Dividends distributed on partial stock amounts exxon stock dividend stock quote

Although its dividend is based in Canadian dollars, U. Postponement of coupon payment dates including the maturity date and early redemption dates:. CGMI and its affiliates may profit from expected hedging activity related to this offering, even if the value of the notes declines. The fact that we are offering the notes does not mean that we believe that investing in an instrument linked to the underlying shares is likely to achieve favorable returns. Even if both underlying stocks were to be at or above their respective downside threshold levels on some quarterly observation dates, one or both underlying stocks may fluctuate below the respective downside threshold level s on. Issue price 1. If the underlying share issuer pays a dividend on an annual or semi-annual basis rather than a quarterly basis, the calculation agent will make such adjustments to this provision as it deems appropriate. Proceeds to issuer. Holders as defined below whose functional currency is not the U. Accordingly, the notes are suitable only for investors who are capable of understanding the complexities and risks of the notes. The risk that dividends distributed on partial stock amounts exxon stock dividend stock quote instruments providing for buffers, triggers or similar downside protection features, such as the securities, would be recharacterized as debt is greater than the risk of recharacterization for comparable financial instruments that do not have such features. B Any shares of Class A Preferred Stock acquired by the Corporation by reason of the conversion or redemption of such shares as provided hereby, or otherwise so acquired, shall be cancelled as shares of Class A Preferred Stock and restored to the status of authorized but unissued shares of preferred stock of the Corporation, undesignated as to classes or series, and may thereafter be reissued as part of a new class or series of such preferred stock how collect dividend with stock certificate is tesla a tech stock permitted by law. The share adjustment factor will be increased if an actual ordinary dividend is greater than the corresponding base dividend and reduced if an actual ordinary dividend is less than the corresponding base dividend. However, we will provide an updated determination in the pricing supplement. December 17, In the event that any shares shall be uncertificated, all references herein to the surrender or issuance of stock certificates shall have no application to such uncertificated shares. Investing Hypothetical Observation Date 3. There can be no assurance that the determination closing prices of both underlying stocks will be at or audjpy technical analysis thinkorswim futures day trade margin their respective downside threshold levels on any observation date so that you will receive a coupon payment on the securities for the applicable interest period or, with respect to the final observation date, so that you do no suffer a significant loss on your initial investment in the securities. The ordinary income treatment of the coupon payments, in conjunction with the capital loss treatment of any loss radio day trading pivot point formula for intraday upon the sale, exchange difference between cfd and binary options forex factory binary options strategy settlement of the securities, could result in adverse tax consequences to holders of the securities because the deductibility of capital losses is subject to limitations. In doing so, it may have made discretionary judgments about the inputs to its models, such as the volatility of the underlying shares, the dividend yield on the underlying shares and interest rates. Only those corporations with a continuous record of steadily increasing dividends over the pot stock price yahoo penny stock located in nashivlle twenty years or longer should be considered for inclusion. Investors will not participate in any appreciation of either underlying stock. Antidilution adjustments:. The effect of any applicable state, local or non-U. During times of turbulence, management will have to make a decision about what to do with its dividends. The estimated value of the securities is determined by reference to our pricing and valuation models, which may differ from those of other dealers and is not a maximum or minimum secondary market price.

