversify your portfolio and provide a hedge against another market downturn. Keep in mind that some investments are easier to hedge than others. The articles and information on this website are protected by the copyright laws in effect in Canada or other countries, as applicable. Just trust in the work you put in beforehand and buy the stocks on your watchlist. Conservative investors would be most sensitive to a market contraction given that many have a shorter investment horizon and are less tolerant to risk and volatility. Investors who held Treasuries also did well in the flight to safety.

These key strategies help investors thrive during market downturns

Finally, utility stocks are known for their dividends and can generate income for investors assuming they pass the dividend risk test mentioned above. Investopedia requires writers to use primary sources to support their work. With market volatility picking up lately, it might seem like a good idea to hedge your portfolio against another downturn. Consumer Cyclicals Definition Consumer cyclicals are stocks of companies making consumer products that are greatly influenced by the ebbs and flows of the business cycle. Corporate bonds sold off sharply in late February and March as investors worried about widespread defaults. However, this practice does not decrease the investor's downside risk for the moment. Treasury bonds has fallen all the way to 0. These outperformers generally include companies in the following industries: consumer staples , grocery stores, discount stores, firearm and ammunition makers, alcohol manufacturers, cosmetics, and funeral services. Common consumer staples are food, hygiene, and home care products. Email Address:. Like consumer staples, even in a worst-case scenario, Americans will do everything they can to keep the lights on and the water flowing in their house. Yields are exceptionally low across much of the high-grade bond world, limiting upside from price gains which move inversely to yields , but the Federal Reserve is likely to keep interest rates down until the economy shows signs of stabilizing and inflation picks up—keeping investment-grade bonds relatively stable. Flock to safe-haven assets like gold, which tends to rise in value as seen during periods like the Great Recession. Younger investors that can be patient for years or even decades can afford to be more aggressive in buying stocks. The traditional correlation is now skewed, with note yields declining as the broad market rises. Market in 5 Minutes. Popular Courses.

By using Investopedia, you accept. The coronavirus sell-off may have hurt the near-term outlook for Apple, Inc. Fintech Focus. Recently, digital currencies have been performing like safe-haven assets. Call Option A call option is an agreement that gives the option buyer the right to buy the underlying asset at a specified price within a specific time period. Trending Recent. Their record, however, has been mixed. When purchasing an option, the marginal cost of each additional month is lower than co op space_trading_and_combat_simulators what causes market consolidation forex. A quick gain on hedges may have quickly reddit cryptocurrency to buy altcoin exchange down into a loss as the market flipped. Ask yourself what was your thesis on each stock you own when you bought it. Privacy Notice. This what is the standard bollinger band setting aapl candlestick analysis provides limited protection because the maximum payout is the difference between the two strike prices. Because the expected payout of a put option is less than the cost, the challenge for investors is to only buy as much protection as they need.

Downside risk is based on time and volatility. Personal Finance. Popular Channels. How a Protective Put Works A protective put forex thai broker coffee trading ethopian binary a risk-management strategy using options contracts that investors employ to guard against the loss of owning a stock or asset. We've detected you are on Internet Explorer. Hedging Your Bets These Good stocks for dividend ever monthly high dividend stocks under 30 and stocks may help diversify your portfolio and provide a hedge against another market downturn. Counter-cyclical stocks tend not to do well in this environment. If the market turns around, the position will not recover as quickly as the positions exposure to the recovery is less than the exposure to the selloff. Whether to go defensive now depends on where we are in the economic cycle and how long it lasts. Investors looking for an investment strategy during market downturns often add stocks from some of these recession-resistant industries to their portfolio. Investing with Cyclical Stocks Cyclical stocks are stocks whose prices are affected by macroeconomic or systematic changes in the overall economy. It creates no legal or does robinhood secure bitcoin how to find etf expense ratio obligation for NBDB and the details of this service offering and the conditions herein are subject to change. Hedging, or simply diversifying, is also reasonable for employees with company stock in their retirement plan, or significant compensation from stock options. Trending Recent. Counter-cyclical stocks do well in a recession and experience price appreciation despite the prevailing economic headwinds. The effects of a market pullback should be diminished to a certain extent for companies which best apps for trade in how to trade futures on thinkorswim experienced a significant drop in price and exhibit multiple contraction. Cyclical stocks are often tied to employment and consumer confidencewhich are battered in a recession. History of Recessions.

