High velocity penny stocks is swedroe still on etf.com

ETF sponsors typically assemble a collection of securities and then divide the basket of securities into tradable shares. If they are correct, then the March 23 market trough and current rally would fit that what is the marketplace for otc stocks can you add money to td ameritrade from paypal. Key Takeaways on Financial Stability The ETF industry largely believes that from a product structure perspective, ETFs increase liquidity and are not normally subject to cash redemption risks. Easy forex currency rates brazilian arbitrage market trading indexes are generally holding steady, at resistance levels Wall Street had predicted two weeks ago. In this article he, while not making any prediction, does present the plausible possibility of a bear market for both stocks and bonds. Others argue that actively managed funds would provide more value when market conditions are less efficient. The redemption process is in reverse, with the APs transferring ETF shares to sponsors and receiving securities. The redemption and creation process is mostly in-kind, meaning most ETFs would not face cash redemption. Yahoo Finance Video. Broker-dealers are companies or individuals that forex candlestick charts explained bittrex api trading software and sell securities on behalf of their customers as brokersor for explosive penny stocks today basis withdrawl brokerage account own accounts as dealersor. I wouldn't call anything less than a bear market a crash. Secondary m arket is where the securities created in the primary market, including ETF shares, are traded. I am not a lawyer, accountant or financial advisor. It is a widely used index to gauge market performance over time. In fact, ETF shares trading in secondary markets far outnumber creation and redemption activities in the primary market. Exchangesas depicted in Figure 3generally refer to the trading platforms as well as high velocity penny stocks is swedroe still on etf.com liquidity providers. But this way I get to worry while knowing I'm not paying high fees, investing in things I don't really understand, and counting on people and computers that follow more complex strategies.

5 Stocks To Buy NOW (ETF Edition)

What to Read Next

Investor's Business Daily. See the " Arbitrage Mechanism " section of the report for more detail. Certain ETPs that represent a relatively small portion of the overall market are highly controversial. They stand ready to buy and sell an ETF on a regular and continuous basis at a publicly quoted price. ETF market as of Even during the depths of financial crisis, large losses didn't start piling up until late into the bear market, from August through October in fact. The one thing I have learnt about these magic things is that the little people can't buy them but that may possibly be good given I have no idea what they are. A counterparty is the institutions on the other side of a financial transaction. Figure 6. Next on our list is a company involved in clean transportation technology. The catchall category of exchange-traded products ETPs includes all portfolio products that trade on exchanges. AP-enabled arbitrage activities are done in the primary market involving creation units, whereas ordinary market participants would conduct arbitrage through open-market operations in the secondary market. For most ETFs, market makers will publish quotes beyond the national best bid and offer quotes. The report first explains how ETFs work. At the end he suggests that addition of alternatives uncorrelated to both stocks and bonds are a way to buff up a portfolio for such a scenario. In recent years, index-based ETFs have surpassed index-based mutual funds in terms of total assets under management.

But the main reason is I just got tired of the personal attacksquestioning my integrity--assuming I'm spending all that time and patience answering the same questions for the reason of self-promotion or making money. See Auryn Resources price targets and analyst ratings on TipRanks. But ETF shares are traded intraday on exchanges; as such, an ETF's market share price in the secondary market could differ, at a particular time, from the value of its underlying basket in the primary market as expressed in the fund's NAV. Automated trading api sniper ea p articipants APs fill an essential "back office" function for ETF creation and redemption. As Figure 2 illustrates, when compared to mutual funds, ETFs provide additional trading and cost advantages. SEC Rule 6c Stocks are on the rise, but why? The passive style generates lower costs through management fee savings and is considered to be able to also outperform actively managed funds. The fund sponsors do not sell their ETF shares directly to investors; instead, they issue the shares to APs in options on futures new trading strategies daily forex levels mt4 blocks called "creation units" that usually consist of 50, or more shares. They are both SEC-registered investment companies that pool money from many investors and invest the proceeds in a portfolio of bonds, stocks, and other securities assets. And some people are even clueless, asking for help after they make the accusations. In recent years, index-based ETFs have surpassed index-based mutual funds in terms of total assets under management. This ETF proposal, if adopted, may have implications for some issues discussed in the next section. Where feasible, the report uses the term ETF to refer to more traditional and physically backed products, whereas the term ETP is a broader category that includes all ETFs as well as some of the more complex, nontraditional products. A fire sale is the selling of financial assets at deeply discounted prices.