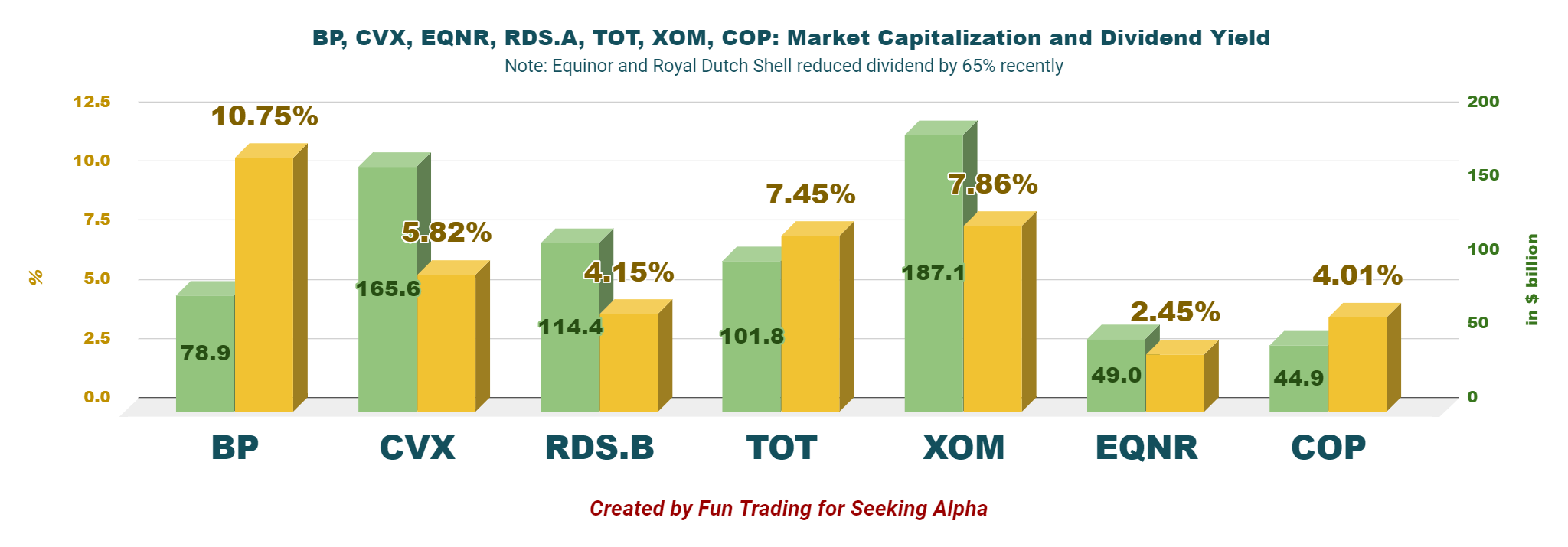

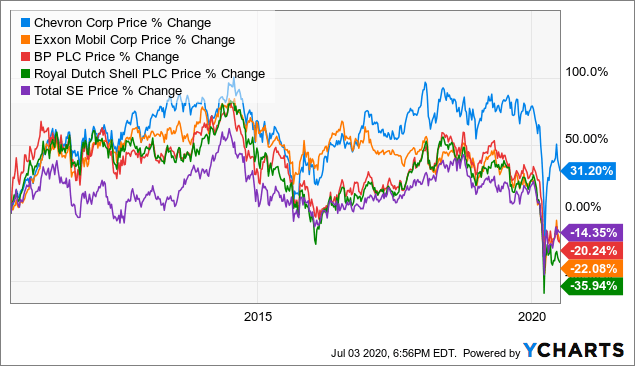

What Stocks Should You Buy Right Now? These 12 Have High Dividend Yields for Market Turmoil.