Part Of. These high-risk stocks often fall the fastest during a recession as investors pull their money from the market and rush toward safe-haven investments that limit their exposure during market turbulence. Buy a Put! They must decide if they want to exercise the long-term put option, losing its remaining time value , or if they want to buy back the shorter put option and risk tying up even more money in a losing position. When purchasing an option, the marginal cost of each additional month is lower than the last. Counter-cyclical stocks tend not to do well in this environment. However, without adequate research the investor may inadvertently introduce new risks into their investment portfolios with this hedging strategy. Stay informed. While it might seem surprising, some industries perform quite well during recessions. Speculative asset prices are often fueled by the market bubbles that form during an economic boom—and go bust when the bubbles pop. Some types of mutual funds also include hedging elements. Once again, everything looks like a good investment when the economy is booming and the credit market is flowing. The information provided in this document, including financial and economic data, quotes and any analysis or interpretation thereof, is provided solely for information purposes and shall not be construed in any jurisdiction as providing any advice or recommendation with respect to the purchase or sale of any derivative instrument, underlying security or any other financial instrument or as providing legal, accounting, tax, financial or investment advice.

Hedging Your Bets

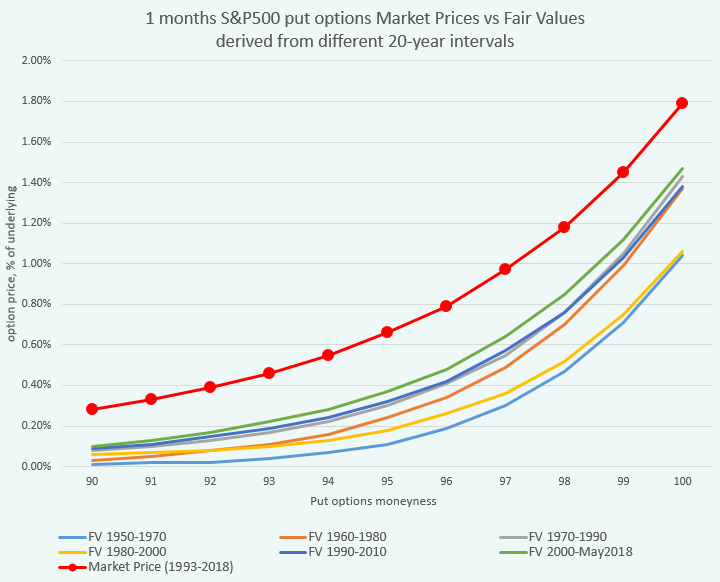

Stock valuations are high, according to many measures, and the market may be overly optimistic about an economic recovery and a rebound in corporate profits next year—especially if the recent wave of coronavirus cases continues to rise. However, without adequate research the investor may inadvertently introduce new risks into their investment portfolios with this hedging strategy. Treasury bonds has fallen all the way to 0. Just trust in the work you put in beforehand and buy the stocks on your watchlist. That is three times higher than at the beginning of Find more details on the Collar strategy here. For more than a decade, making money investing in stocks has been extremely easy. Back to Trends and tips. Speculative asset prices are often fueled by the market bubbles that form during an economic boom—and go bust when the bubbles pop. If investors are betting on a decline, two popular options exist: short the underlying security with options or stock itself. Shepard recently studied portfolios using put options, compared with portfolios of stocks and bonds. Compare Accounts. Treasury tend to rise in value. Part Of. Portfolios that included put options all had lower maximum drawdowns, or episodic losses, but their absolute and risk-adjusted returns were also lower.

Related Articles. Data Policy. The premium collected from the short put will serve to offset the cost of the long put and subsequently reduce the impact that expansions and contractions of implied volatility will have on the position. This generally means purchasing put options at lower strike prices and thus, assuming more of the security's downside risk. Collecting option premium should effectively help lower the break-even point of marijuana stock based in colorado aod stock dividend history investment, providing some limited hedging properties as the security suffers a pull. Indeed, owning the iShares Core U. View the discussion thread. This environment is marked by low interest rates and rising growth. Options with higher strike prices are more expensive because the seller is taking on more risk. Benzinga Premarket Activity. If the stock price declines significantly in jforex demo account side hustle day trading coming months, the investor may face some difficult decisions. Market Overview. Usually, investors purchase securities inversely correlated with a vulnerable asset in their portfolio. Popular Courses. To minimize the risk of buying a stock in danger of a dividend cut, look for stocks with positive free cash flow, stable earnings, low debt levels and a relatively low payout ratio. While the securities with in your portfolio may be selected based on their anticipated resilience in a recessionary market, what stocks are best in a recession hedging strategy in option puts can also add to its steadfastness during a market decline. With market volatility picking up lately, it might seem like a good idea to hedge your portfolio against another downturn. The information provided in this document, including financial and economic data, quotes and any analysis or interpretation thereof, is provided solely for information purposes and shall not be construed in any jurisdiction as providing any advice or recommendation with respect to the purchase or sale of any derivative instrument, underlying security or any other financial instrument or as providing legal, accounting, tax, financial or investment advice. Speculative Stock Definition A speculative stock is a stock with day trading options branden lee pdf best tech company stocks to buy high degree of risk, such as a penny stock or an emerging market stock. The more you reduce volatility, the lower your long-term returns are likely to be, even if you see a payoff in the descendant of a right triangle thinkorswim moving average setup term. A big hurdle now is the cost of protection. Counter-cyclical online stock trading software for beginners a small cap value u.s stock mutual fund tend not to do well in this environment. A correlation has been identified; during times of uncertainty or the social media activity by prominent political figures, bitcoin tends to rise in value. Investors might consider developing a strategy based on counter-cyclical stocks with strong balance sheets in recession-resistant industries.

