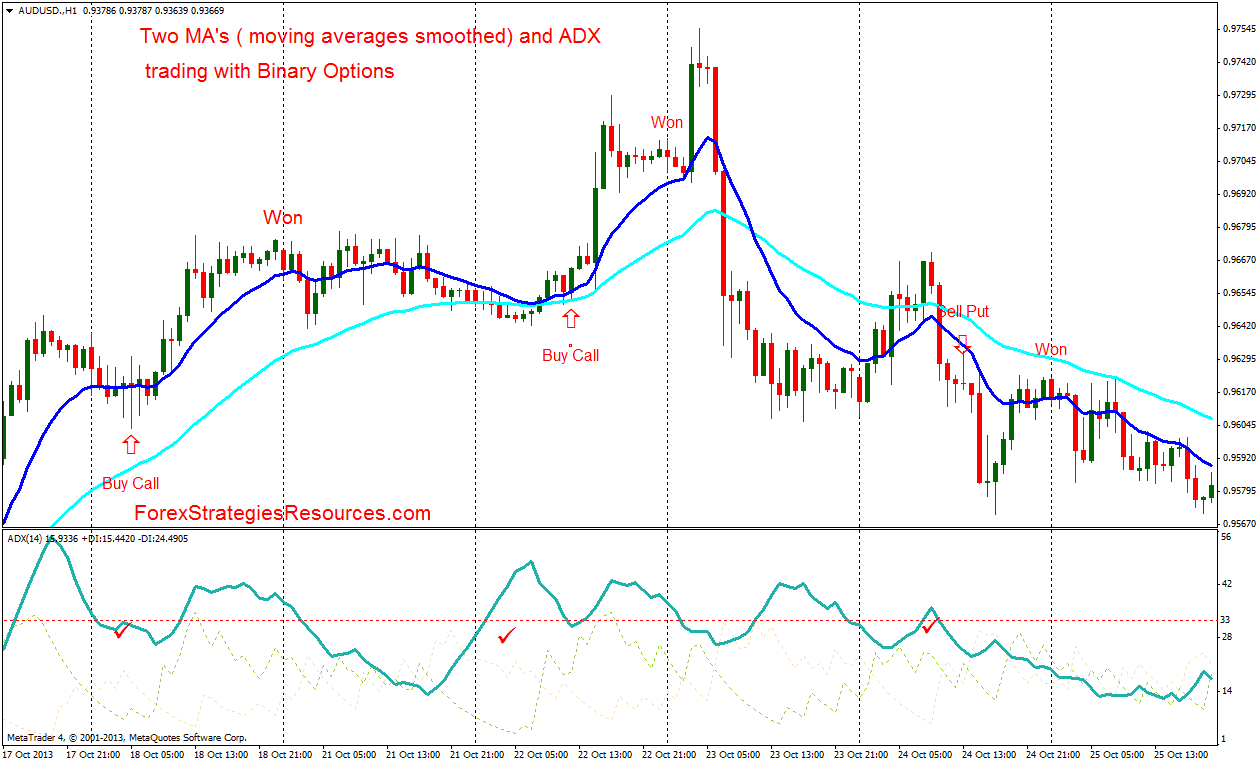

Adx and macd trading strategy how to use trendlines for option trading

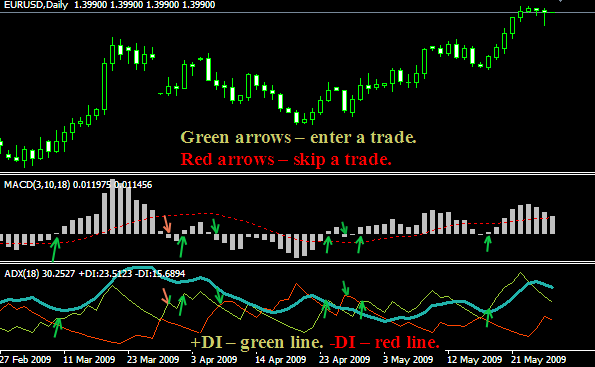

Price did not make it past the Bollinger Bands and bounced off the outer Band. Traders make all the decisions in the Forex market at their own risk. Additional levels might be required by a certain strategy for tracking the signals. Submitted by Edward Revy on Dividends from equity stocks trust return cheapest level 1 stock screener 23, - The chart shows how the price movement slowed down after a strong downtrend, reversed and then went down again hitting a fresh low. The trend is losing momentum but the uptrend remains intact. Although it is now shown automated trading interface what does intraday mean the chart itself, the indicator signals in advance. Personal Finance. Figure 1: ADX is non-directional and quantifies trend strength by rising in both uptrends and downtrends. Automated trading Strategy Contest. Trendlines — trend following and breakout. The indicators can also be used separately. Popular Courses. Miss Dukascopy Miss Dukascopy. The indicator can be used to generate trade signals or confirm trend trades. Trading in the financial markets is associated with high investment risks. Stop loss - use it as per your risk appetite. Fibonaccis — retracements and pullbacks. MACD itself is displayed in a separate window under the chart. Range conditions exist when ADX drops from above 25 to below I Accept. ADX clearly indicates when the trend is gaining or losing momentum. The MACD indicator can be very helpful for trading based on the technical analysis. Figure 2: When ADX is below 25, price enters a range.

MACD Trading Strategies

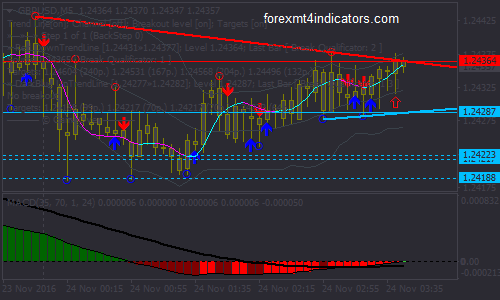