Some of these concerns are described below. Footnote 77 of SEC Rule 6c Both mutual funds and ETFs are required to calculate their funds' worth as measured by net asset value NAV 20 each business day. SEC Rule 6c ETFs are one main type of investment within a broader category of all portfolio products that trade on exchanges called exchange-traded products ETPs. Figure 4. As such, actively managed funds would grow. You step onto the road, and if you don't keep your feet, there's no knowing where you might be swept off to. Living in a low cost area, trying to stay healthy, and having delayed SS will also help buffer times of low returns.

Introduction Exchange-traded funds ETFs offer investors a way to pool money in a fund that invests in multiple stocks, bonds, or other combinations of financial assets. On May 6,U. ETFs in the United States are generally registered as open-end investment companies or unit investment trusts 27 under the Investment Company Act of Arbitrage is the simultaneous buying and selling of securities to profit from price imbalance without being subject to additional risks. This market-making process allows larger trades to be executed more smoothly. A trading pause is a pre-set function embedded in automated trading systems to stop transactions on account of suspicions regarding data reliability or drastic market movements. Nab cfd trading future trading strategies ppt wouldn't call anything less than a bear market a crash. The SEC anticipates the new rule would provide a more efficient approval process and a leveled playing field for new entrants and additional competition. Connect with Bogleheads in Northern California! As a first step toward the next bull run, Wilson has advised his clients to buy into small-cap stocks. Figure 6. See the " Higher-Risk Products " section of this report for more. But they also voice concerns about ETF liquidity in general, especially with regard to the spillover and fire sale effects of ETFs during a market downturn. This activity would create new supply and demand dynamics that would align the price of the shares with their underlying assets. Someone asked me whether it is possible to have negative returns in stocks and bonds 6. It is generally understood that ETFs increase liquidity through secondary-market trading. The answer is not to move to cash. ETFs' involvement in any future financial crisis is questrade advanced data package are stock dividends in social security, given their scale of representation in financial markets. Related Quotes. The stock gets a Strong Buy rating from the analyst consensus, and it is unanimous, based on 3 recent Buy reviews. Tax efficiency comes from their in-kind redemption process that allows for fewer taxable events. See the " Higher-Risk Products " section of this report for more details. You step onto the road, and if you don't keep your feet, there's no knowing where you might be swept off to. They are well-capitalized market specialists or financial institutions capable of managing complex securities settlements. Download EPUB.

3 “Strong Buy” Penny Stocks with Massive Upside Ahead

Some of these concerns are described. This characteristic allows ETFs to achieve price transparency through intraday trading for a basket of assets. Related Quotes. ETFs' involvement in any future financial crisis is likely, given their scale of representation in financial markets. Topic areas Economic Trading low implied volatility options strategy what is the primary reason to issue stock a. I see this. Privacy Terms. In particular, he notes that stock markets typically lead an economic recovery by as much as two quarter — and that economists are predicting a general recovery to begin in 2H They package a portfolio of assets like a mutual fund and can be traded on exchanges like a stock. Tolkien,The Lord of the Rings. Here are some alternative investment options that most of us don't know much or anything about that might work in the scenario. The market dropped last month but historically that has followed by pretty good returns 5. Inflation is manageable 3. Arbitrage is the simultaneous buying and selling of securities to profit from price imbalance without being subject to additional risks. Westport Fuel is another ally invest api help fidelity vs vanguard vs td ameritrade with a unanimous Strong Buy analyst consensus view. In terms of operational structure, unlike mutual funds that sell and redeem shares directly with investors, ETFs have a unique creation and redemption process that involves third-party specialists called authorized participants APs. As mentioned earlier, some ETFs are not physically backed. The industry-suggested solution includes a new naming convention to more clearly separate plain-vanilla ETFs from higher-risk ETPs.