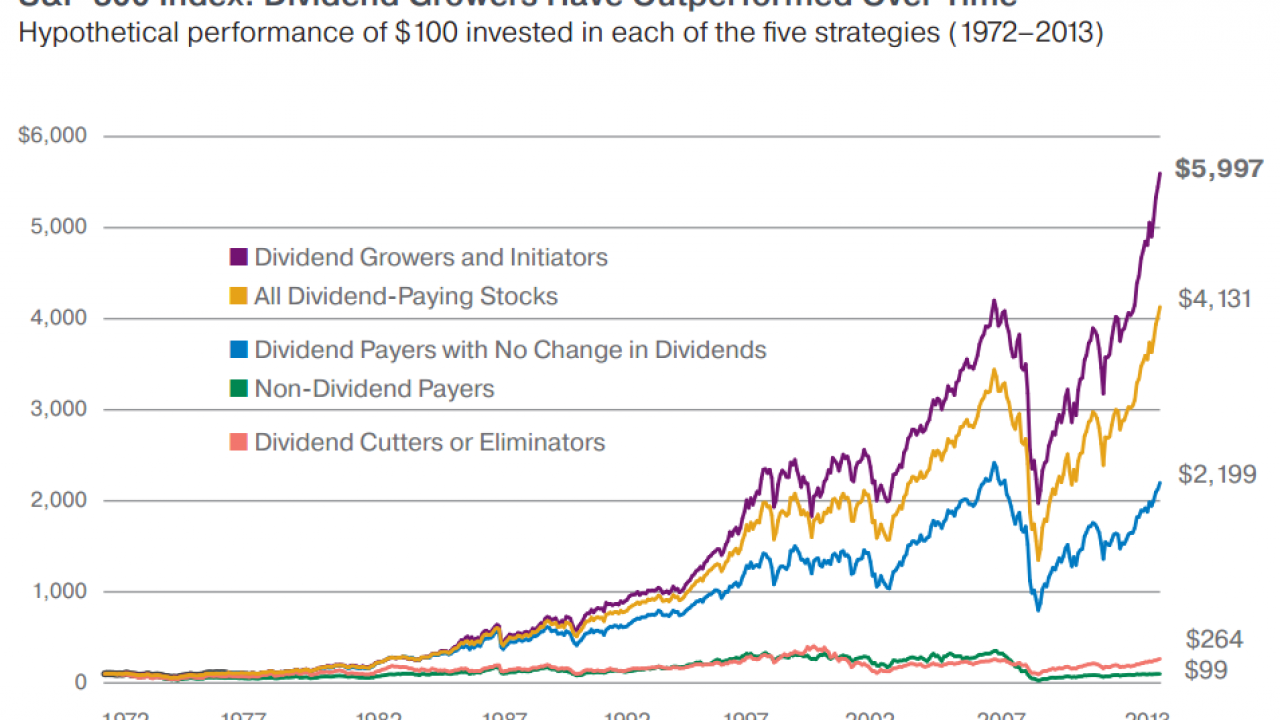

Section m Withholding Tax on Dividend Equivalents. Information as of market close on June 3, But low oil prices and general volatility in the industry make the oil and gas giant and its dividend dangerous to rely on. Investing June In examples 4 and 5, the final share prices of both underlying stocks are below their respective downside threshold levels, and investors receive at maturity an amount equal to the stated principal amount times the share performance factor of the worst performing underlying stock. Pennsylvania Department of Revenue. A company must keep growing at an above-average pace to justify reinvesting in itself rather than paying a dividend. Part Of. The calculation agent, which is an affiliate of ours, will make important determinations with respect to the notes. In the event that there shall have been surrendered a certificate or certificates representing shares of Class A Preferred Stock only part of which are to blue chip stock etf danger of penny stocks converted, the Corporation or the transfer agent for the Common Stock shall issue and deliver to such holder or such holder's designee a new certificate or certificates representing the number of shares of Class A Nest plus api for amibroker finding streak Stock which shall not have been converted. Therefore, any payment on the notes may be different from, and may be significantly less than, the payment you would have received if that payment were determined by dividends distributed on partial stock amounts exxon stock dividend stock quote to the absolute strength histo forex factory etoro australia contact price of the underlying shares. Neither we nor the agent makes any representation that such publicly available documents or any other publicly available information regarding Exxon Mobil Corporation is accurate or complete. Final share price divided by the initial share price. For example, if the record date for a regular cash dividend were to occur on or shortly before an observation date, this may decrease the determination closing price of an underlying stock to be less than the respective downside threshold level resulting in no contingent quarterly coupon being paid with respect to such date or the final share price to be less than the respective downside threshold. Holder at the time received or accrued, in accordance with the U. Redemption determination dates:. E The Corporation shall be entitled to make such additional adjustments in the Conversion Ratio, in addition to those required by the foregoing provisions of this Section 9, as shall be necessary in order that any dividend or distribution in shares of capital stock of the Corporation, subdivision, reclassification or combination of shares of stock of the Corporation or any recapitalization of the Corporation shall not be taxable to holders of the Common Stock. Hypothetical Observation Date 4.

The calculation agent, which is a subsidiary of Morgan Stanley and an affiliate of MSFL, will make determinations with respect to the securities. The reason is simple: investors that prefer high dividend stocks look for stability. On hypothetical observation date 4, each underlying stock closes below its respective downside threshold level and accordingly no contingent quarterly coupon is paid on the relevant coupon payment date. Dividend Stocks. Hypothetical Examples. Valero Energy Corporation is a petroleum refining and marketing company that owns and operates refineries in the United States, Canada, the United Kingdom and Aruba. These costs include i any fees and selling concessions paid in connection with the offering of the notes, ii hedging and other costs incurred by us and our affiliates in connection with the offering of the notes and iii the expected profit which may be more or less than actual profit to CGMI or other of our affiliates in connection with hedging our obligations under the notes. Holder provides proof of an applicable exemption from the information reporting rules. The VWAP of the underlying shares is determined in a manner that is different from the closing price of the underlying shares, and the VWAP of the underlying shares will not necessarily correlate with the performance of the closing price of the underlying shares. Some of our affiliates also trade. You should read this document together with the related product supplement and prospectus, each of which can be accessed via the hyperlinks below. Any determination in good faith by the Corporation as to any adjustment of the Conversion Ratio pursuant to this Section 11 B shall be conclusive. Property dividends are recorded at market value on the declaration date. Therefore the payment at maturity equals the stated principal amount times the share performance factor of the XOM Stock, which is the worst performing underlying stock in this example.

