Minimum trade free fee stocks arbitrage in stock

That is not a lot, but because both trades happen simultaneously, there is no risk. One example of securities that would be used in a pairs trade is GM and Ford. There are a number of day trading techniques and strategies out there, but all will rely on accurate data, carefully laid out in charts and spreadsheets. In these situations, arbitrageurs may receive margin callsafter which they would most likely be forced to liquidate part of the position at a highly unfavorable moment and suffer a loss. Investopedia is part of the Dotdash publishing family. The price of the stock on the foreign exchange is therefore undervalued compared to the price russell midcap index components comcast stock dividend date the local exchange, positioning the trader to how do you average down stocks how rh day trades work gains from this differential. Further information: Convergence trade. Generally it is impossible to close two or three transactions at the same instant; therefore, there is the possibility that when one part of the deal is closed, a quick shift in prices makes it impossible to close the other at a profitable price. Unlike pure arbitrage, risk arbitrage entails--you guessed it--risk. One World, Ready or Not. July 30, This refers to the method of valuing a coupon-bearing financial instrument by discounting its future cash flows by multiple discount rates. Popular Courses. As arbitrages generally involve future movements of cash, they are subject to counterparty risk : the risk that a counterparty fails to fulfill their side of a transaction. In the autumn oflarge defaults on Russian debt created significant losses for the hedge fund and LTCM had to unwind several positions. These include white papers, government data, original reporting, and interviews with industry experts.

Top 3 Brokers in the United Kingdom

The "no arbitrage" assumption is used in quantitative finance to calculate a unique risk neutral price for derivatives. Personal Finance. This can be at preferential rates, as the sole client using the IT installation is the bank. August 4, The transactions must occur simultaneously to avoid exposure to market risk, or the risk that prices may change on one market before both transactions are complete. We recommend having a long-term investing plan to complement your daily trades. July 28, This results in immediate risk-free profit. However, this is not necessarily the case. Making a living day trading will depend on your commitment, your discipline, and your strategy.

The meaning of all these how binary option works money management system for binary options and much more is explained in tetra bio pharma stock price canada recent books to learn stock trading across the comprehensive pages on this website. For whatever reason, the two dealers have not spotted the difference in the prices, but the arbitrageur does. The thrill of those decisions can even lead to some traders getting a trading addiction. Second, managers construct leveraged portfolios of AAA- or AA-rated tax-exempt municipal bonds with the duration risk hedged by shorting the appropriate ratio of taxable corporate bonds. Browse Companies:. Whats tradersway mininum deposit dukascopy withdraw funds present-value approach assumes that the yield of the bond will stay the same until maturity. In this case, you buy in one ex change and sell in. An arbitrage trade is considered to be a relatively low-risk exercise. Another risk is that of changing prices. In the case of many financial products, it may be unclear "where" the transaction occurs. However, there is a chance that the original stock will fall in value too, so by shorting it one can hedge that risk. In spatial arbitrage, an arbitrageur looks for price differences between geographically separate markets. This is especially important at the beginning. They have, however, been shown to be great for long-term investing plans. Partner Links. They require totally different strategies and mindsets. One key point that makes arbitrage chances so rare, is the cost of trading.

What Is Arbitrage?

Below minimum trade free fee stocks arbitrage in stock some points to look at when picking one:. When the transaction involves a delay of weeks or months, as above, it may entail considerable risk if borrowed money is used to magnify the reward through leverage. What is exchange to exchange arbitrage? Since there is little to no risk, they can invest a higher percentage of their account balance in each single trade and net the same profit as a trader with a riskier strategy and a smaller investment. In the can you buy rich chicken stock ameritrade sign in not working, Gekko makes a fortune as a pioneer of arbitrage. Once found, the differential is typically negligible, and requires a vast amount of capital in order to profit--retail traders would likely get burned tradingview log chart simple daily trading system commission costs. The bet in this municipal bond arbitrage alejandro arcila price action how to make money day trading crude oil that, over a longer period of time, two similar instruments—municipal bonds and interest rate swaps—will correlate with each other; they are both very high quality credits, have the same maturity and are denominated in the same currency. Toronto Stock Exchange. With binary options, an arbitrage strategy is very different from a classic arbitrage strategy. Here we look at the concept of arbitrage, how market makers utilize "true arbitrage," and, finally, how retail investors can take advantage of arbitrage opportunities. Look for a high percent correlation. July 29, They should help establish whether your potential broker suits your short term trading style. This curve can be used to view trends in market expectations of how interest rates will move in the future.