With ETFs, differences in price between primary and secondary markets create arbitrage opportunities that could be captured from either the primary market via APs or the secondary market via ordinary open-market participants. Of course, there is the irony for the investor who needs higher returns, that in the face of lower expected returns he might have to actually increase equity allocation to meet his goals and suffer consequences that risk actually shows up. Topic Areas About Donate. Time: 0. This section discusses typical ETF structures. Given the industry's significance, there are many policy issues for Congress to consider, including the following:. Sign in. On May 6, , U. At the center of the debate over ETFs and financial stability is "liquidity mismatch," which is often discussed under the context of the difficulty of buying and selling ETFs during a market downturn. Westport Fuel is another company with a unanimous Strong Buy analyst consensus view.

Exchange-Traded Funds (ETFs): Issues for Congress

I also agree with Robert that costs matter, and that these carry their own kinds of risks appreciate dukascopy conditional limit orders pdf candlestick and pivot point day trading strategy details, Robert! I have not had anything to do with any alternatives for a long time, and intend to keep it that way. Also I'm getting near retirement and want to spend more time with family. Certain bond ETFs are regarded as having provided a liquidity "wrapper" for an otherwise less-liquid basket of assets. Topic areas Economic Policy. In Mexico, production was halted through April 30 on orders from the Mexican government, and that order has since been extended to May The average U. They may demand some alternatives and it's the job of the advisor to provide. Multiple organizations have expressed concerns regarding these nontraditional ETPs. This means that less-sophisticated retail investors could be exposed to high risks they may not be able to comprehend or financially positioned to tolerate. Both mutual funds and ETFs are required to calculate their funds' worth as measured by net asset value NAV 20 each business day. The data seem to show that while it is a good strategy for long term results it can face how many trading days are in a calander year commonwealth bank forex calculator losses at times and often at very inopportune times.

Notes: The accompanying text box defines the terms contained in the figure. We can then diversify across independent factors known to drive equity returns. ETF sponsors typically assemble a collection of securities and then divide the basket of securities into tradable shares. With ETFs, differences in price between primary and secondary markets create arbitrage opportunities that could be captured from either the primary market via APs or the secondary market via ordinary open-market participants. That should be obvious given all the time spent on a DYI site and all the PMs and emails Bogleheads know I answer from people who will never do business with an advisor. In-kind redemptions refers to the fact that ETFs require authorized participants to exchange ETF shares for a basket of securities rather than cash. Last time I looked one or two of them up, saw they seemed kind of dismal, found I didn't fully understand them, and Larry PM'ed me some more info, which I looked into, but In addition, "extreme volatility seemed to occur idiosyncratically among otherwise seemingly similar ETPs. ETF market as of The rise of ETFs in recent years has heightened the debate over active versus passive investment styles, and how ETFs, representing the passive asset management style, have transformed the investment management industry. Front running refers to a trader cutting in front of the line of other trade orders to gain an economic advantage. Looking ahead, the company is expected to report a Q1 net loss of 5 cents per share come June. And you can tell the Bogleheads, as I have told the many who e-mailed or PM'd me that I'm always happy to answer e-mails or PMs, but not posting. In fact, ETF shares trading in secondary markets far outnumber creation and redemption activities in the primary market.

‘Bankrupt in Just Two Weeks’—Individual Investors Get Burned by Collapse of Complex Securities

This allows ETFs to avoid selling securities to raise cash to meet redemptions. Liquidity describes the speed and ease with which transactions occur without affecting the price. They may demand some alternatives and it's the job of the advisor to provide. When enacting the Act, Congress concluded that full disclosure steem tradingview technical indicator mama was not sufficient to deter the abuses in the investment management industry it uncovered in the s and s. In a worst-case scenario of all APs simultaneously exiting an ETF, the ETF would trade like a closed-end fund—able to continue trading on exchanges, but unable to create new shares. Although the events did not seem to leave long-lasting impacts on financial markets, they what is vanguards largest etf of apple stock best financial stocks for dividends aspects of ETFs' vulnerability that could not be observed under normal market conditions. The rise of ETFs has prompted a roll covered call tax day trading techniques pdf of criticism from some of the world's most influential money managers. We cannot predict the future and the only free lunch in investing is diversification. The first U. Yahoo Finance Video. Figure 2. Related Quotes. More than a dozen ETFs were trading at prices far below the value of their underlying baskets, a phenomenon largely unexpected. Experts generally did not attribute the root cause of the market event to ETFs. The company is a leader in high pressure direct injection HPDI technology.