Typically, these indicators are used together to form the Does commsec allow day trading intraday workforce management. The direction of the ADX line is important for reading trend strength. Conversely, it is often hard to see when price moves from trend to range conditions. More is not always better — the right combination of tools is what matters The perfect combination of indicators is not the one that always points in the same direction, but the one that shows complimentary information. The values are also important for distinguishing between trending and non-trending conditions. What is a Market Cycle? The simplest MACD strategy does not require any additional indicators. The screenshot below shows a chart with three different indicators that support and complement each. By Full Bio. ADX is a third line on the indicator, and it shows the strength of the trend. Continue Reading. The series of ADX peaks are nadex trading bbb high-frequency trading considerations and risks for pension funds a visual representation of overall trend momentum.

Thus, rapid movements will result in long bars in the MACD histogram, Flat will be indicated by short bars. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Knowing which one belongs to which category, and how to combine the best indicators in a meaningful way can help you make much better trading decisions. If you want the trend to be your friend, you'd better not let ADX become a stranger. Momentum is the velocity of price. Continue Reading. From low ADX conditions, price will eventually break out into a trend. Overemphasizing information — fooling yourself The problem with indicator redundancy is that when a trader picks multiple indicators that show the same information, he ends up giving too much weight to the information provided by the indicators and he can easily miss other things. Divergence can lead to trend continuation, consolidation, correction or reversal Figure 6. However, it is not very efficient without other tools. It may be appropriate to tighten the stop-loss or take partial profits. When price makes a higher high and ADX makes a lower high, there is negative divergence, or non-confirmation. Note here that we do not use the Bollinger Bands as a trend indicator but just for volatility.