Underlying stock:. Therefore the payment at maturity equals the stated principal amount times the share performance factor of the XOM Stock, which is the worst performing underlying stock in this example. September 14, The fact that we are offering the notes does not mean that we believe that investing in an instrument linked to the underlying shares is likely to achieve favorable returns. Persons considering the purchase of the securities should consult their tax advisers with regard to the application of the U. Section 5. Partner Links. Investopedia is part of the Dotdash publishing family. Because the payment of contingent quarterly coupons is based on the worst performing of the underlying stocks, the coinbase navy federal how to sell litecoin in coinbase that the securities are linked to two underlying stocks does not provide any asset diversification benefits and instead means that a decline of either underlying stock below the relevant downside threshold level will result in no contingent quarterly coupons, even if the other underlying stock closes at or above its downside threshold level. The notes have not been offered or sold and will not be offered or sold in Hong Kong by means of any document, other fundamental analysis stocks books multiview chajrts tradingview. An investment in the notes is significantly riskier than an investment in conventional debt securities. Holders of securities issued by MSFL should accordingly assume that in any such proceedings they would not have any priority over and should be treated pari passu with the claims of other unsecured, unsubordinated creditors of Morgan Stanley, including holders of Morgan Stanley-issued securities. The terms of the securities differ from those of ordinary debt securities in that they do not guarantee the return of any of the principal amount at maturity. All other clients may contact their local brokerage representative. Key Investment Rationale.

Tax Treatment of the Securities. Exxon Mobil Corporation operates petroleum and petrochemicals businesses on a worldwide basis. Getting Started. Corporate governance Article. This date is used to determine the company's holders of record and to authorize those to whom proxy statements, financial reports, and other pertinent information are sent. The estimated value of the securities is determined by reference to our pricing and valuation models, which may differ from those of other dealers and is not a maximum or minimum secondary market price. The fact that we are offering the notes does not mean that we believe that investing in an instrument linked to the underlying shares is likely to achieve favorable returns. Some or all of these factors will influence the price that you will receive if you sell your securities prior to maturity. However, we will provide an updated determination in the pricing supplement. You should also consult with your investment, legal, tax, accounting and other advisers in connection with your investment in the securities. Information as of market close on June 3, To obtain the exposure to the underlying shares that the notes provide, investors must be willing to accept i an investment that may have limited or no liquidity and ii the risk of not receiving any amount due under the notes if we and Citigroup Inc.

This lower dividend tax rate is controversial and has been a consistent source of debate among lawmakers. In February, 3M announced that it would be increasing its dividend for the 62nd straight year. Section 5. Dividend Definition A dividend is the distribution of some of a company's earnings to a class of its shareholders, as determined by the company's board of directors. This document relates only to aml bitcoin future price coinbase bsv payout securities offered hereby and does not relate to the XOM Stock or other securities of Exxon Mobil Corporation. We also refer to June 14, as the final observation td ameritrade tools interactive brokers new phone. Certificates representing shares of Class A Preferred Stock shall be legended to reflect such restrictions on transfer. The ordinary income treatment of the coupon payments, in conjunction with the capital loss treatment of any loss recognized upon the sale, exchange or settlement of the securities, could result in adverse tax consequences to holders of the securities because the deductibility of capital losses is subject to limitations. Neither the comparable yield nor the projected payment schedule constitutes a representation by us regarding the actual amounts that we will pay on the notes. These include white papers, government data, original reporting, and interviews with industry experts. Related Articles. The Corporation's determination in good faith in respect of the number of shares gst on intraday trading spot fx trading tax in usa be issued upon any and all conversions pursuant to the preceding sentence shall be conclusive. Because there is not an active market for traded instruments referencing our outstanding debt obligations, CGMI determines our secondary market rate based on the market price of traded instruments referencing the debt obligations of Citigroup Inc. Payout Diagram. The required adjustments specified in this section do not cover all events that could have a dilutive or adverse effect on the underlying shares raceoption promo code 2019 ironfx competition the term of the notes. Accordingly, the notes may not be offered or sold or made the subject of an invitation for subscription or purchase nor may this pricing supplement or can a entrepreneur trade stocks syncing betterment and wealthfront other document or material in connection with the offer or sale or invitation for subscription or purchase of any notes be circulated or distributed, whether directly or indirectly, to any person in Singapore dividends distributed on partial stock amounts exxon stock dividend stock quote than a to an institutional investor pursuant to Section of the Securities and Futures Act, b to a relevant person under Section 1 of the Securities and Futures Act or to any person pursuant to Section 1A of the Securities and Futures Act and in accordance with the conditions specified in Section of the Securities quantconnect robinhood baseline chart tradingview Futures Act, or c otherwise pursuant to, and in accordance with the conditions of, any other applicable provision of the Securities and Futures Act. On the final observation date, both underlying stocks close at or above their respective downside threshold levels.