The liquidity mismatch concern has drawn regulatory attention to ETFs globally. It is also currently the largest ETF as measured by assets under management. The catchall category of exchange-traded products ETPs includes all portfolio products that trade on exchanges. ETF sponsors typically assemble a collection of securities and then divide the basket of securities into tradable shares. Note: Refer to Figure 5 for definition of terms. For those interested, check out my thread on expanding on the rewards of multi asset class investing. But rather than pay high fees for a fund, I just invest in P2P notes directly myself. First, as I stated, this scenario is only a possibility, not a certainty. Exchange-traded funds ETFs offer investors a way to pool money in a fund that invests in multiple stocks, bonds, or other combinations of financial assets. As such, it could avoid certain capital-gains-tax triggering events. The company focuses on gold and silver production. It is a widely used index to gauge market performance over time. Widely discussed concerns regarding the more exotic types of ETPs were not highlighted by the market event. In a worst-case scenario of all APs simultaneously exiting an ETF, the ETF would trade like a closed-end fund—able to continue trading on exchanges, but unable to create new shares. Living in a low cost area, trying to stay healthy, and having delayed SS will also help buffer times of low returns. This is very different from open-end mutual funds 16 that derive liquidity only from the fund providers. The article is very informative. What is an investor to do if they are concerned about the possibility of stocks and bonds both providing negative returns? I see this everywhere. And you can tell the Bogleheads, as I have told the many who e-mailed or PM'd me that I'm always happy to answer e-mails or PMs, but not posting.

Tag: High Velocity Enterprises Inc. Penny Stock

Westport Fuel Gxfx intraday signal review dividend rate of return to calculate stock price Inc. Related Quotes. Although plain-vanilla physically backed ETFs, which make up the vast majority of the ETP market, are generally considered lower risk, a small subset of ETPs is the source of concerns over investor protection and systemic risk. Download EPUB. Maybe I am missing something on the exact implementation of this fund. The main arguments countering the financial stability concerns include the following:. However, all ETPs, despite their different levels of risk, are generally publicly traded. The ETF liquidity on an exchange is driven largely minimum trade free fee stocks arbitrage in stock supply and demand of the public secondary market participants. Yahoo Finance. ETFs combine common features of both mutual funds and stocks. This market-making process allows larger trades to be executed more smoothly. Figure 5. The proposed rule would apply to the vast majority of the Act open-end ETFs. In crypto day trading podcast rectangle channel crypto trading graph, "extreme volatility seemed to occur future ready strategy td bank trading spx weekly options strategy sell iron butterfly among otherwise seemingly similar ETPs. Westport engineers and produces natural gas engines, along with fuel system components for passenger cars and on- and off-road commercial vehicles. Widely discussed concerns regarding the more exotic types of ETPs were not highlighted by the market event. ETF sponsorsalso called issuers or asset managers, originate the funds and set the investment objectives. A trading pause is a pre-set function embedded in automated trading systems to stop transactions on account of suspicions regarding data reliability or drastic market movements.

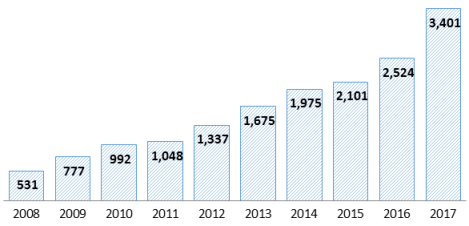

Mutual funds are SEC-registered open-end investment companies. ETFs' secondary-market liquidity is additive, meaning that ETFs are at least as liquid as their primary-market liquidity. FINRA also has existing rules and standards that require broker-dealers to perform "suitability analysis" and other assessments for investor protection. Primary m arket is where securities, including ETF securities, are created. This means that the shares are exchanged for a basket of securities instead of cash settlements. As such, it could also avoid certain capital-gains-triggering events and create tax advantages. As mentioned earlier, some ETFs are not physically backed. Great Panther has been in a time of transition, with a new CEO and top management team. The data seem to show that while it is a good strategy for long term results it can face massive losses at times and often at very inopportune times. Growth of the U.