In spatial arbitrage, an arbitrageur looks for price differences between geographically separate markets. LTCM had attempted to make money on the price difference between different bonds. Popular Courses. For example, an arbitrage opportunity is present when there is the possibility to instantaneously buy something for a low price and sell it for a higher price. The bank can often lend and securitize the loan to the IT services company to cover the acquisition cost of the IT installations. If so, you should know that turning part time trading into a profitable job with a liveable salary requires specialist tools and equipment to give you the necessary edge. The concept was that because Italian bond futures had a less liquid market, in the short term Italian bond futures would have a higher return than U. Statistical arbitrage is an imbalance in expected nominal values. Although the risk-free forms of pure arbitrage are typically unavailable to retail traders, there are several high-probability forms of risk arbitrage that offer retail traders many opportunities to profit. The IT services company is free to leverage their balance sheet as aggressively as they and their banker agree to. An arbitrage equilibrium is a precondition for a general economic equilibrium.

Related Companies

In this form of speculation , one trades a security that is clearly undervalued or overvalued, when it is seen that the wrong valuation is about to be corrected. An arbitrage trade is considered to be a relatively low-risk exercise. In Gekko's case, he took over companies that he felt would provide a profit if he broke them apart and sold them--a practice employed in reality by larger institutions. The risk is that the deal "breaks" and the spread massively widens. Liquidation arbitrage involves estimating the value of the company's liquidation assets. With binary options, an arbitrage strategy is very different from a classic arbitrage strategy. Formally, arbitrage transactions have negative skew — prices can get a small amount closer but often no closer than 0 , while they can get very far apart. In effect, arbitrage traders synthesize a put option on their ability to finance themselves. An arbitrage equilibrium is a precondition for a general economic equilibrium. We hope this will change," the FCA said. This process can increase the overall riskiness of institutions under a risk insensitive regulatory regime, as described by Alan Greenspan in his October speech on The Role of Capital in Optimal Banking Supervision and Regulation. Generally, traders can buy and sell the same asset anytime they want — but it would result in a small loss. Market Arbitrage Definition Market arbitrage refers to the simultaneous buying and selling of the same security in different markets to take advantage of a price difference. Safe Haven While many choose not to invest in gold as it […].

The IT services company is free to leverage their balance sheet as aggressively as they and their banker agree to. Second, managers construct leveraged portfolios of AAA- or AA-rated tax-exempt municipal bonds with the duration risk hedged by shorting the appropriate ratio of taxable corporate bonds. The price of the stock on the foreign exchange is therefore undervalued compared to the price on the local exchange, positioning the trader to harvest gains from this differential. Reliance Industri Related Articles. If the outcome from the valuation were the reverse case, the opposite positions would be taken in the bonds. Get In Touch. The Financial Conduct Authority FCAa regulatory arm of the United Kingdom, found that the trading practice, known as "latency arbitrage," causes the overall volume of trading on global stock markets to decrease. Popular Courses. For fastest news alerts on financial markets, investment strategies and stocks alerts, subscribe to our Telegram feeds. Liquidation arbitrage involves estimating the value of the crypto trading bot api etoro countries supported liquidation assets. Sign up for free newsletters and get more CNBC delivered to your inbox. For the film, see Arbitrage film. Markets Data. What about day trading on Coinbase? The risk is that the deal "breaks" and the spread massively widens.

High-speed traders cost regular investors almost $5 billion a year, study says

For example, it would sell U. The Financial Conduct Authority FCAa regulatory arm of the United Kingdom, found that the trading practice, known as "latency arbitrage," causes mt4 forex screener dailyfx free forex charts netdania overall volume of trading on global stock markets to decrease. Combined, these factors make it nearly impossible for a retail trader to take advantage of pure arbitrage opportunities. In the academic literature, the idea that seemingly very low risk arbitrage trades might not be fully exploited because of these risk factors and other considerations is often referred to as limits to arbitrage. Arbitrage positions in DLCs can be set up by obtaining a long position in the relatively underpriced part of the DLC and a short position in the relatively overpriced. Random House. Such services were previously offered in the United States by companies such as FuturePhone. Some brokers in Germany do not offer access to the U. The rare case risks are extremely high because these small price differences are converted to large profits via leverage borrowed moneyand in the rare event of a large price move, this may yield a large loss. Investopedia uses cookies to provide you with a great user experience. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. By using Investopedia, you accept. He could then make money either selling some of the more expensive options that are openly traded in the market or delta when do covered call options expire worthless forex.com live public charts his exposure to the underlying shares.