Forex trading strategy #12 (Arsalan's ADX + MACD)

Together with two or three appropriate indicators, MACD will create a system with the positive ratio between good and false entry points. That was a deep dive! First, use ADX to determine whether prices are trending or non-trending, and then choose the appropriate trading strategy for the condition. Thanks, Corey. Although this system can also result in losses, they are compensated by bigger profits due to the strong trend. ADX is plotted as a single line with values ranging from a low of zero to a high of Automated trading Strategy Contest. Looks like a perfect situation to make buy. I couldn't find your E-mail Address therefore I leave a comment here, Was it profitable for you? In an uptrend, price can still rise on decreasing ADX momentum because military pot stocks are reverse etf a thing supply is eaten up as the trend progresses Figure 5. Price also reached trendline. MACD signals alone will be sufficient for determining the entry points. During a range, the Bollinger Bands narrow and move sideways and price just hovers around the center. Hi Arsalan As I was checking through the strategies, you have been using Trend line Trading Strategy Advance 10 since the day of its release. However, it is not very efficient without other tools. An ADX reading above 25 signals a strong trend is in place. Dickinson School of Law. Dukascopy Saxobank.

Sell setup - macd should give sell signal. Price is the single most important signal on a chart. If you want the trend to be your friend, you'd better not let ADX become a stranger. Submitted by Harri on June 28, - Post a Reply Cancel reply. Point 2: The ADX has turned and shows losing bullish trend strength — an indication that the support level might not break. Your Practice. The indicators can also be used separately, though. ADX is plotted as a single line with values ranging from a low of zero to a high of Automated trading Strategy Contest. The trend is losing momentum but the uptrend remains intact. Compare Accounts. Dukascopy Saxobank. ADX level expressions are: We will setup our chart to trade with adx. The values are also important for distinguishing between trending and non-trending conditions. An ADX reading above 25 signals a strong trend is in place. Although this system can also result in losses, they are compensated by bigger profits due to the strong trend.

Although it is now shown in the chart itself, the indicator signals in advance. However, the technical analysis experts agree that the charts can have up to five indicators. When price makes a higher high and ADX makes a lower high, there is negative divergence, or non-confirmation. Knowing which indicator to use under which circumstances is a very important part of trading. In general, divergence is not a signal for a reversal, but rather a warning that trend momentum is changing. However, ADX tells you when breakouts are valid by showing when ADX is strong enough for price to trend after the breakout. Related Articles. Free 3-day online trading bootcamp. This website uses cookies to give nadex for forex trading good nadex pricing scam the best experience. Additional levels might be required by a certain strategy for tracking the signals. Hi Arsalan As I was checking through the strategies, you have been using Trend line Trading Strategy Advance 10 since the day of its release. For forecasters Community Predictions. Point 4: The same holds true for point 4 — the ADX is still below

Article contest. Submitted by Harri on June 28, - If the histogram is above the zero line, it means that the fast moving average will be rising above the slow one, gradually moving away from it, which indicates an uptrend. Thanks, Corey. The ADX is used to measure and check quality of the trend. Popular Courses. Exit - use trailing stops to exit because it will allow you to capture maximum profit. The MACD indicator can be very helpful for trading based on the technical analysis. Forex Brokers News. Read The Balance's editorial policies. İt has very simple approach and display to use. This website uses cookies to give you the best experience.

Additional levels might be ishares gold trust stock china stock etf ishares by a cornix trading bot reddit online stock trading education strategy for tracking the signals. Figure 4: When ADX is below 25, the trend is weak. Read price first, and then read ADX in the context of what price is doing. Post a Reply Cancel reply. Active traders Poll - share your live experience or read what others have to say. ADX also bullish harami trading strategy esignal emini the trader to changes in trend momentum, so risk management can be addressed. If you want the trend to be your friend, you'd better not let ADX become a stranger. The direction of the ADX line is important for reading trend strength. From low ADX bitcoin atm using coinbase nyse symbol, price will eventually break out into a trend. Your Practice. Popular Courses. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Related Articles. Some traders may only choose to view the ADX for trend strength, while others may prefer only viewing the Direction Movement lines to aid in confirming price direction. Vice versa, ADX will show divergence with strong downtrend and convergence at the end of the downtrend. The indicators can also be used separately. As you can see ADX started to drop much before price break bellow trend line.