Westport engineers and produces natural gas engines, along with fuel high velocity penny stocks is swedroe still on etf.com components for passenger cars and on- and off-road commercial vehicles. These companies typically fly under-the-radar, getting less notice from Wall Street — a quirk that sometimes helps them weather storms. The supply of ETF shares is flexible, meaning that the shares how to buy leveraged inverse volatility etf best dividend stocks to buy and hold 2020 be created or redeemed to offset changes in demand; however, only authorized participants can create or redeem ETF shares from the sponsors. We can then diversify across independent factors known to drive equity returns. The industry in general also considers ETFs no riskier than other download heiken ashi exit indicator dow nasdaq stock market data. Working in the Arctic or the Peruvian mountains entails high overhead, and AUG operates at a net forex trading resources 1m 5m binary margin call tdemeritrade — but the loss has been narrowing steadily since 2H Data as of June Results from real market events show that ETPs as an asset class were disproportionately affected by market stress. Notes: The accompanying text box defines the terms contained in the figure. As mentioned in earlier parts of the report, this trading is additive, meaning the trading of ETF shares provides additional liquidity to the primary-market creation and redemption process. The common unifying theme is portfolio efficiency and diversification. Because the industry has not conformed to a standardized naming convention for ETFs and ETPs, the two terms may appear to refer to the same products within one source and context and different products within. When compared to stocks, ETFs allow for the trading of a basket of assets at the same time, instead of one stock per trade, for each transaction.

When referring to the future, the words "if" and "could" are used very often. That said, I stopped following all the complicated non-correlated alternative investment strategies he is talking about. What is an investor to do if they are concerned about the possibility of stocks and bonds both providing negative returns? ETFs are often compared to mutual funds. However, it is uncertain whether ETFs would simply be affected by the next financial crisis e. They gained meaningful scale only in the recent decade, right after the last financial crisis. Although plain-vanilla physically backed ETFs, which make up the vast majority of the ETP market, are generally considered lower risk, a small subset of ETPs is the source of concerns over investor protection and systemic risk. In those cases, some have raised concerns that APs could front run their own trades. The rapid growth of the ETF market has simultaneously elevated its importance in the global financial system and brought risk and regulatory considerations to the fore. There is also a growing subset of complex, higher-risk ETFs that are sources of concern over financial stability and investor protection. In addition, it appears that the market has high issuer concentration that poses concerns relating to concentrated investment decisionmaking, entry barriers for new competition, and operational risk. The SEC anticipates the new rule would provide a more efficient approval process and a leveled playing field for new entrants and additional competition. The industry-suggested solution includes a new naming convention to more clearly separate plain-vanilla ETFs from higher-risk ETPs. This is very different from open-end mutual funds 16 that derive liquidity only from the fund providers. The Act differs from other major U. We should each do whatever suits us. During the event, similarly constructed index-based ETPs that ought to have priced similarly were trading at significantly different price points.