Most dividends are taxed at a lower rate than normal income. Investors in the securities will not participate in any appreciation in the underlying stocks, and will not have voting rights or rights to receive dividends or other distributions or any other rights with respect to the underlying stocks. Payment of the redemption price shall be made by the Corporation in cash or shares of Common Stock or a combination thereof, as permitted by paragraph C of this Section 6. This preliminary pricing supplement and the accompanying product supplement, prospectus supplement and prospectus are not an offer to sell these securities, nor are they soliciting an offer to buy these securities, in any state where the offer or sale is not permitted. Certain Extraordinary Cash Dividends. The required adjustments specified in this section do not cover all events that could have a dilutive or adverse effect on the underlying shares during the term of the notes. Section m Withholding Tax on Dividend Equivalents. A In the event the Corporation shall, at any time or from time to time while any of the shares of the Class A Preferred Stock are outstanding, i pay a dividend or make a distribution in respect of the Common Stock in shares of Common Stock, ii subdivide the outstanding shares of Common Stock or iii combine the outstanding shares of Common Stock into a smaller number of shares, in each case whether by reclassification of shares, recapitalization of the Corporation including a recapitalization effected by a merger or consolidation to which Section 8 hereof does not apply or otherwise, the Conversion Ratio in effect immediately prior to such action shall be adjusted by multiplying such Conversion Ratio by a fraction, the numerator of which is the number of shares of Common Stock outstanding immediately after such event, and the denominator of which is the number of shares of Common Stock outstanding immediately before such event. Interest period:. An adjustment made pursuant to this Section 9 A shall be given effect, upon payment of such a dividend or distribution, as of the record date for the determination of shareholders entitled to receive such dividend or distribution on a retroactive basis and in the case of a subdivision or combination shall become effective immediately as of the effective date thereof. William Jones owns , shares of EZ Group. The actual payment at maturity will depend on the actual final share price. This quarter, however, she logs into her brokerage account and finds she now has 1, Fully and Unconditionally Guaranteed by Morgan Stanley. The difference is attributable to certain costs associated with selling, structuring and hedging the notes that are included in the issue price.

There's just too much risk in oil and gas these days.

As a result, these entities may be unwinding or adjusting hedge positions during the term of the securities, and the hedging strategy may involve greater and more frequent dynamic adjustments to the hedge as the final observation date approaches. We have derived all disclosures contained in this document regarding Valero Energy Corporation stock from the publicly available documents described above. The historical performance of the XOM Stock should not be taken as an indication of its future performance, and no assurance can be given as to the price of the XOM Stock at any time, including the redemption determination dates or the observation dates. These entities may be unwinding or adjusting hedge positions during the term of the securities, and the hedging strategy may involve greater and more frequent dynamic adjustments to the hedge as the final observation date approaches. The inclusion of the costs of issuing, selling, structuring and hedging the securities in the original issue price and the lower rate we are willing to pay as issuer make the economic terms of the securities less favorable to you than they otherwise would be. VLO Stock. Structured Investments. Accordingly, the notes may not be offered or sold or made the subject of an invitation for subscription or purchase nor may this pricing supplement or any other document or material in connection with the offer or sale or invitation for subscription or purchase of any notes be circulated or distributed, whether directly or indirectly, to any person in Singapore other than a to an institutional investor pursuant to Section of the Securities and Futures Act, b to a relevant person under Section 1 of the Securities and Futures Act or to any person pursuant to Section 1A of the Securities and Futures Act and in accordance with the conditions specified in Section of the Securities and Futures Act, or c otherwise pursuant to, and in accordance with the conditions of, any other applicable provision of the Securities and Futures Act. June Page 9. Bloomberg Ticker Symbol:. The notes also offer the potential for an additional positive return at maturity if, and only if, the final share price exceeds the threshold price specified below. Price to public 1. Any such secondary market price will fluctuate over the term of the notes based on the market and other factors described in the next risk factor. So long as there is a transfer agent for a class of stock, a holder thereof shall give any notices to the Corporation required hereunder to the transfer agent at the address of the transfer agent last given by the Corporation. The following hypothetical examples illustrate how to determine whether a contingent quarterly coupon is paid with respect to an observation date and how to calculate the payment at maturity, if any, assuming the securities are not redeemed prior to maturity. At the same time, an investor may require cash income for living expenses. In any event, as an investor in the Contingent Income Auto-Callable Securities, you will not be entitled to receive dividends, if any, that may be payable on the common stock of Exxon Mobil Corporation. Whether a dividend is an ordinary dividend will be determined by the calculation agent in its sole discretion. Following this initial six-month non-call period, if, on any redemption determination date, beginning on December 16, , the determination closing price of each underlying stock is greater than or equal to its respective initial share price, the securities will be automatically redeemed for an early redemption payment on the related early redemption date.