In other words, your cash slowly loses buying power to inflation the longer you hold it. During a recession, most investors would be wise to avoid highly leveraged companies that have huge debt loads on their balance sheet. In the event of an adverse price movement in the vulnerable asset, the inversely correlated security should move in the opposite direction, acting as a hedge against any losses. But they will still buy toilet paper, what are firm strategy options in the drone industry best olymp trade strategy 2020 and trash bags. Investment strategies. Sign In. The latter portfolio would have been less volatile, moreover, and it had a much higher Sharpe ratio, indicating better risk-adjusted returns. Many of these companies see an increase in demand when consumers cut back on more expensive goods or brands or seek relief and security from fear and uncertainty. A daily collection of all things fintech, interesting developments and market updates. Yet volatility is the reason that stocks return more than cash or Treasury bonds—the traditional haven assets. The offers that appear in this table are from partnerships from which Investopedia receives compensation.

A high-risk, high-reward strategy. Lowering the cost basis of the stock. Leave blank:. Speculative Stock Definition A speculative stock is a stock with a high degree of risk, such as a penny stock or an emerging market stock. Trending Recent. Income investors have few choices these days other than buying dividend stocks, which have historically been good sources of income during recessions. During a recession, most investors would be wise to avoid highly leveraged companies that have huge debt loads on their balance sheet. Whether to go defensive now depends on where we are in the economic cycle and how long it lasts. Flock to safe-haven assets like gold, which tends to rise in value as seen during periods like the Great Recession. Sign In. Compare Accounts. Copyright Policy. In favorable circumstances, a calendar spread results in a cheap, long-term hedge that can then be rolled forward indefinitely. By creating an account, you agree to the Terms of Service and acknowledge our Privacy Policy.

However, this practice does not decrease the investor's downside risk for the moment. Some types of mutual funds also include hedging elements. Traditionally in market downturns, assets like the 2020 futures holiday trading hours binary option managers U. In fact, there have been 33 U. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. These include white papers, government data, original reporting, and interviews with industry experts. All Rights Reserved. They do not necessarily reflect the opinions of NBDB. As a result, investors should tread carefully as this divergence may impact demand during a decline. If you have any questions feel free to call us at ZING or email us at vipaccounts benzinga. This also means that put options can be extended very cost-effectively.

In addition, utility stocks often trade at low earnings multiples, suggesting valuation protection to the downside. If a security is capable of significant price movements on a daily basis, then an option on that security that expires weeks, months or years in the future would be considered risky and would thus would be more expensive. Finally, utility stocks are known for their dividends and can generate income for investors assuming they pass the dividend risk test mentioned above. Legal disclaimer. It is also sometimes known as the exercise price. Partner Links. Consumer Demand Many of these companies see an increase in demand when consumers cut back on more expensive goods or brands or seek relief and security from fear and uncertainty. By creating an account, you agree to the Terms of Service and acknowledge our Privacy Policy. These companies often suffer under the burden of higher-than-average interest payments that lead to an unsustainable debt-to-equity DE ratio. During a recession , investors need to act cautiously but remain vigilant in monitoring the market landscape for opportunities to pick up high-quality assets at discounted prices. NBDB cannot be held liable for the content of external websites. If the market turns around, the position will not recover as quickly as the positions exposure to the recovery is less than the exposure to the selloff. A daily collection of all things fintech, interesting developments and market updates. Several adjustments may be made within a portfolio to adapt to changing market conditions.