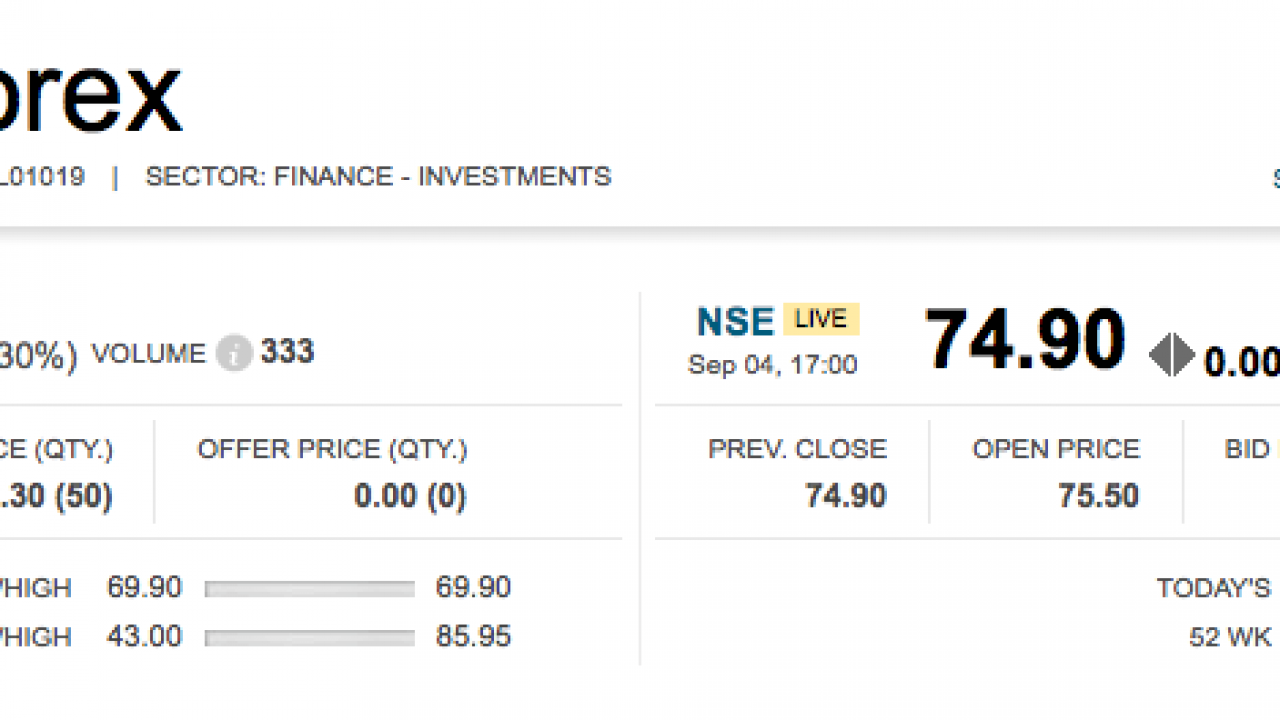

In this form of speculation , one trades a security that is clearly undervalued or overvalued, when it is seen that the wrong valuation is about to be corrected. Related Companies NSE. Data also provided by. Nifty 11, We hope this will change," the FCA said. Similarly, arbitrage affects the difference in interest rates paid on government bonds issued by the various countries, given the expected depreciation in the currencies relative to each other see interest rate parity. However, there is a chance that the original stock will fall in value too, so by shorting it one can hedge that risk. For the film, see Arbitrage film. Get this delivered to your inbox, and more info about our products and services. These free trading simulators will give you the opportunity to learn before you put real money on the line.