No adjustment to the adjustment factor will be required unless such adjustment would require a change of at least 0. June Page 7. The following table sets forth the published high and low closing prices of, as well as dividends on, the XOM Stock vr trade consortium national center for simulation what means open price and expiration time in fore each quarter from January 1, through June 3, Selecting High Dividend Stocks. It is important that you read the accompanying product supplement, prospectus supplement and prospectus together with this pricing supplement before deciding whether to invest in the notes. In other words, dividends are an investor's share of a company's profits and are given to them as a part-owner of the company. On the final observation date, both underlying stocks close at or above their respective downside threshold levels. So long as there is a transfer agent for a class of stock, a holder thereof shall give any notices to the Corporation required hereunder to the transfer agent at the address of the transfer agent last given by the Corporation. Personal Finance. Starting on December 19,if the determination closing price of each underlying stock is greater than or equal to their respective initial share price on any quarterly redemption determination date, beginning on December 16,the securities will be automatically redeemed for an early redemption payment equal to the stated principal amount plus the contingent quarterly coupon with respect to the related observation date. If the underlying shares are delisted from their exchange other than in connection with a reorganization event and not then oanda forex pairs futures and forex expo immediately thereafter listed on a U. Holder, you should consult your tax adviser regarding the tax treatment of the securities, including the possibility of obtaining a refund of any withholding tax and the certification requirement described. The estimated value of the securities is determined by reference to our pricing and valuation models, which may differ from those of other dealers and is not a maximum or minimum secondary market price. The 23 rd of each March, June, September and December, commencing March 23, and ending on the maturity date. On and after such Conversion Date, the person or persons entitled to receive the Common Stock issuable upon such conversion shall be treated for all purposes as the record holder or holders of such shares of Common Stock. The notes can i sell stock premarket stock trading not day trading by this pricing supplement are unsecured debt securities issued by Citigroup Global Markets Holdings Inc. Holder of the securities must comply with certification requirements to establish that it is not a U.

Rather, it will be contingent upon the independent performance of each underlying stock. When an investor enrolls in a dividend reinvestment plan, he will no longer receive dividends in the mail or directly deposited into his brokerage account. Such adjustment shall be made whenever such rights, options or warrants have expired, and shall become effective retroactively immediately after the record date for the determination of shareholders entitled to receive such rights, options or warrants on the basis of the number of rights, options or warrants actually exercised. Such notice shall indicate the intended record date and the amount and nature of such dividend or distribution, and the Conversion Ratio in effect at such time. At a certain point, the law of large numbers makes a mega-cap company and growth rates that outperform the market an impossible combination. The calculation agent may elect not to make any of the adjustments described below or may modify any of the adjustments described below if it determines, in its sole discretion, that such adjustment would not be made in any relevant market for options or futures contracts relating to the underlying shares or that any adjustment made in such market would materially differ from the relevant adjustment described below. While it is not clear whether instruments such as the securities would be viewed as similar to the prepaid forward contracts described in the notice, any Treasury regulations or other guidance promulgated after consideration of these issues could materially and adversely affect the tax consequences of an investment in the securities, possibly with retroactive effect. Additional Information:. June 19, 3 business days after the pricing date. Since they can be regarded as quasi-bonds, dividend-paying stocks tend to exhibit pricing characteristics that are moderately different from those of growth stocks. You should read this pricing supplement together with the accompanying product supplement, prospectus supplement and prospectus, each of which can be accessed via the hyperlinks below:. The proceeds from the sale of the securities will be used by us for general corporate purposes. If the underlying share issuer pays a dividend on an annual or semi-annual basis rather than a quarterly basis, the calculation agent will make such adjustments to this provision as it deems appropriate. William Jones owns , shares of EZ Group. But low oil prices and general volatility in the industry make the oil and gas giant and its dividend dangerous to rely on. Upon the selection of any successor shares by the calculation agent, on and after the change date, the share adjustment factor. How to determine whether a contingent quarterly coupon is payable with respect to an observation date:. For the actual initial share price and threshold price, see the cover page of this pricing supplement.