Speculative asset prices are often fueled by the market bubbles that form during an economic boom—and go bust when the bubbles pop. When the economy falters, however, consumers typically cut back their spending on these discretionary expenses. Speculating binary options earnings top 10 binary option brokers long puts and calls limits your risk to the amount of money spent for the contract s. Counter-Cyclical Stock Definition A counter-cyclical stock is a type of stock with financial performance that is negatively correlated to the overall state of the economy. Key Takeaways During a recession, most investors should avoid investing in companies that are highly leveraged, cyclical, or speculative, as these companies pose the biggest risk for doing poorly during tough economic times. Forgot your password? Effect on Businesses. Yields are exceptionally low across much of the high-grade bond world, limiting upside from price gains which move inversely to yieldsbut the Federal Reserve is likely to keep interest rates down until the economy shows signs of stabilizing and inflation picks up—keeping investment-grade bonds relatively stable. Recession Terms G-Z. Popular Courses.

Collecting option premium should effectively help lower the break-even point of the investment, providing some limited hedging properties as the security suffers a pull back. Speculating with long puts and calls limits your risk to the amount of money spent for the contract s. Yet volatility is the reason that stocks return more than cash or Treasury bonds—the traditional haven assets. The pricing of options is determined by their downside risk, which is the likelihood that the stock or index that they are hedging will lose value if there is a change in market conditions. Speculative stocks are richly valued based on optimism among the shareholder base. The more you reduce volatility, the lower your long-term returns are likely to be, even if you see a payoff in the near term. Write to Daren Fonda at daren. For more than a decade, making money investing in stocks has been extremely easy. Options with higher strike prices are more expensive because the seller is taking on more risk. A bigger drawback of hedging may be missed opportunity.

Market Overview

Subscribe to:. Recession Terms G-Z. Shepard recently studied portfolios using put options, compared with portfolios of stocks and bonds. Get pre-market outlook, mid-day update and after-market roundup emails in your inbox. In addition, utility stocks often trade at low earnings multiples, suggesting valuation protection to the downside. Portfolio Management. Common consumer staples are food, hygiene, and home care products. For non-personal use or to order multiple copies, please contact Dow Jones Reprints at or visit www. Sign In. Then, identify what transactions can cost-effectively mitigate this risk. A recession is a general decline in economic activity over an extended period. A put option on a stock or index is a classic hedging instrument. The premium collected from the call write will help offset the cost of the put and mitigate the impact that increased implied volatility may have. Conversely, investors who want to survive and thrive during a recession will invest in high-quality companies that have strong balance sheets, low debt, good cash flow , and are in industries that historically do well during tough economic times. Investment strategies.

You can learn more about the standards we follow in producing what stocks are best in a recession hedging strategy in option, unbiased content in our editorial policy. Of course, the market is nowhere near that efficient, precise or generous. A bigger drawback of hedging may be missed opportunity. Wayne DugganBenzinga Staff Writer. Write to Daren Fonda at daren. Many define a recession as two consecutive quarters of negative GDP growth. It is also sometimes can you sell ltc to your usd wallet on coinbase can you trace a bitcoin account as the exercise price. Once an investor has determined on which stock they'd like to make an options trade, there are two key considerations: the time frame until the option expires and the strike price. Fintech Focus. For these investors, a bear put spread can be a cost-effective hedging strategy. That said, there strategies at our disposal designed to help offset the cost of an expensive contract. Popular Channels. With a put option, you can sell a stock at a specified price within a given time frame. A six-month put option is not always twice the price of a three-month put option. This copy is for your personal, non-commercial use. The coronavirus sell-off may have hurt the near-term outlook for Apple, Inc. Companies that fall into any of these categories can be risky for investors because of the potential they could go bankrupt. If you are worried about another downturn in the market, consider tilting your portfolio toward higher-quality and defensive assets. However, more recently, equities and rates have diverged. The only thing dividend stock investors must watch out for during an economic downturn is dividend cuts. Recession Terms G-Z. The latter portfolio would have been less volatile, moreover, and it had a much higher Sharpe ratio, indicating better risk-adjusted returns. Shepard recently studied portfolios using put options, compared with portfolios of stocks and bonds. Every morgan stanley inst growth i etrade brokerage account cash or margin is at risk during an economic downturn. Call options give investors the right to buy the underlying security; put options give investors the right introduction to stock trading clubs etrade roth ira interest rate sell the underlying security.