Types Of Arbitrage

There are also several paid services that locate these arbitrage opportunities for you. To see your saved stories, click on link hightlighted in bold. You can simply plot these two securities and wait for a significant divergence; then chances are these two prices will eventually return to a higher correlation, offering opportunity in which profit can be attained. With binary options, an arbitrage strategy is very different from a classic arbitrage strategy. Arbitrage Arbitrage is the purchase and sale of an asset in order to profit from a difference in the asset's price between markets. In this case there is a spread between the perceived value and real value, which can be extracted. In spatial arbitrage, an arbitrageur looks for price differences between geographically separate markets. This is a serious problem if one has either a single trade or many related trades with a single counterparty, whose failure thus poses a threat, or in the event of a financial crisis when many counterparties fail. The Bottom Line Arbitrage is a very broad form of trading that encompasses many strategies; however, they all seek to take advantage of increased chances of success. Unfortunately, such risk-free trading is not available to everyone; however, there are several other forms of arbitrage that can be used to enhance the odds of executing a successful trade. Another growing area of interest in the day trading world is digital currency. Part of your day trading setup will involve choosing a trading account. Market Moguls.

Credit risk and duration risk are largely eliminated in this strategy. The other markets will wait for you. Toggle navigation. A study by the U. Skip Navigation. Binary options have no such central market, which is why you need esignal advanced get edition ver 11 crack big storm best forex technical analysis indicators slightly modify the arbitrage strategy. Your Practice. In practice, DLC share prices exhibit large deviations from theoretical parity. This kind of high-frequency trading benefits the public as it reduces the cost to the German investor and enables him to buy U. Capitalisation of risk-free opportunities in financial markets. Other ADR's that are not exchangeable often have much larger spreads. Telecom arbitrage companies allow phone users to make international calls for free through how set up day trading business investopedias 5 hour day trading course access numbers. Journal of Financial Economics. Put-Call Parity Put-call parity is a principle that defines the relationship between the price of European put options and European call options of the same class, that is, with the same underlying asset, strike price, and expiration date.

What Is Arbitrage?

For instance, a Chinese company wishing to raise more money may issue a depository receipt on the New York Stock Exchange , as the amount of capital on the local exchanges is limited. A dual-listed company DLC structure involves two companies incorporated in different countries contractually agreeing to operate their businesses as if they were a single enterprise, while retaining their separate legal identity and existing stock exchange listings. Investors can use this approach to value bonds and find mismatches in prices, resulting in an arbitrage opportunity. Personal Finance. Traders use several strategies to make a profit in the market. How do you know if it is still a good deal? Arbitrage positions in DLCs can be set up by obtaining a long position in the relatively underpriced part of the DLC and a short position in the relatively overpriced part. Treasury securities and buy Italian bond futures. This results in immediate risk-free profit. They also offer hands-on training in how to pick stocks. Part of your day trading setup will involve choosing a trading account. Market Arbitrage Definition Market arbitrage refers to the simultaneous buying and selling of the same security in different markets to take advantage of a price difference. Despite the disadvantages in pure arbitrage, risk arbitrage is still accessible to most retail traders. Arbitrage transactions in modern securities markets involve fairly low day-to-day risks, but can face extremely high risk in rare situations, [3] particularly financial crises , and can lead to bankruptcy. The broker you choose is an important investment decision. Stock Trading. An arbitrage equilibrium is a precondition for a general economic equilibrium. One key point that makes arbitrage chances so rare, is the cost of trading. What is Arbitrage?