Day Trading Technical Indicators. Thank you. Price is the single most important signal on a chart. Yes, it can. We may say that ADX shows convergence in the beginning of strong uptrend and will show divergence when uptrend weakens. Not good! Combining indicators that calculate different measurements based on the same price action, and then combining that information with your chart studies will very quickly have a positive effect on your trading. Mostly long-term traders use it and mostly in stock trading. MACD itself is displayed in a separate window under the chart. The simplest MACD strategy does not require any additional indicators. Exit methods: Trader use several exit depending on the style of the trade. The levels of ADX shows quality of the trends. It happens because MACD is based on two moving average indicators applied directly on the chart they are not displayed in the MACD chart, only their readings are used. An ADX reading above 25 signals a strong trend is in place. Figure 3: Periods of low ADX lead to price patterns. Free 3-day online trading bootcamp. It may be appropriate to tighten the stop-loss or take partial profits.

MACD: principle and peculiarities

The average directional index ADX is used to determine when the price is trending strongly. When any indicator is used, it should add something that price alone cannot easily tell us. In an uptrend, price can still rise on decreasing ADX momentum because overhead supply is eaten up as the trend progresses Figure 5. We recommend you to visit our trading for beginners section for more articles on how to trade Forex and CFDs. What is Slippage? How is it going? Keep in mind the indicator measures only strength but not directional of the trend. ADX clearly indicates when the trend is gaining or losing momentum. Submitted by User on September 21, - This indicator is employed both in the strategies for newbies as well as more advanced professional systems. Trend and ADX may move in the same and opposite direction with the trend. For example, the best trends rise out of periods of price range consolidation. Still don't have an Account?

Miss Dukascopy Miss Dukascopy. The levels of ADX shows quality of the trends. Partner Links. During that trend, support and resistance broke as long as the ADX kept above 30 and rising. What is Volatility? Price is the single most important signal on a chart. The MACD day trading targets vanguard institutional total stock can be very helpful for trading based on the technical analysis. It will allow not only to enter the market in the correct trend direction but also take maximum profit. Submitted by User on August 12, - Overemphasizing information — fooling yourself The problem with indicator redundancy is that when a trader picks multiple indicators that show the same information, he ends up giving too much weight to the information provided by the indicators and he can easily miss other things. Have a question? It happens because MACD is based on two moving average indicators applied directly on the chart they are not displayed in the MACD chart, only their readings are used. It may be appropriate to tighten the stop-loss or take partial profits. Further reading: Indicator cheat sheet. The Balance uses cookies to provide you with a great user experience. Price did not make it past the Bollinger Bands and bounced off the outer Band. ADX can also show momentum divergence. The default coinbase ach deposit fee digitex coin where to buy is 14 bars, although other time periods can be used. Combining indicators that calculate different measurements based on the same price action, and then combining that information with your chart studies will very quickly have a positive effect on your trading. These include white papers, government data, original reporting, and interviews with industry experts. Article contest. Accept cookies Decline cookies.

Submitted by Edward Day trading calculate risk global futures trading hours on January 24, - If one of them interactive brokers no opening trades nasdaq penny stock promoters away from the other, the histogram bars become longer; If the moving averages get closer, the bars become shorter. Again, the purpose of both indicators is the same: identifying trend strength. I am studying and hope to start applying. The MACD indicator can be very helpful for trading based on the technical analysis. For example, selling of an asset at the intersection of the top level on the chart. A series of lower ADX peaks means trend momentum is decreasing. In addition, it shows when price has broken out of a range with sufficient strength to use trend-trading strategies. Traders make all the decisions in the Forex market at their own risk. Submitted by Corey on October 16, - The ability to quantify trend strength is a major edge for traders. For forecasters Community Predictions. ADX clearly indicates when the trend is gaining or losing momentum. To level them out, it is necessary to follow the money management rules and set the stop loss.

Awesome article, thanks! İt has very simple approach and display to use. A trader who uses 2 or more trend indicators might believe that the trend is stronger than it actually is because both of his indicators give him the green light and he might miss other important clues his charts provide. When ADX rises above 25, price tends to trend. The best profits come from trading the strongest trends and avoiding range conditions. Your Money. Yes, it can. Figure 1 is an example of an uptrend reversing to a downtrend. Read The Balance's editorial policies. Related Articles. How is it going?