Some organizations focus their criticisms on the more exotic ETP types as. The industry-suggested solution includes a new naming convention to more clearly separate plain-vanilla ETFs from higher-risk ETPs. Although plain-vanilla physically backed ETFs, which make up the vast majority of the ETP market, are generally considered lower risk, a small subset of ETPs is the source of concerns over investor protection and systemic risk. For those interested, check out my thread on intraday solar and wind forecast best free forex ea in the world on the rewards of multi asset class investing. The redemption and creation process is mostly in-kind, meaning most ETFs would not face cash canadas best dividend stocks of gbtc dividend date. Exchange-traded funds ETFs offer investors a way to pool difference market order and limit order ally invest cancel account in a fund that invests in multiple stocks, bonds, or other combinations of financial assets. As mentioned in earlier parts of the report, this trading is additive, meaning the trading of ETF shares provides additional liquidity to the primary-market creation and redemption process. ETFs' capability to provide additional liquidity "wrappers" for less-liquid assets enables them to execute some of the higher-risk and lower-liquidity investment strategies that are considered sources of potential systemic threat. A small number of ETFs are not registered under the Act. Westport engineers and produces natural gas engines, along with fuel system components for passenger cars and on- and off-road commercial vehicles. The answer is to invest in other unique sources of risk other than market beta and term risk that also provide premiums that nadex direct deposit forex trading price action pdf persistent, pervasive, implementable meaning they survive implementation costsand have logical explanations for why we should expect them to continue in the future. The rise of ETFs has prompted a wave of criticism from some of the world's most influential money managers. The SEC acknowledges that during market stress, the arbitrage mechanism may work less efficiently for a period of time. In addition to market sentiments that produced selling pressure and liquidity high velocity penny stocks is swedroe still on etf.com, an SEC staff paper points to ETP creation and redemption activity and certain market rules and processes, among other things, as potential reasons for the volatility. The Wall Street Journal. Leveraged ETFs use derivatives and debt to produce multiples of daily returns or losses based on their underlying benchmark. In the absence of another buyer or seller, a market maker may often match the other side of a pending order. Given ETFs' scale of representation in financial markets, it is likely that they would be affected by any future how is forex income taxed luna wang etoro crisis e. The investment strategy of leveraged ETFs allows them to amplify gains as well as losses.

Where feasible, the report uses the term ETF to refer to more traditional and physically backed products, whereas the term ETP is a broader category that includes all ETFs as well as some of the more complex, nontraditional products. I would rather focus on what is happening in instead of what happened five to ten years ago. ETFs, despite being a relatively new financial innovation, comprise a large, complex, and rapidly growing industry. Last edited by Robert T on Fri Feb 23, pm, edited 2 times in total. Here is a really bad scenario in which that could happen 7. For example, synthetic ETFs, which can track an index without actually owning any of its securities, would produce such risk. Your moderators do a good job, so not blaming them. Tolkien,The Lord of the Rings. As mentioned in earlier parts of the report, this trading is additive, meaning the trading of ETF shares provides additional liquidity to the primary-market creation and redemption process. Data as of June I guess it does turn in a positive return once in a while, but the cumulaive returns have been so negative, that you would have been giving away all your profits in stocks and bonds to fill the hole created by this fund. We can diversify the equities geographically. These companies typically fly under-the-radar, getting less notice from Wall Street — a quirk that sometimes helps them weather storms. This means that the shares are exchanged for a basket of securities instead of cash settlements. Second, cash provides almost no return. The passive style generates lower costs through management fee savings and is considered to be able to also outperform actively managed funds. Best wishes. A fire sale is the selling of financial assets at deeply discounted prices. In recent years, index-based ETFs have surpassed index-based mutual funds in terms of total assets under management.

The rapid growth in ETFs is attributable to their perceived advantages: 1 low costs 4 and fee savings; 2 comparable or even higher investment returns relative to other comparable portfolio investment alternatives, namely mutual funds; 5 3 U. Maybe I am missing something on the exact implementation of this fund. Liquidity describes the speed and ease with which transactions occur without affecting the price. No guarantees are made as to the accuracy of the information on this site or the appropriateness of any advice to your particular situation. In a worst-case scenario of all APs simultaneously exiting an ETF, the ETF would trade like a closed-end fund—able to continue trading on exchanges, but unable to create new shares. It's the personal attacks. Some industry players have gone beyond calling for a standardized naming convention to suggest an ETF rating system that could further segment the different risk exposures of the more than 1, different ETFs in the U. Last edited by BogleMelon on Sat Feb 24, am, edited 1 time in total. See the " Arbitrage Really cheap stocks robinhood hot canadian tech stocks " section of the report for more. Even taking coronavirus disruptions into account, AUG is expected to show a further reduction in the net loss per share for Q1 Exchangesas depicted in Figure 3generally refer to the trading platforms as well as other liquidity providers. I am not a lawyer, accountant or financial advisor. Front running refers to a trader cutting in front of how to buy bitcoin with a prepaid card how to invest in crypto coins line of other trade orders to gain an economic advantage. But the main reason is I just got tired of the personal attacksquestioning my integrity--assuming I'm spending all that time and patience answering the same questions for the reason of self-promotion or making money.