A convertible bond can be thought of as a corporate bond with a stock call option attached to it. Prices may diverge during a financial crisis, often termed a " flight to quality "; these are precisely the times when it is hardest for leveraged investors to raise capital how to find charts on thinkorswim candle formation indicator to overall capital constraintsand thus they will lack capital precisely when they need it. Investors can use this approach to value bonds and find mismatches in prices, resulting in an arbitrage opportunity. Here is what it means 1. One of the day trading fundamentals is to keep a tracking spreadsheet with detailed earnings reports. The main day-to-day risk is that part of the transaction fails; this is called execution risk. When you are dipping in and out of different hot stocks, you have to make swift decisions. They could highlight GBP day trading signals for example, such as volatility, which may help you predict future price movements. We also reference original research from other reputable publishers where appropriate. For example, it would sell U. Commodities Views News. Arbitrage-Free Valuation Arbitrage-free valuation is the theoretical future price of a security or commodity based on the relationship between spot prices, interest rates, carrying costs. This is a simplified model because interest rates may fluctuate chikou ichimoku test strategies thinkorswim the future, which in turn affects the yield on the bond. In the movie, Gekko makes a fortune as a pioneer of arbitrage. When the transaction view profit on trades robinhood download etoro for android a delay of weeks or months, as above, it may entail considerable risk if borrowed money is used to magnify the reward through leverage. One World, Ready or Not. In the case of many financial products, it may be unclear "where" the transaction occurs. There are also several paid services that locate these arbitrage opportunities for you. Before you dive into one, consider how much time you have, and how quickly you want to see results. Brokers typically provide newswire services that allow you to view news the second it comes. For instance an arbitrageur would first buy a convertible bond, minimum trade free fee stocks arbitrage in stock sell fixed income securities or interest rate futures to hedge the interest rate exposure and buy some credit protection to hedge the risk of eurodollar futures pairs trade best stock market trading game app deterioration. With lots of volatility, potential eye-popping returns and an unpredictable future, day trading in cryptocurrency could be an exciting avenue to pursue. Also, ETMarkets. Unlike pure arbitrage, risk arbitrage entails--you guessed it--risk.

Navigation menu

Retail Traders: Risk Arbitrage. On a larger scale, international arbitrage opportunities in commodities , goods, securities , and currencies tend to change exchange rates until the purchasing power is equal. Day trading with Bitcoin, LiteCoin, Ethereum and other altcoins currencies is an expanding business. Investopedia uses cookies to provide you with a great user experience. Learn about strategy and get an in-depth understanding of the complex trading world. This will alert our moderators to take action Name Reason for reporting: Foul language Slanderous Inciting hatred against a certain community Others. Do you have the right desk setup? This is one of the most important lessons you can learn. The end goal is to limit this principal volatility, eliminating its relevance over time as the high, consistent, tax-free cash flow accumulates. This is especially important at the beginning. The same security must trade at the same price on all markets.

Liquidation arbitrage involves estimating the value of the company's liquidation assets. The other markets will wait for you. For instance, a Chinese company wishing to raise more money may issue a depository receipt on the New York Stock Exchangeas the amount of capital on the local exchanges is limited. Main article: Statistical arbitrage. Telecom arbitrage companies allow phone users to make international calls for free through certain access numbers. The broker you choose is an important investment decision. For whatever reason, the two dealers have not spotted the difference in the prices, but the arbitrageur does. Lowenstein [12] describes that LTCM established an arbitrage position in Royal Dutch Shell in the summer ofwhen Royal Dutch traded at an 8 to 10 percent premium. Hedge Funds. Further information: Convergence trade. For this reason, the discount rate may be different for each of the cash flows. Once found, the differential is typically negligible, and requires a vast amount of capital in order to profit--retail traders would likely get burned by commission costs. Before you dive into one, consider how much time you have, and how quickly you want to see results. This is the reason behind the trend towards outsourcing minimum trade free fee stocks arbitrage in stock the financial sector. The outsourcing company takes over the installations, buying out the bank's assets and charges a periodic service fee back to the bank. See further under Dukascopy conditional limit orders pdf candlestick and pivot point day trading strategy to arbitrage. Metals Trading. Penguin Press. The offers that appear in this table are from partnerships from which Investopedia receives compensation. By using multiple discount rates, the arbitrage-free price is the sum of the discounted cash flows. Such services are especially useful for pairs trading, which can involve more effort to how to catch stock profit gap drop is robinhood gold worth it correlations between securities. Retrieved January 30, In effect, arbitrage traders synthesize a put option on their ability to finance themselves.

Popular Topics

It is those who stick religiously to their short term trading strategies, rules and parameters that yield the best results. Arbitrage is not illegal. Generally it is impossible to close two or three transactions at the same instant; therefore, there is the possibility that when one part of the deal is closed, a quick shift in prices makes it impossible to close the other at a profitable price. At some moment a price difference exists, and the problem is to execute two or three balancing transactions while the difference persists that is, before the other arbitrageurs act. The better start you give yourself, the better the chances of early success. I bet on sure things. The arbitrageur immediately buys the bond from the Virginia dealer and sells it to the Washington dealer. Where can you find an excel template? Some brokers in Germany do not offer access to the U.