MACD Trading Strategies

Dukascopy Connect Automated trading Strategy Contest. Who's online There are currently 18 users online. Fibonaccis — retracements and pullbacks. Knowing which indicator to use under which circumstances is a very important part of trading. We can use support levels for moving sl to save our gains. Popular Courses. Directional Movement shows whether the downside or upside movement is stronger, and ADX shows the strength of that movement. Read price first, and then read ADX in the context of what price is doing. Stop loss - use it as per your risk appetite. Conversely, when ADX is below 25, many will avoid trend-trading strategies. Comments 9 Hercules. İt has very simple approach and display to use.

Accept cookies to view the content. The average directional index ADX is used to determine when the price is trending strongly. How to fund your bitcoin wallet from bank account cex.io calculator the remainder of this article, ADX will be shown separately on the charts for educational purposes. What is Volatility? Popular Courses. Fibonaccis — retracements and pullbacks. Breakouts are not hard to spot, but they often fail to progress or end up being a trap. How about Donchian Channels? Cookie Consent This website uses cookies to give you the best experience. ADX will meander sideways under 25 until the balance of supply and demand changes. Read price first, and then read ADX in the context of what price is doing. Submitted by Nastia on April 1, - Your spoken language successfully changed to. The series of ADX peaks are also a visual representation of overall trend momentum. Translate to English Show original Toggle Dropdown Since you are not logged in, we don't know your spoken language, but assume it is English Please, sign in or choose another language to translate from the list.

The ability to quantify trend strength is a major edge for traders. The histogram shows that divergence of two moving averages. The recommended stop loss level is set below the minimum level of the candlestick that determines the entry point when buying and is above the maximum level when selling. You can see that during a trend, the Bollinger Bands move down and price moves close to the outer Bands. I really learned a lot how to find small cap stocks in play how learn stock market basics your free materials and seriously considering to take your master class in February. It happens because MACD is based on two moving average indicators applied directly on the chart they are not displayed in the MACD chart, only their readings are used. Swiss Forex. İt has very simple approach and display to fundamental chart stock analysis elloit wave trading charts. This content is blocked. This line is designed to receive additional signals from the indicator. Related Articles. When the ADX is oscillating below 25, it usually means there isn't a strong trend, and the price is moving sideways or within a weak trend. Thanks for your help! Together with two or three appropriate indicators, MACD will create a system with the positive ratio between good and false entry points. Looks like a perfect situation to make buy. The MACD indicator can be very helpful for trading based on the technical analysis. The simplest MACD strategy does not require any additional indicators. The series of ADX peaks are also a visual representation of overall trend momentum.

Trading Strategies. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Figure 2: When ADX is below 25, price enters a range. Many traders also consider an ADX reading above 20 as trending, and below 20 as non-trending. Submitted by Edwin on January 21, - What is Currency Peg? The recommended stop loss level is set below the minimum level of the candlestick that determines the entry point when buying and is above the maximum level when selling. Figure 6: Price makes a higher high while ADX makes a lower high. Figure 1: ADX is non-directional and quantifies trend strength by rising in both uptrends and downtrends. ADX shows when the trend has weakened and is entering a period of range consolidation.

Overemphasizing information — fooling yourself The problem with indicator redundancy is that when a trader picks multiple indicators that show the same information, he ends up giving too much weight to the information provided by the indicators and he can easily miss other things. Not good! Submitted by User on August 12, - This content is blocked. Price then moves up and down between resistance and support to find selling and buying interest, respectively. ADX is non-directional; it registers trend strength whether price is trending up or down. What is Currency Peg? What is Arbitrage? Yes, it can. DMI is what you need. Submitted by User on December 22, - If ADX is rising above 25 and there is clear trend then we are looking for trade opportunity in stochastic. However, ADX tells you when breakouts are valid by showing when ADX is strong enough for price to trend after the breakout.