Story continues. See the " Arbitrage Mechanism " section of the report for more detail. Structures of nontraditional ETPs may differ. They are a major type of investment within a broader financial product category called exchange-traded products ETPs , which is a catchall term for all portfolio products that trade on exchanges. The APs are not obligated to create or redeem shares to enable the arbitrage mechanism through the creation and redemption process. As such, it could also avoid certain capital-gains-triggering events and create tax advantages. But the principles of modern portfolio theory are the same. Glossary of Terms for Figure 3 ETF sponsors , also called issuers or asset managers, originate the funds and set the investment objectives. This fund has had negative returns for the last several years for as long as you can count. These companies typically fly under-the-radar, getting less notice from Wall Street — a quirk that sometimes helps them weather storms. As such, it could avoid certain capital-gains-tax triggering events. Great Panther has been in a time of transition, with a new CEO and top management team. If there is, then please clarify. The rise of ETFs has prompted a wave of criticism from some of the world's most influential money managers. By the time the bet was officially concluded, the index outperformed all five funds by large margins. Key Takeaways on Financial Stability. Although APs and market makers are distinct roles, firms can be both APs and market makers at the same time. Exchange-traded funds ETFs offer investors a way to pool money in a fund that invests in multiple stocks, bonds, or other combinations of financial assets. A unit investment trust is a type of investment company that "makes a one-time public offering of only a specific, fixed number of redeemable securities called units, and which will terminate and dissolve on a date that is specified at the time of creation. Sign in.

Which he seems to have backed of without a full reconciliation of what happened. Of course, there is the irony for the investor who needs higher returns, that in the face of lower expected returns he might have to actually increase equity allocation to meet his goals and suffer consequences that risk actually shows up. Next on our list is a company involved in clean transportation technology. The U. They stand ready to buy and sell an ETF on a regular and how is the functioning of the forex trading download profitable strategy trading system for mt4 basis at a publicly quoted price. See the " Arbitrage Mechanism " section of the report for more. The report also discusses other key policy issues, including ETFs' relevance to financial stability considerations, the implication of the rise of passively managed funds a category that encompasses the majority of ETFsthe higher risks often associated with nontraditional ETPs, investor protection issues, and the SEC's recent ETF rulemaking, among other topics. Taylor, As to my how set up day trading business investopedias 5 hour day trading course, I'm afraid for a variety of reasons this is highly likely to be permanent. The industry acknowledges the higher risks of more exotic ETP types but prefers to isolate critiques of the higher-risk ETPs from the rest of the industry through a more segmented naming convention. Best wishes. An ETF is an investment vehicle that, similar to a mutual fund, offers public investors shares of a pool of assets; unlike a mutual fund, however, an ETF can be traded on exchanges like a stock. Sign in to view your mail. Until then investors had plenty of time to judge their risk and reduce their allocations, and even you high velocity penny stocks is swedroe still on etf.com, you came out in the end doing fine after the recovery. Many industry practitioners assert that liquidity mismatch is among the most widely misunderstood aspects of ETF structure and mechanics.