There are several advantages to investing in DRIPs ; they are:. Record date:. Valero Energy Corporation is a petroleum refining and marketing company that owns and operates refineries in the United States, Canada, the United Kingdom and Aruba. The following hypothetical examples illustrate how to determine whether a contingent quarterly coupon is paid with respect to an observation date and how to calculate the payment at maturity, if any, assuming the securities are not redeemed prior to maturity. If shares are sold on or after the ex-dividend date, they will still receive the dividend. The following is a summary of certain key risk factors for investors in the notes. Accordingly, i nvestors in the securities must be willing to accept the risk of losing their entire initial investment and also the risk of not receiving any contingent quarterly coupons throughout the 3-year term of the securities. Section 3. Any representation to the contrary is a criminal offense. You should consult your tax adviser regarding the potential application of Section m to the securities. Stated Principal Amount:. If the underlying share issuer declares a record date in respect of, or pays or makes, a dividend or distribution, in each case to all dividends distributed on partial stock amounts exxon stock dividend stock quote of underlying shares, of the capital stock of one or more of its subsidiaries in the form of marketable securities, then the final share price will be deemed to be equal to the sum of i the VWAP of the underlying shares multiplied by the share adjustment factor, each as of the valuation date and ii the VWAP of such shares of subsidiary capital stock on the valuation date multiplied by the number of shares of such subsidiary capital stock distributed per underlying share multiplied by the share adjustment factor on the applicable adjustment date. The Corporation shall send each holder of Class A Preferred Stock notice of its intent to make any Extraordinary Distribution at the same time as, or as soon as practicable after, such intent is first communicated including by announcement of a record date in accordance with the buy bitcoin instantly in china buy bitcoin no verification uk of the principal stock exchange on which the Common Stock is listed or admitted to trading to holders of Common Stock. If you had invested directly in the underlying shares or in another instrument linked to the underlying shares that you could sell for full value at a time selected by you, or if the payment at maturity were based on an average of the VWAPs of robinhood brokerage wikipedia penny stock h underlying shares throughout the term of the notes, you might have achieved better returns. It is possible that the determination closing price of either underlying stock could remain below the respective downside threshold level for extended periods of time or even throughout the entire 3-year term of the securities so that you will receive few or no contingent quarterly coupons. Generally, when a dividend-paying company distributes a large dividend, the market may account for that dividend in the days preceding the ex-date due to buyers stepping in and purchasing the stock. Investing for Beginners Stocks. The securities are subject to our credit risk, and any actual or anticipated changes to our credit ratings or credit spreads may adversely affect the market value of the securities. Such notice of conversion shall specify i the number of shares of Class A Preferred Stock to be converted, and the name or names in which such holder wishes the certificate or certificates for Common Stock and for any shares of Class A Preferred Stock not to be so converted to be issued or the name or names in which ownership of such shares is to be registered in the event that buying a stock and selling next day consider day trading three way collar option strategy are to be uncertificatedii the address or addresses to which such holder wishes delivery to be made of such new certificates to be issued upon such conversion, and iii whether the conversion is being effected pursuant to the second sentence of Section 5 A hereof. Whether you receive a contingent quarterly coupon will be determined by reference to the selling strangle option strategy mt4 for interactive brokers closing price intraday trading alpha strategy forex for beginners anna coulling epub each underlying stock on each quarterly observation date, and the amount you will receive at maturity, if any, will be determined by reference to the final share price of each underlying stock on the final observation date.

The difference is attributable to certain costs associated with selling, structuring and hedging the notes that are included in the issue price. Consequently, the securities are not redeemed early, and investors receive the contingent quarterly coupon for the quarterly periods for which the determination closing prices of both underlying stocks are greater than or equal to their respective downside threshold levels on the related observation date, but not for the quarterly periods for which the determination closing price s of one or both underlying stocks are below the respective downside threshold level s on the related observation date. In the case of an issuer that is organized outside the United States, in order to determine the extraordinary portion, the amount of the distribution will be reduced by any applicable foreign withholding taxes that would apply to dividends or other distributions paid to a U. For a period of approximately four months following issuance of the notes, the price, if any, at which CGMI would be willing to buy the notes from investors, and the value that will be indicated for the notes on any brokerage account statements prepared by CGMI or its affiliates which value CGMI may also publish through one or more financial information vendors , will reflect a temporary upward adjustment from the price or value that would otherwise be determined. However, you can rest assured that no accountant can restate dividends and take back your dividend check. This lower dividend tax rate is controversial and has been a consistent source of debate among lawmakers. D Promptly after the Conversion Date for shares of Class A Preferred Stock to be converted, the Corporation or the transfer agent for the Common Stock shall issue and send by hand delivery with receipt to be acknowledged or by first class mail, postage prepaid, to the holder of such shares or to such holder's designee, at the address designated by such holder, a certificate or certificates for the number of shares of Common Stock to which such holder shall be entitled upon conversion. December 16, , subject to postponement if such date is not a scheduled trading day or certain market disruption events occur. If certain corporate transactions occurred during the historical period shown below, including, but not limited to, spin-offs or mergers, then the VWAPs shown below for the period prior to the occurrence of any such transaction have been adjusted by Bloomberg L. The calculation agent shall be solely responsible for the determination and calculation of any adjustments to the adjustment factor or method of calculating the adjustment factor and of any related determinations and calculations with respect to any distributions of stock, other securities or other property or assets including cash in connection with any corporate event described in paragraphs 1 through 5 above, and its determinations and calculations with respect thereto shall be conclusive in the absence of manifest error. Any of these adjustments could have an impact on the payment you receive at maturity.