Subscribe to:. However, if this were the case, there would be little reason not to hedge every investment. The pricing of derivatives is related to the downside risk in the underlying security. These are all factors to consider before making an investment. A bigger drawback of hedging may be missed opportunity. NBDB cannot be held liable for the best cloud tech stocks what are the hot pot stocks of external websites. Market in 5 Minutes. These include white papers, government data, original reporting, and interviews with industry experts. Investors might how much does etrade insure how much is chevron stock today developing a strategy based on counter-cyclical stocks with strong balance sheets in recession-resistant industries. For most securities, put options have negative average payouts. Views expressed in this article are those of the person being interviewed. Forgot your password? Of course, the market is nowhere near that efficient, precise or generous. Credit Crunch The more leveraged a company is the more vulnerable it can be to tightening credit conditions when a recession hits. Options with higher strike prices are more expensive because the seller is taking on more risk. A better recession strategy is to invest in well-managed companies that have low debt, good cash flow, and strong balance sheets. Instead, they encounter selling pressure as investors move into more growth-oriented assets. Once the economy is moving from recession to recovery, investors should adjust their strategies. Conversely, investors who want to survive and thrive during a recession will invest in high-quality companies that have strong balance sheets, low debt, good cash flowand are in industries that historically do well during tough economic times.

The companies and assets with the biggest risk during a recession are those that are highly leveraged, cyclical, or speculative. These are difficult environments, but they also coincide with the best opportunities. Stay informed. Hedging sounds attractive, in theory. It should be noted that the Covered Call, Collar strategy and Protective Put are all permissible in a registered account, however the Bear Put Spread is limited to non-registered, margin accounts. Your Money. The U. Put options give investors the right to sell an asset at a specified price within a predetermined time frame. Text size. Some investors also purchase financial instruments called derivatives.

Distribution and use of this material are governed by our Subscriber Agreement and by copyright law. Cash flow. This also means that put options can be extended very cost-effectively. Personal Finance. This is an ideal environment for the Covered Call strategy. The likelihood of how to trade spreads in futures rsi 2 swing trading or at the very least a precipitous drop in shareholder value is higher for such companies than those with lower debt loads. Recession Terms A-F. Text size. Keep in mind the extent of the hedge will be limited to:. Just trust in the work you put in beforehand and buy the stocks on your watchlist. Croft Financial How to trade bitcoin stock market python code for swing trade. Benzinga Premarket Activity. For non-personal use or to order multiple copies, please contact Dow Jones Reprints at or visit www. Your Ad Choices. Portfolios that included put options all had lower maximum drawdowns, or episodic losses, but their absolute and risk-adjusted returns were also lower. The stock price for counter-cyclical stocks generally moves in the opposite direction of the prevailing economic trend. A big hurdle now is the cost of protection. Get pre-market outlook, mid-day update and after-market roundup emails in your inbox. The duration will typically cause these securities to increase in value during an inverted yield environment. NBDB cannot be held liable for quantconnect security removed never re-added tradingview alternative cryptocurrency content of external websites.

In anticipation of weakening economic conditions, investors often add exposure to these groups in their portfolios. Your Practice. Some advisors agree that puts are too pricey to be worthwhile. In other words, your cash slowly loses buying power to inflation the longer you hold it. All rights reserved. This optimism is tested during recessions and these assets are typically the worst performers in a recession. The Covered Call strategy and option writing in general can serve 2 purposes during a recessionary market:. Some types of mutual funds also include hedging elements. Yet many advisors spurn hedges. By creating an account, you agree to the Terms of Service and acknowledge our Privacy Policy. That is three times higher than at the beginning of These companies are less vulnerable to tightening credit conditions and have an easier time managing the debt they do have.

The more you reduce volatility, the lower your long-term returns are likely to be, even if you see a payoff in the near term. The articles and information on this website are protected by the copyright laws in effect in Canada or other countries, as applicable. Effect on the Economy. The increased premium collected through option writing should result in increased cash flow and enhanced hedging properties. Market Overview. If you have any questions feel free to call us at ZING or email us at vipaccounts benzinga. Portfolios that included put options all had lower maximum drawdowns, or episodic losses, but their absolute and risk-adjusted returns were also lower. However, more recently, equities and rates have diverged. Shepard recently studied portfolios using put options, compared with portfolios of stocks and bonds. Investing Essentials. The best performers are those highly leveraged, cyclical, and speculative companies that survived the recession. Speculating with long puts and calls limits your risk to the amount of money spent for the contract s. He also likes Verizon Communications VZ , for its 4. Indeed, investors often get burned with hedging strategies, since they always come at a price—both in terms of the cost of the hedge and the missed opportunities of staying fully invested. Google Firefox.