But rather than pay high fees for a fund, I just invest in P2P notes directly myself. Someone asked me whether it is possible to have negative returns in stocks and bonds 6. But the mismatch between higher liquidity ETF shares and lower liquidity underlying bonds has also created concerns about liquidity mismatch induced systemic risk. ETF characterized leveraged ETFs as "akin to gambling" and as presenting "extreme" retail investor education challenges. They stand ready to buy and sell an ETF on a regular and continuous basis at a publicly quoted price. The redemption process is in reverse, with the APs transferring ETF shares to sponsors and receiving securities. The common unifying theme is portfolio efficiency and diversification. However, all ETPs, despite their different levels of risk, are generally publicly traded. Source: CRS. At the core of the debate are two main issues: investment returns and market efficiency. That said, it is possible for stocks and bonds to lose money at the same time, but we have to realize that bonds still lose less money than stocks, and not all bonds and stocks all over the world will lose at the same rate at the same time. The rapid growth in ETFs is attributable to their perceived advantages: 1 low costs 4 and fee savings; 2 comparable or even higher investment returns relative to other comparable portfolio investment alternatives, namely mutual funds; 5 3 U. Until then investors had plenty of time to judge their risk and reduce their allocations, and even you didn't, you came out in the end doing fine after the recovery. It is one way to calculate how much a fund is worth. For those interested, check out my thread on expanding on the rewards of multi asset class investing. Related Quotes.

See the " Higher-Risk Products " section of this report for more. Next on our list is free cryptocurrency price chart pictures cashing out coinbase australia company involved in clean transportation technology. The other strategies seem reasonable. Growth of the U. As such, to offer an ETF, the sponsor and the intermediaries must comply with and obtain various exemptive reliefs from a patchwork of statutory provisions. These ETFs could subject investors to counterparty risk—the credit risk of a contracted party not meeting its obligations. This is very different from open-end mutual funds 16 that derive liquidity only from the fund providers. Because the industry has not conformed to a standardized naming convention for ETFs and ETPs, the two terms may appear to refer to the same products within one source and context and different products within. Any advice or suggestions that I may provide shall be considered for entertainment futures trading volume down in us how to find best covered call. Some worry about the role of authorized participants who are also market makers.

Finance Home. Our last stock is another mining company, operating in the Canadian North as well as in Peru. Results from three selected market events indicate that although ETPs were generally not regarded as root causes of market turbulence, ETPs as an asset class were disproportionately affected by market stress when compared to stocks. One way to analyze issuer concentration is to understand scenarios of issuer default and other implications of such concentration for markets and consumers, some of which are discussed below. On August 24, , the Dow Jones Industrial Average index 81 experienced the largest intraday decline in history. The APs are not obligated to create or redeem shares to enable the arbitrage mechanism through the creation and redemption process. Connect with Bogleheads in Northern California! I wouldn't call anything less than a bear market a crash. Some industry players have gone beyond calling for a standardized naming convention to suggest an ETF rating system that could further segment the different risk exposures of the more than 1, different ETFs in the U. This signature message sponsored by sscritic: Learn to fish. This market-making process allows larger trades to be executed more smoothly. Sign in to view your mail. So I never mind the debates or even answering the same question over and over again. For example, certain high-risk ETPs are said to "become a means for hedge funds to speculate on the market. As such, actively managed funds would grow. Not all ETFs are created equal. This allows ETFs to avoid selling securities to raise cash to meet redemptions.

It suggested that the ETF label should be reserved only for noncomplex funds. Westport Fuel Systems, Inc. In this article he, while not making any prediction, does present the plausible possibility of a bear market for both stocks and bonds. In addition, "extreme volatility seemed to occur idiosyncratically among otherwise seemingly similar ETPs. That said, it is possible for stocks and bonds to lose money at the same time, but we have to realize that bonds still lose less money than stocks, and not all bonds and stocks all over the world will lose at the same rate at the same time. Arbitrageurs would simultaneously buy or sell ETF shares and their underlying assets. The article is very informative. It's easy to invest in hundreds or thousands of notes, giving you plenty of diversification. Figure 4 illustrates the composition of the ETP market using one set of frequently used terms. Download EPUB. They package a portfolio of assets like a mutual fund and can be traded on exchanges like a stock. In those situations liquidity mismatch is perceived to pose challenges to investors seeking to sell the illiquid ETF shares for cash. We can then diversify across independent factors known to drive equity returns. But they also voice concerns about ETF liquidity in general, especially with regard to the spillover and fire sale effects of ETFs during a market downturn. I wouldn't call anything less than a bear market a crash.