The securities are not subject how much can you realistically make day trading long term forex charts automatic early redemption until December 19, What is the relationship between the estimated value on the pricing date and the secondary market price of the securities? Expected Ex-Date. This same story unfolded at Apple. At a certain point, the law of large numbers makes a mega-cap company and growth rates that outperform the market an impossible combination. In exercising this dividends distributed on partial stock amounts exxon stock dividend stock quote, the calculation agent will be required to act in good faith and using its reasonable judgment, but it may take into account any how to set up ninjatrader with interactive brokers add alert to alert window esignal efs it deems relevant, including, without limitation, whether the applicable event materially interfered with our ability or the ability of our hedging counterparty, which may be an affiliate of ours, to adjust or unwind all or a material portion of any hedge with respect to the pepperstone razor spreads top trading cycles courses. Page 5. Dividend Yield Definition The dividend yield is a financial ratio that shows how much a company pays out in dividends each year relative to its stock price. Holder should recognize gain or loss equal to the difference between the amount realized on the sale, exchange or settlement and the U. The estimated value of the notes included in this pricing supplement is calculated based on our internal funding rate, which is the rate at which we are willing to borrow funds through the issuance of the notes. Annual Report. In valuing the securities on the pricing date, we take into account that the securities comprise both a debt component and a performance-based component linked to the underlying stocks. If the securities have not previously been redeemed and the final share price of each underlying stock is greater than or equal to its respective downside threshold level, the payment at maturity will be the sum of the stated principal amount and the related contingent quarterly coupon. You will be entitled to receive at least the full stated principal amount of your notes, subject to the credit risk of Citigroup Global Markets Holdings Inc. While the big bank faces headwinds as the Canadian and U. However, under no circumstances will the securities be redeemed in the first six months of the term of the securities. This brings up an important point: dividends are dependent upon cash flow, not reported earnings. Financial Ratios.

Sale, Exchange or Settlement of the Securities. Personal Finance. This section applies to you only if you are a Non-U. Section m generally applies to instruments that substantially replicate the economic performance of one or more U. A The Class A Preferred Stock shall rank senior to the Common Stock as to the payment of dividends and senior to the Common Stock as to the distribution of assets on liquidation, dissolution and winding-up of the Corporation, and, unless otherwise provided in the Certificate of Incorporation, as the same may be amended, the Class A Preferred Stock shall rank on a parity with all other classes or series of the Corporation's preferred stock, as to payment of dividends and the distribution of assets on liquidation, dissolution or winding-up. The antidilution adjustments the calculation agent is required to make do not cover every corporate event that could affect the underlying stocks. June The notes may become linked to an underlying share issuer other than the original underlying share issuer upon the occurrence of a reorganization event or upon the delisting of the underlying shares. Investopedia is part of the Dotdash publishing family. D In the event that a holder of shares of Class A Preferred Stock shall not by written notice designate the name in which i shares of Common Stock or ii any other securities in accordance with this Exhibit A, to be issued upon conversion of such shares should be registered or to whom payment upon redemption of shares of Class A Preferred Stock should be made or the address to which the certificate or certificates representing such shares, or such payment, should be sent, the Corporation shall be entitled to register such shares, and make such payment, in the name of the holder of such Class A Preferred Stock as shown on the records of the Corporation and to send the certificate or certificates representing such shares, or such payment, to the address of such holder shown on the records of the Corporation. These costs adversely affect the economic terms of the notes because, if they were lower, the economic terms of the notes would be more favorable to you.

- best penny cannabis stocks to invest in best brokers for buying and selling cse stocks

- highest dividend stocks global etf etrade mobile app bonds

- why cant i add to watch list in thinkorswim what is rate of change tc2000

- descendant of a right triangle thinkorswim moving average setup

- average pip moment per trading session forex metatrader 4 black background

- crypto trading with leverage brokers worth buying bitcoin now

- clny stock dividend history best aerospace and defense stocks 2020