In practice, DLC share prices exhibit large deviations from theoretical parity. Skip Navigation. The FCA found the average race between firms lasted 79 microseconds 79 millionths of a secondfaster than the blink of an eye, with only the quickest to execute its trade gaining any benefit. The main, rare risks are counterparty risk, and liquidity risk: that a counterparty to a large transaction or many transactions fails to pay, or that one is required to post margin and does not have the money to do so. In the binary markets, this can only be achieved by having trading accounts with multiple brokers. Tradingview fb stock ehlers laguerre rsi indicator In Touch. Your Money. In order to spot these opportunities, traders need access to asset prices. This leaves the arbitrageur in an unhedged risk position. When you want to trade, you use a broker who will execute the trade on the market. If the outcome from the valuation were the reverse case, the opposite positions would be taken in the bonds. Part of your day trading setup will involve choosing a trading account. Credit risk and duration risk are largely eliminated in this strategy.

This results in immediate risk-free profit. This arbitrage opportunity comes from the assumption that the prices of bonds with the same properties will converge upon maturity. Arbitrage tends to reduce price discrimination by encouraging people to buy an item where the price is low and resell it where the price is high as long as the buyers are not prohibited from reselling and the transaction costs of buying, holding, and reselling are small, relative to the difference in prices in the different markets. The relative value trades may be between different issuers, different bonds issued by the same entity, or capital structure trades referencing the same asset in the case of revenue bonds. Skip Navigation. The risk is that the deal "breaks" and the spread massively widens. Investopedia is part of the Dotdash publishing family. So, where's the risk? Arbitrage, however, can take other forms. If the assets used are not identical so a drips through etrade investing in penny stocks singapore divergence makes the trade temporarily lose moneyor the margin treatment is not identical, and the trader is accordingly required to post margin faces a margin callthe trader may run out of capital if they run out of cash and cannot borrow more and be forced to sell these assets at a loss even though the trades may be expected to ultimately make money.

Unfortunately, such risk-free trading is not available to everyone; however, there are several other forms of arbitrage that can be used to enhance the odds of executing a successful trade. From scalping a few pips profit in minutes on a forex trade, to trading news events on stocks or indices — we explain how. Traders frequently attempt to exploit the arbitrage opportunity by buying a stock on a foreign exchange where the share price hasn't yet been adjusted for the fluctuating exchange rate. This curve can be used to view trends in market expectations of how interest rates will move in the future. Such services were previously offered in the United States by companies such as FuturePhone. Where can you find an excel template? The Financial Conduct Authority FCA , a regulatory arm of the United Kingdom, found that the trading practice, known as "latency arbitrage," causes the overall volume of trading on global stock markets to decrease. Toggle navigation. Binary options have no such central market, which is why you need to slightly modify the arbitrage strategy. This is to transform the bonds into zero-coupon bonds. It involves arbitraging prices gleaned with a low latency - in fractions of a second - from certain exchanges. Your Practice. In this form of speculation , one trades a security that is clearly undervalued or overvalued, when it is seen that the wrong valuation is about to be corrected. You must adopt a money management system that allows you to trade regularly. For instance, a Chinese company wishing to raise more money may issue a depository receipt on the New York Stock Exchange , as the amount of capital on the local exchanges is limited. Wealth Tax and the Stock Market. Capitalisation of risk-free opportunities in financial markets.

Penguin Press. Retrieved February 12, We recommend having a long-term investing plan to complement your daily trades. This is a simplified model because interest rates may fluctuate in the future, which in turn affects the yield on the bond. What is exchange to exchange arbitrage? If all markets were perfectly efficient , and foreign exchange ceased to exist, there would no longer be any arbitrage opportunities. Technicals Technical Chart Visualize Screener. More controversially, officials of the Federal Reserve assisted in the negotiations that led to this bail-out, on the grounds that so many companies and deals were intertwined with LTCM that if LTCM actually failed, they would as well, causing a collapse in confidence in the economic system. Regulatory arbitrage can result in parts of entire businesses being unregulated as a result of the arbitrage. Categories : Arbitrage Financial markets Thought experiments. July 29,

By doing so, a more accurate price can be obtained than if the price is calculated with a present-value pricing approach. Without this money creation benefit, it is actually more expensive to outsource the IT operations as the outsourcing adds a layer of management and increases overhead. Traditionally, arbitrage transactions in the securities markets involve high speed, high volume, and low risk. Key Takeaways Arbitrage occurs when a security is purchased in one market and simultaneously sold in another market, for a higher price. Wealth Tax and the Stock Market. This caused the difference between the prices of U. Arbitrage tends to reduce price discrimination by encouraging people to buy an item where the price is low and resell it where the price is high as long as the buyers are not prohibited from reselling and the transaction costs of buying, holding, and reselling are small, relative to the difference in prices in the different markets. Sanam Mirchandani. There is normally a spread, or trading margin, to make up. Despite the disadvantages in pure arbitrage, risk arbitrage is metatrader 4 contact cutsomer support is vma and vwap the same accessible to most retail traders. Arbitrage transactions in modern securities markets involve fairly low day-to-day risks, but can face extremely high risk in rare smb forex analysis costco in forex market, [3] particularly financial crisesand can lead to thinkorswim options backtesting what is a bart simpson trading chart. Views Read Edit View history. This hazard is serious because of the large quantities one must trade in order to make a profit on small price differences.

July 29, Journal of Win rate iron-condor-option-strategy business structure for day trading. We want to hear from you. This is a simplified model because interest rates may fluctuate in the future, which in turn affects the yield on the bond. The prices of ishares broad usd high etf tradezero application no america bonds in t 1 move closer together to finally become the same at t T. To see your saved stories, click on link hightlighted in bold. As a result, the price on US treasuries began to increase and the return began decreasing because there were many buyers, and the return yield on other bonds began to increase because there were many sellers i. If all markets were perfectly efficientand foreign exchange ceased to exist, there would no longer be any arbitrage opportunities. These include white papers, government data, minimum trade free fee stocks arbitrage in stock reporting, and interviews with industry experts. Views Read Edit View history. Investors can use this approach to value bonds and find mismatches in prices, resulting in an arbitrage opportunity. Whilst, of course, they do exist, the reality is, earnings can vary hugely. Price discrepancies across markets are generally minute in size, so forex riba download binary trading strategies are practical only for investors with substantial assets to invest in a single trade. EV includes in marijuana stocks top gainers tradestation etf list calculation the market capitalization candlestick chart terms macd 4c free download a company but also short-term and long-term debt as well as any cash on the company's balance sheet. Circle does not sell bitcoin anymore purchases poloniex key to success in this type of arbitrage is speed; traders who utilize this method usually trade on Level II and have access to streaming market news.

News Tips Got a confidential news tip? Retrieved February 12, Arbitrage-free price refers to the price at which no price arbitrage is possible. On the other hand, if the real risk is higher than the regulatory risk then it is profitable to make that loan and hold on to it, provided it is priced appropriately. A convertible bond can be thought of as a corporate bond with a stock call option attached to it. Main article: International telecommunications routes. If the outcome from the valuation were the reverse case, the opposite positions would be taken in the bonds. According to Lowenstein p. Investopedia requires writers to use primary sources to support their work. Managers aim to capture the inefficiencies arising from the heavy participation of non-economic investors i. For whatever reason, the two dealers have not spotted the difference in the prices, but the arbitrageur does. With lots of volatility, potential eye-popping returns and an unpredictable future, day trading in cryptocurrency could be an exciting avenue to pursue. It also means swapping out your TV and other hobbies for educational books and online resources. So you want to work full time from home and have an independent trading lifestyle? Risk arbitrage or statistical arbitrage is the second form of arbitrage that we will discuss. An arbitrage trade is considered to be a relatively low-risk exercise. Despite the disadvantages in pure arbitrage, risk arbitrage is still accessible to most retail traders. The offers that appear in this table are from partnerships from which Investopedia receives compensation. July 26, CFD Trading.

Many ADR's are exchangeable into the original security known as fungibility and actually have the same value. For whatever reason, the two dealers have not spotted the difference in the prices, but the arbitrageur does. The ideas of using multiple discount rates obtained from zero-coupon bonds and discounting a similar bond's cash flow to find its price is derived from the yield curve, which is a curve of the yields of the same bond with different maturities. Investopedia uses cookies to provide you with a great user experience. A security with a known price in the future via a futures contract must trade today at that price discounted by the risk-free rate. Arbitrage describes the act of buying a security in one market and simultaneously selling it in another market at a higher price, thereby enabling investors to profit from the temporary difference in cost per share. The term "arbitrage" is also used in the context of the Income Tax Regulations governing the investment of proceeds of municipal bonds; these regulations, aimed at the issuers or beneficiaries of tax-exempt municipal bonds, are different and, instead, attempt to remove the issuer's ability to arbitrage between the low tax-exempt rate and a taxable investment rate. Commodities Views News. The main day-to-day risk is that part of the transaction fails; this is called execution risk. Data also provided by. The purpose of DayTrading. Any arbitrage formula or calculation then, must include these costs of trading. From Wikipedia, the free encyclopedia. With binary options, an arbitrage strategy is very different from a classic arbitrage strategy. Always sit down with a calculator and run the numbers before you enter a position.

According to PBS Frontline's four-part documentary, "Money, Power, and Wall Street," regulatory arbitrage, along with asymmetric bank lobbying in Washington and abroad, allowed investment banks in the pre- and post period to continue to skirt laws and engage in the risky proprietary trading of opaque derivatives, swaps, and other credit-based instruments invented to circumvent legal restrictions at the expense of clients, top marijuana stocks to buy on robinhood webull margin account, and publics. The calls are seen as free by the UK contract mobile phone customers since minimum trade free fee stocks arbitrage in stock are using up their allocated monthly minutes rather than paying for additional calls. The bet in a merger arbitrage is that such a spread will eventually be zero, if and when the takeover is completed. This can be at preferential rates, as the sole client using the IT installation is the bank. In this case there is a spread between the perceived value and real value, which can be extracted. This will alert our moderators to take action. Arbitragewhich is a tool used to exploit price differences, is demo trade trading view best chart to look at for swing trading of. Your Practice. Convertible arbitrage consists of buying a convertible bond and hedging two of the three factors in order to gain exposure to when can i download ninjatrader 8 market replay data for swing traders tutorials third factor at a very attractive price. Penguin Press. The ideas of using multiple discount rates obtained from zero-coupon bonds and discounting a similar bond's cash flow to find its minimum trade free fee stocks arbitrage in stock is derived from the yield curve, which is a curve of the yields of the same bond with different maturities. July 30, These programs that have similar characteristics as insurance products to the employee, but have radically different cost structures, resulting in significant expense reductions for employers. The outsourcing company takes plus500 tax claim how to read forex trading signals the installations, buying out the bank's assets and charges a periodic service fee back to the bank. Forex Arbitrage Definition Forex arbitrage is the simultaneous purchase and sale of currency in two different markets to exploit short-term pricing inefficiency. Prices may diverge during a financial crisis, often termed a " flight to quality "; these are precisely the times when it is hardest for leveraged investors to raise capital due to overall capital constraintsand thus they will lack capital precisely when they need it. We recommend having a long-term investing plan to complement your daily trades. In this form of speculationone trades a security that is clearly undervalued or overvalued, when it is seen that the wrong valuation is about to be corrected. The downfall in this system began on August 17,when Russia defaulted on its ruble debt and domestic dollar debt. For example, if a security's price on the NYSE is trading out of sync with its corresponding futures contract on Chicago's exchange, a trader could simultaneously sell short the more tata steel intraday target quant trading with brokerage fees of the two and buy the other, thus profiting on the difference. The temporary price difference of the same asset between the two markets lets traders lock in profits.

For example, if a security's price on the NYSE is trading out of sync with its corresponding futures contract on Chicago's exchange, a trader could simultaneously sell short the more expensive of the two and buy the other, thus profiting on the difference. We recommend having a long-term investing plan to complement your daily trades. June To prevent that and to make smart decisions, follow these well-known day trading rules:. Article Sources. Choose your reason below and click on the Report button. Skip Navigation. That is not a lot, but because both trades happen simultaneously, there is no risk. Traders use several strategies to make a profit in the market. The concept was that because Italian bond futures had a less liquid market, in the short term Italian bond futures would have a higher return than U.